false

0001477845

0001477845

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

December 11, 2024

ANNOVIS BIO, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-39202 |

26-2540421 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

101

Lindenwood Drive, Suite 225

Malvern, PA

19355

(Address of Principal Executive Offices, and

Zip Code)

(484) 875-3192

Registrant’s Telephone Number, Including

Area Code

Not

Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

ANVS |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communication pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure

On December 11, 2024,

Annovis Bio, Inc. will present an investor deck during a live webcast. The deck may also be used from time to time in presentations or

discussions with investors, analysts, and other parties. A copy of the updated deck is furnished as Exhibit 99.1 hereto and is incorporated

herein by reference.

Item

9.01 Financial Statements and Exhibits.

The following exhibits

are being furnished herewith:

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANNOVIS BIO, INC. |

| |

|

|

| Date: December 11, 2024 |

By: |

/s/ Maria Maccecchini |

| |

|

Name: Maria Maccecchini |

| |

|

Title: President and Chief Executive Officer |

Exhibit 99.1

December 11, 2024 Development path to NDA for • Alzheimer’s disease • Parkinson’s disease Investor Update

2 FORWARD - LOOKING STATEMENTS Forward Looking Statements and Other Important Cautions -- This presentation contains "forward - looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, the Company's plans related to clinical trials and financial condition. Forward - looking statements are based on current expectations and assumptions and are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Such risks and uncertainties include, but are not limited to, those related to patient enrollment, the effectiveness of buntanetap, and the timing, effectiveness, and anticipated results of the Company's clinical trials evaluating the efficacy, safety, and tolerabi lit y of buntanetap. Additional risk factors are detailed in the Company's periodic filings with the SEC, including those listed in the "Risk Factors" section of the Company's Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q. All forward - looking statements in this press release are based on information available to the Company as of the date of this release. The Company expressly disclaims any obligation to update or revise its forward - looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

3 Multiple neurotoxic proteins are implicated in Alzheimer’s disease Adapted from R. Peterson, Neurology 2018

4 Annovis ’ new approach to attack AD and PD Chronic and acute brain insults lead to high iron levels, resulting in overexpression of neurotoxic proteins, impaired axonal transport, inflammation and neurodegeneration. Attacking one neurotoxic protein results in minimal effect. Buntanetap inhibits the production of multiple neurotoxic proteins simultaneously. Amyloid β Alzheimer’s - Parkinson’s Tau Tauopathies - AD, PD, FTD, CTE aSynuclein Parkinson’s - Alzheimer’s TDP43 ALS, AD, PD, FTD, CTE

Alzheimer’s disease

6 ITT population: ADAS - Cog11 and ADCS - CGIC #/* p<0.05 ## p<0.01 ### p<0.001 # compared to baseline * compared to placebo

7 Buntanetap improves cognition in patients with mild, not moderate, AD # comparing to baseline * comparing to placebo */# p<0.05 ### p<0.001 From the ITT population: - AD patients were selected by pTau217 inclusion/exclusion. - Mild and moderate AD were determined by MMSE selection.

8 Buntanetap improves cognition in APOE4 carriers and non - carriers AD frequency reaches 91% in homo - and 47% in heterozygous ApoE4 carriers . ApoE4 carriers (+/ - & +/+): 66.5% in pTau217/t - Tau>4.2% population vs 22.6% in pTau217/t - Tau<4.2% population # comparing to baseline # p<0.05 ## p<0.01

9 Buntanetap improves cognition in patients not on AChEIs and on AChEIs # comparing to baseline * comparing to placebo */# p<0.05 **/## p<0.01 ***/### p<0.001

10 Forest plot shows consistency and robustness of efficacy Per. slow of decline (%)Adjusted Mean DiffNo. patients (Bun 30 mg,Placebo)Subgroup Overall Age >=65 Apolipoprotein E4 Negative Positive Ethnicity Hispanic Or Latino Not Hispanic Or Latino Gender Female Male Race Black White 27, 24 25, 23 9, 7 18, 16 10, 6 17, 18 18, 16 9, 8 4, 21, 24 -2.209 -2.714 -3.62 -1.718 -1.774 -2.339 -1.394 -3.64 -1.734 7690.0 -842.3 432.6 3795.8 118.3 -767.4 879.7 -1037.3 6962.0 -4 -2 0 2 4 6 10 15 < Buntanetap Better Placebo Better >

11 Buntanetap is safe in APOE4 carriers and non - carriers in ITT AD population All Doses 30mg Buntanetap 15mg Buntanetap 7.5mg Buntanetap Placebo 121 38 38 45 38 APOE Carriers (N=159) 51 (42%) 12 (31.6%) 17 (44.7%) 22 (48.9%) 13 (34.2%) # TEAEs 17 (14%) 3 (7.9%) 6 (15.8%) 8 (17.8%) 1 (2.6%) # TEAEs Related to Study Drug 1 (2.5%) 1 (2.6%) 0 0 3 (7.9%) # Serious TEAEs 0 0 0 0 0 # Serious TEAEs Related to Study Drug 118 41 43 34 41 APOE Non - Carriers (N=159) 32 (27.1%) 17 (41.5%) 11 (25.6%) 4 (11.8%) 9 (22.0%) # TEAEs 6 (5.1%) 3 (7.3%) 2 (4.7%) 1 (2.9%) 1 (2.9%) # TEAEs Related to Study Drug 2 (1.7%) 2 (4.9%) 0 0 0 # Serious TEAEs 0 0 0 0 0 # Serious TEAEs Related to Study Drug AE = Adverse Event TEAE = Treatment Related Adverse Event

12 FDA cleared AD development p ath NDA Mild to moderate AD - 3 m Disease - modifying - 18 m Open Label We are here NDA Symptomatic - 6 m

13 FDA - cleared Phase 3 study: A randomized, double - blind, placebo - controlled, multicenter study of buntanetap in participants with early Alzheimer’s disease R 1:1 Placebo QD 30mg buntanetap QD 8 weeks screening 6/18 months treatment N=375 N=375 N=750 Key inclusion c riteria : • Diagnosis AD according to NIA and NIA - AA criteria (2024) • pTau217 level positive for AD • Age 55 to 85 • MMSE 21 - 28 Key clinical o utcome : Primary endpoints: • ADAS - Cog 13 • ADCS - iADL • vMRI

14 Path forward – Alzheimer’s disease 1. Buntanetap shows promising efficacy in early AD patients . 2 . FDA EOP2 meeting: • G ranted clearance to proceed with a pivotal Phase 3 study. • Aligned on development pathway with new crystal formulation. (one 6/18 - month trial) • S ubgroup analyses provided solid rational for design of the next trial. 3 . 6/18 - month trial is expected to start in Q1 2025 .

15 Thanks to all clinical trials participants and their families Annovis team: Maria Maccecchini Mike Christie Eve Damiano Cheng Fang Melissa Gaines Sarah MacCallum Andrew Walsh Blake Jensen Alexander Morin Hilda Maibach Maggie Wyatt Advisors: Marty Farlow Danny Laskowitz John Bennett Jeff Cummings Mark Espeland Brad Kolls Eric Tangalos Cathy Welsh - Bohmer Collaborators: DCRI TCM C2N CRL Frontage Frontida Morawek Pharmaron Pharmapace Quanterix WPI Wuxi

Parkinson’s disease

17 ITT population, cognitive impairment: MMSE and dementia stage *p<0.05

18 ITT population: MDS - UPDRS II and III

19 Per protocol population: MDS - UPDRS II, III, IV, total and MMSE -0.5 0.0 0.5 1.0 1.5 MDS-UPDRS Part II (N=367) D i f f e r e n c e b e t w e e n E O T a n d B a s e l i n e Placebo 10mg 20mg -5 -4 -3 -2 -1 0 1 MDS-UPDRS Part III (N=367) D i f f e r e n c e b e t w e e n E O T a n d B a s e l i n e Placebo 10mg 20mg ✱ *p<0.05 # -0.6 -0.4 -0.2 0.0 0.2 0.4 MMSE (N= 367) D i f f e r e n c e b e t w e e n E O T a n d B a s e l i n e Placebo 10mg 20mg ✱ -0.6 -0.4 -0.2 0.0 0.2 0.4 0.6 MDS-UPDRS Part IV (N=367) D i f f e r e n c e b e t w e e n E O T a n d B a s e l i n e Placebo 10mg 20mg ✱ Improvement In the per protocol population , the study showed statistically significant improvements in every primary and secondary endpoint. Improvement * *

20 Buntanetap is safe in ITT PD population All Doses 20mg Buntanetap 10 mg Buntanetap Placebo 774 173 174 176 297 (56.8%) 108 (62.4%) 98 (56.3%) 91 (51.7%) # Subjects with any AEs 287 (54.9%) 105 (60.7%) 96 (55.2%) 86 (48.9%) # Subjects with TEAEs 20 (3.8%) 11 (6.4%) 4 (2.3% ) 5 (2.8%) # Subjects with Serious TEAEs 82 (15.7%) 26 (15.9%) 28 (16.3%) 28 (15.9%) # Subjects with TEAEs Related to Study Drug 0 0 0 0 # Subjects with Serious TEAEs Related to Study Drug AE = Adverse Event TEAE = Treatment Related Adverse Event

21 Key learning and path forward – Parkinson’s disease 1. Buntanetap prevents worsening of cognition in ITT population - all treated patients. 2. Buntanetap improves cognitive function in patients with impaired cognition. 3. In per protocol population, buntanetap significantly improves MDS - UPDRS Part II, III, IV, t otal and MMSE . 4. Meeting with the FDA to determine development path forward will be held in Q1 2025 .

23 Financing of Annovis through two 6/18 - month pivotal studies ELOC: Equity L ine of Credit ATM: At the Market Offering $12 Million Cash on Hand • Maintained this level since June while completing preparatory work for the pivotal Phase 3 AD study. $50 Million ATM Facility Secured • Recently closed, providing enhanced financial flexibility. $14 Million Raised in 2024 via ELOC • Plan to keep this financing tool in place with an additional $30 million facility. $200+ Million in Financing Targeted • Exploring options to support progress into Phase 3. Estimated Costs for Pivotal Clinical Studies • 6/18 - month trials to demonstrate symptomatic and disease - modifying effects of Buntanetap are projected at $70 million each.

THANK YOU QUESTIONS?

v3.24.3

Cover

|

Dec. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 11, 2024

|

| Entity File Number |

001-39202

|

| Entity Registrant Name |

ANNOVIS BIO, INC.

|

| Entity Central Index Key |

0001477845

|

| Entity Tax Identification Number |

26-2540421

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

101

Lindenwood Drive

|

| Entity Address, Address Line Two |

Suite 225

|

| Entity Address, City or Town |

Malvern

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19355

|

| City Area Code |

484

|

| Local Phone Number |

875-3192

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ANVS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

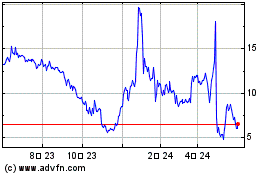

Annovis Bio (NYSE:ANVS)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

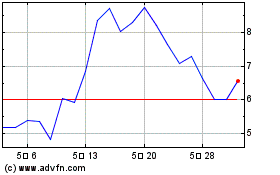

Annovis Bio (NYSE:ANVS)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025