Van Eck Global® and Merk Investments® Announce Marketing Agreement

26 10월 2015 - 10:05PM

Business Wire

Merk’s physical gold ETF will be marketed by

Van Eck, rebranded as Van Eck Merk Gold Trust

Van Eck Global and Merk Investments LLC are today announcing

that Van Eck has begun to act as marketing agent for the Van Eck

Merk Gold Trust (NYSE Arca:OUNZ), previously known as the Merk Gold

Trust.

OUNZ, launched by Merk President & CIO Axel Merk and his

team, seeks to provide investors with a convenient and

cost-efficient way to buy and hold gold through an exchange-traded

fund (ETF) while also giving investors the option to take physical

delivery of gold if and when desired. While other exchange-traded

products provide investors with exposure to gold, OUNZ is the only

that provides a patented, physical gold delivery option.

“Van Eck has a long history of gold investing. We launched the

first gold mutual fund and the first gold miners ETF in the U.S.,”

said Jan van Eck CEO of Van Eck Global. “Through OUNZ, investors

may buy gold with the ease of an ETF, but also have the option to

take delivery of their gold when they want, where they want, in the

form they want. We’re pleased to be teaming up with Merk

Investments to offer the fund to more investors.”

OUNZ joins other gold-themed offerings in the Van Eck family of

funds, including Market Vectors® Gold Miners ETF (NYSE Arca:GDX),

Market Vectors® Junior Gold Miners ETF (NYSE Arca:GDXJ) and the Van

Eck International Investors Gold Fund (ticker:INIVX).

“Van Eck’s long and storied history in gold investing makes them

a natural partner for us as we continue to educate investors about

OUNZ and the role that physical gold exposure can play in a

portfolio,” said Axel Merk. “Our unique approach to providing

investors with the opportunity to redeem their shares for physical

gold coupled with Van Eck’s deep knowledge base, marketing acumen

and outstanding reputation make this a very exciting

partnership.”

Merk remains the sponsor of this exchange-traded product, which

is being rebranded as Van Eck Merk Gold Trust. The ticker symbol

for the fund, OUNZ, will remain the same. OUNZ will continue to

feature an expense ratio of 0.40 percent.

About Van Eck Global

Founded in 1955, Van Eck Global was among the first U.S. money

managers to help investors achieve greater diversification through

global investing. Today, the firm continues this tradition by

offering innovative investment choices in specialized asset classes

such as hard assets, emerging markets, and precious metals

including gold. Van Eck offers a broad array of Market Vectors ETFs

spanning broad-based and specialized asset classes, and is one of

the largest providers of ETPs in the U.S. and worldwide. The Firm

has offices around the world and managed approximately $25.4

billion in investor assets as of September 30, 2015.

About Merk Investments

Merk is a leader in the currency asset class and a pioneer in

providing uncorrelated returns and portfolio diversification

through transparent no-load currency and gold funds. The Merk Funds

may provide valuable diversification benefits. Merk White Papers

and other primary research on the currency asset class and gold can

be found at www.merkfunds.com. Aside from the Van Eck Merk Gold

Trust, the Merk Funds® include: the Merk Hard Currency Fund®

(MERKX), the Merk Asian Currency Fund® (MEAFX), and the Merk

Absolute Return Currency Fund® (MABFX).

This material must be preceded or accompanied by a

prospectus. Before investing, you should carefully consider the

Trust's investment objectives, risks, charges and expenses. This

and other information is in the prospectus, a copy of which may be

obtained by visiting www.vaneck.com/ounz or calling

800-826-2333. Please read the prospectus carefully before you

invest.

Investing involves risk, including possible loss of principal.

The Trust is not an investment company registered under the

Investment Company Act of 1940 or a commodity pool for the purposes

of the Commodity Exchange Act. Shares of the Trust are not subject

to the same regulatory requirements as mutual funds. Because shares

of the Trust are intended to reflect the price of the gold held in

the Trust, the market price of the shares is subject to

fluctuations similar to those affecting gold prices. Additionally,

shares of the Trust are bought and sold at market price, not at net

asset value (“NAV”). Brokerage commissions will reduce returns.

The request for redemption of shares for gold is subject to a

number of risks including but not limited to the potential for the

price of gold to decline during the time between the submission of

the request and delivery. Delivery may take a considerable amount

of time depending on your location. Commodities and commodity-index

linked securities may be affected by changes in overall market

movements and other factors such as weather, disease, embargoes, or

political and regulatory developments, as well as trading activity

of speculators and arbitrageurs in the underlying commodities.

The sponsor of the Trust is Merk Investments LLC (the

“Sponsor”). Van Eck Securities Corporation and Foreside Fund

Services, LLC, provide marketing services to the Trust.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151026005773/en/

Media:MacMillan CommunicationsMike MacMillan/Chris

Sullivan, 212-473-4442chris@macmillancom.com

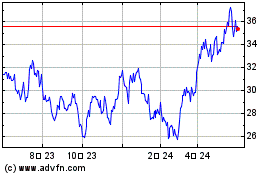

VanEck Gold Miners ETF (AMEX:GDX)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

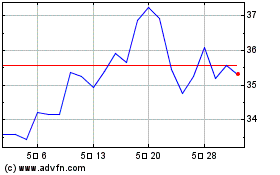

VanEck Gold Miners ETF (AMEX:GDX)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025