UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its charter)

Calle 94 N°

11-30 8° piso

Bogota, Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Press Release dated January 21, 2025 titled “Geopark Announces Proposed Offering of Senior Notes” |

| 2. |

Press Release dated January 21, 2025 titled “Geopark Announces Commencement of Cash Tender Offer for Any and All of its Outstanding 5.500% Senior Notes due 2027” |

Item 1

FOR IMMEDIATE DISTRIBUTION

GEOPARK ANNOUNCES PROPOSED

OFFERING OF SENIOR NOTES

Bogotá, Colombia, January 21, 2025 –

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), an exempted company incorporated under the laws of

Bermuda, today announced that it intends to offer senior notes (the “Notes”), guaranteed by certain subsidiaries of the Company,

in a private placement to qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”), and outside the United States to non-U.S. persons in accordance with Regulation S under the Securities

Act. The timing of pricing and terms of the Notes are subject to market conditions and other factors.

Concurrent with the announcement of this

proposed offering of Notes, the Company has announced that it is making a cash tender offer to purchase any and all of the

Company’s outstanding 5.500% notes due 2027 (the "2027 Notes"). The Company intends to use the net proceeds from the

offering of the Notes to purchase the 2027 Notes, to repay up to US$152.0 million of outstanding prepayments due under an offtake

and prepayment agreement and the remainder, if any, for general corporate purposes, including capital expenditures.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor will there be any sale of these securities, in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any state

or jurisdiction. The Notes have not been registered under the Securities Act, or any applicable state securities laws, and will be offered

only to qualified institutional buyers pursuant to Rule 144A promulgated under the Securities Act and outside the United States to non-U.S.

persons in accordance with Regulation S under the Securities Act. Unless so registered, the Notes may not be offered or sold in the United

States except pursuant to an exemption from the registration requirements of the Securities Act and any applicable state securities laws.

For further information, please contact:

INVESTORS:

|

Maria Catalina Escobar

Shareholder Value and Capital Markets Director |

mescobar@geo-park.com |

| |

|

|

Miguel Bello

Investor Relations Officer |

mbello@geo-park.com

|

| |

|

|

Maria Alejandra Velez

Investor Relations Leader |

mvelez@geo-park.com

|

MEDIA:

| Communications Department |

communications@geo-park.com |

*****

CAUTIONARY STATEMENT ON FORWARD-LOOKING

STATEMENTS

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often are preceded by words such

as “believes,” “expects,” “may,” “anticipates,” “plans,” “intends,”

“assumes,” “will” or similar expressions. The forward-looking statements contained herein include statements about

the tender offer for the 2027 Notes, the Company’s notes offering and its intended use of proceeds therefrom. These expectations

may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition,

GeoPark’s business and operations involve numerous risks and uncertainties, many of which are beyond the control of GeoPark, which

could result in GeoPark’s expectations not being realized or otherwise materially affect the financial condition, results of operations

and cash flows of GeoPark. Some of the factors that could cause future results to materially differ from recent results or those projected

in forward-looking statements are described in GeoPark’s filings with the United States Securities and Exchange Commission.

The forward-looking statements are made only as

of the date hereof, and GeoPark does not undertake any obligation to (and expressly disclaims any obligation to) update any forward-looking

statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated

events. In light of the risks and uncertainties described above, and the potential for variation of actual results from the assumptions

on which certain of such forward-looking statements are based, investors should keep in mind that the results, events or developments

disclosed in any forward-looking statement made in this document may not occur, and that actual results may vary materially from those

described herein, including those described as anticipated, expected, targeted, projected or otherwise.

Item 2

FOR IMMEDIATE DISTRIBUTION

GEOPARK ANNOUNCES COMMENCEMENT OF CASH TENDER

OFFER FOR

ANY AND ALL OF ITS OUTSTANDING 5.500% SENIOR

NOTES DUE 2027

(CUSIP NOS. 37255B AB5; G38327 AB1 / ISIN NOS. US37255BAB53; USG38327AB13)

Bogotá, Colombia, January 21, 2025 –

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), an exempted company incorporated under the laws of

Bermuda, today announced the commencement of an offer to purchase for cash any and all of its outstanding 5.500% Senior Notes due 2027

(the “Notes”) (the “Tender Offer”). The Tender Offer is being made upon the terms and subject to the conditions

(including the Financing Condition (as defined in the Offer to Purchase)) set forth in the offer to purchase dated January 21, 2025 (the

“Offer to Purchase”) and the notice of guaranteed delivery (the “Notice of Guaranteed Delivery” and, together

with the Offer to Purchase, the “Offer Documents”).

The table below summarizes certain payment terms

for the Notes:

|

Description

of Security |

CUSIP

No. |

ISIN |

Outstanding

Principal Amount as of the Date Hereof |

Consideration

per U.S.$1,000 Outstanding Principal Amount* |

| 5.500% Senior Notes due 2027 |

144A: 37255B AB5

Reg S: G38327 AB1 |

144A: US37255BAB53

Reg S: USG38327AB13 |

U.S.$500,000,000 |

U.S.$1,000 |

| * | The Consideration for the Notes will be paid

together with accrued and unpaid interest from the last interest payment date for the Notes

up to, but not including, the Settlement Date (as defined below). |

The Tender Offer will expire at 5:00 p.m., New

York City time, on January 27, 2025, or any other date and time to which GeoPark extends the Tender Offer (such date and time, as it may

be extended, the “Expiration Time”). Holders of Notes must validly tender their Notes (or, where applicable, Notices of Guaranteed

Delivery) at or prior to the Expiration Time and not validly withdraw them at or prior to the applicable Withdrawal Deadline (as defined

in the Offer to Purchase) in order to be eligible to receive the Consideration (as defined in the Offer to Purchase) plus accrued and

unpaid interest for such Notes. Tendered Notes may be validly withdrawn at any time at or prior to the Withdrawal Deadline but not thereafter.

Notes may be tendered and accepted for payment

in principal amounts equal to minimum denominations of U.S.$200,000 and integral multiples of U.S.$1,000 in excess thereof. Holders who

tender less than all of their Notes must continue to hold Notes in at least the minimum authorized denomination of U.S.$200,000 principal

amount. No alternative, conditional or contingent tenders will be accepted.

The obligation of GeoPark to

purchase Notes in the Tender Offer is conditioned on the satisfaction or waiver of certain conditions, including, without limitation,

the Financing Condition, described in the Offer Documents. GeoPark reserves the right, in its sole discretion, to amend or terminate the

Tender Offer at any time.

The Tender Offer is being made in connection with

a proposed offering of U.S. dollar denominated senior notes (the “New Notes”) to be issued by GeoPark (the “Proposed

New Notes Offering”). The Proposed New Notes Offering will be exempt from the registration requirements of the U.S. Securities Act

of 1933, as amended.

The information and tender agent for the Tender

Offer is Sodali & Co. Requests for documentation and questions regarding the Tender Offer can be directed to Sodali & Co. at

its telephone numbers +1 203 658 9457 and +44 20 4513 6933, or by email at GeoPark@investor.sodali.com.

Copies of each of the Offer Documents are available

from the tender offer website (the “Tender Offer Website”): https://projects.sodali.com/geopark,

subject to eligibility confirmation and registration.

Any questions or requests for assistance or for

additional copies of this notice may be directed to the dealer managers at their respective telephone numbers set forth below or, if by

any Holder, to such Holder’s broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Tender

Offer.

The dealer managers for the Tender Offer are:

|

Banco BTG Pactual S.A.

– Cayman Branch

601 Lexington Avenue, 57th Floor

New York, NY 10022

United States

Attn: Debt Capital Markets

E-mail: OL-DCM@btgpactual.com |

Deutsche Bank Securities

Inc.

1 Columbus Circle

New York, NY 10019

United States

Attention: Liability Management Group |

J.P. Morgan Securities LLC

383 Madison Avenue

New York, New York 10179

United States

Attn: Latin America Debt

Capital Markets |

| |

|

|

|

Collect: +1 (212) 293-4600

|

Collect: +1 (212) 250-2955

Toll-Free: +1 (866) 627-0391 |

Collect: +1 (212) 834-7279

Toll Free: +1 (866) 846-2874 |

This notice does not constitute or form part of

any offer or invitation to purchase, or any solicitation of any offer to sell, the Notes or any other securities in the United States

or any other country, nor shall it or any part of it, or the fact of its release, form the basis of, or be relied on or in connection

with, any contract therefor. The Tender Offer is made only by and pursuant to the terms of the Offer Documents, and the information in

this notice is qualified by reference to the Offer to Purchase and the Notice of Guaranteed Delivery. None of GeoPark, the dealer managers

or the information and tender agent makes any recommendation as to whether Holders should tender their Notes pursuant to the Tender Offer.

For further information, please contact:

INVESTORS:

|

Maria Catalina Escobar

Shareholder Value and Capital Markets Director |

mescobar@geo-park.com |

| |

|

|

Miguel Bello

Investor Relations Officer |

mbello@geo-park.com

|

| |

|

|

Maria Alejandra Velez

Investor Relations Leader |

mvelez@geo-park.com

|

MEDIA:

| Communications Department |

communications@geo-park.com |

*****

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often are preceded by words such

as “believes,” “expects,” “may,” “anticipates,” “plans,” “intends,”

“assumes,” “will” or similar expressions. The forward-looking statements contained herein include statements about

the tender offer for the notes due 2027, the Company’s notes offering and its intended use of proceeds therefrom. These expectations

may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition,

GeoPark’s business and operations involve numerous risks and uncertainties, many of which are beyond the control of

GeoPark, which could result in GeoPark’s

expectations not being realized or otherwise materially affect the financial condition, results of operations and cash flows of GeoPark.

Some of the factors that could cause future results to materially differ from recent results or those projected in forward-looking statements

are described in GeoPark’s filings with the United States Securities and Exchange Commission.

The forward-looking statements are made only as

of the date hereof, and GeoPark does not undertake any obligation to (and expressly disclaims any obligation to) update any forward-looking

statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated

events. In light of the risks and uncertainties described above, and the potential for variation of actual results from the assumptions

on which certain of such forward-looking statements are based, investors should keep in mind that the results, events or developments

disclosed in any forward-looking statement made in this document may not occur, and that actual results may vary materially from those

described herein, including those described as anticipated, expected, targeted, projected or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GeoPark Limited |

| |

|

| |

|

| |

By: |

/s/ Jaime Caballero Uribe |

| |

|

Name: Jaime Caballero Uribe |

| |

|

Title: Chief Financial Officer |

Date: January 21, 2025

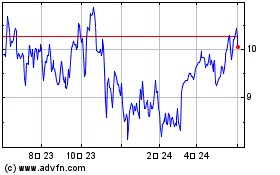

GeoPark (NYSE:GPRK)

과거 데이터 주식 차트

부터 12월(12) 2024 으로 1월(1) 2025

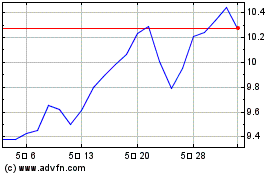

GeoPark (NYSE:GPRK)

과거 데이터 주식 차트

부터 1월(1) 2024 으로 1월(1) 2025