As filed with the Securities and Exchange Commission on February 28, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RAPID7, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 35-2423994 |

| (State or other jurisdiction of Incorporation or organization) | | (I.R.S. Employer Identification No.) |

120 Causeway Street

Boston, Massachusetts 02114

(Address of principal executive offices) (Zip Code)

Rapid7, Inc. 2015 Equity Incentive Plan

Rapid7, Inc. 2015 Employee Stock Purchase Plan

(Full titles of the plans)

Raisa Litmanovich

General Counsel and Secretary

Rapid7, Inc.

120 Causeway Street

Boston, Massachusetts 02114

(617) 247-1717

(Name, address and telephone number, including area code, of agent for service)

Copies to:

Nicole Brookshire, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

(212) 450-4000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. | | | | | |

Large accelerated filer ý | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Emerging growth company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨ |

INCORPORATION BY REFERENCE OF CONTENTS

OF REGISTRATION STATEMENT ON FORM S-8

Pursuant to General Instruction E to Form S-8, this Registration Statement is being filed by Rapid7, Inc. (the “Registrant”) for the purpose of registering (i) an additional 2,539,878 shares of Common Stock issuable pursuant to the Rapid7, Inc. 2015 Equity Incentive Plan (the “2015 EIP”) and (ii) an additional 634,969 shares of Common Stock issuable pursuant to the Rapid7, Inc. 2015 Employee Stock Purchase Plan (the “2015 ESPP”). These additional shares of Common Stock are securities of the same class as other securities for which Registration Statements on Form S-8 of the Registrant relating to the same employee benefit plans are effective. The Registrant previously registered shares of its Common Stock for issuance under the 2015 EIP and 2015 ESPP under Registration Statements on Form S-8 filed with the Securities and Exchange Commission (the “Commission”) on July 17, 2015 (File No. 333-205716), October 13, 2015 (File No. 333-207395), March 10, 2016 (File No. 333-210082), March 9, 2017 (File No. 333-216566), March 8, 2018 (File No. 333-223525), February 28, 2019 (File No. 333-229960), February 28, 2020 (File No. 333-236766), February 26, 2021 (File No. 333-253566), February 24, 2022 (File No. 333-262983), February 24, 2023 (File No. 333-270002) and February 26, 2024 (File No.333-277355). This Registration Statement hereby incorporates by reference the contents of the Registration Statements referenced above to the extent not superseded hereby.

PART I

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

The documents containing the information specified in Item 1 and Item 2 of Part I of Form S-8 will be sent or given to participants as specified by Rule 428(b)(1) under the Securities Act. In accordance with the rules and regulations of the Commission and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents are incorporated herein by reference:

(a) The Registrant’s Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the Commission on February 28, 2025; and

(b) The description of the Registrant’s common stock which is contained in the registration statement on Form 8-A filed on July 13, 2015, including any amendment or supplements thereto.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this Registration Statement and prior to the filing of a post-effective amendment that indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, are incorporated by reference in this Registration Statement and are a part hereof from the date of filing of such documents; except as to any portion of any future annual or quarterly report to stockholders or document or current report furnished under current Items 2.02 or 7.01 of Form 8-K that is not deemed filed under such provisions. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

ITEM 8. EXHIBITS.

| | | | | |

Exhibit No. | Description |

4.1(1) | |

4.2(2) | |

4.3(3) | |

| 5.1 | |

| 23.1 | |

| 23.2 | |

| 24.1 | |

99.1(4) | |

| 99.2 | |

99.3(5) | |

| 107.1 | |

(1)Filed as Exhibit 3.1 to the Registrant’s Quarterly Report on Form 10-Q filed with the Commission on August 10, 2020, and incorporated herein by reference.

(2)Filed as Exhibit 3.2 to the Registrant’s Quarterly Report on Form 10-Q filed with the Commission on August 10, 2020, and incorporated herein by reference.

(3)Filed as Exhibit 4.1 to the Registrant’s Registration Statement on Form S-1/A filed with the Commission on July 6, 2015 (File No. 333-204874), as amended, and incorporated herein by reference.

(4)Filed as Exhibit 10.1 to the Registrant’s Current Report on Form 8-K filed with the Commission on October 13, 2015 and incorporated herein by reference.

(5)Filed as Exhibit 10.4 to the Registrant’s Registration Statement on Form S-1/A filed with the Commission on July 6, 2015 (File No. 333-204874), as amended, and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Boston, Commonwealth of Massachusetts, on February 28, 2025.

RAPID7, INC. | | | | | |

| /s/ Tim Adams |

| By: | Tim Adams |

| |

| Chief Financial Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Corey Thomas and Tim Adams, and each of them, his or her true and lawful attorney-in-fact and agent, each with full power of substitution and resubstitution, and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, or any related registration statement filed pursuant to Rule 462(b) under the Securities Act, and to file the same, with exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

| | | | | | | | | | | | | | |

| Name | | Title | | Date |

| /s/ Corey E. Thomas | | Chief Executive Officer and Director | | February 28, 2025 |

| Corey E. Thomas | | (Principal Executive Officer) | | |

| | | | |

| /s/ Tim Adams | | Chief Financial Officer | | February 28, 2025 |

| Tim Adams | | (Principal Financial Officer) | | |

| | | | |

| /s/ Scott Murphy | | Chief Accounting Officer | | February 28, 2025 |

| Scott Murphy | | (Principal Accounting Officer) | | |

| | | | |

| /s/ Michael Berry | | Director | | February 28, 2025 |

| Michael Berry | | | | |

| | | | |

| /s/ Marc Brown | | Director | | February 28, 2025 |

| Marc Brown | | | | |

| | | | |

| /s/ Judy Bruner | | Director | | February 28, 2025 |

| Judy Bruner | | | | |

| | | | |

| /s/ Benjamin Holzman | | Director | | February 28, 2025 |

| Benjamin Holzman | | | | |

| | | | |

| /s/ J. Benjamin Nye | | Director | | February 28, 2025 |

| J. Benjamin Nye | | | | |

| | | | |

| /s/ Thomas Schodorf | | Director | | February 28, 2025 |

| Thomas Schodorf | | | | |

| | | | |

| /s/ Reeny Sondhi | | Director | | February 28, 2025 |

| Reeny Sondhi | | | | |

| | | | |

0001560327Rapid7, Inc.EX-FILING FEESS-8xbrli:sharesiso4217:USDxbrli:pure000156032712025-02-282025-02-28000156032722025-02-282025-02-2800015603272025-02-282025-02-28

Exhibit 107.1

Calculation of Filing Fee Table

FORM S-8

(Form Type)

Rapid7, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Notes | Fee Calculation Rule | Amount Registered | Proposed Maximum Offering Price Per Share | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Common Stock, $0.01 par value per share, Rapid7, Inc. 2015 Equity Incentive Plan | (1) | Other | 2,539,878 | $31.11 | $79,015,605 | 0.00015310 | $12,097.29 |

| Equity | Common Stock, $0.01 par value per share, Rapid7, Inc. 2015 Employee Stock Purchase Plan | (2) | Other | 634,969 | $26.45 | $16,794,931 | 0.00015310 | $2,571.31 |

| Total Offering Amounts | | $95,810,536 | | — |

| Total Fees Previously Paid | | | | — |

| Total Fee Offsets | | | | — |

| Net Fees Due | | | | $14,668.60 |

| | | | | |

(1) | (a) Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common stock, par value $0.01 per share (the “Common Stock”) that become issuable under the Rapid7, Inc. 2015 Equity Incentive Plan (the “2015 EIP”) by reason of any stock dividend, stock split, recapitalization or other similar transaction. (b) The Amount Registered represents shares of Common Stock that were automatically added to the shares authorized for issuance under the 2015 EIP on January 1, 2025. (c) The Proposed Maximum Offering Price Per Unit is estimated in accordance with Rule 457(c) and (h) under the Securities Act, solely for the purpose of calculating the registration fee for the additional shares to be reserved under the 2015 EIP, on the basis of the average of the high and low prices of the Registrant’s Common Stock as reported on The Nasdaq Global Market on February 25, 2025. (d) The Amount of Registration Fee is rounded up to the nearest penny. |

(2) | (a) Pursuant to Rule 416(a) of the Securities Act, this Registration Statement shall also cover any additional shares of the Registrant’s Common Stock that become issuable under the Rapid7, Inc. 2015 Employee Stock Purchase Plan (the “2015 ESPP”) by reason of any stock dividend, stock split, recapitalization or other similar transaction. (b) The Amount Registered represents shares of Common Stock that were automatically added to the shares authorized for issuance under the 2015 ESPP on January 1, 2025. (c) The Proposed Maximum Offering Price Per Unit is estimated in accordance with Rule 457(c) and (h) under the Securities Act, solely for the purpose of calculating the registration fee for the additional shares to be reserved under the 2015 ESPP, on the basis of the average of the high and low prices of the Registrant’s Common Stock as reported on The Nasdaq Global Market on February 25, 2025. Under the 2015 ESPP, the purchase price of a share of common stock is equal to 85% of the fair market value of the Registrant’s common stock on the offering date or the purchase date, whichever is less. (d) The Amount of Registration Fee is rounded up to the nearest penny.

|

Exhibit 5.1 and 23.2

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

davispolk.com

OPINION OF DAVIS POLK & WARDWELL LLP

February 28, 2025

RAPID7, INC.

120 Causeway Street

Boston, Massachusetts 02114

Ladies and Gentlemen:

We have acted as special counsel to Rapid7, Inc., a Delaware corporation (the “Company”), and are delivering this opinion in connection with the Company’s Registration Statement on Form S-8 (the “Registration Statement”) filed with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended, for the registration of (i) 2,539,878 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share, that were added to the shares of common stock authorized for issuance pursuant to the Rapid7, Inc. 2015 Equity Incentive Plan, as may be amended from time to time (the “2015 EIP”), and (ii) 634,969 Shares of the Company’s common stock that were added to the shares of common stock authorized for issuance pursuant to the Rapid7, Inc. 2015 Employee Stock Purchase Plan, as may be amended from time to time (the “2015 ESPP,” and together with the 2015 EIP, the “Plans”).

We, as your counsel, have examined originals or copies of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary or advisable for the purpose of rendering this opinion.

In rendering the opinion expressed herein, we have, without independent inquiry or investigation, assumed that (i) all documents submitted to us as originals are authentic and complete, (ii) all documents submitted to us as copies conform to authentic, complete originals, (iii) all signatures on all documents that we reviewed are genuine, (iv) all natural persons executing documents had and have the legal capacity to do so, (v) all statements in certificates of public officials and officers of the Company that we reviewed were and are accurate and (vi) all representations made by the Company as to matters of fact in the documents that we reviewed were and are accurate.

On the basis of the foregoing, we are of the opinion that the Shares have been duly authorized and, when and to the extent issued pursuant to the Plans upon receipt by the Company of the consideration for the Shares specified therein, will be validly issued, fully paid and non-assessable.

We are members of the Bar of the State of New York and the foregoing opinion is limited to the laws of the State of New York and the General Corporation Law of the State of Delaware.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement.

Very truly yours,

/s/ Davis Polk & Wardwell LLP

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the use of our report dated February 28, 2025, with respect to the consolidated financial statements of Rapid7, Inc. and the effectiveness of internal control over financial reporting, incorporated herein by reference.

/s/ KPMG LLP

Boston, Massachusetts

February 28, 2025

Exhibit 99.2

AMENDMENT NO. 1

RAPID7, INC.

2015 EQUITY INCENTIVE PLAN

1.This Amendment No. 1 (this “Amendment”) of the Rapid7, Inc. 2015 Equity Incentive Plan (as amended from time to time, the “Equity Plan”) of Rapid7, Inc., a Delaware corporation (the “Company”) dated as of January 28, 2025, amends the Equity Plan, and is made pursuant to Section 2 of the Equity Plan.

2.Unless otherwise expressly provided for in this Amendment, all capitalized words or phrases or other defined terms used in this Amendment will have the same meaning ascribed to them in the Equity Plan.

3.Section 3(b) of the Equity Plan is hereby amended and restated in its entirety as follows:

“Reversion of Shares to the Share Reserve. If a Stock Award or any portion thereof (i) expires or otherwise terminates without all of the shares covered by such Stock Award having been issued or (ii) is settled in cash (i.e., the Participant receives cash rather than stock), such expiration, termination or settlement will not reduce (or otherwise offset) the number of shares of Common Stock that may be available for issuance under the Plan. If any shares of Common Stock issued pursuant to a Stock Award are forfeited back to or repurchased by the Company because of the failure to meet a contingency or condition required to vest such shares in the Participant, then the shares that are forfeited or repurchased will revert to and again become available for issuance under the Plan. Any shares reacquired by the Company in satisfaction of tax withholding obligations on a Stock Award will again become available for issuance under the Plan. Notwithstanding the foregoing, in no event shall any shares reacquired by the Company as consideration for the exercise or purchase price of a Stock Award again become available for issuance under the Plan.”

Approved by the Compensation Committee of the Company on January 28, 2025.

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings

|

Feb. 28, 2025

USD ($)

shares

|

| Offering: 1 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Stock, $0.01 par value per share, Rapid7, Inc. 2015 Equity Incentive Plan

|

| Amount Registered | shares |

2,539,878

|

| Proposed Maximum Offering Price per Unit |

31.11

|

| Maximum Aggregate Offering Price |

$ 79,015,605

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 12,097.29

|

| Offering Note |

(a) Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common stock, par value $0.01 per share (the “Common Stock”) that become issuable under the Rapid7, Inc. 2015 Equity Incentive Plan (the “2015 EIP”) by reason of any stock dividend, stock split, recapitalization or other similar transaction. (b) The Amount Registered represents shares of Common Stock that were automatically added to the shares authorized for issuance under the 2015 EIP on January 1, 2025. (c) The Proposed Maximum Offering Price Per Unit is estimated in accordance with Rule 457(c) and (h) under the Securities Act, solely for the purpose of calculating the registration fee for the additional shares to be reserved under the 2015 EIP, on the basis of the average of the high and low prices of the Registrant’s Common Stock as reported on The Nasdaq Global Market on February 25, 2025. (d) The Amount of Registration Fee is rounded up to the nearest penny.

|

| Offering: 2 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Stock, $0.01 par value per share, Rapid7, Inc. 2015 Employee Stock Purchase Plan

|

| Amount Registered | shares |

634,969

|

| Proposed Maximum Offering Price per Unit |

26.45

|

| Maximum Aggregate Offering Price |

$ 16,794,931

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 2,571.31

|

| Offering Note |

(a) Pursuant to Rule 416(a) of the Securities Act, this Registration Statement shall also cover any additional shares of the Registrant’s Common Stock that become issuable under the Rapid7, Inc. 2015 Employee Stock Purchase Plan (the “2015 ESPP”) by reason of any stock dividend, stock split, recapitalization or other similar transaction. (b) The Amount Registered represents shares of Common Stock that were automatically added to the shares authorized for issuance under the 2015 ESPP on January 1, 2025. (c) The Proposed Maximum Offering Price Per Unit is estimated in accordance with Rule 457(c) and (h) under the Securities Act, solely for the purpose of calculating the registration fee for the additional shares to be reserved under the 2015 ESPP, on the basis of the average of the high and low prices of the Registrant’s Common Stock as reported on The Nasdaq Global Market on February 25, 2025. Under the 2015 ESPP, the purchase price of a share of common stock is equal to 85% of the fair market value of the Registrant’s common stock on the offering date or the purchase date, whichever is less. (d) The Amount of Registration Fee is rounded up to the nearest penny.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ffd_OfferingAxis=2 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlPrevslyPdAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

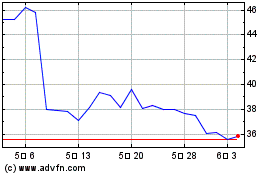

Rapid7 (NASDAQ:RPD)

과거 데이터 주식 차트

부터 2월(2) 2025 으로 3월(3) 2025

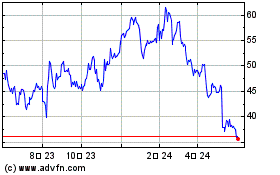

Rapid7 (NASDAQ:RPD)

과거 데이터 주식 차트

부터 3월(3) 2024 으로 3월(3) 2025