As filed with the United States Securities and Exchange Commission on December

11, 2024

Registration

No. 333-282993

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

F-1

(Amendment No. 3)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

MAINZ

BIOMED N.V.

(Exact name of registrant as specified in its charter)

| The

Netherlands |

|

8731 |

|

Not

Applicable |

(State or other jurisdiction

of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

Mainz

Biomed N.V.

Robert Koch Strasse 50

55129 Mainz

Germany

Telephone: 0049 6131 5542860

(Address

of principal executive offices, including zip code, and telephone number, including area code)

Vcorp

Services, LLC

25 Robert Pitt Drive, Suite 204

Monsey, NY 10952

Telephone:

(Name,

address, including zip code, and telephone number, including area code, of agent of service)

Copies

to:

William Rosenstadt,

Esq.

Mengyi “Jason” Ye, Esq.

Tim Dockery, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue

New York, New York 10022

Telephone: (212) 588-0022 |

|

M.

Ali Panjwani, Esq.

Pryor

Cashman LLP

7

Times Square, New York

New

York 10036-6569

Telephone: (212) 421-4100 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933,

check the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective

on such date as the United States Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration

statement filed with the United States Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to

sell, nor does it seek an offer to buy, the securities in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED DECEMBER

11, 2024 |

Up to 1,147,776 Ordinary Units

Each Ordinary Unit Consisting of

One Ordinary Share,

One Class A Warrant to purchase One Ordinary

Share and

One Class B Warrant to purchase One Ordinary

Share

Up To 1,147,776 Pre-Funded Units

Each Pre-Funded Unit Consisting of

One Pre-Funded Warrant to purchase One Ordinary

Share,

One Class A Warrant to purchase One Ordinary

Share and

One Class B Warrant to purchase One Ordinary

Share

Up To 3,443,328 Ordinary Shares underlying

the Class A Warrants,

the Class B Warrants, and the Pre-Funded

Warrants

Mainz

Biomed N.V.

We are offering on a “best efforts”

basis up to 1,147,776 ordinary units of Mainz Biomed N.V. with each ordinary unit consisting of one ordinary share, one Class A ordinary

share purchase warrant (“Class A Warrant”) and one Class B ordinary share purchase warrant (“Class B Warrant”).

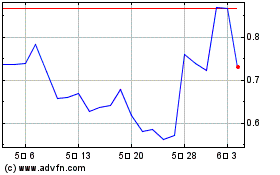

Our ordinary shares are traded on the Nasdaq Capital Market under the symbol “MYNZ.” The last reported sale price of our

ordinary shares on December 6, 2024 as reported on Nasdaq, was $6.97 per share rounded to the nearest whole cent, which is the per ordinary

unit offering price we have assumed for purposes of this preliminary prospectus.

We are also offering to each purchaser of

ordinary units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding ordinary

shares immediately following the consummation of this offering the opportunity to purchase pre-funded units in lieu of ordinary units

with each pre-funded unit consisting of one pre-funded warrant to purchase an ordinary share, one Class A Warrant and one Class B Warrant.

The purchase price of each pre-funded unit will be equal to the price per ordinary unit minus $0.0001. The number of ordinary units we

are offering will be decreased on a one-for-one basis. We do not intend to apply for any listing of the ordinary units, the pre-funded

units, the pre-funded warrants, the Class A Warrants or the Class B Warrants on any securities exchange or nationally recognized trading

system, and we do not expect a market to develop for any of such securities. We are also registering the ordinary shares issuable from

time to time upon the exercise of the pre-funded warrants, the Class A Warrants and the Class B Warrants offered hereby. We refer to

the ordinary units, the pre-funded units, the pre-funded warrants, the Class A Warrants and the Class B Warrants offered hereby as the

offered securities.

Each pre-funded warrant will be exercisable

for one ordinary share, and the remaining exercise price of each pre-funded warrant will equal $0.0001 per ordinary share. The pre-funded

warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full.

Each Class A Warrant will be exercisable for

one ordinary share. The exercise price of each Class A Warrant will equal the per ordinary unit offering price hereunder, which we have

assumed to be $6.97 based on the closing price of our ordinary shares rounded to the nearest whole cent on the Nasdaq Capital Market

on December 6, 2024. The Class A Warrants will be immediately exercisable and may be exercised until the fifth anniversary of the date

of issuance.

Each Class B Warrant will be exercisable for

one ordinary share. The exercise price of each Class B Warrant will equal the per ordinary unit offering price hereunder, which we have

assumed to be $6.97 based on the closing price of our ordinary shares rounded to the nearest whole cent on the Nasdaq Capital Market

on December 6, 2024. The Class B Warrants will be immediately exercisable and may be exercised until the earlier of (i) first anniversary

of the date of issuance or (ii) 30 days following the public disclosure of results from the eAArly Detect 2 study.

A holder of pre-funded warrants, Class A Warrants

and Class B Warrants will not have the right to exercise any portion of such warrants if the holder, together with its affiliates, would

beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of ordinary shares outstanding immediately

after giving effect to such exercise.

On December 3, 2024 we effectuated a 1:40

reverse stock split of our ordinary shares. All share and per share amounts in this prospectus (except where otherwise indicated) account

for this reverse stock split. Any share and per share amounts incorporated by reference into this prospectus from documents that we have

previously fielded with the U.S. Securities and Exchange Commission (the “SEC”) do not account for such reverse stock split.

The

public offering price for the offered securities will be determined at the time of pricing and may be at a discount to the current market

price at the time. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering

price. The final public offering price will be determined through negotiation between us, the placement agent and the investors based

upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results,

the previous experience of our executive officers and the general condition of the securities markets at the time of this offering.

This is a best-efforts offering and the placement

agent does not have an obligation to purchase any securities. Because there is no minimum offering amount required as a condition to

closing this offering, we may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds

received by us, and investors in this offering will not receive a refund in the event that we do not sell a number of securities sufficient

to pursue the business goals outlined in this prospectus. Because there is no minimum offering amount, investors could be in a position

where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this offering. Also,

any proceeds from the sale of securities offered by us will be available for our immediate use despite uncertainty about whether we would

be able to use such funds to effectively implement our business plan.

This offering will terminate on December 24,

2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one

closing for all the securities purchased in this offering. The public offering price per ordinary unit and per pre-funded unit will be

fixed for the duration of this offering. The offering will settle delivery versus payment (“DVP”)/receipt versus payment

(“RVP”). Accordingly, we and the placement agent have not made any arrangements to place investor funds in an escrow account

or trust account since the placement agent will not receive investor funds in connection with the sale of the securities offered hereunder.

We are both an “emerging growth company”

and a “foreign private issuer” under applicable U.S. Securities and Exchange Commission rules and will be eligible for reduced

public company disclosure requirements. See section titled “Prospectus Summary – Implications of Being an Emerging Growth

Company” and “Prospectus Summary – Implications of being a Foreign Private Issuer” for additional information.

Investing

in our securities involves a high degree of risk. You should carefully consider the matters described under the caption “Risk Factors”

beginning on page 13.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per

Ordinary Unit | | |

Per

Pre-Funded

Unit | | |

Total | |

| Public

offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement

Agent Fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds

to us, before expenses(2) | |

$ | | | |

$ | | | |

$ | | |

| (1) | The

placement agent, Maxim Group LLC, will receive compensation in addition to the placement

agent fees. See “Plan of Distribution” for a description of compensation payable

to the placement agent. |

| (2) | The

total estimated expenses related to this offering are set forth in the section entitled “Expenses

Relating to this Offering.” |

If we complete this offering, net proceeds will

be delivered to us on the closing date.

The

placement agent expects to deliver the offered securities on or about ,

2024.

Maxim

Group LLC

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

This

prospectus is part of a registration statement on Form F-1 that we filed with the SEC. You should read this prospectus and the information

and documents incorporated herein by reference carefully. Such documents contain important information you should consider when making

your investment decision. See “Where You Can Find Additional Information” and “Incorporation of Documents by Reference”

in this prospectus.

You

should rely only on the information contained in this prospectus (inclusive of the documents incorporated by reference herein), any amendment

or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Neither we nor the placement agent have

authorized any other person to provide you with different or additional information. Neither we nor the placement agent take responsibility

for, nor can we provide assurance as to the reliability of, any other information that others may provide. The placement agent is not

making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this

prospectus or incorporated by reference in this prospectus is accurate only as of the date of this prospectus or such other date stated

in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Except

as otherwise set forth in this prospectus, neither we nor the placement agent have taken any action to permit a public offering of these

securities outside the United States or to permit the possession or distribution of this prospectus outside the United States.

Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions

relating to the offering of these securities and the distribution of this prospectus outside the United States.

Unless

the context otherwise requires, in this prospectus, the term(s) “we”, “us”, “our”, “Company”,

“our company”, “our business” and “Mainz Biomed” refer to Mainz Biomed N.V.

All share and per share amounts in this prospectus

(except where otherwise indicated) account for a 1:40 reverse stock split of our ordinary shares that occurred on December 3, 2024. Any

share and per share amounts incorporated by reference into this prospectus from documents that we have previously fielded with the SEC

do not account for such reverse stock split.

PROSPECTUS

SUMMARY

The

following summary highlights, and should be read in conjunction with, the more detailed information contained elsewhere in this prospectus

or incorporated by reference into this prospectus. You should read carefully the entire document or documents incorporated by reference

in this prospectus, including our historical financial statements and related notes incorporated by reference herein, to understand our

business, the offered securities and the other considerations that are important to your investment decision. You should pay special

attention to the “Risk Factors” section beginning on page 13 as well as the risk factors described under the heading “Risk

Factors” in our Annual Report on Form 20-F for the year ended December 31, 2023, filed on April 9, 2024.

We

are a public company under Dutch law. We were incorporated on March 8, 2021 as a private limited liability company (besloten

vennootschap met beperkte aansprakelijkheid) under Dutch law. We were formed to acquire PharmGenomics GmbH (“PharmGenomics”),

a German company with limited liability, and we acquired PharmGenomics on September 20, 2021. On November 9, 2021, we converted

into a Dutch public company with limited liability (naamloze vennootschap). The address for our principal place of business is

Robert Koch Strasse 50, 55129 Mainz, Germany, and the telephone number is +49 6131 5542860.

We

have registered our ordinary shares under the Exchange Act, and we intend to make our current and periodic reports and other information

(including interactive data files) filed with or furnished to the SEC, pursuant to Section 13(a) or 15(d) of the Exchange Act,

available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically

filed with, or furnished to, the SEC. The SEC maintains a website at http://www.sec.gov that contains reports and other information

regarding issuers that file electronically with the SEC, and all of our reports and other information filed or submitted publicly with

the SEC may also be found there.

Information

on our website or any other website is not incorporated by reference into this annual report and does not constitute a part of this annual

report. We have included our website address as an inactive textual reference only.

General

We

develop and market in-vitro diagnostic (“IVD”) tests for early cancer detection, initially focusing on colorectal cancer

(“CRC”) and advanced precancerous lesions. Our flagship product, ColoAlert, is currently available in European markets. Additionally,

we are developing a next-generation mRNA-based colorectal cancer screening test, with plans for future launch in both the United States

and Europe. While we operated a clinical diagnostic laboratory through 2023 and early 2024, our primary business model focuses on distributing

IVD kits to third-party laboratories across Europe and the United States.

Our

research and development efforts are aimed at expanding and diversifying our product portfolio. In 2023 and early 2024, we managed a

government-funded R&D project for early pancreatic cancer detection, which provided non-refundable grant income to cover a portion

of related project costs. Although this funding has concluded, we have continued our R&D activities in 2024, albeit at a reduced

level.

We are headquartered in Mainz, Germany where

we have approximately 25 employees.

Products

and Product Candidates

Our

mission is to enhance disease diagnosis by applying cutting-edge genetic diagnostic technologies, enabling earlier and more accurate

detection for timely and improved treatment. Alongside our current ColoAlert CRC screening test, we are developing an advanced mRNA-based

CRC screening test, as well as PancAlert, a product candidate for pancreatic cancer detection. Our approach integrates proprietary, validated

biomarkers with reliable diagnostic tools, further strengthened by machine learning and artificial intelligence to optimize accuracy

and applicability. We strive to make the diagnosis of various diseases more effective by using the latest genetic diagnostic technologies.

Enabling earlier detection of these diseases allows for earlier and better therapy for affected individuals. In addition to offering

the CRC screening test, ColoAlert, we are currently developing our product candidate PancAlert for the detection of pancreatic cancer.

We aim to use proprietary, known and existing biomarkers in applicable and reliable diagnostic tools.

ColoAlert

and Our Next Generation Colorectal Cancer Screening Test

We currently offer ColoAlert, a CE-IVD certified

diagnostic test for CRC to laboratories across Europe. The CE-IVD marking indicates that our diagnostic test complies with the European

In-Vitro Diagnostic Devices Directive (IVDD 98/79/EC) Its simple, at-home collection process makes it easier for individuals to

participate in CRC screening, promoting early detection and increasing the likelihood of effective treatment.

According the World Health Organization, as

of July 2023 CRC is the third most commonly diagnosed cancer in the world. 1 Due to its ability to move into large, adjacent

areas leading to other cancers, including pancreatic cancer and other gastro-intestinal cancers, the World Health Organization suggests

as of February 2022, CRC is the second leading cause of cancer death globally.2 Further, Global Market Insights anticipates

that the annual market for CRC diagnostics will surpass $30 billion by 20323. Colorectal cancer screening presents a significant

opportunity in the molecular diagnostics market.

In the intestines, epithelial cells are continuously

shed into the stool. This includes not only healthy cells but also cells from polyps and colon cancer. Using advanced genetic diagnostic

techniques like PCR analysis—which amplifies DNA from a small sample into millions of copies—these shed cells can be isolated

and examined for genetic mutations, enhancing the early detection of CRC.

ColoAlert is a multitarget test that analyzes

stool samples for both genetic abnormalities and hidden (occult) blood by combining a fecal immunochemical test (“FIT”) for

detection of human hemoglobin with the PCR results of specific tumor DNA markers. The genetic analysis includes quantifying human DNA

and detecting specific somatic point mutations in the KRAS (codon 12/13) and BRAF (codon 600) genes. An independent clinical study led

by Professor Matthias Dollinger and conducted with 566 patients at the University Hospitals of Leipzig and Halle-Wittenberg, Germany,

demonstrated ColoAlert’s high sensitivity (85%) and specificity (92%), with a patient satisfaction rate of 98%. The selected genetic

markers enhance the diagnostic precision of the occult blood test, increasing the clinical value of the test. Since this study, we have

upgraded the occult blood test component of ColoAlert to a fully automated version, further improving the test’s overall sensitivity.

Early screening for CRC has the potential

to dramatically impact its treatment and prevention and, ultimately, save lives. For example, the Journal of the National Cancer Institute

has reported in 2022 that diagnostic tests with a sensitivity of 10% for advanced adenomas (“AA”), a type of pre-cancerous

polyp often attributed to CRC, could reduce mortality rates for adults over 45 by 47% and that diagnostic tests with

a sensitivity of 76% for AA could reduce mortality rates for adults over 45 by 67%.5 Most CRC screening programs currently

recommend beginning screening at age 50. However, there is a growing trend to lower this starting age. For example, the U.S. Food and

Drug Administration (the “FDA”) recently recommended starting CRC screening at age 45. This means that as members of Generation

X age into their 40s and 50s they become part of the age group recommended to begin testing for CRC. In 2023, the American Cancer Society

highlighted the rapid progression of CRC among younger individuals, noting that CRC diagnoses in people under 55 increased from 11% in

1995 to 20% in 2019. Given the rising prevalence of CRC in younger populations, we anticipate that screening guidelines will continue

to lower the starting age, particularly for methods like ColoAlert that can detect cancer in its early stages. Additional factors supporting

CRC screening include a family history of CRC, risk factors such as obesity, irritable bowel syndrome (IBS), inflammatory bowel disease

(IBD), high consumption of red meat, alcohol, and nicotine, as well as pre-existing conditions like breast cancer or type 2 diabetes.

Until

February 2023, we licensed the ColoAlert test from the Norwegian research and development firm ColoAlert AS. In February 2023, we acquired

the test and its related intellectual property from ColoAlert AS under an agreement that includes: (i) a $2 million cash payment, to

be made over the next four years, (ii) the issuance of 300,000 ordinary restricted shares, and (iii) a revenue share capped at $1 per

test sold over a 10-year period.

In

the European Union, the ColoAlert PCR kit (“ColoAlert Lab Kit Core II”) is CE-IVD certified under the current In-Vitro Diagnostics

Directive 98/79/EC (IVD-D). As of May 26, 2022, IVD products in the EU are regulated by the In-Vitro Diagnostics Regulation, EU 2017/746

(IVD-R), which supersedes the IVD-D. The ColoAlert sample collection kit has already been successfully registered under the IVD-R, and

we are currently assessing the requirements to certify our ColoAlert PCR kit under these new regulations. ColoAlert is validated for

use on the Roche LightCycler 480 II, and Mainz BioMed plans to validate it for additional real-time PCR instruments used in laboratories

worldwide, which may accelerate market adoption. The ColoAlert PCR kits are manufactured at our facility in Mainz, Germany.

| 1 | https://www.who.int/news-room/fact-sheets/detail/colorectal-cancer |

| 2 | https://www.who.int/news-room/fact-sheets/detail/cancer |

| 3 | https://www.gminsights.com/industry-analysis/colorectal-cancer-diagnostics-market |

| 54 | https://academic.oup.com/view-large/365872704 |

In

January 2022, we entered into a Technology Rights Agreement concerning a portfolio of novel mRNA biomarkers developed at the Université

de Sherbrooke (“UdeS Biomarkers”). mRNA testing can detect molecular changes in cells even before visible abnormalities or

symptoms manifest. mRNA biomarkers often reflect the dynamic changes in gene expression that occur during the progression of adenomas

to advanced stages. As adenomas evolve, certain genes may be upregulated or downregulated, and RNA biomarkers can capture these changes,

providing insights into the stage of adenoma development. mRNA biomarkers are highly specific to particular stages or types of adenomas.

By targeting RNA molecules associated with the advanced stage of adenomas, we believe that these biomarkers can distinguish between advanced

adenomas and less advanced forms or benign conditions.

Through

our agreement with the Université de Sherbrooke, we obtained an exclusive, unilateral option to acquire a license for the UdeS

Biomarkers. We exercised this option on February 15, 2023, by entering into an Assignment Agreement to acquire the intellectual property

rights for these biomarkers. In exchange, we agreed to (i) pay €25,000 in cash and (ii) provide a 2% profit share of net sales from

any products incorporating the UdeS biomarkers.

Historical and Proposed

Clinical Trials

The

UdeS Biomarkers consist of five gene expression markers shown to be highly effective in detecting colorectal cancer (CRC) lesions, including

advanced precancerous lesions, AAs, a type of precancerous polyp often associated with CRC. In a UdeS-sponsored study evaluating these

biomarkers, results demonstrated sensitivities of 75% for detecting AA and 95% for CRC, with a specificity of 96%.

Clinical validation and

trials – Statistics and Proposed Timeline

In

relation to the UdeS Biomarkers, we initiated two feasibility studies to assess our next-generation mRNA CRC screening test, combining

UdeS Biomarkers with FIT tests. The first study, ColoFuture, is an international, multicenter clinical study across Europe designed to

validate the effectiveness of the UdeS biomarkers, specifically their capability to identify advanced precancerous lesions or AA while

enhancing sensitivity and specificity for CRC detection. ColoFuture includes 662 participants, covering individuals with average CRC

risk and those at increased risk or known to have CRC or AA. Enrollment in ColoFuture concluded in late 2023.

Additionally,

we conducted a U.S.-based multicenter study called “eAArly DETECT,” which evaluates feasibility and stability in 450 participants,

including those with average CRC risk and individuals at elevated risk or known to have CRC or AA. eAArly DETECT was completed by the

end of 2023. These studies aim to identify the optimal combination of biomarkers, potentially including mRNA and housekeeping biomarkers

alongside a FIT test, for our next-generation product. This product will undergo further testing in the eAArly DETECT v2 study and in

the evaluation in our pivotal FDA PMA study, labeled “reconAAsense.” Both ColoFuture and eAArly DETECT studies utilized an

advanced machine learning and AI-driven algorithm, developed in partnership with Liquid Biosciences, based in California.

In October 2023, we announced the results

of the ColoFuture study, which demonstrated a sensitivity of 94% for colorectal cancer (CRC) and 97% specificity, along with an 80% sensitivity

for Aas and 95% specificity. In December 2023, we released topline results from our eAArly DETECT clinical study in the U.S., which reported

a sensitivity of 97% for CRC, 97% specificity, and an 82% sensitivity for advanced adenomas and 97% specificity. These topline results

reaffirm the positive findings from ColoFuture, our European counterpart, which were reported in October 2023.

The

eAArly DETECT study enrolled 254 evaluable subjects across 21 sites in the United States, featuring a design similar to that of ColoFuture.

Patients aged 45 and older were invited to participate when referred for a colonoscopy, whether for CRC screening (average risk), follow-up

on a positive non-invasive test, imaging, or symptoms. Additionally, individuals already diagnosed with CRC were included prior to receiving

treatment. Participants who agreed to provide a stool sample before the colonoscopy (or treatment for identified CRC patients) were eligible.

Subjects were classified following a central pathology review: CRC, advanced adenoma, non-advanced adenoma, no findings, or non-colorectal

cancer. Each subject’s outcome was then compared to the results of the next-generation mRNA-based CRC screening test.

In

June 2024, the Company presented pivotal data from its largest cohort to date during a poster session at the American Society of Clinical

Oncology (ASCO) 2024 Annual Meeting in Chicago, Illinois. This data combined results from the ColoFuture and eAArly DETECT studies, along

with additional patients collected since the initial study results were reported, underscoring the significance of our innovative screening

approach.

The

combined analysis included 690 clinical subjects from 30 specialized gastroenterology centers across Europe and the United States, incorporating

previously unexamined and unreported samples. This highlighted the exceptional efficacy of Mainz Biomed’s multimodal screening

test, which integrates the Fecal Immunochemical Test (FIT) with proprietary mRNA biomarkers, supported by an advanced AI and machine

learning algorithm. This comprehensive approach allows for precise differentiation between colorectal cancer (CRC), AAs, non-advanced

adenomas, and samples with no pathological findings.

| | |

ColoFuture | | |

eAArly

DETECT | | |

Pooled

study | |

| CRC

Sensitivity | |

| 94 | % | |

| 97 | % | |

| 92 | % |

| CRC

Specificity | |

| 97 | % | |

| 97 | % | |

| 90 | % |

| AA

Sensitivity | |

| 80 | % | |

| 82 | % | |

| 82 | % |

| AA

Specificity | |

| 95 | % | |

| 97 | % | |

| 90 | % |

| Location | |

| EU | | |

| US | | |

| EU

& US | |

| # of Participants | |

| 220 | | |

| 254 | | |

| 690 | |

The

following tables set out the CRC and AA sensitivity and specificity results of our next-generation mRNA CRC screening test as compared

to some competing products.

Recent Developments

In November 2024, we entered into a Collaboration

Agreement with Life Technologies Corporation, a subsidiary of Thermo Fisher Scientific Inc. (“Thermo Fisher”). Thermo Fisher

is a world leader in serving science, with annual revenue over $40 billion in its latest fiscal year. The collaboration agreement provides

us the opportunity to develop our mRNA based next generation assays on the Thermo Fisher Extraction (King Fisher) and PCR (QuantStudio)

platforms. Life Science Technologies will contribute development resources and provide the extraction and PCR instrumentation and consumables

during development at significant discounts to market. There is no minimum cost expenditure in connection with the development of the

assays. All of the development work will occur in our facility in Mainz, Germany.

| |

|

|

|

| |

Thermo KingFisher APEX |

QuantStudio™ 7 Pro Dx

(Thermo Fisher Scientific) |

|

| 5 | Chung

D, et al. N Engl J Med 2024;390:973-983 |

| 6 | Imperiale

T, et al. N Engl J Med 2024;390:984-93 |

| 7 | Barnell

E, JAMA, 2023;330(18):1760-1768 |

| 8 | Barnell E, et al. JAMA, 2023;330(18):1760-1768 |

| 9 | Imperiale T, et al. N Engl J Med 2024;390:984-93 |

| 10 | Barnell E, JAMA, 2023;330(18):1760-1768 |

| 11 | Chung D, et al. N Engl J Med 2024;390:973-983 |

Expansion of ColoAlert in Europe

We have advanced

ColoAlert’s commercial presence in Germany, leveraging our headquarters proximity to Frankfurt. In the near term, Germany will

remain our focal market, as we aim to enlarge our footprint by building new laboratory partnerships and increasing product visibility.

Through our medical

lab partners in Germany, ColoAlert is offered to medical professionals overseeing CRC screening in Germany. This group is not limited

to the 1,800 gastroenterologists who primarily conduct colonoscopies but extends to 55,000 general practitioners and over 7,000 specialized

practices in gynecology and urology, who customarily initiate CRC screening, predominantly through the FIT stool test. For individuals

with statutory health insurance, ColoAlert is an out-of-pocket expense. However, it may be reimbursed on a case-by-case basis for those

with private insurance. Out of Germany’s 84 million populace, approximately 10 million have private health coverage. To facilitate

sales, we are developing targeted marketing resources and planning to engage physicians and healthcare providers at medical conferences.

Our strategy focuses

on partnering with laboratories that have a stronghold in CRC screening. These partnerships enable us to reach broader physician networks

affiliated with these labs. Approximately 12 lab chains in Germany process about 64% of the FIT tests, amounting to roughly 3 million

tests annually. By partnering with significant lab chains and independent laboratories, we aim to amplify ColoAlert’s market penetration.

We are not currently

seeking statutory reimbursement for ColoAlert, as we believe our next-generation test, currently under development, is more attuned to

the stringent criteria set by German regulatory and reimbursement agencies. With enhanced sensitivity and specificity for detecting early-stage

colorectal cancer and advanced adenomas, this forthcoming product is poised for inclusion in statutory reimbursement schemes, thereby

establishing a solid market presence in anticipation of its release.

Mainz Biomed is progressively

extending its operations to additional European markets that are accustomed to personal health expenditures, as ColoAlert is not included

in statutory health insurance programs in these regions. Currently, our reach includes established connections in the United Kingdom,

Spain & Portugal, Italy, Austria.

Through our commercial

team, we aim to expand our reach within other European markets.. Our growth strategy is to target clinical labs directly, bolstering

our sales efforts with specialized training for sales reps, educational seminars for physicians, and joint marketing initiatives to heighten

ColoAlert’s profile.

As we pursue these expansions, we remain committed to adapting our commercial strategies

to align with the healthcare payment practices prevalent in each locale. We recognize the importance of catering to markets with a predisposition

towards out-of-pocket payments for health services, which presents a favorable environment for ColoAlert’s integration and acceptance

in the near term, while pursuing statutory reimbursement for our next generation product.

PancAlert

We

are in the early stages of developing PancAlert, a stool-based screening test aimed at detecting pancreatic cancer. According to the

Global Cancer Observatory, over 460,000 cases of pancreatic cancer were diagnosed worldwide in 2018. Due to its asymptomatic early stages,

this disease is often detected too late, making pancreatic cancer one of the most lethal malignancies, with over 430,000 annual deaths

reported by the Global Cancer Observatory. In the United States, the SEER program estimated 62,210 new cases and 49,830 deaths from pancreatic

cancer in the same year. Between 2012 and 2018, SEER reported that the 5-year survival rate was approximately 44% for localized cases,

15% for regional cases, and only 3% for distant-stage disease. Studies have indicated that asymptomatic patients diagnosed incidentally

during other medical examinations have significantly better prognoses than those presenting with characteristic symptoms, such as rapid

weight loss or back pain.

The

average age of onset for pancreatic cancer is 71 years for men and 75 years for women, with age being a significant risk factor similar

to other cancers. Most patients are over 50, with the majority of diagnoses occurring between the ages of 60 and 80. Despite being the

seventh most common cancer, pancreatic cancer ranks as the third leading cause of cancer-related death in the European Union, underscoring

the dire prognosis for patients. Although survival rates for pancreatic cancer have improved in recent decades, there remains an urgent

need for enhanced early diagnostic methods.

A

definitive diagnosis of pancreatic cancer is currently made through a series of investigations, including imaging scans, blood tests,

and biopsies, which are typically conducted only in symptomatic patients. However, recent research indicates that the disease can persist

for an extended period without presenting symptoms, highlighting a crucial opportunity for early detection. Since pancreatic cancer initiates

at the molecular level, genetic diagnostic methods show promise for early identification. Biomarkers associated with pancreatic cancer

can be found in the stool, primarily via pancreatic juice, facilitating user-friendly sample collection.

Our

development strategy involves selecting and validating a specific panel of biomarkers, establishing an appropriate method for sample

preparation, and validating the detection and measurement technology using purchased or clinically defined samples (biopsies, pancreatic

juice, stool, and others). The next steps include transitioning to routine diagnostics using stool samples, optimizing the process, and

conducting clinical evaluations to assess its potential as a screening tool for the early detection of pancreatic cancer.

Our

goal is to establish PancAlert as the world’s first pancreatic cancer screening test utilizing Real-Time PCR-based multiplex detection

of molecular-genetic biomarkers in stool samples. We have recently partnered with Liquid Biosciences, an artificial intelligence and

machine learning company, to further evaluate the most promising candidates for disease-specific biomarkers. The platform technology

we are using will also allow for the easy integration of additional biomarkers as needed.

We have entered into an agreement with Microba

Life Sciences to conduct a pilot research project utilizing Microba’s proprietary metagenomic sequencing technology and bioinformatic

tools to potentially discover novel microbiome biomarkers for pancreatic cancer detection. We believe that this relationship could provide

multiple diagnostic opportunities including discovery of diagnostic and prognostic biomarkers. Such faecal microbiota-based screening

could also be applicable to other gastrointestinal cancers. There is no minimum cost expenditure in connection with

the agreement.

Strategy

Realignment

Between

July 2024 and October 2024, we restructured our operations to concentrate on: (1) our ColoAlert business in Europe, (2) the development

of its next-generation product, and (3) planning and conducting the eAArly Detect 2 clinical study in the U.S. in 2025, aimed at validating

the strong clinical performance of our next-generation mRNA-based CRC screening test in an average-risk population.

In

line with this focus, we implemented cost reduction measures, including a 65% reduction in personnel, decreased external consulting expenses,

and the sale or closure of its European Oncology Lab (EOL) business in St. Ingbert, Germany. We believe that these cost reductions will

position the business for success in 2025 and beyond.

Legal Proceedings

In connection with a right of first refusal granted

to an investment bank in connection with our initial public offering in 2021, Mainz filed a lawsuit against such investment bank in 2024

in the New York State Supreme Court in New York County, asking the court to determine our and the investment banks rights and obligations

under the relevant contracts by and between us and the investment bank. Shortly after our filing of such lawsuit, the investment

bank initiated arbitration proceedings against us with the Financial Industry Regulatory Authority (“FINRA”). Thereafter,

we requested the arbitration panel stay its proceeding in light of the existing lawsuit. The arbitration panel agreed with us and

on September 13, 2024, issued an order formally staying the arbitration proceeding.

Except as set out above, we are not involved in,

or aware of, any legal or administrative proceedings contemplated or threatened by any governmental authority or any other party. As

of the date of this prospectus supplement, no director, officer or affiliate is a party adverse to us in any legal proceeding or has an

adverse interest to us in any legal proceeding.

Convertible Note Development

We have reached an agreement with the holder

of our remaining convertible debenture, which has approximately $1.4 million in principal outstanding as of the date hereof, for the

repayment of such convertible debenture. Pursuant to this agreement, we would pay approximately $0.4 million on such convertible note

plus any accrued and unpaid interest thereon at or shortly after the successful conclusion of this offering and thereafter we would pay

$100,000 of the unpaid interest (plus a redemption premium of 8% and any accrued but unpaid interest) each month for ten months starting

on January 31, 2025. The holder of the convertible debenture has agreed that it will be unable to convert any portion of the convertible

debenture that remains outstanding until July 1, 2025, but it may thereafter utilize the conversion provisions of the convertible debenture.

As a result, we do not know the exact amount of the cash payments that we will have to make under the convertible debenture, but it will

range from a minimum of approximately $1.0 million (plus accrued and unpaid interest) to $1.5 million (plus accrued but unpaid interest).

The funds for such repayment will come from cash on hand, the net proceeds of this offering and, if applicable, any future financings.

IMPLICATIONS

OF BEING AN EMERGING GROWTH COMPANY

We

qualify as and elect to be an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012,

or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable

generally to public companies. These provisions include, but not limited to:

| ● | reduced

disclosure about the emerging growth company’s executive compensation arrangements

in our periodic reports, proxy statements and registration statements; and |

| ● | an

exemption from the auditor attestation requirement in the assessment of our internal control

over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

We

may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company.

We would cease to be an emerging growth company if we have more than $1.07 billion in annual gross revenue, have more than $700 million

in market value of our shares of ordinary shares held by non-affiliates or issue more than $1.0 billion of non-convertible debt

over a three-year period.

Implications

of Being a Foreign Private Issuer

We

are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies.

For example:

| ● | we

are not required to provide as many Exchange Act reports or provide periodic and current

reports as frequently, as a domestic public company; |

| ● | for

interim reporting, we are permitted to comply solely with our home country requirements,

which are less rigorous than the rules that apply to domestic public companies; |

| ● | we

are not required to provide the same level of disclosure on certain issues, such as executive

compensation; |

| ● | we

are exempt from provisions of Regulation FD aimed at preventing issuers from making

selective disclosures of material information; |

| ● | we

are not required to comply with the sections of the Exchange Act regulating the solicitation

of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

and |

| ● | we

are not required to comply with Section 16 of the Exchange Act requiring insiders

to file public reports of their share ownership and trading activities and establishing insider

liability for profits realized from any “short-swing” trading transaction. |

Summary

Risk Factors

An investment in the offered securities involves

a high degree of risk. If any of the factors below or in the section entitled “Risk Factors” occurs, our business, financial

condition, liquidity, results of operations and prospects could be materially and adversely affected.

Risks

Related to Our Business Generally

| ● | We

are an early revenue stage company and have incurred operating losses since inception, and

we do not know when we will attain profitability. An investment in our securities is highly

risky and could result in a complete loss of your investment if we are unsuccessful in our

business plans. |

| ● | Terms

of subsequent financings may adversely impact your investment. |

| ● | Our

inability to manage growth could harm our business. |

| ● | We

substantially depend upon our management. |

| ● | Our

financial statements for the fiscal year ended December 31, 2023 include an explanatory paragraph

from our auditor indicating that there is substantial doubt about our ability to continue

as a going concern. |

| ● | You

may face difficulties protecting your interests, and your ability to protect your rights

through the U.S. federal courts may be limited because we are incorporated under the

laws of the Netherlands, a substantial portion of our assets are in the European Union and

substantial portion of our directors and executive officers reside outside the United States. |

Risks

Related to Our Technology and Business Strategy

| ● | We

may fail to generate sufficient revenue from our relationships with our clients or laboratory

partners to achieve and maintain profitability. |

| ● | Our

success depends heavily on our ColoAlert screening tests. |

| ● | Sales

of our diagnostic tests could be adversely impacted by the reluctance of physicians to adopt

the use of our tests and by the availability of competing diagnostic tests. |

| ● | We

may not succeed in establishing, maintaining and strengthening ColoAlert and other brands

associated with our products, which would materially and adversely affect acceptance of our

diagnostic tests, and our business, revenues and prospects. |

| ● | We

might decide not to incorporate the UdeS Biomarkers after we conclude additional studies

on such biomarkers. |

| ● | We

may face technology transfer challenges and expenses in adding new tests to our portfolio

and in expanding our reach into new geographical areas. |

| ● | We

may depend on possible future collaborations to develop and commercialize many of our diagnostic

test candidates and to provide the manufacturing, regulatory compliance, sales, marketing

and distribution capabilities required for the success of our business. |

| ● | If

we are unable to obtain and enforce patents and to protect our trade secrets, others could

use our technology to compete with us, which could create undue competition and pricing pressures.

There is no certainty that any future patent applications will result in the issuance of

patents or that issued patents, if we receive any, will be deemed enforceable. |

| ● | Results

of FDA required studies may not create desired clinical performance resulting in follow-on

studies delaying the launch of the product in the US. |

Risks

Related to Regulations

| ● | Our

global operations expose us to numerous and sometimes conflicting legal and regulatory requirements,

and violations of these requirements could harm our business. |

| ● | Our

business is subject to various complex laws and regulations. We could be subject to significant

fines and penalties if we or our partners fail to comply with these laws and regulations. |

| ● | We

will have to maintain facilities, or maintain relationships with third party laboratories,

for the manufacture and use of diagnostic tests. Our ability to provide services and pursue

our research and development and commercialization efforts may be jeopardized if these facilities

were to be harmed or rendered inoperable. |

| ● | We

anticipate being required to obtain regulatory approval of our diagnostic test products to

enter new markets. |

Risks Related to the Offered Securities

and this Offering

| ● | This

is a best-efforts offering, no minimum amount of securities is required to be sold and we

may not raise the amount of capital we believe is required for our business plans. |

| ● | The

market price of our ordinary shares may be volatile and may fluctuate in a way that is disproportionate

to our operating performance. |

| ● | You

will experience immediate and substantial dilution as a result of this offering. |

| ● | You

may experience dilution of your ownership interests if we issue additional ordinary shares

or preferred shares. |

| ● | We

do not intend to pay dividends, and there will thus be fewer ways in which you are able to

make a gain on your investment. |

| ● | We

do not intend to pay dividends, and there will thus be fewer ways in which you are able to

make a gain on your investment. |

| ● | FINRA

sales practice requirements may limit your ability to buy and sell our ordinary shares, which

could depress the price of our shares. |

| ● | Volatility

in our ordinary shares price may subject us to securities litigation. |

| ● | We

have been notified by Nasdaq that we are not in compliance with certain standards which Nasdaq

requires listed companies meet for their respective securities to continue to be listed and

traded on its exchange. If we are unable to regain compliance with such continued listing

requirements, Nasdaq may choose to delist our securities from its exchange or may subject

us to additional restrictions, which may adversely affect the liquidity and trading price

of our securities. |

| ● | In

an effort to regain compliance with the Minimum Bid Price Requirement, we enacted a reverse

stock split, and the public market may react negatively to this reverse stock split. |

| ● | We

have broad discretion in the use of the net proceeds from this offering and may not use them

effectively. |

| ● | There

is no public market for the pre-funded warrants, the Class A Warrants and the Class B Warrants

being offered in this offering. |

| ● | Holders

of the pre-funded warrants, the Class A Warrants and the Class B Warrants purchased in this

offering will have no rights as ordinary shareholders until such holders exercise such respective

warrants and acquire our ordinary shares, except as otherwise provided in the respective

warrants. |

Offering

Summary

Ordinary Units Offered:

|

|

1,147,776 ordinary units at an assumed offering price of $6.97 per

ordinary unit, the closing price of our ordinary shares on the Nasdaq Capital Market on December 6, 2024, rounded to the nearest whole

cent. Each ordinary unit consists of one ordinary share, one Class A Warrant and one Class B Warrant |

| |

|

|

Pre-Funded Units Offered:

|

|

Up

to 1,147,776 pre-funded units at an assumed offering price of $6.97 per pre-funded unit, the closing

price of our ordinary shares on the Nasdaq Capital Market on December 6, 2024, rounded to the

nearest whole cent minus $0.0001. We are offering to each purchaser of ordinary units that would

otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding

ordinary shares immediately following the consummation of this offering the opportunity to purchase

pre-funded units in lieu of ordinary units. Each pre-funded unit consists of one pre-funded warrant

to purchase an ordinary share, one Class A Warrant and one Class B Warrant.

For each pre-funded unit we sell (without

regard to any limitation on exercise set forth therein), the number of ordinary units we are offering will be decreased on a one-for-one

basis.

|

| Pre-Funded Warrants: |

|

Each pre-funded warrant will be exercisable for one ordinary share.

The remaining exercise price of each pre-funded warrant will equal $0.0001 per ordinary share. The pre-funded warrants will be immediately

exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the pre-funded warrants are exercised

in full. |

| |

|

|

| Class A Warrants: |

|

Each Class A Warrant will be exercisable for one ordinary share. The exercise price of each Class

A Warrant will equal the per ordinary unit offering price hereunder, which we have assumed to be $6.97 based on the closing price

of our ordinary shares rounded to the nearest whole cent on the Nasdaq Capital Market on December 6, 2024. The Class A Warrants will

be immediately exercisable (subject to the beneficial ownership cap) and may be exercised until the fifth anniversary from the date

of issuance. |

| |

|

|

| Class B Warrants: |

|

Each Class B Warrant will be exercisable for one ordinary share. The exercise price of each Class

B Warrant will equal to the per ordinary unit offering price hereunder, which we have assumed to be $6.97 based on the closing price

of our ordinary shares rounded to the nearest whole cent on the Nasdaq Capital Market on December 6, 2024. The Class B Warrants will

be immediately exercisable (subject to the beneficial ownership cap) and may be exercised until the earlier of (i) the first anniversary

of the date of issuance or (ii) 30 days following the public disclosure of results from the eAArly Detect 2 study. |

| |

|

|

| Beneficial Ownership Limitation: |

|

A holder of pre-funded warrants, Class

A Warrants and Class B Warrants will not have the right to exercise any portion of those warrants if the holder, together with its

affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of ordinary shares

outstanding immediately after giving effect to such exercise.

|

| Shares Outstanding After the Offering*: |

|

3,149,276 |

| |

|

|

| Use of Proceeds: |

|

We estimate that we will receive net proceeds of approximately $7,125,000 from this offering, after deducting the placement agent

fees and estimated offering expenses of approximately $875,000 payable by us. However, because this is a best-efforts offering

and there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, the

placement agent’s fees and net proceeds to us are not presently determinable and may be substantially less than the maximum

amounts set forth on the cover page of this prospectus.

We intend to use the net proceeds from

this offering for the eAArly Detect 2 study, the development of our next generation screening product, the commercial expansion of

our ColoAlert product, repayment of convertible debt and for general corporate purposes. |

| Market for the Offered Securities: |

|

Our

ordinary shares are currently listed on the Nasdaq Capital Market under the symbol “MYNZ”.

The closing price of our ordinary shares rounded to the nearest whole cent on the Nasdaq

Capital Market on December 6, 2024 was $6.97.

There is no market for any of our pre-funded

warrants, Class A Warrants or Class B Warrants, and we do not anticipate that one will develop for any of these securities. We do

not intend to apply for our pre-funded warrants, Class A Warrants or Class B Warrants to be traded on any public market or quotation

system.

|

| Risk Factors: |

|

See “Risk Factors” for a discussion of the factors you should consider before deciding to invest in our securities. |

| |

|

|

| Reasonable Best Efforts: |

|

We have agreed to offer and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 42 of this prospectus. |

| |

* |

Shares

outstanding after the offering (i) is based on 2,001,500 ordinary shares that are outstanding as of the date of this prospectus,

(ii) assumes an offering price of $6.97 per share, the closing price of our ordinary shares rounded to the nearest whole cent on

the Nasdaq Capital Market on December 6, 2024, (iii) assumes that any pre-funded warrants sold hereunder are immediately exercised

and (iv) excludes: |

| |

● |

up to 104,167 ordinary shares underlying warrants that are outstanding

as of the date hereof; |

| |

|

|

| |

● |

up to 2,295,552 ordinary shares

underlying the Class A Warrants and Class B Warrants that are being offered hereby; |

| ● | up

to 69,679 ordinary shares underlying options that we have granted as of the date hereof;

and |

| ● | up

to 348,122 ordinary shares underlying principal as of the date hereof under outstanding convertible

notes (assuming their conversion at the floor price contained in such notes). |

Summary

Financial Data

The

following tables summarize our financial data. We derived the summary financial statement data for the years ended December 31,

2023 and 2022 set forth below from our audited financial statements included in our Annual Report on Form 20-F filed on April 9, 2024

(each of which are incorporated by reference into this prospectus), and for the six months ended June 30, 2024 and 2023 from our unaudited

financial statements for the six months ended June 30, 2024 included in our report on Form 6-K filed on October 18, 2024 (which

are incorporated by reference into this prospectus). Our financial statements have been prepared in accordance with International Financial

Reporting Standards as issued by the International Accounting Standards Board. Our historical results are not necessarily indicative

of the results that may be expected in the future. You should read the information presented below together with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” our financial statements, the notes to those statements

and the other financial information incorporated by reference into this prospectus.

Summary

of Operations in U.S. Dollars

| | |

Six Months

Ended

June 30, | | |

Years

Ended

December 31, | |

| | |

2024 | | |

2023 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 520,773 | | |

$ | 499,049 | | |

$ | 895,479 | | |

$ | 529,877 | |

| Cost of Revenues | |

| 201,735 | | |

| 211,310 | | |

| 385,820 | | |

| 347,726 | |

| GROSS PROFIT | |

| 319,038 | | |

| 287,739 | | |

| 509,659 | | |

| 182,151 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Research and Development | |

| 3,242,622 | | |

| 5,481,229 | | |

| 9,590,393 | | |

| 5,019,366 | |

| Sales and marketing | |

| 2,361,105 | | |

| 3,992,975 | | |

| 6,158,477 | | |

| 6,396,906 | |

| General and administrative | |

| 4,522,639 | | |

| 5,227,181 | | |

| 11,405,471 | | |

| 15,209,919 | |

| Total operating expenses | |

| 10,126,366 | | |

| 14,701,385 | | |

| 27,154,341 | | |

| 26,626,191 | |

| Operating loss | |

| (9,807,328 | ) | |

| (14,413,646 | ) | |

| (26,644,682 | ) | |

| (26,444,040 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME/(EXPENSE) | |

| (1,216,434 | ) | |

| (398,997 | ) | |

| 348,955 | | |

| 56,094 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

$ | (11,023,762 | ) | |

$ | (14,812,643 | ) | |

| (26,295,727 | ) | |

| (26,387,336 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| TOTAL COMPREHENSIVE

LOSS | |

$ | (11,086,128 | ) | |

$ | (14,963,239 | ) | |

$ | (26,800,221 | ) | |

$ | (26,337,633 | ) |

Balance

Sheet in U.S. Dollars

| | |

As

of

June 30,

2024 (unaudited)

| | |

As

of December 31, 2023

(audited)

| |

| Cash | |

$ | 977,764 | | |

$ | 7,070,925 | |

| Total

Current Assets | |

| 2,389,703 | | |

| 8,979,896 | |

| Total

Assets | |

| 8,545,030 | | |

| 15,409,028 | |

| Total

Current Liabilities | |

| 10,013,944 | | |

| 9,236,936 | |

| Total

Liabilities | |

| 12,592,730 | | |

| 12,159,802 | |

Working

Deficit | |

$ | (7,624,241 | ) | |

$ | (257,040 | ) |

| Total

Stockholders’ Equity (Deficit) | |

| (4,138,700 | ) | |

| 3,249,226 | |

RISK

FACTORS

An investment in the offered securities

carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in

this prospectus (or incorporated by reference herein), including risk factors in the documents incorporated herein by reference and our

historical financial statements and related notes incorporated by reference herein, before you decide to purchase the offered securities.

Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition

and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a

significant decrease in the value of the offered securities. Refer to “Special Note Regarding Forward-Looking Statements”.

We

may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential

risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties

that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse

effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to the Offered Securities

and this Offering

This

is a best-efforts offering, no minimum amount of securities is required to be sold and we may not raise the amount of capital we believe

is required for our business plans.

The

placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities being offered in this offering.

The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number

or dollar amount of the securities. There is no required minimum number of securities or amount of proceeds that must be sold as a condition

to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering,

the actual offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than

the maximum amounts set forth above. We may sell fewer than all of the securities offered hereby, which may significantly reduce the

amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount

of securities sufficient to fund for our operations as described in the “Use of Proceeds” section herein. Thus, we may not

raise the amount of capital we believe is required for our operations in the short-term and even if we raise the maximum offering amount

in this public offering, we will need to raise additional funds in the future, which may not be available or available on terms acceptable

to us.

The

market price of our ordinary shares may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

The public market for our ordinary shares

has a limited history. Our ordinary shares began trading on the Nasdaq Capital Market on November 5, 2021, and since that date they

have had a high closing price of $1,110.40 per share and a low closing price of $6.79 per share. The daily trading volume and our per

ordinary share market price may decrease significantly after the date of this annual report. The value of our ordinary shares could decline

due to the impact of any of the following factors upon the market price of our ordinary shares:

| ● | sales

or potential sales of substantial amounts of our ordinary shares; |

| ● | announcements

about us or about our competitors; |

| ● | litigation

and other developments relating to our intellectual property or other proprietary rights

or those of our competitors; |

| ● | conditions

in the diagnostic test industry; |

| ● | governmental

regulation and legislation; |

| |

● |

variations in our anticipated

or actual operating results; |

| |

● |

change in securities analysts’

estimates of our performance, or our failure to meet analysts’ expectations; |

| |

● |

change in general economic

trends; and |

| |

● |

investor perception of

our industry or our prospects. |

Many

of these factors are beyond our control. These fluctuations often have been unrelated or disproportionate to the operating performance

of these companies. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal

or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support

continuous sales without an adverse effect on share price. A broad or active public trading market for our ordinary shares may not develop

or be sustained.

You

will experience immediate and substantial dilution as a result of this offering.

You will incur immediate and substantial dilution

as a result of this offering. After giving effect to the sale by us of 1,147,776 ordinary shares (assuming no pre-funded units are sold

in this offering) at an assumed public offering price of $6.97 per ordinary unit and after deducting the placement agent fees and estimated

offering expenses payable by us, investors in this offering can expect an immediate dilution of $2.74 per ordinary share on a pro forma

as adjusted basis (see Dilution).

In addition, you may experience further dilution)

upon the exercise of outstanding warrants, the Class A Warrants and the Class B Warrants being offered hereunder and outstanding options

and the conversion of outstanding convertible debt.

You

may experience dilution of your ownership interests if we issue additional ordinary shares or preferred shares.

In

the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests

of our present shareholders. Any such issuances could dilute your voting and economic interest. For example, as of December 6, 2024,

we had approximately $1,392,487 in principal and interest outstanding under convertible promissory notes. If all of such amounts were

to be converted at the floor price contained in such notes, we would issue approximately 348,122 ordinary shares, an amount that is equal

to 15% of the outstanding shares on the date hereof and 10% of the outstanding shares after this offering, assuming a per ordinary unit

price of $6.97 and that any pre-funded warrants issued hereunder are immediately exercised.

We

may issue additional ordinary shares or other securities that are convertible into or exercisable for ordinary shares in order to raise

additional capital, or in connection with hiring or retaining employees, directors, or consultants, or in connection with future acquisitions

of licenses to technology or diagnostic tests in connection with future business acquisitions, or for other business purposes. The future

issuance of any such additional ordinary shares or other securities, including those underlying the warrants and options we have issued

and granted, would dilute the voting power of our current shareholders, could dilute the net tangible book value per share at the time

of such future issuance and may create downward pressure on the trading price of our ordinary shares.

We

may also issue preferred shares having rights, preferences, and privileges senior to the rights of our ordinary shares with respect to

dividends, rights to share in distributions of our assets if we liquidate our company or voting rights. Any preferred shares may also

be convertible into ordinary shares on terms that would be dilutive to holders of ordinary shares.

We

do not intend to pay dividends, and there will thus be fewer ways in which you are able to make a gain on your investment.

We

have never paid any cash or stock dividends, and we do not intend to pay any dividends for the foreseeable future. To the extent that

we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of any dividends.

Because we do not intend to declare dividends, any gain on your investment will need to result from an appreciation in the price of our

ordinary shares. There will therefore be fewer ways in which you will be able to make a gain on your investment. Our articles of association

prescribe that any profits in any financial year will be distributed first to holders of preferred shares, if outstanding.

We

do not intend to pay dividends, and there will thus be fewer ways in which you are able to make a gain on your investment.

We

have never paid any cash or stock dividends, and we do not intend to pay any dividends for the foreseeable future. To the extent that

we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of any dividends.

Because we do not intend to declare dividends, any gain on your investment will need to result from an appreciation in the price of our

ordinary shares. There will therefore be fewer ways in which you will be able to make a gain on your investment. Our articles of association

prescribe that any profits in any financial year will be distributed first to holders of preferred shares, if outstanding.

FINRA

sales practice requirements may limit your ability to buy and sell our ordinary shares, which could depress the price of our shares.

FINRA

rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending

that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers

must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives,

among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced

securities will not be suitable for at least some customers. Thus, FINRA requirements may make it more difficult for broker-dealers to

recommend that their customers buy our ordinary shares, which may limit your ability to buy and sell our shares, have an adverse effect

on the market for our shares and, thereby, depress their market prices.

Volatility

in our ordinary shares price may subject us to securities litigation.

The

market for our ordinary shares may have, when compared to seasoned issuers, significant price volatility, and we expect that our share

price may continue to be more volatile than that of a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated

securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in

the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert

management’s attention and resources.

We

have been notified by Nasdaq that we are not in compliance with certain standards which Nasdaq requires listed companies meet for their

respective securities to continue to be listed and traded on its exchange. If we are unable to regain compliance with such continued

listing requirements, Nasdaq may choose to delist our securities from its exchange or may subject us to additional restrictions, which

may adversely affect the liquidity and trading price of our securities.

Our

securities are currently listed on Nasdaq. In May 2024, we received written notice (the “Notice”) from the Listing Qualifications