SergeFerrari Group: 2024 First-Half Revenues of €161.9 million

26 7월 2024 - 1:17AM

Business Wire

- Confirmed improvement in second-quarter activity vs. Q1 (-2.5%

vs. -14.1%)

- Ongoing operational execution of the Transform 2025 plan

Regulatory News:

SergeFerrari Group (FR0011950682 – SEFER), a leading global

supplier of innovative flexible composite materials, listed on

Euronext Paris – Compartment C, today announces its revenues for

the first half 2024.

Revenue breakdown by region (unaudited)

(€ thousands)

Q2 2024

Q2 2023

Ch. at current scope and exchange

rates

Ch. at constant scope and

exchange rates

H1 2024

H1 2023

Ch. at current scope and exchange

rates

Ch. at constant scope and

exchange rates

Europe

66,730

65,335

+2.1%

+2.5%

120,519

130,105

-7.4%

-7.1%

Americas

8,325

10,853

-23.3%

-23.9%

16,003

20,129

-20.5%

-20.5%

Asia – Africa – Pacific

13,387

14,537

-7.9%

-9.0%

25,382

25,314

+0.3%

+0.6%

Total revenues

88,442

90,724

-2.5%

-2.5%

161,904

175,548

-7.8%

-7.6%

Sébastien Baril, SergeFerrari Group’s Chairman of the

Executive Board, comments: “In an economic climate that is

gradually coming back to normal, SergeFerrari Group continued to

adapt its cost structure through its Transform 2025 plan. Over the

period, driven by the aim of optimizing our organization, we

decided to concentrate our logistics activities and some of our

cross-functional functions at our La Tour du Pin site, while

continuing activities transfer. Although generating significant

non-recurring expenses in the short term, these initiatives will

reinforce our operating leverage and agility to take full advantage

of the upturn in business expected in the second half of 2024.”

Q2 2024 Activity

Revenues for Q2 2024 totaled €88.4 million, down slightly

(-2.5%) on the same period last year, both on current and constant

scope and exchange rates.

This change is explained by:

- A scope effect of +0.2%, resulting from the final effects of

the creation of BSI, incorporated since Q4 2023;

- A favorable price-mix effect of +9.1%, due mainly to the strong

recovery in the solar protection market;

- A volume effect of -11.8%, due in particular to the decline in

the Modular Structures segment in the Americas and the

Furniture/Marine segment in Europe;

- An exchange rate effect of -0.2%.

H1 2024 activity

The Group reported revenues of €161.9 million for the first half

of 2024, down -7.8% at current scope and exchange rates and -7.6%

at constant scope and exchange rates, as the market context

observed in 2023 continued to weigh on the 1st quarter (Q1 revenues

showed a decline of -14.1% vs. -2.5% in Q2).

Sales trends by geographical area over the half-year were as

follows:

- Sales in Europe fell by -7.4% at current scope and exchange

rates (vs -17.0% for Q1 2024) and -7.1% at constant scope and

exchange rates, for revenues of €121 million over the period,

thanks to a recovery in its historic markets in Q2 2024.

- Sales in Americas fell by some 20.5% on both a current and

constant scope and exchange rates. Sales in the region were

penalized by a wait-and-see environment, and a significant base

effect over the period following a record Q2 2023.

- Sales in the Asia - Africa - Pacific region were stable vs. H1

2023, at +0.3% on current scope and exchange rates, and +0.6% at

constant scope and exchange rates. Good business momentum on

tensile architecture projects offsets lower sales in the modular

structure segment.

Outlook

In the second half of 2024, the Group will continue its efforts

to optimize operations through the various components of its

Transform 2025 plan. The operational implementation of this plan is

notably reflected in transfers of activity between the various

European sites, and the launch of a social plan in Germany linked

to the transfer of Verseidag's logistics activities to the La Tour

du Pin site; this operation should have a significant non-recurring

impact on the results for the first half of 2024 published on

September 9, which should result in a net loss for the half-year.

The implementation of the Transform 2025 plan, combined with an

upturn in business that appears to be underway, gives the Group

confidence in its ability to return to profitability in the medium

term.

Financial Calendar

- Publication of half-year results 2024,

on September 9, 2024, after market close. - Publication of

Q3 2024 revenues, on October 31, 2024, after market

close.

ABOUT SERGEFERRARI GROUP

The Serge Ferrari Group is a leading global supplier of

composite materials for Tensile Architecture, Modular Structures,

Solar Protection and Furniture/Marine, in a global market estimated

by the Company at around €6 billion. The unique characteristics of

these products enable applications that meet the major technical

and societal challenges: energy-efficient buildings, energy

management, performance and durability of materials, concern for

comfort and safety together, opening up of interior living spaces

etc. Its main competitive advantage is based on the implementation

of differentiating proprietary technologies and know-how. The Group

has manufacturing facilities in France, Switzerland, Germany, Italy

and Asia. Serge Ferrari operates in 80 countries via subsidiaries,

sales offices and a worldwide network of over 100 independent

distributors.

In 2023, Serge Ferrari posted consolidated revenues of €327.6

million, over 80% of which was generated outside France. The

SergeFerrari Group share is listed on Euronext Paris – Compartment

C (ISIN: FR0011950682). SergeFerrari Group shares are eligible for

the French PEA-PME and FCPI investment schemes.

www.sergeferrari.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725413867/en/

Valentin Chefson Head of Investor Relations

investor@sergeferrari.com

NewCap Investor Relations – Financial

Communication Théo Martin / Nicolas Fossiez Tél. : 01 44 71 94

94 sferrari@newcap.eu

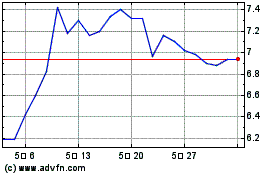

Sergeferrari (EU:SEFER)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

Sergeferrari (EU:SEFER)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025