TIDMWCW

RNS Number : 3135U

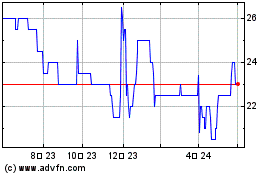

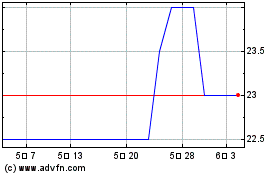

Walker Crips Group plc

29 July 2022

29 July 2022

Walker Crips Group plc

("Walker Crips", the "Company" or the "Group")

Final results for the year ended 31 March 2022

Walker Crips Group plc, the investment management and wealth

management services, pensions administration and regulation

technology Group, announces audited results for the year ended 31

March 2022.

Financial Highlights

-- Total revenues increased 8.1% to GBP32.8 million (2021: GBP30.3 million).

-- A significant improvement in operating profit to GBP326,000

(2021: GBP22,000), being GBP1,866,000 (2021: GBP441,000) when

adjusted for operational exceptional items*.

-- Profit before tax GBP324,000 (2021: loss before tax

GBP114,000), being profit before tax GBP1,761,000 (2021:

GBP305,000) when adjusted for total exceptional items*.

-- Adjusted EBITDA increased 49% to GBP3.90 million (2021: GBP2.61 million) **.

-- Underlying cash generated from operations improves 71% to

GBP1.34 million (2021: GBP0.78 million)***.

-- Cash and cash equivalents GBP11.11 million (2021: GBP8.86 million).

-- Assets Under Management ("AUM") increased by 5.9% to GBP3.6 billion (2021: GBP3.4 billion).

-- Proposed final dividend of 1.20 pence per share (2021: 0.60

pence per share), bringing the total dividends for the year to 1.50

pence per share (2021: 0.75 pence per share).

* Exceptional items are disclosed in note 10 to the accounts and

a full reconciliation to IFRS results is presented in the Finance

Director's review.

** Adjusted EBITDA represents earnings before interest,

taxation, depreciation and amortisation, and exceptional items. The

Directors present this result as it is a metric widely used by

stakeholders when considering an entity's financial performance. A

full reconciliation to IFRS results is provided in the Finance

Director's review.

*** Underlying cash generated from operations represents the

cash generated from operations adjusted for lease liability

payments under IFRS 16, non-cyclical working capital movements and

exceptional items. The Directors consider that this metric helps

readers understand the cash generating performance of the Group. A

full reconciliation to the IFRS results is provided in the Finance

Director's review.

For further information, please contact:

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Craig Harrison, Media Relations

Four Communications

Mark Knight Tel: +44 (0)20 3697 4200

walkercrips@fourcommunications.com

Singer Capital Markets

Will Goode / George Tzimas Tel: +44 (0)20 7496 3000

Further information on Walker Crips Group is available on the

Company's website: www.walkercrips.co.uk

Chairman's statement

Return to operational profitability and continued focus on

improving operating margins.

Martin Wright

Chairman

The combination of the recovery in financial markets and focus

on profit improvement has seen the Group return to profit for the

full year. The core business delivered a strong performance, and

continues to do so in the first part of our new financial year,

albeit the impact of good growth in revenues and improving margins

were marred by the exceptional costs we are reporting and which are

explained further below and in the CEO's report. At a strategic

level, we continue to progress a number of projects that will incur

additional costs in the near-term and, as I said in my statement

for the interim report, the Investment Management division's

project to improve operating margins will be a long-term exercise,

with the overall impact on operating margins expected to be

positive, but unlikely to be smooth from reporting period to

reporting period.

Overview of 2021/2022

The tumultuous events that accompanied my first year as Chairman

of your company have been succeeded by conditions that are,

mercifully, less traumatic but which, perhaps, still deserve to be

labelled as extraordinary. The rapid rise of inflation to 40-year

highs has made management strategy and investment conditions

tricky, to say the least, and markets are understandably struggling

to cope with the impact.

The rewards of management's efforts to reduce costs during the

pandemic, accompanied by the more-benign market conditions which

applied throughout the first three quarters of the financial year,

gave the Group breathing space to focus on improving operating

margins within the Investment Management division, in tandem with

the ongoing efforts to renew growth in the Wealth Management

division. That strategy is bearing fruit and should continue to do

so over the longer-term.

I am also pleased to report that the Structured Investments

business has bounced back from its annus horribilis of the previous

year, under the guidance of its new managers, and I wish them

continued success. The Investment Management division, which

includes the structured investment team, was the principal driver

of growth in operating profits during the year, and the division's

performance was also enhanced by the improved contributions of the

investment management teams in the firm's York, London and

Inverness offices and the Barker Poland Asset Management team in

London. We were disappointed that two investment managers from the

division's Truro office have departed. Having spent eight

successful years in Truro, we are committed to maintaining a local

presence, and will continue to serve our existing clients. I thank

our team members who have stepped in to provide continuity to our

clients, while we recruit locally.

As set out in the financial highlights, revenues for the year

grew by GBP2.5 million to GBP32.8 million and Adjusted EBITDA*

increased by GBP1.29 million to GBP3.90 million (2021: GBP2.61

million), an incremental operating margin of 51.6% and testament to

management's focus on margin improvement. It is therefore extremely

disappointing that the very welcome improvements in financial

performance generally have been undermined by a number of matters

that have given rise to significant exceptional costs. Although

certain exceptional costs relate to the restructuring initiated

during the pandemic, those required firstly to improve our

financial crime framework and separately for the estimated cost of

redress to a small number of customers caused by the actions of one

associate, were neither anticipated nor acceptable. We are making

the changes necessary to address these matters and the associate

concerned has been sanctioned. I would add that insurers have been

informed of the redress matter, although at this stage no recovery

has been recognised in the accounts pending finalisation of the

loss and insurer's confirmation of cover. The Group is taking all

appropriate measures to ensure losses in relation to this matter

are recovered. I can also confirm that the Executive Directors were

not awarded the discretionary bonuses approved by shareholders at

last year's annual general meeting.

Results have also been hampered by the residual effect of the

decline in Bank of England base rates during the previous year and

lower contributions from the Group's alternative businesses.

After exceptional costs, the Group's profit before tax for the

year is GBP324,000, an improvement on the loss of GBP114,000

reported in the previous year. The exceptional costs noted are

non-recurring and therefore, given the underlying improvement in

trading, the Directors are recommending a final dividend of 1.20

pence per share, doubling the previous year's final dividend.

Strategy

The pandemic demonstrated the resilience of the core Investment

Management business, which, exceptional costs aside, has bounced

back robustly. The Wealth Management business has rebounded from

adviser and client losses during the previous year and its

recruitment strategy has started to produce revenue growth. The

York office, which is home to our biggest Wealth Management team

and one of our largest Investment Management teams, leads the firm

in its ability to derive revenue-synergies from both types of

service, and points the way forward for the rest of the Group in

generating top-line growth. We hope to replicate that close working

relationship between the Wealth Management division's new

Southampton office and our other teams of investment managers

around the country.

The Group's seamless transition to flexible working, which is

now more entrenched than ever as a working practice at our own and

most other companies, justified our focus on technology. The Group

believes that continued investment in technology is crucial to

providing innovative and effective services to our clients,

investment managers and staff. EnOC Technologies Limited's project

to commercialise our technology remains a key limb of our growth

plan. The Group will therefore maintain its focus on revenue growth

and margin improvement, and continue keeping a tight rein on costs

in light of current inflationary pressures and the tight labour

markets.

Dividend

Our aim is always to reward our shareholders for their continued

support. In that light, having taken into account the Group's

improved profitability and potential for continuing improved

operating margins, capital headroom, and short-term and long-term

cash flow considerations, the Board will recommend for

shareholders' approval at the forthcoming AGM for a final dividend

of 1.20 pence per share (2021: 0.60 pence) payable on 7 October

2022 to those shareholders on the register at the close of business

on 23 September 2022, with an ex-dividend date of 22 September

2022. As noted earlier, this is a twofold increase on the previous

year's final dividend.

Our community

We believe that in challenging times, it is important that we

continue to support our chosen charities. In addition to financial

support, we try to do more by using our technology for good,

engaging in technology philanthropy, and using technology as a

catalyst to boost the efforts of those charities, working with them

to design, deploy and maintain those systems.

Our partner charity, www.twiningenterprise.org.uk, has a mission

to combat mental health stigma and to assist people who are

struggling with mental health issues around work. Their goal is to

ensure that everyone with a mental health issue can find employment

and cope with the challenges of working life, to support employers

and raise awareness around mental health in general and to reduce

stigma and discrimination.

This is a mission whose work is crucial, as has been highlighted

during this pandemic. We urge you to join us by signing on to

support Twining in their mission, staying informed of their latest

news and activities, and support them financially by going to

www.enoc.pro/community.

Directors, Account Executives and staff

Whilst I am hopeful that the challenging period of the pandemic

is behind us all, and pleased to have reported a return to profit,

the Group nevertheless faces challenges ahead. This includes

acknowledging and making the necessary changes to our culture,

leadership team, behaviours and controls to mitigate recurrence of

the failures that gave rise to the exceptional costs noted above.

We know these costs and the reasons therefore will be disappointing

news for our shareholders. Your Directors and the leadership team

are focused on the required changes and the need to make them

without distracting from the many positive actions being taken to

grow the business and improve margins. I would like to thank my

fellow Directors, our investment managers and advisers and all

members of staff for their efforts, resilience and continued

commitment to the highest levels of client service, support and

diligence.

Outlook

The rebound in the underlying trading performance this year

demonstrates the Group's potential to generate revenue growth and

improve profitability, which continues to bode well for the

future.

Martin Wright

Chairman

29 July 2022

* Adjusted EBITDA represents earnings before interest, taxation,

depreciation and amortisation, and exceptional items. The Directors

present this result as it is a metric widely used by stakeholders

when considering an entity's financial performance. A full

reconciliation to IFRS results is provided in the Finance

Director's review.

CEO's statement

Innovating, Digitising and Focussing on Customer Outcomes

Sean Lam

Chief Executive Officer

I am proud that our investment managers, financial planners,

advisers, and our staff have continued to serve our customers

diligently through the global challenges of the past few years.

There was a job to be done, and they got it done. I am thankful to,

and grateful for, all my colleagues for ensuring that our customers

were well taken care of, without interruption in service.

After nearly two years of working from home, we have now

comfortably settled into a hybrid working model where members can

either work all week in the office, desk-share a few days a week,

hot-desk once in a while, or work from home, depending on the needs

of the department while balancing the needs of the staff. This can

only work if there's mutual trust and responsibility, and I'm

pleased to say that we have both in spades. As long as our

performance and customer engagement remain high, hybrid working can

continue.

Group's Performance

In our Investment Management division, we were sensitive to the

dual risk of a simultaneous fall in asset values and a decline in

interest income, but we reviewed and streamlined certain parts of

our business during the past two years which led to significant

improvements in operating margins and profitability. We will

accelerate our effort to simplify and digitise our business

further, making our business more efficient, more scalable, but

still providing good outcomes to our customers. We will continue to

improve the revenue-growth potential of the existing businesses,

generate greater profitability from such growth opportunities,

while also maintaining a tight control of, and increasing the

productivity of, our cost-base. The division generally had a strong

year, with robust, double-digit growth in fee income offsetting the

decline in commissions and interest income.

Our Wealth Management and Barker Poland Asset Management

divisions have also had a year of strong revenue growth. Our new

Solent branch in Fareham has had a great start and contributed

strongly to the Wealth Management division. Our York office has

worked very well together, providing financial planning, investment

management and pensions (SIPP & SSAS) services, working

together for our customers. The investment team continues to manage

the firm's flagship Service First model portfolios, Inheritance Tax

Relief model portfolios, and has oversight over the Truro branch,

ensuring that we maintain our service offering to our customers in

Cornwall.

Our Structured Investments team contributed to the Investment

Management division's performance with significant growth in fee

income, as the industry bounced back vigorously from a very

difficult last financial year. Walker Crips is now the leading

structured products distributor in the UK and we thank the team for

holding fast during the difficulties of last year, where one of the

most significant players exited the market completely, and we are

now poised to capitalise on the opportunities of this year.

Challenges

We continue to invest heavily in our regulatory framework.

Regulation continues to move forward unabated and we must adapt

swiftly. The next big regulatory initiative is Consumer Duty which,

amongst other things, places emphasis on consumer outcomes and

firms' obligations to proactively deliver them. Firms are required

to take all reasonable steps to avoid causing foreseeable harm to

customers, enabling them to pursue their financial objectives, and

always act in good faith towards them.

During the year, the Investment Management division incurred

significant costs that have been designated exceptional in the

accounts that follow and explained in note 10 to the financial

statements, including two material items I want to address upfront.

The first relates to expenditure to upgrade and improve our

financial crime control framework, which was subject to an

independent review. I wish to stress that there has been no

evidence of financial crime, but our controls and procedures around

this area needed significant improvement. The remediation and

enhancement project commenced during the year and the total

estimated cost of GBP595,000 has been provided for. Secondly, and

separate from upgrading and improving our financial crime control

framework, we identified that there was inappropriate conduct by an

associate that caused financial detriment to a small number of

customers. The associate concerned has been sanctioned and their

contract terminated, and whilst we should have identified it in a

timelier manner, management is satisfied that this was an isolated

incident. All relevant parties have been informed, including the

regulator, and we are in the process of finalising the redress

calculation which is presently estimated to be GBP650,000 including

associated costs before any potential insurance recoveries. Any

future recovery will also be treated as an exceptional item.

In light of these weaknesses, management is embedding a broader

review of the Group's regulatory compliance framework to ensure our

processes are at industry standards and are able to adapt to the

changing regulatory landscape. Our financial planning and budgeting

reflect this planned step-up in risk and compliance costs. We are

also reinforcing a tenet of our core principles that "Compliance

and Risk are everybody's responsibility", renewing our emphasis and

setting the tone from the top.

During the year, the Group sold its one-third share of its

investment in Walker Crips Property Income Limited for GBP105,000.

This will have minimal impact on our future revenues. We stopped

onboarding new customers to the Tier 1 Investor Visa programme in

November 2021 and the government permanently closed the Tier 1

(Investor) Visa route for foreign nationals on 17 February 2022.

For customers who are already in the programme, we will continue to

service them until its natural conclusion.

Nevertheless, the Group is able to report a profit before tax of

GBP324,000 for the full year after all exceptional items, an

improvement on the GBP114,000 loss reported in the previous year.

This was assisted by the return to growth of the core businesses of

investment management, wealth management and structured

investments.

Technology Advantage

We will accelerate our vision to "Simplify and Digitise". We

will do what we do but we must do it better, faster, and more

economically. We will use our EnOC Pro Platform to create

technologies that will transform processes, create greater

efficiencies, reduce the use of paper, provide better services to

our customers, and allow our staff to do the more complex, thinking

work and less of the manual repetitive processes. We must continue

to adapt and innovate, and our dependence on technology will only

increase. We will continue to prioritise and invest in developing

our own technology, utilising our digital capabilities to create

and innovate for our customers and the firm. We are technology

makers, not just technology takers.

Reducing our Carbon Footprint

If we want our children to see tomorrow, like we saw yesterday,

then let's not screw up today. We must not pillage the earth like a

Ponzi scheme; it is unconscionable to plunder from the future to

satisfy today. Put simply, we must safeguard our planet for our

children, and for our children's children.

We consciously began our journey in small steps back in 2007

when we moved offices. We installed PIR lighting, refurbished the

old doors instead of buying new (surprisingly, it costs the same!),

and for the first time embarked on a de-papering exercise. In 2013,

we decided to better utilise cloud services which resulted in the

long-term reduction of our server room size by 75%, reducing heat

emissions by requiring fewer on-site servers, less air conditioning

and less electricity. Our lighting is powered by low-energy

consumption LEDs.

Hybrid working is here to stay, and we are currently merging

some of our offices to better utilise our available square footage.

We have turned off excess appliances like refrigerators and

dishwashers. It may seem minuscule, but it all adds up. We are also

persuading the landlords of our buildings to sign up with "green"

energy suppliers using sustainable resources. One of our mantras is

to "Simplify and Digitise"; digitisation increases efficiencies and

reduces the drain on resources. We have engaged carbon emission

auditors to determine our carbon output, and our goal is to

continue to reduce it each year. Time is running out for our

planet, so it needs to be more like a sprint, and less like a

marathon.

We can all do our part in reducing our carbon footprint:

-- REFUSE - Avoid buying harmful, wasteful or non-recyclable

products, e.g. unnecessary product packaging and single-use

plastics. Don't need, don't buy. Less painful on the pocket

too.

-- REDUCE - Reduce the use of harmful, wasteful, and

non-recyclable products so that fewer of them end up in landfill.

Use the minimum required to avoid unnecessary waste. E.g. don't

need, don't print. Reduce single-use plastics, plastic packaging,

and styrofoam cups.

-- REUSE - Get rid of the "buy and throw-away" mindset. Use what

you have as often, and for as long, as you can.

-- REPAIR - Try to repair things before tossing them out.

-- REPURPOSE - If something is no longer useful for its original

purpose, think creatively of ways it can be broken down and

reconstituted as something else. I am a big fan of upcycling!

-- ROT - Compost if you can, try not to let your trash end up in landfill.

-- RECYCLE - Make recycling your last step, after going through all the R's above.

We must purposefully and actively practise the seven "R"s at

home and in the office, so that they become automatic and

habitual.

Outward Focus

As a Group, we continue to support www.twiningenterprise.org.uk,

the mental health charity. In addition to financial support, we

also try to use our technology for good, through technology

philanthropy. If you wish to find out more, or want to support

Twining financially, please visit enoc.pro/community.

Conclusion

As I conclude, I wish to reiterate our mission: to make

investment rewarding for our customers, our shareholders and our

staff, and to give our customers a fair deal. And we support our

investment advisers and our staff by being a technology-driven

financial services company.

I wish to thank all my colleagues at Walker Crips for their

energy, enthusiasm, loyalty, dedication and their can-do attitude,

and for their unwavering focus on ensuring that our customers are

well looked after.

Sean Lam

Chief Executive Officer

29 July 2022

Chief Investment Officer's analysis

The persistence of speculative excess was the market's

undoing

Chris Darbyshire

Chief Investment Officer

Having reached peak exuberance during the year, investor

sentiment ended up accelerating into the trough of despair. But it

was a hard-fought contest and, for much of the year, the enormous

amounts of cash being pumped into the economy by central banks and

governments continued to find their way into financial assets. The

nature of the assets being bought showing very clearly who was

doing the buying: analysts at Bank of America estimated that

American retail investors poured nearly $900 billion into global

equity funds in the year to November 2021, more than the combined

total over the previous 19 years. Robust inflows continued right

through the inflation shock and the situation in Ukraine, with US

equity funds taking in an estimated $84 billion in the first

calendar quarter of 2022. Meanwhile, US corporate share buybacks

reached all-time highs during our financial year, and were still

accelerating as the year ended.

Reflection

The vast majority of flows were captured by index trackers,

reinforcing the dominance of the world's largest companies which,

in turn, reinforced the dominance of the technology sector. Flush

with money and enthusiasm, investors in the US ignored a growing,

global wave of anti-technology lawsuits and regulations. Indeed, as

recently as December, a three-times leveraged fund tracking the

Nasdaq 100 stock index saw record inflows (of $1.5 billion) in a

single day. At the same time, Apple's market value reached nearly

3% of the value of all the world's stock markets combined, and the

top five US technology companies represented over 10% of the

world's stock market value. Not only did the behemoths lead indexes

higher, but they did so with an unusual serenity for most of the

year: at one point in the fourth calendar quarter of 2021, the

S&P 500 rose to all-time highs for seven days in a row. Long

after the peak in equity markets, signs of speculation in the

mega-caps were still abundant, with announcements of stock splits

by US technology companies greeted by extremely outsized responses.

Alphabet (Google) enjoyed a $130 billion boost to its market value

on the day of the announcement, Amazon saw an $80 billion boost for

its stock split and, more recently, Tesla an $84 billion boost.

As a result, equity markets were able to maintain their relative

calm while bond markets entered an inflation-inspired meltdown, but

that's now history, of course. Within two months of the end of

2021, the capital markets were in panic mode, catalysed by

inflation and the war in Ukraine. Indeed, markets themselves have

now become the headlines, and not in a good way. Having spent most

of the last two years blithely ignoring any and all risks, many

investors have no choice but to focus only on risk.

Nothing captured the zeitgeist better than the cryptocurrency

universe, whose total market value exceeded $2 trillion in April

2021, supposedly driven by "institutional" demand as traditional

asset managers discovered its true value. To put that in

perspective, $2 trillion exceeded the cash in circulation of most

national currencies, and you could have bought the entire German

stock market with it. At one point the government of El Salvador

caught the speculative bug with its historic, but ultimately

botched, decision to make Bitcoin legal tender. Other governments

moved in the other direction: central banks in the developed world

began to encircle the technology with the threat of regulation, and

China went all-out when it declared all crypto-currency

transactions to be illegal. In case anybody missed it, this edict

was issued simultaneously by the People's Bank of China and nine

other government institutions, including the Supreme Court and the

police. Cryptos were already losing value by the end of the year as

the inflows of cash required to pump prices higher began to subside

and, subsequent to the year-end, there has been a more substantial

implosion caused by failures of the technologies involved. Books

about cryptocurrencies will soon take their place in the economic

literature about speculative bubbles.

The rise of inflation and the fall of central bankers

A sharp acceleration in inflationary forces first became visible

in the economic data in May 2021, but it was a full six months

before bond markets began to pay much attention. By then,

expectations for inflation had already doubled. Month after month,

as each inflation report trounced expectations, bonds refused to

concede defeat. In July 2021, for example, German government

10-year bonds rallied by the most since the start of the pandemic.

It was a similar story across the rest of the developed world, with

bonds rallying despite economic growth roaring back and inflation

surging towards its highs of the last two decades.

Central bankers were complicit in the delusion. As late as

August, Federal Reserve Chairman Jerome Powell was reiterating his

view that the surge in inflation was only temporary and, not only

would the asset purchases continue in the near-term, but any

"tapering" of asset purchases would not be accompanied by higher

interest rates. At that time, Chairman Powell was unwilling to pick

a fight with markets, even if that meant running more inflation

risk and further inflating asset-price bubbles. Everything was

priced for perfection, but with a massive, post-pandemic rebound in

the economy, record levels of corporate profits, and ultra-loose

monetary policy providing maximum support, perfection was still

very much on the menu. By the end of the year, inflation had more

than doubled but $300 billion a month was still being injected into

government bond markets via asset purchase programmes. The monetary

policy needle was still set to "maximum growth", and bond markets

had begun to reflect uncertainty around the extent, duration and

consequences of inflation.

The Federal Reserve's ("the Fed") credibility was further

undermined by reports in the media that Fed officials had front-run

crucial decisions by the central bank, and that the Chairman's own

portfolio had been advantaged by the choice of assets under the

Fed's asset purchase programme. The officials concerned immediately

liquidated their personal portfolios, and the Chairman initiated a

review of the rules on investments by Fed insiders. As a result,

Fed officials were forced to exit markets in their personal

portfolios, while simultaneously facing the biggest policy dilemma

since the Credit Crunch.

Within a couple of months, the energy crisis had begun to

materialise and central banks went from dismissing inflation as

being "transitory" to inflation being their main concern. At first,

only the tone changed, while the existing policy guidance was left

intact. However, bond markets weren't buying it, prompting

gut-wrenching shifts in rate expectations all around the world.

Such was the momentum that, at one point, investors were able to

observe in real time the President of the European Central Bank

("ECB") explaining at length why the ECB would not be raising rates

anytime soon while, simultaneously, Eurozone bond yields rocketed

into orbit. It was like a visit to the Hall of Mirrors.

By now, Fed governors were queuing up to signal a faster

withdrawal from the Fed's $120 billion a month asset-purchase

programme but, in a sign of the times, markets initially reacted

with exuberance. Equity markets hit new all-time highs in December

and even Bond markets managed a decent rally during the fourth

calendar quarter of 2021. It was January before they finally got

the message: bond markets shifted from steady eddies to screaming

demons in a regime change of record-breaking rapidity.

The mood darkened further, however, as successive inflation

reports outstripped forecasters' expectations, and inflation spread

from pandemic-affected goods to the broader service economy. With

higher house prices also feeding into higher rental costs, a major

component of inflation calculations, a higher trajectory for

inflation was locked in.

China went from investable to uninvestable, and back again

Having been the lead underwriter of global economic growth since

the Credit Crunch, China spent the year in reverse gear. China's

economy was the first to lose some momentum following the pandemic,

as the central bank acted early to tighten interest rates and the

costs of financing. The Chinese government, meanwhile, reined in

borrowing by heavily indebted local authorities to fund

infrastructure projects. A series of high-profile corporate

restructurings dealt a further blow to China's economic

credibility, starting with Huarong Asset Management, a state-owned

enterprise and one of China's biggest issuers. Huarong threatened

to default on $42 billion of debt, of which $23 billion was

denominated in US dollars and held by foreigners. This was followed

by the effective bankruptcy of the giant, debt-laden Chinese

property company Evergrande, whose debt burden was estimated by

some sources to be equivalent to 2-3% of Chinese GDP.

But what really scared investors was a year-long regulatory

crackdown on technology companies. First was the authorities'

cancellation of the flotation of Ant Financial, one of the largest

initial public offerings ever planned, apparently following public

criticisms by its founder, Jack Ma, of China's regulatory approach

to the finance sector. Jack Ma disappeared from view for several

months afterwards, but was back in the spotlight recently when

another of his creations, internet giant Alibaba Group Holdings,

was fined a record $2.8 billion by Chinese regulators for

anti-competitive practices.

These fears moved to a whole new level of intensity with the

announcement of probes into three Chinese companies that had listed

on US stock exchanges within the last few weeks. One of them, Didi

Global (the Chinese version of on-line taxi company Uber), had

listed on the New York Stock Exchange a mere two days previously.

All three companies were ordered to halt new user registrations,

and app stores were told to remove Didi's service from their

platforms. That the authorities were targeting Chinese companies

that have just raised money in the US should be seen in the context

of the broader trade war between China and the developed world. By

doing this, Beijing demonstrated its dislike of overseas listings,

discouraged Chinese technology firms from having foreign investors

and, moreover, undermined the credibility of the New York Stock

Exchange as a venue for Chinese listings. Capital markets became

weaponised. This would normally have subdued capital markets in the

developed world but, fortunately for investors, pandemic stimulus

had replaced Chinese government stimulus as the driver of

sentiment.

Meanwhile, the rapid downward spiral in US-China political and

trade relations continued. President Biden put another nail in the

coffin with a ban on investment in a blacklist of Chinese companies

with ties to China's military; US investors were given one year to

divest any holdings. The legislation was a continuation of an

initiative started by President Trump, but Biden took it a step

further, adding more companies to the list and strengthening it

against legal challenges. International investors and global

corporates were faced with a dilemma: Chinese markets are

attractive because the economic growth expectations are huge. But

to participate you have to bow-down to the powers in Beijing, while

running the gauntlet of western public opinion.

Adding to these issues, the pandemic continued to cause serious

problems for China's economy due to the government's zero-tolerance

approach to managing Covid risk. Although the onset of the Omicron

variant initially panicked markets all over the world, causing the

worst daily decline in more than a year, it took only a month for

developed world stock markets to shrug it off. This largely

reflected the response of western consumers, whose behaviour

(influenced by vaccination programmes) has been progressively less

affected by each wave of the virus. China's zero-Covid policy, on

the other hand, which was so effective at containing the first wave

of the pandemic, has led to a lack of acquired immunity. Moreover,

Sinovac, the Chinese Covid vaccine, was found to be relatively

ineffective against Omicron - a result that increases the risk of

any given variant causing a healthcare crisis. This makes it very

unlikely that China will be able to alter its zero-tolerance

approach to Covid even if it wanted to, and increases the

likelihood of Chinese factory closures, further global supply chain

blockages and persistent inflation.

The Chinese off-shore stock market, and its technology sector in

particular, reflected this sequence of disasters. The Hang Seng

China Enterprises Index, which measures the prices of Chinese

companies listed in Hong Kong, fell by 32% during our financial

year, and subsequently fell another 10% on top of that. The Nasdaq

Golden Dragon Index, an index of Chinese companies listed in the

US, fell 70% from peak-to-trough. Even the on-shore domestic equity

markets, which were reported to have benefited from government

support, traded below the levels reached in 2015.

Following our year-end, the pendulum swung back in favour of

investors, with a series of supportive statements from the

authorities, including from President Xi himself. First among them,

the top Chinese financial regulator committed to stability in

capital markets, supporting overseas stock listings, resolving

risks in the property market and to completing the crackdown on the

technology sector "as soon as possible." The Nasdaq Golden Dragon

Index of Chinese companies listed in America promptly rallied by a

third. At one point, the Hang Seng China Enterprises Index,

comprising Chinese companies listed in Hong Kong, rallied by 20% in

two days. Next, the central bank intervened to weaken the Chinese

yuan, and the Chinese government distanced itself from the conflict

in Ukraine. Finally, President Xi offered the prospect of a change

in the country's longstanding zero-Covid policy by committing to

reduce Covid's economic impact. Optimists described this as akin to

Draghi's "we will do whatever it takes" moment during the eurozone

crisis. While the pace of good news-flow has slowed somewhat since

then, such public statements are usually perceived by Chinese

investors as a state-sanctioned buy-signal.

How did we do?

The year started with our clients' portfolios enjoying some of

the best returns in years, with UK shares having been caught up in

the all-encompassing global stock market rally. The further down

the size-scale you went, the better it got: the FTSE 100 index had

rallied but was outshone by small and mid-sized British companies,

where our portfolios are typically overweight compared with

relevant benchmarks. The FTSE 250, which tracks the performance of

small and mid-sized British companies, reached new all-time highs

early in our financial year and the FTSE AIM, which tracks the

smallest UK listed companies, rose to 35% above its pre-pandemic

level.

The pound sterling was the missing piece, however, as

acrimonious post-Brexit dealings with the EU damaged confidence in

the prospects for what is still the UK's single biggest trading

relationship. Threats by the British government to walk away from

its treaty obligations with the EU set a worrying precedent and, at

the very least, are hardly likely to encourage investment from the

EU. Meanwhile the EU was aggressively encouraging providers of

financial services - one of the UK's biggest exports - to relocate

within the single market.

As the year went on, and the speculative fervour supporting

small-cap stocks wore off, the FTSE 100's bias towards energy,

mining and banking stocks meant it actually benefited from the

surge in inflation, while most other global stock market indices

slipped. Our portfolios benefited from an inherent overweight to UK

large-cap exposure and to old-economy dividend-payers. The decision

by European countries, notably Germany, to increase military

expenditure predictably sent defence-related stocks soaring. This

was a boon to a host of British companies. For the first time in

nearly two decades, investors seeking income outperformed those

seeking growth. It's tempting to say that the long-running

pre-eminence of growth stocks over value stocks has finally come to

an end, but there have been many false dawns of this kind in the

past.

Clients seeking growth have been impacted by the crash in the

valuations of growth stocks. However, the reversal in the market's

attitude to growth stocks has been indiscriminate, punishing some

companies whose prospects for revenues and profits remain undimmed

by inflationary trends. The ability of a company to prosper despite

inflation, or even during a recession, depends on the strength of

its brand, products and business model. It's extremely unlikely

that good companies become bad companies overnight, but that is

what the market is pricing. Good companies are now available on

very attractive valuations, and we are inclined to see this as an

opportunity. Time will tell whether we are correct, but, for now,

we do not believe that the current market swing towards value will

endure long enough to justify wholesale changes to portfolios. We

remain long term investors and believe the quality of the

underlying investments will outlast this uncertainty.

Where now for ESG?

Progress towards a parallel, Environmental, Social and

Governance ("ESG") conscious world for investors is accelerating.

Even central banks are getting in on the act. During our financial

year, the European Central Bank set out plans to involve climate

change considerations in its analysis of the economy and financial

markets, the Bank of Japan published a climate change strategy, in

which it will purchase foreign currency-denominated green bonds

issued by governments and other foreign institutions. Meanwhile,

the UK became the first country to introduce a green savings

product from a sovereign issuer.

Should investors be weighting portfolios towards ESG-friendly

investments? With extreme weather events affecting the harvests of

coffee, corn, wheat and sugar this year, sending their

commodity-market prices soaring, and with wildfires and other

extreme weather-events becoming seemingly commonplace, it's natural

to want to respond.

The war in Ukraine may have caused some governments to roll back

plans to mothball fossil fuel technologies, but it has also been a

boon to energy generators everywhere, including those of renewable

energy. Moreover, performance of ESG-friendly funds has been strong

over the past several years, though that has more to do with their

historically large allocations to the technology sector than their

inherent ESG qualities.

Ultimately, all types of risk end up being financial if they

cause asset prices to fluctuate. The ESG concept isolates and

unites particular sources of risk under a common banner, which is

increasingly being championed by governments, the financial

services sector and regulators worldwide. It's not unusual for

major risks to attract this level of attention - witness the

pandemic stimulus programmes that united governments and central

banks in a coordinated policy response.

The difference is that the "E" in ESG is going to be with us for

a very long time. Unlike social and governance issues,

climate-related risks have potentially profound and wide-ranging

consequences for asset prices. The good news is that these will

most likely unfold over a long horizon, giving investors - and

asset prices - the ability to react appropriately. Financial theory

says that competitive markets are very quick to assess and

incorporate threats and opportunities, so it should not be easier

to earn returns in ESG investments than in any other sector. But

it's worth considering the risks and potential rewards that are

specific to this sector, and which make it so distinctive. One is

the pace of climate change itself which, if it becomes very

volatile, raises the risk of abrupt, unforeseen shifts in

government policies. These would be reflected in increasing

volatility of prices of fossil fuel-dependent industries as well as

of green champions.

Another distinct risk is whether, and how, societies adapt to

the long-term goal of a zero-emissions world. After all, adapting

to the post-Covid world has not exactly gone smoothly. Like

vaccine-deniers, climate change-deniers abound, and society as a

whole must bear the cost of the transition to sustainable energy

production and consumption. With inflation already raging, that

looks unlikely to be a vote-winner in the short-term. Volatility in

the pace of policy change is therefore a distinct possibility,

despite the current momentum towards green goals.

Chris Darbyshire

Chief Investment Officer

29 July 2022

Finance Director's review

Building on the strength of the underlying business.

Sanath Dandeniya

Finance Director

The business responded well to the challenges caused by the

pandemic, and now we look to build on that resilience as the Group

continues its focus on revenue growth and margin improvement.

Financial performance

Our response to the pandemic challenged the Group to focus on

revenue generation, cost reduction and cash management in the core

business. These actions served us well and the resilience of the

core business, recovery in markets and actions taken have returned

the Group to profitability, notwithstanding the inflationary

pressures we now face and the significant investment we made and

continue to make in strengthening our risk and compliance

functions.

Total revenue

Total revenue increased by 8.1% to GBP32.8 million (2021:

GBP30.3 million), a record for the Group and more than offsetting

the loss in interest income that adversely impacted the results in

recent years. The increase was due to strong performances in our

core business. Management fee income was robust, rising by 9.7%.

The recovery in markets played a role in this, but most of our

businesses were also able to generate additional revenue growth,

strengthening our position against the heightened uncertainty

encountered in market conditions since the start of the current

calendar year. Our Structured Investment business recovered from an

extremely difficult year in 2020/21, and made a significant

contribution to revenue growth. Barker Poland Asset Management also

had another strong year, generating revenue growth of 19%. The

Wealth Management division began to see the benefits of its

recruitment drive, with revenue growth of 14.9%.

These sources of revenue growth compensated for other areas of

our business where performance was below that of the previous year.

Specifically, trading commissions decreased by 10.5% (equating to

GBP0.95 million) due to lower volumes, our arbitrage desk made a

positive but reduced contribution (GBP0.67 million down), and the

investor immigration business contracted by GBP0.1 million. This

latter business has subsequently closed to new applicants following

the government's decision to shut the Tier 1 Investor visa route

based on rising worldwide security concerns, but we will continue

to service our existing clients. The effects of the reduction in

base rates from the previous year continued to exert a residual

downward effect on revenues and operating profit, reducing both by

GBP0.1 million.

As a result of the strength in management fees and the changing

mix in our business, broking income fell to 24.5% of revenues, from

29.7% in 2021. Our gross operating margin also increased from 68.2%

to 72.4%, reflecting the changing mix and management actions to

improve profitability. Notwithstanding the increase in revenues,

commissions and fees paid reduced by GBP0.6 million, reflecting a

strong performance by the Private Client Department teams and

actions tilting the mix of revenue growth towards full-time

employees and away from self-employed associates. Commissions and

fees paid decreased as a percentage of revenues from 32% to 27.8%,

although some of this gain was offset by higher staff costs in

administrative expenses.

The Wealth Management division, excluding exceptional income and

the new Solent addition, has seen a marginal growth in revenue in

the year and the increase in both client numbers and Assets under

Administration ("AUA") bodes well for the future. Client numbers

increased by 144 to 1,117 and AUA increased by GBP61 million to

GBP579 million. The new Solent office (Southampton team) is now up

and running and continuing to onboard new clients and recorded

recurring revenues of GBP164,000 by the year-end.

The Wealth Management division is continuing its graduate

training plan which was successfully launched last year and due to

be replicated this July, with the idea of growing its talented

financial planners of the future. Additionally, the continual

search for advisers to join the firm who share the same ethos on

looking after clients' long-term and holistic needs. Working more

closely with the internal Investment Managers is gaining momentum

to facilitate greater client servicing for the wider Group.

Expenses

Administrative expenses, excluding exceptional items, increased

by GBP1.63 million, or 8.0%, but this increase does not represent a

like-for-like comparison due to various initiatives taken during

the height of the pandemic last year to reduce costs. In addition,

we have made further investments to develop our new Southampton

office. Adjusting for these factors, expenses increased by 5.4%,

largely driven by increases in staff costs, including the

restoration of directors' pay from a voluntary pay-cut taken in the

previous year. It should be noted that with tight labour markets,

we continue to experience inflationary wage pressures.

We are also reporting significantly increased exceptional costs

this year. These relate to the restructuring and redundancy

initiatives initiated during the pandemic along with specific items

noted in the CEO's report and the Chairman's Statement. These costs

were partially offset by the exceptional income from a confidential

settlement agreement also reported in the interim results. The

exceptional items are further explained in note 10.

Cash management

The Group is highly cash generative and recorded a cash inflow

from operations of GBP4.2 million (2021: GBP1.8 million).

Underlying cash generated from operations, principally reflecting

the impact of lease liability payments, non-cyclical working

capital movements and cash flows from exceptional items (see

adjacent reconciliation), was GBP1.34 million (2021: GBP0.78

million), demonstrating cash generative ability of the Group's

operating model. After deducting cash deployed in investing

activities and dividends paid, cash and cash equivalents increased

to GBP11.11 million at year-end (2021: GBP8.86 million).

Financial result and alternative performance measures

The Group's operating profit and profit before tax for the year

of GBP326,000 and GBP324,000, respectively (2021: GBP22,000 and a

loss of GBP114,000, respectively), reflect the continued momentum

from the first half of the year, although the pace of revenue

growth slowed as markets declined and volatility increased towards

the end of our financial year. Nevertheless, the Group was able to

report operating profit of GBP206,000 in the second half of the

financial year, up from GBP120,000 in the first half.

The annual results include operating exceptional charges of

GBP1,540,000, being total exceptional charges of GBP1,437,000

including the profit on disposal of our associated company Walker

Crips Property Income Limited (renamed Crystal Property Income

Limited) (2021: GBP419,000). Adjusting for exceptional items (see

adjacent reconciliations and further detail in note 10, the Group's

operating profit and profit before tax for the year are GBP1.87

million and GBP1.76 million, respectively (2021: GBP441,000 and

GBP305,000, respectively), and reflect the improvement in the

Group's core business.

The Group's adjusted EBITDA (being EBITDA adjusted for

exceptional items - see adjacent reconciliation) is GBP3.9 million

(2021: GBP2.6 million), an increase of 49.3% demonstrating a robust

current year trading performance.

Total Assets Under Management and Administration ("AUMA")

averaged GBP5.6 billion during the year, compared with GBP4.9

billion in the previous year, reflecting the recovery in equity

markets from the global pandemic. Discretionary and Advisory Assets

Under Management similarly benefited from the market recovery,

rising by the end of the year to GBP3.6 billion (2021: GBP3.4

billion). Total AUMA is up slightly from March 2021 levels to

GBP5.5 billion (2021: GBP5.4 billion).

Reconciliation of operating profit to operating 2022 2021

profit before exceptional items GBP'000 GBP'000

------------------------------------------------- --------- ---------

Operating profit 326 22

------------------------------------------------- --------- ---------

Operating exceptional items (note 10) 1,540 419

------------------------------------------------- --------- ---------

Operating profit before exceptional items 1,866 441

------------------------------------------------- --------- ---------

Reconciliation of profit/(loss) before tax to profit 2022 2021

before tax and total exceptional items GBP'000 GBP'000

------------------------------------------------------ --------- ---------

Profit/(loss) before tax 324 (114)

------------------------------------------------------ --------- ---------

Total exceptional items (note 10) 1,437 419

------------------------------------------------------ --------- ---------

Profit before tax and exceptional items 1,761 305

------------------------------------------------------ --------- ---------

2022 2021

Adjusted EBITDA GBP'000 GBP'000

--------------------------------------------------- --------- ---------

Operating profit 326 22

--------------------------------------------------- --------- ---------

Operating exceptional items (note 10) 1,540 419

--------------------------------------------------- --------- ---------

Amortisation/depreciation (note 31) 1,165 1,212

--------------------------------------------------- --------- ---------

Right-of-use assets depreciation charge (note 31) 873 961

--------------------------------------------------- --------- ---------

Adjusted EBITDA 3,904 2,614

--------------------------------------------------- --------- ---------

2022 2021

Underlying cash generated from operations GBP'000 GBP'000

--------------------------------------------------- --------- ---------

Net cash inflow from operations 4,217 1,806

--------------------------------------------------- --------- ---------

Working capital (note 31) (2,257) (8)

--------------------------------------------------- --------- ---------

Lease liability payments under IFRS 16 (note 31) (1,052) (1,133)

--------------------------------------------------- --------- ---------

Cash outflow on operating exceptional items (note

10, 27 and 31) 435 118

--------------------------------------------------- --------- ---------

Underlying cash generated in the period 1,343 783

--------------------------------------------------- --------- ---------

Divisional performance

The Investment Management division, including exceptional costs,

delivered an operating profit of GBP1.16 million for the year,

compared to GBP1.33 million in the previous year. Operating profits

when adjusted for exceptional costs grew by GBP1.2 million to

GBP2.9 million (2021: GBP1.27 million). This reflects the strong

performance of Investment Management and advisory fees, plus a

rebound in Structured Investments business, offset by reduced

activity in commissions, in the arbitrage and investor immigration

businesses, as well as the continuing drag from the reduction in

BoE base rate in the previous year. Regarding the latter: the

change in the interest rate cycle, with continued increases in base

rate expected, should exert a favourable impact on revenues and

profits during the next financial year. Nevertheless, management

will remain focused on initiatives to improve the division's

operating margins and reduce reliance on interest returns. The

prospects for the Structured Investments business remain positive

as pricing conditions have improved and certain competitors have

exited this sector, we believe that the Structured Investments team

is well-positioned to build on its prominent market position.

The Wealth Management division has cemented its recovery from

departures of several advisers in the previous year, and revenues

have been rejuvenated by the hiring of new advisers and the

acquisition of a client book with funds under management. The

cost-base should improve as recruitment-related costs subside but,

as yet, the division has not returned to profit, reporting a loss

before tax of GBP258,000 (2021: loss before tax of GBP127,000).

Our tech arm, EnOC Technologies Limited ("EnOC"), reported an

operating loss of GBP86,000 (2021: GBP122,000). EnOC's tech

capabilities are integral to the Group's operational efficiencies,

deploying cloud solutions to the business and we continue to invest

in its capabilities and prospects.

Capital resources, liquidity and regulatory capital

The Group's capital structure, comprising solely of equity

capital, provides a stable platform to support growth. At year end,

net assets are GBP22.11 million (2021: GBP22.32 million),

reflecting a net decrease of GBP0.21 million (2021: reduction of

GBP0.3 million), due to the reported profit after tax less

dividends paid. Liquidity remains strong with cash and cash

equivalents increasing over the year to GBP11.1 million (2021:

GBP8.9 million), testimony to the Group's underlying resilience and

the continued recovery from the pandemic. Regulatory capital at

year end, including audited reserves for the year, is GBP12.3

million (2021: GBP11.7 million), comfortably in excess of the

Group's capital requirements as shown in the tables below. The

finance team has also implemented the new prudential regulatory

regime.

2022 2021

Regulatory own funds and own funds requirements GBP'000 GBP'000

------------------------------------------------- --------- ---------

Own funds

Share capital 2,888 2,888

Share premium 3,763 3,763

Retained earnings 11,050 11,260

Other reserves 4,723 4,723

Less:

Own shares held (312) (312)

Regulatory adjustments (9,804) (10,584)

------------------------------------------------- --------- ---------

Total own funds 12,308 11,738

------------------------------------------------- --------- ---------

Total own funds requirement (4,676) (5,382)

------------------------------------------------- --------- ---------

Regulatory capital surplus 7,632 6,356

------------------------------------------------- --------- ---------

Cover on own funds as a % 263.2% 218.1%

------------------------------------------------- --------- ---------

Dividends

In view of the Group's financial performance, capital and

liquidity position, the Board is recommending a final dividend of

1.20 pence per share to be paid on 7 October 2022 for those members

on the shareholders' register on 23 September 2022. The ex-dividend

date of 22 September 2022. Including the interim dividend of 0.30

pence per share (2021: 0.15 pence per share), the total dividend

for the year is 1.50 pence per share (2021: 0.75 pence per

share).

Sanath Dandeniya

Finance Director

29 July 2022

Consolidated income statement

year ended 31 March 2022

2022 2021

Note GBP'000 GBP'000

-------------------------------------------- ------- --------- ----------

Revenue 5 32,820 30,348

Commissions and fees paid 7 (9,110) (9,702)

Share of associate after tax profit 8 57 66

-------------------------------------------- ------- --------- ----------

Gross profit 23,767 20,712

Administrative expenses 9 (21,901) (20,271)

Exceptional items 10 (1,540) (419)

-------------------------------------------- ------- --------- ----------

Operating profit 326 22

Investment revenue 11 9 10

Finance costs 12 (114) (146)

Exceptional item - Profit on disposal of

associate investment 8 & 10 103 -

-------------------------------------------- ------- --------- ----------

Profit/(loss) before tax 324 (114)

Taxation 14 (151) (144)

-------------------------------------------- ------- --------- ----------

Profit/(loss) for the year attributable to

equity holders of the Parent Company 173 (258)

-------------------------------------------- ------- --------- ----------

Earnings/(loss) per share

-------------------------------------------- ------- --------- ----------

Basic and diluted 16 0.41p (0.61)p

-------------------------------------------- ------- --------- ----------

The following Accounting Policies and Notes form part of these

financial statements.

Consolidated statement of comprehensive income

year ended 31 March 2022

2022 2021

GBP'000 GBP'000

------------------------------------------------------- ---------- ---------

Profit/(loss) for the year 173 (258)

------------------------------------------------------- ---------- ---------

Total comprehensive income/(loss) for the year

attributable to equity holders of the Parent Company 173 (258)

------------------------------------------------------- ---------- ---------

The following Accounting Policies and Notes form part of these

financial statements.

Consolidated statement of financial position

as at 31 March 2022

2022 2021

Note GBP'000 GBP'000

----------------------------------------- ----- ---------- ----------

Non-current assets

Goodwill 17 4,388 4,388

Other intangible assets 18 5,752 6,566

Property, plant and equipment 19 1,169 1,477

Right-of-use asset 20 2,597 3,612

Investment in associate 8 - 2

Investments - fair value through profit

or loss 21 - 37

----------------------------------------- ----- ---------- ----------

13,906 16,082

----------------------------------------- ----- ---------- ----------

Current assets

Trade and other receivables 22 50,003 49,098

Investments - fair value through profit

or loss 21 1,647 920

Cash and cash equivalents 23 11,113 8,855

----------------------------------------- ----- ---------- ----------

62,763 58,873

----------------------------------------- ----- ---------- ----------

Total assets 76,669 74,955

----------------------------------------- ----- ---------- ----------

Current liabilities

Trade and other payables 26 (49,625) (47,395)

Current tax liabilities (132) (123)

Deferred tax liabilities 24 (414) (400)

Provisions 27 (1,137) (205)

Lease liabilities 28 (245) (946)

Deferred cash consideration 36 (89) -

----------------------------------------- ----- ---------- ----------

(51,642) (49,069)

----------------------------------------- ----- ---------- ----------

Net current assets 11,121 9,804

----------------------------------------- ----- ---------- ----------

Long-term liabilities

Deferred cash consideration 36 (29) (33)

Lease liabilities 28 (2,300) (2,856)

Provision 27 (586) (675)

----------------------------------------- ----- ---------- ----------

(2,915) (3,564)

----------------------------------------- ----- ---------- ----------

Net assets 22,112 22,322

----------------------------------------- ----- ---------- ----------

Equity

Share capital 29 2,888 2,888

Share premium account 29 3,763 3,763

Own shares 30 (312) (312)

Retained earnings 30 11,050 11,260

Other reserves 30 4,723 4,723

----------------------------------------- ----- ---------- ----------

Equity attributable to equity holders

of the Parent Company 22,112 22,322

----------------------------------------- ----- ---------- ----------

The following Accounting Policies and Notes form part of these

financial statements.

The financial statements of Walker Crips Group plc (Company

registration no: 01432059) were approved by the Board of Directors

and authorised for issue on 29 July 2022.

Signed on behalf of the Board of Directors

Sanath Dandeniya FCCA

Director

29 July 2022

Consolidated statement of cash flows

year ended 31 March 2022

2022 2021

Note GBP'000 GBP'000

-------------------------------------------------- ----- --------- ---------

Operating activities

Cash generated from operations 31 4,217 1,806

Tax paid (120) (379)

-------------------------------------------------- ----- --------- ---------

Net cash generated from operating activities 4,097 1,427

-------------------------------------------------- ----- --------- ---------

Investing activities

Purchase of property, plant and equipment (119) (24)

(Purchase)/sale of investments held for

trading (342) 78

Consideration paid on acquisition of intangibles (93) -

Consideration paid on acquisition of client

lists - (100)

Consideration received on sale of associate 105 -

Dividends received 11 9 8

Dividends received from associate investment 8 57 64

Interest received 11 - 2

-------------------------------------------------- ----- --------- ---------

Net cash (used in)/generated from investing

activities (383) 28

-------------------------------------------------- ----- --------- ---------

Financing activities

Dividends paid 15 (383) (64)

Interest paid 12 (21) (12)

Repayment of lease liabilities* (959) (999)

Repayment of lease interest* (93) (134)

-------------------------------------------------- ----- --------- ---------

Net cash used in financing activities (1,456) (1,209)

-------------------------------------------------- ----- --------- ---------

Net increase in cash and cash equivalents 2,258 246

-------------------------------------------------- ----- --------- ---------

Net cash and cash equivalents at beginning

of period 8,855 8,609

-------------------------------------------------- ----- --------- ---------

Net cash and cash equivalents at end of

period 11,113 8,855

-------------------------------------------------- ----- --------- ---------

* Total repayment of lease liabilities under IFRS 16 in the

period was GBP1,052,000 (2021: GBP1,133,000)

The following Accounting Policies and Notes form part of these

financial statements.

Consolidated statement of changes in equity

year ended 31 March 2022

Share Own

Share premium shares Capital Retained Total

capital account held redemption Other earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Equity as at 31 March

2020 2,888 3,763 (312) 111 4,612 11,582 22,644

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Comprehensive loss

for the year - - - - - (258) (258)

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Total comprehensive

loss for the year - - - - - (258) (258)

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Contributions by and

distributions to owners

Dividends paid - - - - - (64) (64)

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Total contributions

by and distributions

to owners - - - - - (64) (64)

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Equity as at 31 March

2021 2,888 3,763 (312) 111 4,612 11,260 22,322

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Comprehensive income

for the year - - - - - 173 173

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Total comprehensive

income for the year - - - - - 173 173

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Contributions by and

distributions to owners

Dividends paid - - - - - (383) (383)

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Total contributions

by and distributions

to owners - - - - - (383) (383)

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

Equity as at 31 March

2022 2,888 3,763 (312) 111 4,612 11,050 22,112

-------------------------- ---------- --------- --------- ------------ --------- ---------- ---------

The following Accounting Policies and Notes form part of these

financial statements.

Notes to the accounts

year ended 31 March 2022

1. General information

Walker Crips Group plc ("the Company") is the Parent Company of

the Walker Crips group of companies ("the Company"). The Company is

a public limited company incorporated in the United Kingdom under

the Companies Act 2006 and listed on the London Stock Exchange. The

Group is registered in England and Wales. The address of the

registered office is Old Change House, 128 Queen Victoria Street,

London EC4V 4BJ.

The significant accounting policies have been disclosed below.

The accounting policies for the Group and the Company are

consistent unless otherwise stated.

2. Basis of preparation

The consolidated financial statements have been prepared in

accordance with UK-adopted international accounting standards in

conformity with the requirements of the Companies Act 2006.

The principal accounting policies adopted in the preparation of

the consolidated financial statements are set out in note 3. The

policies have been consistently applied to all the years presented,

unless otherwise stated.

The Group financial statements are presented earlier in this

announcement.

The consolidated financial statements are presented in GBP

sterling (GBP). Amounts shown are rounded to the nearest thousand,

unless stated otherwise.

The consolidated financial statements have been prepared on the

historical cost basis, except for certain financial instruments

that are measured at fair value, and are presented in Pounds

Sterling, which is the currency of the primary economic environment

in which the Group operates. The principal accounting policies

adopted are set out below and have been applied consistently to all

periods presented in the consolidated financial statements.

The preparation of financial statements requires the use of

certain critical accounting estimates. It also requires management

to exercise its judgement in the process of applying the Group's

accounting policies. The areas involving a higher degree of

judgement or complexity, or areas where assumptions and estimates

are significant to the consolidated financial statements, are

disclosed in note 4.

Going concern

The financial statements of the Group have been prepared on a

going concern basis. At 31 March 2022, the Group had net assets of

GBP22.11 million (2021: GBP22.32 million), net current assets of

GBP11.1 million (2021: GBP9.8 million) and cash and cash

equivalents of GBP11.1 million (2021: GBP8.9 million). The Group

reported an operating profit of GBP326,000 for the year ended 31

March 2022 (2021: GBP22,000), inclusive of exceptional expense of

GBP1,540,000

(2021: GBP419,000), and net cash inflows from operating

activities of GBP4.2 million (2021: GBP1.8 million).

The Directors consider the going concern basis to be appropriate

following their assessment of the Group's financial position and

its ability to meet its obligations as and when they fall due. In

making the going concern assessment the Directors have taken into

account the following:

-- The Group's three-year base case projections based on current

strategy, trading performance, expected future profitability,

liquidity, capital solvency and dividend policy.

-- Outcome of stress scenarios applied to the Group's base case

projections prior to deployment of management actions.

-- The principal risks facing the Group and its systems of risk management and internal control.

-- The Group's ability to generate positive operating cash flow

during the year to 31 March 2022 and the projections over the next

three years.

Key assumptions that the Directors have made in preparing the

base case cash flow forecasts are that:

-- Revenues reflect the impact of (i) expected client and

revenue losses from Truro IM resignation, (ii) net interest income

from managing client deposits prudently capped at GBP1.2 million,

and (iii) no further significant impact from the pandemic other

than what is already known. The total revenue is expected to

increase by 1.27% with gains from fee income offset by the lower

trading commissions. Years two and three growth expectation set

conservatively at 2%.

-- Base case costs prudently reflect only the actions Management has taken to date.

Key stress scenarios that the Directors have then considered

include:

-- A "bear stress scenario": representing a further 10% fall in

income compared to the base case scenario in the reporting periods

ending 31 March 2023 and 31 March 2024.

-- A remote "severe stress scenario": representing a 20% fall in

commission income and 15% fall in fee income compared to the base

case for each forecast period.

-- Both stress scenarios assume no mitigating actions and

include a further prudent adjustment for the estimation uncertainty