TRX Gold Corporation (TSX:TNX) (NYSE American:TRX) (the “Company”

or “TRX Gold”) today reported its results for the fourth quarter

(“Q4 2022”) and year end August 31, 2022. Financial results will be

available on the Company’s website on November 30, 2022.

Key highlights for Q4 and Year Ended

2022 include:

- A

management team that was laser-focused on execution: The

TRX Gold team delivered two mill expansions on site at the Buckreef

Gold Project. In Q2 2022, Phase 1 of the 1,000 tpd+ mill was

commissioned, allowing for an increase in production rates and

plant throughput to 360 tonnes per day (“tpd”). Subsequent to

year-end, in September 2022 Buckreef Gold announced successful

commissioning of the second phase of the mill expansion to 1,000+

tpd. As a result, since Q2 2022, the production of low-cost, high

margin gold ounces has steadily increased each month.

- A

reliable, local supply chain and labor force: Thanks to

TRX Gold’s local employees, contractors, trades people, material

suppliers and service providers, the two mill expansions were

delivered on time and on budget, at a capital cost of approximately

$5.6 million for both phases. Tanzania continues to prove itself as

a country that is self-sufficient, dependable and capable. Thanks

to these qualities, Buckreef Gold did not experience any slowdowns

or cost overruns caused by ongoing global supply chain

challenges.

- Full

year and Q4 gold production that exceeded expectations and

guidance: For the year ended August 31, 2022, Buckreef

Gold poured 8,874 ounces of gold and sold 8,598 ounces of gold. The

Company recognized revenue of $15.1 million, cost of sales of $5.7

million and cash costs1 of $665 per ounce of gold, generating a

strong full year gross profit of $9.4 million, gross profit

margin of 62% and Adjusted EBITDA1

of $3.5 million. For Q4 2022, Buckreef Gold poured

3,619 ounces of gold, a new quarterly production record, exceeding

previous production guidance of 750-800 ounces of gold per month.

Furthermore, 3,363 ounces of gold were sold, also a new quarterly

sales record for the Company, resulting in positive

operating cash flow of $2.4 million. Buckreef recognized

revenue of $6.0 million in Q4 2022, cost of sales of $1.9 million,

and cash costs1 of $560 per ounce of gold, below guidance,

generating strong Q4 gross profit of $4.1 million, gross

profit margin of 69% and Adjusted EBITDA1

of $2.2 million.

- Drilling

at Buckreef Gold resulting in discovery, expansion and

definition: In 2022, the Company drilled over 22,000

meters at Buckreef Gold ($3.7 million) including infill drilling,

step-out drilling and grade control drilling. During the year, the

Company extended Buckreef Gold’s Main Zone by 300 meters or 30%, to

2.0 kilometers, as a result of its northeast step-out drilling

program. In Q4 2022, an additional drill rig was added to expand

the exploration program and, to date, a total of 22 holes

representing over 7,592 meters in the northeast extension of the

Buckreef Main Zone, have been completed. The Company executed an

infill drill program at the Main Zone, consisting of 16 drill

holes, representing 3,695 meters. Also, during Q4 2022, the Company

explored under the South Pit and tested the South Zone extension

with 24 drill holes, representing 4,255 meters. Results from both

programs are pending. Subsequent to year-end, the Company commenced

exploration drilling at the Anfield Zone, where the drill rig is

now active with 9 drill holes representing 1,650 meters. Assay

results from this program are also pending.

- A strong

Balance Sheet that is positioned to support expansion and

growth: At the end of Q4 2022, TRX Gold had no debt on

record, cash of $8.5 million and working capital of $5.4 million

after adjusting for liabilities which will only be settled by

issuing equity of the Company. During the year, the Company

successfully closed three financing transactions providing the

Company with additional flexibility and liquidity, if necessary, to

help fund acceleration of its growth strategy including: (i) a

registered direct offering with a single institutional investor for

net proceeds of $6.4 million; (ii) a pre-paid gold purchase

agreement with a contract price totaling $5 million with OCIM

Metals & Mining SA; and (iii) a purchase agreement with Lincoln

Park Capital Fund, LLC (“Lincoln Park”) enabling TRX Gold, in its

sole discretion, to sell up to $10 million of its shares to Lincoln

Park over a 36-month period.

-

Continued commitment to ESG and Health &

Safety: In 2022, Buckreef Gold continued to expand its CSR

program, successfully partnering with both regional and district

Commissioners on school, water and health projects. From an

environmental standpoint, Buckreef Gold continued to look for ways

in which to employ sustainable mining practices. The operation

continues to: (i) utilize the Tanzanian national electricity grid

for power which is significantly and increasingly sourced from

hydroelectric facilities in Tanzania; (ii) recycle all water used

in its operations; (iii) not discharge water from its operations;

(iv) employ a workforce that is 100% Tanzanian. In 2022, the

Company achieved zero lost time to injuries (“LTIs”) and had no

confirmed COVID-19 cases at site. Subsequent to year-end the

Company achieved a significant safety milestone of 1.0 million

operating hours with no LTIs.

TRX Gold’s CEO, Stephen Mullowney comments:

“2022 has been an outstanding year for TRX Gold and Buckreef Gold.

We could not be happier with the progress that we’ve made on all

fronts, including building and expanding our mill, increasing gold

production, increasing our expertise and skill-set on site and at

the corporate office, and significantly improving the Company’s

Balance Sheet. We have demonstrated what a dedicated and ambitious

group can accomplish within 12 months, and we now look forward to

2023 to continue to move in the same direction. In 2023, our

commitment to creating stakeholder value will continue, quite

simply, by way of more growth. In less than two years, the Company

has been transformed from a cash burning enterprise into a

sustainable, stable business with strong local relationships that

is poised to provide significant upside through increases in

production and continued exploration. Importantly, the option value

explicit in exploration is now firmly intact.”

Fiscal 2023 Outlook – Planning For More

Growth

- Gold production

from the 1,000+ tpd processing plant at Buckreef Gold is expected

to be between 20,000 - 25,000 ounces at total average cash costs2

of $750 - $850 per ounce. Gold production is expected to be lower

in the first half of fiscal 2023 (“F2023”) due to the ramp-up and

commissioning of the processing plant during Q1. Higher production

is expected in the second half (H2) of the year once the ramp-up is

complete and the processing plant achieves steady state operation

at nameplate capacity of 1,000+ tpd.

- Operating cash

flow from the 1,000+ tpd processing plant will be reinvested into

the Buckreef Gold project with a focus on value enhancing

activities, including: (i) exploration and drilling with a focus on

potential resource expansion at Buckreef Main (northeast and

south), Buckreef West, Anfield, Eastern Porphry extension, Bingwa

and Tembo; (ii) additional capital programs focused on further

plant expansions and production growth; and (iii) enhanced CSR/ESG

programs.

- The Company is

evaluation a project aimed at increasing the average annual

throughput by 75-100% through the addition of a new ball mill.

Detailed engineering and procurement of equipment has commenced.

Upon a positive construction decision, the expansion project is

expected to start in F2023.

- Sustaining

capital, excluding waste rock stripping, includes certain one-time

expenditures including final road realignment around the Special

Mining License (SML) which will enable full life of mine access to

the Main Zone. Sustaining capital also includes infrastructure

investments, for example: construction of a significantly expanded

tailings storage facility (TSF), and procurement of heavy plant

equipment, including a wheel loader, grizzly, forklift, crane and

light vehicles to support the expanded production.

- Exploration

spending in F2023 includes diamond drill and reverse circulation

drilling services provided by STAMICO for a program which includes:

brownfields drilling at Buckreef Main Zone (NE and SW), Buckreef

West, Eastern Porphyry, and greenfield drilling at Anfield.

Sterilization drilling will commence at site expansion facilities,

including tailings storage and waste rock facilities.

- The Sulphide

Development Project, in which the ‘sulphide ore’ encompasses

approximately 90% of the Buckreef Main Zone’s Measured and

Indicated Mineral Resources, is a key mid-to-long term value

driver. Unlocking this value is an important business objective for

the Company. The Sulphide Development Project will evaluate the

options for a high return large scale project. It is the goal of

the Company to exceed the metrics outlined in the 2018 Technical

Report3, including annual production and strip ratio. TRX continues

to work with its principal consultants on advancing the Sulphide

Development Project, including advanced metallurgical testing

across the deposit, geotechnical studies for a deeper pit, and

assessing a significantly larger sulphide ore processing

facility.

Qualified Person

Mr. Andrew Mark Cheatle, P.Geo., MBA, ARSM, is

the Company’s Qualified Person under National Instrument 43-101

“Standards of Disclosure for Mineral Projects” (“NI 43-101”) and

has reviewed and assumes responsibility for the scientific and

technical content in this press release.

Q4 2022 and Full Year 2022 Results

Conference Call and Webcast Details

When: Monday, December 5, 2022 at 11:00 AM

ESTWebcast URL:

https://services.choruscall.ca/links/trxgold2022ye.html Conference

call numbers:Canada/USA TF: 1-800-319-4610 International Toll:

+1-604-638-5340A replay will be made available for 30 days

following the call on the Company’s website.

Corporate video of the Buckreef Gold

Project

To view our latest corporate video, click here

About TRX Gold Corporation

TRX Gold is rapidly advancing the Buckreef Gold

Project. Anchored by a Mineral Resource published in May 2020, the

project currently hosts an NI 43-101 Measured and Indicated Mineral

Resource of 35.88 MT at 1.77 g/t gold containing 2,036,280 ounces

of gold and an Inferred Mineral Resource of 17.8 MT at 1.11 g/t

gold for 635,540 ounces of gold. The leadership team is focused on

creating both near-term and long-term shareholder value by

increasing gold production to generate positive cash flow. The

positive cash flow will be utilized for exploratory drilling with

the goal of increasing the current gold Resource base and advancing

the Sulphide Ore Project which represents 90% of current gold

Resources. TRX Gold’s actions are led by the highest ESG standards,

evidenced by the relationships and programs that the Company has

developed during its nearly two decades of presence in Geita

Region, Tanzania.

Non-IFRS Performance

Measures

The company has included certain non-IFRS

measures in this new release. Refer to pages 32 and 33 of the

Company’s August 31, 2022 MD&A for an explanation, discussion

and reconciliation of non-IFRS measures. The Company believes that

these measures, in addition to measures prepared in accordance with

International Financial Reporting Standards (“IFRS”), provide

readers with an improved ability to evaluate the underlying

performance of the Company and to compare it to information

reported by other companies. The non-IFRS measures are intended to

provide additional information and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. These measures do not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to similar measures presented by other issuers.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TRX Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to continued operating

cash flow, expansion of its process plant, estimation of mineral

resources, ability to develop value creating activities,

recoveries, subsequent project testing, success, scope and

viability of mining operations, the timing and amount of estimated

future production, and capital expenditure.

Although TRX Gold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TRX Gold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that TRX Gold files with the SEC and the various Canadian

securities authorities. You can review and obtain copies of these

filings from the SEC's website at http://www.sec.gov/edgar.shtml

and the Company’s profile on the System for Electronic Document

Analysis and Retrieval (“SEDAR”) at www.sedar.com.

The information contained in this press release

is as of the date of the press release and TRX Gold assumes no duty

to update such information.

For investor or shareholder inquiries,

please contact:

Investors Christina Lalli Vice

President, Investor RelationsTRX Gold Corporation+1-438-399-8665

c.lalli@TRXgold.comwww.TRXgold.com

1 Refer to “Non-IFRS Performance Measures” section.2 Refer to

“Non-IFRS Performance Measures” section.3 NI 43-101 Technical

Report: Updated Mineral Resource Estimate for the Buckreef Gold

Mine Project, Tanzania, East Africa” prepared by Virimai Projects

(“Virimai”), effective date May 15, 2020, was filed as an exhibit

to Form 6-K on June 23, 2020, as amended on July 20, 2021, and on

SEDAR on June 23, 2020.

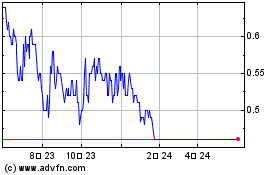

TRX Gold (TSX:TNX)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

TRX Gold (TSX:TNX)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024