TRX Gold Corporation (TSX: TNX) (NYSE American: TRX) (the “Company”

or “TRX Gold”) today reported its results for the first quarter of

2024 (“Q1 2024”) for the three months ended November 30, 2023.

Financial results are available on the Company’s website at

www.TRXgold.com.

Key highlights for Q1 2024

include:

- Positive

operating cash flow: The Company poured 4,927 ounces of

gold and sold 4,895 ounces of gold, resulting in positive operating

cash flow of $5.1 million.

- Strong

gross profit margins: The Company recognized revenue of

$9.4 million and cost of sales of $5.7 million, generating gross

profit of $3.7 million, gross profit margin of 40%, and Adjusted

EBITDA1 of $2.6 million.

- Growth

through prudent capital management: The Company continues

to demonstrate its ability to manage capital and use cash flow from

mining operations to fund additional growth at Buckreef Gold, as it

reinvested $3.8 million during the quarter to advance its 3rd

consecutive mill expansion to 2,000+ tonnes per day (“tpd”) and to

advance construction on a significantly expanded tailings storage

facility (“TSF”) to accommodate higher production volumes and

support the long-term growth of Buckreef Gold.

- Fiscal

2024 production guidance unchanged: The Company continues

to expect gold production for 2024 to be between 25,000 – 30,000

ounces at total average cash cost1 of $800 – 900 per ounce.

-

Expansion to 2,000+ tpd continues to progress on

schedule: The new 1,000 tpd ball mill arrived on site in

early October 2023 and earthworks have commenced for the ball mill

plinth, tank line foundation and bund wall, which will support the

additional leach tanks. In-depth engineering reviews and

construction work have begun, including concrete construction and

steel fabrication on the new crushing circuit which commenced in

November 2023. The process plant expansion aimed at expanding

throughput by 75-100% has a targeted completion date in the second

half of fiscal 2024 and is expected to benefit production in Q4

2024.

- Expanded

crushing circuit construction underway: The initial phase

of the new crushing circuit arrived on site in January 2024 and is

configured to produce a finely crushed ore ‘product’ suitable for

the existing and future ball mills. It is expected that the new

crushing circuit will help drive increased throughput and recovery

percentages and will provide capacity for increased production. It

is also expected to improve options for material handling, provide

equipment redundancy to eliminate or reduce plant downtime, and

improve grind size allowing for more efficient, cost-effective

processing of sulphide ore. Concrete construction has been

completed and is curing. Steel design, fabrication and construction

of the new crushing circuit continues at a rapid pace, and

completion is expected in Q2 2024.

-

Exploration, a key area of focus: The Company

expects to continue to build on past exploration successes through

a drill program that is expected to begin in the second half of

fiscal 2024. While the Company primarily focused on grade control

drilling to support mining activity during Q1 2024, exploration

drilling for 2024 will focus on infill and expansion drilling at

Eastern Porphyry, Buckreef West, Inferred Mineral Resources and

strike extensions, both to the NE and SW of the Main Zone – which,

if successful, has the potential to increase tonnes to higher

Mineral Resource categories.

- Health

& Safety remains top of mind: The Company achieved

zero lost time injuries (“LTI”) and there were no reportable

environmental or community related incidents during Q1 2024.

Subsequent to Q1 2024, Buckreef Gold achieved, for a second time, 1

million hours LTI free work.

TRX Gold’s CEO, Stephen Mullowney comments: “Q1

2024 has been an exceptionally busy quarter at Buckreef Gold as our

team continues to work hard on our next growth phase, including

another expansion in processing capacity at the mill. We are very

pleased with the exceptional progress that has been made over the

last few months in advancing construction for the plant expansion,

including commencement of concrete and steel works related to the

new crushing circuit. We continue to be impressed with the

excellent and efficient work being done by our 100% Tanzanian

staff, consultants and by the quality of locally sourced materials

and equipment. We look forward to completing the plant expansion

later this year and utilizing the expected increase in cashflow to

unlock value through a larger exploration program in the

future.”

Figure 1: 1,000+ tpd Processing Plant at Buckreef Gold

Mine, showing new CIL tanks and conveyor feed

to the new ball mills (Q1 2024)

Figure 2: Buckreef Gold Tailings Storage

Facility Expansion at TSF 2.2 (Q1 2024 – first

lift completed and TSF is now

operational)

Figure 3: Buckreef Gold’s new and

expanded crushing circuit under construction (Q1 2024)

Figure 4: Buckreef Gold’s new cone

crusher and site construction underway (Q1 2024)

Figure 5: Buckreef Gold’s new jaw

crusher and site construction underway (Q1 2024)

Qualified Person

Mr. Andrew Mark Cheatle, P.Geo., MBA, ARSM, is

the Company’s Qualified Person under National Instrument 43-101

“Standards of Disclosure for Mineral Projects” (“NI 43-101”) and

has reviewed and assumes responsibility for the scientific and

technical content in this press release.

Q1 2024 Results Conference Call and

Webcast Details

When: Thursday, January 18 at 11:00 AM

ESTWebcast URL: https://shorturl.at/movwMConference call

numbers:Canada/USA TF: 1-844-763-8274International Toll:

+1-647-484-8814A replay will be made available for 30 days

following the call on the Company’s website.

About TRX Gold Corporation

TRX Gold is rapidly advancing the Buckreef Gold

Project. Anchored by a Mineral Resource published in May 20202, the

project currently hosts an NI 43-101 Measured and Indicated Mineral

Resource of 35.88 MT at 1.77 g/t gold containing 2,036,280 ounces

of gold and an Inferred Mineral Resource of 17.8 MT at 1.11 g/t

gold for 635,540 ounces of gold. The leadership team is focused on

creating both near-term and long-term shareholder value by

increasing gold production to generate positive cash flow. The

positive cash flow will be utilized for exploratory drilling with

the goal of increasing the current gold Resource base and advancing

the Sulphide Ore Project which represents 90% of current gold

Resources. TRX Gold’s actions are led by the highest ESG standards,

evidenced by the relationships and programs that the Company has

developed during its nearly two decades of presence in Geita

Region, Tanzania.

For investor or shareholder inquiries,

please contact:

Investors Christina Lalli Vice

President, Investor RelationsTRX Gold Corporation+1-438-399-8665

c.lalli@TRXgold.comwww.TRXgold.com

Non-IFRS Performance

Measures

The company has included certain non-IFRS

measures in this news release. The following non-IFRS measures

should be read in conjunction with the Company’s unaudited interim

consolidated financial statements for the three months ended

November 30, 2023, filed on SEDAR+ and with the Securities and

Exchange Commission (“SEC”), as well as the Company’s audited

consolidated financial statements included in the Company's Annual

Report on Form 40-F and Annual Information Form for the year ended

August 31, 2023. The financial statements and related notes of TRX

Gold have been prepared in accordance with International Financial

Reporting Standards (“IFRS”). Additional information has been filed

electronically on SEDAR+ and with the SEC and is available online

under the Company’s profile at www.sedarplus.ca and the Company’s

filings with the SEC at www.sec.gov and on our website at

www.TRXgold.com.

Cash cost per ounce of gold

sold

Cash cost per ounce of gold sold is a non-IFRS

performance measure and does not constitute a measure recognized by

IFRS and does not have a standardized meaning defined by IFRS. Cash

cost per ounce may not be comparable to information in other gold

producers’ reports and filings. Upon declaration of commercial

production of the 1,000+ tpd processing plant in Q1 2023,

capitalization of mine development costs ceased, and depreciation

of capitalized mine development costs commenced. As the Company

uses this measure to monitor the performance of our gold mining

operations and its ability to generate positive cash flow,

beginning in Q1 2023, total cash cost per ounce of gold sold starts

with cost of sales related to gold production and removes

depreciation.

Adjusted EBITDA

Adjusted EBITDA is a non-IFRS performance

measure and does not constitute a measure recognized by IFRS and

does not have a standardized meaning defined by IFRS. Adjusted

EBITDA may not be comparable to information in other gold

producers’ reports and filings. Adjusted EBITDA is presented as a

supplemental measure of the Company’s performance and ability to

service its obligations. Adjusted EBITDA is frequently used by

securities analysts, investors and other interested parties in the

evaluation of companies in the industry, many of which present

Adjusted EBITDA when reporting their results. Issuers present

Adjusted EBITDA because investors, analysts and rating agencies

consider it useful in measuring the ability of those issuers to

meet their obligations. Adjusted EBITDA represents net income

(loss) before interest, income taxes, and depreciation and also

eliminates the impact of a number of items that are not considered

indicative of ongoing operating performance.

Certain items of expense are added, and certain

items of income are deducted from net income that are not likely to

recur or are not indicative of the Company’s underlying operating

results for the reporting periods presented or for future operating

performance and consist of:

- Change in fair value of derivative

financial instruments;

- Accretion related to the provision

for reclamation;

- Share-based compensation expense;

and

- Tax adjustments

related to a prior period tax assessment (2012-2020).

The following table provides a reconciliation of

net income (loss) and comprehensive income (loss) to Adjusted

EBITDA per the financial statements for the three ended November

30, 2023.

|

|

Three Months Ended |

Three Months Ended |

|

|

November 30, 2023 |

November 30, 2022 |

| Net

(loss) income and comprehensive (loss) income per financial

statements |

(39 |

) |

5,160 |

|

| Add: |

|

|

|

Depreciation |

484 |

|

193 |

|

| Interest

and other non-recurring expenses |

340 |

|

180 |

|

| Income

tax expense |

1,191 |

|

1,486 |

|

| Change in

fair value of derivative financial instruments |

(199 |

) |

(3,365 |

) |

|

Share-based payment expense |

810 |

|

753 |

|

|

Adjusted EBITDA |

2,587 |

|

4,407 |

|

The Company has included “cash cost per ounce of

gold sold” and “Adjusted EBITDA” as non-IFRS performance measures

throughout this news release as TRX Gold believes that these

generally accepted industry performance measures provide a useful

indication of the Company’s operational performance. The Company

believes that certain investors use this information to evaluate

the Company’s performance and ability to generate cash flow.

Accordingly, they are intended to provide additional information

and should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS.

Forward-Looking and Cautionary Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TRX Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to continued operating

cash flow, expansion of its process plant, estimation of mineral

resources, ability to develop value creating activities,

recoveries, subsequent project testing, success, scope and

viability of mining operations, the timing and amount of estimated

future production, and capital expenditure.

Although TRX Gold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TRX Gold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that TRX Gold files with the SEC and the various Canadian

securities authorities. You can review and obtain copies of these

filings from the SEC's website at http://www.sec.gov/edgar.shtml

and the Company’s profile on the System for Electronic Document

Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca.

The disclosure contained in this press release

of a scientific or technical nature relating to the Company’s

Buckreef Project has been summarized or extracted from the

technical report entitled “The National Instrument 43-101

Independent Technical Report, Updated Mineral Resource Estimate for

the Buckreef Gold Mine Project, Tanzania, East Africa for TRX Gold”

with an effective date (the “Effective Date”) of May 15, 2020 (the

“2020 Technical Report”). The 2020 Technical Report was prepared by

or under the supervision Mr. Wenceslaus Kutekwatekwa (Mining

Engineer, Mining and Project Management Consultant) BSc Hons

(Mining Eng.), MBA, FSAIMM, of Virimai Projects, and, Dr Frank

Crundwell, MBA, PhD, a Consulting Engineer, each of whom is an

independent Qualified Person as such term is defined in NI 43-101.

The information contained herein is subject to all of the

assumptions, qualifications and procedures set out in the 2020

Technical Report and reference should be made to the full details

of the 2020 Technical Report which has been filed with the

applicable regulatory authorities and is available on the Company’s

profile at www.sedarplus.ca. The Company did not complete any new

work that would warrant reporting material changes in the

previously reported Mineral Resource (“MRE”) and Mineral Reserve

statements during the prior reporting period. The Company has

engaged two globally recognized and respected mining consulting

groups to undertake a comprehensive review of the MRE, and economic

analysis which was previously conducted under the 2003 CIM code.

This in turn follows significant infill and exploration drilling,

plus other required technical work undertaken over the prior 18

months. This work is currently being undertaken to be compliant

with the November 2019 CIM Code for the Valuation of Mineral

Properties, which are different with respect to the 2003

guidelines. There can be no assurance that there will not be a

change in the MRE and Mineral Reserve as disclosed in the 2020

Technical Report after such work has been updated (in accordance

with the 2019 CIM code).

The information contained in this press release

is as of the date of the press release and TRX Gold assumes no duty

to update such information.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0c922ca0-4d9d-40cd-aeeb-c447be6bf52b

https://www.globenewswire.com/NewsRoom/AttachmentNg/0d78f5bc-ca71-4514-a380-e2e9c67da4f3

https://www.globenewswire.com/NewsRoom/AttachmentNg/d96296f0-972c-4bca-9e74-53920fc2353a

https://www.globenewswire.com/NewsRoom/AttachmentNg/4c2d9341-bf64-4b10-a284-c9224e389190

https://www.globenewswire.com/NewsRoom/AttachmentNg/331e34ab-6c85-4b57-b1f7-429a1ec8c2fe

1 Refer to “Non-IFRS Performance Measure” section. 2 See

Forward-Looking and Cautionary Statements

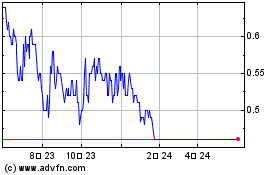

TRX Gold (TSX:TNX)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

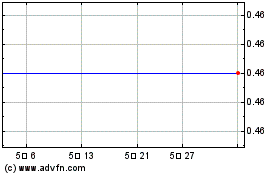

TRX Gold (TSX:TNX)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024