0001856725false00018567252023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 08, 2023 |

Rani Therapeutics Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

001-40672 |

86-3114789 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2051 Ringwood Avenue |

|

San Jose, California |

|

95131 |

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (408) 457-3700 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value $0.0001 per share |

|

RANI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Rani Therapeutics Holdings, Inc. (the “Company”) issued a press release providing a corporate update and announcing its financial results for the third quarter ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 7, 2023, the Board of Directors of the Company (the “Board”) approved a reduction in the annual salary of Talat Imran, the Company’s Chief Executive Officer, from his current annual salary of $520,000 to $100,000, effective November 1, 2023 through December 31, 2024 or until such earlier time as the Company receives gross proceeds of $50,000,000 or more, in the aggregate, from equity financing and/or one or more non-dilutive strategic, licensing or partnering transactions. The decreased base salary amends the Amended and Restated Employment Agreement, dated August 31, 2022, by and between Rani Therapeutics, LLC and Mr. Imran, previously filed with the SEC as Exhibit 10.19 to the Company’s Annual Report on Form 10-K for the year ended December 2022.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Rani Therapeutics Holdings, Inc. |

|

|

|

|

Date: |

November 8, 2023 |

By: |

/s/ Svai Sanford |

|

|

|

Svai Sanford

Chief Financial Officer |

Exhibit 99.1

Rani Therapeutics Reports Third Quarter 2023 Financial Results; Provides Corporate Update

- Cash runway extended into 2025 -

- Announced strategic program prioritization, expansion of manufacturing and plans to streamline business operations -

- Initiated Phase 1 clinical trial of RT-111, a RaniPill GO containing ustekinumab biosimilar CT-P43, with topline results expected in 1Q 2024 -

- Initiation of Phase 2 clinical trial of RT-102, a RaniPill GO containing teriparatide for osteoporosis, expected by the year-end 2023 -

- Announced RaniPill capsule was well-tolerated in 60-day, repeat oral-administration GLP safety study -

- Announced successful drug delivery with RaniPill HC high-capacity capsule in multiple preclinical studies with cumulative >90% success rate -

SAN JOSE, Calif., November 8, 2023 --Rani Therapeutics Holdings, Inc. (“Rani Therapeutics” or “Rani”) (Nasdaq: RANI), a clinical-stage biotherapeutics company focused on the oral delivery of biologics and drugs, today reported financial results for the third quarter ended September 30, 2023, and provided a corporate update.

“In the third quarter, we made important decisions to drive forward our key programs to create long-term value for our shareholders and extend our cash runway into 2025. We announced a strategic prioritization of our RT-102 and RT-111 programs, as well as development of the RaniPill HC to be Phase 1 ready,” said Talat Imran, Chief Executive Officer of Rani Therapeutics. “We are highly encouraged by the continued development of the RaniPill HC, a novel high-capacity capsule capable of delivering up to a 500%-plus higher drug payload than Rani’s existing oral biologics capsule. We have completed multiple preclinical studies of the RaniPill HC with antibodies and other molecules. Our goal is to get this capsule ready for Phase 1 studies in the clinic and we look forward to potential partnering opportunities involving the RaniPill HC.”

Third Quarter or Subsequent Highlights:

•Announced Strategic Program Prioritization, Expansion of Manufacturing and Plans to Streamline Business operations to Support Near-Term Value Drivers and Long-Term Growth of the RaniPill Technology Platform. The plans include strategic prioritization of its key development programs, RT-102, RT-111 and the RaniPill HC and expansion of its manufacturing footprint to support increased scale and partnerships, and cost reduction initiatives that align with Rani’s near-term goals. Development of RT-101 will be discontinued, while the development of RT-105 and RT-110 programs will be paused. In addition, Rani will reduce its workforce by approximately 25%. Anticipated cost savings are expected to support Rani’s operating plans into 2025.

•Completed 60-Day, Repeat Oral-Administration GLP Safety Study. In October 2023, Rani announced preclinical data from a 60-day, repeat oral-administration GLP safety study of the RaniPill capsule in healthy animals. The RaniPill capsule was well-tolerated with no treatment-related adverse events and all animals remained clinically healthy throughout the study.

•Presented an Abstract on RT-102 at the 2023 Annual Meeting of the American Society for Bone and Mineral Research. The abstract focused on the safe and reliable delivery of teriparatide with high bioavailability through daily administration of an oral robotic pill (RT-102) in female volunteers.

•Initiated Phase 1 Clinical Trial of RT-111 (RaniPill Containing Ustekinumab Biosimilar, CT-P43). In September 2023, Rani announced the initiation of a Phase 1 clinical trial to evaluate the safety and

tolerability of RT-111, an orally administered RaniPill GO capsule containing an ustekinumab biosimilar, CT-P43. Currently, ustekinumab is available only as a subcutaneous injection. In preclinical testing of RT-111 in animal models, the RaniPill delivered ustekinumab biosimilar orally with bioavailability comparable to subcutaneous injection. Topline results from this study are expected early in the first quarter of 2024.

•Announced Successful Drug Delivery of High-Capacity Pill in Preclinical Studies. In September and October 2023, Rani announced results from multiple preclinical studies of the RaniPill HC, a version of the RaniPill capsule capable of delivering up to a 500%-plus higher drug payload than Rani’s existing oral biologics capsule. In such studies, the RaniPill HC achieved successful drug delivery with a cumulative >90% success rate.

Development Update

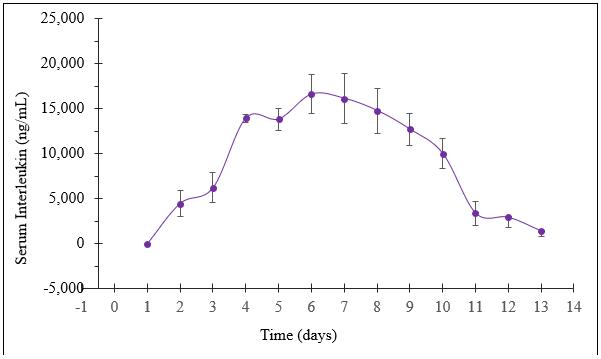

•Rani has completed two preclinical studies of the RaniPill HC with antibodies, adalimumab and an undisclosed interleukin (“Interleukin”). In the two antibody studies, the RaniPill HC achieved an oral delivery success rate of 100% (10/10). In one study, Rani tracked the serum concentrations of adalimumab, following the oral administration of the enteric-coated, RaniPill HC capsule containing 11mg of Humira (adalimumab) to four canine models. In the second study, Rani tracked the serum concentrations of the Interleukin, following the oral administration of the enteric-coated RaniPill HC capsule containing 16.5mg of Interleukin to six canine models. In both studies, the RaniPill HC was well-tolerated, all animals remained healthy throughout the study period with no clinical findings or adverse events, and all device remnants were excreted normally without sequelae.

•Comparing the pharmacokinetic results of 11mg of adalimumab delivered via the RaniPill HC (N=4) with historical pharmacokinetic data generated by Rani with 5mg of an adalimumab biosimilar (GP2017) delivered via subcutaneous injection (N=3), there is a higher estimated bioavailability of adalimumab delivered via the RaniPill HC relative to the subcutaneous injection route.

Adalimumab 11mg via RaniPill HC vs Adalimumab Biosimilar 5mg via Subcutaneous Injection

All Data are Means ± SE

Pharmacokinetics of Interleukin (16.5mg) Delivered Orally via RaniPill HC Capsules to Awake Canines (N=6)

All Data are Means ± SE

Preliminary preclinical testing supports the potential for the RaniPill HC to have high reliability and initial analysis of drug delivery via the RaniPill HC shows a potential for mimicking parenteral (subcutaneous) administration. Rani expects to continue preclinical testing of RaniPill HC to confirm the preliminary reliability rate and optimize device performance with a goal for the RaniPill HC to be ready to advance into the clinic in the second half of 2024.

Near-Term Milestone Expectations:

•Initiation of Phase 2 clinical trial of RT-102, a RaniPill GO containing teriparatide for osteoporosis, expected by year-end 2023.

•Topline results of Phase 1 clinical trial of RT-111, a RaniPill GO containing ustekinumab biosimilar CT-P43, expected in the first quarter of 2024.

•Development of RaniPill HC to be ready for potential Phase 1 clinical trials in the second half of 2024.

Third Quarter Financial Results:

•Cash, cash equivalents and marketable securities as of September 30, 2023, totaled $60.5 million, compared to cash, cash equivalents and marketable securities of $98.5 million as of December 31, 2022. Rani expects its cash, cash equivalents and marketable securities to be sufficient to fund its operations through at least the next twelve months.

•Research and development expenses were $11.2 million for the three months ended September 30, 2023, compared to $9.1 million for the three months ended September 30, 2022. The increase was primarily attributed to higher third-party services expense of $2.1 million due to pre-clinical and clinical development activities.

•General and administrative expenses were $6.6 million for the three months ended September 30, 2023, compared to $7.2 million for the three months ended September 30, 2022. The decrease was primarily attributed to third-party services of $0.7 million related to support for compliance with public company requirements.

•Net loss for the three months ended September 30, 2023 was $18.3 million, compared to $16.2 million for the comparable period in 2022, including stock-based compensation expense of $5.0 million for the three months ended September 30, 2023 compared to $4.4 million for the comparable period in 2022.

About Rani Therapeutics

Rani Therapeutics is a clinical-stage biotherapeutics company focused on advancing technologies to enable the development of orally administered biologics and drugs. Rani has developed the RaniPill capsule, which is a novel, proprietary and patented platform technology, intended to replace subcutaneous injection or intravenous infusion of biologics and drugs with oral dosing. Rani is progressing two RaniPill capsules, the RaniPill GO and the RaniPill HC. Rani has successfully conducted several preclinical and clinical studies to evaluate safety, tolerability and bioavailability using RaniPill capsule technology. For more information, visit ranitherapeutics.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include statements regarding, among other things, the advancement of Rani’s pipeline and RaniPill platform technology including the RaniPill HC, the potential of the RaniPill HC to deliver 500%-plus higher drug payload than Rani’s existing oral biologics capsule, the expected initiation of a Phase 2 clinical trial of RT-102 in 2023, the ability to confirm preliminary reliability and optimize performance of the RaniPill HC, the expected timing of topline results from the RT-111 Phase 1 clinical trial in the first quarter of 2024, the expected readiness of the RaniPill HC for clinical development in the second half of 2024, the ability of expanded manufacturing footpoint to support scaling of manufacturing and partnering, the ability to streamline its business operations and to realize the cost-savings contemplated by such streamlining of business operations, reduction in workforce and other initiatives announced by Rani, the potential for the RaniPill HC to have high reliability and mimic parenteral (subcutaneous) administration, the potential for partner opportunities with the RaniPill HC, customer acceptance of the RaniPill capsule technology, the potential benefits of the RaniPill capsule technology, cash sufficiency forecast, and Rani’s growth as a company. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “capable of,” “potential,” “expects,” “with a goal for,” “anticipate” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon Rani’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks and uncertainties associated with Rani’s business in general and the other risks described in Rani’s filings with the Securities and Exchange Commission, including Rani’s annual report on Form 10-K for the year ended December 31, 2022, and subsequent filings and reports by Rani. All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. Rani undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Trademarks

Trade names, trademarks and service marks of other companies appearing in this press release are the property of their respective owners. Solely for convenience, the trademarks and trade names referred to in this press release appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

Investor Contact:

investors@ranitherapeutics.com

Media Contact:

media@ranitherapeutics.com

RANI THERAPEUTICS HOLDINGS, INC

Condensed Consolidated Balance Sheets

(In thousands, except par value)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,972 |

|

|

$ |

27,007 |

|

Marketable securities |

|

|

55,554 |

|

|

|

71,475 |

|

Prepaid expenses and other current assets |

|

|

2,696 |

|

|

|

2,442 |

|

Total current assets |

|

|

63,222 |

|

|

|

100,924 |

|

Property and equipment, net |

|

|

6,255 |

|

|

|

6,038 |

|

Operating lease right-of-use asset |

|

|

959 |

|

|

|

1,065 |

|

Total assets |

|

$ |

70,436 |

|

|

$ |

108,027 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,405 |

|

|

$ |

1,460 |

|

Accrued expenses and other current liabilities |

|

|

3,930 |

|

|

|

2,349 |

|

Current portion of long-term debt |

|

|

1,222 |

|

|

|

— |

|

Current portion of operating lease liability |

|

|

788 |

|

|

|

1,006 |

|

Total current liabilities |

|

|

7,345 |

|

|

|

4,815 |

|

Long-term debt, less current portion |

|

|

28,101 |

|

|

|

29,149 |

|

Operating lease liability, less current portion |

|

|

171 |

|

|

|

59 |

|

Total liabilities |

|

|

35,617 |

|

|

|

34,023 |

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.0001 par value - 20,000 shares authorized; none issued and outstanding as of September 30, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

Class A common stock, $0.0001 par value - 800,000 shares authorized; 25,876 and 25,295 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively |

|

|

3 |

|

|

|

3 |

|

Class B common stock, $0.0001 par value - 40,000 shares authorized; 24,116 issued and outstanding as of September 30, 2023 and December 31, 2022 |

|

|

2 |

|

|

|

2 |

|

Class C common stock, $0.0001 par value - 20,000 shares authorized; none issued and outstanding as of September 30, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

Additional paid-in capital |

|

|

83,380 |

|

|

|

75,842 |

|

Accumulated other comprehensive loss |

|

|

(41 |

) |

|

|

(73 |

) |

Accumulated deficit |

|

|

(65,791 |

) |

|

|

(38,919 |

) |

Total stockholders' equity attributable to Rani Therapeutics Holdings, Inc. |

|

|

17,553 |

|

|

|

36,855 |

|

Non-controlling interest |

|

|

17,266 |

|

|

|

37,149 |

|

Total stockholders' equity |

|

|

34,819 |

|

|

|

74,004 |

|

Total liabilities and stockholders' equity |

|

$ |

70,436 |

|

|

$ |

108,027 |

|

RANI THERAPEUTICS HOLDINGS, INC

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

11,220 |

|

|

$ |

9,103 |

|

|

$ |

32,018 |

|

|

$ |

26,221 |

|

General and administrative |

|

|

6,635 |

|

|

|

7,239 |

|

|

|

20,647 |

|

|

|

19,748 |

|

Total operating expenses |

|

$ |

17,855 |

|

|

$ |

16,342 |

|

|

$ |

52,665 |

|

|

$ |

45,969 |

|

Loss from operations |

|

|

(17,855 |

) |

|

|

(16,342 |

) |

|

|

(52,665 |

) |

|

|

(45,969 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income and other, net |

|

|

839 |

|

|

|

379 |

|

|

|

2,626 |

|

|

|

430 |

|

Interest expense and other, net |

|

|

(1,316 |

) |

|

|

(352 |

) |

|

|

(3,789 |

) |

|

|

(352 |

) |

Loss before income taxes |

|

|

(18,332 |

) |

|

|

(16,315 |

) |

|

|

(53,828 |

) |

|

|

(45,891 |

) |

Income tax expense |

|

|

— |

|

|

|

107 |

|

|

|

— |

|

|

|

(111 |

) |

Net loss |

|

$ |

(18,332 |

) |

|

$ |

(16,208 |

) |

|

$ |

(53,828 |

) |

|

$ |

(46,002 |

) |

Net loss attributable to non-controlling interest |

|

|

(9,135 |

) |

|

|

(8,253 |

) |

|

|

(26,956 |

) |

|

|

(24,200 |

) |

Net loss attributable to Rani Therapeutics Holdings, Inc. |

|

$ |

(9,197 |

) |

|

$ |

(7,955 |

) |

|

$ |

(26,872 |

) |

|

$ |

(21,802 |

) |

Net loss per Class A common share attributable to Rani Therapeutics Holdings, Inc., basic and diluted |

|

$ |

(0.36 |

) |

|

$ |

(0.33 |

) |

|

$ |

(1.06 |

) |

|

$ |

(0.93 |

) |

Weighted-average Class A common shares outstanding—basic and diluted |

|

|

25,552 |

|

|

|

24,468 |

|

|

|

25,380 |

|

|

|

23,449 |

|

v3.23.3

Document And Entity Information

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity Registrant Name |

Rani Therapeutics Holdings, Inc.

|

| Entity Central Index Key |

0001856725

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-40672

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

86-3114789

|

| Entity Address, Address Line One |

2051 Ringwood Avenue

|

| Entity Address, City or Town |

San Jose

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95131

|

| City Area Code |

(408)

|

| Local Phone Number |

457-3700

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

RANI

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Rani Therapeutics (NASDAQ:RANI)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

Rani Therapeutics (NASDAQ:RANI)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024