As

filed with the Securities and Exchange Commission on April 8, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-1

UNDER

THE

SECURITIES ACT OF 1933

| HWH

International Inc. |

| (Exact

Name of Registrant as Specified in its Charter) |

| Delaware |

|

5122 |

|

87-3296100 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

4800

Montgomery Lane, Suite 210

Bethesda,

MD

1-301-971-3955

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John

Thatch

Chief

Executive Officer

HWH

International Inc.

4800

Montgomery Lane, Suite 210

Bethesda,

MD 20814

1-301-971-3955

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Darrin

Ocasio, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

Telephone:

(212) 930-9700

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholder named in this prospectus may not sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not

permitted.

Subject

to Completion, dated April 8, 2024

PROSPECTUS

HWH

International Inc.

149,443

Shares of Common Stock

This

prospectus relates to the resale by the selling stockholders named in this prospectus from time to time of up to 149,443 shares of our

common stock, par value $0.0001 per share, issued pursuant to a Satisfaction and Discharge of Indebtedness Agreement (the “Satisfaction Agreement”), dated as of

December 18, 2023.

We

will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

Our

registration of the shares of common stock covered by this prospectus does not mean that the selling stockholders will offer or sell

any of such shares of common stock. The selling stockholders named in this prospectus, or their donees, pledgees, transferees or other

successors-in-interest, may resell the shares of common stock covered by this prospectus through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the possible

methods of sale that may be used by the selling stockholders, you should refer to the section of this prospectus entitled “Plan

of Distribution.”

No

underwriter or other person has been engaged to facilitate the sale of the common stock in this offering. We will bear all costs, expenses

and fees in connection with the registration of the common stock. The selling stockholders will bear all commissions and discounts, if

any, attributable to their sales of our common stock.

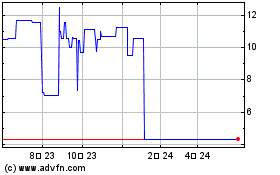

Our

common stock commenced trading on the Nasdaq Global Market LLC under the ticker symbol “HWH” on January 9, 2024, and the

Company’s warrants are expected to commence trading under the symbol “HWHW” at a later date.

Investment

in our common stock involves a high degree of risk. See “Risk Factors” contained in this prospectus on page 5, in our

periodic reports filed from time to time with the Securities and Exchange Commission (the “SEC”), which are incorporated

by reference in this prospectus, and in any applicable prospectus supplement. You should carefully read this prospectus and the documents

we incorporate by reference, before you invest in our common stock.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is April , 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of the registration statement that we filed with the SEC pursuant to which the selling stockholders named herein may,

from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. As permitted by

the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus.

This

prospectus and the documents incorporated by reference into this prospectus include important information about us, the securities being

offered and other information you should know before investing in our securities. You should not assume that the information contained

in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information

we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though

this prospectus is delivered or shares of common stock are sold or otherwise disposed of on a later date. It is important for you to

read and consider all information contained in this prospectus, including the documents incorporated by reference therein, in making

your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus.

You

should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We

have not, and the selling stockholders have not, authorized anyone to give any information or to make any representation to you other

than those contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in

any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

otherwise indicated, information contained or incorporated by reference in this prospectus concerning our industry, including our general

expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry

and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly

available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be

reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily uncertain due to

a variety of factors, including those described in “Risk Factors” beginning on page 5 of this prospectus. These and other

factors could cause our future performance to differ materially from our assumptions and estimates.

This

prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful

to do so. We are not making an offer to sell these securities in any state or jurisdiction where the offer or sale is not permitted.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you

should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk

Factors” section in this prospectus and under similar captions in the documents incorporated by reference into this prospectus.

In this prospectus, unless otherwise stated or the context otherwise requires, references to “HWH International,” “Company,”

“we,” “us,” “our” or similar references mean HWH International Inc. and/or our subsidiaries on a

consolidated basis.

Company

Overview

Our

newly acquired business started in South Korea with a single-level membership marketing model with limited products for sale. We registered

the business on April 1, 2019, and we started selling founders package on July 1, 2019. While we had been profitable and growing,

the COVID-19 pandemic had a material adverse effect on such growth and profits. Due to the decline in membership and revenue starting

in 2020, we reorganized our internal staff by adding a broader team in each of the United States, Hong Kong and Singapore with direct

selling and business development experience to head up and expand our operations across various geographies and revised our business

plan to a multi-level membership tier model in 2022, with more products and services to be made available to our members. We created

a new corporate structure, with subsidiaries in the U.S., Hong Kong and Singapore, that would allow for quick geographical expansion

and turned our focus to the Hapi Café development.

We

have 9,811 individuals with founding member status. This is a privileged class that will be able to enjoy continuous membership

benefits in time to come given that they have trusted the company and joined at an early stage. Such benefits include the ability to

purchase new memberships, in the model described below, at a favorable rate to be determined by the Company. They will also continue

to be able to earn affiliate commissions as they sell our products in the marketplace and enjoy discounted rates when visiting Hapi Cafés

until further notice. The total number of founding members was capped at 10,000. The Company is in the midst of implementing a

new membership model that operates on a yearly subscription basis. While we are not currently selling memberships, we intend to

resume membership sales under this new model.

Members

will get exclusive discounts on HWH Marketplace products, priority invites to product launch events and other parties, and can

earn passive income when a member’s referral signs up for membership or makes an initial purchase through the HWH Marketplace products

through them.

Our

segments include:

HWH

Marketplace, which offers certain products manufactured by our affiliate companies, at a discounted price to our members. It

is substantially in the development stage, as we have been in discussions regarding the import and export of these products internationally.

The various aspects of the HWH Marketplace will be launched in phases across the various regions, each with their own timeline, depending

on the completion of the establishment of the logistical aspects for implementation (i.e., payment gateway systems, business licenses,

banking set up, import licenses, managerial resources, etc.) This will be an on-going process as we expand our product and service offering

range. There are, however, certain limited products currently for sale at our Hapi Cafés, including spaghetti, a gig-economy business

book and certain skincare products.

Hapi

Cafés, which are, and will be, in-person, location-based social experiences, offer members the opportunity to build a

sense of community with like-minded customers who share a potential interest in our products. The cafes expose our members to and educate

them about the products and services of our affiliates, providing us with the chance to significantly increase our membership base as

well as increase the amounts spent by our members on our affiliates’ products and services. Each of our cafés is a “Hapi

Café.” We opened proof-of-concept Hapi Café locations in Seoul, the Republic of Korea and Singapore in May and July

2022, respectively, and plan to open additional Hapi Cafés as we beta test and further improve our business concept. We intend

to grow our memberships as we grow the number of Hapi Cafés around the world. Hapi Cafe is

positioned to be an integral part of HWH’s business model.

Our

travel business is in the planning stage as we are

working with our affiliates to determine the market-by-market services. Through our travel business, we plan to offer exclusive

access to unpublished rates and discounts on air travel, cruises, car rentals, hotels, and resorts for members.

Hapi

Wealth Builder is in the planning stage as we are exploring the options of providing services to our members through financial

educational materials aimed at various types of investing opportunities. The team has been diligently producing digital content for

Hapi Wealth Builder and working to collaborate with the right partners to launch the program and make it available to members. We

have been establishing Hapi Cafés as venues and destinations that help build the credibility and reputation of the Company and

its Hapi Wealth Builder business, which we intend to launch in 2024.

Market

Opportunity

Following

the COVID-19 Pandemic, we believe people are looking for in-person community. By offering a social and business centric atmosphere at

our Hapi Cafés, we plan to leverage this deeply-rooted desire and build a membership organization, increase their familiarity

with and educate them about the products and services of our affiliates and how those products and services can help them in their own

individual pursuits of health, wealth and happiness.

Growth

Strategy

Our

strategy is to continuously grow our membership base, while displaying to our members the added benefits of the higher tiers of membership.

We will look to accomplish this by providing a comfortable in person setting of a Hapi Café for our customers in many more locations.

We also plan to continually expand our product offerings and the services our affiliate companies can provide in the belief that this

can serve to grow our membership base and have our members increasingly opt to avail themselves of membership options that offer them

larger discounts and other benefits on the products and services of our affiliates,

Corporate

Information

Our

mailing address is 4800 Montgomery Lane, Suite 210, Bethesda, MD, 20814. We were incorporated in Delaware on October 20, 2021 under the

name Alset Capital Acquisition Corp. The Company was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition,

stock purchase, reorganization or similar business combination with one or more businesses. The Company consummated a business combination

on January 9, 2024 and changed its name from “Alset Capital Acquisition Corp.” to “HWH International Inc.” The

Company is an early stage and emerging growth company and, as such, the Company is subject to all of the risks associated with early

stage and emerging growth companies. The Company maintains a website at https://www.hwhintl.com.

THE OFFERING

Common

Stock to be Offered

by

the Selling Stockholders |

|

Up

to 149,443 shares of our common stock. |

| |

|

|

| Use

of Proceeds |

|

All

shares of our common stock offered by this prospectus are being registered for the account of the selling stockholders and we will

not receive any proceeds from the sale of these shares. See “Use of Proceeds” beginning on page 6 of this prospectus

for additional information. |

| |

|

|

| Plan

of Distribution |

|

The

selling stockholders named in this prospectus, or their pledgees, donees, transferees, distributees,

beneficiaries or other successors-in-interest, may offer or sell the shares of common stock

from time to time through public or private transactions at prevailing market prices, at

prices related to prevailing market prices or at privately negotiated prices. The selling

stockholders may also resell the shares of common stock to or through underwriters, broker-dealers

or agents, who may receive compensation in the form of discounts, concessions or commissions.

See

“Plan of Distribution” beginning on page 8 of this prospectus for additional information on the methods of sale that

may be used by the selling stockholders. |

| |

|

|

| Nasdaq

Global Market Symbol |

|

Our

common stock is listed on the Nasdaq Global Market LLC under the ticker symbol “HWH”. |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves significant risks. See “Risk Factors” beginning on page 5 of this prospectus and the

documents incorporated by reference in this prospectus. |

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should carefully consider the risks set forth under the section captioned

“Risk Factors” contained in our Annual Report on Form 10-K for the year ended November 30, 2023, which is incorporated by

reference into this prospectus, and in the other reports that we file with the SEC and incorporate by reference into this prospectus,

before deciding to invest in our common stock. The risks and uncertainties we have described are not the only ones we face.

If

any of the events described in these risk factors actually occurs, or if additional risks and uncertainties that are not presently known

to us or that we currently deem immaterial later materialize, then our business, prospects, results of operations and financial condition

could be materially adversely affected. In that event, the trading price of our securities could decline, and you may lose all or part

of your investment in our securities. The risks discussed include forward-looking statements, and our actual results may differ substantially

from those discussed in these forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, and any documents we incorporate by reference, contain certain forward-looking statements that involve substantial risks

and uncertainties. All statements contained in this prospectus and any documents we incorporate by reference, other than statements of

historical facts, are forward-looking statements including statements regarding our strategy, future operations, future financial position,

future revenue, projected costs, prospects, plans, objectives of management and expected market growth. These statements involve known

and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The

words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “may”,

“plan”, “predict”, “project”, “target”, “potential”, “will”,

“would”, “could”, “should”, “continue” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements

include, among other things, statements about: the status, progress and results of our research programs; our ability to obtain regulatory

approvals for, and the level of market opportunity for, our product candidates; our business plans, strategies and objectives, including

plans to pursue collaboration, licensing or other similar arrangements or transactions; our expectations regarding our liquidity and

performance, including our expense levels, sources of capital and ability to maintain our operations as a going concern; the competitive

landscape of our industry; and general market, economic and political conditions.

These

forward-looking statements are only predictions and we may not actually achieve the plans, intentions or expectations disclosed in our

forward-looking statements, so you should not place undue reliance on our forward-looking statements. Actual results or events could

differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have based these

forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect

our business, financial condition and operating results. We have included important factors in the cautionary statements included in

this prospectus that could cause actual future results or events to differ materially from the forward-looking statements that we make.

Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures

or investments we may make.

You

should read this prospectus with the understanding that our actual future results may be materially different from what we expect. We

do not assume any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise,

except as required by applicable law.

USE

OF PROCEEDS

All

shares of common stock offered by this prospectus are being registered for the account of the selling stockholders and we will not receive

any proceeds from the sale of these shares.

SELLING

STOCKHOLDERS

Unless

the context otherwise requires, as used in this prospectus, “selling stockholders” includes the selling stockholders listed

below and donees, pledgees, transferees or other successors-in-interest selling shares received after the date of this prospectus from

the selling stockholders as gifts, pledges or other non-sale related transfers.

We

have prepared this prospectus to allow the selling stockholders or their successors, assignees or other permitted transferees to sell

or otherwise dispose of, from time to time, up to 149,443 shares of our common stock.

Business

Combination

On

February 3, 2022, we consummated our initial public offering (the “Offering”) of an aggregate of 8,625,000 units (“Units”)

including the issuance of 1,125,000 Units as a result of the underwriter’s full exercise of its over-allotment option. The Units

were sold at an offering price of $10.00 per Unit, generating gross proceeds of $86,250,000.

Simultaneously

with the consummation of the Offering, the Company consummated the private placement of 473,750 units (the “Private Placement Units”)

to the sponsor, including the issuance of 33,750 Private Placement Units in connection with the underwriter’s full exercise of

its over-allotment option, at a price of $10.00 per Private Placement Unit, generating total gross proceeds of $4,735,500 (the “Private

Placement”). The Private Placement was conducted as a non-public transaction and, as a transaction by an issuer not involving a

public offering, is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act’), in reliance

upon Section 4(a)(2) of the Securities Act.

Of

the gross proceeds received from the Offering, including the full exercise of the over-allotment option, and the Private Placement Units,

$86.25 million and $4.7 million was placed in the trust account, respectively.

On

February 3, 2022, the Company paid a cash underwriting discount of $0.20 per Unit, or $1,725,000. In addition, the underwriters were

entitled to a deferred fee of $0.35 per Unit, or $3,018,750 in the aggregate. The deferred fee became payable to the underwriters from

the amounts held in the trust account solely in the event that the Company completed a business combination, subject to the terms of

the underwriting agreement.

On

December 18, 2023, the Company entered into the Satisfaction Agreement in connection with the Underwriting Agreement, dated January 31,

2022, with EF Hutton, pursuant to which EF Hutton will accept a combination of $325,000 in cash upon the closing of the business combination,

149,443 shares of the Company’s common stock and a $1,184,375 promissory note as full satisfaction of the deferred underwriting

commission.

Satisfaction

and discharge of the deferred underwriting commission is dependent on the Company’s delivery of the cash payment, the shares of

common stock and the promissory note under the terms of the Satisfaction Agreement. Additionally, the Company has granted EF Hutton an

irrevocable right of first refusal (the “ROFR”) to act as the sole investment banker, sole book-runner, and/or sole placement

agent, at EF Hutton’s sole discretion, for each and every future public and private equity and debt offering, including all equity

linked financing for a period commencing on the date of the satisfaction and ending twenty-four (24) months after the closing of the

business combination.

Pursuant

to the terms of the Satisfaction Agreement, we are required to file a registration statement on Form S-1 or other appropriate form registering

the resale of the shares of common stock issued to EF Hutton pursuant to the deferred underwriting commission.

Relationship

with the Selling Stockholders

EF

Hutton has been engaged in investment banking, advisory and other commercial dealings in the ordinary course of business with us for

which it has received customary compensation.

Information

About Selling Stockholders Offering

The

shares of common stock being offered by the selling stockholders are the 149,443 shares of common stock issued pursuant to the terms

of the Satisfaction Agreement. We are registering these shares in order to permit the selling stockholders to offer the shares for resale

from time to time.

The

table below lists the selling stockholders and other information regarding the ownership of the shares of common stock by the selling

stockholders. The second column lists the number of shares of common stock owned by the selling stockholders, based on their respective

ownership of the shares of common stock as of April 8, 2024 and securities convertible or exercisable into shares of common stock

within 60 days of April 8, 2024, assuming the exercise of the warrants held by each selling stockholder on that date, without

regard to any limitations on the exercise of the warrants. The third column lists the maximum number of shares of common stock being

offered in this prospectus by each selling stockholder. The fourth and fifth columns list the number of shares of common stock owned

after the offering and the percentage of outstanding common stock, assuming in both cases the exercise of the warrants held by that selling

stockholder, without regard to any limitations on the exercise of the warrants and the sale of all of the shares of common stock offered

by that selling stockholder pursuant to this prospectus.

Name of Selling Stockholder | |

Number of shares of common stock owned prior to offering | | |

Maximum number of shares of common stock to be sold pursuant to this Prospectus | | |

Number of shares of common stock owned after offering(1) |

| | Percentage

of common

stock owned

after

offering

|

|

| EF Hutton, LLC (2) | |

| 0 | | |

| 149,443 | (1) | |

| 149,443 |

(1) | | |

* |

% |

*

Less than 1%.

(1) Assumes the sale of the maximum number of shares of common stock registered pursuant to this prospectus by such selling stockholder.

(2) The selling stockholder is a registered broker dealer with a registered address of EF Hutton, LLC, 590 Madison Avenue, 39th Floor, New York, New York 10022, and has sole voting and dispositive power over the securities held.

DESCRIPTION

OF SECURITIES TO BE REGISTERED

The

following summary of the rights of our capital stock is not complete and is subject to and qualified in its entirety by reference to

our Articles of Incorporation and Bylaws, copies of which are filed as exhibits to our Annual Report on Form 10-K for the year ended

November 30, 2023, filed with the SEC on February 28, 2023, and the forms of securities, copies of which are filed as exhibits to the

registration statement of which this prospectus forms a part, which are incorporated by reference herein.

Authorized

Capital Stock

Our

authorized capital stock consists of 56,000,000 shares, consisting of 55,000,000 shares of common stock, and 1,000,000 shares of preferred

stock.

Common

Stock

The

holders of our common stock are entitled to one vote for each share held of record on all matters to be voted on by stockholders.

Holders

of our common stock are entitled to receive dividends or other distributions, if any, as may be declared from time to time by our board

of directors in its discretion out of funds legally available therefor and share equally on a per share basis in all such dividends and

other distributions. In the event of any liquidation, dissolution or winding up of the Company, either voluntary or involuntary, holders

of our common stock will be entitled to receive their ratable and proportionate share of the remaining assets of the Company.

Holders

of our common stock will have no cumulative voting rights, conversion, preemptive or other subscription rights and there are no sinking

fund or redemption provisions applicable to our common stock. The following description is a summary of the material provisions of our

capital stock. You should refer to our Articles of Incorporation and our Bylaws, each as amended to date, both of which are on file with

the SEC as exhibits to previous SEC filings, for additional information. The summary below is qualified by provisions of applicable law.

PLAN

OF DISTRIBUTION

The

selling stockholders, including their pledgees, donees, transferees, distributees, beneficiaries or other successors in interest may,

from time to time, offer some or all of the shares of common stock covered by this prospectus. We will not receive any of the proceeds

from the sale of the shares of common stock covered by this prospectus by the selling stockholders. We will bear all fees and expenses

incident to our obligation to register the shares of our common stock covered by this prospectus.

The

selling stockholders may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time

to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters

or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions.

The shares of common stock may be sold on any national securities exchange or quotation service on which the securities may be listed

or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the

over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying

prices determined at the time of sale, or at privately negotiated prices. These sales may be effected in transactions, which may involve

crosses or block transactions.

The

selling stockholders may use any one or more of the following methods when disposing of shares:

| ● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

| ● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

| ● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account;

|

| ● |

an

over-the-counter distribution; |

| |

|

| ● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

| ● |

privately

negotiated transactions; |

| |

|

| ● |

short

sales effected after the effective date of the registration statement of which this prospectus is a part; |

| |

|

| ● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

| ● |

broker-dealers

may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; |

| |

|

| ● |

a

combination of any such methods of sale; or |

| |

|

| ● |

any

other method permitted pursuant to applicable law. |

The

selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by

them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares

of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable

provision of the Securities Act, amending the list of the selling stockholders to include the selling stockholders’ pledgees, transferees,

or other successors in interest as selling stockholder under this prospectus. The selling stockholders also may transfer the shares of

common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial

owners for purposes of this prospectus.

In

connection with the sale of shares of our common stock, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they

assume. The selling stockholders may also sell shares of our common stock short and deliver these shares to close out their short positions,

or loan or pledge the common stock to broker-dealers that in turn may sell these shares. The selling stockholders may also enter into

option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require

the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Broker-dealers

engaged by the selling stockholders may arrange for other broker-dealers to participate in sales. If the selling stockholders effect

certain transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers

or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from

purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal. Such commissions will

be in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction will

not be in excess of a customary brokerage commission in compliance with applicable FINRA rules; and in the case of a principal transaction

a markup or markdown in compliance with applicable FINRA rules.

The

aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common

stock less discounts or commissions, if any. The selling stockholders reserve the right to accept and, together with their agents from

time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not

receive any of the proceeds from this offering.

The

selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities

Act, provided that they meet the criteria and conforms to the requirements of that rule.

The

selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock may be deemed to

be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or

profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. The selling stockholders

are subject to the prospectus delivery requirements of the Securities Act.

To

the extent required pursuant to Rule 424(b) under the Securities Act, the shares of our common stock to be sold, the names of the selling

stockholders, the purchase price and public offering price, the names of any agent, dealer or underwriter, and any applicable commissions

or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective

amendment to the registration statement that includes this prospectus.

In

order to comply with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through

registered or licensed brokers or dealers. In addition, in some states, the common stock may not be sold unless it has been registered

or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

The

selling stockholders and any other person participating in a sale of the common stock registered under this prospectus will be subject

to applicable provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations

thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of

purchases and sales of any of the shares of common stock by the selling stockholders and any other participating person. All of the foregoing

may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities

with respect to the shares of common stock. In addition, we will make copies of this prospectus (as it may be supplemented or amended

from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities

Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against

certain liabilities, including liabilities arising under the Securities Act.

LEGAL

MATTERS

The

validity of the securities offered by this prospectus will be passed upon by Sichenzia Ross Ference Carmel, LLP, New York, New York.

EXPERTS

The

consolidated financial statements of the Company as of and for the year ended November 30, 2023, included in our Annual Report on Form

10-K for the year ended November 30, 2023, have been audited by MaloneBailey, LLP, independent registered public accounting firm, as

stated in their report, and have been incorporated by reference herein in reliance on the report of such firm given upon their authority

as experts in accounting and auditing.

The

consolidated financial statements of the Company as of and for the year ended December 31, 2023 and December 31, 2022, respectively,

included in our Current Report on Form 8-K/A filed on March 25, 2024, have been audited by Grassi & Co., CPAs, P.C., independent

registered public accounting firm, as stated in their report, and have been incorporated by reference herein in reliance on the report

of such firm given upon their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Exchange Act and in accordance therewith file annual, quarterly and current reports,

proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements

and other information regarding registrants that file electronically with the SEC. The address of the SEC’s website is http://www.sec.gov/.

We

make available free of charge on or through our website at https://www.hwhintl.com/sec-filings, our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d)

of the Exchange Act as soon as reasonably practicable after we electronically file such material with or otherwise furnish it to the

SEC.

We

have filed with the SEC a registration statement under the Securities Act, relating to the offering of these securities. The registration

statement, including the attached exhibits, contains additional relevant information about us and the securities. This prospectus does

not contain all of the information set forth in the registration statement. You can obtain a copy of the registration statement for free

at www.sec.gov. The registration statement and the documents referred to below under “Incorporation of Certain Information By Reference”

are also available on our website, https://www.hwhintl.com/sec-filings.

We

have not incorporated by reference into this prospectus the information on our website, and you should not consider it to be a part of

this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we have filed with it, which means that we can disclose important

information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus,

and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference

the documents listed below and any future documents (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) we

file with the SEC pursuant to Sections l3(a), l3(c), 14 or l5(d) of the Exchange Act subsequent to the date of this prospectus and prior

to the termination of the offering:

| ● |

our

Annual Report on Form 10-K for the year ended November 30, 2023, filed on February 28, 2024; |

| |

|

| ● |

our

Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2023, filed on October 16, 2023; |

| |

|

| ● |

our

Current Reports on Form 8-K filed on March 11, 2024 and March 25, 2024 (other than any portions thereof deemed furnished and not

filed); and |

| |

|

| ● |

our

Form 8-A12B, filed on January 27, 2022. |

All

filings filed by us pursuant to the Exchange Act after the date of the initial filing of this registration statement and prior to the

effectiveness of such registration statement (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) shall also

be deemed to be incorporated by reference into the prospectus.

You

should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone else to provide

you with different information. Any statement contained in a document incorporated by reference into this prospectus will be deemed to

be modified or superseded for the purposes of this prospectus to the extent that a later statement contained in this prospectus or in

any other document incorporated by reference into this prospectus modifies or supersedes the earlier statement. Any statement so modified

or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You should not assume

that the information in this prospectus is accurate as of any date other than the date of this prospectus or the date of the documents

incorporated by reference in this prospectus.

We

will provide without charge to each person to whom a copy of this prospectus is delivered, upon written or oral request, a copy of any

or all of the reports or documents that have been incorporated by reference in this prospectus but not delivered with this prospectus

(other than an exhibit to these filings, unless we have specifically incorporated that exhibit by reference in this prospectus). Any

such request should be addressed to us at:

HWH

International Inc.

Attn:

Corporate Secretary

4800

Montgomery Lane, Suite 210

Bethesda,

MD 20814

1-301-971-3955

You

may also access the documents incorporated by reference in this prospectus through our website at https://www.hwhintl.com/sec-filings.

Except for the specific incorporated documents listed above, no information available on or through our website shall be deemed to be

incorporated in this prospectus or the registration statement of which it forms a part.

149,443

Shares of Common Stock

COMMON

STOCK

PROSPECTUS

PART

II:

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

13. Other Expenses of Issuance and Distribution

The

following table sets forth the various costs and expenses payable by us in connection with the sale of the securities being registered.

All such costs and expenses shall be borne by us. Except for the SEC registration fee, all the amounts shown are estimates.

| SEC registration fee | |

$ | 20 | |

| Legal fees and expenses | |

| 35 | |

| Accounting fees and expenses | |

| 25 | |

| | |

| | |

| Total | |

$ | 80 | |

Item

14. Indemnification of Directors and Officers

Our

certificate of incorporation will provide that our officers and directors will be indemnified by us to the fullest extent authorized

by Delaware law, as it now exists or may in the future be amended. In addition, our certificate of incorporation will provide that our

directors will not be personally liable for monetary damages to us or our stockholders for breaches of their fiduciary duty as directors,

unless they violated their duty of loyalty to us or our stockholders, acted in bad faith, knowingly or intentionally violated the law,

authorized unlawful payments of dividends, unlawful stock purchases or unlawful redemptions, or derived an improper personal benefit

from their actions as directors.

We

will enter into agreements with our officers and directors to provide contractual indemnification in addition to the indemnification

provided for in our certificate of incorporation. Our bylaws also permit us to secure insurance on behalf of any officer, director or

employee for any liability arising out of his or her actions, regardless of whether Delaware law would permit such indemnification. We

have purchased a policy of directors’ and officers’ liability insurance that insures our officers and directors against the

cost of defense, settlement or payment of a judgment in some circumstances and insures us against our obligations to indemnify our officers

and directors.

These

provisions may discourage stockholders from bringing a lawsuit against our directors for breach of their fiduciary duty. These provisions

also may have the effect of reducing the likelihood of derivative litigation against officers and directors, even though such an action,

if successful, might otherwise benefit us and our stockholders. Furthermore, a stockholder’s investment may be adversely affected

to the extent we pay the costs of settlement and damage awards against officers and directors pursuant to these indemnification provisions.

We

believe that these provisions, the directors’ and officers’ liability insurance and the indemnity agreements are necessary

to attract and retain talented and experienced officers and directors.

Item

15. Recent Sales of Unregistered Securities.

On

November 8, 2021, our sponsor purchased 2,156,250 founder shares for an aggregate purchase price of $25,000, or approximately $0.012

per share. Such securities were issued pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act.

Prior to the initial investment in the company of $25,000 by our sponsor, the Company had no assets, tangible or intangible. The per

share purchase price of the founder shares was determined by dividing the amount of cash contributed to the Company by the aggregate

number of founder shares issued. The number of founder shares issued was determined based on the expectation that the founder shares

would represent 20% of the outstanding shares after the Offering (excluding the placement units and underlying securities).

On

February 3, 2022, we consummated our Offering of an aggregate of 8,625,000 units including the issuance of 1,125,000 units as a result

of the underwriter’s full exercise of its over-allotment option. The units were sold at an offering price of $10.00 per unit, generating

gross proceeds of $86,250,000.

Simultaneously

with the consummation of the Offering, the Company consummated the private placement of 473,750 units to the sponsor, including the issuance

of 33,750 Private Placement Units in connection with the underwriter’s full exercise of its over-allotment option, at a price of

$10.00 per Private Placement Unit, generating total gross proceeds of $4,735,500. The Private Placement was conducted as a non-public

transaction and, as a transaction by an issuer not involving a public offering, is exempt from registration under the Securities Act

in reliance upon Section 4(a)(2) of the Securities Act.

Of

the gross proceeds received from the Offering, including the full exercise of the over-allotment option, and the Private Placement Units,

$86.25 million and $4.7 million was placed in the trust account, respectively.

On

February 3, 2022, the Company paid a cash underwriting discount of $0.20 per Unit, or $1,725,000. In addition, the underwriters were

entitled to a deferred fee of $0.35 per Unit, or $3,018,750 in the aggregate. The deferred fee became payable to the underwriters from

the amounts held in the trust account solely in the event that the Company complete a business combination, subject to the terms of the

underwriting agreement.

On

December 18, 2023, the Company entered into the Satisfaction Agreement, pursuant to which EF Hutton will accept 149,443 shares of the

Company’s common stock, excluding additional compensation, as full satisfaction of the deferred underwriting commission.

Item

16. Exhibits and Financial Statement Schedules.

The

list of exhibits following the signature page of this registration statement is incorporated by reference herein.

Item

17. Undertakings

The

undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and

price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

Provided,

however, that:

Paragraphs

(1)(i), (1)(ii) and (1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by

those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d)

of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant

to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

The undersigned registrant hereby undertakes that:

(i)

For purposes of determining any liability under the Securities Act, the information omitted from a form of prospectus filed as part of

this registration statement in reliance upon Rule 430A and contained in the form of prospectus filed by the registrant pursuant to Rule

424(b)(1) or (4) or 497(h) under the Securities Act, shall be deemed to be part of this registration statement as of the time it was

declared effective.

(ii)

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

(5)

That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant

to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant

to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(6)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been informed that in the opinion of the SEC

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that

a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

| |

|

|

| 1.1 |

|

Underwriting

Agreement, incorporated by reference to Exhibit 1.1 of the Registrant’s Current Report on Form 8-K/A filed with the SEC on

February 8, 2022 |

| 2.1 |

|

Merger

Agreement dated September 9, 2022 by and among Alset Capital Acquisition Corp., HWH Merger Sub, Inc. and HWH International Inc.,

incorporated by reference to Exhibit 2.1 to Form 8-K filed with the SEC on September 12, 2022. |

| 3.1 |

|

Amended

and Restated Certificate of Incorporation dated February 2, 2022, incorporated by reference to Exhibit 3.1 of the Registrant’s

Current Report on Form 8-K/A filed with the SEC on February 8, 2022. |

| 3.2 |

|

By

Laws, incorporated by reference to Exhibit 3.3 of the Registrant’s Registration Statement on Form S-1 filed with the SEC on

January 13, 2022. |

| 3.3 |

|

Amendment

to the Amended and Restated Certificate of Incorporation of Alset Capital Acquisition Corp., dated May 2, 2023, incorporated by reference

to Exhibit 3.1 of the registrant’s current report on Form 8-K filed with the SEC on May 3, 2023. |

| 3.4 |

|

Amendment

to Certificate of Incorporation, incorporated by reference to the registrant’s current report on Form 8-K filed with the SEC

on November 3, 2023. |

| 4.1 |

|

Specimen

Unit Certificate, incorporated by reference to Exhibit 4.1 of the Registrant’s Registration Statement on Form S-1 filed with

the SEC on January 13, 2022 |

| 4.2 |

|

Specimen

Class A Common Stock Certificate, incorporated by reference to Exhibit 4.2 of the Registrant’s Registration Statement on Form

S-1 filed with the SEC on January 13, 2022 |

| 4.3 |

|

Specimen

Warrant Certificate, incorporated by reference to Exhibit 4.3 of the Registrant’s Registration Statement on Form S-1 filed

with the SEC on January 13, 2022 |

| 4.4 |

|

Specimen

Right Certificate, incorporated by reference to Exhibit 4.4 of the Registrant’s Registration Statement on Form S-1 filed with

the SEC on January 13, 2022 |

| 4.5 |

|

Warrant

Agreement between Vstock Transfer LLC and the Registrant, incorporated by reference to Exhibit 4.1 of the Registrant’s Current

Report on Form 8-K/A filed with the SEC on February 8, 2022 |

| 4.6 |

|

Rights

Agreement between Vstock Transfer LLC and the Registrant, incorporated by reference to Exhibit 4.2 of the Registrant’s Current

Report on Form 8-K/A filed with the SEC on February 8, 2022 |

| 5.1* |

|

Opinion

of Sichenzia Ross Ference Carmel LLP |

| 10.1 |

|

Letter

Agreement among the Registrant and our officers, directors and Alset Management Group, Inc., incorporated by reference to Exhibit

10.1 of the Registrant’s Current Report on Form 8-K/A filed with the SEC on February 8, 2022. |

| 10.2 |

|

Promissory

Note, dated November 8, 2021, issued to Alset Acquisition Sponsor LLC, incorporated by reference to Exhibit 10.2 of the Registrant’s

Registration Statement on Form S-1 filed with the SEC on January 13, 2022. |

| 10.3 |

|

Investment

Management Trust Agreement between Wilmington Trust Company and the Registrant, incorporated by reference to Exhibit 10.2 of the

Registrant’s Current Report on Form 8-K/A filed with the SEC on February 8, 2022. |

| 10.4 |

|

Registration

Rights Agreement between the Registrant and certain security holders, incorporated by reference to Exhibit 10.3 of the Registrant’s

Current Report on Form 8-K/A filed with the SEC on February 8, 2022. |

| 10.5 |

|

Securities

Subscription Agreement, dated November 8, 2021, between the Registrant and Alset Acquisition Sponsor LLC, incorporated by reference

to Exhibit 10.5 of the Registrant’s Registration Statement on Form S-1 filed with the SEC on January 13, 2022. |

| 10.6 |

|

Placement

Unit Purchase Agreement between the Registrant and Alset Acquisition Sponsor, LLC, incorporated by reference to Exhibit 10.4 of the

Registrant’s Current Report on Form 8-K/A filed with the SEC on February 8, 2022. |

| 10.7 |

|

Form

of Indemnity Agreement, incorporated by reference to Exhibit 10.7 of the Registrant’s Registration Statement on Form S-1 filed

with the SEC on January 13, 2022. |

| 10.8 |

|

Administrative

Support Agreement by and between the Registrant and Alset Management Group, Inc., incorporated by reference to Exhibit 10.6 of the

Registrant’s Current Report on Form 8-K/A filed with the SEC on February 8, 2022 |

| 10.9 |

|

Sponsor

Support Agreement dated as of September 9, 2022, by and among Alset Capital Acquisition Corp. and each of the Persons set forth on

Schedule I attached thereto, incorporated by reference to Exhibit 10.1 to Form 8-K filed with the SEC on September 12, 2022. |

| 10.10 |

|

Shareholder

Support Agreement dated as of September 9, 2022, by and among Alset Capital Acquisition Corp., HWH International Inc. and each of

the Persons set forth on Schedule I attached thereto, incorporated by reference to Exhibit 10.2 to Form 8-K filed with the SEC on

September 12, 2022. |

| 10.11 |

|

Amendment

No. 1 to Investment Management Trust Agreement, incorporated by reference to Exhibit 10.1 of the registrant’s current report

on Form 8-K filed with the SEC on May 3, 2023. |

| 10.12 |

|

Form

of Forward Share Purchase Agreement, dated July 30, 2023, incorporated by reference to Exhibit 10.1 of the registrant’s current

report on Form 8-K filed with the SEC on July 31, 2023. |

| 10.13 |

|

Form

of FPA Funding Amount PIPE Subscription Agreement, dated July 30, 2023, incorporated by reference to Exhibit 10.2 of the registrant’s

current report on Form 8-K filed with the SEC on July 31, 2023. |

| 10.14 |

|

Amendment

No. 2 to Investment Management Trust Agreement, incorporated by reference to Exhibit 10.1 of the registrant’s current report

on Form 8-K filed with the SEC on November 3, 2023. |

| 10.15 |

|

Satisfaction

and Discharge Agreement, dated December 18, 2023, incorporated by reference to Exhibit 10.3 of the registrant’s current report

on Form 8-K filed with the SEC on January 12, 2024. |

| 21 |

|

Subsidiaries

of the Company, incorporated by reference to Exhibit 21 of the registrant’s annual report on Form 10-K filed with the SEC on

February 28, 2024. |

| 23.1* |

|

Auditor Consent of MaloneBailey, LLP., independent registered public accounting firm. |

| 23.2* |

|

Auditor Consent of Grassi & Co., CPAs, P.C., independent registered public accounting firm. |

| 23.3* |

|

Consent

of Sichenzia Ross Ference Carmel LLP (included in Exhibit 5.1). |

| 24.1 |

|

Power

of Attorney (included on signature page of Registration Statement). |

| 99.1 |

|

Audit

Committee Charter, incorporated by reference to Exhibit 99.1 of the registrant’s Registration Statement on Form S-1 filed with

the SEC on January 13, 2022. |

| 99.2 |

|

Compensation

Committee Charter, incorporated by reference to Exhibit 99.2 of the registrant’s Registration Statement on Form S-1 filed with

the SEC on January 13, 2022. |

| 107* |

|

Filing

Fee Table |

* Filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant has duly caused this Registration Statement to be signed

on its behalf by the undersigned, thereunto duly authorized, in the City of Bethesda, State of Maryland, on the 5th day of

April, 2024.

| HWH

International Inc. |

|

| |

|

|

| By: |

/s/

Rongguo (Ronald) Wei |

|

| Name: |

Rongguo

(Ronald) Wei |

|

| Title: |

Chief

Financial Officer |

|

POWER

OF ATTORNEY

Each

of the undersigned officers and directors of HWH International Inc., a Delaware corporation, hereby constitutes and appoints John Thatch

and Rongguo (Ronald) Wei and each of them, severally, as his or her attorney-in-fact and agent, with full power of substitution and resubstitution,

in his or her name and on his or her behalf, to sign in any and all capacities this registration statement and any and all amendments

(including post-effective amendments) and exhibits to this registration statement and any and all applications and other documents relating

thereto, with the SEC, with full power and authority to perform and do any and all acts and things whatsoever which any such attorney

or substitute may deem necessary or advisable to be performed or done in connection with any or all of the above described matters, as

fully as each of the undersigned could do if personally present and acting, hereby ratifying and approving all acts of any such attorney

or substitute.

Pursuant

to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the

registrant and in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

John Thatch |

|

Chief

Executive Officer |

|

April

8, 2024 |

| John

Thatch |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Rongguo (Ronald) Wei |

|

Chief

Financial Officer |

|

April

8, 2024 |

| Rongguo

(Ronald) Wei |

|

(Principal

Financial Officer and

Principal

Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Wong Shui Yeung (Frankie) |

|

Director |

|

April

8, 2024 |

| Wong

Shui Yeung (Frankie) |

|

|

|

|

| |

|

|

|

|

| /s/

William Wu |

|

Director |

|

April

8, 2024 |

| William

Wu |

|

|

|

|

| |

|

|

|

|

| /s/

Wong Tat Keung (Aston) |

|

Director |

|

April

8, 2024 |

| Wong

Tat Keung (Aston) |

|

|

|

|

| |

|

|

|

|

| /s/

Heng Fai Ambrose Chan |

|

Director |

|

April

8, 2024 |

| Heng

Fai Ambrose Chan |

|

|

|

|

Exhibit 5.1

April

8, 2024

HWH

International Inc.

4800

Montgomery Lane, Suite 210

Bethesda,

MD 20814

Re:

Common Stock registered under Registration Statement on Form S-1

Ladies

and Gentlemen:

HWH

International Inc., a Delaware corporation (the “Company”), has filed with the Securities and Exchange Commission (the “SEC”)

a Registration Statement on Form S-1 (the “Registration Statement”) for the purpose of registering for resale under the Securities

Act of 1933, as amended (the “Securities Act”), by the selling stockholder named in the prospectus contained in the Registration

Statement an aggregate of 149,443 shares (the “Shares”) of its common stock, par value $0.0001 per share (the “Common

Stock”).

We

have examined originals or copies of such documents, corporate records, certificates of public officials and other instruments as we

have deemed necessary or advisable for the purpose of rendering this opinion.

In

rendering the opinion expressed herein, we have, without independent inquiry or investigation, assumed that (i) all documents submitted

to us as originals are authentic and complete, (ii) all documents submitted to us as copies conform to authentic, complete originals,

(iii) all signatures on all documents that we reviewed are genuine, (iv) all natural persons executing documents had and have the legal

capacity to do so, (v) all statements in certificates of public officials and officers of the Company that we reviewed were and are accurate

and (vi) all representations made by the Company as to matters of fact in the documents that we reviewed were and are accurate.

Based

upon the foregoing, and subject to the additional qualifications set forth below, we advise you that, in our opinion, as of the date

hereof, the Shares will be validly issued, fully paid and non-assessable.

Without

limiting any of the other limitations, exceptions and qualifications stated elsewhere herein, we express no opinion with regard to the

applicability or effect of the laws of any jurisdiction other than the corporate laws of the State of Delaware and the laws of the State

of New York, as currently in effect (based solely upon our review of a standard compilation thereof). This opinion letter deals only

with the specified legal issues expressly addressed herein, and you should not infer any opinion that is not explicitly stated herein

from any matter addressed in this opinion letter.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement and further consent to the use of our name therein.

In giving this consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities

Act.

| |

Very truly yours, |

| |

|

| |

/s/ Sichenzia Ross Ference Carmel

LLP |

| |

Sichenzia Ross Ference Carmel LLP |

1185

AVENUE OF THE AMERICAS | 31ST FLOOR | NEW YORK, NY | 10036

T

(212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

Exhibit

23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

consent to the incorporation by reference in this Registration Statement on Form S-1 of our report dated February 28, 2024 with respect

to the audited consolidated financial statements of HWH International Inc. formerly known as Alset Capital Acquisition Corp (the “Company”)

as of November 30, 2023 and 2022 and for the years then ended. Our report contains an explanatory paragraph regarding the Company’s

ability to continue as a going concern.

We

also consent to the references to us under the heading “Experts” in such Registration Statement.

/s/

MaloneBailey, LLP

www.malonebailey.com

Houston,

Texas

April

8, 2024

Exhibit

23.2

Consent

of Independent Registered Public Accounting Firm

We

hereby consent to the incorporation by reference in this Form S-1 of our report, dated March 25, 2024, with respect to our audits of

the consolidated financial statements of HWH International Inc. and Subsidiaries as of December 31, 2023 and 2022 and for the years then

ended. Our report included an emphasis of matter paragraph relating to the restatement of the 2022 consolidated financial statements.

We also consent to the reference to our firm under the heading “Experts” appearing therein.

Grassi

& Co., CPAs, P.C.

Jericho,

New York

April

8, 2024

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-1

(Form

Type)

HWH

International Inc.

(Exact

Name of Registrant as Specified in Its Charter)

Table

1: Newly Registered and Carry Forward Securities

| | |

Security Type | |

Security Class Title | |

Fee Calculation or Carry Forward Rule | |

Amount Registered (1) | | |

Proposed Maximum Offering Price per Share (2) | | |

Maximum Aggregate Offering Price (1) | | |

Fee Rate | | |

Amount of Registration Fee | | |

Carry Forward Form Type | | |

Carry Forward File Number | | |

Carry Forward Initial Effective Date | | |

Filing Fee Previously Paid in Connection with Unsold Securities to be Carried Forward | |

| Newly Registered Securities |

| Fees to be Paid | |

Equity | |

Common Stock, par value $0.0001 per share | |

Rule 457(c) | |

| 149,443 | | |

$ | 0.88 | | |

$ | 131,509.84 | | |

$ | 147.60 per million | | |

$ | 19.41 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Fees Previously Paid | |

- | |

- | |

- | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |