Vopak reports continued strong results and announces capacity expansions in industrial terminals

26 7월 2024 - 2:00PM

UK Regulatory

Vopak reports continued strong results and announces capacity

expansions in industrial terminals

The Netherlands, 26 July 2024

Vopak reports continued strong results and announces

capacity expansions in industrial terminals

Key highlights HY1 2024

Improve

- Net profit -including exceptional items- in HY1 2024 of EUR 213

million and EPS of EUR 1.73

- Proportional EBITDA -excluding exceptional items1-

increased in HY1 2024 to EUR 599 million compared to HY1 2023 (EUR

586 million), driven by growth project contributions and a certain

one-off item that fully offset divestment impacts

- Updated FY2024 proportional EBITDA outlook to EUR 1,150-1,180

million, EBITDA outlook to EUR 920-950 million and consolidated

growth capex outlook to around EUR 350 million

Grow

- Growing in gas terminals by building a large-scale LPG export

terminal in Prince Rupert, Western Canada, with a total investment

of EUR 924 million of which EUR 462 million is the Vopak share

- Growing our industrial footprint in Saudi Arabia and China,

investing EUR 63 million proportional growth capex in capacity

expansion

- Started market consultation to explore extension of

EemsEnergyTerminal in the Netherlands for LNG, and potential for

new energies such as CO2 and hydrogen

Accelerate

- Entered the FEED phase of CO2next project, an important

milestone for developing CO2 infrastructure in

Rotterdam

- Commissioned repurposed 15k cbm capacity in Alemoa, Brazil for

renewable feedstock

|

Q2 2024 |

Q1 2024 |

Q2 2023 |

|

In EUR millions |

HY1 2024 |

HY1 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

IFRS Measures -including exceptional

items- |

|

|

|

325.5 |

328.2 |

359.0 |

|

Revenues |

653.7 |

720.8 |

|

106.7 |

105.8 |

121.0 |

|

Net profit / (loss) attributable to holders of ordinary shares |

212.5 |

224.1 |

|

0.88 |

0.85 |

0.97 |

|

Earnings per ordinary share (in EUR) |

1.73 |

1.79 |

|

|

|

|

|

|

|

|

|

239.1 |

278.8 |

250.8 |

|

Cash flows from operating activities (gross) |

517.9 |

477.8 |

|

- 153.2 |

-111.1 |

77.1 |

|

Cash flows from investing activities (including derivatives) |

- 264.3 |

-26.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Alternative performance measures -excluding exceptional

items- 1 |

|

|

|

475.5 |

477.9 |

480.8 |

|

Proportional revenues |

953.4 |

966.9 |

|

301.6 |

297.8 |

292.2 |

|

Proportional group operating profit / (loss) before depreciation

and amortization (EBITDA) |

599.4 |

586.3 |

|

|

|

|

|

|

|

|

|

252.1 |

235.0 |

245.2 |

|

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

487.1 |

494.2 |

|

120.8 |

105.8 |

103.5 |

|

Net profit / (loss) attributable to holders of ordinary shares |

226.6 |

206.6 |

|

0.99 |

0.85 |

0.83 |

|

Earnings per ordinary share (in EUR) |

1.84 |

1.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business KPIs |

|

|

|

34.7 |

34.8 |

36.4 |

|

Storage capacity end of period (in million cbm) |

34.7 |

36.4 |

|

20.1 |

20.2 |

22.0 |

|

Proportional storage capacity end of period (in million cbm) |

20.1 |

22.0 |

|

|

|

|

|

|

|

|

|

92% |

92% |

91% |

|

Subsidiary occupancy rate |

92% |

91% |

|

92% |

93% |

91% |

|

Proportional occupancy rate |

92% |

91% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial KPIs

1 |

|

|

|

16.4% |

17.0% |

13.7% |

|

Proportional operating cash return |

16.7% |

14.6% |

|

2,571.6 |

2,223.4 |

2,852.8 |

|

Net interest-bearing debt |

2,571.6 |

2,852.8 |

|

2.28 |

1.76 |

2.46 |

|

Total net debt : EBITDA |

2.28 |

2.46 |

| |

|

|

|

|

|

|

| |

|

|

|

Sustainability performance |

|

|

| |

|

|

|

Total Injury Rate (TIR), own employees and contractors (per 200,000

hours worked) |

0.16 |

0.15 |

| |

|

|

|

Lost-time Injury Rate (LTIR), own employees and contractors (per

200,000 hours worked) |

0.10 |

0.08 |

| |

|

|

|

Process Safety Event Rate (PSER), own employees and contractors

(per 200,000 hours worked) |

0.07 |

0.14 |

| |

|

|

|

Total GHG emissions - Scope 1 & 2 (metric tons) |

190.9 |

225.2 |

| |

|

|

|

Percentage women in senior management positions |

20.0% |

20.4% |

1. See Enclosure 2 for

reconciliation to the most directly comparable subtotal or total

specified by IFRS Accounting Standards

CEO statement

“In the first half of 2024, financial performance of our network

improved and we executed on our strategy by growing in industrial

and gas terminals and accelerating towards new energies and

sustainable feedstocks. A continued healthy demand for our

infrastructure services resulted in a 92% proportional occupancy in

the first half year. With regards to safety, we continued to

perform well compared to the first half of last year. We had strong

results in executing our strategy by committing to develop a

large-scale LPG export facility, together with our partner in

Western Canada. In our existing industrial terminal portfolio we

are expanding in Saudi Arabia and China. Simultaneously, we are

accelerating in new energies and sustainable feedstocks by entering

the FEED phase for CO2 infrastructure in Rotterdam, and

we commissioned repurposed capacity for renewable feedstock in

Brazil and vegetable oil in the United States of America. We are

well-positioned to capture opportunities which fit our improve,

grow and accelerate strategy.”

Financial Highlights for HY1 2024

IFRS Measures -including exceptional items-

- Revenues were EUR 654 million (HY1 2023: EUR

721 million). Adjusted for divestment impacts of chemical

distribution terminals in Rotterdam and Savannah and currency

translation impacts of EUR 91 million, revenues increased by 4%

year-on-year. The positive performance was driven by favorable

storage demand across different geographies and markets and

contribution of growth projects. Demand for our services was

healthy during the first half of 2024. Throughput levels in our

industrial terminals were solid, with new capacity coming into

service. Gas terminals showed firm throughput levels, backed by

growing energy demand and energy security considerations. In

chemical distribution terminals, the impact on demand for storage

infrastructure was stable. In the oil hub locations, solid storage

demand was primarily driven by the continued growth in oil demand

globally and the rerouting of trade flows. Demand in the oil

distribution terminals also remained firm.

- Operating expenses were EUR 325 million in HY1

2024 (HY1 2023: EUR 352 million). Adjusted for divestment impacts

of EUR 47 million, these expenses increased by EUR 20 million,

mainly due to other expenses recorded as a result of a true up of

AVTL earn out payables of EUR 7 million and an increase in

personnel expenses partly offset by a decrease in energy

costs.

- Cash flows from operating activities increased

by EUR 40 million to EUR 518 million compared to HY1 2023 EUR 478

million, an 8% increase year-on-year, mainly related to increased

dividends received from joint ventures (EUR 85 million) partly

offset derivatives settlements and by lower EBITDA due to

divestment impacts.

- Net profit attributable to holders of ordinary

shares was EUR 213 million (HY1 2023: EUR 224 million)

with a reduction mainly driven by the divestment impacts. Earnings

per share (EPS) in HY1 2024 were EUR 1.73 compared to EUR 1.79 in

HY1 2023.

- Share buyback program of up to EUR 300 million

announced on 14 February 2024, is progressing well. Since its

start, around 75% of the program has been executed per July 25th,

and will be finalized in the course of HY2 2024, barring unforeseen

circumstances. For progress on our share buyback program please

visit our website.

Alternative performance measures -excluding exceptional

items-2

- Proportional revenues were EUR 953 million,

(HY1 2023: EUR 967) an 8% increase after adjusting for divestments

of EUR 87 million.

- Proportional EBITDA increased to EUR 599

million (HY1 2023: EUR 586 million). Adjusted for divestment

impacts of EUR 43 million, proportional EBITDA increased by EUR 56

million (10% year-on-year). Compared to Q1 2024, proportional

EBITDA increased by EUR 4 million, mainly due to an unconditional

success fee related to positive FID taken on our new LPG terminal

in Canada (EUR 7 million). Proportional EBITDA margin in HY1 2024

was 58.9% (HY1 2023: 57.4%) reflecting good business

conditions.

- EBITDA was EUR 487 million (HY1 2023: EUR 494

million). Adjusted for divestment impacts of EUR 43 million, EBITDA

increased by EUR 36 million (8% year-on-year). The increase was

driven by favorable storage demand across the various markets and

geographies and positive growth project contribution which includes

an unconditional success fee related to a positive FID taken

related to the new LPG terminal in Canada (EUR 7 million) and a

deferred income tax release in our joint venture in Pakistan (EUR

10 million). Compared to Q1 2024 (EUR 235 million), EBITDA

increased to EUR 252 million, partly due to certain one-off items

totalling EUR 17 million, related to a deferred income tax release

in our joint venture in Pakistan (EUR 10 million) and an

unconditional success fee related to a positive FID taken related

to the new LPG terminal in Canada (EUR 7 million).

- Growth capex in the first half year was EUR

189 million (HY1 2023: EUR 110 million) reflecting growth

investments in India, Belgium, the United States and Canada.

Proportional growth investments in HY1 2024 were EUR 231 million

(HY1 2023: EUR 184 million).

- Operating capex, which includes sustaining and

IT capex, was EUR 92 million (HY1 2023: EUR 120 million) due to

divestment impacts. Proportional operating capex decreased to EUR

104 million compared to EUR 138 million in HY1 2023, mainly due to

the divestment of the chemical distribution terminals.

- Proportional operating cash flow in HY1 2024

increased by EUR 32 million (8% year-on-year) to EUR 447 million

(HY1 2023: EUR 415 million) driven mainly by lower proportional

operating capex. Proportional operating cash flow per share in HY1

2024 increased to EUR 3.63 per share from EUR 3.31 in HY1

2023.

Business KPIs

- Proportional occupancy rate at Q2 2024 was 92%

compared to 93% in Q1 2024, mainly related to decreased occupancy

in the China Business Unit and out of service capacity in the

Netherlands.

Financial KPIs

- Proportional operating cash return in HY1 2024

improved to 16.7% compared to 14.6% in HY1 2023. The increase was

mainly due to a lower average capital employed due to divestments,

and positive contribution from new growth projects.

- Total net debt : EBITDA ratio was 2.28x at the

end of HY1 2024 compared to 2.46x at the end of HY1 2023. The

increase compared to Q1 2024 was mainly driven by dividends paid to

shareholders in May and the ongoing share buyback program. Our

ambition is to keep total net debt to EBITDA in the range of around

2.50-3.00x. Proportional leverage in HY1 2024 was 2.67x compared to

2.85x in HY1 2023.

Exceptional items in Q2 2024 consist of:

- Divestment gain of EUR 4.3 million following the sale of the

chemical distribution terminal Lanshan in China in May 2024.

- Impairment of EUR 10.1 million of the Ningbo terminal in China

as a result of further infrastructure development plans in the

Zhenhai port that will lead to a reduction of the capacity of

Ningbo terminal.

- Other expenses of EUR 6.9 million following true up of earn out

payables related to AVTL joint venture in India.

For more information please contact:

Vopak Press: Liesbeth Lans - Manager External Communication,

e-mail: global.communication@vopak.com

Vopak Analysts and Investors: Fatjona Topciu - Head of Investor

Relations, e-mail: investor.relations@vopak.com

The analysts’ presentation will be given via an on-demand audio

webcast on Vopak’s corporate website, starting at 10:00 AM CEST on

26 July 2024.

This press release contains inside information as meant in

clause 7 of the Market Abuse Regulation. The content of this report

has not been audited or reviewed by an external auditor.

2. To supplement Vopak’s financial information presented in

accordance with IFRS, management periodically uses certain

alternative performance measures to clarify and enhance

understanding of past performance and future outlook. For further

information please refer to page 8 of the press release.

- Vopak Press Release HY1 2024

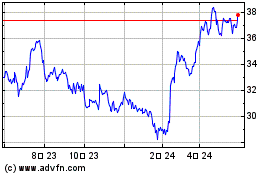

Koninklijke Vopak (EU:VPK)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

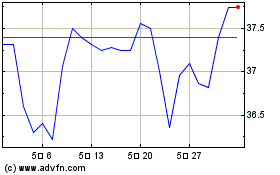

Koninklijke Vopak (EU:VPK)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024