TIDMWEN

RNS Number : 7895V

Wentworth Resources PLC

06 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) NO 596/2014 (AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018). UPON PUBLICATION OF THIS ANNOUNCEMENT, THIS

INSIDE INFORMATION WILL BE CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

6 December 2023

WENTWORTH RESOURCES PLC

("Wentworth" or the "Company")

Update on Offer from Maurel & Prom

Wentworth Resources ( : WEN), the independent, Tanzania-focused

natural gas production company, today provides an update on the

offer from Etablissements Maurel & Prom S.A. ("M&P").

Background

On 5 December 2022, the boards of Wentworth and M&P

announced that they had reached agreement on the terms of a

recommended all cash offer by M&P for the entire issued, and to

be issued, share capital of Wentworth (the "Acquisition"). The

Acquisition is to be implemented by means of a scheme of

arrangement pursuant to Article 125 of the Jersey Companies Law.

The circular in relation to the Scheme was published or made

available to Wentworth Shareholders on 25 January 2023 (the "Scheme

Document").

The Acquisition was approved by Wentworth Shareholders at the

Court Meeting and the General Meeting which were held on 23

February 2023, but remains subject to the satisfaction or (where

capable of being waived) waiver of the other Conditions to the

Acquisition as set out in Part III (Conditions to and certain

further terms of the Acquisition and the Scheme) of the Scheme

Document.

These Conditions include, inter alia, (i) consent from the

Minister responsible for petroleum affairs in Tanzania under the

Petroleum Act 2015 and any other applicable laws ("MoE Consent");

(ii) the waiver of any right of first refusal or pre-emption right

to which by the Tanzania Petroleum Development Corporation ("TPDC")

is entitled in respect of the Mnazi Bay asset (the "TPDC Waiver");

and (iii) approval from the Tanzanian Fair Competition Commission

("FCC") (together the "Governmental Approval Conditions"), in each

case on terms satisfactory to M&P, acting reasonably.

Scheme Court Hearing

Commercial discussions have been ongoing between M&P and

relevant Tanzanian stakeholders regarding the satisfaction of the

above-mentioned Governmental Approval Conditions. Over the course

of the last two weeks, representatives of the Company and M&P

attended a number of meetings with TPDC.

As a result of progress made in these commercial discussions,

the Board has made arrangements for the Jersey Court to consider,

and if thought fit, sanction the Scheme at a Scheme Court Hearing

to be held on 19 December 2023 and all parties are working to

satisfy the Governmental Approval Conditions prior to this

date.

The Scheme remains subject to certain other conditions,

including sanction by the Court at the Court Sanction Hearing and

the delivery of a copy of the Court Order to the Registrar of

Companies. Subject to the satisfaction of the Governmental Approval

Conditions, the Scheme receiving the sanction of the Court, the

delivery of a copy of the Court Order to the Registrar of Companies

and the satisfaction (or, where applicable, the waiver) of the

other Conditions set out in Part III of the Scheme Document, the

Scheme is expected to become effective on 21 December 2023. The

expected timetable of principal events for the implementation of

the Scheme is set out below. If any change to the key dates and/or

times set out in the timetable are made, whether by reason of any

delay in the Governmental Approval Conditions being satisfied or

otherwise, Wentworth will give notice of this change by issuing an

announcement through a Regulatory Information Service and such

announcement will be made available on Wentworth's website at

www.wentplc.com/investors/offer-for-wentworth/

Expected timetable of principal events

Event Expected time / date(1)

Scheme Court Hearing (2) 19 December 2023

----------------------------

Last day for dealings in, and for the by 6.00 p.m. on 20 December

registration of transfer of, and disablement 2023

in CREST of, Wentworth Shares

----------------------------

Scheme Record Time 6.00 p.m. on 20 December

2023

----------------------------

Suspension of Wentworth Shares from 7.30 a.m. on 21 December

trading on AIM 2023

----------------------------

Effective Date of the Scheme(3) 21 December 2023

----------------------------

Cancellation of admission to trading 7.00 a.m. on 22 December

of Wentworth Shares on AIM 2023

----------------------------

Latest date for despatch of cheques by 4 January 2024

and crediting of CREST accounts for

cash consideration due under the Scheme

----------------------------

Long Stop Date (4) 31 December 2023

----------------------------

(1) References to times are to London, United Kingdom time unless otherwise stated.

(2) The time for the Court Sanction Hearing, the number of the

Court and the name of the judge will be available at least 1

business day before the Court Sanction Hearing.

(3) A copy of the Court Order sanctioning the Scheme is expected

to be delivered to the Registrar of Companies one Business Day

after the date of the Court Sanction Hearing, such that the

Effective Date is then expected to be 20 December 2023. The events

which are stated as occurring on subsequent dates are conditional

on the Effective Date and operate by reference to this time.

(4) This is the latest date by which the Scheme may become

Effective. However, the Long Stop Date may be extended to such

later date as may be agreed by Wentworth and M&P (with the

Panel's consent and as the Court may approve (if such consent

and/or approval is required)) or if the Panel requires an extension

to the Long Stop Date pending final determination of an issue under

section 3(g) of Appendix 7 of the Code.

Scheme Shareholders are entitled to attend and be heard at the

Scheme Court Hearing to support or oppose the sanction of the

Scheme, should they wish to do so. Such Scheme Shareholders may

appear in person or be represented by Jersey counsel. Scheme

Shareholders may also write to the Company's Jersey counsel, Carey

Olsen Jersey LLP, 47 Esplanade, St Helier, Jersey JE1 0BD (for the

attention of Guy Coltman) or email guy.coltman@careyolsen.com at

least 72 hours before the date of the Scheme Court Hearing setting

out their objections to the Scheme.

Should any Scheme Shareholder wish to support or oppose the

Scheme at the Scheme Court Hearing, they are advised to seek

appropriate legal advice before doing so.

Terms used but not defined herein shall have the meaning given

to them in the Scheme Document.

In accordance with Rule 26 of the Code, a copy of this

announcement will be available on the Company's website at

www.wentplc.com/investors/offer-for-wentworth/ , where a copy of

the Scheme Document can also be found. The content of the website

referred to in this announcement is not incorporated into and does

not form part of this announcement.

Ends

Enquiries:

Wentworth Resources Katherine Roe, katherine.roe@wentplc.com

Chief Executive Officer +44 (0) 7841 087 230

Financial Adviser, Nominated

Adviser and Joint Broker

Callum Stewart

Stifel Nicolaus Europe Jason Grossman

Limited Simon Mensley +44 (0) 20 7710 7600

Joint Broker

Richard Crichton

Peel Hunt LLP Georgia Langoulant +44 (0) 20 7418 8900

Communications Advisor

Sara Powell

FTI Consulting Ben Brewerton +44 (0) 20 3727 1000

Further information

This Announcement is for information purposes only and is not

intended to and does not constitute, or form part of, an offer,

invitation or the solicitation of an offer of invitation to

purchase or otherwise acquire, subscribe for, sell, or otherwise

dispose of, any securities or the solicitation of any vote or

approval in any jurisdiction pursuant to the Acquisition or

otherwise, nor shall there be any sale, issuance or transfer of

securities of Wentworth in any jurisdiction in contravention of

applicable laws.

The Acquisition will be implemented solely pursuant to the terms

of the Scheme Document (or, in the event that the Acquisition is to

be implemented by means of a Takeover Offer, the Offer Document),

which, together with the Forms of Proxy, will contain the full

terms and conditions of the Acquisition, including details of how

to vote in respect of the Acquisition. Any decision by Wentworth

Shareholders in respect of, or other response to, the Acquisition

(including any vote in respect of the Resolutions to approve the

Acquisition, the Scheme or related matters), should be made only on

the basis of the information contained in the Scheme Document (or,

if the Acquisition is implemented by way of a Takeover Offer, the

Offer Document).

Please be aware that addresses, electronic addresses and certain

other information provided by Wentworth Shareholders, persons with

information rights and other relevant persons in connection with

the receipt of communications from Wentworth may be provided to

M&P during the offer period as required under Section 4 of

Appendix 4 of the Code.

Important Notices relating to the Financial Advisers

Stifel Nicolaus Europe Limited ("Stifel"), which is authorised

and regulated by the FCA in the UK, is acting as financial adviser,

nominated adviser and corporate broker exclusively for Wentworth

and no one else in connection with the matters referred to in this

announcement and will not be responsible to anyone other than

Wentworth for providing the protections afforded to its clients or

for providing advice in relation to matters referred to in this

announcement. Neither Stifel, nor any of its affiliates, owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Stifel in

connection with this announcement, any statement contained herein

or otherwise.

Peel Hunt LLP ("Peel Hunt"), which is authorised and regulated

by the FCA in the UK, is acting as corporate broker exclusively for

Wentworth and no one else in connection with the matters referred

to in this announcement and will not be responsible to anyone other

than Wentworth for providing the protections afforded to its

clients or for providing advice in relation to matters referred to

in this announcement. Neither Peel Hunt, nor any of its affiliates,

owes or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of Peel

Hunt in connection with this announcement, any statement contained

herein or otherwise.

Overseas jurisdictions

The release, publication or distribution of this Announcement in

or into, and the availability of the Acquisition to persons who are

residents, citizens of nationals of, jurisdictions other than the

United Kingdom or Jersey may be restricted by law and therefore any

persons who are subject to the laws of any jurisdiction other than

the United Kingdom or Jersey should inform themselves about, and

observe any applicable legal or regulatory requirements. In

particular, the ability of persons who are not resident in the

United Kingdom or Jersey to accept or procure the acceptance of the

Acquisition (when made) may be affected by the laws of the relevant

jurisdictions in which they are located. Any failure to comply with

the applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. To the fullest extent

permitted by applicable law the companies and persons involved in

the Acquisition disclaim any responsibility or liability for the

violation of such restrictions by any person. This Announcement has

been prepared for the purpose of complying with English and Jersey

law, the Code, the Market Abuse Regulation and the Disclosure

Guidance and Transparency Rules and the information disclosed may

not be the same as that which would have been disclosed if this

Announcement had been prepared in accordance with the laws of

jurisdictions outside the United Kingdom or Jersey.

The receipt of cash pursuant to the Acquisition by Wentworth

Shareholders may be a taxable transaction under applicable

national, state and local, as well as foreign and other tax laws.

Each Wentworth Shareholder is urged to consult their independent

professional adviser regarding the tax consequences of the

Acquisition applicable to them.

Further details in relation to Wentworth Shareholders in

overseas jurisdictions will be contained in the Scheme

Document.

The Acquisition will be subject to the applicable requirements

of the Code, the Panel, the Jersey Companies Law, the London Stock

Exchange and the FCA.

Notes to US investors in Wentworth

Shareholders in the United States should note that the

Acquisition relates to the shares of a Jersey company and is

proposed to be made by means of a scheme of arrangement provided

for under, and governed by, Jersey law. Neither the proxy

solicitation nor the tender offer rules under the US Securities

Exchange Act of 1934, as amended, will apply to the Scheme.

Moreover the Scheme will be subject to the disclosure requirements

and practices applicable in the UK and Jersey to schemes of

arrangement, which differ from the disclosure requirements of the

US proxy solicitation rules and tender offer rules. Financial

information included in this Announcement and the Scheme Document

has been or will be prepared in accordance with accounting

standards applicable in the UK and Jersey and may not be comparable

to financial information of US companies or companies whose

financial statements are prepared in accordance with generally

accepted accounting principles in the United States. If M&P

exercises its right to implement the Acquisition by way of a

Takeover Offer and determines to extend the offer into the United

States, such offer will be made in compliance with applicable

United States securities laws and regulations.

Wentworth and M&P are organised under the laws of Jersey and

France respectively. Some or all of the officers and directors of

Wentworth and M&P are residents of countries other than the

United States. It may not be possible to sue Wentworth and M&P

in a non-US court for violations of US securities laws. It may be

difficult to compel Wentworth, M&P and their respective

affiliates to subject themselves to the jurisdiction and judgment

of a US court.

In accordance with normal UK practice and pursuant to Rule

14e-5(b) of the US Exchange Act, M&P or its nominees, or its

brokers (acting as agents), may from time to time make certain

purchases of, or arrangements to purchase Wentworth Shares outside

of the United States, other than pursuant to the Acquisition, until

the date on which the Acquisition becomes Effective, lapses or is

otherwise withdrawn. These purchases may occur either in the open

market at prevailing prices or in private transactions at

negotiated prices. Any information about such purchases will be

disclosed as required in the UK, will be reported to the Regulatory

Information Service of the London Stock Exchange and will be

available on the London Stock Exchange website at

http://www.londonstockexchange.com/exchange/news/market-news/market-news-home.html.

This Announcement does not constitute or form a part of any

offer to sell or issue, or any solicitation of any offer to

purchase, subscribe for or otherwise acquire, any securities in the

United States.

Neither the US Securities and Exchange Commission nor any

securities commission of any state or other jurisdiction of the

United States has approved the Acquisition, passed upon the

fairness of the Acquisition, or passed upon the adequacy or

accuracy of this Announcement. Any representation to the contrary

is a criminal offence in the United States.

Disclosure requirements

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the Announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

Announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk ,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Forward - looking statements

This Announcement contains certain forward-looking statements,

including statements regarding M&P's and Wentworth's plans,

objectives and expected performance. Such statements relate to

events and depend on circumstances that will occur in the future

and are subject to risks, uncertainties and assumptions. There are

a number of factors which could cause actual results and

developments to differ materially from those expressed or implied

by such forward looking statements, including, among others the

enactment of legislation or regulation that may impose costs or

restrict activities; the re-negotiation of contracts or licences;

fluctuations in demand and pricing in the oil and gas industry;

fluctuations in exchange controls; changes in government policy and

taxations; industrial disputes; war and terrorism. These

forward-looking statements speak only as at the date of this

Announcement.

Rounding

Certain figures included in this Announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of figures that precede them.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPFSDESIEDSESE

(END) Dow Jones Newswires

December 06, 2023 02:00 ET (07:00 GMT)

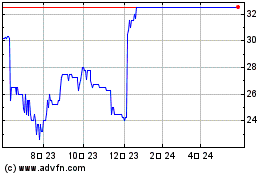

Wentworth Resources (LSE:WEN)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

Wentworth Resources (LSE:WEN)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025