Form 8-K - Current report

16 8월 2024 - 5:35AM

Edgar (US Regulatory)

false 0001227636 0001227636 2024-08-15 2024-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 15, 2024

NEURONETICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38546 |

|

33-1051425 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 3222 Phoenixville Pike, Malvern, PA |

|

19355 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (610) 640-4202

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock ($0.01 par value) |

|

STIM |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

On August 15, 2024, Neuronetics, Inc. (the “Company”) is hosting a pre-recorded virtual fireside chat with certain customers. A copy of the presentation prepared by the Company (the “Presentation”) in connection therewith is attached hereto as Exhibit 99.1 and a transcript of the Presentation is attached hereto as Exhibit 99.2. The information contained in Exhibit 99.1 and Exhibit 99.2 is incorporated herein by reference.

The information in this report furnished pursuant to Item 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this report, except as shall be expressly set forth by specific reference in such a filing.

“Safe harbor” statement under the Private Securities Litigation Reform Act of 1995:

This document includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws and other applicable laws and “forward-looking information” within the meaning of applicable Canadian securities laws. Statements in the press release that are not historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by terms such as “outlook,” “potential,” “believe,” “expect,” “plan,” “anticipate,” “predict,” “may,” “will,” “could,” “would” and “should” as well as the negative of these terms and similar expressions. These statements include those relating to the proposed combination of Greenbrook TMS Inc. (“Greenbrook”) and the Company (the “Proposed Arrangement”), potential benefits of the Proposed Arrangement and the timing thereof. These statements are subject to significant risks and uncertainties and actual results could differ materially from those projected. Investors are cautioned not to place undue reliance on the forward-looking statements contained in this document.

These risks and uncertainties include, without limitation, risks and uncertainties related to: the Proposed Arrangement; our ability to achieve or sustain profitable operations due to our history of losses; our reliance on the sale and usage of our NeuroStar Advanced Therapy System to generate revenues; the scale and efficacy of our salesforce; availability of coverage and reimbursement from third-party payors for treatments using our products; physician and patient demand for treatments using our products; developments in respect of competing technologies and therapies for the indications that our products treat; product defects; the fact that our revenue has been concentrated among a small number of customers; our ability to obtain and maintain intellectual property protection for our technology; developments in clinical trials or regulatory review of the NeuroStar Advanced Therapy System for additional indications; developments in regulation in the U.S. and other applicable jurisdictions; the terms of our credit facility; our ability to successfully roll-out our Better Me Provider Program on the planned timeline; our self-sustainability and existing cash balances; and our ability to achieve cash flow break-even in the fourth quarter of 2024 and on a full-year basis in 2025.

Without limiting the foregoing, these risks and uncertainties also include, without limitation, risks and uncertainties related to: the parties’ ability to meet expectations regarding the timing and completion of the Proposed Arrangement; the occurrence of any event, change or other circumstance that would give rise to the termination of the Proposed Arrangement; the fact that Greenbrook’s and Neuronetics’ respective stockholders may not approve the Proposed Arrangement; the fact that certain terminations of the agreements related to the Proposed Arrangement require Greenbrook or Neuronetics to pay a termination fee; the failure to satisfy each of the conditions to the consummation of the Proposed Arrangement; the disruption of management’s attention from ongoing business operations due to the Proposed Arrangement; the effect of the announcement of the Proposed Arrangement on Greenbrook’s and Neuronetics’ relationships with their respective customers, as well as their respective operating results and business generally; the outcome of any legal proceedings related to the Proposed Arrangement; retention of employees of Greenbrook following the announcement of the Proposed Arrangement; the fact that Greenbrook’s and Neuronetics’ stock price may decline significantly if the Proposed Arrangement is not completed; and other factors described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as each may be updated or supplemented by subsequent reports that the Company has filed or files with the SEC.

These forward-looking statements are based on expectations and assumptions as of the date of this Current Report. Except as required by law, Neuronetics and Greenbrook undertake no duty or obligation to update any forward-looking statements contained in this Current Report as a result of new information, future events, or changes in their expectations.

Important Additional Information and Where to Find It

In connection with the Proposed Arrangement, Neuronetics and Greenbrook will be filing preliminary and definitive joint proxy statements and other relevant documents relating to the proposed transaction with the Securities and Exchange Commission (the “SEC”) and on SEDAR+, as applicable. This communication is not a substitute for the joint proxy statement or any other document that Neuronetics or Greenbrook may file with the SEC or on SEDAR+ or send to their stockholders in connection with the Proposed Arrangement. The description of the Definitive Agreement and voting agreements above do not purport to be complete and are qualified in its entirety by reference to such agreement as filed pursuant to the joint proxy statement and/or any other filing with the SEC and on SEDAR+. Before making any voting decision, Neuronetics’ and Greenbrook’s stockholders are urged to read all relevant documents filed with the SEC and on SEDAR+, including the joint proxy statement, when they become available because they will contain important information about the Proposed Arrangement. Investors and security holders will be able to obtain the joint proxy statement and other documents filed by Neuronetics or Greenbrook with the SEC (when available) free of charge at the SEC’s website, www.sec.gov or on SEDAR+, at www.sedarplus.ca, as applicable, or from Neuronetics or Greenbrook at the investor relations page of their respective websites, https://ir.neuronetics.com/ and greenbrooktms.com/investor-relations. These documents are not currently available.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Neuronetics, Greenbrook and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Neuronetics’ stockholders in connection with the Proposed Arrangement. Neuronetics’ stockholders and other interested persons may obtain, without charge, more detailed information (i) regarding the directors and officers of Neuronetics in Neuronetics’ Annual Report on Form 10-K filed with the SEC on March 7, 2024, its proxy statement relating to its 2024 Annual Meeting of Stockholders filed with the SEC on April 11, 2024 and other relevant materials filed with the SEC when they become available; and (ii) regarding Greenbrook’s directors and officers in Greenbrook’s Annual Report on Form 10-K filed with the SEC and on SEDAR+ on April 25, 2024 and other relevant materials filed with the SEC and on SEDAR+, as applicable, when they become available. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Neuronetics’ stockholders in connection with the Proposed Arrangement will be set forth in the joint proxy statement for the Proposed Arrangement when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Proposed Arrangement will be included in the joint proxy statement that Neuronetics and Greenbrook intend to file with the SEC and on SEDAR+, as applicable.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

| Date: August 15, 2024 |

|

NEURONETICS, INC. |

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Stephen Furlong |

|

|

|

|

|

|

|

|

Stephen Furlong |

|

|

|

|

|

|

|

|

EVP, Chief Financial Officer and Treasurer |

|

|

3

Exhibit 99.1 Fireside Chat Keith Sullivan President & CEO,

Neuronetics, Inc. Bill Leonard President & CEO, Greenbrook TMS

Forward Looking Statements This presentation contains estimates and

other statistical data prepared by independent parties and by Neuronetics, Inc. (the “Company”) relating to market size and growth and other data about the industry in which the Company operates. These estimates and data involve a number

of assumptions and limitations, and you are cautioned not to give undue weight to such estimates and data. Certain statements in this presentation and accompanying commentary that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by terms such as “outlook,” “potential,” “believe,” “expect,”

“plan,” “anticipate,” “predict,” “may,” “will,” “could,” “would” and “should” as well as the negative of these terms and similar expressions. These

statements include those relating to the Company’s business outlook and current expectations for upcoming quarters and fiscal year 2024, including with respect to revenue, expenses, growth, and any statements of assumptions underlying any of

the foregoing items. These statements are subject to significant risks and uncertainties and actual results could differ materially from those projected. The Company cautions investors not to place undue reliance on the forward-looking statements

contained in this presentation. These risks and uncertainties include, without limitation, risks and uncertainties related to: our ability to achieve or sustain profitable operations due to our history of losses; our reliance on the sale and usage

of our NeuroStar Advanced Therapy System to generate revenues; the scale and efficacy of our salesforce; availability of coverage and reimbursement from third-party payors for treatments using our products; physician and patient demand for

treatments using our products; developments in respect of competing technologies and therapies for the indications that our products treat; product defects; our revenue has been concentrated among a small number of customers; our ability to obtain

and maintain intellectual property protection for our technology; developments in clinical trials or regulatory review of the NeuroStar Advanced Therapy System for additional indications; developments in regulation in the U.S. and other applicable

jurisdictions; the terms of our credit facility; our ability to successfully roll-out our Better Me Guarantee Provider Program on the planned timeline; our self-sustainability and existing cash balances; and our ability to achieve cash flow

break-even in the fourth quarter of 2024 and on a full-year basis in 2025. Without limiting the foregoing, these risks and uncertainties also include, without limitation, risks and uncertainties related to: the parties’ ability to meet

expectations regarding the timing and completion of the transaction; the occurrence of any event, change or other circumstance that would give rise to the termination of the transaction agreement; the fact that Greenbrook’s and

Neuronetics’ respective stockholders may not approve the transaction; the fact that certain terminations of the transaction agreement require Greenbrook or Neuronetics to pay a termination fee; the failure to satisfy each of the conditions to

the consummation of the transaction; the disruption of management’s attention from ongoing business operations due to the transaction; the effect of the announcement of the transaction on the Greenbrook’s and Neuronetics’

relationships with their respective customers, as well as its operating results and business generally; the outcome of any legal proceedings related to the transaction; retention of employees of Greenbrook following the announcement of the

transaction; the fact that Greenbrook’s and Neuronetics’ stock price may decline significantly if the transaction is not completed; and other factors described under the heading “Risk Factors” in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023, and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as each may be updated or supplemented by subsequent reports that the Company has filed or files with the

SEC. In connection with the transaction, Neuronetics and Greenbrook will be filing preliminary and definitive joint proxy statements and other relevant documents relating to the proposed transaction with the Securities and Exchange Commission (the

“SEC”) and on SEDAR+, as applicable. This communication is not a substitute for the joint proxy statement or any other document that Neuronetics or Greenbrook may file with the SEC or on SEDAR+ or send to their stockholders in connection

with the transaction. The description of the transaction agreement and voting agreements above do not purport to be complete and are qualified in its entirety by reference to such agreement as filed pursuant to the joint proxy statement and/or any

other filing with the SEC and on SEDAR+. Before making any voting decision, Neuronetics’ and Greenbrook’s stockholders are urged to read all relevant documents filed with the SEC and on SEDAR+, including the joint proxy statement, when

they become available because they will contain important information about the transaction. Investors and security holders will be able to obtain the joint proxy statement and other documents filed by Neuronetics or Greenbrook with the SEC (when

available) free of charge at the SEC’s website, www.sec.gov or on SEDAR+, at www.sedarplus.ca, as applicable, or from Neuronetics or Greenbrook at the investor relations page of their respective websites, https://ir.neuronetics.com/ and

greenbrooktms.com/investor-relations. These documents are not currently available. 2

No Offer or Solicitation This communication is for information purposes

only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation

of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Neuronetics, Greenbrook and their

respective directors and executive officers may be deemed participants in the solicitation of proxies from Neuronetics’ stockholders in connection with the transaction. Neuronetics’ stockholders and other interested persons may obtain,

without charge, more detailed information (i) regarding the directors and officers of Neuronetics in Neuronetics’ Annual Report on Form 10-K filed with the SEC on March 7, 2024, its proxy statement relating to its 2024 Annual Meeting of

Stockholders filed with the SEC on April 11, 2024 and other relevant materials filed with the SEC when they become available; and (ii) regarding Greenbrook’s directors and officers in Greenbrook’s Annual Report on Form 10-K filed with

the SEC and on SEDAR+ on April 25, 2024 and other relevant materials filed with the SEC and on SEDAR+, as applicable, when they become available. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation

of proxies to Neuronetics’ stockholders in connection with the transaction will be set forth in the joint proxy statement for the transaction when available. Additional information regarding the interests of participants in the solicitation of

proxies in connection with the transaction will be included in the joint proxy statement that Neuronetics and Greenbrook intend to file with the SEC and on SEDAR+, as applicable. 3

Fireside Chat Keith Sullivan President & CEO, Neuronetics, Inc. Bill

Leonard President & CEO, Greenbrook TMS

You had a LOT of Questions! How will acquisition help my individual

practice? What will happen to the Greenbrook brand name? Company Confidential 5

Question Themes Is NeuroStar now going to be competing with me? How will

NeuroStar’s marketing strategy change? How will acquisition help my individual practice? Company Confidential 6

Focused on Practice Success PHQ-10 NeuroStar University Company

Confidential 7

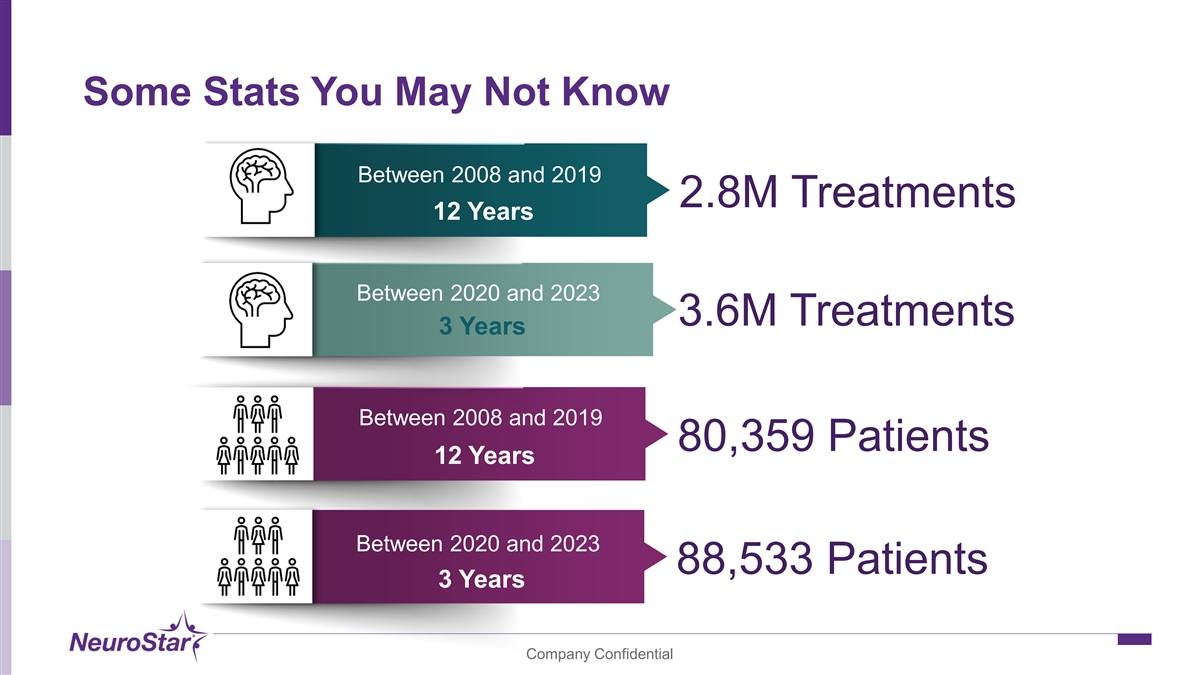

Some Stats You May Not Know Between 2008 and 2019 2.8M Treatments 12

Years Between 2020 and 2023 3.6M Treatments 3 Years Between 2008 and 2019 80,359 Patients 12 Years Between 2020 and 2023 88,533 Patients 3 Years Company Confidential

Advantages of Greenbrook Acquisition Knowledge Patient Access to and

Best Lifecycle Services Practices Management Company Confidential 9

Amplifying Brand Awareness Company Confidential 10

11

12

Company Confidential 13

Company Confidential 14

Company Confidential

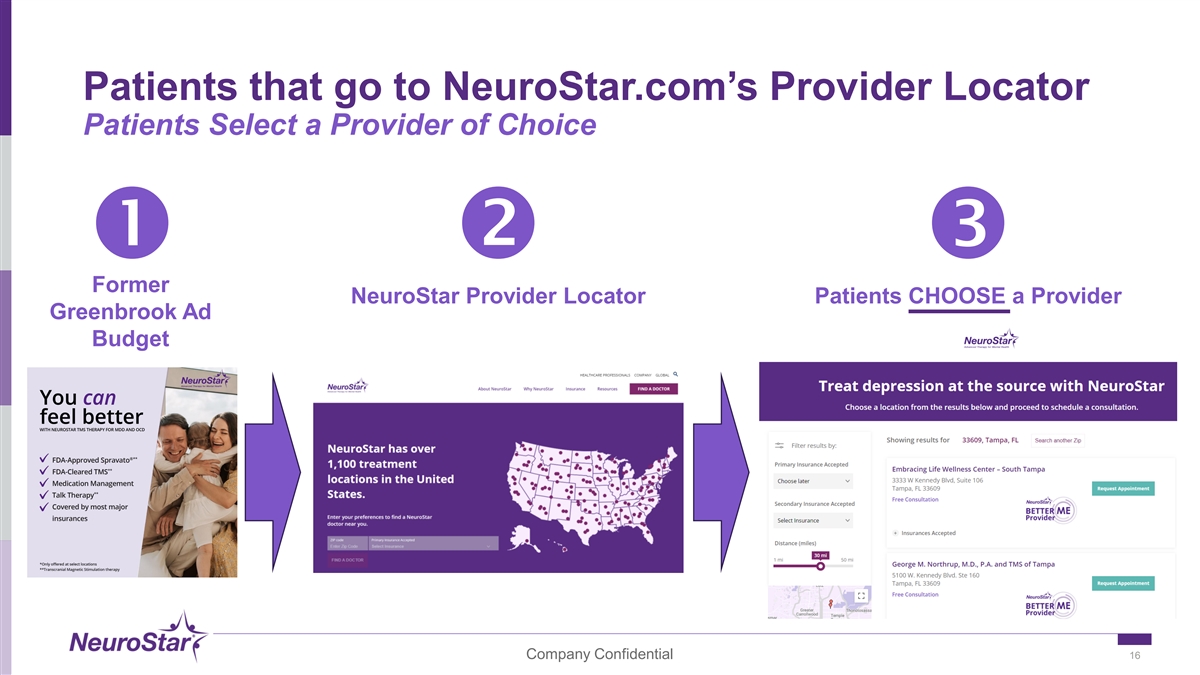

Patients that go to NeuroStar.com’s Provider Locator Patients

Select a Provider of Choice ŒŽ Former NeuroStar Provider Locator Patients CHOOSE a Provider Greenbrook Ad Budget Company Confidential 16

Amplifying Brand Awareness What this means to you is that the current

NeuroStar inside your practice BECOMES EVEN MORE RECOGNIZABLE TO PATIENTS Company Confidential 17

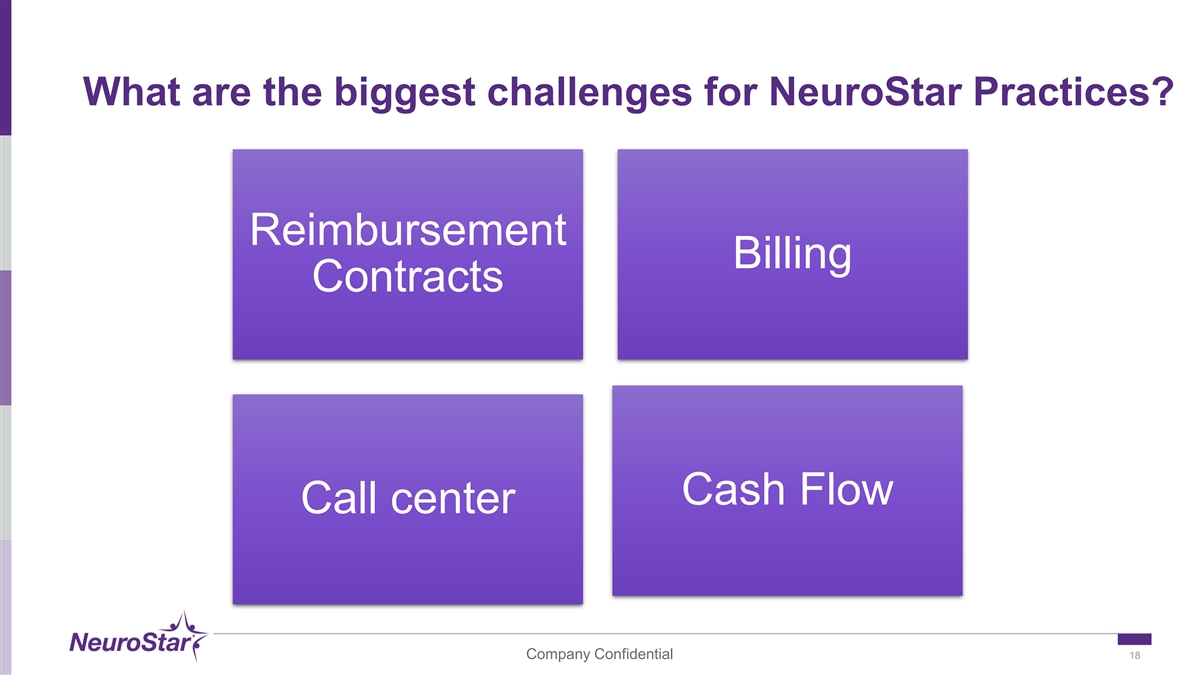

What are the biggest challenges for NeuroStar Practices? Reimbursement

Billing Contracts Cash Flow Call center Company Confidential 18

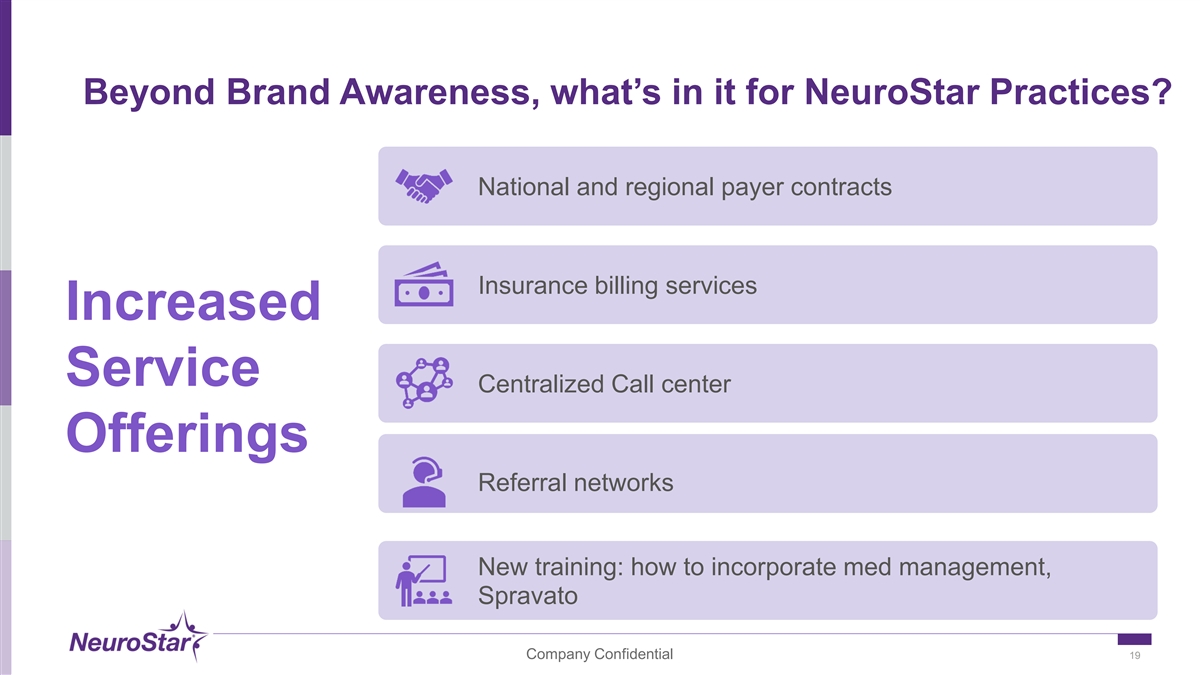

Beyond Brand Awareness, what’s in it for NeuroStar Practices?

National and regional payer contracts Insurance billing services Increased Service Centralized Call center Offerings Referral networks New training: how to incorporate med management, Spravato Company Confidential 19

Q&A

Exhibit 99.2

NeuroStar Fireside Chat Transcript

Marjorie Donovan

Head of Customer Education

Keith Sullivan

President & CEO,

Neuronetics, Inc.

Bill Leonard

President & CEO, Greenbrook TMS

Marjorie Donovan

Head of Customer Education

Good afternoon, and welcome to the NeuroStar Fireside Chat. We are honored that you joined us today to hear more about how the acquisition of

Greenbrook will impact our NeuroStar practices across the country. I am joined today by Keith Sullivan, the CEO of NeuroStar, and Bill Leonard, the CEO of Greenbrook TMS, and they are going to be with us here today. Before we begin, I would like to

caution listeners that certain information discussed by management during this meeting will include forward looking statements covered under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements

related to our business strategy, financial, and revenue guidance, and other operational issues and metrics.

Actual results can differ materially from

those stated or implied by these forward-looking statements due to risks and uncertainties associated with the company’s businesses. For a discussion of risks and uncertainties associated with Neuronetics or Greenbrook’s business, I

encourage you to review the company’s filings with the Securities and Exchange Commission on SEDAR as applicable. Neuronetics and Greenbrook disclaim any obligation to update any forward-looking statements made during the course of this call

except as required by law.

Now I’d like to officially kick off the fireside chat. My name is Marjorie Donovan. I am the head of customer education

for Neuronetics, and many of you know me from NeuroStar University.

As you saw on Monday, NeuroStar has announced that we have entered into a definitive

agreement to acquire Greenbrook by the end of 2024.

This is the biggest event to happen to the TMS market since its inception.

Now as you all know, NeuroStar is the largest TMS manufacturer.

Greenbrook is the largest TMS provider with a hundred and twenty locations in eighteen states.

Now what you must be wondering is, how does the NeuroStar acquisition of Greenbrook impact me and my practice? And that’s why you all joined us here

today, and that’s exactly why we were having this fireside chat because we want to reassure you that as our partner, the purpose of this acquisition is to leverage the strengths of each company to do one thing, and that is to bring value to

your practice like never before.

We are honored that you took time out of your busy professional and personal lives to join this call, and I also want to

thank you for submitting so many thoughtful questions in advance.

The good news is that with all of the various questions that we received from you is

that they all had a distinct theme, and there were three distinct themes that all the questions laddered up into.

And those three themes are, number one,

is NeuroStar now going to be competing with me? Number two, how will NeuroStar’s marketing efforts change with the acquisition of Greenbrook? And number three, how is this acquisition ultimately going to help my individual practice?

We have created a small presentation to address all of these questions and more. So first, I wanted to share with you a little bit about Keith Sullivan.

As many of you know, Keith joined NeuroStar in 2020. And since then, Keith’s leadership has really been defined by a focus on practice success.

Over the last three-plus years, Keith has spearheaded programs such as NeuroStar University, my personal favorite, the enhanced TrakStar, PHQ-10, the Better Me program, so many of these initiatives and programs that you’ve all entered into.

And I have to tell you that the data has been proven. If you look at the last fifteen years that we’ve

been an organization, I want to first look at the first twelve years. There were two point eight million treatment sessions performed.

Under Keith’s

leadership over the last three and a half years, there have been three point six million treatments performed.

Now let’s define that in terms that

we all care about, which is in the amount of patients’ lives. In the first ten first twelve years, eighty thousand three hundred and fifty-nine patients were treated. And under Keith’s leadership, eighty-eight thousand five hundred and

thirty-three patients have been treated in all of your practices.

Keith is going to share with you the vision of how the acquisition of Greenbrook is

going to make NeuroStar a household name so that more patients get treated with our life-saving therapy. Keith, are you with me? Are you on the call? How are you doing today?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

Doing great, Marjorie. And thank you all for joining us today.

Excellent. Now I want to tell you about Bill Leonard, who’s the CEO and co-founder of Greenbrook TNX. Bill co-founded Greenbrook back in 2011, and since then, Greenbrook has expanded to a hundred and twenty locations in eighteen states.

Now what I think is interesting from our practices’ perspective is that what started as a TMS-only business,

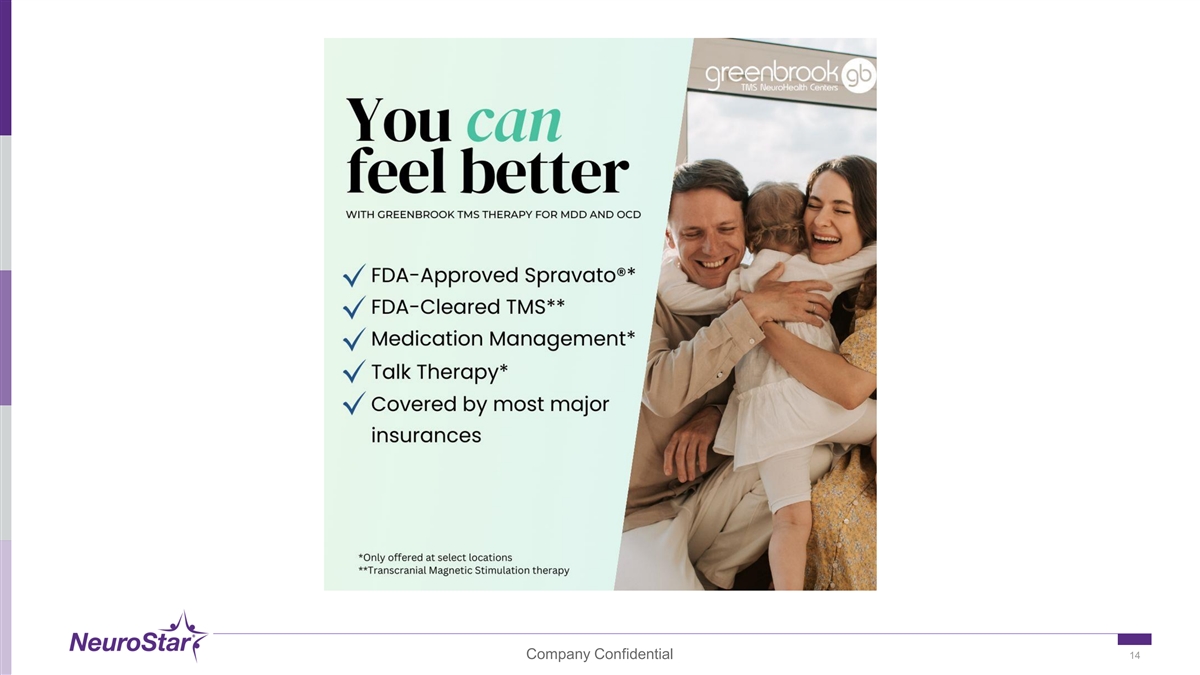

Greenbrook has expanded to other services like Spravato and Med Management.

One of the advantages of acquiring Greenbrook is that Bill and his team have

a wealth of knowledge and best practices that they will share with you when the deal is closed, as well as giving you our practices access to shared service offerings.

So, Bill, are you there? How are you feeling? Can you give a hi to all of our practices across the country?

Bill Leonard

President & CEO, Greenbrook TMS

Hello,

everyone. Excited to be part of this special opportunity and glad to participate in this, fireside chat.

Marjorie Donovan

Head of Customer Education

Excellent.

Thank you.

So, Keith, I’m going to kick it off first to

you. And I’m curious, when you look at the last we announced this on Monday. Why are you acquiring Greenbrook? What is the impetus? Tell us a little bit more about that.

Keith Sullivan

President & CEO,

Neuronetics, Inc.

Thanks, Marjorie.

You know, Bill

and I first started talking, honestly, the day I, joined Neuronetics.

Their office is in McLean, Virginia, and I lived three miles away from their

corporate headquarters.

And that morning at ten o’clock, that I took this job, I was sitting in Bill Leonard’s office telling him that our

interests are aligned, that there is a lack of awareness of patients in this industry, and there is no shortage of them that need to be treated. And that if we could drive better awareness and brand recognition, that we could help treat more

patients that are looking for help with this technology.

So, over the last, four years, we’ve had many meetings, talking about how we can work

closer together, and potentially get together to be able to amplify this brand.

Greenbrook today has a hundred and twenty stores.

But yet with that, hundred and twenty stores, they’re marketing Greenbrook.

With our BMP providers, we have another roughly three hundred accounts, and they’re all marketing their brand.

Under this new opportunity, we can market NeuroStar.

And

whether it’s NeuroStar Health Centers or NeuroStar Mind Centers, I don’t we don’t know yet. And our chief marketing officer Lisa Rosas is going to do the work that needs to be done to determine what the best name should be. But it is

an opportunity for us to take the brick-and-mortar stores of Greenbrook and turn them into NeuroStar centers.

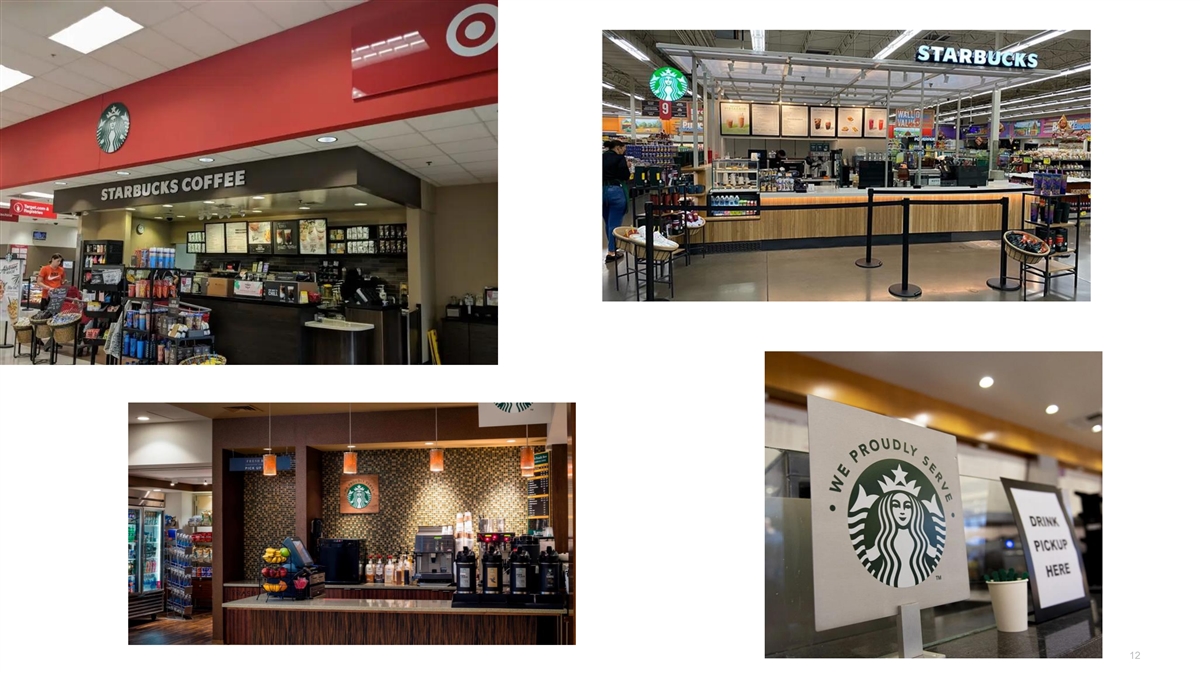

This is not a unique situation in the marketplace. And if I can give you an example, when Starbucks started many years ago, they formed brick-and-mortar stores all across the country. If you go into New York City, there’s one almost on every block. If you go into a small town, there’s at least three.

But they got brand recognition because they built their brick-and-mortar

stores.

But today, if you look for Starbucks, where do you see it? It’s not just in their stores.

You go into your grocery store, and there is a kiosk with, Starbucks. You go into the Marriott, and you’re going to see an entire center, which is

focused on Starbucks.

So, wherever you go today, they all say, we proudly serve Starbucks here.

I think we have that same opportunity.

Marjorie Donovan

Head of Customer Education

So, Keith, let’s

dig into that. So, I’m understanding that we have the two different models for Starbucks. There’s the physical brick-and-mortar stores. That’s what got

them their brand awareness. And now, of course, you can get your coffee at the local Marriott where they proudly service. How does this relate to what the opportunity is at Greenbrook, and where do our practices fit into the store in the store

model?

Let’s dig first into what does it mean for the hundred and twenty Greenbrook stores that exist today.

Keith Sullivan

President & CEO,

Neuronetics, Inc.

So, if we look at the Greenbrook stores, to me, they’re the Starbucks brick-and-mortar. Bill Leonard has built a tremendous network of a hundred and twenty brick-and-mortar stores around the

country.

But once we complete this acquisition, we are going to transform those stores into NeuroStar centers.

Marjorie Donovan

Head of Customer Education

Okay. So the hundred and twenty Greenbrook stores, they’re now being branded bleeding purple. They’re now NeuroStar. What does it mean

for the ads?

Keith Sullivan

President & CEO, Neuronetics, Inc.

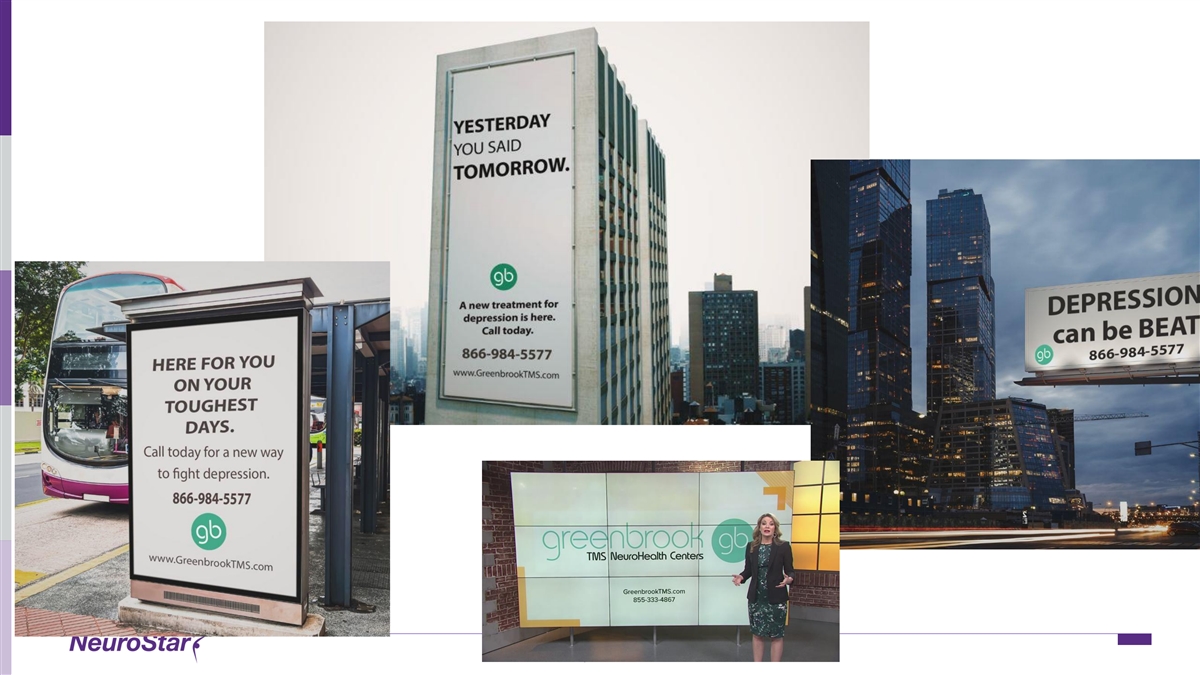

Through that branding, we are going to change the look and the feel of the Greenbrook ads to be NeuroStar ads. So these are print ads and Facebook ads. Here

are the billboard ads that are all across, their sites at around the eighteen states where they have locations.

All of those will be transformed into

NeuroStar centers. So when your patients see these ads and then they come into your office and they see that you too have NeuroStar, it’s the store within the store concept.

Marjorie Donovan

Head of Customer Education

Okay. But, Keith, what

does this mean to our practices? I know that a lot of the questions we had were revolving. Are we now going to be competing with NeuroStar? Can you walk us through that from your perspective?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

You know, Marjorie, in a lot of industries and in my past, the fear with competing is that you’re going to compete on

price.

That doesn’t happen in this space. What we’re really competing for is awareness.

And I think by having a brand, NeuroStar, that is recognized on a street level and then a brand that is NeuroStar that’s represented by a given practice,

NeuroStar by fill in the blank with your name, I think that it tells the patient that you’re bigger and part of a bigger network of stores. We have over eight hundred practices.

Eight hundred of them have come through NSU.

In every intake

form that we give to these people that attend NSU, we ask them, what are the three biggest challenges that you face in your practice?

Challenges are

always the same, but not one of them ever has been, Greenbrook has taken all my patients. How do I fight them?

Greenbrook is going to help amplify the

brand by being a NeuroStar Center, and it’s going to help all of our practices appear that they are part of a bigger network of NeuroStar providers.

Marjorie Donovan

Head of Customer Education

So, when you look here, let’s talk about the patient journey. Because what you’re saying is through the acquisition, we’re going to

amplify brand awareness so that more patients are asking for NeuroStar by name. But I know a lot of practices have approached me to say, how do we make sure that any of these prospective patients how do we know that they’re going to come to us?

So, can you walk us through that and how that will exist today?

Keith Sullivan

President & CEO, Neuronetics, Inc.

I can,

and I think it’s a very fair question.

I think that today, we have made a commitment through the Better Me provider program that if you commit to

these five standards, and those five standards are open to all of our twelve hundred sites across the country, I don’t care whether you treat one patient a month or whether you treat fifty patients a month.

Our standards, if you meet them, you’re in the Better Me provider program.

If you’re in that program, that means you’re going to answer your phone. You’re going to follow-up on

patient leads. You’re going to have the brand awareness on your website and on your social media, and that you’ve attended NSU that has put it all together for you. And more importantly, you’re going to treat your patients to thirty-six sessions.

If you’re in that program, and I invite every single one of our sites to be, it doesn’t

change. Today, a patient who sees a NeuroStar ad will have an opportunity to go to NeuroStar dot com. When they go to NeuroStar dot com, they are going to see the providers that are closest to them. They pick which provider they want to go to. We

don’t pick who they go to. And as a result, they can either click on a web form and fill it out, or they can click the call. Hopefully, it’s the closest site to their house so that they have convenience in their treatments.

Marjorie Donovan

Head of Customer Education

Okay. So now that we talked through the patient journey of how they find practices, I want to just take a moment to say, Keith, of all the things

that you’re doing with this acquisition, I know the goal is to amplify brand awareness.

But, fundamentally, what does that mean to the practices across the country who purchased NeuroStar TMS

maybe seven months ago or seven years ago? What is different now? What does this mean to them?

Keith Sullivan

President & CEO, Neuronetics, Inc.

Marjorie, if we can get the broader awareness, if we can spend our fifteen million dollars and make NeuroStar a household name for patients that are battling

depression, then all tides are going to rise on, all ships are going to rise on that tide. We are going to help build a brand so that people battling depression and their family members and loved ones, all of whom are consumed with this depression,

will be able to recognize that brand either walking down the street or in those physician offices.

Marjorie Donovan

Head of Customer Education

So, the NeuroStar

inside the practices that we have today, they become more recognizable because now more patients are starting to ask for it by name. So that current NeuroStar, it just infinitely became more valuable. Right?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

That’s our goal.

Marjorie Donovan

Head of Customer Education

More identifiable. Okay. So now that we understand the aspect of amplifying brand awareness with this acquisition and what it means to our

practices, what else does this acquisition help for our practices? What else what else can they think about from this perspective?

Keith Sullivan

President & CEO, Neuronetics, Inc.

I think we have tremendous opportunities for our practices.

Again, if I go back to NeuroStar dot if I go back to, NSU and the intake form—Most of the people who

come to NeuroStar University, when we ask them, why are you here? What do you want to learn?

The most common things that they say is, I have trouble with

reimbursement.

I have trouble getting prior authorizations.

I have trouble with billing.

I have trouble with my front desk

and keeping the typically lowest-paid employee with the highest turnover trained and educated.

And I have trouble with the time it takes to get my money

back from the payers.

So those are the biggest problems that our customers are seeing, and I think we have a solution for them.

Marjorie Donovan

Head of Customer Education

So, if we

Keith Sullivan

President & CEO, Neuronetics, Inc.

Go

ahead.

Marjorie Donovan

Head of

Customer Education

Let’s take. No. Well, let’s so I just want to do a little teach-back. So

Keith Sullivan

President & CEO, Neuronetics, Inc.

Okay.

Marjorie Donovan

Head of Customer

Education

We’ve identified the challenges. Right? We know that the brand awareness, we talked about that, but we’ve got the

reimbursement, the billing, cash flow call center. So, what made the acquisition of Greenbrook appealing to you that ultimately means it’s going to benefit our practices across the country?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

So when, Bill and I have been, again, talking for years, the opportunity that is out there through the great system that Bill

has put together is we can we can now take advantage of the back office structure that he has put into place. I’ll give you an example.

Bill has

contracts with the payers on a local and a regional level.

Now with three hundred stores, offices that are part green that are Greenbrook and are BMP

accounts, we now have the size and scale to be able to go to the payers, the Uniteds, the Aetnas, the Cignas of the world, and say, we have a uniform group of people that all follow the same standards that provide the same level of care to these

patients with the ultimate goal of getting higher re reimbursement across the board.

If I take a list of four or five of the payers, Greenbrook will have

a higher reimbursement rate today than, any of our current customers do on an individual basis. So, I think our opportunity is to take our existing customers and, again, give them the scale that NeuroStar will have and be able to allow them to take

advantage of it.

Through that same opportunity, Bill has an entire network of insurance billing services that we can scale up or down, and it would give

our providers a chance to get rid of one of the major pain points that they have. One, dealing with the payers, but two, having to bill them and get their claims denied.

And now we can help fight that. I know some of our accounts do this on their own, but we can make it

available to them either, for specific payers or for everything.

Some of them hate to do it.

So, it is an opportunity, I think, that we can provide to our accounts.

Through that same opportunity, we can improve their cash flow. Because through Bill’s contracts, he gets paid faster than everybody else, and we can,

they would fall under that same category.

Marjorie Donovan

Head of Customer Education

Okay. So let me let

me let me slow you down. I’m get you’re getting you’re getting me excited.

But let me just let me just do a little slowdown because the

practices, they need to understand what benefits to them. So let’s just I want to do a little teach-back. So first of all, what you’re saying is with this acquisition, because of the strength of what builds network rates and also with BMP,

so now we’re talking about three hundred and fifty practices that you’re going to be able to go to the payers and be able to get better reimbursement rates. So that’s number one because that’s a huge benefit to our practices. I

heard that at NSU all the time. So you’re confident based on what you’ve seen that you can get better national or regional payer contracts. Yes?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

I’m pretty confident that we can. And I think, Bill is, in agreement with it, and his team is the one that is confident

that they can get it done.

Marjorie Donovan

Head of Customer Education

Okay. And then in

addition to our reimbursement team, obviously, with Bill’s network and his team right now, we’ll be able to get the insurance billing services to be able to get these practices paid faster. That’s what it’s all about. So

that’s another advantage of the acquisition. I’m seeing here now about a call center and for a lot of the practices that are on today, they’ve spent two days with me at NeuroStar University. So, these practices know the importance of

answering the phones and using our ACEs methodology and not just for the for the patients that call in, but also for those patients who might fill in a web form. How do you do, patient follow-up?

You know, our practices have been really committed to getting into that standard. Walk us through the

advantage of the call center with this acquisition, Keith.

Keith Sullivan

President & CEO, Neuronetics, Inc.

Yeah.

I think it’s an important, part. We all know how hard it is. You know?

And I our accounts that are in the BMP program have all gone to NSU and have

all had their offices secret-shopped, and we know how terrifying it is. But quite honestly, they’ve all gotten better. They’re in the program, and they’ve stayed in the program. They’re doing it right.

But it’s hard because those people turn over a lot.

So,

Bill has a call center that we could utilize either on a part-time basis while you’re looking for a new person to man your front desk or that either left or is promoted and you want somebody else to answer those phones or a full-time basis. But

we can answer those phones as though it’s your office.

We don’t answer it NeuroStar. We don’t answer it Greenbrook. It would be answered

with a number that would be recognized as your office. So to the patient, it’s a system that it is you, and we can we can do that for you.

Marjorie Donovan

Head of Customer Education

Okay. So through the acquisition of Greenbrook, now NeuroStar, we’ve got the national regional payer contracts. We’ve got the insurance

billing services that Bill’s team has built, the centralized call center. I want to give Bill an opportunity to talk about our key message number four, which is extremely important, Bill, to our practices. I can’t tell you how many,

practice and decision makers and owners and doctors will pull me aside and say that they know that the richest source of quality prospective patients is in with the referral networks.

How has your team been able to, I’ll say, crack the code, but how can that help our practices across

the country?

Bill Leonard

President & CEO, Greenbrook TMS

Yeah.

That’s a great question. I think one of the opportunities I see is the ability to build referral networks within communities of practices.

Fifty

percent of the Greenbrook TMS patients come from a mix of, community psychiatrists, behavioral therapists, and primary care. Greenbrook has a dedicated sales team out in the field to really educate patients, educate doctors on TMS and Spravato and

also to really give them an outlet for patients who have filled first-line treatment. So that’s something I believe that the Neuronetics team will be cross-trained on how to be more effective in generating more patients from our providers in

the community to become referral sources by educating not only the doctors, but also the staff.

Marjorie Donovan

Head of Customer Education

Hey. So there’s,

there’s a lot, there’s a lot there. So, you were saying that moving forward with your team, we’re going to be able to give some of that access to our current practices to have that richer source of referral networks.

Bill Leonard

President & CEO,

Greenbrook TMS

Yes.

Absolutely.

Marjorie Donovan

Head of Customer

Education

Okay. So now that we talked about referral networks, you know, when I think back to your background over the last twenty years, you

started out as TMS only, but then you made the decision to branch out into Spravato and Med Management.

And I don’t want to speak for you, but I know a big component of that is that we know for as great as

NeuroStar TMS is, there are some patients who we want through the whole life cycle. So, can you walk us through what value your experience in that will have to our practices across the country? Because many of them have started to get into Spravato.

What can your experience and maybe lessons learned, maybe you found out the riddle on how to operationalize Spravato. Tell me more about that, Bill.

Bill Leonard

President & CEO,

Greenbrook TMS

Yeah. This was a big move for us. We want to take advantage of our hundred and twenty locations around the country, but we really

want to capture a wider range of patients. Not everyone is great for TMS, and not everyone’s great for med management, and not everyone’s great for Spravato. But for us, it was the ability to kind of take that patient who is suffering from

depression and be there from the start to the finish and help them choose the right treatment modality for them. So for us, it was just a way of kind of capturing a wider range and really giving our doctors the chance to kind of provide the best

care and pick the treatment option for them. We’re proud to be the largest provider of TMS and Spravato today in the US, and we look forward to kind of sharing our, knowledge and those that secret riddle with everyone.

Marjorie Donovan

Head of Customer

Education

I’m looking forward to it as well because foreshadowing, I’d like to teach it at NeuroStar University as a different

curriculum, but let’s not get ahead of myself. Okay. If you’re ready, say ready, Bill.

Bill Leonard

President & CEO, Greenbrook TMS

I’m ready.

Marjorie Donovan

Head of Customer Education

Ready. Okay. So,

Keith, we talked about these five increased service offerings. Before I go to the q and a, any final thoughts on how our practices should really be thinking about these increased service offerings and the benefit that now Greenbrook that is now

NeuroStar is going to offer in the future? How should they frame this up for themselves?

Keith Sullivan

President & CEO, Neuronetics, Inc.

Marjorie, the majority of people on the call have either been to one of our summits or NSU.

They’ve heard the same consistent stories over and over that we are patient-centric. If I can help these patients, the patient wins, we win, practice

wins.

Nothing has changed, and I believe that this, purchase of Greenbrook will help drive that awareness, will help, educate patients more, and it we

have not changed from what we have said we would we were going to do four years ago. This is actually, I think, the crescendo for it. I think it gives us an opportunity to really put our money where our mouth is and be able to help more patients

that are battling depression and help all of these accounts get to them. We know that there are twenty nine million patients out there that are battling depression.

There are more patients that need help than we can get to, all of us. So I don’t think we have a shortage of a group of people to treat. We have more

people than we, than are looking for help than ever before.

Marjorie Donovan

Head of Customer Education

Okay. So, Keith, I want

to dig into some questions. One of the most frequent questions that we receive from our practice is trying to better understand how they’re going to get prospective patients after the acquisition happens, because this is changing. Right? Now

Greenbrook stores are now NeuroStar.

The ads, they’re now NeuroStar. But how can we assure our practices that they’re going to be able to

continue to get prospective patients after this acquisition occurs?

Keith Sullivan

President & CEO, Neuronetics, Inc.

It’s a really good question, and I’ll say it again. It’s fair. I think the concern we can put aside because we know, again, there’s

twenty-nine million patients that are out there that are battling depression and need help. And I think our combination with Greenbrook will help drive greater awareness and get to those patients. But in our current practices, the customers that are

with us today that are in the BMP program, on average, they have five hundred patients in their practice that have failed four drugs.

There is no shortage of patients inside the practice and outside of the practice.

So, our methodology the methodology still doesn’t, doesn’t change. We have PHQ-10s that we are going to

support, monitor, and make sure that those patients are followed up on within your practice. They are a tremendous source of patients in need and want treatment. So that doesn’t change. Our marketing outside of the practice and co-op marketing with our practices doesn’t change either.

It may look a little different. We would suggest to an

account that they do NeuroStar by TMS of whatever, but we would want the co-op marketing to continue and to do co-branded marketing. I’m not asking any accounts to

do away with their total practice branding.

The branding I’m talking about is the TMS side of their business.

So, the marketing that we put forth and drives patients to NeuroStar dot com doesn’t change. That patient does the same thing. They go to NeuroStar dot

com. They put in their ZIP code.

The closest, accounts show up to them, and they’re able to pick it, and they’re able to click a web form or

click to call. None of that is changing, and none of it has a plan to change. So our dig digital marketing efforts stay the same. Our PHQ-10s stay the same.

And if you, if your PDM has kept you up to date, they’ll tell you that we are doing a TV campaign currently in, in Tampa, Florida. It’s going to

start between the Olympics and the election, but we are doing a test down there to see if we know the ad works. We want to see if we can make sure we get those patients to the practices.

If we can prove that that works, then we’ll be able to do TV elsewhere.

But there are real opportunities here for our current practices to thrive and treat more patients.

Marjorie Donovan

Head of Customer Education

And I think, Keith,

that’s a great explanation, especially because we’re you’re really starting to outline this amplification of brand awareness, this rising tide raises all ships. I it just from the practice’s perspective, many of them just simply

asked, you know, how is it that NeuroStar wouldn’t then want to push a prospective patient over to the former Greenbrook stores as opposed to putting them into NeuroStar practices? And so, I just wanted you to address that. And then and, Bill,

I wanted you to say a few words because I think that that’s what a lot of practices are looking to understand.

Keith Sullivan

President & CEO, Neuronetics, Inc.

As I

said a minute ago, the algorithm on how a patient looking for a practice doesn’t change, it is not going to change. I don’t want to have to make a patient travel further than necessary to get the treatment.

We have twelve hundred sites that we are committing to support, not only through our marketing efforts, through our BMP program, and through our practice

development managers in the field.

None of that changes.

Marjorie Donovan

Head of Customer Education

Thank you. Bill, what about from your perspective?

Bill Leonard

President & CEO,

Greenbrook TMS

Look. It’s simple. When this deal closes, we’re one team. So from my end, we’re going to be able to share best

practices and create access to many of the kind of services that Greenbrook has done really well.

Services like our call center, which is able to connect

with the patient quickly. Services like our billing department, which is able to turn around claims in shorter amount of time than most. And obviously, having the ability to kind of use the patient journey on multiple treatment modalities that are

in our centers now. We’re part of NeuroStar now. So when you win, we win, and it’s really our job to do everything we can to make that happen.

Marjorie Donovan

Head of Customer Education

Excellent.

Keith, a couple of questions came in about, is our pricing model going to change? How does this change the treatment session price? Can you walk us through a

little bit about your methodology on that?

Keith Sullivan

President & CEO, Neuronetics, Inc.

There

is no change, Marjorie. The current system stays in place, and it’s a so there should be the whole thing is transparent to, our accounts. There is no change.

Marjorie Donovan

Head of Customer Education

Keith, why did you decide to buy Greenbrook and not another TMS practice?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

Because Greenbrook has the scale that we were looking for to be able to drive greater awareness.

They have a hundred and twenty sites. If we are able across eighteen states, if we are able to amplify that message in those locations, we will drive greater

awareness. And as I said earlier, all ships are going to rise on that tide. So I think not only does Greenbrook have the footprint to give us the scale to drive greater awareness, they have the footprint to do what I talked about, get reimbursement

contracts that a single practitioner or a multistore practitioner can’t get, that they have the backup services that is are scalable so that if we have all of our BMP accounts decide to use the call center, we can do that. If we have all of

them decide to use billing, we can scale that up too. So they give us the opportunity to help our current practices thrive and actually solve the pain points that they all talk about at NSU.

Marjorie Donovan

Head of Customer Education

So another question I

received as soon as the announcement was made was, do we have to become a Greenbrook practice, now NeuroStar, to receive the additional benefits in the future?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

You don’t because you already are a NeuroStar center.

When you purchase NeuroStar, you are part of the family that Bill has talked about. So you don’t have to do anything differently if you want to, get into

the BMP program. As I said earlier, it’s open to every one of our sites across the country, whether you do one patient a month or you do fifty patients a month.

Everyone, if they meet the standards, is in that program.

So,

our opportunity hasn’t changed for our practices. If they choose to let us help them, we are going to help them and make them successful.

Marjorie Donovan

Head of Customer Education

Okay. So you just mentioned BMP. And at NeuroStar University, I’ve had the pleasure of meeting so many practices who’ve done a lot of

work inside their practice to get into the Better Me provider program with those five standards. How does this acquisition change BMP? Does it?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

It doesn’t. It it’s it actually you know, quite honestly, each of Greenbrook sites that are now going to be NeuroStar

sites have to comply with it also. So even though they’re going to be owned stores, they still have to provide that same level of follow-up of care, of marketing, of look and feel that every one of our

BMP accounts have to. You know, honestly, Marjorie, our BMP program has worked.

It has worked. The accounts that are in it have grown their business on average between twenty-five and

thirty five percent.

So, we are helping more patients through that program. There is no need to change it.

Marjorie Donovan

Head of Customer Education

So, we talked before about how these Greenbrook stores are going to become NeuroStar, so maybe this is redundant. But I did get asked it. What is

going to happen to the Greenbrook name?

Keith Sullivan

President & CEO, Neuronetics, Inc.

It

will be phased out, in the next few months. Marketing reports to me, but I don’t run it. Lisa Rosas is in charge of, marketing, branding, social media, all of those things, and she will, be the one that is going to work with her team to

identify what the exact name of these stores should be. But, ultimately, NeuroStar is going to be the brand name.

Marjorie Donovan

Head of Customer Education

K. Now is NeuroStar

looking to open new Greenbrook locations or close any of these locations?

Keith Sullivan

President & CEO, Neuronetics, Inc.

You

know, over the last, I’m going to say eighteen months, Bill and his team have done a great job in identifying what stores are working and what stores aren’t. So, I think, two years ago, they had a little over two hundred stores. Now

there’s a hundred and twenty. These stores are doing well. So right now, there is no plan to close any additional stores, and there’s no need for us to currently, open up any new ones. If there are voids in areas where, there is a need,

then we would consider it. But right now, in the models that we have put in front of our board and our investors, there is no plan to open up any new stores.

Marjorie Donovan

Head of Customer Education

Keith, questions came

in about the PDM relationship. So many of our practices, obviously, they rely on the PDM partnership. What changes to our, product team practice development reimbursement will this acquisition have?

Keith Sullivan

President & CEO,

Neuronetics, Inc.

So this is, you know the PDMs are near and dear to my heart, and we have forty-eight of them across the country. We, they are

the lifeblood for both the company and our, and our accounts. The only thing I can say about our PDMs is we are going to try and make them better and help them serve our accounts more.

Marjorie Donovan

Head of Customer Education

So, Keith, we got through a lot of the q and a’s. I have to ask you one more question, which is so many of our prospects and practices have

been to our NeuroStar summits, have met, you know, patient advocates whose lives were saved by NeuroStar. So many of our practices, over eight hundred attendees have come to NeuroStar University, and they’ve all heard you talk over the last

several years about how you feel that especially with what we’ve done with the Better Me provider program, that we are at the tipping point. You know what I mean when I say tipping point.

Right? The tipping point of NeuroStar TMS. How does this acquisition in one fell swoop sort of, catapult that to new heights? So how does this relate to the

tipping point and where you think this is going?

Keith Sullivan

President & CEO, Neuronetics, Inc.

I

believe that through the combination of, Greenbrook, and now I’m going to start referring to them as the NeuroStar Centers, by coupling those and building that brand and then being able to take the, the pain points that our customers have and

be able to offer solutions to them rather whether they take advantage of all of them or they take advantage of one of them. This is the first time I’m going to allow them to cherry-pick. You know, I think on the, BMP program, we don’t

allow them to cherry-pick. But here, I think we can offer these services that can make their practices run smoother. So all of it gives us the opportunity to treat more patients and get more patients that are in need, the help that they need,

whether it is med management, whether it is, TMS, or whether it is Spravato. And now we can educate all our practices on how to incorporate all three of those things into their existing practice.

Marjorie Donovan

Head of Customer Education

Well, Bill, Keith,

thank you so much for your time today, and thank you most of all to all of you practices who have taken time out of your busy personal, professional lives, the patients that you have currently right now in your practice, for taking the time to learn

more about how this acquisition is going to impact your practice. And if you remember nothing else, the two key messages that what this means do is number one, amplification of brand awareness so that, ultimately, more patients are asking for

NeuroStar by name. And that current NeuroStar in your practice that you committed to, it just became infinitely more recognizable to patients.

That’s number one. And then number two, as Bill and Keith mentioned, the additional service offerings that can drive more patients to your practice,

more, efficiencies in your practice, we’re really looking forward to in the coming months describing more about how this will affect your practice. So my—our ask is simple. I’m going to share my screen here.

If you have any additional questions that you would like to, number one, you always have your practice development manager, but we also were going to ask you

to email wendy at neurostar dot com. She will be manning any questions that you have about the acquisition. We thank you so much for your time and commitment, and I personally look forward to seeing you all at NeuroStar University and in the months

to come. Thank you so much.

Keith Sullivan

President & CEO, Neuronetics, Inc.

Thank

you all.

Bill Leonard

President & CEO, Greenbrook TMS

Thank

you, everyone.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Neuronetics (NASDAQ:STIM)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

Neuronetics (NASDAQ:STIM)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024