UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File No. 001-41010

MAINZ BIOMED N.V.

(Translation of registrant’s name into English)

Robert Koch Strasse 50

55129 Mainz

Germany

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F

Form

20-F ☒ Form

40-F ☐

Other Events

Furnished as Exhibit 99.1 to this Report on Form 6-K is a press release

dated November 29, 2024 entitled “Mainz Biomed Announces Stock Split.”

The information contained in this Report on Form 6-K is hereby incorporated

by reference into our Registration Statement on Form F-3 (File No. 333-269091).

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 29, 2024 |

By: |

/s/

William J. Caragol |

| |

Name: |

William J. Caragol |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Mainz Biomed Announces Stock Split

BERKELEY, US and MAINZ, Germany – November 29, 2024 -

Mainz Biomed N.V. (NASDAQ:MYNZ) (“Mainz Biomed” or the “Company”), a molecular genetics diagnostic company

specializing in the early detection of cancer, today announced a 1-for-40 reverse stock split of its issued and outstanding shares. The

reverse stock split was authorized by the Board of Directors of the Company pursuant to shareholder approval granted at its Extraordinary

Shareholders Meeting on November 20, 2024.

The reverse stock split is expected to become effective on December

3, 2024 (the “Effective Date”), and the Company’s ordinary shares are expected to begin trading on the split-adjusted

basis on the Nasdaq under the Company’s existing trading symbol “MYNZ” at market open on December 3, 2024, upon Nasdaq’s approval.

The new CUSIP number for the Company’s ordinary shares following the reverse stock split will be N5436L119.

The reverse stock split is intended to increase the market price per

share of its common stock to comply with the continued listing standards of the Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2)

and to make investments in the Company more attractive to investors by increasing the trading price of the Company’s ordinary shares on

such market.

Information for Stockholders

On the Effective Date, every 40 issued and outstanding ordinary shares

of the Company will be converted automatically into one share of the Company’s ordinary shares without any change in the par value per

share. Once effective, the reverse stock split will reduce the number of ordinary shares issued and outstanding from approximately 80.1

million shares to approximately 2.0 million.

Immediately after the reverse stock split, each stockholder’s percentage

ownership interest in the Company and proportional voting power will remain unchanged, except for minor changes and adjustments that will

result from the treatment of fractional shares. The Company will not issue fractional shares but will pay cash in lieu of fractional shares.

The rights and privileges of the holders of ordinary shares of the Company will be substantially unaffected by the reverse stock split.

Shareholders who hold their shares in brokerage accounts or in “street

name” will have their positions automatically adjusted to reflect the reverse stock split, subject to each broker’s particular processes,

and will not be required to take any action in connection with the reverse stock split.

Registered shareholders holding pre-split shares of the Company’s ordinary

shares electronically in book-entry form are not required to take any action to receive post-split shares. Those shareholders holding

shares of the Company’s ordinary shares in certificate form will receive a transmittal letter from our transfer agent, Transhare Corporation,

with instructions as soon as practicable after the Effective Date.

Nasdaq Capital Market Compliance

Mainz Biomed’s securities are currently listed on Nasdaq. In

May 2024, the Company received written notice (the “Notice”) from the Listing Qualifications Department of Nasdaq notifying

that, based on the closing bid price of Mainz Biomed’s ordinary shares for the last 30 consecutive trading days, the Company no

longer complied with the minimum bid price requirement for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5550(a)(2)

requires listed securities to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”), and Nasdaq

Listing Rule 5810(c)(3)(A) provides that a failure to meet the Minimum Bid Price Requirement exists if the deficiency continues for a

period of 30 consecutive trading days. Pursuant to the Nasdaq Listing Rules, Mainz Biomed were provided with an initial compliance period

of 180 calendar days to regain compliance with the Minimum Bid Price Requirement. To regain compliance, the closing bid price of the ordinary

shares has to be at least $1.00 per share for a minimum of 10 consecutive trading days prior to November 25, 2024. Additionally, the Company

no longer meets the minimum $2,500,000 minimum stockholders’ equity requirement for continued listing on the Nasdaq Capital Market

set forth in Listing Rule 5550(b)(1).

On November 27, 2024, Mainz Biomed received a staff determination letter

(the “Determination Letter”) from Nasdaq stating that the Company had not regained compliance with the Minimum Bid Price Requirement

by November 25, 2024, and is not eligible for a second 180-day period The Determination Letter has no immediate effect on the listing

of Mainz Biomed’s ordinary shares on the Nasdaq Capital Market. The Company intends to shortly file a hearing request that automatically

stays any suspension or delisting action pending the hearing and the expiration of any additional extension period granted by the Nasdaq

Hearing Panel (the “Panel”) following the hearing. In that regard, pursuant to the Nasdaq Listing Rules, the Panel has the

authority to grant an extension not to exceed 180 days from the date of the Determination Letter.

Please visit Mainz Biomed’s official website for investors

at mainzbiomed.com/investors/ for more information

Please follow us to stay up to date:

LinkedIn

X (Previously Twitter)

Facebook

About

Mainz Biomed NV

Mainz Biomed

develops market-ready molecular genetic diagnostic solutions for life-threatening conditions. The Company’s flagship product is

ColoAlert®, an accurate, non-invasive and easy-to-use, early-detection diagnostic test for colorectal cancer. ColoAlert® is marketed

across Europe. The Company is currently running a pivotal FDA clinical study for US regulatory approval. Mainz Biomed’s product

candidate portfolio also includes PancAlert, an early-stage pancreatic cancer screening test based on real-time Polymerase Chain Reaction-based

(PCR) multiplex detection of molecular-genetic biomarkers in stool samples. To learn more, visit mainzbiomed.com or follow

us on LinkedIn, Twitter and Facebook.

For media inquiries

MC Services AG

Anne Hennecke/Caroline Bergmann

+49 211 529252 20

mainzbiomed@mc-services.eu

For investor inquiries, please contact info@mainzbiomed.com

Forward-Looking Statements

Certain statements made in this press release are “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”,

“estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict

or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect the current

analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying

on forward-looking statements. Due to known and unknown risks, actual results may differ materially from the Company’s expectations

or projections. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking

statements: (i) the failure to meet projected development and related targets; (ii) changes in applicable laws or regulations; (iii) the

effect of the COVID-19 pandemic on the Company and its current or intended markets; and (iv) other risks and uncertainties described herein,

as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the Securities and

Exchange Commission (the “SEC”) by the Company. Additional information concerning these and other factors that may impact

the Company’s expectations and projections can be found in its initial filings with the SEC, including its annual report on Form

20-F filed on April 9, 2024. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov. Any forward-looking

statement made by us in this press release is based only on information currently available to Mainz Biomed and speaks only as of the

date on which it is made. Mainz Biomed undertakes no obligation to publicly update any forward-looking statement, whether written or oral,

that may be made from time to time, whether as a result of new information, future developments or otherwise, except as required by law.

3

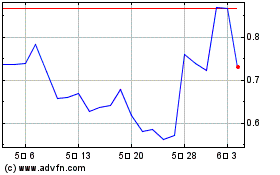

Mainz BioMed NV (NASDAQ:MYNZ)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

Mainz BioMed NV (NASDAQ:MYNZ)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024