false

0001693577

0001693577

2024-10-10

2024-10-10

0001693577

mnsb:CommonStockCustomMember

2024-10-10

2024-10-10

0001693577

mnsb:DepositarySharesCustomMember

2024-10-10

2024-10-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 10, 2024

MainStreet Bancshares, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

Virginia

|

001-38817

|

81-2871064

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

10089 Fairfax Boulevard, Fairfax, VA

|

|

22030

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(703) 481-4567

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

MNSB

|

|

The Nasdaq Stock Market LLC

|

|

Depositary Shares (each representing a 1/40th

interest in a share of 7.50% Series A Fixed-Rate

Non-Cumulative Perpetual Preferred Stock)

|

|

MNSBP

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 7.01 Regulation FD Disclosure.

On October 10, 2024, MainStreet Bancshares, Inc. (the "Company") issued guidance for its third quarter 2024 earnings. A copy of the statement and provided guidance is attached hereto as Exhibit 99.1, is hereby incorporated by reference, and will be posted on the Company’s website.

The Company also announced that it will conduct a virtual webcast and quarterly earnings conference call on Monday, October 28, 2024, at 2:00 p.m. Eastern Time during which the Company will discuss third quarter results as well as provide an update on recent activities. Investors that are interested in attending the virtual webcast should contact Hattie Lester by email at hlester@mstreetbank.com or by phone at (571)-375-1364.

Item 9.01 Other Events.

(d) Exhibits.

The information furnished under Items 7.01 and 9.01 of this Current Report on Form 8-K, including the exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and it shall not be deemed incorporated by reference in any filing under the Exchange Act, or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing to this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

MAINSTREET BANCSHARES, INC

|

|

|

|

|

|

|

Date: October 10, 2024

|

|

By:

|

/s/ Thomas J. Chmelik

|

|

|

|

|

Name: Thomas J. Chmelik

|

|

|

|

|

Title: Chief Financial Officer

|

Exhibit 99.1

MainStreet Bancshares Issues Guidance for Third Quarter 2024 Earnings

FAIRFAX, Va., October 10, 2024 – MainStreet Bancshares, Inc. (Nasdaq: MNSB & MNSBP), the holding company for MainStreet Bank, today issued guidance for its upcoming third quarter earnings. The Company estimates a loss of four cents per common share for the third quarter.

During the third quarter, the Company charged-off $1.9 million to successfully offload $21.8 million in nonperforming loans. The loans originated between March 2020 and April 2021, and bore the full brunt of pandemic-related construction delays, higher costs, supply chain delays and rapidly increasing interest rates.

In addition, the Company reversed $983,000 of accrued interest income, and paid $593,519 in nonrecurring liquidation expenses. The Company made a provision of $1 million to support loan growth and ensure the Allowance for Credit Losses is directionally consistent.

“We’ve been thorough in identifying problem loans and where possible, have found creative means to work with borrowers to preserve their ownership,” said Tom Floyd, Chief Lending Officer of MainStreet Bank. “However, in a few cases the borrowers’ options dwindled and the best course of action was liquidation.”

Changes to nonperforming loans are summarized in the table below.

|

Nonperforming loan activity between Q2 and Q3

|

|

Beginning balance 6/30/2024:

|

$20,690,967

|

|

|

Additions:

|

31,352,865

|

|

|

Dispositions:

|

-21,802,695

|

|

|

Charge-offs:

|

-1,906,503

|

|

|

Normal paydowns:

|

-70,678

|

|

|

Ending balance 9/30/2024:

|

$28,263,956

|

|

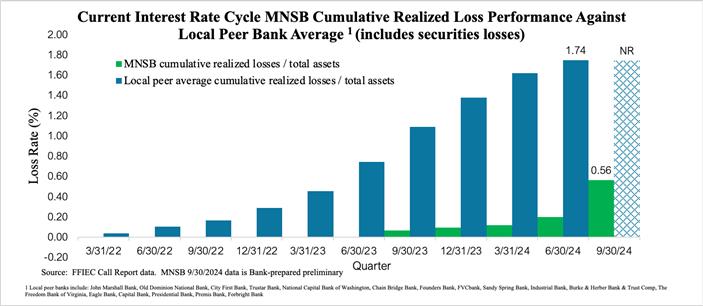

Despite the activity recognized during the third quarter, the Company’s cumulative loss history over the course of the entire interest rate cycle is less than one-third of its local peer average cumulative losses, as shown in the table below.

The Company maintained a superior net interest margin throughout the current interest rate cycle, led by strong loan yields. The Company’s core net interest margin is expanding, estimated to be 3.25% for the quarter. The Generally Accepted Accounting Principles net interest margin is estimated to be 3.05% for the quarter and is estimated to be 3.19% year-to-date.

“The Bank continues to originate good loans and grow deposits,” said Abdul Hersiburane, President of MainStreet Bank. “The FOMC has started down the path of easing interest rates, which will take the pressure off our variable rate borrowers and open the Washington, D.C. condo market to a new field of buyers.”

Third Quarter 2024 Earnings Release and Virtual Meeting

The Company anticipates releasing earnings before the market opens on Monday, October 28, and hosting a conference call at 2 p.m. EST to discuss the company's third quarter and year-to-date results.

ABOUT MAINSTREET BANK: MainStreet operates six branches in Herndon, Fairfax, McLean, Leesburg, Clarendon, and Washington, D.C. MainStreet Bank has 55,000 free ATMs and a fully integrated online and mobile banking solution. The Bank is not restricted by a conventional branching system, as it can offer business customers the ability to Put Our Bank in Your Office®. With robust and easy-to-use online business banking technology, MainStreet has "put our bank" in thousands of businesses in the metropolitan area.

MainStreet Bank has a robust line of business and professional lending products, including government contracting lines of credit, commercial lines and term loans, residential and commercial construction, and commercial real estate. MainStreet is an SBA Preferred Lender. From sophisticated cash management to enhanced mobile banking and instant-issue Debit Cards, MainStreet Bank is always looking for ways to improve our customer's experience.

MainStreet Bank was the first community bank in the Washington, D.C., metropolitan area to offer a full online business banking solution. MainStreet Bank was also the first bank headquartered in the Commonwealth of Virginia to offer CDARS – a solution that provides multi-million-dollar FDIC insurance. Further information on the Bank can be obtained by visiting its website at mstreetbank.com.

Banking-as-a-Service

In recent months, the weaknesses of other embedded banking solutions have been exposed—to the detriment of banks, their fintech clients and their end-customers. The Avenu team digested all the lessons that could be learned from these weaknesses and implemented enhancements to provide a scalable and compliance-rich solution. Version 1 of the Avenu Software as a Service solution was completed on September 18, 2024.

Avenu

Avenu is the first and only embedded banking solution that connects our partners and their apps directly and seamlessly to our purpose-built Avenu core solution. We are not a sponsor bank without our own technology, and we are not a middleware software company without our own bank. We are Avenu, a leading financial technology company owned by an established community bank in the heart of Washington, D.C.

Avenu’s clients are fintechs, social media, application developers, money movers, and entrepreneurs. They all have one thing in common: They are innovating how money moves to solve real-world issues and help communities thrive. We are focused on servicing our community and creating long-term business relationships.

This release contains forward-looking statements, including our expectations with respect to future events that are subject to various risks and uncertainties. The statements contained in this release that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as "may," "will," "could," "should," "expect," "plan," "project," "intend," "anticipate," "believe," "estimate," "predict," "potential," "pursuant," "target," "continue," and similar expressions are intended to identify such forward-looking statements. Factors that could cause actual results to differ materially from management's projections, forecasts, estimates and expectations include: fluctuation in market rates of interest and loan and deposit pricing, adverse changes in the overall national economy as well as adverse economic conditions in our specific market areas, , maintenance and development of well-established and valued client relationships and referral source relationships, and acquisition or loss of key production personnel. We caution readers that the list of factors above is not exclusive. The forward-looking statements are made as of the date of this release, and we may not undertake steps to update the forward-looking statements to reflect the impact of any circumstances or events that arise after the date the forward-looking statements are made. In addition, our past results of operations are not necessarily indicative of future performance.

v3.24.3

Document And Entity Information

|

Oct. 10, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MainStreet Bancshares, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 10, 2024

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

001-38817

|

| Entity, Tax Identification Number |

81-2871064

|

| Entity, Address, Address Line One |

10089 Fairfax Boulevard

|

| Entity, Address, City or Town |

Fairfax

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

22030

|

| City Area Code |

703

|

| Local Phone Number |

481-4567

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

true

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001693577

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MNSB

|

| Security Exchange Name |

NASDAQ

|

| DepositaryShares Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares

|

| Trading Symbol |

MNSBP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mnsb_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mnsb_DepositarySharesCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

MainStreet Bancshares (NASDAQ:MNSBP)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

MainStreet Bancshares (NASDAQ:MNSBP)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024