Form 8-K - Current report

09 8월 2024 - 5:15AM

Edgar (US Regulatory)

false

0001145255

0001145255

2024-08-08

2024-08-08

0001145255

hnna:CommonStockNoParValueCustomMember

2024-08-08

2024-08-08

0001145255

hnna:NotesDue20264875CustomMember

2024-08-08

2024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

HENNESSY ADVISORS, INC.

(Exact name of registrant as specified in its charter)

|

California

|

001-36423

|

68-0176227

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

7250 Redwood Blvd., Suite 200

Novato, California

|

94945

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant’s telephone number including area code: (415) 899-1555

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a‑12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol

|

Name of each exchange on which registered

|

|

Common stock, no par value

|

HNNA

|

The Nasdaq Stock Market LLC

|

|

4.875% Notes due 2026

|

HNNAZ

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition

|

On August 8, 2024, Hennessy Advisors, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8‑K and is incorporated by reference herein.

|

Item 7.01.

|

Regulation FD Disclosure

|

On August 8, 2024, the Company issued a press release announcing that it had declared a cash dividend of $0.1375 per share on its common stock. The cash dividend is payable September 5, 2024, to shareholders of record at the close of business on August 22, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8‑K and is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits

|

EXHIBIT INDEX

|

Exhibit

|

Description

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HENNESSY ADVISORS, INC. |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| August 8, 2024 |

By: |

/s/ Teresa M. Nilsen |

|

| |

|

Teresa M. Nilsen |

|

| |

|

President |

|

Exhibit 99.1

|

Media Contacts:

Teresa Nilsen

Hennessy Advisors, Inc.

Terry@hennessyadvisors.com; 800-966-4354

|

Hibre Teklemariam

SunStar Strategic

HTeklemariam@sunstarstrategic.com; 703-894-1057

|

FOR IMMEDIATE RELEASE

Hennessy Advisors, Inc. Reports 73% Increase in Quarterly

Earnings Per Share and Announces Quarterly Dividend

August 8, 2024, Novato, CA - Hennessy Advisors, Inc. (Nasdaq: HNNA) reported results for its third fiscal quarter of 2024, which ended June 30, 2024. The firm also announced a quarterly dividend of $0.1375 per share to be paid on September 5, 2024, to shareholders of record as of August 22, 2024, which represents an annualized dividend yield of 6.6%.*

“The U.S. stock market continues to perform well in 2024, with the Dow Jones Industrial Average up 4.79% and the S&P 500® Index up 15.29% for the calendar year-to-date through June 30, 2024. Even the most persistent stock market naysayers seem to have come to a consensus that the markets will likely remain positive through the end of the year. Investors appear to be optimistic about lower inflation data, continued earnings growth, possible interest rate cuts, and solid 2.3% GDP growth estimates for 2024 – and rightly so in my opinion,” said Neil Hennessy, Chairman and CEO. “We at Hennessy Funds are proud to manage a successful fund lineup. Our family of funds has delivered both recent solid returns and consistent long-term results,” he added.

“We are both pleased with our product performance and encouraged by the flows into our funds. In the nine months ended June 30, 2024, we have grown assets under management by nearly $1 billion, due to our three-pronged effort of fund acquisitions of $72 million, net inflows of $364 million, and fund performance of $560 million,” said Teresa Nilsen, President and COO. “With our total assets under management over $4 billion, we are notably increasing net income, earnings per share, and cash flow over prior periods,” she added.

Summary Highlights (compared to the prior comparable quarter ended June 30, 2023):

| |

●

|

Total revenue of $7.8 million, an increase of 37%.

|

| |

●

|

Net income of $2.0 million, an increase of 82%.

|

| |

●

|

Fully diluted earnings per share of $0.26, an increase of 73%.

|

| |

●

|

Average assets under management, upon which revenue is earned, of $3.9 billion, an increase of 37%.

|

| |

●

|

Total assets under management of $4.0 billion, an increase of 36%.

|

| |

●

|

Cash and cash equivalents, net of gross debt, of $21.8 million, an increase of 14%.

|

| |

|

Three Months Ended June 30,

|

|

|

Change

|

|

| |

|

2024

|

|

|

2023

|

|

|

Amount

|

|

|

Percent

|

|

|

Total Revenue

|

|

$ |

7,784,523 |

|

|

$ |

5,701,330 |

|

|

$ |

2,083,193 |

|

|

|

36.5 |

% |

|

Net Income

|

|

|

2,029,527 |

|

|

|

1,116,039 |

|

|

|

913,488 |

|

|

|

81.9 |

% |

|

Earnings Per Share (Diluted)

|

|

|

0.26 |

|

|

|

0.15 |

|

|

|

0.11 |

|

|

|

73.3 |

% |

|

Weighted Average Number of Shares Outstanding (Diluted)

|

|

|

7,732,068 |

|

|

|

7,605,689 |

|

|

|

126,379 |

|

|

|

1.7 |

% |

|

Average Fund Assets Under Management

|

|

|

3,893,131,722 |

|

|

|

2,850,912,822 |

|

|

|

1,042,218,900 |

|

|

|

36.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of June 30,

|

|

|

|

|

|

|

|

|

|

| |

|

2024

|

|

|

2023

|

|

|

|

|

|

|

|

|

|

|

Total Fund Assets Under Management

|

|

$ |

4,027,830,779 |

|

|

$ |

2,964,013,210 |

|

|

$ |

1,063,817,569 |

|

|

|

35.9 |

% |

|

Cash and Cash Equivalents, Net of Gross Debt Balance

|

|

|

21,767,015 |

|

|

|

19,149,184 |

|

|

|

2,617,831 |

|

|

|

13.7 |

% |

|

*

|

Based on the closing stock price of $8.34 on August 7, 2024, and an annualized dividend of $0.55 per share.

|

About Hennessy Advisors, Inc.

Hennessy Advisors, Inc. is a publicly traded investment manager offering a broad range of domestic equity, multi-asset, and sector and specialty funds. Hennessy Advisors, Inc. is committed to providing superior service to shareholders and employing a consistent and disciplined approach to investing based on a buy‑and‑hold philosophy that rejects the idea of market timing.

Supplemental Information

Nothing in this press release shall be considered a solicitation to buy or an offer to sell a security to any person in any jurisdiction where such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction.

Forward-Looking Statements

This press release contains “forward-looking statements” for which Hennessy Advisors, Inc. claims the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. Forward‑looking statements relate to expectations and projections about future events based on currently available information. Forward‑looking statements are not a guarantee of future performance or results and are not necessarily accurate indications of the times at which, or means by which, such performance or results may be achieved. Forward‑looking statements are subject to risks, uncertainties, and assumptions, including those described in the sections entitled “Risk Factors” and elsewhere in the reports that Hennessy Advisors, Inc. files with the Securities and Exchange Commission. Unforeseen developments could cause actual performance or results to differ substantially from those expressed in, or suggested by, the forward‑looking statements. Hennessy Advisors, Inc. management does not assume responsibility for the accuracy or completeness of the forward-looking statements and undertakes no responsibility to update any such statement after the date of this press release to conform to actual results or to changes in expectations.

v3.24.2.u1

Document And Entity Information

|

Aug. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HENNESSY ADVISORS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 08, 2024

|

| Entity, Incorporation, State or Country Code |

CA

|

| Entity, File Number |

001-36423

|

| Entity, Tax Identification Number |

68-0176227

|

| Entity, Address, Address Line One |

7250 Redwood Blvd.

|

| Entity, Address, City or Town |

Novato

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94945

|

| City Area Code |

415

|

| Local Phone Number |

899-1555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001145255

|

| CommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, no par value

|

| Trading Symbol |

HNNA

|

| Security Exchange Name |

NASDAQ

|

| NotesDue20264875 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2026

|

| Trading Symbol |

HNNAZ

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hnna_CommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hnna_NotesDue20264875CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

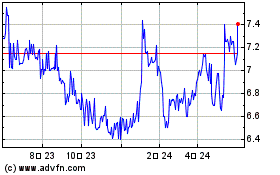

Hennessy Advisors (NASDAQ:HNNA)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

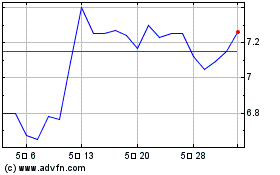

Hennessy Advisors (NASDAQ:HNNA)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025