Community West Bancshares (“Community West” or the “Company”),

(NASDAQ: CWBC), parent company of Community West Bank (the “Bank”),

today reported net income of $2.5 million, or $0.27 per diluted

share, for the first quarter of 2023, compared to $3.4 million, or

$0.38 per diluted share, for the preceding quarter, and $4.0

million, or $0.45 per diluted share, for the first quarter of 2022.

The Company’s Board of Directors declared a

quarterly cash dividend of $0.08 per common share, payable May 31,

2023, to common shareholders of record on May 12, 2023.

“Our first quarter 2023 results reflected a

strong balance sheet, net interest margin and stable credit quality

metrics” stated Martin E. Plourd, President & Chief Executive

Officer of Community West Bancshares. “With the destabilization of

our industry we quickly moved to secure liquidity to cover all

uninsured deposits. We benefited by previously having approximately

78% of our deposits fully insured or collateralized, which is the

direct result of our community-focused business model. We will

continue to focus on funding our balance sheet primarily through

core deposits. Our outlook over the next few quarters remains

cautious, as we anticipate a leaner loan pipeline, as recessionary

concerns continue, and deposit pricing pressures persist. While

recent developments in the banking industry have been unsettling in

the short term, we believe that with our resilient deposit

franchise, margin, sound capital levels and stable credit quality

we are well positioned to capitalize on new market

opportunities.”

First Quarter 2023 Financial

Highlights:

- Net income was

$2.5 million, or $0.27 per diluted share in the first quarter 2023,

compared to $3.4 million, or $0.38 per diluted share in fourth

quarter 2022, and $4.0 million, or $0.45 per diluted share in first

quarter 2022.

- Net interest

income decreased $1.1 million to $11.0 million for first quarter

2023, compared to $12.1 million in fourth quarter 2022, and

increased $294,000 compared to $10.7 million in first quarter

2022.

- Net interest

margin was 4.25% for the first quarter 2023, compared to 4.58% in

fourth quarter 2022, and 3.86% in first quarter 2022.

- Return on

average assets was 0.92% for the first quarter 2023, compared to

1.24% in fourth quarter 2022, and 1.39% in first quarter 2022.

- Return on

average common equity was 8.84% for the first quarter 2023,

compared to 11.98% in fourth quarter 2022, and 15.52% in first

quarter 2022.

- The Company

adopted and implemented Accounting Standard Update (ASU) 2016-13

(“CECL”) on January 1, 2023. The “Day 1” impact of the adoption was

a $1.8 million increase to the Allowance for Credit Losses (“ACL”)

and a $421,000 increase to the reserve for unfunded commitments

resulting in a $1.6 million decrease to retained earnings net of

tax.

- The Company

recorded a negative provision for credit loss expense of $607,000

for first quarter 2023, compared to a negative provision for loan

losses of $461,000 for fourth quarter 2022, and a negative

provision for loan losses of $284,000 for first quarter 2022.

- The ACL was

1.30% of total loans held for investment at March 31, 2023 compared

to 1.15% at December 31, 2022, and 1.22% at March 31, 2022.

- Net non-accrual loans increased to $1.6 million at March 31,

2023, compared to $211,000 at December 31, 2022, and $536,000 at

March 31, 2022.

- Total loans

decreased by $3.8 million to $951.5 million at March 31, 2023,

compared to $955.3 million at December 31, 2022, and increased

$61.2 million compared to $890.3 million at March 31, 2022.

- Total deposits

increased by $45.7 million during the quarter to $920.8 million at

March 31, 2023, compared to $875.1 million at December 31, 2022.

Non-interest-bearing demand deposits decreased $11.2 million, or

5%, to $205.3 million at March 31, 2023, compared to $216.5 million

at December 31, 2022.

- The Bank’s

uninsured or uncollateralized deposits totaled approximately 22% of

total deposits at March 31, 2023, compared to 25% at December 31,

2022.

- Available

borrowing capacity was $178 million at March 31, 2023.

- Stockholders’

equity increased $139,000 to $112.8 million at March 31, 2023,

compared to $112.7 million at December 31, 2022, and increased $7.9

million compared to $104.8 million at March 31, 2022.

- Book value per

common share decreased to $12.77 at March 31, 2023, compared to

$12.80 at December 31, 2022, and $12.07 at March 31, 2022.

- The Bank’s Tier

1 leverage ratio* was 10.41% at March 31, 2023, compared to 10.34%

at December 31, 2022, and 8.88% at March 31, 2022.

* Capital Ratios are preliminary.

Income Statement

Total interest income increased $307,000 in the

first quarter to $13.6 million, compared to $13.3 million in the

preceding quarter, and increased by $2.1 million compared to the

first quarter of 2022. Interest income from loans remained

unchanged at $12.5 million compared to the prior quarter. Interest

income from securities and interest-earning deposits increased

$285,000 compared to the prior quarter, primarily due to increased

average interest-earning deposit balances and higher yields due to

increased market rates. Total interest expenses for the quarter

increased $1.4 million compared to the prior quarter due to

increased average balances and rates paid on interest-bearing

demand deposits and time deposits. The increase in deposit expense

was largely due to increased levels of wholesale funding as the

Bank utilized wholesale funding sources to increase on-balance

sheet liquidity. Net interest income decreased 9.2% to $11.0

million in the first quarter 2023, compared to $12.1 million in the

preceding quarter, and increased 2.7% compared to $10.7 million in

first quarter 2022.

Net interest margin was 4.25% for first quarter

2023, a 33-basis point decrease compared to fourth quarter 2022,

and a 39-basis point increase compared to first quarter 2022. The

yield on loans for the first quarter 2023 increased 11 basis points

to 5.32%, compared to 5.21% for the fourth quarter 2022, resulting

from increased loan rates on new originations and the impact of

higher market rates. The yield on federal funds and

interest-earning deposits increased 102 bps to 4.41% for the first

quarter 2023 due to increases in rates earned for overnight

deposits and money market deposits. The cost of funds for the first

quarter increased 62 basis points to 1.09%, compared to 0.47% for

the preceding quarter due to higher rates paid on deposit accounts

and changes in the portfolio mix. Non-interest income for the first

quarter 2023 remained relatively unchanged at $762,000 compared to

$764,000 in fourth quarter 2022. Other loan fees were $169,000 for

the first quarter 2023 compared to $246,000 in fourth quarter 2022.

Gain on sale of loans increased $18,000 to $30,000 in the first

quarter 2023 compared to $12,000 in the fourth quarter of 2022 as a

result of higher sales during the quarter.

Non-interest expenses increased $140,000 to $8.7

million in the first quarter 2023 compared to $8.6 million in

fourth quarter 2022. The increase is primarily due to an increase

in salaries and benefits of $381,000 due to annual merit increases,

seasonal increases in payroll taxes and increased benefit costs;

increased stock-based compensation of $214,000 primarily due to

annual stock awards; and increased FDIC assessments of $71,000

because of higher assessment rates. The increases were partially

offset by lower professional fees of $317,000 due to less

consulting expense during the quarter and lower other non-interest

expenses of $174,000.

Income tax expense decreased $195,000 to $1.2

million in the first quarter of 2023 compared to $1.4 million in

the fourth quarter of 2022. The $1.2 million included a one-time

deferred tax expense adjustment of $158,000. The effective tax rate

for the first quarter of 2023 was 33.0% compared to 29.5% in the

fourth quarter of 2022.

Balance Sheet

Total assets increased $76.1 million, or 7%, to

$1.17 billion at March 31, 2023, compared to $1.09 billion at

December 31, 2022, and increased $30.9 million, or 2.7%, compared

to $1.14 billion, at March 31, 2022. Total interest-earning

deposits in other financial institutions increased $103.0 million

to $166.3 million at March 31, 2023, compared to $63.3 million at

December 31, 2022, and decreased $24.8 million compared to March

31, 2022. Total investment securities were $18.2 million at quarter

end, compared to $29.5 million in the prior quarter.

Total loans decreased $3.8 million, or 0.4%, to

$951.5 million at March 31, 2023, compared to $955.3 million at

December 31, 2022, and increased $61.2 million, or 6.9%, compared

to $890.3 million at March 31, 2022. Commercial real estate loans

outstanding (which include SBA 504, construction and land)

increased $10 million during the quarter to $555.3 million at March

31, 2023, compared to $545.3 million at December 31, 2022, and

increased $63.2 million compared to $492.2 million at March 31,

2022. Manufactured housing loans decreased $499,000 during the

quarter to $315.3 million at March 31, 2023, compared to $315.8

million at December 31, 2022, and increased $15.4 million compared

to $300 million at March 31, 2022. Commercial loans decreased $12.5

million during the quarter to $62.5 million at March 31, 2023,

compared to $75 million at December 31, 2022, and decreased $8

million compared to $70.5 million at March 31, 2022.

Total deposits increased $45.7 million, or 5.2%,

to $920.8 million at March 31, 2023, compared to $875.1 million at

December 31, 2022, and decreased $4.9 million, or 0.5%,

compared to $925.7 million at March 31, 2022. Non-interest-bearing

demand deposits were $205.3 million at March 31, 2023, a $11.2

million decrease compared to $216.5 million at December 31, 2022,

and a $20.7 million increase compared to $226.1 million at March

31, 2022. Interest-bearing demand deposits increased $9.6 million

to $437.8 million at March 31, 2023, compared to $428.2 million at

December 31, 2022, and decreased $66.4 million compared to $504.2

million at March 31, 2022. Certificates of deposit, which include

brokered deposits, increased $49.9 million during the quarter to

$256.8 million at March 31, 2023, compared to $206.9 million at

December 31, 2022, and increased $85.6 million compared to $171.2

million at March 31, 2022.

Total borrowings increased $25 million, or 28%,

to $115 million at March 31, 2023, compared to $90 million at

December 31, 2022, and March 31, 2022. The increase was due to $15

million in additional FHLB overnight advances and $10 million in

unsecured borrowing to support on-balance sheet liquidity.

Stockholders’ equity increased to $112.8 million

at March 31, 2023, compared to $112.7 million at December 31, 2022,

and $104.8 million at March 31, 2022. Book value per common

share decreased to $12.77 at March 31, 2023, compared to $12.80 at

December 31, 2022, and $12.07 at March 31, 2022.

Credit Quality

In accordance with changes in generally accepted

accounting principles, the Company adopted the new credit loss

accounting standard known as Current Expected Credit Loss (“CECL”)

on January 1, 2023. With the adoption, the allowance for credit

losses ("ACL") for loans increased by $1.8 million and the reserve

on unfunded commitments increased $420,000. Under CECL, the ACL is

based on expected credit losses rather than on incurred losses.

Adoption of CECL resulted in a cumulative effect after-tax

adjustment to stockholders’ equity as of January 1, 2023, of $1.6

million, which had no impact on earnings.

The Company recorded a negative provision for

loan loss expense of $607,000 in the first quarter 2023, compared

to a negative provision for loan loss expense of $461,000 in fourth

quarter 2022, and a negative provision expense of 284,000 in first

quarter 2022. The total allowance for credit losses was $12.1

million, or 1.30% of total loans held for investment, at March 31,

2023. Net non-accrual loans, plus net other assets acquired through

foreclosure, were $3.8 million at March 31, 2023, $2.5 million at

December 31, 2022, and $2.9 million at

March 31, 2022.

Net non-accrual loans were $1.6 million as of

March 31, 2023, compared to $211,000 at December 31, 2022, and

$536,000 at March 31, 2022. Of the $1.6 million of net

non-accrual loans at March 31, 2023, $817,000 were agriculture

loans, $628,000 were manufactured housing loans and $148,000 were

single family loans. The $817,000 in agriculture loans includes a

guaranteed balance of $735,000.

There was $2.3 million in other assets acquired

through foreclosure as of March 31, 2023 and on December 31, 2022.

This compared to $2.4 million at March 31, 2022. The OREO balance

relates to one property the Bank is currently marketing and expects

to sell this year.

Stock Repurchase Program

On August 27, 2021, the Company announced that

its Board of Directors had extended the stock repurchase plan until

August 31, 2023. The Company did not repurchase shares during the

first quarter of 2023, leaving $1.4 million available under the

previously announced repurchase program.

Company Overview

Community West Bancshares is a financial

services company with headquarters in Goleta, California. The

Company is the holding company for Community West Bank, the largest

publicly traded community bank serving California’s Central Coast

area of Ventura, Santa Barbara and San Luis Obispo counties.

Community West Bank has seven full-service California branch

banking offices in Goleta, Santa Barbara, Santa Maria, Ventura, San

Luis Obispo, Oxnard and Paso Robles. The principal business

activities of the Company are Relationship Banking, Manufactured

Housing lending and Government Guaranteed lending.

Safe Harbor Disclosure

This release contains certain forward-looking

statements about the Company and the Bank that are intended to be

covered by the safe harbor for “forward-looking statements”

provided by the Private Securities Litigation Reform Act of 1995.

Statements that are not historical or current facts, including

statements about future financial and operational results,

expectations, or intentions are forward-looking statements. Such

statements reflect management's current views of future events and

operations. These forward-looking statements are based on

information currently available to the Company as of the date of

this release. It is important to note that these forward-looking

statements are not guarantees of future performance and involve and

are subject to significant risks, contingencies, and uncertainties,

many of which are difficult to predict and are generally beyond our

control, which may cause actual results, performance, or

achievements to differ materially from those expressed in such

statements, including, but not limited to, risks from the COVID-19

pandemic, deterioration in the strength of the United States

economy in general and of the local economies in which we conduct

operations, the effect of, and changes in, trade, monetary and

fiscal policies and laws, including changes in the interest rate

policies of the Board of Governors of the Federal Reserve System,

continued high inflation,, disruptions in credit and capital

markets and government policies that could lead to a tightening of

credit and an increase in credit losses, our ability to attract and

retain deposits and other sources of funding and liquidity, the

impact of recent bank failures and other adverse developments to

financial institutions and the general reaction by bank customers

and by investors in the capital markets regarding the stability and

ability of banks to meet ongoing liquidity demands, risks from the

COVID-19 pandemic, weather, natural disasters, climate change,

increased unemployment, deterioration in credit quality of our loan

portfolio and/or the value of the collateral securing the repayment

of those loans, including those involving real estate, reduction in

the value of our investment securities, the costs and effects of

litigation and of adverse outcomes of such litigation, the cost and

ability to attract and retain key employees, a breach of our

operational or security systems, policies or procedures including

cyber-attacks on us or third party vendors or service providers,

regulatory or legal developments, United States tax policies,

including our effective income tax rate, and our ability to

implement and execute our business plan and strategy and expand our

operations as provided therein. Actual results may differ

materially from those set forth or implied in the forward-looking

statements as a result of a variety of factors including the risk

factors contained in documents filed by the Company with the

Securities and Exchange Commission and are available in the

“Investor Relations” section of our website,

https://www.communitywest.com/sec-filings/documents/default.aspx.

The Company is under no obligation (and expressly disclaims any

obligation) to update or alter such forward-looking statements,

whether as a result of new information, future events, or

otherwise, except as required by law.

|

COMMUNITY WEST BANCSHARES |

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

(in 000's, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

1,533 |

|

|

$ |

1,379 |

|

|

|

$ |

2,043 |

|

|

Interest-earning deposits in other financial institutions |

|

166,342 |

|

|

|

63,311 |

|

|

|

|

191,145 |

|

|

Investment securities |

|

18,225 |

|

|

|

29,470 |

|

|

|

|

21,805 |

|

|

Loans: |

|

|

|

|

|

|

|

Commercial |

|

62,477 |

|

|

|

74,929 |

|

|

|

|

70,480 |

|

|

Commercial real estate |

|

555,339 |

|

|

|

545,317 |

|

|

|

|

492,181 |

|

|

SBA |

|

6,418 |

|

|

|

6,855 |

|

|

|

|

8,403 |

|

|

Paycheck Protection Program (PPP) |

|

684 |

|

|

|

1,773 |

|

|

|

|

7,504 |

|

|

Manufactured housing |

|

315,326 |

|

|

|

315,825 |

|

|

|

|

299,969 |

|

|

Single family real estate |

|

9,582 |

|

|

|

8,678 |

|

|

|

|

8,824 |

|

|

HELOC |

|

2,557 |

|

|

|

2,613 |

|

|

|

|

3,475 |

|

|

Other (1) |

|

(890 |

) |

|

|

(648 |

) |

|

|

|

(528 |

) |

|

Total loans |

|

951,493 |

|

|

|

955,342 |

|

|

|

|

890,308 |

|

| |

|

|

|

|

|

|

|

Loans, net |

|

|

|

|

|

|

|

Held for sale |

|

21,045 |

|

|

|

21,033 |

|

|

|

|

24,193 |

|

|

Held for investment |

|

930,448 |

|

|

|

934,309 |

|

|

|

|

866,115 |

|

|

Less: Allowance for credit losses |

|

(12,065 |

) |

|

|

(10,765 |

) |

|

|

|

(10,547 |

) |

|

Net held for investment |

|

918,383 |

|

|

|

923,544 |

|

|

|

|

855,568 |

|

|

NET LOANS |

|

939,428 |

|

|

|

944,577 |

|

|

|

|

879,761 |

|

| |

|

|

|

|

|

|

|

Other assets |

|

42,055 |

|

|

|

52,765 |

|

|

|

|

41,849 |

|

| |

|

|

|

|

|

|

|

TOTAL ASSETS |

$ |

1,167,583 |

|

|

$ |

1,091,502 |

|

|

|

$ |

1,136,603 |

|

| |

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

Non-interest-bearing demand |

$ |

205,324 |

|

|

$ |

216,494 |

|

|

|

$ |

226,073 |

|

|

Interest-bearing demand |

|

437,770 |

|

|

|

428,173 |

|

|

|

|

504,209 |

|

|

Savings |

|

20,929 |

|

|

|

23,490 |

|

|

|

|

24,239 |

|

|

Certificates of deposit ($250,000 or more) |

|

6,268 |

|

|

|

6,693 |

|

|

|

|

13,197 |

|

|

Other certificates of deposit |

|

250,513 |

|

|

|

200,234 |

|

|

|

|

158,022 |

|

|

Total deposits |

|

920,804 |

|

|

|

875,084 |

|

|

|

|

925,740 |

|

|

Other borrowings |

|

115,000 |

|

|

|

90,000 |

|

|

|

|

90,000 |

|

|

Other liabilities |

|

18,990 |

|

|

|

13,768 |

|

|

|

|

16,035 |

|

|

TOTAL LIABILITIES |

|

1,054,794 |

|

|

|

978,852 |

|

|

|

|

1,031,775 |

|

| |

|

|

|

|

|

|

|

Stockholders' equity |

|

112,789 |

|

|

|

112,650 |

|

|

|

|

104,828 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

$ |

1,167,583 |

|

|

$ |

1,091,502 |

|

|

|

$ |

1,136,603 |

|

| |

|

|

|

|

|

|

|

Common shares outstanding |

|

8,835 |

|

|

|

8,798 |

|

|

|

|

8,682 |

|

| |

|

|

|

|

|

|

|

Book value per common share |

$ |

12.77 |

|

|

$ |

12.80 |

|

|

|

$ |

12.07 |

|

| |

|

|

|

|

|

|

|

(1) Includes consumer, other loans, securitized loans, and deferred

fees |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

COMMUNITY WEST BANCSHARES |

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED INCOME STATEMENTS |

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

(in 000's, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

|

December 31, |

September 30, |

June 30, |

|

March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2022 |

|

|

2022 |

|

|

2022 |

|

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

12,489 |

|

|

$ |

12,467 |

|

|

$ |

11,867 |

|

$ |

11,129 |

|

$ |

11,194 |

|

|

Investment securities and other |

|

|

1,096 |

|

|

|

811 |

|

|

|

787 |

|

|

577 |

|

|

306 |

|

|

Total interest income |

|

|

13,585 |

|

|

|

13,278 |

|

|

|

12,654 |

|

|

11,706 |

|

|

11,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

2,277 |

|

|

|

913 |

|

|

|

528 |

|

|

500 |

|

|

570 |

|

|

Other borrowings |

|

|

278 |

|

|

|

224 |

|

|

|

203 |

|

|

196 |

|

|

194 |

|

|

Total interest expense |

|

|

2,555 |

|

|

|

1,137 |

|

|

|

731 |

|

|

696 |

|

|

764 |

|

|

Net interest income |

|

|

11,030 |

|

|

|

12,141 |

|

|

|

11,923 |

|

|

11,010 |

|

|

10,736 |

|

|

Provision (credit) for credit losses |

|

|

(607 |

) |

|

|

(461 |

) |

|

|

298 |

|

|

252 |

|

|

(284 |

) |

|

Net interest income after provision (credit) for credit losses |

|

|

11,637 |

|

|

|

12,602 |

|

|

|

11,625 |

|

|

10,758 |

|

|

11,020 |

|

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

Other loan fees |

|

|

169 |

|

|

|

246 |

|

|

|

292 |

|

|

377 |

|

|

246 |

|

|

Gains from loan sales, net |

|

|

30 |

|

|

|

12 |

|

|

|

49 |

|

|

136 |

|

|

60 |

|

|

Document processing fees |

|

|

78 |

|

|

|

85 |

|

|

|

114 |

|

|

122 |

|

|

101 |

|

|

Service charges |

|

|

154 |

|

|

|

143 |

|

|

|

114 |

|

|

93 |

|

|

88 |

|

|

Other |

|

|

331 |

|

|

|

278 |

|

|

|

303 |

|

|

323 |

|

|

796 |

|

|

Total non-interest income |

|

|

762 |

|

|

|

764 |

|

|

|

872 |

|

|

1,051 |

|

|

1,291 |

|

|

Non-interest expenses |

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

5,202 |

|

|

|

4,821 |

|

|

|

4,752 |

|

|

4,910 |

|

|

4,865 |

|

|

Occupancy, net |

|

|

1,098 |

|

|

|

1,116 |

|

|

|

1,046 |

|

|

1,021 |

|

|

997 |

|

|

Professional services |

|

|

919 |

|

|

|

1,236 |

|

|

|

653 |

|

|

635 |

|

|

399 |

|

|

Data processing |

|

|

349 |

|

|

|

346 |

|

|

|

302 |

|

|

307 |

|

|

310 |

|

|

Depreciation |

|

|

180 |

|

|

|

176 |

|

|

|

173 |

|

|

179 |

|

|

183 |

|

|

FDIC assessment |

|

|

182 |

|

|

|

111 |

|

|

|

131 |

|

|

164 |

|

|

171 |

|

|

Advertising and marketing |

|

|

210 |

|

|

|

234 |

|

|

|

196 |

|

|

233 |

|

|

258 |

|

|

Stock-based compensation |

|

|

246 |

|

|

|

32 |

|

|

|

71 |

|

|

94 |

|

|

92 |

|

|

Other |

|

|

333 |

|

|

|

507 |

|

|

|

286 |

|

|

569 |

|

|

(304 |

) |

|

Total non-interest expenses |

|

|

8,719 |

|

|

|

8,579 |

|

|

|

7,610 |

|

|

8,112 |

|

|

6,971 |

|

|

Income before provision for income taxes |

|

|

3,680 |

|

|

|

4,787 |

|

|

|

4,887 |

|

|

3,697 |

|

|

5,340 |

|

|

Provision for income taxes |

|

|

1,216 |

|

|

|

1,411 |

|

|

|

1,409 |

|

|

1,062 |

|

|

1,380 |

|

|

Net income |

|

$ |

2,464 |

|

|

$ |

3,376 |

|

|

$ |

3,478 |

|

$ |

2,635 |

|

$ |

3,960 |

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.28 |

|

|

$ |

0.38 |

|

|

$ |

0.40 |

|

$ |

0.30 |

|

$ |

0.46 |

|

|

Diluted |

|

$ |

0.27 |

|

|

$ |

0.38 |

|

|

$ |

0.39 |

|

$ |

0.30 |

|

$ |

0.45 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

COMMUNITY WEST BANCSHARES |

|

|

|

|

|

|

|

|

|

Average Balance, Average Yield Earned, and Average Rate

Paid |

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

(in 000's) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Three Months Ended |

|

|

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

|

AverageBalance |

Interest |

AverageYield/Cost |

|

AverageBalance |

Interest |

AverageYield/Cost |

|

AverageBalance |

Interest |

AverageYield/Cost |

|

Interest-Earning Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Federal funds sold and interest-earning deposits |

$ |

73,179 |

|

$ |

795 |

4.41 |

% |

|

$ |

48,512 |

|

$ |

415 |

3.39 |

% |

|

$ |

205,815 |

|

$ |

109 |

0.21 |

% |

|

Investment securities |

|

27,213 |

|

|

301 |

4.49 |

% |

|

|

54,022 |

|

|

396 |

2.91 |

% |

|

|

26,897 |

|

|

197 |

2.97 |

% |

|

Loans (1) |

|

952,192 |

|

|

12,489 |

5.32 |

% |

|

|

949,007 |

|

|

12,467 |

5.21 |

% |

|

|

894,539 |

|

|

11,194 |

5.08 |

% |

|

Total earnings assets |

|

1,052,584 |

|

|

13,585 |

5.23 |

% |

|

|

1,051,541 |

|

|

13,278 |

5.01 |

% |

|

|

1,127,251 |

|

|

11,500 |

4.14 |

% |

|

Nonearning Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

1,976 |

|

|

|

|

|

2,145 |

|

|

|

|

|

2,161 |

|

|

|

|

Allowance for credit losses |

|

(12,479 |

) |

|

|

|

|

(11,204 |

) |

|

|

|

|

(10,615 |

) |

|

|

|

Other assets |

|

38,716 |

|

|

|

|

|

36,432 |

|

|

|

|

|

39,138 |

|

|

|

|

Total

assets |

$ |

1,080,797 |

|

|

|

|

$ |

1,078,914 |

|

|

|

|

$ |

1,157,935 |

|

|

|

|

Interest-Bearing Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand deposits |

$ |

417,662 |

|

$ |

1,298 |

1.26 |

% |

|

$ |

442,313 |

|

$ |

591 |

0.53 |

% |

|

$ |

519,454 |

|

$ |

319 |

0.25 |

% |

|

Savings deposits |

|

23,230 |

|

|

12 |

0.21 |

% |

|

|

22,801 |

|

|

13 |

0.23 |

% |

|

|

23,931 |

|

|

16 |

0.27 |

% |

|

Time deposits |

|

200,875 |

|

|

967 |

1.95 |

% |

|

|

152,249 |

|

|

309 |

0.81 |

% |

|

|

175,448 |

|

|

235 |

0.54 |

% |

|

Total interest-bearing deposits |

|

641,767 |

|

|

2,277 |

1.44 |

% |

|

|

617,363 |

|

|

913 |

0.59 |

% |

|

|

718,833 |

|

|

570 |

0.32 |

% |

|

Other borrowings |

|

96,333 |

|

|

278 |

1.17 |

% |

|

|

92,391 |

|

|

224 |

0.96 |

% |

|

|

90,000 |

|

|

194 |

0.87 |

% |

|

Total interest-bearing liabilities |

$ |

738,100 |

|

$ |

2,555 |

1.40 |

% |

|

$ |

709,754 |

|

$ |

1,137 |

0.64 |

% |

|

$ |

808,833 |

|

$ |

764 |

0.38 |

% |

|

Noninterest-Bearing Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing demand deposits |

|

211,940 |

|

|

|

|

|

241,759 |

|

|

|

|

|

227,980 |

|

|

|

|

Other liabilities |

|

17,766 |

|

|

|

|

|

15,555 |

|

|

|

|

|

17,640 |

|

|

|

|

Stockholders' equity |

|

112,991 |

|

|

|

|

|

111,846 |

|

|

|

|

|

103,482 |

|

|

|

|

Total Liabilities and Stockholders' Equity |

$ |

1,080,797 |

|

|

|

|

$ |

1,078,914 |

|

|

|

|

$ |

1,157,935 |

|

|

|

|

Net interest income and margin |

|

$ |

11,030 |

4.25 |

% |

|

|

$ |

12,141 |

4.58 |

% |

|

|

$ |

10,736 |

3.86 |

% |

|

Net interest spread |

|

|

3.83 |

% |

|

|

|

4.37 |

% |

|

|

|

3.76 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of total deposits |

|

|

1.08 |

% |

|

|

|

0.42 |

% |

|

|

|

0.24 |

% |

|

Cost of funds |

|

|

1.09 |

% |

|

|

|

0.47 |

% |

|

|

|

0.30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDITIONAL FINANCIAL INFORMATION |

|

|

|

|

|

|

(Dollars and shares in thousands except per share

amounts)(Unaudited) |

|

|

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

|

Three Months Ended |

|

PERFORMANCE MEASURES AND RATIOS |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

Return on average common equity |

|

8.84% |

|

|

|

11.98% |

|

|

|

15.52% |

|

|

Return on average assets |

|

0.92% |

|

|

|

1.24% |

|

|

|

1.39% |

|

|

Efficiency ratio |

|

73.94% |

|

|

|

66.48% |

|

|

|

57.97% |

|

|

Net interest margin |

|

4.25% |

|

|

|

4.58% |

|

|

|

3.86% |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

|

Three Months Ended |

|

AVERAGE BALANCES |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

Average assets |

$ |

1,080,797 |

|

|

$ |

1,078,914 |

|

|

$ |

1,157,935 |

|

|

Average earning assets |

|

1,052,584 |

|

|

|

1,051,541 |

|

|

|

1,127,251 |

|

|

Average total loans |

|

952,192 |

|

|

|

949,007 |

|

|

|

894,539 |

|

|

Average deposits |

|

853,707 |

|

|

|

859,122 |

|

|

|

946,813 |

|

|

Average common equity |

|

112,991 |

|

|

|

111,846 |

|

|

|

103,482 |

|

| |

|

|

|

|

|

|

EQUITY ANALYSIS |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

Total common equity |

$ |

112,789 |

|

|

$ |

112,650 |

|

|

$ |

104,828 |

|

|

Common stock outstanding |

|

8,835 |

|

|

|

8,798 |

|

|

|

8,682 |

|

| |

|

|

|

|

|

|

Book value per common share |

$ |

12.77 |

|

|

$ |

12.80 |

|

|

$ |

12.07 |

|

| |

|

|

|

|

|

|

ASSET QUALITY |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

Nonaccrual loans, net |

$ |

1,592 |

|

|

$ |

211 |

|

|

$ |

536 |

|

|

Nonaccrual loans, net/total loans |

|

0.17% |

|

|

|

0.02% |

|

|

|

0.06% |

|

|

Other assets acquired through foreclosure, net |

$ |

2,250 |

|

|

$ |

2,250 |

|

|

$ |

2,389 |

|

| |

|

|

|

|

|

|

Nonaccrual loans plus other assets acquired through foreclosure,

net |

$ |

3,842 |

|

|

$ |

2,461 |

|

|

$ |

2,925 |

|

|

Nonaccrual loans plus other assets acquired through foreclosure,

net/total assets |

|

0.33% |

|

|

|

0.23% |

|

|

|

0.26% |

|

|

Net loan (recoveries)/charge-offs in the quarter |

$ |

(96) |

|

|

$ |

(113) |

|

|

$ |

(427) |

|

|

Net (recoveries)/charge-offs in the quarter/total loans |

|

(0.01%) |

|

|

|

(0.01%) |

|

|

|

(0.05%) |

|

| |

|

|

|

|

|

|

Allowance for credit losses |

$ |

12,065 |

|

|

$ |

10,765 |

|

|

$ |

10,547 |

|

|

Plus: Reserve for undisbursed loan commitments |

|

400 |

|

|

|

94 |

|

|

|

90 |

|

|

Total allowance for credit losses |

$ |

12,465 |

|

|

$ |

10,859 |

|

|

$ |

10,637 |

|

|

Allowance for credit losses/total loans held for investment |

|

1.30% |

|

|

|

1.15% |

|

|

|

1.22% |

|

|

Allowance for credit losses/nonaccrual loans, net |

|

757.85% |

|

|

|

5101.90% |

|

|

|

1966.82% |

|

| |

|

|

|

|

|

|

Community West Bank * |

|

|

|

|

|

|

Tier 1 leverage ratio |

|

10.41% |

|

|

|

10.34% |

|

|

|

8.88% |

|

|

Tier 1 capital ratio |

|

11.76% |

|

|

|

11.44% |

|

|

|

11.33% |

|

|

Total capital ratio |

|

12.89% |

|

|

|

12.56% |

|

|

|

12.50% |

|

|

|

|

|

|

|

|

|

INTEREST SPREAD ANALYSIS |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

Yield on total loans |

|

5.32% |

|

|

|

5.21% |

|

|

|

5.08% |

|

|

Yield on investments |

|

4.49% |

|

|

|

2.91% |

|

|

|

2.97% |

|

|

Yield on interest earning deposits |

|

4.41% |

|

|

|

3.39% |

|

|

|

0.21% |

|

|

Yield on earning assets |

|

5.23% |

|

|

|

5.01% |

|

|

|

4.14% |

|

| |

|

|

|

|

|

|

Cost of interest-bearing deposits |

|

1.44% |

|

|

|

0.59% |

|

|

|

0.32% |

|

|

Cost of total deposits |

|

1.08% |

|

|

|

0.42% |

|

|

|

0.24% |

|

|

Cost of borrowings |

|

1.17% |

|

|

|

0.96% |

|

|

|

0.87% |

|

|

Cost of interest-bearing liabilities |

|

1.40% |

|

|

|

0.64% |

|

|

|

0.38% |

|

|

Cost of funds |

|

1.09% |

|

|

|

0.47% |

|

|

|

0.30% |

|

| |

|

|

|

|

|

|

* Capital ratios are preliminary until the Call Report is

filed. |

|

|

|

|

|

| |

|

|

|

|

|

Contact:

Richard Pimentel, EVP &

CFO805.692.4410www.communitywestbank.com

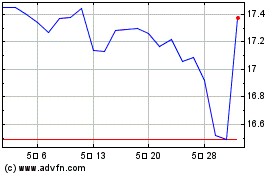

Community West Bancshares (NASDAQ:CWBC)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

Community West Bancshares (NASDAQ:CWBC)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024