0001187953false--12-31Q220240.0010.00110000000114000010000049861250058650000229701000001000000001832400000011879532024-01-012024-06-300001187953celz:WarrantsMember2023-06-300001187953celz:WarrantsMember2022-05-012022-05-310001187953celz:PrivateOfferingMember2022-05-012022-05-310001187953celz:MinimumsssMember2024-06-300001187953celz:MinimumsssMember2024-01-012024-06-300001187953celz:MinimumsssMember2023-12-310001187953celz:UnderTheTwoThousandTwentyOnePlanMember2024-06-300001187953celz:BoardOfDirectorsMember2023-01-012023-06-300001187953celz:BoardOfDirectorsMember2024-01-012024-06-300001187953celz:BoardOfDirectorsMember2022-01-012022-02-280001187953celz:WarrantssMember2024-06-300001187953celz:WarrantssMember2024-01-012024-06-300001187953us-gaap:OptionMember2024-01-012024-06-300001187953us-gaap:OptionMember2023-12-310001187953celz:JadiCellLicenseAgreementMember2020-12-280001187953celz:JadiCellLicenseAgreementMember2020-12-012020-12-280001187953celz:StemSpinePatentPurchaseMember2017-05-012017-05-170001187953celz:StemSpinePatentPurchaseMember2021-01-310001187953celz:StemSpinePatentPurchaseMember2021-09-300001187953celz:StemSpinePatentPurchaseMember2017-05-170001187953celz:StemSpinePatentPurchaseMember2020-12-310001187953celz:StemSpinePatentPurchaseMember2020-12-1200011879532022-12-012022-12-150001187953us-gaap:OptionMember2020-12-012020-12-120001187953celz:WarrantssMember2020-12-012020-12-120001187953us-gaap:OptionMember2017-05-012017-05-1700011879532017-05-012017-05-170001187953celz:ImmCelzMember2024-06-300001187953celz:StemSpineMember2024-06-300001187953celz:LicenseAgreementMember2024-06-300001187953celz:ImmCelzPatentMember2024-06-300001187953celz:EDIPatentMember2024-06-300001187953celz:JadiCellMember2022-02-280001187953celz:ImmCelzMember2023-01-012023-06-300001187953celz:StemSpineMember2023-01-012023-06-300001187953celz:StemSpineMember2024-01-012024-06-300001187953celz:LicenseAgreementMember2023-01-012023-06-300001187953celz:LicenseAgreementMember2024-01-012024-06-300001187953celz:EDIPatentMember2024-01-012024-06-300001187953celz:ImmCelzPatentMember2023-01-012023-06-300001187953celz:ImmCelzPatentMember2024-01-012024-06-300001187953us-gaap:LicensingAgreementsMember2023-01-012023-06-300001187953us-gaap:LicensingAgreementsMember2024-01-012024-06-300001187953celz:ImmCelzMember2023-08-3100011879532023-08-310001187953celz:ImmCelzMember2024-01-012024-06-300001187953celz:WarrantssMember2017-05-012017-05-1700011879532020-12-1200011879532021-01-3100011879532021-09-3000011879532020-12-310001187953celz:ImmCelzMember2021-01-310001187953celz:ImmCelzMember2021-09-300001187953celz:ImmCelzMember2020-12-310001187953celz:ImmCelzMember2020-12-1200011879532016-02-020001187953celz:JadiCellMember2022-02-012022-02-280001187953celz:JadiCellMember2020-12-012020-12-280001187953celz:WarrantsMember2024-06-300001187953us-gaap:OptionMember2024-06-3000011879532023-06-012023-06-120001187953celz:TreasuryStockCommonShareMember2024-04-012024-06-300001187953us-gaap:RetainedEarningsMember2024-04-012024-06-300001187953us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001187953celz:CommonShareStockMember2024-04-012024-06-300001187953celz:SeriesBPreferredStocksMember2024-04-012024-06-3000011879532024-03-310001187953celz:TreasuryStockCommonShareMember2024-03-310001187953us-gaap:RetainedEarningsMember2024-03-310001187953us-gaap:AdditionalPaidInCapitalMember2024-03-310001187953celz:CommonShareStockMember2024-03-310001187953celz:SeriesBPreferredStocksMember2024-03-310001187953celz:TreasuryStockCommonShareMember2024-06-300001187953us-gaap:RetainedEarningsMember2024-06-300001187953us-gaap:AdditionalPaidInCapitalMember2024-06-300001187953celz:CommonShareStockMember2024-06-300001187953celz:SeriesBPreferredStocksMember2024-06-300001187953celz:TreasuryStockCommonShareMember2024-01-012024-06-300001187953us-gaap:RetainedEarningsMember2024-01-012024-06-300001187953us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001187953celz:CommonShareStockMember2024-01-012024-06-300001187953celz:SeriesBPreferredStocksMember2024-01-012024-06-300001187953celz:TreasuryStockCommonShareMember2023-12-310001187953us-gaap:RetainedEarningsMember2023-12-310001187953us-gaap:AdditionalPaidInCapitalMember2023-12-310001187953celz:CommonShareStockMember2023-12-310001187953celz:SeriesBPreferredStocksMember2023-12-310001187953us-gaap:RetainedEarningsMember2023-04-012023-06-300001187953us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001187953celz:SeriesAPreferredStocksMember2023-04-012023-06-300001187953celz:SeriesCPreferredStocksMember2023-04-012023-06-300001187953celz:CommonShareStockMember2023-04-012023-06-300001187953celz:SeriesBPreferredStocksMember2023-04-012023-06-3000011879532023-03-310001187953us-gaap:RetainedEarningsMember2023-03-310001187953us-gaap:AdditionalPaidInCapitalMember2023-03-310001187953celz:SeriesAPreferredStocksMember2023-03-310001187953celz:SeriesCPreferredStocksMember2023-03-310001187953celz:CommonShareStockMember2023-03-310001187953celz:SeriesBPreferredStocksMember2023-03-310001187953us-gaap:RetainedEarningsMember2023-06-300001187953us-gaap:AdditionalPaidInCapitalMember2023-06-300001187953celz:SeriesAPreferredStocksMember2023-06-300001187953celz:SeriesCPreferredStocksMember2023-06-300001187953celz:CommonShareStockMember2023-06-300001187953celz:SeriesBPreferredStocksMember2023-06-300001187953us-gaap:RetainedEarningsMember2023-01-012023-06-300001187953us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001187953celz:SeriesAPreferredStocksMember2023-01-012023-06-300001187953celz:SeriesCPreferredStocksMember2023-01-012023-06-300001187953celz:CommonShareStockMember2023-01-012023-06-300001187953celz:SeriesBPreferredStocksMember2023-01-012023-06-300001187953us-gaap:RetainedEarningsMember2022-12-310001187953us-gaap:AdditionalPaidInCapitalMember2022-12-310001187953celz:SeriesAPreferredStocksMember2022-12-310001187953celz:SeriesCPreferredStocksMember2022-12-310001187953celz:CommonShareStockMember2022-12-310001187953celz:SeriesBPreferredStocksMember2022-12-3100011879532023-06-3000011879532022-12-3100011879532023-01-012023-06-3000011879532023-04-012023-06-3000011879532024-04-012024-06-300001187953celz:PreferredStocksSeriesBMember2024-06-300001187953us-gaap:SeriesBPreferredStockMember2023-12-310001187953us-gaap:SeriesBPreferredStockMember2024-06-3000011879532023-12-3100011879532024-06-3000011879532024-08-05iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number: 000-53500

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. |

(Exact name of Registrant as specified in its charter) |

Nevada | | 87-0622284 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

211 E Osborn Road, Phoenix, AZ | | 85012 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (480) 399-2822

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | | CELZ | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of August 5, 2024, there were 1,338,126 shares of the registrant’s common stock outstanding.

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. |

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

|

| | | June 30, 2024 | | | December 31, 2023 | |

ASSETS | | | | | | | |

CURRENT ASSETS | | | | | | | |

Cash | | | $ | 7,471,476 | | | $ | 3,466,867 | |

Investments | | | | - | | | | 6,520,191 | |

Inventory | | | | 3,394 | | | | 6,594 | |

Prepaids and other current assets | | | | 129,086 | | | | 277,246 | |

Total Current Assets | | | | 7,603,956 | | | | 10,270,898 | |

| | | | | | | | | |

OTHER ASSETS | | | | | | | | | |

Other assets | | | | 3,281 | | | | 3,281 | |

Licenses, net of amortization | | | | 382,469 | | | | 441,011 | |

TOTAL ASSETS | | | $ | 7,989,706 | | | $ | 10,715,190 | |

| | | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | |

| | | | | | | | | |

CURRENT LIABILITIES | | | | | | | | | |

Accounts payable | | | $ | 322,158 | | | $ | 317,280 | |

Accrued expenses | | | | 39,920 | | | | 39,920 | |

Advances from related party | | | | 14,194 | | | | 14,194 | |

Total Current Liabilities | | | | 376,272 | | | | 371,394 | |

| | | | | | | | | |

TOTAL LIABILITIES | | | | 376,272 | | | | 371,394 | |

| | | | | | | | | |

STOCKHOLDERS' EQUITY | | | | | | | | | |

Preferred stock, $0.001 par value, 10,000,000 shares authorized at June 30, 2024 and December 31, 2023 | | | | - | | | | - | |

Series B preferred stock, $0.001 par value, 1 share authorized, issued and outstanding at June 30, 2024 | | | | 100 | | | | - | |

Common stock, $0.001 par value, 5,000,000 and 50,000,000 shares authorized; 1,431,126 and 1,431,126 issued and 1,338,126 and 1,373,626 outstanding at June 30, 2024 and December 31, 2023, respectively | | | | 1,431 | | | | 1,431 | |

Additional paid-in capital | | | | 69,730,073 | | | | 69,711,749 | |

Accumulated deficit | | | | (61,697,704 | ) | | | (59,098,432 | ) |

Treasury stock, at cost, 93,000 and 57,500 shares as of June 30, 2024 and December 31, 2023 | | | | (420,466 | ) | | | (270,952 | ) |

| | | | | 7,613,434 | | | | 10,343,796 | |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | |

| | | | $ | 7,989,706 | | | $ | 10,715,190 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. |

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

| | For the Three Months Ended June 30, 2024 | | | For the Three Months Ended June 30, 2023 | | | For the Six Months Ended June 30, 2024 | | | For the Six Months Ended June 30, 2023 | |

| | | | | | | | | | | | |

Revenues | | $ | 8,000 | | | $ | - | | | $ | 8,000 | | | $ | - | |

| | | | | | | | | | | | | | | | |

Cost of revenues | | | 3,200 | | | | - | | | | 3,200 | | | | - | |

| | | | | | | | | | | | | | | | |

Gross profit | | | 4,800 | | | | - | | | | 4,800 | | | | - | |

| | | | | | | | | | | | | | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

Research and development | | | 924,749 | | | | 309,480 | | | | 1,347,141 | | | | 628,509 | |

Selling, general and administrative | | | 676,086 | | | | 859,537 | | | | 1,347,570 | | | | 1,630,557 | |

Amortization of patent costs | | | 29,271 | | | | 23,021 | | | | 58,542 | | | | 46,042 | |

TOTAL EXPENSES | | | 1,630,106 | | | | 1,192,038 | | | | 2,753,253 | | | | 2,305,108 | |

| | | | | | | | | | | | | | | | |

Operating loss | | | (1,625,306 | ) | | | (1,192,038 | ) | | | (2,748,453 | ) | | | (2,305,108 | ) |

| | | | | | | | | | | | | | | | |

OTHER INCOME/(EXPENSE) | | | | | | | | | | | | | | | | |

Interest income | | | 67,578 | | | | 89,913 | | | | 149,181 | | | | 151,060 | |

Total other income (expense) | | | 67,578 | | | | 89,913 | | | | 149,181 | | | | 151,060 | |

| | | | | | | | | | | | | | | | |

LOSS BEFORE PROVISION FOR INCOME TAXES | | | (1,557,728 | ) | | | (1,102,125 | ) | | | (2,599,272 | ) | | | (2,154,048 | ) |

| | | | | | | | | | | | | | | | |

Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

NET LOSS | | $ | (1,557,728 | ) | | $ | (1,102,125 | ) | | $ | (2,599,272 | ) | | $ | (2,154,048 | ) |

| | | | | | | | | | | | | | | | |

NET LOSS PER SHARE - BASIC AND DILUTED | | $ | (1.11 | ) | | $ | (0.78 | ) | | $ | (1.84 | ) | | $ | (1.53 | ) |

| | | | | | | | | | | | | | | | |

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - BASIC AND DILUTED | | | 1,405,208 | | | | 1,409,948 | | | | 1,413,324 | | | | 1,408,793 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. |

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

| | For the Six Months Ended June 30, 2024 | | | For the Six Months Ended June 30, 2023 | |

| | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

Net loss | | $ | (2,599,272 | ) | | $ | (2,154,048 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Stock-based compensation | | | 18,324 | | | | 18,324 | |

Amortization | | | 58,542 | | | | 46,042 | |

Changes in assets and liabilities: | | | | | | | | |

Inventory | | | 3,200 | | | | - | |

Prepaids and other current assets | | | 148,160 | | | | 184,428 | |

Accounts payable | | | 4,878 | | | | (2,923,125 | ) |

Net cash used in operating activities | | | (2,366,168 | ) | | | (4,828,379 | ) |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

Purchase of investments | | | - | | | | (4,551,049 | ) |

Redemptions of investments | | | 6,520,191 | | | | 5,048,459 | |

Net cash provided by investing activities | | | 6,520,191 | | | | 497,410 | |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

Purchase of common stock | | | (149,514 | ) | | | - | |

Issuance of Series B preferred stock | | | 100 | | | | - | |

Net cash used in financing activities | | | (149,414 | ) | | | - | |

| | | | | | | | |

NET INCREASE (DECREASE) IN CASH | | | 4,004,609 | | | | (4,330,969 | ) |

BEGINNING CASH BALANCE | | | 3,466,867 | | | | 8,320,519 | |

ENDING CASH BALANCE | | $ | 7,471,476 | | | $ | 3,989,550 | |

| | | | | | | | |

SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | |

Cash payments for interest | | $ | - | | | $ | - | |

Cash payments for income taxes | | $ | - | | | $ | - | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. |

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Series B Preferred Stock | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Treasury | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Stock | | | Equity | |

Balance, December 31, 2023 | | | - | | | $ | - | | | | 1,431,126 | | | $ | 1,431 | | | $ | 69,711,749 | | | $ | (59,098,432 | ) | | $ | (270,952 | ) | | $ | 10,343,796 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Purchase of treasury stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (149,514 | ) | | | (149,514 | ) |

Stock-based compensation | | | - | | | | - | | | | - | | | | - | | | | 18,324 | | | | - | | | | - | | | | 18,324 | |

Issuance of Series B preferred stock | | | 1 | | | | 100 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 100 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,599,272 | ) | | | - | | | | (2,599,272 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, June 30, 2024 | | | 1 | | | $ | 100 | | | | 1,431,126 | | | $ | 1,431 | | | | 69,730,073 | | | $ | (61,697,704 | ) | | | (420,466 | ) | | $ | 7,613,434 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Series B Preferred Stock | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Treasury | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Stock | | | Equity | |

Balance, March 31, 2024 | | | - | | | $ | - | | | | 1,431,126 | | | $ | 1,431 | | | $ | 69,720,911 | | | $ | (60,139,976 | ) | | $ | (353,748 | ) | | $ | 9,228,618 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Purchase of treasury stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (66,718 | ) | | | (66,718 | ) |

Stock-based compensation | | | - | | | | - | | | | - | | | | - | | | | 9,162 | | | | - | | | | - | | | | 9,162 | |

Issuance of Series B preferred stock | | | 1 | | | | 100 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 100 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,557,728 | ) | | | - | | | | (1,557,728 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, June 30, 2024 | | | 1 | | | $ | 100 | | | | 1,431,126 | | | $ | 1,431 | | | | 69,730,073 | | | $ | (61,697,704 | ) | | | (420,466 | ) | | $ | 7,613,434 | |

| | Series A Preferred Stock | | | Series B Preferred Stock | | | Series C Preferred Stock | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

Balance, December 31, 2022 | | | - | | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,407,624 | | | $ | 1,408 | | | $ | 69,675,124 | | | $ | (53,811,858 | ) | | $ | 15,864,674 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Round-up shares issued in reverse stock split | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 23,502 | | | | 23 | | | | (23 | ) | | | - | | | | - | |

Stock-based compensation | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 18,324 | | | | - | | | | 18,324 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,154,048 | ) | | | (2,154,048 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, June 30, 2023 | | | - | | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,431,126 | | | $ | 1,431 | | | | 69,693,425 | | | $ | (55,965,906 | ) | | $ | 13,728,950 | |

| | Series A Preferred Stock | | | Series B Preferred Stock | | | Series C Preferred Stock | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

Balance, March 31, 2023 | | | - | | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,407,624 | | | $ | 1,408 | | | $ | 69,684,286 | | | $ | (54,863,781 | ) | | $ | 14,821,913 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Round-up shares issued in reverse stock split | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 23,502 | | | | 23 | | | | (23 | ) | | | - | | | | - | |

Stock-based compensation | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 9,162 | | | | - | | | | 9,162 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,102,125 | ) | | | (1,102,125 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, June 30, 2023 | | | - | | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | | 1,431,126 | | | $ | 1,431 | | | | 69,693,425 | | | $ | (55,965,906 | ) | | $ | 13,728,950 | |

The accompanying notes are an integral part of these condensed consolidated financial statements

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2024

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization - Creative Medical Technologies Holdings, Inc. (the “Company”) is a commercial stage biotechnology company dedicated to the advancement of identifying and translating novel biological therapeutics in the fields of immunotherapy, endocrinology, urology, neurology and orthopedics. The Company was incorporated on December 3, 1998, in the State of Nevada under the name Jolley Marketing, Inc. On May 18, 2016, the Company closed a transaction which was accounted for as a recapitalization, reverse merger, under which Creative Medical Technologies, Inc., a Nevada corporation (“CMT”) became the Company’s wholly owned subsidiary, and Creative Medical Health, Inc. (“CMH”), which was CMT’s sole stockholder prior to the merger, became the Company’s principal stockholder. In connection with this merger, the Company changed its name to Creative Medical Technologies Holdings, Inc. to reflect its current business.

CMT was originally created on December 30, 2015 (“Inception”), as the urological arm of CMH to monetize a patent and related intellectual property related to the treatment of erectile dysfunction (“ED”), which it acquired from CMH in February 2016. Subsequently, the Company has expanded its development and acquisition of intellectual property beyond urology to include therapeutic treatments utilizing “re-programmed” stem cells, and the treatment of neurologic disorders, lower back pain, type I diabetes, and heart, liver, kidney, and other diseases using various types of stem cells through our ImmCelz, Inc., StemSpine, Inc. and AlloCelz LLC subsidiaries. However, neither ImmCelz Inc., StemSpine Inc. nor AlloCelz LLC have commenced commercial activities.

The Company currently conducts substantially all of its commercial operations through CMT, which markets and sells the Company’s CaverStem® and FemCelz® disposable kits utilized by physicians to perform autologous procedures that treat erectile dysfunction and female sexual dysfunction, respectively.

In 2020, through the Company’s ImmCelz Inc. subsidiary, the Company began developing treatments that utilize a patient’s own extracted immune cells that are then “reprogrammed” by culturing them outside the patient’s body with optimized stem cells. The immune cells are then re-injected into the patient from whom they were extracted. The Company believes this process endows the immune cells with regenerative properties that may be suitable for the treatment of multiple indications. In contrast to other stem cell-based approaches, the immune cells are significantly smaller in size than stem cells and are believed to more effectively penetrate areas of the damaged tissues and induce regeneration.

Use of Estimates –The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the balance sheet and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Basis of Presentation – The consolidated financial statements and accompanying notes have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. In the opinion of the Company’s management, the consolidated financial statements include all adjustments, which include only normal recurring adjustments, necessary for the fair presentation of the Company’s financial position for the periods presented.

Risks and Uncertainties - The Company has a limited operating history and has generated minimal revenues from its operations.

The outbreak of the COVID-19 coronavirus has spread across the globe and is impacting worldwide economic activity. A pandemic, including COVID-19 or other public health epidemic, poses the risk that we or our employees, CROs, suppliers, manufacturers and other partners may be prevented from conducting business activities for an indefinite period of time, including due to the spread of the disease or shutdowns that may be requested or mandated by governmental authorities. Another significant, outbreak of COVID-19, a communicable disease, could disrupt our clinical trials, supply chain and the manufacture or shipment of our products, and other related activities, which could have a material adverse effect on our business, financial condition and results of operations, and may also have an adverse impact on global economic conditions which could impair our ability to raise capital when needed.

The Company’s business and operations are sensitive to general business and economic conditions in the U.S. and worldwide. These conditions include short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets and the general condition of the U.S. and world economy. A host of factors beyond the Company’s control could cause fluctuations in these conditions, including the political environment and acts or threats of war or terrorism. Adverse developments in these general business and economic conditions, including through recession, downturn or otherwise, could have a material adverse effect on the Company’s financial condition and the results of its operations.

The Company has generated minimal sales and has limited marketing and/or distribution capabilities. The Company has limited experience in developing, training, or managing a sales force and will incur substantial additional expenses if it decides to market any of its current and future products and services with an internal sales organization. Developing a marketing and sales force is also time-consuming and could delay the launch of its future products and services. In addition, the Company will compete with many companies that currently have extensive and well-funded marketing and sales operations. The Company’s marketing and sales efforts may be unable to compete successfully against these companies. In addition, the Company has limited capital to devote to sales and marketing.

The Company’s industry is characterized by rapid changes in technology and customer demands. As a result, the Company’s products and services may quickly become obsolete and unmarketable. The Company’s future success will depend on its ability to adapt to technological advances, anticipate customer demands, develop new products and services, and enhance the Company’s current products and services on a timely and cost-effective basis. Further, the Company’s products and services must remain competitive with those of other companies with substantially greater resources. The Company may experience technical or other difficulties that could delay or prevent the development, introduction or marketing of new products and services or enhanced versions of existing products and services. Also, the Company may not be able to adapt new or enhanced products and services to emerging industry standards, and the Company’s new products and services may not be favorably received. In addition, the Company may not have the capital resources to further the development of existing and/or new ones.

We cannot predict how global supply chain activities, or the economy at large may be impacted by prolonged global conflicts or sanctions imposed in response to the wars, or whether future conflicts, if any, may adversely affect our results of operations.

Revenue - The Company recognizes revenues in accordance with Accounting Standards Codification (“ASC”) 606, “Revenue from contracts with customers”. Revenues are recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. Deferred revenue represents amounts which still have yet to be earned.

The Company generates revenue from the sale of disposable stem cell concentration kits. Revenues are recognized when control of the promised goods or services are transferred to the customer, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services, which is generally on delivery to the customer.

Payments received for which the earnings process is not yet complete are deferred. As of June 30, 2024 and December 31, 2023, the Company had $40,000 in deferred revenue, respectively.

Concentration Risks – The Federal Deposit Insurance Corporation insures cash deposits in most general bank accounts for up to $250,000 per institution. The Company maintains its cash balances at four financial institutions. As of June 30, 2024, the Company’s balance exceeded the limit at three institutions.

Fair Value of Financial Instrument – The Company’s financial instruments consist of cash and cash equivalents, and payables. The carrying amount of cash and cash equivalents and payables approximates fair value because of the short-term nature of these items.

Fair value is an exit price, representing the amount that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. Fair value measurements are required to be disclosed by level within the following fair value hierarchy:

Level 1 – Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2 – Inputs (other than quoted prices included in Level 1) are either directly or indirectly observable for the asset or liability through correlation with market data at the measurement date and for the duration of the instrument’s anticipated life.

Level 3 – Inputs lack observable market data to corroborate management’s estimate of what market participants would use in pricing the asset or liability at the measurement date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs to the model.

When determining fair value, whenever possible the Company uses observable market data, and relies on unobservable inputs only when observable market data is not available. As of June 30, 2024, and December 31, 2023, the Company had no outstanding derivative liabilities.

Basic and Diluted Income (Loss) Per Share – The Company follows Financial Accounting Standards Board (“FASB”) ASC 260 Earnings per Share to account for earnings per share. Basic earnings per share (“EPS”) calculations are determined by dividing net loss by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per share calculations are determined by dividing net income by the weighted average number of common shares and dilutive common share equivalents outstanding. During loss periods when common stock equivalents, if any, are anti-dilutive they are not considered in the computation. During the three and six-months ended June 30, 2024 and 2023, the Company had options to purchase 11,183 shares of common stock and warrants to purchase 2,284,932 shares of common stock; however, the effects were anti-dilutive due to the net loss.

Following the approval of the Company’s Board of Directors, on June 12, 2023, the Company effected a 1-for-10 reverse split of the Company’s outstanding shares of common stock by filing a Certificate of Change Pursuant to NRS 78.209 with the Secretary of State of the State of Nevada. The filing of the Certificate of Change also reduced the authorized number of shares of the Company’s Common Stock from 50 million to five million. All share references in this filing have been restated to reflect the reverse split to the earliest period presented. No fractional shares were issued, and no cash or other consideration were paid in connection with the Reverse Stock Split. Instead, the Company issued one whole share of the post-Reverse Stock Split Common Stock to any stockholder who otherwise would have received a fractional share as a result of the Reverse Stock Split. As a result, the Company issued an additional 23,502 shares.

Stock-Based Compensation – The Company accounts for its stock-based compensation in accordance with Accounting Standards Codification (“ASC”) 718, Compensation - Stock Compensation. The Company accounts for all stock-based compensation using a fair-value method on the grant date and recognizes the fair value of each award as an expense over the requisite vesting period. The Company recognizes stock option forfeitures as they occur as there is insufficient historical data to accurately determine future forfeitures rates.

Cash Equivalents – The Company classifies its highly liquid investments with maturities of three-months or less at the date of purchase as cash equivalents. Management determines the appropriate classification of its investments at the time of purchase and reevaluates the designations of each investment as of the balance sheet date for each reporting period. The Company classifies its investments as either short-term or long-term based on each instrument’s underlying contractual maturity date. Investments with maturities of less than 12 months are classified as short-term and those with maturities greater than 12 months are classified as long-term. The cost of investments sold is based upon the specific identification method.

Inventories – Inventories are valued on a cost basis. The cost of inventories is determined on a first-in, first-out basis.

Recent Accounting Pronouncements – The Company has reviewed all recently issued, but not yet adopted, accounting standards in order to determine their effects, if any, on its results of operation, financial position or cash flows. Based on that review, the Company believes that none of these pronouncements will have a significant effect on its financial statements.

NOTE 2 – LICENSING AGREEMENTS

ED Patent – The Company acquired a patent from CMH, a related company on February 2, 2016, in exchange for 43,112 shares of CMTH common stock valued at $100,000. The patent expires in 2025 and the Company has elected to amortize the patent over a ten-year period on a straight-line basis. Amortization expense of $4,986 was recorded for the six-months ended June 30, 2024, and 2023. As of June 30, 2024, the carrying value of the patent was $16,055. The Company expects to amortize $9,972 annually through 2026 related to the patent costs.

Multipotent Amniotic Fetal Stem Cells License Agreement - On August 25, 2016, CMT entered into a License Agreement dated August 25, 2016, with a university. This license agreement grants to CMT the exclusive right to all products derived from a patent for use of multipotent amniotic fetal stem cells composition of matter throughout the world during the period ending on the expiration date of the longest-lived patent rights under the patent. The license agreement also permits CMT to grant sublicenses. Under the terms of the license agreement, CMT is required to diligently develop, manufacture, and sell any products licensed under the agreement. CMT paid the University an initial license fee within 30 days of entering into the agreement. CMT is also required to pay annual license maintenance fees on each anniversary date of the agreement, which maintenance fees would be credited toward any earned royalties for any given period. The License Agreement provides for payment of various milestone payments and earned royalties on the net sales of licensed products by CMT or any sub licensee. CMT is also required to reimburse the University for any future costs associated with maintaining the patent. CMT may terminate the license agreement for any reason upon 90 days’ written notice and the University may terminate the agreement in the event CMT fails to meet its obligations set forth therein, unless the breach is cured within 30 days of the notice from the University specifying the breach. CMT is also obligated to indemnify the University against claims arising due to the exercise of the license by CMT or any sub licensee. As of June 30, 2024, no amounts are currently due to the University.

The Company estimates that the patent expires in February 2026 and has elected to amortize the patent through the period of expiration on a straight-line basis. Amortization expense of $586 was recorded for the six-months ended June 30, 2024, and 2023. As of June 30, 2024, the carrying value of the patent was $1,447. The Company expects to amortize approximately $1,172 annually through 2025 related to the patent costs.

Lower Back Patent– The Company, through its subsidiary StemSpine, LLC, acquired a patent from CMH, a related company, on May 17, 2017, covering the use of various stem cells for the treatment of lower back pain from pursuant to a Patent Purchase Agreement, which was amended in November 2017. As amended, the agreement provides the following:

| · | The Company is required to pay CMH $100,000 within 30 days of demand as an initial payment. |

| · | In the event the Company determines to pursue the technology via use of autologous cells, the Company will pay CMH: |

| o | $100,000 upon the signing agreement with a university for the initiation of an IRB clinical trial. |

| o | $200,000, upon completion of the IRB clinical trial. |

| o | $300,000 in the event we commercialize the technology via use of autologous cells by a physician without a clinical trial. |

| · | In the event the Company determines to pursue the technology via use of allogenic cells, the Company will pay CMH: |

| o | $100,000 upon filing an IND with the FDA. |

| o | $200,000 upon dosing of the first patient in a Phase 1-2 clinical trial. |

| o | $400,000 upon dosing the first patient in a Phase 3 clinical trial. |

| · | Payment may be made in cash or shares of our common at a discount of 30% to the lowest closing price within 20 business days prior to the conversion date. |

| · | In the event the Company’s shares of common stock trade below $0.01 per share for two or more consecutive trading days, the number of any shares issuable as payment doubles. |

| · | For a period of five years from the date of the first sale of any product derived from the patent, the Company is required to make royalty payments of 5% from gross sales of products, and 50% of sale price or ongoing payments from third parties for licenses granted under the patent to third parties. |

The Company paid CMH the $100,000 obligation of the initial payment due under this agreement, by a $50,000 cash payment and the issuance of 667 shares of common stock on December 12, 2020. On December 31, 2020, following the Company’s announcement with respect to the clinical commercialization of the StemSpine technology, the Company paid CMH $50,000 of the $300,000 obligation due under this agreement through the issuance of 14 shares of common stock. On September 30, 2021, the Company paid CMH an additional $40,000 of the $300,000 obligation due under this agreement through the issuance of 8,466 shares of common stock, and in January 2021 the Company paid CMH an additional $50,000 of the $300,000 obligation due under this agreement through the issuance of 8,929 shares of common stock. The remaining portion of the $300,000 obligation was paid in cash in 2020. In August 2023, the Company paid CMH $100,000 related to the filing of an IND with the FDA per the terms of the agreement.

The patent expires on May 19, 2027, and the Company has elected to amortize the patent over a ten-year period on a straight-line basis. Amortization expense of $5,000 was recorded for the six-months ended June 30, 2024, and 2023. As of June 30, 2024, the carrying value of the initial patent license was $30,000. The Company expects to amortize approximately $10,000 annually through 2027 related to the patent costs.

The Company has elected to amortize the additional $300,000 associated with the patent over a ten-year period on a straight-line basis. Amortization expense of $22,970 was recorded for the six-months ended June 30, 2024, and 2023. As of June 30, 2024, the carrying value of the patent was $87,464. The Company expects to amortize approximately $46,000 annually through 2026 related to the patent costs.

The Company has elected to amortize the additional $100,000 associated with the filing of the IND with the FDA over a four-year period on a straight-line basis. Amortization expense of $12,500 was recorded for the six-months ended June 30, 2024, and no expense was recorded for the six-months ended June 30, 2023. As of June 30, 2024, the carrying value of the patent was $85,000 The Company expects to amortize approximately $25,000 annually through 2027 related to the patent costs.

ImmCelz™ - On December 28, 2020, ImmCelz, Inc. (“ImmCelz”), a newly formed Nevada corporation and wholly owned subsidiary of the Company, entered into a Patent License Agreement dated December 28, 2020 (the “Agreement”), with Jadi Cell, LLC. (“Jadi”), a company controlled by Dr. Amit Patel, a former director of the Company. The Agreement grants to ImmCelz™ the patent rights under U.S. Patent# 9,803,176 B2, “Methods and compositions for the clinical derivation of an allogenic cell and therapeutic uses”. The contract grants ImmCelz™ access to proprietary process of expanding the master cell bank of Jadi Cell LLC, as currently practiced by Licensor, and as documented in standard operating procedures (SOPs) and other written documentation to augment autologous cells. The terms of the agreement are as follows:

| · | Licensee shall pay Licensor a license fee of $250,000 (the “Upfront Royalty”), which can also be paid in CELZ stock at a discount of 25% of the closing price of $0.0037, which is based on the date of this agreement |

| · | Within thirty (30) days of the end of each calendar quarter during the term of this Agreement, Licensee will pay Licensor five percent (5%) of the Net Income of ImmCelz™. during such calendar quarter (the “Continuing Royalty”) |

| · | in one or a series of related transactions, of all or substantially all of the business or assets of Licensee ImmCelz, Inc. (“Sale of Assets”) will result in a one-time ten-percent allocation to the licensor, the Continuing Royalty will be calculated at five percent (5%) of the Net Income of Licensee in any calendar quarter in which the Net Income in such calendar quarter reflects the receipt of any consideration from such Sale of Assets. |

To date, the Company has not made any payments to Jadi Cell under this agreement, other than the $250,000 initial license fee, which was paid by the issuance of 18,018 shares of common stock to Jadi Cell in February 2022.

The Company has elected to amortize the patent over a ten-year period on a straight-line basis. Amortization expenses of $12,500 were recorded for the six-months ended June 30, 2024, and 2023. As of June 30, 2024, the carrying value of the patent was $162,500. The Company expects to amortize approximately $25,000 annually through 2030 related to the patent costs.

The following is a rollforward of the Company’s licensing agreements for the six-months ended June 30, 2024.

| | Assets | | | Accumulated Amortization | |

| | | | | | |

Balances at December 31, 2023 | | $ | 860,000 | | | $ | (418,989 | ) |

Addition of new assets | | | - | | | | - | |

Amortization | | | - | | | | (58,542 | ) |

Balances at June 30, 2024 | | $ | 860,000 | | | $ | (477,531 | ) |

NOTE 3 – RELATED PARTY TRANSACTIONS

Jadi Cell License Agreement

On December 28, 2020, the Company entered into a patent license agreement with Jadi Cell, LLC, a company owned and controlled by Dr. Amit Patel, a former director of the Company. The agreement provides the Company with an exclusive, worldwide license to U.S. Patent No. 9,803,176 “Methods and compositions for the clinical derivation of an allogenic cell and therapeutic uses” and the proprietary process of expanding the master cell bank of Jadi Cell LLC, in the field of enhancing autologous cells. The agreement is described in detail in Note 2 above. To date, the Company has not made any payments to Jadi Cell under this agreement, other than the $250,000 initial license fee, which was paid by the issuance of 18,018 shares of common stock to Jadi Cell in February 2022.

StemSpine Patent Purchase

The Company acquired U.S. Patent No. 9,598,673 covering the use of various stem cells for the treatment of lower back pain from its affiliate CMH pursuant to a Patent Purchase Agreement dated May 17, 2017, which was amended in November 2017. The inventors of the patent were Thomas Ichim, PhD and Amit Patel, MD, former directors of the Company, and Annette Marleau, PhD. The Patent Purchase Agreement is described in detail in Note 2 above. Pursuant to the Patent Purchase Agreement, the Company paid CMH the $100,000 obligation of the initial payment due under this agreement, by a $50,000 cash payment and the issuance of 667 shares of common stock on December 12, 2020. On December 31, 2020, following the Company’s announcement with respect to the clinical commercialization of the StemSpine technology, the Company paid CMH $50,000 of the $300,000 obligation due under this agreement through the issuance of 14 shares of common stock. On September 30, 2021 the Company paid CMH an additional $40,000 of the $300,000 obligation due under this agreement through the issuance of 8,466 shares of common stock, and in January 2021 the Company paid CMH an additional $50,000 of the $300,000 obligation due under this agreement through the issuance of 8,929 shares of common stock. The remaining portion of the $300,000 obligation has been paid in cash. In August 2023, the Company paid CMH $100,000 related to the filing of an IND with the FDA per the terms of the agreement.

Narkeshyo Research Tools Purchase

On December 15, 2022, the Company purchased a set of components referred to as “research tools” for $5,000,000 from Narkeshyo LLC, an entity a former director and current consultant of the Company is affiliated with, pursuant to the terms of an Asset Purchase Agreement between the Company and Narkeshyo. The final payments under the agreement of $3.0 million was made during the three months ended March 31, 2023.

Series B Preferred Stock Purchase

On May 14, 2024 our CEO and Chairman, Timothy Warbington, purchased one share of Series B Preferred Stock for a purchase price of $100.00 in cash. The Series B Preferred Stock has no voting rights other than the right to 100,000,000 votes solely with respect to a proposal to increase the Company’s authorized shares of common stock (a “Share Increase Proposal”). The Series B Preferred stock will vote together with the Company’s outstanding shares of common stock, as a single class with respect to any Share Increase Proposal, in the same proportion as shares of common stock are voted on such Share Increase proposal. The outstanding share of Series B Preferred Stock will be redeemed by the Company for $100, upon the earlier of (i) the time such redemption is ordered by the Board of Directors in its sole discretion, or (ii) the approval by the stockholders of a Share Increase Proposal.

NOTE 4 – STOCK-BASED COMPENSATION

On September 6, 2021, the Company’s Board of Directors, and holders of a majority of the voting power of the Company’s stockholders approved the Company’s 2021 Equity Incentive Plan (the “2021 Plan”) and reserved 60,000 shares of common stock for the issuance of awards thereunder. The 2021 Plan provides for the granting to our employees, officers, directors, consultants, and advisors of performance awards payable in shares of common stock, stock options (non-statutory and incentive), restricted stock awards, stock appreciation rights (“SARs”), restricted share units (“RSUs”) and other stock-based awards. The purpose of the 2021 Plan is to secure for the Company and its stockholders the benefits arising from capital stock ownership by eligible participants who are expected to contribute to the Company’s future growth and success. As of June 30, 2024, stock options to purchase 11,183 common shares had been granted under the 2021 Plan.

During the six-months ended June 30, 2024 and 2023, the fair market value of the options was insignificant to the financial statements.

Since the expected life of the options was greater than the Company’s historical stock information available, the Company determined the expected volatility based on price fluctuations of comparable public companies.

There were no options issued during the six-months ended June 30, 2024 and 2023.

Option activity for the six-months ended June 30, 2024, consists of the following:

| | Stock Options | | | Weighted Average Exercise Price | | | Weighted Average Life Remaining | |

Outstanding, December 31, 2023 | | | 11,183 | | | $ | 83.96 | | | | 8.11 | |

Issued | | | - | | | | - | | | | - | |

Exercised | | | - | | | | - | | | | - | |

Expired | | | - | | | | - | | | | - | |

Outstanding, June 30, 2024 | | | 11,183 | | | $ | 83.96 | | | | 7.51 | |

Vested, June 30, 2024 | | | 11,183 | | | $ | 83.96 | | | | 7.51 | |

In February 2022, we granted a total of 11,183 options to Timothy Warbington and Donald Dickerson at an exercise price of $16.90. The value of the options was determined to be $145,525 based upon the Black-Scholes method, see variables used below. During the six-month periods ended June 30, 2024 and 2023, the Company recorded $18,324 in stock-based compensation. As of June 30, 2024, future estimated stock-based compensation expected to be recorded was estimated to be $21,809.

| | Inputs Used | |

| | | |

Annual dividend yield | | $ | - | |

Expected life (years) | | | 6.5 | |

Risk-free interest rate | | | 0.81 | % |

Expected volatility | | | 92.95 | % |

Common stock price | | $ | 16.90 | |

See Note 2 for discussion related to the issuance of common stock in connection with licensing agreements.

NOTE 5 – STOCKHOLDERS’ EQUITY

Warrants

In connection with our May 2022 private offering, we issued pre-funded warrants to purchase 456,389 shares of common stock and accompanying warrants to purchase 1,624,446 shares of common stock at a price of $20.00 per share.

Assumptions used in calculating the fair value of the warrants issued in 2022 were as follows:

| | Range of Inputs Used | |

Annual dividend yield | | $ | - | |

Expected life (years) | | | 5.0 | |

Risk-free interest rate | | | 0.81 | % |

Expected volatility | | | 92.95 | % |

Common stock price | | $ | 18.30 | |

As of June 30, 2024, and 2023, warrants to purchase 2,284,932 shares of common stock were outstanding.

Warrant activity for the six-months ended June 30, 2024 consists of the following:

| | Warrants | | | Weighted Average Exercise Price | | | Weighted Average Life Remaining | |

Outstanding, December 31, 2023 | | | 2,284,932 | | | $ | 26.59 | | | | 3.22 | |

Issuances | | | - | | | | - | | | | - | |

Exercises | | | - | | | | - | | | | - | |

Outstanding, June 30, 2024 | | | 2,284,932 | | | $ | 26.59 | | | | 2.72 | |

NOTE 6 – SUBSEQUENT EVENTS

Management has reviewed subsequent events through the date of the filing noting none.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations analyzes the major elements of our balance sheets and statements of operations. This section should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2023, and accompanying notes to these financial statements included in this report. All amounts are in U.S. dollars.

Forward-Looking Statement Notice

This quarterly report on Form 10-Q contains forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by us with the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, those set forth in our most recent annual report referenced below.

This report identifies important factors which could cause our actual results to differ materially from those indicated by the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf speak only as of the date of this report and are expressly qualified in their entirety by the cautionary statements included in this report. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

Overview

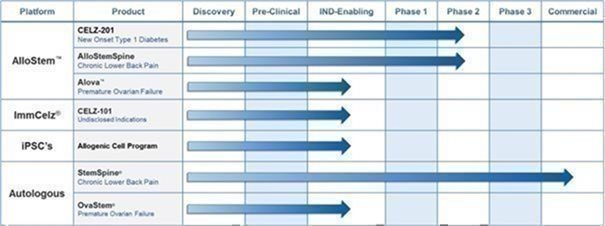

We are a commercial stage biotechnology company dedicated to the advancement of identifying and translating novel biological therapeutics in the fields of immunotherapy, endocrinology, urology, neurology and orthopedics. Our platforms, therapies and products include the following:

Our subsidiary, Creative Medical Technologies, Inc. (“CMT”), was originally created to monetize U.S. Patent No. 8,372,797 and related intellectual property related to the treatment of erectile dysfunction (“ED”), which it acquired in February 2016. Subsequently, we have expanded our development and acquisition of intellectual property beyond urology to include therapeutic treatments utilizing “re-programmed” stem cells, and the treatment of neurologic disorders, lower back pain, Type-1 diabetes, and heart, liver, kidney, and other diseases using various types of stem cells through our ImmCelz, Inc., StemSpine, Inc. and AlloCelz LLC subsidiaries. However, neither ImmCelz Inc., nor AlloCelz LLC have commenced commercial activities.

We currently conduct substantially all of our commercial operations through CMT, which markets and sells our CaverStem® and FemCelz® disposable kits utilized by physicians to perform autologous procedures that treat erectile dysfunction and female sexual dysfunction, respectively. Our CaverStem® and FemCelz® kits are currently available through physicians at eight locations in the United States.

In 2020, through our ImmCelz Inc. subsidiary, we began developing treatments under our ImmCelz™ platform (CELZ-100), that utilize a patient’s own extracted immune cells that are then “reprogrammed/supercharged” by culturing them outside the patient’s body with optimized cell-free factors. The immune cells are then re-injected into the patient from whom they were extracted. We believe this process endows the immune cells with regenerative properties (or “supercharges” them) providing them with the ability to treat multiple indications. We have validated this ability through the third-party studies described below that were independently conducted on selected human donor patient cells for accuracy and reproducibility. In contrast to other stem cell-based approaches, the immune cells are significantly smaller in size than stem cells and are believed to more effectively penetrate areas of the damaged tissues and induce regeneration.

In June 2022, we signed an agreement with Greenstone Biosciences Inc. (“Greenstone”) for the development of a human induced pluripotent stem cell (iPSC) pipeline for our ImmCelz™ platform. This project was identified as iPScelz™. The efforts by Greenstone are expected to complement and expand our current work on novel therapeutic cell lines. In May 2023, we announced that we had received confirmation that Greenstone had successfully developed a human induced pluripotent stem cell (iPSC). We estimate that the development of this cell line will save the Company two to three years in research and development time along with associated expenses. The final iPScelz™ results in a viral-free cell line which has great potential for differentiation into therapeutic biologics both for the cellular and cell-free programs along with targeted drug discovery. Greenstone’s developments were confirmed by an independent, industry-leading research firm.

In October 2022, we announced the development of our AlloStem™ Clinical Cell Line (CELZ-200), a proprietary allogenic cell line which includes a Master Cell Bank and a Drug Master File. We believe we will able to use this cell line for many of our programs, including our ImmCelz™ immunotherapy platform for multiple diseases, OvaStem® for Premature Ovarian Failure, Type I Diabetes (CELZ-201 CREATE-1), AlloStemSpine™ Chronic Lower Back Pain (CELZ-201 ADAPT), and IPScelz™ inducible pluripotent stem cell program in ongoing development with Greenstone.

In November 2022, we announced that the FDA had cleared the Company’s Type I Diabetes (CELZ-201 CREATE-1) Investigational New Drug (IND) application for the treatment of Type 1 Diabetes utilizing our AlloStem™ Clinical Cell Line, which will allow us to begin a Phase I/II clinical trial. The primary objective of the study will be to evaluate CELZ-201 treatment in patients with newly diagnosed Type 1 Diabetes. The trial has also received Institutional Board Review (IRB) approval for the trial to proceed as well as approval of the patient recruitment material. Patient recruitment was initiated in September 2023.

In February 2023, the Company reported positive three-year follow-up data for its StemSpine™ pilot study. The three-year data demonstrates continued efficacy of the StemSpine® procedure for treating chronic lower back pain without any serious adverse effects reported.

In March 2023, we reported the following results of independent studies:

| · | ImmCelz™ (CELZ-100) platform required 75% fewer donor patient cells compared to industry standard. |

| · | The purity of the final ImmCelz™ (CELZ-100) product was greater than 95% compared to the industry standard of greater than 80%. |

| · | ImmCelz™ (CELZ-100) demonstrated a greater than 200% reduction in functional suppression of effector T cells, which are a critical concern for patients with autoimmune issues, while still possessing a high number of functional T regulatory cells. |

| · | The ability to verify repeated potency of the final ImmCelz™(CELZ-100) product. |

We believe these results show that we will be able to substantially reduce production costs, while allowing for the manufacture of the best clinical product for patients with immune disorders, which will enable us to accelerate our clinical applications and encourage potential collaborations with respect to our ImmCelz™ platform.

In March 2023, the Company announced that it filed an application with the FDA to receive Orphan Drug Designation (“ODD”) for the treatment of Brittle Type 1 Diabetes using its ImmCelz™ (CELZ-100) platform. In March 2024, the Company received ODD for the treatment of Brittle Type 1 Diabetes from the FDA. This designation provides multiple important benefits to support the therapy's development including tax advantages, user fee exemptions, and the opportunity for market exclusivity following approval.

In April 2023, the Company reported positive one-year follow-up data and significant efficacy using CELZ-001 to treat patients with Type 2 Diabetes. There were no safety concerns related to CELZ-001 at one year follow-up utilizing the same infusion procedure as in the currently U.S. FDA cleared Type I Diabetes (CELZ-201 CREATE-1) clinical trial. There were 30 patients in the study, 15 who received CELZ-001 and the rest received optimized medical therapy. At one year, there was an overall efficacy of 93% in the treated patients demonstrating at least a 50% reduction in insulin requirement.

In September 2023, the Company received FDA clearance to initiate a Phase I/II clinical trial of AlloStemSpine™ Chronic Lower Back Pain (CELZ-201 ADAPT) using AlloStem™ (CELZ-201-DDT) for the treatment of lower back pain. The first in country study, which will enroll 30 individuals suffering from chronic lower back pain, is designed to evaluate the safety, efficacy, and tolerability of AlloStem™ (CELZ-201-DDT). The minimally invasive procedure uses ultrasound for the targeted delivery of the cell product, and thus prevents radiation exposure to the patient or the injecting physician. In October, 2023 we filed for and received approval from an institutional review board (IRB) to proceed with this trial. This trial, protected by issued patents, is a huge milestone for the Company and for patients suffering from this debilitating problem and their need for opioids for pain.

In March 2024, the Company secured FDA authorization for an expanded access therapy using CELZ-201, in managing abnormal glucose tolerance and preventing Type I Diabetes in high-risk individuals. The therapy uses CELZ-201 to potentially prevent Type I Diabetes onset and is believed to be a first in medical history. This personalized medicine approach, focuses on a single high-risk patient. CELZ-201 has a multi-target mechanism to address abnormal glucose tolerance, a Type I Diabetes precursor, at the cellular level.

In June 2024, the Company announced that it has successfully generated human induced pluripotent stem cells (iPSC)-derived Islet Cells that produce human insulin. The Company believes this development has the potential for not only clinical translation of the human Islet Cells, but also the stand-alone human insulin which is produced by these cells.

During the second quarter of 2024, the Company selected and contracted with the clinical trial site and Contract Research Organization (CRO), initiated the clinical trial site and launched patient recruitment on the Phase I/II clinical trial of AlloStemSpine™ Chronic Lower Back Pain (CELZ-201 ADAPT) using AlloStem™ (CELZ-201-DDT) for the treatment of lower back pain.

Results of Operations – For the Three-months Periods Ended June 30, 2024, and 2023

Gross Revenue. There was $8,000 in revenues generated for the three-months ended June 30, 2024 in comparison with no revenues for the comparable period a year ago.

Cost of Goods Sold. There was $3,200 in cost of goods sold for the three-months ended June 30, 2024 in comparison to no cost of goods sold for the comparable period a year ago.

Gross Profit/(Loss). There was $4,800 in gross profits for the three-months ended June 30, 2024 in comparison to no gross profit for the comparable period a year ago.

Selling, General and Administrative Expenses. General and administrative expenses for the three-months ended June 30, 2024, totaled $676,086, in comparison with $859,537 for the comparable period a year ago. The decrease of $183,451, or 21% is primarily due to decreases of $67,103 in marketing, $62,049 in marketing-based compensation, $30,736 in Director and Officer (D&O) insurance, and $31,000 in professional fees.

Amortization Expenses. Amortization expenses for the three-months ended June 30, 2024 totaled $29,271 in comparison with $23,021 for the comparable period a year ago.

Research and Development Expenses. Research and development expenses for the three-months ended June 30, 2024, totaled $924,749 in comparison to $309,480 for the comparable period a year ago. The increase of $615,269, or 199% was primarily due to increases of $107,021 associated with the CELZ 201 CREATE-1 Type 1 Diabetes clinical trial, $195,792 associated with the CELZ-201 ADAPT Chronic Lower Back Pain clinical trial, and $301,884 in general research and development.

Operating Loss. For the reasons stated above, our operating loss for the three-months ended June 30, 2024, was $1,625,306 in comparison with $1,192,038 for the comparable period a year ago.

Other Income. Other income for the three-months ended June 30, 2024, totaled $67,578 in comparison with $89,913 for the comparable period a year ago. The decreased income of $22,335 is due to lower short-term investment balances.

Net Income/Loss. For the reasons stated above, our net loss for the six-months ended June 30, 2024, was $1,557,728 in comparison with a net loss of $1,102,125 for the comparable period a year ago.

Results of Operations – For the Six-month Periods Ended June 30, 2024, and 2023

Gross Revenue. There was $8,000 in revenues generated for the six-months ended June 30, 2024 in comparison with no revenues for the comparable period a year ago.

Cost of Goods Sold. There was $3,200 in cost of goods sold for the six-months ended June 30, 2024 in comparison to no cost of goods sold for the comparable period a year ago.

Gross Profit/(Loss). There was $4,800 in gross profits for the six-months ended June 30, 2024 in comparison to no gross profit for the comparable period a year ago.

Selling, General and Administrative Expenses. General and administrative expenses for the six-months ended June 30, 2024, totaled $1,347,570, in comparison with $1,630,557 for the comparable period a year ago. The decrease of $282,987, or 17% is primarily due to decreases of $122,216 in marketing, $65,167 in public company related expenses, and $112,158 in professional fees.

Amortization Expenses. Amortization expenses for the six-months ended June 30, 2024 totaled $58,542 in comparison with $46,042 for the comparable period a year ago.

Research and Development Expenses. Research and development expenses for the six-months ended June 30, 2024, totaled $1,347,141 in comparison to $628,509 for the comparable period a year ago. The increase of $718,632, or 114% was primarily due to increases of $149,729 associated with the CELZ 201 CREATE-1 Type 1 Diabetes clinical trial, $246,139 associated with the CELZ-201 ADAPT Chronic Lower Back Pain clinical trial, and $312,193 in general research and development.

Operating Loss. For the reasons stated above, our operating loss for the six-months ended June 30, 2024, was $2,748,453 in comparison with $2,305,108 for the comparable period a year ago.

Other Income. Other income for the six-months ended June 30, 2024, totaled $149,181 in comparison with $151,060 for the comparable period a year ago. The decreased income of $1,879 is due to lower short-term investment balances offset by increased interest rates.

Net Income/Loss. For the reasons stated above, our net loss for the six-months ended June 30, 2024, was $2,599,272 in comparison with a net loss of $2,154,048 for the comparable period a year ago.

Liquidity and Capital Resources

As of June 30, 2024, we had $7,471,476 of available cash, certificates of deposit and US Treasuries and positive working capital of approximately $7,227,684. In comparison, as of December 31, 2023, we had $9,987,058 of available cash, certificates of deposit and US Treasuries and positive working capital of $9,899,504.

Cash Flows

Net Cash used in Operating Activities. We used cash in our operating activities due to our losses from operations. Net cash used in operating activities was $2,366,168 for the six-months ended June 30, 2024, in comparison to $4,828,379 for the comparable period a year ago, a decrease of $2,462,211 or 51%. The decrease in cash used in operations was primarily related to a $3,000,000 payment of an outstanding accounts payable balance made in the six-months ended June 30, 2023.

Net Cash Received From Investing Activities. Cash received in investing activities was $6,520,191 for the six-months ended June 30, 2024, from the net redemptions of certificates of deposit, in comparison to $497,410 of cash received from net redemptions of certificates of deposit for the comparable period a year ago.

Net Cash from Financing Activities.

Cash used in financing activities for the six-months ended June 30, 2024 was $149,414 associated with the repurchase of our common stock under our stock re-purchase program. There were no financing activities during the six-months ended June 30, 2023.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with generally accepted accounting principles accepted in the United States. In connection with the preparation of our financial statements, we are required to make assumptions and estimates about future events and apply judgments that affect the reported amounts of assets, liabilities, revenue, expenses, and the related disclosures. We base our assumptions, estimates and judgments on historical experience, current trends, and other factors that management believes to be relevant at the time our consolidated financial statements are prepared. On a regular basis, we review the accounting policies, assumptions, estimates and judgments to ensure that our financial statements are presented fairly and in accordance with GAAP. However, because future events and their effects cannot be determined with certainty, actual results could differ from our assumptions and estimates, and such differences could be material.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

As a smaller reporting company, we have elected not to provide the disclosure required by this item.

Item 4. Controls and Procedures

Evaluation of disclosure controls and procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 15(d)-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this report. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures as of the end of the period covered by this report were effective in ensuring that information required to be disclosed by us in reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and (ii) is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Changes in internal control over financial reporting

There were no changes in our internal control over financial reporting that occurred during the period covered by this Quarterly Report on Form 10-Q that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

Item 2. Unregistered Sales of Equity Securities, Use of Proceeds, and Issuer Purchases of Equity Securities

On June 12, 2023, we announced that our Board of Directors authorized a share repurchase program for the repurchase of up to $2 million of our common stock (the “Repurchase Plan). Purchases under the Repurchase Plan commenced in August 2023. The following table provides information about our monthly share repurchases for the three months ended June 30, 2024, which consisted solely of repurchases under the Repurchase Plan.

ISSUER PURCHASES OF EQUITY SECURITIES |

| | | | | | | | | | | | |

Period | | Total Number of Shares Purchased | | | Average Price Paid per Share | | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | | Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs | |

January 1 - January 31, 2024 | | | 6,000 | | | $ | 4.30 | | | | 63,500 | | | $ | 1,703,253 | |

| | | | | | | | | | | | | | | | |

February 1 - February 29, 2024 | | | 7,500 | | | | 4.24 | | | | 71,000 | | | | 1,671,453 | |

| | | | | | | | | | | | | | | | |

March 1 - March 31, 2024 | | | 5,500 | | | | 4.58 | | | | 76,500 | | | | 1,646,253 | |

| | | | | | | | | | | | | | | | |

April 1 – April 30, 2024 | | | 6,500 | | | | 4.74 | | | | 83,000 | | | | 1,615,440 | |

| | | | | | | | | | | | | | | | |

May 1 – May 31, 2024 | | | 500 | | | | 4.47 | | | | 83,500 | | | | 1,613,206 | |

| | | | | | | | | | | | | | | | |

June 1 – June 30, 2024 | | | 9,500 | | | | 3.54 | | | | 93,000 | | | | 1,579,534 | |

| | | | | | | | | | | | | | | | |

2024 YTD Total | | | 35,500 | | | | 4.23 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Cumulative Purchases | | | 93,000 | | | | 4.52 | | | | | | | | | |

Series B Preferred Stock Purchase

On May 14, 2024 our CEO and Chairman, Timothy Warbington, purchased one share of Series B Preferred Stock for a purchase price of $100.00 in cash. The Series B Preferred Stock has no voting rights other than the right to 100,000,000 votes solely with respect to a proposal to increase the Company’s authorized shares of common stock (a “Share Increase Proposal”). The Series B Preferred stock will vote together with the Company’s outstanding shares of common stock, as a single class with respect to any Share Increase Proposal, in the same proportion as shares of common stock are voted on such Share Increase proposal. The outstanding share of Series B Preferred Stock will be redeemed by the Company for $100, upon the earlier of (i) the time such redemption is ordered by the Board of Directors in its sole discretion, or (ii) the approval by the stockholders of a Share Increase Proposal.

Item 6. Exhibits

Exhibits | | |

3.1.1 | | Articles of Incorporation of Creative Medical Technology Holdings, Inc., a Nevada corporation (incorporated by reference to Exhibit 3.1 to the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 17, 2021). |

3.1.2 | | Certificate of Amendment to Articles of Incorporation Pursuant to NRS 78.385 and 78.390, as filed with the Secretary of State of the State of Nevada on November 2, 2021 (incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 5, 2021). |

3.1.3 | | Certificate of Change Pursuant to NRS 78.209, as filed with the Secretary of State of the State of Nevada on November 8, 2021 (incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 9, 2021). |

3.4 | | Certificate of Change Pursuant to NRS 78.209, as filed with the Secretary of State of the State of Nevada on June 1, 2023 (incorporated by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on June 9, 2023). |

3.2 | | Bylaws of Creative Medical Technology Holdings, Inc., a Nevada corporation (incorporated by reference to Exhibit 3.2 to the Company’s Form 10 filed with the Securities and Exchange Commission on November 18, 2008). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Creative Medical Technology Holdings, Inc. | |

| | | |