| PROSPECTUS DATED AUGUST 8, 2024 |

Filed pursuant to Rule 424(b)(4) |

| |

Registration No. 333-279733 |

Up

to 31,300,000 Class A Ordinary Shares

Offered

by the Selling Shareholders

Antelope

Enterprise Holdings Limited

This

prospectus relates to the offer and resale, from time to time, by the five selling shareholders identified in this prospectus (the “Selling

Shareholders”, each individually, the “Selling Shareholder”), of up to 31,300,000 Class A ordinary shares, no par value

each (the “Class A Ordinary Shares”), of Antelope Enterprise Holdings Limited (the “Company”), consisting of

(i) up to 30,000,000 Class A Ordinary Shares issuable pursuant to the Subscription Agreements (as defined below) from time to time after

the date of this prospectus and; (ii) 1,300,000 Class A Ordinary Shares issued upon exercise of certain warrants issued

on February 23, 2024 (the “Warrants”, the holders of such Warrants, the “Warrant Holders”). The Selling Shareholders

are identified in the table commencing on page 109 of this prospectus.

On

March 25, 2024, the Company entered into two standby equity subscription agreements with Dafu International Group Ltd. (“Dafu”)

and Baisheng International Group Ltd. (“Baisheng”), respectively. On June 25, 2024, the Company entered into a standby equity

subscription agreement with Hongfeng International Group Ltd., a British Virgin Islands company (“Hongfeng”, together with

“Dafu” and “Baisheng”, the “Investors”, each, an “Investor”), substantially in the same

form of the agreements with Dafu and Baisheng (each, a “Subscription Agreement”, collectively, the “Subscription Agreements”).

There is no relationship between each of the Investors and none of the Investors is a related party of the Company.

Each

Subscription Agreement provided for the sale of up to 10,000,000 of the Class A Ordinary Shares. Under the Subscription Agreements,

the Company has the right, but not the obligation, to issue to the Investors, and each Investor has the obligation to subscribe for,

up to 10,000,000 Class A Ordinary Shares. Each Class A Ordinary Share will be issued at a per share purchase price (the “Subscription

Price”) equal to the lesser of (i) the average closing price of the Class A Ordinary Shares during the three consecutive trading

days commencing on the applicable advance notice date, as set forth in the Subscription Agreements, or (ii) $1.12. As a result, the

maximum principal amount available under each Subscription Agreement is $11,200,000 and, collectively under the three Subscription Agreements,

$33,600,000.

Each

Subscription Agreements is effective upon

the date thereof and will expire on the date when it is terminated in accordance with the terms and conditions set forth therein.

Each Subscription Agreement will be terminated automatically on the earliest of (i) April 1, 2027 or (ii) the date on which the

Investor shall have made payment for all 10,000,000 Class A Ordinary Shares. Each Subscription Agreements may be

also terminated at any time by the mutual written consent of the parties, effective as of the date of such mutual written consent unless

otherwise provided in such written consent.

On

February 23, 2024, the Company entered into a securities purchase agreement with the Warrant Holders (the “Securities Purchase

Agreement”), pursuant to which, the Company issued to the Warrant Holders the Warrants to purchase up to an aggregate of 1,300,000

Class A Ordinary Shares, at an initial exercise price equal to $1.10 per share. The Warrants were issued on February 23, 2024 and

were fully exercised by the Warrant Holders on June 28, 2024.

We

are not selling any Class A Ordinary Shares under this prospectus and will not receive any proceeds from the sale of Class A Ordinary

Shares by the Selling Shareholders. However, we received proceeds from cash exercise of the Warrants by the Warrant Holders with

respect to all of the 1,300,000 Class A Ordinary Shares, and resulted in gross proceeds of $1.43 million to us, at the

exercise price of $1.10 per share. We will also receive gross proceeds of approximately $33.6 million from sales of our Class

A Ordinary Shares to the Investors under the Subscription Agreements, assuming the per share price is $1.12, from time to time after

the date of this prospectus. We plan to use the proceeds for the repayment of three promissory notes of the Company with an aggregate

outstanding balance of approximately $6.75 million, recruitment of personnel in the U.S., the expansion of our business into the U.S.,

and working capital and general corporate purposes. See “Use of Proceeds”.

Information

regarding the Selling Shareholders, the number of Class A Ordinary Shares that may be sold by them, and the times and manner in which

they may offer and sell the Class A Ordinary Shares under this prospectus is provided under the sections titled “Selling Shareholders”

and “Plan of Distribution,” respectively, in this prospectus. We do not know when or in what amount the Selling Shareholders

may offer the Class A Ordinary Shares for sale. The Selling Shareholders may sell any, all, or none of the Class A Ordinary Shares offered

by this prospectus.

No

Class A Ordinary Shares are being registered hereunder for sale by us. The Selling Shareholder may sell the Class A Ordinary Shares included

in this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Shareholders

may sell the shares in the section entitled “Plan of Distribution.” Each Selling Shareholder is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act.

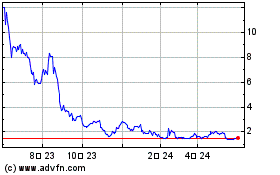

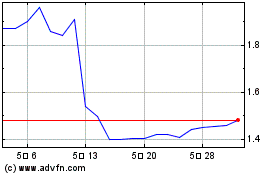

Our

Class A Ordinary Shares are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “AEHL”. On August 8,

2024, the last reported sale price of our Class A Ordinary Shares on Nasdaq was $3.00 per share.

We are not a Chinese operating company but a British

Virgin Islands holding company with operations conducted by our subsidiaries based in China and that this structure involves unique risks

to investors. Although we currently do not have or intend to have any contractual arrangement to establish a VIE structure with any entity

in mainland China, we are still subject to certain legal and operation risks associated with our operating subsidiaries in China. Chinese

regulatory authorities could disallow our current corporate structure, which would likely

result in a material change in our operations and a material change in the value of the securities we are registering for sale, including

that it could cause the value of such securities to significantly decline or become worthless. See “Risk Factors - Risks Related

to the Our Corporate Structure” and “Risk Factors - Risk Factors Relating to Our Operations in China” in this prospectus.

We

are subject to certain legal and operational risks associated with being based in China. PRC laws and regulations governing our current

business operations are sometimes vague and uncertain, and as a result these risks may result in material changes in the operations of

the subsidiaries, significant depreciation of the value of our Class A Ordinary Shares, or a complete hindrance of our ability to offer

or continue to offer our securities to investors. Recently, the PRC government adopted a series of regulatory actions and issued statements

to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision

over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement. As of the date of this prospectus, our Company, the subsidiaries have

not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received

any inquiry, notice or sanction. As of the date of this prospectus, there are currently no relevant laws or regulations in the PRC that

prohibit companies whose entity interests are within the PRC from listing on overseas stock exchanges. However, since these statements

and regulatory actions are newly published, official guidance and related implementation rules have not been issued. It is highly uncertain

what the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept

foreign investments and our ability to continue our listing on an U.S. exchange. See “Risk Factors - Risk Factors Relating

to Our Offering - The Chinese government may intervene or influence our operations at any time, which could result in

a material change in our operations and/or the value of the securities we are registering. Also, given recent statements by the Chinese

government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers, such action could significantly limit or completely hinder our ability to offer or continue to offer securities

to investors and cause the value of such securities to significantly decline or be worthless.” and other risk factors disclosed

in “Risk Factors - Risk Factors Relating to Our Operations in China” in this prospectus.

Our

Class A Ordinary Shares may be delisted and prohibited from being traded under the Holding Foreign Companies Accountable Act if the Public

Company Accounting Oversight Board (the “PCAOB”) is unable to inspect our auditor. On May 20, 2020, the Senate passed the

Holding Foreign Companies Accountable Act prohibiting an issuer’s securities from being traded on a national exchange if the PCAOB

is unable to inspect the issuer’s auditors for three consecutive years. Pursuant to the Holding Foreign Companies Accountable Act,

(the “HFCAA”), if the Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect an issuer’s auditors

for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB issued a Determination

Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms

headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in

mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more

authorities in Hong Kong. Furthermore, the PCAOB’s report identified the specific registered public accounting firms which are

subject to these determinations. On June 22, 2021, United States Senate has passed the Accelerating Holding Foreign Companies Accountable

Act (the “Accelerating HFCAA”), which, if enacted, would decrease the number of “non-inspection years” from three

years to two years, and thus, would reduce the time before our securities may be prohibited from trading or delisted if the PCAOB determines

that it cannot inspect or investigate completely our auditor. Our former auditor, Centurion ZD CPA & Co (the “CZD CPA”),

the independent registered public accounting firm of the Company, is headquartered in Hong Kong. CZD CPA is currently subject to Public

Company Accounting Oversight Board (“PCAOB”) inspections under a regular basis. Our current auditor, ARK PRO CPA & CO

(the “ARK PRO”), is headquartered in Hong Kong, and is currently subject to the PCAOB inspections under a regular basis.

As of the date of the prospectus, ARK PRO, our current auditor, and CZD CPA, our former auditor, are not subject to the determinations

as to inability to inspect or investigate completely as announced by the PCAOB on December 16, 2021. On August 26, 2022,

the PCAOB announced that it had signed a Statement of Protocol (the “Statement of Protocol”) with the China Securities Regulatory

Commission and the Ministry of Finance of China. The terms of the Statement of Protocol would grant the PCAOB complete access to audit

work papers and other information so that it may inspect and investigate PCAOB-registered accounting firms headquartered in China and

Hong Kong. According to the PCAOB, its December 2021 determinations under the HFCAA remain in effect. The PCAOB is required to reassess

these determinations by the end of 2022. Under the PCAOB’s rules, a reassessment of a determination under the HFCA Act may result

in the PCAOB reaffirming, modifying or vacating the determination. However, recent developments with respect to audits of China-based

companies create uncertainty about the ability of ARK PRO or CZD CPA to fully cooperate with the PCAOB’s request for audit work

papers without the approval of the Chinese authorities. In the event it is later determined that the PCAOB is unable to inspect or investigate

completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection

could cause trading in the Company’s securities to be prohibited under the HFCAA ultimately result in a determination by a securities

exchange to delist the Company’s securities. See “Risk Factors - Relating to Our Operations in China - Our

shares may be delisted under the HFCA Act as the PCAOB is unable to inspect our auditor with presence in Hong Kong, and the delisting

of our shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.” in this

prospectus.

During

our fiscal year 2022, we were conclusively listed by the SEC as a Commission-Identified Issuer under the HFCA Act following the filing

of our annual report on Form 20-F for the fiscal year ended December 31, 2021. Our auditor for the years ended December 31, 2022, 2021

and 2020, a registered public accounting firm that the PCAOB was not able to inspect or investigate completely in 2021 according to the

PCAOB’s December 16, 2021 determinations, issued the audit report for us for the fiscal year ended December 31, 2021. On December

15, 2022, the PCAOB issued a HFCA Act determination report that vacated its December 16, 2021 determinations and removed mainland China

and Hong Kong from the list of jurisdictions where it had been unable to completely inspect or investigate the registered public accounting

firms. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCA Act as of the date of this

prospectus.

The

jurisdictions in which our consolidated foreign operating entities are incorporated include mainland China, Hong Kong, and British Virgin

Islands. We hold 100% equity interests in its consolidated operating entities, except for Hainan Kylin Cloud Services Technology Co.,

Ltd., in which the Company indirectly holds 51% equity interest. We reviewed (i) the shareholder register provided by Transhare Corporation,

our transfer agent, and (ii) Schedules 13D and 13G filed by the shareholders, the absence of any Schedule 13D or 13G filing made by any

foreign governmental entity with respect to the Company’s securities, and the absence of foreign government representation on its

board of directors, we have no awareness or belief that we are owned or controlled by a government entity in mainland China.

We

received written confirmations from the directors of the Company and its consolidated foreign operating entities and each of them represented

that he/she is not an official of the Chinese Communist Party. The currently effective memorandum and articles of association of our

Company and equivalent organizing documents of our consolidated foreign operating entities do not contain any charter of the Chinese

Communist Party.

Therefore,

to the best of our knowledge, no governmental entity in mainland China, Hong Kong, or the British Virgin Islands owns shares of our significant

consolidated foreign operating entities.

We

are a “foreign private issuer”, as defined under federal securities laws, as amended, and, as such, are subject to

reduced public company reporting requirements.

We

are a “controlled company” as defined under the Nasdaq Listing Rules, because our chairman and Chief Executive Officer, Mr.

Weilai Zhang, beneficially owns an aggregate of less than 1% of our issued and outstanding Class A Ordinary Shares, and an aggregate

of 100% of our issued and outstanding Class B Ordinary. Mr. Zhang has approximately 83.45% of total outstanding voting power of

the Company, based on 9,877,303 outstanding Class A Ordinary Shares and 2,305,497 Class B Ordinary Shares of the Company outstanding

as of August 5, 2024.

For

more information, including a more detailed description of risks related to being a “controlled company,” see “Prospectus

Summary - Implications of Being a Controlled Company” and “Risk Factors - Risks Related to Our Business and

Industry - “We are a “controlled company” within the meaning of the Nasdaq Listing Rules and, as a result, may

rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.”

Investing

in our Class A Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk

Factors” beginning on page 12 of this prospectus to read about factors you should consider before buying our Class A Ordinary

Shares.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or

disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is August 8, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-1 that we filed with the U.S. Securities and Exchange Commission (the “SEC”).

As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained

in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website described

below under the heading “Where You Can Find More Information.”

In

this prospectus, , “we,” “us,” “our,” “the Company,” and “Antelope Enterprises”

refers to Antelope Enterprise Holdings Limited (formerly China Ceramics Co., Ltd.), a British Virgin Islands company, and its subsidiaries,

including Success Winner Limited (“Success Winner”), a British Virgin Islands company and wholly owned subsidiary of Antelope

Enterprises, Antelope Enterprise Holdings USA Inc. (“Antelope USA”), a Delaware corporation and a wholly owned subsidiary

of Antelope Enterprises, Million Stars US Inc. (“Million Stars”), a California corporation and a wholly owned subsidiary

of Antelope USA, Vast Elite Limited (“Vast Elite”), a Hong Kong company and wholly owned subsidiary of Success Winner and

the entity that wholly owns Chengdu Future Talented Management and Consulting Co., Ltd, (“Chengdu Future”) a PRC operating

company, Antelope Enterprise (HK) Holdings Limited (“Antelope HK”), a Hong Kong company and wholly owned subsidiary of Success

Winner and the entity that wholly owns Antelope Holdings (Chengdu) Co., Ltd (“Antelope Chengdu”), a PRC operating company,

and the entity that wholly owns Antelope Future (Yangpu) Investment Co., Ltd (“Antelope Yangpu”), a PRC operating company

that in turn wholly owns Antelope Ruicheng Investment (Hainan) Co., Ltd (“Antelope Ruicheng”) that in turn owns 51% of Hainan

Kylin Cloud Services Technology Co., Ltd (“Hainan Kylin”), and the entity that wholly owns Hainan Antelope Holdings Co.,

Ltd (“Hainan Antelope”), a PRC operating company that in turn wholly owns Antelope Investment (Hainan) Co., Ltd (“Antelope

Investment”), Hainan Kylin Cloud Services Technology Co., Ltd (“Hainan Kylin”) that in turrn owns 100% of Hangzhou

Kylin Cloud Services Technology Co., Ltd (“Hangzhou Kylin”), Anhui Kylin Cloud Services Technology Co., Ltd (“Anhui

Kylin”), WenzhouKylin Cloud Services Technology Co., Ltd. (“Wenzhou Kylin”), Hubei Kylin Cloud Services Technology

Co., Ltd. (“Hubei Kylin”), and Jiangxi Kylin Cloud Services Technology Co., Ltd. (“Jiangxi Kylin”).

You

should rely only on the information that is contained in this prospectus or that is incorporated by reference into this prospectus. We

have not authorized anyone to provide you with information that is in addition to or different from what is contained in, or incorporated

by reference into, this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

We

are not offering to sell or solicit any securities other than the Class A Ordinary Shares offered by this prospectus. In addition, we

are not offering to sell or solicit any securities to or from any person in any jurisdiction where it is unlawful to make this offer

to or solicit an offer from a person in that jurisdiction. The information contained in this prospectus is accurate as of the date on

the front of this prospectus only, regardless of the time of delivery of this prospectus or of any sale of our Class A Ordinary Shares.

Our business, financial condition, results of operations and prospects may have changed since that date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated herein by reference as exhibits to the registration

statement, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More

Information.”

Our

financial statements are prepared and presented in accordance with IFRS. Our historical results do not necessarily indicate our expected

results for any future periods.

We

or the Selling Shareholders have not taken any action to permit a public offering of the securities outside the United States or to permit

the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession

of this prospectus must inform themselves about and observe any restrictions relating to the offering of the securities and the distribution

of this prospectus outside of the United States.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should

consider before investing in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully,

including the sections titled “Risk Factors.” “Business” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

Our

Company

We

are a British Virgin Islands limited liability company with no material operations. Our operations were conducted in China by our subsidiaries.

We provide livestream e-commerce services, business management and information systems consulting services business.

Livestreaming

Ecommerce Business

Our

livestreaming ecommerce business is operated in China through our 51% subsidiary, Hainan Kylin and its subsidiaries, Hangzhou Kylin,

Anhui Kylin, Wenzhou Kylin, Hubei Kylin and Jiangxi Kylin. We aim to provide one-stop solutions for our customers to adopt the emerging

sales channel of livestreaming ecommerce. We believe that livestreaming ecommerce is an important growth engine for consumer good brands

as it leverages the content of livestreaming to boost customers engagement and sales as it combines instant purchasing of a featured

product and audience participation through a chat function or reaction buttons. Our customers usually include consumer goods brands,

merchants, and small-scale ecommerce platforms. Our product management office assesses and selects the products from our customers. Then,

we connect with different suppliers, usually staffing agencies that have a growing and diverse pool of hosts and influencers. The hosts

and influencers register and claim the jobs for livestreaming for our customers’ products via Hainan Kylin’s SaaS platform.

We track the sales of products of each host on this SaaS platform and report the sales results to our customers. We charge our commissions

based on the final sales results.

In

addition, services and promotion fees paid to social media and e-commerce platforms are a material part of the costs of livestreaming

ecommerce business in China. By leveraging our network and resources in the e-commerce industry, we provide cost-efficient promotion

and placement services to our customers by offering a discounted price of DUO+, which is an advertising option available to users of

Douyin, China’s most downloaded video-sharing platform (the mainland Chinese counterpart of TikTok). DOU+ is a content promotion

and targeting tool developed by Douyin and available for purchase by users to boost the reach and engagement for any videos or livestreaming

on its platform. We also customize the timing and target audience of the promotion placed through DOU+ for our customers to realize the

optimal engagement and retention based on our industry experience. We bring even more traffic to customers which purchased DOU+ through

us by engaging our own community of viewers to further boost the exposure.

Hainan

Kylin’s SaaS platform also includes a job-listing page designed especially for our enterprise customers to retain and engage freelancers

and independent contractors in a cost effective manner. We expect to further develop this function of the SaaS platform to provide value-added

services to our livestreaming ecommerce customers.

Hainan

Kylin has a limited operating history as it started its business in September 2021. For the fiscal year 2023, Hainan Kylin accounted

for 98.1% of our total revenue. For the fiscal year 2022, Hainan Kylin comprised virtually all of our ongoing business operations and

accounted for 84.5% of our total revenue.

Business

Management and Consulting Business

We

also provide business management and consulting services which consists of computer consulting services and software development through

our subsidiaries in China, including Chengdu Future and Antelope Chengdu. We diagnose difficulties in infrastructure and enterprise systems

and addresses business challenges that enterprises confront by developing strategies to surmount such hurdles to ensure the healthy growth

and development of our customers. Our consulting teams have advanced technological knowledge and capabilities to implement workflow solutions

via proprietary software products and services to help our customers with customized solutions to solve complex problems. For the years

ended December 31, 2023, 2022 and 2021, 1.4%, 3.9% and 6.0% of our total revenue, respectively

was generated from our business management and consulting business.

Planned Energy Supply Business

The Company is aiming to launch energy

supply business through AEHL US, formerly known as Million Star US Inc. AEHL US has taken preliminary steps in developing this business

including engaging a broker to source natural gas from natural gas provider in Texas and the procurement of electricity generators. AEHL

US plans to supply power to a data center in Midland, Texas. The Company anticipates that its energy supply business will start operation

in the third quarter of 2024.

AEHL US also plans to generate

revenue by securing hosting sites for cryptocurrency mining operators as it leverages anticipated cost-effective electricity costs.

Ceramic

Tile Business

We

have historically operated a ceramic tile business which are used for exterior siding and for interior flooring and design in residential

and commercial buildings. We were manufacturer of ceramic tiles used for exterior siding and for interior flooring and design in residential

and commercial buildings in China. Since the ceramic tiles manufacturing business has experienced significant hurdles due to the significant

slowdown of the real estate sector and the impacts of COVID-19 in China, we decided to divest the ceramic tiles manufacturing business,

which had been conducted through our two subsidiaries, Hengda and Hengdali. On December 30, 2022, our operating entities for the ceramic

tile business entered into an agreement with an unaffiliated buyer to sell 100% equity interests of our ceramic tile business. On February

21, 2023, our shareholders approved the sale. On April 28, 2023, this transaction was closed.

For

the year ended December 31, 2022, we utilized production facilities capable of producing 1.40 million square meters ceramic tiles, as

compared with the year ended December 31, 2021, when we utilized production facilities capable of producing 2.38 million square meters.

During the year ended December 31, 2022, we had 10 production lines available for production and utilized two production lines during

the peak season. As of December 31, 2022, we had seven production lines available for production (all were from Hengda), one of which

was in use as of December 31, 2022.

Our

Corporate Structure

We

are an offshore holding company incorporated in the British Virgin Islands. As a holding company with no material operations, our operations

were conducted by our subsidiaries in China.

The

following diagram illustrates our corporate structure as of the date of this prospectus:

We

are subject to certain legal and operational risks associated with our operation in China. PRC laws and regulations governing our current

business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in our subsidiaries’

operations, significant depreciation of the value of our Class A ordinary shares, or a complete hindrance of our ability to offer our

securities to investors in the future. Recently, the PRC government initiated a series of regulatory actions and statements to regulate

business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing

supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the

scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

Pursuant

to the PRC Cybersecurity Law, which was promulgated by the Standing Committee of the National People’s Congress on November 7,

2016 and took effect on June 1, 2017, personal information and important data collected and generated by a critical information infrastructure

operator in the course of its operations in China must be stored in China, and if a critical information infrastructure operator purchases

internet products and services that affects or may affect national security, it should be subject to cybersecurity review by the Cyberspace

Administration of China (“CAC”). Due to the lack of further interpretations, the exact scope of “critical information

infrastructure operator” remains unclear. On December 28, 2021, the CAC and other relevant PRC governmental authorities jointly

promulgated the Cybersecurity Review Measures (the “CAC Revised Measures”) to replace the original Cybersecurity Review Measures.

The CAC Revised Measures took effect on February 15, 2022. Pursuant to the CAC Revised Measures, if critical information infrastructure

operators purchase network products and services, or network platform operators conduct data processing activities that affect or may

affect national security, they will be subject to cybersecurity review. On November 14, 2021, CAC published the Administration Measures

for Cyber Data Security (Draft for Public Comments), or the “Cyber Data Security Measure (Draft)”, which requires cyberspace

operators with personal information of more than one million users who want to list abroad to file a cybersecurity review with the Office

of Cybersecurity Review. The cybersecurity review will evaluate, among others, the risk of critical information infrastructure, core

data, important data, or a large amount of personal information being influenced, controlled or maliciously used by foreign governments

and risk of network data security after going public overseas. As advised by our PRC counsel, Sichuan Jindouyun Law Firm, we are not

subject to cybersecurity review with the CAC in accordance with the CAC Revised Measures, because (i) we are not in possession of or

otherwise holding personal information of over one million users and it is also very unlikely that it will reach such threshold in the

near future; (ii) as of the date of this prospectus, our data processing activities (including the collection, storage, usage, transmission

and publicity of data) do not damage national security; and (iii) as of the date of this prospectus, we have not received any notice

or determination from applicable PRC governmental authorities identifying it as a critical information infrastructure operator. However,

since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making

bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or

promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the

ability to accept foreign investments and list on an U.S. exchange.

On

February 17, 2023, the CSRC published the Interim Administrative Measures on Overseas Securities Offering and Listing by Domestic Enterprises

(CSRC Announcement [2023] No. 43) (the “Overseas Listing Measures”), which took effect on March 31, 2023. Under the Overseas

Listing Measures, a filing-based regulatory system applies to “indirect overseas offerings and listings” of companies in

mainland China, which refers to securities offerings and listings in an overseas market made under the name of an offshore entity but

based on the underlying equity, assets, earnings or other similar rights of a company in mainland China that operates its main business

in mainland China. The Overseas Listing Measures states that, any post-listing follow-on offering by an issuer in an overseas market,

including issuance of shares, convertible notes and other similar securities, shall be subject to filing requirement within three business

days after the completion of the offering. In connection with the Overseas Listing Measures, on February 17, 2023 the CSRC also published

the Notice on the Administrative Arrangements for the Filing of Overseas Securities Offering and Listing by Domestic Enterprises (the

“Notice on Overseas Listing Measures”). According to the Notice on Overseas Listing Measures, issuers that have already been

listed in an overseas market by March 31, 2023, the date the Overseas Listing Measures became effective, are not required to make any

immediate filing and are only required to comply with the filing requirements under the Overseas Listing Measures when it subsequently

seeks to conduct a follow-on offering. Therefore, as advised by our PRC counsel, Sichuan Jindouyun Law Firm, we are required to go through

filing procedures with the CSRC after the completion of this offering and for our future offerings and listing of our securities in an

overseas market under the Overseas Listing Measures.

Furthermore,

the audit report included in this registration statement for the year ended December 31, 2023, was issued by our auditors, ARK PRO CPA

& CO (“ARK”), an audit firm headquartered in Hong Kong. ARK is not among those audit firms listed by the PCAOB Hong Kong

Determination, a determination announced by the PCAOB on December 16, 2021, that the it was unable to inspect or investigate completely

registered public accounting firms headquartered in Hong Kong, a Special Administrative Region and dependency of the PRC, because of

a position taken by one or more authorities in Hong Kong. Our former auditor Centurion ZD CPA & Co. for the years ended 2022 and

2021, is a registered public accounting firm that the PCAOB was not able to inspect or investigate completely in 2021 according to the

PCAOB’s December 16, 2021 determinations. The PCAOB made this determination pursuant to PCAOB Rule 6100, which provides a framework

for how the PCAOB fulfills its responsibilities under the Holding Foreign Companies Accountable Act (“HFCA Act”). On August

26, 2022, the China Securities Regulatory Commission (“CSRC”), the Ministry of Finance of the PRC (the “MOF”),

and the PCAOB signed a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based

in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public

accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by

the U.S. Securities and Exchange Commission (the “SEC”), the PCAOB shall have independent discretion to select any issuer

audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB

Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered

in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct

or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination.

On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations

Act”), was signed into law by President Biden, which amended the HFCA Act by reducing the number of consecutive non-inspection

years required for triggering the prohibitions under the HFCA Act from three years to two. In the event it is later determined that the

PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause trading in our securities

to be prohibited under the HFCA Act, as amended, and ultimately result in a determination by the Nasdaq Capital Market to delist our

securities.

Summary

of Risk Factors

Investing

in our securities involves significant risks. You should carefully consider all of the information in this prospectus before making an

investment in our securities. The main risks set forth below and others you should consider are discussed more fully in the section entitled

“Risk Factors”, which you should read in its entirety.

Risks

Related to the Offering

| | ● | The

Chinese government may intervene or influence our operations at any time, which could result

in a material change in our operations and/or the value of the securities we are registering.

Also, given recent statements by the Chinese government indicating an intent to exert more

oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers, such action could significantly limit or completely hinder our ability

to offer or continue to offer securities to investors and cause the value of such securities

to significantly decline or be worthless.

|

| ● | It

is not possible to predict the actual number of shares we will sell under the Subscription

Agreements to the Investors, or the actual gross proceeds resulting from those sales. |

| ● | The

sale and issuance of our Class A Ordinary Shares to the Selling Shareholders will cause dilution

to our existing shareholders, and the sale of the Class A Ordinary Shares acquired by the

Selling Shareholders, or the perception that such sales may occur, could cause the price

of our Class A Ordinary Shares to fall. |

| ● | Investors

who buy Class A Ordinary Shares at different times will likely pay different prices. |

| ● | Our

management team will have broad discretion over the use of the net proceeds from our sale

of Class A Ordinary Shares to the Selling Shareholders, if any, and you may not agree with

how we use the proceeds and the proceeds may not be invested successfully. |

Risks Related to the Our Corporate Structure

|

● |

We rely on dividends and other distributions on equity paid by our subsidiaries for our cash and

financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders and service

any debt we may incur. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing the debt may

restrict its ability to pay dividends or make other distributions to us, which could have a material adverse effect on our ability

to conduct our business. |

|

● |

There are uncertainties regarding the enforcement of laws and rules and regulations in China, which

can change quickly with little advance notice, and there is a risk that the Chinese government may exert more oversight and control

over offerings that are conducted overseas and/or foreign investment in China-based issuers, which could materially and adversely affect

our business and hinder our ability to offer or continue our operations, and cause the value of our securities, including the securities

we are registering to sale, to significantly decline or become worthless. |

Risk

Factors Relating to Our Business

| ● | We

have a limited operating history in a highly competitive technology segment. |

| ● | If

certain consumer behavior trends do not continue develop as anticipated, our operating results

will be adversely affected. |

| ● | We

have entered a potentially competitive market segment. |

| ● | We

are subject to rapid technology change and certain of our livestreaming ecommerce business

could have significant barriers to entry. |

| ● | Our

business depends on our ability to maintain and grow our network of high-quality suppliers

of hosts and influencers. If we are unable to do so, our future growth would be limited and

our business, financial condition and results of operations would be harmed. |

| ● | We

rely on existing technology systems, networks and platforms that are outside of our control. |

| ● | We

are dependent on our management team and any loss of our key management personnel without

timely and suitable replacements may reduce our revenues and profits. |

| ● | If

China’s inflation increases or the prices of energy or raw materials increase, we may

not be able to pass the resulting increased costs to our customers and this may adversely

affect our profitability or cause us to suffer operating losses. |

| ● | We

are dependent on our management team and any loss of our key management personnel without

timely and suitable replacements may reduce our revenues and profits. |

| ● | Failure

to compete successfully with our competitors and new entrants to the ceramics industry in

the PRC may result in Antelope Enterprises losing market share. |

| ● | Our

production facilities may be affected by power shortages which could result in a loss of

business. |

| ● | Our

research and development efforts may not result in marketable products. |

| ● | We

may not be able to ensure the successful implementation of our future plans and strategies,

resulting in reduced financial performance. |

| ● | We

may inadvertently infringe third-party intellectual property rights, which could negatively

impact our business and financial results. |

| ● | We

face increasing labor costs and other costs of production in the PRC, which could limit our

profitability. |

Risk

Factors Relating to the Planned Energy Supply Business

| ● | We

might not be able to launch the energy supply business as planned or at all, or generate

revenue as planned. |

| ● | Our

financial performance in this planned business will be affected by commodity price fluctuations

in the wholesale and retail power and natural gas markets and other market factors that are

beyond our control. |

| ● | Extensive

competition in power generation industry could adversely affect our performance. |

| ● | We

will rely on power transmission and fuel distribution facilities owned and operated by other

companies. |

| ● | We

may be unable to obtain an adequate supply of fuel in the future. |

| ● | Our

electricity generators will be subject to impairments. |

| ● | State

legislative and regulatory action could adversely affect our competitive position and business. |

| ● | Existing

and future anticipated environmental regulations could cause us to incur significant costs

and adversely affect our operations generally or in a particular quarter when such costs

are incurred. |

Risk

Factors Relating to Our Operations in China

| | ● | You

may incur additional costs and procedural obstacles in effecting service of legal process,

enforcing foreign judgments or bringing actions in China against us or our management named

in this prospectus.

|

| ● | Violation

of Foreign Corrupt Practices Act or China anti-corruption law could subject us to penalties

and other adverse consequences. |

| ● | Our

independent registered public accounting firm’s audit documentation related to their

audit reports included in this prospectus may be located in the People’s Republic

of China. The Public Company Accounting Oversight Board currently cannot inspect audit documentation

located in China and, as such, you may be deprived of the benefits of such inspection. |

| ● | Our

shares may be delisted under the HFCA Act as the PCAOB is unable to inspect our auditor with

presence in Hong Kong, and the delisting of our shares, or the threat of their being delisted,

may materially and adversely affect the value of your investment. |

| ● | We

are dependent on political, economic, regulatory and social conditions in the PRC. |

| ● | In

light of recent events indicating greater oversight by the Cyberspace Administration of China,

or CAC, over data security, particularly for companies seeking to list or listed on a foreign

exchange, we are subject to a variety of laws and other obligations regarding cybersecurity

and data protection, and any failure to comply with applicable laws and obligations could

have a material and adverse effect on our business, our listing on Nasdaq, financial condition,

results of operations, and the offering. |

| ● | We

are subject to risks related to the laws and regulations of the PRC and the interpretation

and implementation thereof. |

| ● | Our

business activities are subject to certain PRC laws and regulations. |

| ● | PRC

foreign exchange control may limit our ability to utilize our profits effectively and affect

our ability to receive dividends and other payments from our PRC subsidiaries. |

| ● | Introduction

of new laws or changes to existing laws by the PRC government may adversely affect our business. |

| ● | Environmental,

health and safety laws have in the past and may in the future impose material liabilities

on us and require us to incur material capital and operational costs. |

| ● | Our

business will suffer if we lose our land use rights. |

| ● | Our

business will suffer if we fail to comply with environmental protection regulations |

| ● | It

may be difficult for overseas shareholders and/or regulators to conduct investigation or

collect evidence within China. |

| ● | Fluctuations

in exchange rates could adversely affect our business and the value of our shares. |

| ● | Under

the EIT Law, Antelope Enterprises, Success Winner and/or Vast Elite and Antelope HK may be

classified as a “resident enterprise” of the PRC. Such classification could result

in PRC tax consequences to Antelope Enterprises, our non-PRC resident shareholders, Success

Winner and/or Vast Elite and Antelope HK. |

Risks

Factors Relating to Our Class A Ordinary Shares

| ● | The

price of our shares could be volatile and could decline at a time when you want to sell your

holdings. |

| ● | We

are a “controlled company” within the meaning of the NASDAQ Stock Market Rules

and, as a result, may rely on exemptions from certain corporate governance requirements that

provide protection to shareholders of other companies. |

| ● | If

we cease to qualify as a foreign private issuer, we would be required to comply fully with

the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we

would incur significant additional legal, accounting and other expenses that we would not

incur as a foreign private issuer. |

| ● | There

is a risk that Antelope Enterprises will be classified as a passive foreign investment company,

or “PFIC,” which could result in adverse U.S. federal income tax consequences

to U.S. holders of its securities. |

| ● | As

the rights of shareholders under British Virgin Islands law differ from those under U.S.

law, you may have fewer protections as a shareholder. |

| ● | British

Virgin Islands companies may not be able to initiate shareholder derivative actions, thereby

depriving shareholders of the ability to protect their interests. |

| ● | The

laws of the British Virgin Islands may provide comparatively limited protection for minority

shareholders, so minority shareholders will have limited recourse if the shareholders are

dissatisfied with the conduct of our affairs. |

| ● | The

market price for our shares has been and may continue to be volatile. |

| ● | Volatility

in the price of our shares may result in shareholder litigation that could in turn result

in substantial costs and a diversion of our management’s attention and resources. |

| ● | Although

we paid semi-annual dividends in July 2013, January 2014, July 2014 and January 2015, we

did not pay a dividend after January 2015 and do not currently plan to pay a dividend in

the near future. Therefore, shareholders will benefit from an investment in our shares only

if those shares appreciate in value. |

| ● | We

may not be able to pay any dividends on our shares in the future due to British Virgin Islands

law. |

| ● | We

may need additional capital, and the sale of additional shares or equity or debt securities

could result in additional dilution to our shareholders. |

Cash

Transfers Within Our Organization

Our

management monitors the cash position of each entity within our organization regularly and prepare budgets on a monthly basis to ensure

each entity has the necessary funds to fulfill its obligation for the foreseeable future and to ensure adequate liquidity. As a holding

company, we may rely on dividends and other distributions on equity paid by our subsidiary in Hong Kong, and the subsidiaries in China,

for our cash and financing requirements. The payment of dividends to Antelope Enterprises by our Chinese subsidiaries is affected by

means of dividends by those entities to their Hong Kong direct parent and a redividend by that Hong Kong entity to Antelope Enterprises.

Such dividends are effected by resolution of the board of directors of each such entity (after provision for applicable tax obligations).

China is a foreign exchange administration country. Capital injections, cross-border trade and services transactions settled in foreign

exchange, overseas financing and profit repatriations are subject to the foreign exchange administration regulations. A Chinese subsidiary

owned by foreign company must apply for registration of foreign exchange with the SAFE after the issuance of a business license and obtain

a foreign exchange registration certificate. When the Chinese subsidiaries apply for repatriating dividends to foreign shareholders,

it must submit the application form to SAFE with the proof that such dividends have been subjected to all applicable tax withholding.

A Chinese subsidiary can only distribute dividends out of its accumulated profits, which means that any accumulated losses must be more

than offset by its profits in other years, including the current year.

During

each of the fiscal years ended December 31, 2021, 2022 and 2023, the only transfer of assets among Antelope Enterprises and its subsidiaries

have consisted of cash. During that same period, there have been no distributions, dividends or loans extended by any of our direct or

indirectly held subsidiaries to Antelope Enterprises. During that same period Antelope Enterprises has not declared any dividends or

made any distributions to its shareholders.

The

cash transfers within the organization during the years ended December 31, 2021, 2022 and 2023 were as follows:

| For the year 2021 |

Company (Wire

transfer from) | |

Company (Wire

transfer to) | |

Amount (RMB) | | |

Equivalent to amount (USD) | | |

Purpose | |

Asset Type |

| Antelope Enterprise Holdings Limited | |

Success Winner Limited | |

| 48,304,308 | | |

| 7,580,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| | |

Vast Elite Limited | |

| 12,244,951 | | |

| 1,921,500 | | |

Working capital loan to direct subsidiary | |

Cash |

| Success Winner Limited | |

Antelope Enterprise (HK) Holdings Limited | |

| 6,691,230 | | |

| 1,050,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| | |

Stand Best Creation Limited | |

| 12,936,378 | | |

| 2,030,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Enterprise (HK) Holdings Limited | |

Antelope Holdings (Chengdu) Co., Ltd | |

| 4,779,450 | | |

| 750,000 | | |

Capital injection to direct subsidiary | |

Cash |

| Vast Elite Limited | |

Chengdu Future Talented Management and Consulting Co., Ltd | |

| 3,186,300 | | |

| 500,000 | | |

Capital contribution to direct subsidiary | |

Cash |

| Jiangxi Hengdali Ceramics Materials Co., Ltd | |

Jinjiang Hengda Ceramics Co, Ltd | |

| 7,000,000 | | |

| 1,098,453 | | |

Loan repayment to direct holding company | |

Cash |

| For the year 2022 |

| Company (Wire transfer from) | |

Company(Wire transfer to) | |

Amount (RMB) | | |

Equivalent to amount (USD) | | |

Purpose | |

Asset Type |

| Antelope Enterprise (HK) Holdings Limited | |

Antelope Holdings (Chengdu) Co., Ltd | |

| 12,759,820 | | |

| 1,850,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Enterprise (HK) Holdings Limited | |

Antelope Ruicheng Investment (Hainan) Co., Ltd | |

| 1,456,045 | | |

| 406,153 | | |

Working capital loan to direct subsidiary | |

|

| Antelope Enterprise (HK) Holdings Limited | |

Stand Best Creation Limited | |

| 13,436 | | |

| 1,948 | | |

Loan payback | |

Cash |

| Success Winner Limited | |

Antelope Enterprise (HK) Holdings Limited | |

| 14,587,578 | | |

| 2,115,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| Success Winner Limited | |

Antelope Enterprise Holdings Limited | |

| 2,414,020 | | |

| 350,000 | | |

Loan payback | |

Cash |

| Success Winner Limited | |

Vast Elite Limited | |

| 555,840 | | |

| 80,589 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Enterprise Holdings Limited | |

Success Winner Limited | |

| 10,690,660 | | |

| 1,550,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Ruicheng Investment (Hainan) Co., Ltd | |

Hainan Kylin Cloud Services Technology Co., Ltd | |

| 2,550,000 | | |

| 369,715 | | |

Working capital loan to direct subsidiary | |

Cash |

| Hainan Kylin Cloud Services Technology Co., Ltd | |

Anhui Kylin Cloud Services Technology Co., Ltd | |

| 100,000 | | |

| 14,499 | | |

Working capital loan to direct subsidiary | |

Cash |

| Hainan Kylin Cloud Services Technology Co., Ltd | |

Hangzhou Kylin Cloud Services Technology Co., Ltd | |

| 500,000 | | |

| 72,493 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Future (Yangpu) Investment Co., Ltd | |

Antelope Ruicheng Investment (Hainan) Co., Ltd | |

| 2,755,000 | | |

| 399,437 | | |

Working capital loan to direct subsidiary | |

Cash |

| Vast Elite Limited | |

Stand Best Creation Limited | |

| 7,150 | | |

| 1,037 | | |

Loan payback | |

Cash |

| For

the year 2023 |

Company

(Wire

transfer from) |

|

Company

(Wire

transfer to) |

|

|

Amount

(RMB) |

|

|

|

Equivalent

to amount (USD) |

|

|

Purpose |

|

Asset

type |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Company (Wire transfer from) | |

Company(Wire transfer to) | |

Amount (RMB) | | |

Equivalent to amount (USD) | | |

Purpose | |

Asset Type |

| Antelope Enterprise (HK) Holdings Limited | |

Antelope Holdings (Chengdu) Co., Ltd | |

| 6,372,810 | | |

| 900,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| Success Winner Limited | |

Antelope Enterprise (HK) Holdings Limited | |

| 7,199,300 | | |

| 1,016,721 | | |

Working capital loan to direct subsidiary | |

Cash |

| Success Winner Limited | |

Antelope Enterprise Holdings Limited | |

| 1,316,339 | | |

| 185,900 | | |

Loan payback | |

Cash |

| Success Winner Limited | |

Stand Best Creation Limited | |

| 137,432 | | |

| 20,000 | | |

Working capital loan direct subsidiary | |

Cash |

| Success Winner Limited | |

Vast Elite Limited | |

| 2,924 | | |

| 413 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Enterprise USA Inc | |

Antelope Enterprise Holdings Limited | |

| 3,540,450 | | |

| 500,000 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Enterprise (Chengdu) Co., Ltd | |

Chengdu Future Talented Company | |

| 110,000 | | |

| 15,535 | | |

Working capital loan to direct subsidiary | |

Cash |

| Hainan Kylin Cloud Services Technology Co., Ltd | |

Anhui Kylin Cloud Services Technology Co., Ltd | |

| 2,000,000 | | |

| 282,450 | | |

Working capital investment to direct subsidiary | |

Cash |

| Hainan Kylin Cloud Services Technology Co., Ltd | |

Hangzhou Kylin Cloud Services Technology Co., Ltd | |

| 3,500,000 | | |

| 494,287 | | |

Working capital investment to direct subsidiary | |

Cash |

| Hainan Kylin Cloud Services Technology Co., Ltd | |

Wenzhou Kylin Cloud Services Technology Co., Ltd | |

| 100 | | |

| 14 | | |

Working capital loan to direct subsidiary | |

Cash |

| Antelope Future (Yangpu) Investment Co., Ltd | |

Antelope Ruicheng Investment (Hainan) Co., Ltd | |

| 1,000 | | |

| 141 | | |

Working capital loan to direct subsidiary | |

Cash |

Permission

or Approval Required from the PRC Authorities for This Offering and Our PRC Subsidiaries’ Operation

To

operate the general business activities currently conducted in China, each of our subsidiaries in China is required to obtain a business

license from the State Administration for Market Regulation (“SAMR”). All of our PRC subsidiaries have obtained their valid

business licenses from the SAMR, and no application for any such license has been denied.

We

are aware, however, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement.

On

July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council

jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions.

The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the

supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory

systems will be taken to deal with the risks and incidents of China-concept overseas listed companies, and cybersecurity and data privacy

protection requirements and similar matters. The Opinions and any related implementing rules to be enacted may subject us to compliance

requirement in the future. Given the current regulatory environment in the PRC, we are still subject to the uncertainty of different

interpretation and enforcement of the rules and regulations in the PRC adverse to us, which may take place quickly with little advance

notice.

On

December 28, 2021, the CAC published the CAC Revised Measures, which further restates and expands the applicable scope of the cybersecurity

review. The CAC Revised Measures took effect on February 15, 2022. Pursuant to the CAC Revised Measures, if a network platform operator

holding personal information of over one million users seeks for “foreign” listing, it must apply for the cybersecurity review.

In addition, operators of critical information infrastructure purchasing network products and services are also obligated to apply for

the cybersecurity review for such purchasing activities. Although the CAC Revised Measures provides no further explanation on the extent

of “network platform operator” and “foreign” listing, we do not believe we are obligated to apply for a cybersecurity

review pursuant to the CAC Revised Measures, considering that (i) we are not in possession of or otherwise holding personal information

of over one million users and it is also very unlikely that we will reach such threshold in the near future; (ii) as of the date of this

this prospectus, we have not received any notice or determination from applicable PRC governmental authorities identifying it as a

critical information infrastructure operator.

That

being said, the CAC Revised Measures empowers the cybersecurity review office to initiate cybersecurity review when they believe any

particular data processing activities “affect or may affect national security”. In addition, on November 14, 2021, the CAC

promulgated the Regulations on the Administration of Cyber Data Security (Draft for Comments) (the “Draft CAC Regulations”),

and according to the Draft CAC Regulations, any data processors shall, in accordance with relevant state provisions, apply for a cybersecurity

review when carrying out, among other things, “other data processing activities that affect or may affect national security”.

However, neither the CAC Revised Measures nor the Draft CAC Regulations provides for any further explanation or interpretation over what

constitutes activities that “affect or may affect national security”. Therefore, if any competent government authorities

deem that our PRC subsidiaries’ data processing activities may affect national security, we may be subject cybersecurity review,

and in that scenario, failure to pass such cybersecurity review and/or to comply with the data privacy and data security requirements

raised during such cybersecurity review could subject our PRC subsidiaries to penalties, damage its reputation and brand, and harm its

business and results of operations.

On

February 17, 2023, the CSRC published the Interim Administrative Measures on Overseas Securities Offering and Listing by Domestic Enterprises

(CSRC Announcement [2023] No. 43) (the “Overseas Listing Measures”), which took effect on March 31, 2023. Under the Overseas

Listing Measures, a filing-based regulatory system applies to “indirect overseas offerings and listings” of companies in

mainland China, which refers to securities offerings and listings in an overseas market made under the name of an offshore entity but

based on the underlying equity, assets, earnings or other similar rights of a company in mainland China that operates its main business

in mainland China. The Overseas Listing Measures states that, any post-listing follow-on offering by an issuer in an overseas market,

including issuance of shares, convertible notes and other similar securities, shall be subject to filing requirement within three business

days after the completion of the offering. In connection with the Overseas Listing Measures, on February 17, 2023 the CSRC also published

the Notice on the Administrative Arrangements for the Filing of Overseas Securities Offering and Listing by Domestic Enterprises (the

“Notice on Overseas Listing Measures”). According to the Notice on Overseas Listing Measures, issuers that have already been

listed in an overseas market by March 31, 2023, the date the Overseas Listing Measures became effective, are not required to make any

immediate filing and are only required to comply with the filing requirements under the Overseas Listing Measures when it subsequently

seeks to conduct a follow-on offering.

In

summary, other than the CSRC filing procedure we are required to make after the completion of this offering, we and our PRC subsidiaries

are not required to obtain permission or approval from the PRC authorities including CSRC or CAC for our PRC subsidiaries, nor have we

or our PRC subsidiaries, received any denial for our PRC subsidiaries’ operation or this offering. We are subject to the risks

of uncertainty of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that the

permission or approvals discussed here are not required, that applicable laws, regulations or interpretations change such that we or

any of our PRC subsidiaries are required to obtain approvals in the future, or that the PRC government could disallow our holding company

structure, which would likely result in a material change in our operations, including our ability to continue our existing holding company

structure, carry on our current business, accept foreign investments, and continue to offer securities to our investors. These adverse

actions could cause the value of our Class A ordinary shares to significantly decline or become worthless. We may also be subject to

penalties and sanctions imposed by the PRC regulatory agencies, including the CSRC, if we fail to comply with such rules and regulations,

which would likely adversely affect the ability of our securities to be listed on the U.S. exchange, which would likely cause the value

of our Class A ordinary shares to significantly decline or become worthless.

Implications

of Being a Controlled Company

Our

chairman and Chief Executive Officer, Mr. Weilai Zhang, will own a majority of our outstanding voting power following this offering and

we are a “controlled company” as defined under the Nasdaq Listing Rules. For so long as we are a “controlled company”,

we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including:

●an

exemption from the rule that a majority of our board of directors must be independent directors;

●an

exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent

directors; and

●an

exemption from the rule that our director nominees must be selected or recommended

Although

we do not intend to rely on the “controlled company” exemption under the Nasdaq Listing Rules, we could elect to rely on

this exemption in the future. As a result, you will not have the same protection afforded to shareholders of companies that are subject

to these corporate governance requirements. Our status as a “controlled company” could cause our ordinary shares to look

less attractive to certain investors or otherwise harm the trading price of our ordinary shares. Please see “Risk Factors -

Risks Related to Our Business and Industry - We are a “controlled company” within the meaning of the Nasdaq Listing

Rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection to shareholders

of other companies.”

Corporate

Information

Our

principal executive office is located at Suite 7540, The Empire State Building, 350 Fifth Avenue, New York, New York, 10118. Our

telephone number at this address is +1 (838) 500 8888. Our registered office is Craigmuir Chambers, Road Town, Tortola, VG1110, British

Virgin Islands, and our registered agent is Harneys Corporate Services Limited. Our agent for service of process in the United

States is Puglisi & Associates, located at 850 Library Avenue, Suite 204, Newark, Delaware 19711. We maintain a website at

http://www.aehltd.com that contains information about our company. Information on this website is not part of this

prospectus.

THE

OFFERING

| Issuer |

|

Antelope Enterprise Holdings

Limited |

| |

|

|

| Securities offered by the

Selling Shareholders |

|

Up to 31,300,000 Class

A Ordinary Shares consisting of (i) up to 30,000,000 Class A Ordinary Shares issuable under the Subscription Agreements and (ii)

1,300,000 Class A Ordinary Shares issued upon exercise of the Warrants |

| |

|

|

| Class A Ordinary Shares

issued and outstanding prior to the offering |

|

9,877,303

Class A Ordinary Shares. |

| |

|

|

| Class A Ordinary Shares

to be outstanding after this offering (1) |

|

41,177,303

Class A Ordinary Shares, assuming we elect to sell a total of 30,000,000 Class A Ordinary Shares to the Investors

pursuant to the Subscription Agreements |

| |

|

|

| Use of proceeds |

|

We will not receive any

proceeds from the sale of the Class A Ordinary Shares included in this prospectus by the Selling Shareholders. We may receive up

to an aggregate of approximately $35.03 million consisting of (i) $1.43 million from the cash exercise of the Warrants, with

the exercise price at $1.10 per share and (ii) $33.6 million from the sales of the Class A Ordinary Shares that we elect to

make to the Investors pursuant to the Subscription Agreements, if any, from time to time in our sole discretion, assuming the per

share purchase price is $1.12. The actual amount of proceeds that we may receive cannot be determined at this time and will depend

on the number of Warrants that the Warrant Holders elect to exercise in cash and the number of shares we sell under the Subscription

Agreements and market prices at the times of such sales. Any proceeds that we receive from the cash exercise of the Warrants and

the sales of our Class A Ordinary Shares under the Subscription Agreements are expected to be used for the repayment of three promissory

notes of the Company with an aggregate outstanding balance of approximately $6.75 million, the expansion of the Company’s business

in the U.S., for the recruitment of personnel in the U.S. and for general corporate purpose. See “Use of Proceeds.” |

| |

|

|

| Risk factors |

|

Investing in our securities

involves a high degree of risk. You should read the “Risk Factors” section starting on page 12 of this prospectus, for

a discussion of factors to consider carefully before deciding to invest in the Class A Ordinary Shares. |

| |

|

|

| Nasdaq symbol: |

|

Our Class A Ordinary Shares

are listed on Nasdaq under the symbol “AEHL”. |

| (1) |

The

number of the Class A Ordinary Shares to be outstanding immediately after this offering as shown above assumes that all of the

Class A Ordinary Shares offered hereby are sold and is based on 9,877,303 Class A Ordinary Shares outstanding as of August

5, 2024. This number excludes: |

| | ● | 30,463

Class A ordinary shares issuable upon exercise of the warrants issued on June 14, 2021; and |

| | ● | 19,608

Class A ordinary shares issuable upon exercise of the warrants issued on February 17, 2021. |

RISK

FACTORS

An

investment in our securities involves significant risk. Before making an investment in our securities, you should carefully consider

the risk factors set forth in our most recent annual report on Form 20-F for the fiscal year ended December 31, 2022 on file with the

SEC, which is incorporated by reference into this prospectus, as well as the following risk factors, which augment the risk factors set

forth in our most recent annual report. Before making an investment decision, you should carefully consider these risks as well as other

information we include or incorporate by reference in this prospectus. The risks and uncertainties not presently known to us or that

we currently deem immaterial may also materially harm our business, operating results and financial condition and could result in a complete

loss of your investment.

Risks

Related to the Offering

The

Chinese government may intervene or influence our operations at any time, which could result in a material change in our operations and/or

the value of the securities we are registering. Also, given recent statements by the Chinese government indicating an intent to exert

more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, such action could

significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such

securities to significantly decline or be worthless.

The

Majority of our operations are based in China. We are and will be subject to PRC laws relating to, among others, restrictions over foreign

investments and data security. The Chinese government has recently sought to exert more control and impose more restrictions on China-based

companies raising capital offshore and such efforts may continue or intensify in the future. The Chinese government’s exertion

of more control over overseas listing of, offerings conducted overseas by and/or foreign investment in China-based companies could retrospectively