Absci Corporation (Nasdaq: ABSI), a data-first generative AI drug

creation company, today reported financial and operating results

for the quarter ended March 31, 2024.

"During the first quarter, we made significant

strides in advancing both our internal and partnered programs

according to plan," said Sean McClain, Founder and CEO. "I am

especially excited by our progress, which demonstrates the

potential of our generative AI platform to disrupt the economics of

drug discovery and to design differentiated therapeutics addressing

significant unmet medical needs for patients."

Recent Highlights

- Initiated IND-enabling studies for ABS-101, a potential

best-in-class anti-TL1A antibody, in February 2024. Absci recently

completed studies demonstrating ABS-101 candidates' abilities to

bind both the TL1A monomer and trimer, which could potentially lead

to differentiated clinical efficacy. Absci plans to share

additional preclinical data, including data from non-human primate

studies, for this program in the next few months.

- Continuing to advance ABS-201 and ABS-301 programs through

preclinical studies, with plans to share additional information for

each program in the second half of 2024.

- Completed an underwritten public offering of common stock

raising gross proceeds of approximately $86.4 million in March

2024.

Internal Pipeline Updates, Anticipated

Progress, and 2024 Outlook

- ABS-101 (potential best-in-class anti-TL1A

antibody): Absci presented early preclinical data on

ABS-101 in January, with three advanced leads showing properties

consistent with a potentially superior product profile, including

demonstrated high affinity, high potency, favorable developability,

and extended half-life. Following further confirmatory PK studies

in February, the company selected a primary and a backup

development candidate to advance into IND-enabling studies. Absci

recently completed studies demonstrating ABS-101 candidates'

abilities to bind both the TL1A monomer and trimer, which could

potentially lead to differentiated clinical efficacy. Absci plans

to share additional preclinical data, including data from non-human

primate studies, for this program in the next few months. Absci

expects to initiate Phase 1 clinical studies for ABS-101 in early

2025, with an interim data readout expected in the second half of

2025.

- ABS-201 (potential best-in-class antibody for

undisclosed dermatology target): ABS-201 is designed for

an undisclosed dermatological indication with significant unmet

need, where the efficacy of the pharmacological standard of care is

not satisfactory. Absci anticipates selecting a development

candidate for this program in the second half of 2024.

- ABS-301 (potential first-in-class antibody for

undisclosed immuno-oncology target): ABS-301 is a fully

human antibody designed to bind to a novel target discovered

through Absci's Reverse Immunology platform. Absci anticipates

completion of mode-of-action validation studies for this program in

the second half of 2024.

- Additional Internal Pipeline Programs: In

addition to further development of ABS-101, ABS-201, and ABS-301,

Absci expects to advance at least one additional internal asset

program to a lead stage in 2024.

- Drug Creation Partnerships: Absci continues to

make further progress on its existing drug creation partnerships

and anticipates signing additional drug creation partnerships with

at least four Partners in 2024, including one or more multi-program

partnerships.

Absci continues to expect a gross use of cash,

cash equivalents, and short-term investments of approximately $80

million for the fiscal year ending December 31, 2024. This amount

includes the expected costs associated with completing the

IND-enabling studies for ABS-101 with a third-party contract

research organization.

Absci continues to focus its investments and

operations on advancing its internal pipeline of programs,

alongside current and future partnered programs, while achieving

ongoing platform improvements and operational efficiencies. Based

on the company's current plans, Absci believes its existing cash,

cash equivalents, and short-term investments will be sufficient to

fund its operations into the first half of 2027.

First Quarter 2024 Financial

Results

Revenue was $0.9 million for the three months

ended March 31, 2024 compared to $1.3 million for the three

months ended March 31, 2023. This decrease was driven by mix

of partnered and internal programs, and related progress.

Research and development expenses were $12.2

million for the three months ended March 31, 2024 compared to

$12.7 million for the three months ended March 31, 2023. This

decrease was primarily driven by lower personnel costs, offset by

an increase in stock compensation expense.

Selling, general, and administrative expenses

were $8.7 million for the three months ended March 31, 2024

compared to $9.6 million for the three months ended March 31,

2023. This decrease was due to lower personnel costs and continued

reductions in administrative costs, offset by an increase in stock

compensation expense.

Net loss was $22.0 million for the three months

ended March 31, 2024, as compared to $23.4 million for the

three months ended March 31, 2023.

Cash, cash equivalents, and short-term

investments as of March 31, 2024 were $161.5 million, compared

to $97.7 million as of December 31, 2023.

Webcast Information

Absci will host a conference call to discuss its

first quarter 2024 business updates and financial and operating

results on Tuesday, May 14, 2024 at 8:00 a.m. Eastern Time / 5:00

a.m. Pacific Time. A webcast of the conference call can be accessed

at investors.absci.com. The webcast will be archived and available

for replay for at least 90 days after the event.

About Absci

Absci is a data-first generative AI drug

creation company that combines AI with scalable wet lab

technologies to create better biologics for patients, faster. Our

Integrated Drug Creation™ platform unlocks the potential to

accelerate time to clinic and increase the probability of success

by simultaneously optimizing multiple drug characteristics

important to both development and therapeutic benefit. With the

data to learn, the AI to create, and the wet lab to validate, we

can screen billions of cells per week, allowing us to go from

AI-designed antibodies to wet lab-validated candidates in as little

as six weeks. Absci’s headquarters is in Vancouver, WA, with our AI

Research Lab in New York City and an Innovation Center in Zug,

Switzerland. Visit www.absci.com and follow us on LinkedIn

(@absci), X (Twitter) (@Abscibio), and YouTube.

Availability of Other Information About

Absci

Investors and others should note that we

routinely communicate with investors and the public using our

website (www.absci.com) and our investor relations website

(investors.absci.com), including without limitation, through the

posting of investor presentations, SEC filings, press releases,

public conference calls and webcasts on these websites, as well as

on X (Twitter), LinkedIn and YouTube. The information that we post

on these websites and social media outlets could be deemed to be

material information. As a result, investors, the media, and others

interested in Absci are encouraged to review this information on a

regular basis. The contents of our website and social media

postings, or any other website that may be accessed from our

website or social media postings, shall not be deemed incorporated

by reference in any filing under the Securities Act of 1933, as

amended.

Forward-Looking Statements

Certain statements in this press release that

are not historical facts are considered forward-looking within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements containing the words “will,” “pursues,”

“anticipates,” “plans,” “believes,” “forecast,” “potential,”

“estimates,” “extends,” “expects,” and “intends,” or similar

expressions. We intend these forward-looking statements, including

statements regarding our expectations regarding business

operations, financial performance, and results of operations,

including our expectations and guidance regarding the success of

our partnerships, the gross use of cash, cash equivalents, and

short-term investments, our projected cash usage, needs, and

runway, our expectations regarding the signing and number of

additional partners and number of programs included in such

partnerships, our technology development efforts and the

application of those efforts, including the generalizability of our

platform, accelerating drug development timelines, improving the

economics of drug discovery by lowering costs, increasing

probability of successful drug development, and designing and

developing differentiated therapeutics addressing unmet need, and

our drug discovery and development activities related to drug

creation partnerships and our internal therapeutic asset programs,

including our clinical development strategy, the progress,

milestones and success of our internal asset programs, including

the timing for various stages of candidate selection, IND enabling

studies, initiating clinical trials, the generation and disclosure

of data related to these programs, the translation of preclinical

results and data into product candidates, and the significance of

preclinical results for our internal asset programs, including in

comparison to competitor molecules and in leading to differentiated

clinical efficacy, to be covered by the safe harbor provisions for

forward-looking statements contained in Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act, and

we make this statement for purposes of complying with those safe

harbor provisions. These forward-looking statements reflect our

current views about our plans, intentions, expectations,

strategies, and prospects, which are based on the information

currently available to us and on assumptions we have made. We can

give no assurance that the plans, intentions, expectations, or

strategies will be attained or achieved, and, furthermore, actual

results may differ materially from those described in the

forward-looking statements and will be affected by a variety of

risks and factors that are beyond our control, including, without

limitation, risks and uncertainties relating to obtaining and

maintaining necessary approvals from the FDA and other regulatory

authorities, replicating in clinical trials positive results found

in preclinical studies, our dependence on third parties to support

our internal development programs, including for the manufacture

and supply of preclinical and clinical supplies of our product

candidates or components thereof, our ability to effectively

collaborate on research, drug discovery and development activities

with our partners or potential partners, our existing and potential

partners’ ability and willingness to pursue the development and

commercialization of programs or product candidates under the terms

of our partnership agreements, and overall market conditions and

regulatory developments that may affect our and our partners’

activities under these agreements, along with those risks set forth

in our most recent periodic report filed with the U.S. Securities

and Exchange Commission, as well as discussions of potential risks,

uncertainties, and other important factors in our subsequent

filings with the U.S. Securities and Exchange Commission. Except as

required by law, we assume no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Investor Contact: Alex Khan VP,

Finance & Investor Relations investors@absci.com

Media Contact: press@absci.com

absci@methodcommunications.com

|

Absci CorporationUnaudited Condensed

Consolidated Statements of Operations |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

For the Three

Months Ended March 31, |

|

|

|

|

(In thousands, except for share and per share

data) |

|

|

2024 |

|

|

|

2023 |

|

|

|

|

Revenues |

|

|

|

|

|

|

|

Technology development revenue |

|

$ |

898 |

|

|

$ |

1,269 |

|

|

|

| Total

revenues |

|

|

898 |

|

|

|

1,269 |

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

Research and development |

|

|

12,236 |

|

|

|

12,657 |

|

|

|

|

Selling, general and administrative |

|

|

8,744 |

|

|

|

9,593 |

|

|

|

|

Depreciation and amortization |

|

|

3,416 |

|

|

|

3,504 |

|

|

|

| Total

operating expenses |

|

|

24,396 |

|

|

|

25,754 |

|

|

|

| Operating

loss |

|

|

(23,498 |

) |

|

|

(24,485 |

) |

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

Interest expense |

|

|

(176 |

) |

|

|

(321 |

) |

|

|

|

Other income, net |

|

|

1,711 |

|

|

|

1,458 |

|

|

|

| Total other

income, net |

|

|

1,535 |

|

|

|

1,137 |

|

|

|

| Loss before

income taxes |

|

|

(21,963 |

) |

|

|

(23,348 |

) |

|

|

| Income tax

expense |

|

|

(12 |

) |

|

|

(7 |

) |

|

|

| Net

loss |

|

$ |

(21,975 |

) |

|

$ |

(23,355 |

) |

|

|

| |

|

|

|

|

|

|

| Net loss per

share:Basic and diluted |

|

$ |

(0.22 |

) |

|

$ |

(0.26 |

) |

|

|

| |

|

|

|

|

|

|

|

Weighted-average common shares outstanding:Basic and diluted |

|

|

99,393,333 |

|

|

|

91,479,452 |

|

|

|

|

|

|

|

|

|

|

|

| Absci

CorporationUnaudited Condensed Consolidated

Balance Sheets |

|

|

|

|

|

|

|

|

| |

|

March

31, |

|

|

December

31, |

|

|

(In thousands, except for share and per share

data) |

|

|

2024 |

|

|

|

2023 |

|

|

ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

58,831 |

|

|

$ |

72,362 |

|

|

Restricted cash |

|

|

16,350 |

|

|

|

16,193 |

|

|

Short-term investments |

|

|

102,712 |

|

|

|

25,297 |

|

|

Receivables under development arrangements, net |

|

|

42 |

|

|

|

2,189 |

|

|

Prepaid expenses and other current assets |

|

|

3,863 |

|

|

|

4,537 |

|

|

Total current assets |

|

|

181,798 |

|

|

|

120,578 |

|

| Operating

lease right-of-use assets |

|

|

4,275 |

|

|

|

4,490 |

|

| Property and

equipment, net |

|

|

38,755 |

|

|

|

41,328 |

|

| Intangibles,

net |

|

|

47,411 |

|

|

|

48,253 |

|

| Restricted

cash, long-term |

|

|

1,126 |

|

|

|

1,112 |

|

| Other

long-term assets |

|

|

1,533 |

|

|

|

1,537 |

|

| TOTAL

ASSETS |

|

$ |

274,898 |

|

|

$ |

217,298 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

1,653 |

|

|

$ |

1,503 |

|

|

Accrued expenses |

|

|

15,398 |

|

|

|

19,303 |

|

|

Long-term debt |

|

|

3,301 |

|

|

|

3,258 |

|

|

Operating lease obligations |

|

|

1,586 |

|

|

|

1,679 |

|

|

Financing lease obligations |

|

|

287 |

|

|

|

641 |

|

|

Deferred revenue |

|

|

3,063 |

|

|

|

3,174 |

|

|

Total current liabilities |

|

|

25,288 |

|

|

|

29,558 |

|

| Long-term

debt, net of current portion |

|

|

3,745 |

|

|

|

4,660 |

|

| Operating

lease obligations, net of current portion |

|

|

5,296 |

|

|

|

5,643 |

|

| Finance

lease obligations, net of current portion |

|

|

29 |

|

|

|

76 |

|

| Deferred tax

liability, net |

|

|

175 |

|

|

|

186 |

|

| Deferred

revenue, long-term |

|

|

180 |

|

|

|

966 |

|

| Other

long-term liabilities |

|

|

78 |

|

|

|

33 |

|

| TOTAL

LIABILITIES |

|

|

34,791 |

|

|

|

41,122 |

|

| |

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

| Preferred

stock, $0.0001 par value |

|

|

— |

|

|

|

— |

|

| Common

stock, $0.0001 par value |

|

|

11 |

|

|

|

9 |

|

| Additional

paid-in capital |

|

|

668,698 |

|

|

|

582,699 |

|

| Accumulated

deficit |

|

|

(428,470 |

) |

|

|

(406,495 |

) |

| Accumulated

other comprehensive loss |

|

|

(132 |

) |

|

|

(37 |

) |

| TOTAL

STOCKHOLDERS' EQUITY |

|

|

240,107 |

|

|

|

176,176 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

274,898 |

|

|

$ |

217,298 |

|

|

|

|

|

|

|

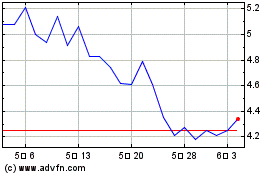

AbSci (NASDAQ:ABSI)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

AbSci (NASDAQ:ABSI)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024