Antipodean Currencies Rise Amid Risk Appetite

11 10월 2024 - 12:33PM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars strengthened against their major currencies in the

Asian session on Friday, as investor sentiment boosted after data

showed the bigger-than-expected increase in U.S. consumer prices

further offset optimism the U.S. Fed will continue to aggressively

lower interest rates in the coming months. China is also falling as

the markets await potential fiscal stimulus announcements on

Saturday.

Following the data, Atlanta Fed President Raphael Bostic told

the Wall Street Journal he was "definitely open" to leaving

interest rates unchanged in November.

CME Group's FedWatch Tool is currently indicating an 84.0

percent chance the Fed will lower rates by 25 basis points next

month after slashing rates by 50 basis points last month.

Crude oil prices rose sharply as worries about escalating

tensions in the Middle East outweighed uncertainty about the

outlook for demand. West Texas Intermediate Crude oil futures for

November ended higher by $2.61 or about 3.56 percent at $75.85 a

barrel.

In the Asian trading today, the Australian dollar rose to a

4-day high of 1.6204 against the euro, from yesterday's closing

value of 1.6220. The aussie may test resistance around the 1.60

region.

Against the U.S. and the Canadian dollars, the aussie advanced

to a 2-day high of 0.6750 and a 1-week high of 0.9283 from

yesterday's closing quotes of 0.6739 and 0.9266, respectively. If

the aussie extends its uptrend, it is likely to find resistance

around 0.69 against the greenback and 0.94 against the loonie.

The aussie edged up to 100.39 against the yen, from Thursday's

closing value of 100.25. On the upside, 103.00 is seen as the next

resistance level for the aussie.

The NZ dollar rose to 2-day highs of 0.6106 against the euro and

1.7913 against the euro, from yesterday's closing quotes of 0.6092

and 1.7937, respectively. If the kiwi extends its uptrend, it is

likely to resistance around 0.63 against the greenback and 1.77

against the euro.

Against the Australia and the yen, the kiwi edged up to 1.1044

and 90.79 from Thursday's closing quotes of 1.1058 and 90.65,

respectively. The next possible upside target for the kiwi is seen

around 1.09 against the aussie and 93.00 against the yen.

Looking ahead, Canada jobs data for September, U.S. PPI for

September, U.S. University of Michigan's consumer sentiment for

October, U.S. WASDE report and U.S. weekly Baker Hughes oil rig

count data are slated for release in the New York session.

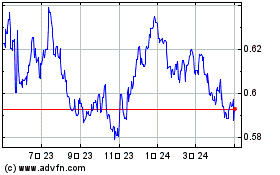

NZD vs US Dollar (FX:NZDUSD)

외환 차트

부터 11월(11) 2024 으로 12월(12) 2024

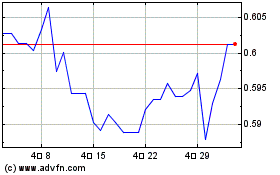

NZD vs US Dollar (FX:NZDUSD)

외환 차트

부터 12월(12) 2023 으로 12월(12) 2024