TIDMPEB

RNS Number : 3458Y

Pebble Beach Systems Group PLC

06 September 2022

Pebble Beach Systems Group plc

Results for the half-year ended 30 June 2022

Pebble Beach Systems Group plc (AIM: "PEB", "Pebble" or the

"Group"), a leading global software business specialising in

playout automation and content management solutions for the

broadcast and streaming service markets, is pleased to announce its

unaudited half-year results for the six months ended 30 June 2022,

which are in line with the Trading Update announced on 2 August

2022 .

Financial highlights

-- Revenue up 3% to GBP5.0m (H1 21: GBP4.9m), recurring revenue

up 9% to GBP2.24m (H1 21: GBP2.05m)

-- Whilst orders received reduced to GBP5.0m (H1 21: GBP6.4m)

these are slightly improved against the underlying, COVID-adjusted,

H1 21 order intake of GBP4.9m thus representing modest growth on a

like for like basis.

-- Adjusted EBITDA(1) down to GBP1.3m (H1 21: GBP1.7m),

representing 26% of revenue (H1 21: 35%)

-- Profit before tax reduced to GBP0.3m (H1 21: GBP1.0m) after

c. GBP257k of non-recurring costs

-- Adjusted earnings per share down to 0.4p (H1 21: 0.8p)

-- Net cash generated from operating activities (after interest

paid and IFRS 16 lease payments) was GBP0.6m (H1 21: GBP1.8m)

-- Gross bank debt reduced by GBP0.5m in last six months to

GBP7.1m as at 30 June 2022. Net debt at 30 June 2022 was c.GBP6.3m

representing a Net debt/last 12 month Adjusted EBITDA(1) of

c.2.2x.

-- Achieved a re-finance of the bank debt through to September 2024.

Operational highlights

-- The delays in sourcing hardware items resulting from the

worldwide shortage of semiconductors have been largely mitigated,

including a measured investment in inventory to allow customer

orders to be delivered.

-- Investment in our new IP-native Oceans platform continues as planned.

-- Strategic move to a fully remote operating model is

delivering operational benefits in terms of resilience,

organisational growth and employee satisfaction.

-- Investigated ways to accelerate funding of growth initiatives.

-- Significant success in the Middle East across multiple

customers, defending our position in this key market.

-- Adding PayTV channels to a customer in Brazil, expanding a

successful long term partnership with one of the largest broadcast

organisations in the world.

-- Breaking into new markets with

o First order in Italy, to a sports broadcaster via a new

channel partner.

o Automation and integrated channel contract awarded by a major

Indonesian media corporation.

Current trading and outlook

-- Orders for the second half are forecast to be stronger than

the first half, and an improved pipeline underpins this outlook.

This will feed through to improved revenue in the second half.

-- Achieved revenue growth in the period despite a sense of a

slowdown in decision making with the Russian invasion of

Ukraine.

John Varney, Non-Executive Chairman of Pebble Beach Systems

Group plc, said:

"The company has delivered a robust performance for the first

half of 2022, despite some difficult headwinds.

Our continued long-term aim of investing in new software

solutions whilst reducing our overall indebtedness remains central

to our strategy to ensure we continue to be well positioned to

benefit from the industry transition to IP as full-scale adoption

occurs.

The Board continues to have confidence that the Group can

deliver a strong second half with improved revenue and achieve

market expectations.

Notes

(1) Adjusted EBITDA (earnings before interest, tax, depreciation

and amortisation) a non-GAAP measure, is EBITDA before

non-recurring items and foreign exchange gains/losses.

For further information please contact:

+44 (0) 75 55 59

Peter Mayhead - CEO 36 02

finnCap Ltd (Nominated Adviser

and Broker )

Marc Milmo / Teddy Whiley - Corporate +44 (0) 207 220

Finance 0500

Tim Redfern / Sunila de Silva

- ECM

The Company is quoted on the LSE AIM market (PEB.L). More

information can be found at www.pebbleplc.com .

About Pebble Beach Systems

Pebble Beach Systems (trading as Pebble) is a world leader in

designing and delivering automation, integrated channel and

virtualised playout solutions, with scalable products designed for

applications of all sizes. Founded in 2000, Pebble has commissioned

systems in more than 70 countries, with proven installations

ranging from single up to over 150 channels in operation, and

around 2000 channels currently on air under the control of our

automation technology. An innovative, agile company, Pebble is

focused on discovering its customers' requirements and pain points,

designing solutions which will address these elegantly and

efficiently, and delivering and supporting these professionally and

in accordance with its users' needs.

Forward-looking statements

Certain statements in this announcement are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to be correct. Because

these statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied by these

forward-looking statements. The Group undertakes no obligation to

update any forward-looking statements whether as a result of new

information, future events or otherwise. Nothing in this

announcement should be construed as a profit forecast.

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report that the Group has continued its robust

performance, benefiting from the opening up of business travel as

COVID restrictions have been relaxed. This resilient performance

has been delivered in spite of a background of war in Ukraine and

hardware supply challenges demonstrating the strength of the

business and the Group's positioning in its market. The first year

of being a remote working operation has been a positive experience

and we have invested in people, IT systems and activities to make

this transition a success. The order intake of GBP5.0m in the

period was modestly up on a like-for-like basis when adjusting for

two large orders delivered in the comparative period in 2021

totalling GBP1.5 million, deferred from 2020 because of COVID which

I identified in the interim statement last year.

We delivered revenue of GBP5.0m, up 3% on the comparative period

of 2021. Recurring revenue from our service contracts was up 9% and

this remains an important element of our growth plans.

Our accelerated investment in cloud and IP-based technology will

facilitate the delivery of our software solutions to meet market

demand, as we continue to see an increase in opportunity for our

software. This, together with our continued investment in Oceans,

Pebble's next generation technology platform, underlines our

commitment to support broadcasters as the media landscape evolves

and cloud and IP technologies are more widely adopted.

Financial performance

-- Orders received in the period of GBP5.0m (H1 21: GBP6.4m);

-- Revenue up 3% to GBP5.0m (H1 21: GBP4.9m), recurring revenue

up 9% to GBP2.24m (H1 21: GBP2.05m);

-- Adjusted EBITDA(1) reduced to GBP1.3m (H1 21: GBP1.7m),

representing 26% of revenue (H1 21: 35%), following planned

investment in headcount, increased travel and marketing costs and

costs associated with the transition to remote working;

-- Net cash from operating activities (after interest paid and

IFRS 16 lease payments) fell to GBP0.6m (H1 21: GBP1.8m); and

-- Increased investment in capitalised R&D of GBP0.9m (H1

21: GBP0.7m) reflecting the Group's strategic focus on continued

product enhancement.

Operational performance

-- GBP3.6m new project wins in the period, including;

-- GBP0.7m project won at the end of the first half from a

national broadcaster in Finland. This is an upgrade and expansion

of their current system providing a flexible hybrid solution

allowing transition to IP-based technologies at a time and scale

that meets their needs.

-- GBP0.6m from two contract wins in the Middle East region. One

is an upgrade to an existing system for a customer who has belief

in our technology vision. The other is a new customer, which is

both a testament to the strength of our playout solution and to our

reputation for service and investment in this important region.

-- Further channels added by a leading global provider of

production services, expanding a successful relationship, providing

sports playout for a leading US sports streaming platform. This is

another project that sits at the heart of our mission of providing

a flexible transition from traditional SDI infrastructure to

IP-based playout.

-- Ongoing software development

-- Oceans Automation. Work continues on a cloud-native playout

solution to complement our current enterprise level automation

offering.

-- Media Processing Engine. Work is progressing on the software

solution for video playout capability with preliminary integration

with Oceans Automation achieved. The next milestones will include

APIs, graphics management and subtitling.

-- Pebble Control. Development of the IP control tool is

advancing with added control functionality with the release of the

first device control version expected by the end of the year. We

are co-chairing the work on the new open standards protocol and are

simultaneously working on the implementation of it.

-- Remote operating model

-- We have recently completed our first year as a remote

operating business. We invested in expert help, introduced new

systems, held our first all-staff conference and have a clear

vision of how we will move forward with our staff to deliver the

benefits of this new model.

-- We have sourced a small workshop to allow us to move out of

our existing location in Weybridge in the second half of 2022.

-- Inventory build

-- The worldwide shortage of semiconductors continues to have

some impact on project delivery timescales for those projects where

customers have asked us to supply configured hardware. We have

mitigated some of the impact by a measured increase in our hardware

inventory.

-- Non-recurring charges

-- During the period we explored a potential equity raise, led

by a VCT qualifying raise, that would have provided the Group with

additional capital primarily to accelerate our development of next

generation solutions. Whilst we secured good levels of support from

existing and new investors, a combination of a worsening global

economic situation and falling investor sentiment for the equity

markets generally led us to curtail our plans at a fairly late

stage in the process. As a result, we incurred professional fees

totaling GBP257k which have been disclosed separately in the income

statement as non-recurring items.

Cash flows and net debt

The Group held cash and cash equivalents of GBP0.8 million at 30

June 2022 (H1 2021: GBP1.4 million). The table below summarises the

cash flows for the half year.

2022 2021

GBP'million GBP'million

------------------------------------------ ------------ ------------

Cash generated from operating activities 0.6 1.8

Net cash used in investing activities (0.9) (0.7)

Net cash used in financing activities (0.5) (0.5)

Net (decrease)/increase in cash and

cash equivalents (0.8) 0.6

Cash and cash equivalents at 1 January 1.6 0.8

------------------------------------------ ------------ ------------

Cash and cash equivalents at 30 June 0.8 1.4

------------------------------------------ ------------ ------------

As at 30 June 2022 net debt(2) , excluding the impact of IFRS16,

was GBP6.3 million (cash GBP0.8 million and bank debt of GBP7.1

million). The Group was using all GBP7.1 million of its available

facilities at 30 June 2022, having re-paid GBP0.5 million in the

period.

Going concern

The Directors, having made suitable enquiries and analysis of

the accounts, consider that the Group has adequate resources to

continue in business for the foreseeable future. In making this

assessment, which covers a minimum period of twelve months from

approval of this half-year report, the Directors have considered

the Group's trading forecast, cash flow forecasts, available

headroom and projected financial covenants on the banking facility,

the levels of opportunities in the pipeline and recurring support

revenue (See Note 3 below).

Board Changes

As previously announced on 23 August 2022 David Dewhurst

resigned as a Director of the company and has left the executive

role of Chief Finance Officer. For the foreseeable future David

will not be replaced and the finance function, as previously, will

report to the CEO.

Principal risks and uncertainties

The principal risks and uncertainties facing the Group remain

consistent with the Principal Risks and Uncertainties reported in

the Group's 31 December 2021 Annual Report with one exception.

Since the publication of our 2021 Annual Report, we have

Russia's invasion of Ukraine and the ongoing war. On a global basis

this has increased financial instability and supply chain risks

which may ultimately result in an adverse impact on the Group's

businesses, operations, and cash flows. More specifically, we have

customers in both Russia and Ukraine and therefore there is risk

for the Group on our business in those regions, although this is

not expected to impact revenue materially.

The impact of the COVID-19 pandemic on the business continues to

be monitored by the Board.

Current trading and outlook

The first half year has seen continuing challenges that are

common to the majority of technology suppliers at the present time.

Customers continue to take time to place orders and the ongoing

challenge of continued delays in the supply chain driven by chip

manufacturing shortages are impacting projects of all scales,

generating some delays.

However, I am pleased to report a modest growth in revenue and

believe that the business has demonstrated its resilience in

showing similar levels of growth in orders on the comparative

period once figures for 2021 are normalised for the post COVID

boost from delayed orders from 2020 being delivered in the first

half of 2021.

We are seeing a vibrancy return to the market and a general

opening up of trading, with conferences, trade shows and informal

meetings all returning to pre-pandemic levels. The Board continues

to have confidence that the Group can deliver a strong second half

and achieve market expectations, with the forward order book and

pipeline reflecting this confidence. This also supports our

decision to invest more heavily in R&D and ensure that we

continue to have the product portfolio to meet the future

requirements of the broadcast and streaming service markets .

John Varney

Non-Executive Chairman

CONSOLIDATED INCOME STATEMENT

for the half year ended 30 June 2022

6 months 6 months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Revenue 4 5,038 4,889 10,620

Cost of sales (1,236) (1,025) (2,490)

------------ ------------ -------------

Gross profit 3,802 3,864 8,130

Sales and marketing expenses (959) (789) (1,777)

Research and development expenses (838) (638) (1,417)

Administrative expenses (1,334) (1,233) (2,782)

Foreign exchange gains/(losses) 47 (33) (40)

Other expenses (257) - (244)

Operating profit 5 461 1,171 1,870

--------------------------------------------- ------ ------------ ------------ -------------

Operating profit is analysed as:

Adjusted EBITDA 1,297 1,746 3,282

Non-recurring items (257) - (244)

Share based payment expense (20) (13) (53)

Exchange gains/(losses) credited/(charged)

to the income statement 47 (33) (40)

--------------------------------------------- ------ ------------ ------------ -------------

Earnings before interest, tax, depreciation

and amortisation (EBITDA) 1,067 1,700 2,945

--------------------------------------------- ------ ------------ ------------ -------------

Depreciation (78) (114) (160)

Amortisation and impairment of acquired - - -

intangibles

Amortisation of capitalised development

costs (528) (415) (915)

Finance costs (183) (168) (373)

Finance income - - -

Profit before tax 278 1,003 1,497

Tax 6 (17) (19) (31)

------------ ------------ -------------

Profit for the period being attributable

to owners of the parent 261 984 1,466

Earnings per share

attributable to the owners of

the parent during the period

Basic earnings per share 7 0.2p 0.8p 1.2p

Diluted earnings per share

Diluted earnings per share 7 0.2p 0.8p 1.2p

--------------------------------------------- ------ ------------ ------------ -------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the half year ended 30 June 2022

6 months 6 months Year ended

to 30 to 30 31 December

June 2022 June 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

----------------------------------- ------------ ------------ -------------

Profit for the financial

year 261 984 1,466

Other comprehensive income

- items that may be reclassified

subsequently to profit

or loss:

Exchange differences on

translation of overseas

operations - 6 (1)

Total profit for the period

attributable to owners

of the parent 261 990 1,465

------------------------------------ ------------ ------------ -------------

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

for the half year ended 30 June 2022

Capital

Ordinary Share redemption Merger Translation Accumulated

shares premium reserve reserve reserve losses Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

At 1 January 2022 3,115 6,800 617 29,778 (151) (42,107) (1,948)

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Share based payments:

value of employee

services - - - - - 20 20

Transactions with

owners - - - - - 20 20

Retained profit

for the period - - - - - 261 261

Exchange differences

on translation of

overseas operations - - - - - - -

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Total comprehensive

income/expense for

the period - - - - - 261 261

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

At 30 June 2022

(Unaudited) 3,115 6,800 617 29,778 (151) (41,826) (1,667)

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

At 1 January 2021 3,115 6,800 617 29,778 (150) (43,626) (3,466)

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Share based payments:

value of employee

services - - - - - 13 13

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Transactions with

owners - - - - - 13 13

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Retained profit

for the period - - - - - 984 984

Exchange differences

on translation of

overseas operations - - - - 6 - 6

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Total comprehensive

income/expense for

the period - - - - 6 984 990

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

At 30 June 2021

(Unaudited) 3,115 6,800 617 29,778 (144) (42,629) (2,463)

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

At 1 January 2021 3,115 6,800 617 29,778 (150) (43,626) (3,466)

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Share based payments:

value of employee

services - - - - - 53 53

Transactions with

owners - - - - - 53 53

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Retained profit

for the year - - - - - 1,466 1,466

Exchange differences

on translation of

overseas operations - - - - (1) - (1)

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

Total comprehensive

income/expense for

the period - - - - (1) 1, 466 1, 465

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

At 31 December 2021

(Audited) 3,115 6,800 617 29,778 (151) (42,107) (1,948)

----------------------- ----------- ---------- ------------ ---------- -------------- -------------- ---------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 June 2022

30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 8 5,993 5,297 5,601

Property, plant and equipment 346 1,114 349

6,339 6,411 5,950

------------ ----------- ------------

Current assets

Inventories 510 282 430

Trade and other receivables 3,805 3,057 3,632

Cash and cash equivalents 799 1,444 1,639

------------ ----------- ------------

5,114 4,783 5,701

Liabilities

Current liabilities

Financial liabilities - borrowings 1,000 1,300 1,200

Trade and other payables 5,904 4,521 5,832

Lease liabilities - current 104 143 173

------------ ----------- ------------

7,008 5,964 7,205

------------ ----------- ------------

Net current liabilities (1,894) (1,181) (1,504)

------------ ----------- ------------

Non-current liabilities

Financial liabilities - borrowings 6,050 6,750 6,350

Lease liabilities - non-current 62 943 44

Deferred tax liabilities - - -

6,112 7,693 6,394

------------ ----------- ------------

Net liabilities (1,667) (2,463) (1,948)

------------------------------------ ------ ------------ ----------- ------------

Equity attributable to owners of

the parent

Ordinary shares 3,115 3,115 3,115

Share premium account 6,800 6,800 6,800

Capital redemption reserve 617 617 617

Merger reserve 29,778 29,778 29,778

Translation reserve (151) (144) (151)

Retained earnings (41,826) (42,629) (42,107)

------------ ----------- ------------

Total equity (1,667) (2,463) (1,948)

------------------------------------ ------ ------------ ----------- ------------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the half year ended 30 June 2022

6 months 6 months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 9 802 2,030 3,815

Interest paid (183) (168) (373)

Taxation paid (17) (19) (31)

------------ ------------ -------------

Net cash from operating activities 602 1,843 3,411

------------ ------------ -------------

Cash flows from investing activities

Interest received - - -

Purchase of property, plant and equipment (22) (21) (82)

Expenditure on capitalised development

costs (920) (711) (1,515)

Net cash used in investing activities (942) (732) (1,597)

------------ ------------ -------------

Cash flows from financing activities

Net cash used in repayment of financing

activities (500) (500) (1,000)

Net cash used in financing activities (500) (500) (1,000)

------------ ------------ -------------

Net (decrease)/increase in cash and

cash equivalents (840) 611 814

Effect of foreign exchange rate changes - 7 (1)

------------ ------------ -------------

Cash and cash equivalents and overdrafts

at 1 January 1,639 826 826

Cash and cash equivalents and overdrafts

at period end 799 1,444 1,639

------------ ------------ -------------

Net debt comprises:

Cash and cash equivalents and overdrafts 799 1,444 1,639

Borrowings (7,050) (8,050) (7,550)

------------ ------------ -------------

Net debt at period end (6,251) (6,606) (5,911)

------------------------------------------- ------ ------------ ------------ -------------

NOTES TO THE HALF-YEAR REPORT

for the six months ended 30 June 2022

1. GENERAL INFORMATION

The Pebble Beach Systems Group is a leading global software

business specialising in solutions for playout automation and

content, serving customers in the broadcast markets.

The Company is a public limited company and is quoted on the

Alternative Investment Market (AIM) of the London Stock Exchange.

The Company is incorporated and domiciled in the UK, with

registered number of 04082188. The address of its registered office

is 12 Horizon Business Village, 1 Brooklands Road, Weybridge,

Surrey, KT13 0TJ.

This half-year results announcement was approved by the board on

5 September 2022.

2. BASIS OF PREPARATION

The financial information for the period ended 30 June 2022 set

out in this half-year report does not constitute statutory accounts

as defined in Section 434 of the Companies Act 2006. The Group's

statutory financial statements for the year ended 31 December 2021

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified.

The half-year financial information has been prepared using the

same accounting policies and estimation techniques as will be

adopted in the Group financial statements for the year ending 31

December 2022. The Group financial statements for the year ended 31

December 2021 were prepared under International Financial Reporting

Standards as adopted by the European Union. These interim financial

statements have been prepared on a consistent basis and format. The

Group has not applied IAS 34 'Interim Financial Reporting', which

is not mandatory for AIM companies, in the preparation of these

interim financial statements.

3. GOING CONCERN

The Directors, having made suitable enquiries and analysis of

the accounts, consider that the Group has adequate resources to

continue in business for the foreseeable future. In making this

assessment, which covers a minimum period of twelve months from

approval of this half-year report, the Directors have considered

the Group's trading forecast, cash flow forecasts, available

headroom and projected financial covenants on the banking facility,

the levels of opportunities in the pipeline and recurring support

revenue.

We maintain a good relationship with our bank. The current loan

agreement secures the facility until 30 September 2024 with banking

covenants and a repayment schedule in place.

We have a strong order book and pipeline which underpin our

third and fourth quarter revenue.

The Directors have a reasonable expectation that the Group will

have adequate resources to continue in business for the foreseeable

future and therefore continue to adopt the going concern basis in

preparing the interim financial statements.

4. SEGMENTAL REPORTING

The Group's internal organisational and management structure and

its system of internal financial reporting to the Board of

Directors comprise of Pebble Beach Systems Limited and Group. The

chief operating decision-maker has been identified as the

Board.

The Board reviews the Group's internal financial reporting in

order to assess performance and allocate resources. Management have

therefore determined that the operating segments for the Group will

be based on these reports.

The Pebble Beach Systems Limited business is responsible for the

sales and marketing of all Group software products and

services.

The table below shows the analysis of Group external revenue and

operating profit by business segment.

Pebble Group Total

Beach Systems

GBP'000 GBP'000 GBP'000

----------------------------------------------- --------------- -------- --------

6 months to 30 June 2022 (Unaudited)

--------------- -------- --------

Total revenue 5,038 - 5,038

--------------- -------- --------

Adjusted EBITDA 1,664 (367) 1,297

Depreciation (78) - (78)

Amortisation of capitalised development

costs (528) - (528)

Share based payment expense - (20) (20)

Non-recurring items - (257) (257)

Exchange gains 47 - 47

Finance costs (3) (180) (183)

Intercompany finance income/(costs) 168 (168) -

Profit/(loss) before taxation 1,270 (992) 278

Taxation (116) 99 (17)

Profit/(loss) for the period being

attributable to owners of the parent 1,154 (893) 261

----------------------------------------------- --------------- -------- --------

6 months to 30 June 2021 (Unaudited)

--------------- -------- --------

Total revenue 4,889 - 4,889

--------------- -------- --------

Adjusted EBITDA 1,987 (241) 1,746

Depreciation (114) - (114)

Amortisation of capitalised development

costs (415) - (415)

Share based payment expense - (13) (13)

Exchange gains (31) (2) (33)

Finance costs (19) (149) (168)

Finance income 46 (46) -

Profit/(loss) before taxation 1,454 (451) 1,003

Taxation (77) 58 (19)

Profit/(loss) for the period being

attributable to owners of the parent 1,377 (393) 984

----------------------------------------------- --------------- -------- --------

Year to 31 December 2021 (Audited)

--------------- -------- --------

Total revenue 10,620 - 10,620

--------------- -------- --------

Adjusted EBITDA 3,862 (580) 3,282

Depreciation (160) - (160)

Amortisation of capitalised development

costs (915) - (915)

Share based payment expense - (53) (53)

Non-recurring items (244) - (244)

Exchange (losses)/gains (40) - (40)

Finance costs (81) (292) (373)

Intercompany finance income/(costs) 107 (107) -

Profit/(loss) before taxation 2,529 (1,032) 1,497

Taxation (298) 267 (31)

Profit/(loss) for the year being attributable

to owners of the parent 2,231 (765) 1,466

----------------------------------------------- --------------- -------- --------

Geographic external revenue analysis

The revenue analysis in the table below is based on the

geographical location of the customer of the business.

6 months 6 months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Total Total Total

GBP'000 GBP'000 GBP'000

---------------- -------------- ------------ -------------

By market

UK & Europe 1,992 3,002 6,385

North America 643 327 927

Latin America 342 156 567

Middle East 1,991 776 1,940

Asia / Pacific 70 628 801

5,038 4,889 10,620

---------------- -------------- ------------ -------------

Net assets

The table below summarises the net assets of the Group by

division. Balance sheet reporting is disclosed by the divisional

assets and liabilities of the Group as this is consistent with the

presentation of internal information provided to the Executive

Management Board and the Board of Directors.

6 months 6 months Year ended

to 30 June to 30 31 December

2022 June 2021 2020

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------------- ------------ ----------- -------------

By division:

Pebble Beach Systems 5,718 5,410 5,860

Group (7,385) (7,873) (7,808)

(1,667) (2,463) (1,948)

---------------------- ------------ ----------- -------------

5. OPERATING PROFIT

The following items have been included in arriving at the

operating profit for the business:

6 months 6 months Year ended

to 30 June to 30 31 December

2022 June 2021 2021

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ----------- -------------

Inventory recognised as an expense 829 605 1,288

Director and employee costs 2,923 2,507 5,888

Depreciation of property, plant and equipment 78 114 160

Exchange (gains)/losses (credited)/charged

to profit and loss (47) 33 40

Amortisation of capitalised development

costs 528 415 915

----------------------------------------------- ------------ ----------- -------------

6. INCOME TAX EXPENSE

6 months 6 months Year ended

to 30 June to 30 31 December

2022 June 2021 2021

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------------------- ------------ ----------- -------------

Current tax

UK corporation tax - - -

Foreign Tax - current year 17 19 31

Total current tax 17 19 31

---------------------------- ------------ ----------- -------------

Deferred tax

UK corporation tax - - -

Total deferred tax - - -

---------------------------- ------------ ----------- -------------

Total taxation 17 19 31

---------------------------- ------------ ----------- -------------

In the Spring Budget 2021, the Government announced that from 1

April 2023 the corporation tax rate would increase from 19 per cent

to 25 per cent. Deferred taxes at the balance sheet date have been

measured using these enacted tax rates and reflected in these

financial statements.

7. EARNINGS PER ORDINARY SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

For diluted earnings per share the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. The dilutive shares are those

share options granted to employees where the exercise price is less

than the average market price of the Company's ordinary shares

during the year. The average market value of the Company's shares

for the purpose of calculating the dilutive effect of share options

was based on quoted market prices for the year during which the

options were outstanding.

Reconciliations of the earnings and weighted average number of

shares used in the calculations are set out below.

6 months to 30 June 2022 (Unaudited)

Weighted

average Earnings

number per share

Earnings of shares pence

GBP'000 '000s

------------------------------------ --------------- ------------ ------------

Basic earnings per share

Profit attributable to ordinary

shareholders 261 0.2p

Basic earnings per share 261 124,477 0.2p

------------------------------------ --------------- ------------ ------------

Diluted earnings per share

Profit attributable to ordinary

shareholders 261 0.2p

------------------------------------ --------------- ------------ ------------

Diluted earnings per share 261 126,761 0.2p

------------------------------------ --------------- ------------ ------------

6 months to 30 June 2021

(Unaudited)

Weighted

average Earnings

number per

Earnings of shares share

GBP'000 '000s pence

--------------------------------- ----------- ------------ --------------

Basic earnings per share

Profit attributable to ordinary

shareholders 984 0.8p

Basic earnings per share 984 124,477 0.8p

--------------------------------- ----------- ------------- -------------

Diluted earnings per share

Profit attributable to ordinary

shareholders 984 0.8p

Diluted earnings per share 984 126,909 0.8p

--------------------------------- ----------- ------------- -------------

Year ended 31 December 2021

(Audited)

Weighted

average Earnings

number per share

Earnings of shares pence

GBP'000 '000s

------------------------------------ ----------- ------------ ------------

Basic earnings per share

Profit attributable to ordinary

shareholders 1,466 1.2p

Basic earnings per share 1,466 124,477 1.2p

------------------------------------ ----------- ------------ ------------

Diluted earnings per share

Profit attributable to ordinary

shareholders 1,466 1.2p

------------------------------------ ----------- ------------ ------------

Diluted earnings per share 1,466 125,775 1.2p

------------------------------------ ----------- ------------ ------------

Adjusted earnings

The directors believe that adjusted EBITDA, adjusted earnings

and adjusted earnings per share provide additional useful

information on underlying trends to shareholders. These measures

are used by management for internal performance analysis and

incentive compensation arrangements. The term "adjusted" is not a

defined term used under IFRS and may not therefore be comparable

with similarly titled profit measurements reported by other

companies. The principal adjustments are made in respect of the

amortisation of acquired intangibles, share based payment expense,

non-recurring items and exchange gains or losses charged to the

income statement and their related tax effects.

The reconciliation between reported and underlying earnings and

basic earnings per share is shown below:

6 months 6 months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

Total Total Total

(Unaudited) (Unaudited) (Audited)

Earnings Earnings Earnings

GBP'000 Pence GBP'000 Pence GBP'000 Pence

-------------------------------- -------- ------ -------- ------ -------- ------

Reported earnings and earnings

per share 261 0.2p 984 0.8p 1,466 1.2p

Share based payment expense 20 0.0p 13 0.0p 53 0.0p

Exchange (gains)/losses (38) 0.0p 27 0.0p 32 0.0p

Non-recurring items 208 0.2p - 0.0p - 0.0p

-------- ------ -------- ------ -------- ------

Adjusted earnings and earnings

per share 451 0.4p 1,024 0.8p 1,551 1.2p

-------------------------------- -------- ------ -------- ------ -------- ------

8. INTANGIBLE ASSETS

Acquired Acquired Capitalised

customer intellectual development

Goodwill relationships property costs Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- --------------- -------------- ------------- ---------

Cost

At 1 January 2021 (audited) 3,218 4,493 3,350 5,423 16,484

Additions (unaudited) - - - 711 711

---------------------------------- -------- --------------- -------------- ------------- ---------

At 30 June 2021 (unaudited) 3,218 4,493 3,350 6,134 17,195

---------------------------------- -------- --------------- -------------- ------------- ---------

At 1 January 2021 (audited) 3,218 4,493 3,350 5,423 16,484

Additions (audited) - - - 1,515 1,515

---------------------------------- -------- --------------- -------------- ------------- ---------

At 1 January 2022 (audited) 3,218 4,493 3,350 6,938 17,999

---------------------------------- -------- --------------- -------------- ------------- ---------

Additions (unaudited) - - - 920 920

---------------------------------- -------- --------------- -------------- ------------- ---------

At 30 June 2022 (unaudited) 3,218 4,493 3,350 7,858 18,919

---------------------------------- -------- --------------- -------------- ------------- ---------

Accumulated amortisation

At 1 January 2021 (audited) - 4,493 3,350 3,640 11,483

Charge for the period (unaudited) - - - 415 415

---------------------------------- -------- --------------- -------------- ------------- ---------

At 30 June 2021 (unaudited) - 4,493 3,350 4,055 11,898

---------------------------------- -------- --------------- -------------- ------------- ---------

At 1 January 2021 (audited) - 4,493 3,350 3,640 11,483

Charge for the year (audited) - - - 915 915

---------------------------------- -------- --------------- -------------- ------------- ---------

At 1 January 2022 (audited) - 4,493 3,350 4,555 12,398

Charge for the period (unaudited) - - - 528 528

---------------------------------- -------- --------------- -------------- ------------- ---------

At 30 June 2022 (unaudited) - 4,493 3,350 5,083 12,926

---------------------------------- -------- --------------- -------------- ------------- ---------

Net book value

At 30 June 2022 (unaudited) 3,218 - - 2,775 5,993

---------------------------------- -------- --------------- -------------- ------------- ---------

At 31 December 2021 (audited) 3,218 - - 2,383 5,601

---------------------------------- -------- --------------- -------------- ------------- ---------

At 30 June 2021 (unaudited) 3,218 - - 2,079 5,297

---------------------------------- -------- --------------- -------------- ------------- ---------

At 1 January 2021 (audited) 3,218 - - 1,783 5,001

---------------------------------- -------- --------------- -------------- ------------- ---------

The amortisation of development costs is included in research

and development expenses in the Consolidated Group Income

Statement. Within capitalised development costs there are GBP3.6

million (2021: GBP2.8 million) of fully written down assets that

are still in use.

9. CASH FLOW GENERATED FROM OPERATING ACTIVITIES

Reconciliation of profit before taxation to net cash flows from

operating activities.

6 months 6 months Year ended

to 30 June to 30 31 December

2022 June 2021 2021

Total Total Total

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ----------- -------------

Profit before tax 278 1,003 1,497

Depreciation of property, plant and equipment 78 114 160

Amortisation and impairment of development

costs 528 415 915

Non-recurring item - - 244

Share based payment expense 20 13 53

Finance income - - -

Finance costs 183 168 373

Increase in inventories (80) (134) (282)

(Increase)/decrease in trade and other

receivables (173) 68 (507)

(Decrease)/increase in trade and other

payables (32) 383 1,362

Net cash generated from operating activities 802 2,030 3,815

----------------------------------------------- ------------ ----------- -------------

10. NET FUNDS

Reconciliation of change in cash and cash equivalents to

movement in net cash:

Net cash and Other borrowings Total

cash equivalents GBP'000 net cash

GBP'000 GBP'000

------------------------------------------- ------------------ ----------------- ----------

At 1 January 2022 1,639 (7,550) (5,911)

Cash flow for the period before financing (340) - (340)

Movement in borrowings in the period (500) 500 -

Exchange rate adjustments - - -

------------------------------------------- ------------------ ----------------- ----------

Cash and cash equivalents at 30 June

2022 (Unaudited) 799 (7,050) (6,251)

------------------------------------------- ------------------ ----------------- ----------

At 1 January 2021 826 (8,550) (7,724)

Cash flow for the period before financing 1,111 - 1,111

Movement in borrowings in the period (500) 500 -

Exchange rate adjustments 7 - 7

------------------------------------------- ------------------ ----------------- ----------

Cash and cash equivalents at 30 June

2021 (Unaudited) 1,444 (8,050) (6,606)

------------------------------------------- ------------------ ----------------- ----------

At 1 January 2021 826 (8,550) (7,724)

Cash flow for the year before financing 1,814 - 1,814

Movement in borrowings in the year (1,000) 1,000 -

Exchange rate adjustments (1) - (1)

------------------------------------------- ------------------ ----------------- ----------

Cash and cash equivalents at 31 December

2021 (Audited) 1,639 (7,550) (5,911)

------------------------------------------- ------------------ ----------------- ----------

Ends

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCGDGDGDU

(END) Dow Jones Newswires

September 06, 2022 02:00 ET (06:00 GMT)

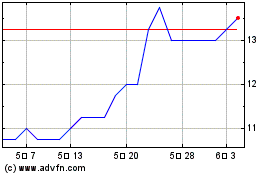

Pebble Beach Systems (LSE:PEB)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

Pebble Beach Systems (LSE:PEB)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025