0001175596false--03-31FY2024falsefalseZ400018660289421170289430000006220800000011755962023-04-012024-03-310001175596ahr:NoExpiryDateMember2024-03-310001175596ifrs-full:LaterThanFiveYearsMember2024-03-310001175596ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2024-03-310001175596ifrs-full:NotLaterThanOneYearMember2024-03-3100011755962021-04-302021-05-020001175596ahr:SalariesFeesAndBenefitsMember2023-04-012024-03-310001175596ahr:SalariesFeesAndBenefitsMember2021-04-012022-03-310001175596ahr:SalariesFeesAndBenefitsMember2022-04-012023-03-310001175596ahr:VPExplorationMember2022-04-012023-03-310001175596ahr:VPExplorationMember2023-04-012024-03-310001175596ahr:FormerVPExplorationMember2023-04-012024-03-310001175596ahr:UnitedMineralServicesLtdMember2023-04-012024-03-310001175596ahr:UnitedMineralServicesLtdMember2022-04-012023-03-310001175596ahr:FormerVPExplorationMember2022-04-012023-03-310001175596ahr:ChiefFinancialOfficersMember2023-04-012024-03-310001175596ahr:ChiefFinancialOfficersMember2022-04-012023-03-310001175596ahr:DirectorsAndOfficersMember2022-04-012023-03-310001175596ahr:DirectorsAndOfficersMember2023-04-012024-03-310001175596ahr:HunterDickinsonServicesIncMember2023-04-012024-03-310001175596ahr:HunterDickinsonServicesIncMember2022-04-012023-03-310001175596ahr:HunterDickinsonServicesIncMember2021-04-012022-03-310001175596ahr:ThomasWilsonCFOFeesMember2024-03-310001175596ahr:UnitedMineralServicesLtdMember2023-03-310001175596ahr:UnitedMineralServicesLtdMember2024-03-310001175596ahr:RobertDickinsonInterestPayableMember2023-03-310001175596ahr:RobertDickinsonInterestPayableMember2024-03-310001175596ahr:HunterDickinsonServicesIncMember2023-03-310001175596ahr:HunterDickinsonServicesIncMember2024-03-310001175596ahr:ThomasWilsonCFOFeesMember2023-03-310001175596ahr:TwentyTwentyThreeNonFlowTthroughWarrantsMember2023-12-310001175596ahr:TwentyTwentyThreeNonFlowTthroughWarrantsMember2023-12-022023-12-310001175596ahr:TwentyTwentyTwoLoanBonusWarrantsMember2022-06-012022-06-300001175596ahr:TwentyNineteenloanBonusWarrantsMember2019-12-012019-12-310001175596ahr:InvestorRelationsAgreementMember2024-03-012024-03-220001175596ahr:InvestorRelationsAgreementMember2023-04-012023-04-110001175596ahr:SharePurchaseOptionMember2022-07-012022-07-080001175596ahr:InvestorRelationsAgreementMember2022-03-012022-03-090001175596ahr:OrdinarySharesCapitalMember2023-03-310001175596ahr:OrdinarySharesCapitalMember2024-03-310001175596ahr:PropertyAgreementMember2023-09-0800011755962020-01-012020-12-310001175596ahr:PrivatePlacementNonFlowShareMember2023-11-282023-12-010001175596ahr:PrivatePlacementFlowShareMember2023-11-282023-12-010001175596ahr:PrivatePlacementNonFlowShareMember2023-12-010001175596ahr:PrivatePlacementFlowShareMember2023-12-0100011755962021-12-012021-12-0200011755962020-10-012020-10-0200011755962020-08-012020-08-200001175596ahr:ExercisePriceSevenMember2023-04-012024-03-310001175596ahr:ExercisePriceSixMember2023-04-012024-03-310001175596ahr:ExercisePriceFiveMember2023-04-012024-03-310001175596ahr:ExercisePriceFourMember2023-04-012024-03-310001175596ahr:ExercisePriceThreeMember2023-04-012024-03-310001175596ahr:ExercisePriceTwoMember2023-04-012024-03-310001175596ahr:ExercisePriceOneMember2023-04-012024-03-310001175596ahr:ExercisePriceSevenMember2024-03-310001175596ahr:ExercisePriceSixMember2024-03-310001175596ahr:ExercisePriceFiveMember2024-03-310001175596ahr:ExercisePriceFourMember2024-03-310001175596ahr:ExercisePriceThreeMember2024-03-310001175596ahr:ExercisePriceTwoMember2024-03-310001175596ahr:ExercisePriceOneMember2024-03-3100011755962021-12-012021-12-1300011755962019-12-3100011755962019-12-052019-12-3100011755962023-06-1500011755962023-06-012023-06-150001175596ahr:JOYDistrictAgreementwithFreeportMember2024-03-310001175596ahr:DukeDistrictCappedRoyaltyMember2023-07-070001175596ahr:DukeDistrictCappedRoyaltyMember2023-04-012024-03-310001175596ahr:DukeDistrictCappedRoyaltyMember2023-07-012023-07-070001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2024-03-310001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2022-04-012023-03-310001175596ahr:OtherPropertyTransactionsMember2022-05-012022-05-160001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2023-04-012024-03-310001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2016-11-012016-11-300001175596ahr:JOYDistrictAgreementwithFreeportMember2023-04-012024-03-310001175596ahr:JOYDistrictAgreementwithFreeportMember2021-05-012021-05-110001175596ahr:PaulaPropertyMember2019-11-300001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2023-04-012024-03-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2019-01-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2019-01-012019-01-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2018-10-012018-10-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2019-12-310001175596ahr:PINEPropertyMember2019-12-310001175596ahr:JoyDistrictMember2018-10-310001175596ahr:PINEPropertyMember2018-10-012018-10-310001175596ahr:CascaderoCopperCorporationMember2018-10-012018-10-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2024-03-310001175596ahr:JoyPropertyMineralMember2016-11-012016-11-300001175596ahr:IKEPropertyMineralMember2024-03-310001175596ahr:OtherPropertyTransactionsMember2023-04-012024-03-310001175596ahr:IKEDistrictMember2023-04-012024-03-310001175596ahr:GranitePropertyMineralMember2023-04-012024-03-310001175596ahr:IKEPropertyMineralMember2023-04-012024-03-310001175596ahr:PaulaPropertyMember2019-11-012019-11-300001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2022-11-012022-11-220001175596ahr:CarlyleCommoditiesCorpSharesMember2022-04-012023-03-310001175596ahr:CarlyleCommoditiesCorpSharesMember2024-03-310001175596ahr:CarlyleCommoditiesCorpSharesMember2023-03-310001175596ahr:CarlyleCommoditiesCorpSharesMember2023-04-012024-03-310001175596ahr:OtherMember2023-04-012024-03-310001175596ahr:CarlyleCommoditiesCorpOneMember2023-04-012024-03-310001175596ahr:CarlyleCommoditiesCorpMember2023-04-012024-03-310001175596ifrs-full:TopOfRangeMember2023-04-012024-03-310001175596ifrs-full:BottomOfRangeMember2023-04-012024-03-310001175596ahr:AmountsReceivableAndOtherAssetsMember2023-04-012024-03-310001175596ahr:RestrictedCashMember2023-04-012024-03-310001175596ahr:MarketableSecuritiesMember2023-04-012024-03-310001175596ahr:CashIfrsMember2023-04-012024-03-310001175596ahr:AccountsPayableAndAccruedLiabilitiesMember2023-04-012024-03-310001175596ahr:BalanceDueToRelatedPartiesMember2023-04-012024-03-310001175596ifrs-full:RetainedEarningsMember2024-03-310001175596ifrs-full:OtherEquityInterestMember2024-03-310001175596ahr:ReserveForInvestmentRevaluationMember2024-03-310001175596ahr:ReserveOfShareBasedPaymentsMember2024-03-310001175596ahr:CommonStockMember2024-03-310001175596ifrs-full:RetainedEarningsMember2023-04-012024-03-310001175596ifrs-full:OtherEquityInterestMember2023-04-012024-03-310001175596ahr:ReserveForInvestmentRevaluationMember2023-04-012024-03-310001175596ahr:ReserveOfShareBasedPaymentsMember2023-04-012024-03-310001175596ahr:CommonStockMember2023-04-012024-03-310001175596ifrs-full:RetainedEarningsMember2023-03-310001175596ifrs-full:OtherEquityInterestMember2023-03-310001175596ahr:ReserveForInvestmentRevaluationMember2023-03-310001175596ahr:ReserveOfShareBasedPaymentsMember2023-03-310001175596ahr:CommonStockMember2023-03-310001175596ifrs-full:RetainedEarningsMember2022-04-012023-03-310001175596ifrs-full:OtherEquityInterestMember2022-04-012023-03-310001175596ahr:ReserveForInvestmentRevaluationMember2022-04-012023-03-310001175596ahr:ReserveOfShareBasedPaymentsMember2022-04-012023-03-310001175596ahr:CommonStockMember2022-04-012023-03-3100011755962022-03-310001175596ifrs-full:RetainedEarningsMember2022-03-310001175596ifrs-full:OtherEquityInterestMember2022-03-310001175596ahr:ReserveForInvestmentRevaluationMember2022-03-310001175596ahr:ReserveOfShareBasedPaymentsMember2022-03-310001175596ahr:CommonStockMember2022-03-310001175596ifrs-full:RetainedEarningsMember2021-04-012022-03-310001175596ifrs-full:OtherEquityInterestMember2021-04-012022-03-310001175596ahr:ReserveForInvestmentRevaluationMember2021-04-012022-03-310001175596ahr:ReserveOfShareBasedPaymentsMember2021-04-012022-03-310001175596ahr:CommonStockMember2021-04-012022-03-3100011755962021-03-310001175596ifrs-full:RetainedEarningsMember2021-03-310001175596ifrs-full:OtherEquityInterestMember2021-03-310001175596ahr:ReserveForInvestmentRevaluationMember2021-03-310001175596ahr:ReserveOfShareBasedPaymentsMember2021-03-310001175596ahr:CommonStockMember2021-03-3100011755962021-04-012022-03-3100011755962022-04-012023-03-3100011755962023-03-3100011755962024-03-310001175596dei:BusinessContactMember2023-04-012024-03-31iso4217:USDiso4217:CADxbrli:sharesiso4217:USDxbrli:sharesiso4217:CADxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| OR |

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended March 31, 2024 |

| |

| OR |

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| OR |

| |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from _______________ to _______________ |

Commission file number 0-49869

AMARC RESOURCES LTD. |

(Exact name of Registrant as specified in its charter) |

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

14th Floor, 1040 West Georgia Street

Vancouver, British Columbia, Canada, V6E 4H1

(Address of principal executive offices)

Thomas Wilson, Chief Financial Officer

tomwilson@amarcresources.com

Phone: 604-561-2873

Facsimile No.: (604) 639-9209

14th Floor, 1040 West Georgia Street

Vancouver, British Columbia, Canada, V6E 4H1

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class: Not applicable | | Name of each exchange on which registered: Not applicable | |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common shares with no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

211,702,894 common shares as of March 31, 2024

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☒ | Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

T A B L E O F C O N T E N T S

GENERAL

In this Annual Report on Form 20-F, all references to “we”, “Amarc” or the “Company” refer to Amarc Resources Ltd.

The Company uses the Canadian Dollar as its reporting currency. All references in this document to “Dollars” or “$” are expressed in Canadian Dollars (“CAD”, “C$”), unless otherwise indicated. See also Item 3 – Key Information for more detailed currency and conversion information.

Except as noted, the information set forth in this Annual Report is as of July 16, 2024 and all information included in this document should only be considered correct as of such date.

Cautionary Note to Investors Concerning Forward-looking Statements This discussion includes certain statements that may be deemed "forward-looking statements". All such statements, other than statements of historical facts that address exploration plans and plans for enhanced relationships are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: Amarc's projects will obtain all required environmental and other permits and all land use and other licenses, studies and exploration of Amarc's projects will continue to be positive, and no geological or technical problems will occur. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, potential environmental issues or liabilities associated with exploration, development and mining activities, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, exploration and development of properties located within Aboriginal groups asserted territories may affect or be perceived to affect asserted aboriginal rights and title, which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on Amarc Resources Ltd., investors should review Amarc's annual Form 20-F filing with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedarplus.ca. |

GLOSSARY OF TERMS

Certain terms used herein are defined as follows:

Coast Plutonic Complex (“CPC”) | The CPC comprises a chain of overlapping batholiths (large bodies of igneous rock) formed as a result of subduction of oceanic crust beneath the western margin of North America, from approximately Early Jurassic to Early Tertiary time (Schiarizza et al. 1997). |

Epithermal Deposit | Deposits formed when the fluids are directed through a structure where the temperature, pressure and chemical conditions are favourable for the deposition of ore minerals, including native gold. |

Induced Polarization (“IP”) Survey | A geophysical survey used to identify a feature that appears to be different from the typical or background survey results when tested for levels of electro-conductivity; IP detects both chargeable, pyrite-bearing rock and non-conductive rock that has a high content of quartz. |

Mineral Symbols | Au – gold; Ag – silver; Cu – copper; Mo – molybdenum. |

Net Smelter Return (“NSR”) Royalty | Monies received for concentrate delivered to a smelter net of metallurgical recovery losses, transportation costs, smelter treatment-refining charges and penalty charges. |

Porphyry Deposit | Mineral deposit characterized by widespread disseminated or veinlet-hosted sulphide mineralization, characterized by large tonnage and moderate to low grade. |

Replacement Deposit | Deposit formed by chemical processes that dissolve a rock and deposit a new assemblage of minerals in its place. |

Vein | A tabular or sheet-like mineral deposit with identifiable walls, often filling a fracture or fissure. |

CURRENCY AND MEASUREMENT

All currency amounts in this Annual Report are stated in Canadian Dollars unless otherwise indicated.

Approximate conversion of metric units into imperial equivalents is as follows:

Metric Units | Multiply by | Imperial Units |

hectares | 2.471 | = acres |

meters | 3.281 | = feet |

kilometers | 3281 | = feet |

kilometers | 0.621 | = miles |

grams | 0.032 | = ounces (troy) |

tonnes | 1.102 | = tons (short) (2,000 lbs) |

grams/tonne | 0.029 | = ounces (troy)/ton |

STATUS AS AN EMERGING GROWTH COMPANY

The Company is an “emerging growth company” as defined in section 3(a) of the Exchange Act, and the Company will continue to qualify as an “emerging growth company” until the earliest to occur of: (a) the last day of the fiscal year during which the Company has total annual gross revenues of US$1.07 billion (as such amount is indexed for inflation every 5 years by the SEC) or more; (b) the last day of the Company's fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement under the Securities Act; (c) the date on which the Company has, during the previous 3-year period, issued more than US$1 billion in non-convertible debt; or (d) the date on which the Company is deemed to be a “large accelerated filer”, as defined in Exchange Act Rule 12b–2. Therefore, the Company expects to continue to be an emerging growth company for the foreseeable future.

Generally, a registrant that registers any class of its securities under section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act, a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an “accelerated filer” or a “larger accelerated filer” (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management's assessment of internal control over financial reporting. However, for so long as the Company continues to qualify as an emerging growth company, the Company will be exempt from the requirement to include an auditor attestation report in its annual reports filed under the Exchange Act, even if it were to qualify as an “accelerated filer” or a “larger accelerated filer”. In addition, auditors of an emerging growth company are exempt from the rules of the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the registrant (auditor discussion and analysis).

The Company has irrevocably elected to comply with new or revised accounting standards even though it is an emerging growth company.

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. DIRECTORS AND SENIOR MANAGEMENT

Not applicable.

B. ADVISERS

Not applicable.

C. AUDITORS

Not applicable.

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3 KEY INFORMATION

A. SELECTED FINANCIAL DATA

The following tables summarize selected financial data for Amarc extracted from the Company's audited financial statements for related fiscal years. The data should be read in conjunction with the Company's audited financial statements included as Item 18 in this Annual Report.

The following table is derived from the financial statements of the Company which have been prepared in accordance with and using accounting policies in full compliance with International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) effective for each of the Company's fiscal year presented.

The following selected financial data is presented in thousands of Canadian Dollars.

Statements of Financial Position Data

($ 000’s) | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

Total assets | | $ | 9,842 | | | $ | 6,091 | | | $ | 991 | | | $ | 1,560 | | | $ | 529 | |

Total liabilities | | | 8,015 | | | | 6,556 | | | | 1,620 | | | | 1,533 | | | | 1,504 | |

Working capital surplus (deficit) | | | 2,063 | | | | (367 | ) | | | (172 | ) | | | 418 | | | | (641 | ) |

Share capital | | | 67,236 | | | | 65,229 | | | | 65,229 | | | | 64,745 | | | | 64,342 | |

Reserves | | | 4,618 | | | | 4,289 | | | | 4,094 | | | | 4,870 | | | | 5,632 | |

Accumulated deficit | | | (70,027 | ) | | | (69,984 | ) | | | (69,952 | ) | | | (69,588 | ) | | | (70,949 | ) |

Net assets (liabilities) | | | 1,826 | | | | (465 | ) | | | (628 | ) | | | 27 | | | | (975 | ) |

Shareholders' equity (deficiency) | | | 1,826 | | | | (465 | ) | | | (628 | ) | | | 27 | | | | (975 | ) |

Statements of Comprehensive Loss Data

($ 000’s, except per share amounts and number of shares) | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

Interest and other income | | $ | (371 | ) | | $ | (139 | ) | | $ | (19 | ) | | $ | (27 | ) | | $ | (6 | ) |

General and administrative expenses | | | 1,162 | | | | 819 | | | | 617 | | | | 630 | | | | 856 | |

Exploration expenditures, net of METC* | | | 12,432 | | | | 14,752 | | | | 5,386 | | | | 1,396 | | | | 1,637 | |

Contributions pursuant to Option Agreements | | | (13,179 | ) | | | (14,774 | ) | | | (5,539 | ) | | | (1,351 | ) | | | (1,491 | ) |

Share-based payments | | | 425 | | | | 264 | | | | 124 | | | | 18 | | | | 42 | |

Other | | | (426 | ) | | | (890 | ) | | | (205 | ) | | | 168 | | | | 215 | |

Gain on sale of mineral property | | | – | | | | – | | | | – | | | | (1,935 | ) | | | – | |

Property option proceeds | | | – | | | | – | | | | – | | | | (260 | ) | | | – | |

Net income (loss) for the year | | | (43 | ) | | | (32 | ) | | | (364 | ) | | | 1,361 | | | | (1,254 | ) |

Other comprehensive income (loss) | | | (98 | ) | | | (168 | ) | | | (715 | ) | | | (626 | ) | | | (11 | ) |

Total comprehensive income (loss) | | $ | (141 | ) | | $ | (200 | ) | | $ | (1,079 | ) | | $ | 734 | | | $ | (1,265 | ) |

| | | | | | | | | | | | | | | | | | | | |

Basic and diluted net earnings (loss) per share | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.01 | ) | | $ | 0.01 | |

Weighted average number of common shares outstanding | | | 194,992,511 | | | | 186,602,894 | | | | 181,479,873 | | | | 178,666,081 | | | | 171,767,287 | |

* | “METC” refers to British Columbia Mining Exploration Tax Credits, which are discussed in Item 5, under the heading “Critical Accounting Policies and Estimates”. |

Currency and Exchange Rates

As of the date of this Annual Report, the average rate of exchange of the Canadian Dollar was US$1.00 = Canadian $1.35. Exchange rates published by the Bank of Canada are available on its website, www.bankofcanada.ca, are nominal quotations — not buying or selling rates — and are intended for statistical or analytical purposes.

The following tables set out the exchange rates for the conversion of Canadian Dollars into U.S. Dollars.

| | For year ended March 31 (Canadian Dollar per U.S. Dollar) | |

| | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

End of period | | $ | 1.3536 | | | $ | 1.3533 | | | $ | 1.2655 | | | $ | 1.2575 | | | $ | 1.4187 | |

Average for the period | | $ | 1.3483 | | | $ | 1.3230 | | | $ | 1.2536 | | | $ | 1.3219 | | | $ | 1.3308 | |

High for the period | | $ | 1.3891 | | | $ | 1.3856 | | | $ | 1.2942 | | | $ | 1.4217 | | | $ | 1.4496 | |

Low for the period | | $ | 1.3091 | | | $ | 1.2451 | | | $ | 1.2040 | | | $ | 1.2455 | | | $ | 1.2970 | |

Monthly High and Low Exchange Rate (Canadian Dollar per U.S. Dollar) |

| | High | | | Low | |

July 2024 (to the date of this Annual Report) | | $ | 1.3755 | | | $ | 1.3589 | |

June 2024 | | $ | 1.3755 | | | $ | 1.3602 | |

May 2024 | | $ | 1.3782 | | | $ | 1.3597 | |

April 2024 | | $ | 1.3845 | | | $ | 1.3478 | |

March 2024 | | $ | 1.3613 | | | $ | 1.3422 | |

February 2024 | | $ | 1.3604 | | | $ | 1.3364 | |

B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

D. RISK FACTORS

An investment in the Company's common shares is highly speculative and subject to a number of risks. Only those persons who can bear the risk of the entire loss of their investment should participate. An investor should carefully consider the risks described below and the other information that the Company furnishes to, or files with, the Securities and Exchange Commission and with Canadian securities regulators before investing in the Company's common shares. The risks described below are not the only ones faced by the Company. Additional risks that management is aware of or that the Company currently believes are immaterial may indeed become important factors that affect the Company's business. If any of the following risks occur, or if others occur, the Company's business, operating results and financial condition could be seriously harmed and the investor may lose all of his investment.

The Company has limited working capital and will require additional capital to advance its projects.

The Company has limited working capital as at the current reporting date. Further exploration on, and development of, the Company's projects will require resources to be delineated and additional funding. The Company currently does not have sufficient funds to fully develop its projects.

There is no assurance that the Company will be successful in obtaining the required financing for these or other purposes, including for general working capital.

The Company has no earnings, has incurred net losses and negative cash flows since inception, and expects to incur losses for the foreseeable future.

The Company does not have any operational history of earnings and has incurred net losses and negative cash flow from its operations since incorporation. Although the Company hopes to eventually generate revenues, significant operating losses are to be anticipated for at least the next several years and possibly longer. To the extent that such expenses do not result in the creation of appropriate revenues, the Company's business may be materially adversely affected. It is not possible to forecast how the business of the Company will develop, and there can be no assurance that the underlying assumed levels of expenses will prove to be accurate.

The advancement of mineral properties to production will require the commitment of substantial resources to conduct time-consuming exploration and development activities. The Company's operating expenses and capital expenditures may increase in subsequent years as needed consultants, personnel and equipment associated with advancing exploration, development and commercial production of the Company's projects and any other properties the Company may acquire are added. The amounts and timing of expenditures will depend on:

· | the progress of ongoing exploration and development; |

| |

· | the results of analyses and programs and subsequent recommendations from its technical team; |

| |

· | the rate at which operating losses are incurred; |

| |

· | the execution of any earn-in and joint venture agreements with strategic allies, or ability to raise funds from investors; and |

| |

· | the acquisition of additional properties and other factors, many of which are beyond the Company's control. |

The Company has no history of mining operations, and does not expect to receive revenues from operations in the foreseeable future.

The Company has no history of mining operations, and there can be no assurance that the Company will generate any revenues or achieve profitability. The Company expects to incur losses unless and until such time as one or more of the Company’s existing projects, or any other properties the Company may acquire, enter into commercial production and generate sufficient revenues to fund its continuing operations, which cannot be assured. The Company does not expect to receive revenues from operations in the foreseeable future, if at all.

The Company is subject to certain risks that are inherent in exploration and mining activities beyond its control.

Resource exploration, development, and operations are highly speculative, and characterized by a number of significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate, including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. Few properties that are explored are ultimately developed into producing mines. No deposit that has been shown to be economic has yet been found on the Company's existing projects, and there can be no assurance that the Company will be able to acquire any additional properties or that any additional properties that are acquired will contain sufficient mineralization to warrant further development.

Unusual or unexpected formations, formation pressures, fires, power outages, labour disruptions, flooding, , landslides, environmental hazards, the discharge of toxic chemicals and other hazards, and the inability to obtain suitable or adequate machinery, equipment or labour, are other risks involved in the conduct of exploration programs, and in the development and operation of mines. Such occurrences may delay development of the Company’s properties, delay production, increase production costs or result in liability.

Substantial expenditures are and will be required to establish mineral resources and mineral reserves.

Substantial expenditures are and will be required to establish mineral resources and mineral reserves through drilling, and to develop metallurgical processes to extract the metal from mineral resources. No assurance can be given that the Company will be able to obtain sufficient financing to cover such expenditures when required, or that such financing can be obtained on terms that are acceptable to the Company.

The Company’s ability to obtain financing to fund its exploration activities and, if warranted, development of any of its properties, will be significantly affected by mineral prices.

The ability of the Company to obtain financing to fund its exploration activities and, if warranted, development of any of its properties, will be significantly affected by changes in the market price of the metals for which it explores. Mineral prices are subject to fluctuation. The effect of these factors cannot accurately be predicted. The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of mineral resource are discovered, a profitable market will exist for the sale of the same.

Factors beyond the control of the Company may affect the marketability of any Cu, Mo, Au, Ag or any other materials discovered. The prices of Cu, Mo, Au, Ag and other minerals are affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, Canadian dollars relative to other currencies), interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. In addition, the world supplies of and demands for of Cu, Mo, Au, Ag and other minerals can cause fluctuations in the price of such minerals.

Development of any of the Company’s properties, if warranted, will be subject to financing risks and potential delays.

Inability to obtain financing, technical considerations, delays in obtaining governmental approvals, and other factors could cause delays in developing any of the Company’s properties that may in the future be determined to contain a commercially mineable orebody.

If it is determined that a commercially mineable orebody exists and it can be economically exploited, the Company will require significant additional financing in order to fund the costs of developing it, or the Company’s other properties, into commercial production, if warranted. The Company may have to seek additional funds through public and private share offerings, arrangements with collaborative parties, or debt financing. There can be no assurance that the Company will be successful in its efforts to raise these required funds, or that it will be able to raise the funds on terms that do not result in high levels of dilution to shareholders.

Before development and production can commence on any of its properties, the Company must obtain regulatory and environmental approvals. There is no assurance that such approvals will be obtained on a timely basis or at all. The cost of compliance with changes in governmental regulations has the potential to reduce the profitability of operations or preclude entirely the economic development of a property.

Mining is one of the most intensely regulated businesses in Canada. The period of time required to obtain environment assessments, consult with aboriginal peoples and other stakeholders as well as governments at the Canadian provincial and federal level can take 10 (ten) years or more. No assurance can be given that permitting of any mine on the Company’s properties will occur.

The Company has a small staff and, as such, will also rely on third-party consultants and contractors – whose availability cannot be assured - to undertake its mineral exploration activities, as well as any future mine development and mining activities.

As the Company has a small staff, it will also rely on consultants and others for exploration, development, construction and operating expertise. No assurance can be given that such consultants and other contractors will be available when required, or that they can be retained on terms that are acceptable to the Company.

The Company may enter into agreements with Indigenous groups, inclusive of First Nations, in relation to its current and future exploration activities, and any potential future production, which could impact any expected earnings.

Our properties are located within First Nations asserted traditional territories, and the exploration and development of these properties may affect, or be perceived to affect, asserted aboriginal rights and title, which has the potential to manifest permitting delays or opposition by First Nations communities.

The Company is working to establish positive relationships with First Nations. As part of this process the Company may enter into agreements, commensurate with the stage of activity, with First Nations in relation to current and future exploration and any potential future production. This could impact any expected earnings.

The Company is subject to intense competition.

The mining industry is competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Because of the high costs associated with exploration, the expertise required to analyze a project's potential and the capital required to develop a mine, larger companies with significant resources may have a competitive advantage over Amarc. Amarc faces strong competition from other mining companies, some with greater financial resources, operational experience and technical capabilities than those that Amarc possesses. As a result of this competition, Amarc may be unable to maintain or acquire financing, personnel, technical resources or attractive mining properties on terms Amarc considers acceptable or at all.

The Company is subject to certain risks that are not insurable.

Hazards such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and development. Amarc may become subject to liability for pollution or hazards against which it cannot insure. The payment of such liabilities could result in increases in Amarc's operating expenses which could, in turn, have a material adverse effect on Amarc's financial position and its results of operations. Although Amarc maintains liability insurance in an amount which it considers adequate, the nature of these risks is such that the liabilities might exceed policy limits, the liabilities and hazards might not be insurable against, or Amarc might elect not to insure itself against such liabilities due to high premium costs or other reasons. In these events, Amarc could incur significant liabilities and costs that could materially increase Amarc's operating expenses.

The Company’s operations are and will be subject to environmental regulations which can significantly increase compliance costs and subject the Company to potential liability.

All of the Company's operations are and will be subject to environmental regulations, which can make operations more expensive or potentially prohibit them altogether. Many of the regulations require the Company to obtain permits for its activities. The Company must update and review its permits from time to time, and is subject to environmental impact analyses and public review processes prior to approval of the additional activities. Amarc may be subject to the risks and liabilities associated with potential pollution of the environment and the disposal of waste products that could occur as a result of its activities.

To the extent the Company is subject to environmental liabilities, the payment of such liabilities or the costs that it may incur to remedy environmental pollution would reduce funds otherwise available to it and could have a material adverse effect on the Company. If the Company is unable to fully remedy an environmental problem, it might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential exposure may be significant and could have a material adverse effect on the Company.

Changes in government regulations and the presence of unknown environmental hazards on the Company’s mineral properties may result in significant unanticipated delays, as well as significant compliance costs.

Changes to existing environmental legislation, regulations and actions could give rise to additional expense, capital expenditures, restrictions and delays in the activities of the Company, the extent of which cannot be predicted. Regulatory requirements and environmental standards are subject to constant evaluation and may be significantly increased. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have a significant impact on some portion of the Company's business, causing those activities to become economically unattractive at that time.

Trading in the Company’s common shares is subject to volatility.

There can be no assurance that an active trading market in the Company's securities will be established or sustained. The market price for the Company's securities is subject to wide fluctuations. Factors such as announcements of exploration results, as well as market conditions in the industry, may have a significant adverse impact on the market price of the securities of the Company. Shares of the Company are suitable only for those who can afford to lose their entire investment. The stock market has from time to time experienced extreme price and volume fluctuations, which have often been unrelated to the operating performance of particular companies.

Certain of the Company's directors and officers may be subject to conflicts of interest.

Certain of the Company's directors and officers may serve as directors or officers of other companies or companies providing services to the Company or they may have significant shareholdings in other companies. Situations may arise where these directors and/or officers of the Company may be in competition with the Company. Any conflicts of interest will be subject to and governed by the law applicable to directors' and officers' conflicts of interest. In the event that such a conflict of interest arises at a meeting of the Company's directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In accordance with applicable laws, the directors of the Company are required to act honestly, in good faith and in the best interests of the Company.

The Company is unlikely to be in a position to pay dividends for the foreseeable future.

There is no assurance that the Company will pay dividends on its shares in the foreseeable future. The Company will likely require all its funds to further the development of its business.

The Company is vulnerable to changes in the financial markets.

Market conditions and unexpected volatility or illiquidity in financial markets may adversely affect the prospects of the Company and the value of its shares.

The Company will be dependent on the continued services of its senior management team, and its ability to retain other key personnel.

The Company will be dependent on the continued services of its senior management team, and its ability to retain other key personnel. The loss of such key personnel could have a material adverse effect on the Company. There can be no assurance that any of the Company's employees will remain with the Company or that, in the future, the employees will not organize competitive businesses or accept employment with companies competitive with the Company.

Furthermore, as part of the Company's growth strategy, it must continue to hire highly qualified individuals. There can be no assurance that the Company will be able to attract, assimilate or retain qualified personnel in the future, which would adversely affect its business.

Changes in government rules, regulations or agreements, or their application, may negatively affect the Company’s ownership rights, its access to or its ability to advance the exploration and development of its mineral properties.

The government currently has in place or may in the future implement laws, regulations, policies or agreements that may negatively affect the Company’s ownership rights with respect to its mineral properties or its access to the properties. These may restrain or block the Company’s ability to advance the exploration and development of its mineral properties or significantly increase the costs and timeframe to advance the properties.

If the Company raises additional funding through equity financings, then the Company's current shareholders will suffer dilution.

The Company will require additional financing in order to complete full exploration of the Company's mineral properties. Management anticipates that the Company will have to sell additional equity securities including, but not limited to, its common stock, share purchase warrants or some form of convertible security. The effect of additional issuances of equity securities will result in the dilution of existing shareholders' percentage ownership interests.

The Company believes it is likely a “passive foreign investment company” which may have adverse U.S. federal income tax consequences for U.S. shareholders.

U.S. shareholders should be aware that the Company believes it was classified as a passive foreign investment company (“PFIC”), as defined in Section 1297 of the Internal Revenue Code of 1986, as amended, during one or more previous tax years, and may be a PFIC in the current tax year and possibly in subsequent tax years. If the Company is a PFIC for any tax year during a U.S. shareholder's holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of common shares, or any so-called “excess distribution” received on its common shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective “qualified electing fund” election or a “mark-to-market” election with respect to the common shares. A U.S. shareholder who makes a qualified electing fund election generally must report on a current basis its share of the Company's net capital gain and ordinary earnings for any tax year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer's basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “Certain United States Federal Income Tax Considerations.” Each U.S. shareholder should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of common shares.

The Company's shareholders could face significant potential equity dilution as a result of grants under the Company’s stock option plan.

Amarc has a stock option plan which allows the management to issue options to its employees and non-employees based on the policies of the Company. If further shares, options, or warrants are issued, they will likely act as an upside damper on the trading range of the Company's shares. As a consequence of the passage of time since the date of their original sale and issuance, none of the Company's shares remain subject to any hold period restrictions in Canada or the United States. The unrestricted resale of outstanding shares from the exercise of dilutive securities may have a depressing effect on the market for the Company's shares.

Penny stock classification could affect the marketability of the Company's common stock and shareholders could find it difficult to sell their stock.

The penny stock rules in the United States require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation.

Further, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These additional broker-dealer practices and disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the Company's common shares in the United States, and shareholders may find it more difficult to sell their shares.

The Company's financial statements have been prepared assuming the Company will continue on a going concern basis, but there can be no assurance that the Company will continue as a going concern.

The Company’s financial statements have been prepared on the basis that it will continue as a going concern. The Company has prioritized the allocation of available financial resources in order to meet key corporate and mineral development expenditure requirements in the near term. The costs required to complete exploration and development of the Company's projects may be well in excess of this amount. Accordingly, unless additional funding is obtained, the going concern assumption may have to change. If Amarc is unable to obtain adequate additional financing, the Company will be required to curtail operations and exploration activities. Furthermore, failure to continue as a going concern would require that Amarc's assets and liabilities be restated on a liquidation basis which could differ significantly from the going concern basis.

The Company may from time to time be subject to litigation.

The Company may in future be subject to legal proceedings. If the Company is unable to resolve these matters favorably it may have a material adverse effect of the Company.

ITEM 4 INFORMATION ON THE COMPANY

A. HISTORY AND DEVELOPMENT OF THE COMPANY

Incorporation

Amarc Resources Ltd. was incorporated on February 2, 1993, pursuant to the Company Act (British Columbia, Canada) (the “BCCA”), as “Patriot Resources Ltd.” and changed its name on January 26, 1994 to “Amarc Resources Ltd.” The BCCA was replaced by the Business Corporations Act (British Columbia) (the “BCA”) in March 2004 and the Company is now governed by the BCA.

Amarc became a public company or “reporting issuer” in the Province of British Columbia (“BC”) on May 30, 1995. The common shares of Amarc were initially listed on the Vancouver Stock Exchange (“VSE”) on August 4, 1995, and continue to trade on the TSX Venture Exchange (“TSX Venture”) under the symbol AHR. The TSX Venture was formerly known as the Canadian Venture Exchange, the successor stock exchange to the VSE.

Amarc commenced trading on the OTC Bulletin Board (“OTCBB”) in the United States in June 2004 and on the OTCQB in August 2014 (at which time quotation of Amarc’s common shares on the OTCBB was discontinued), in each case under the symbol AXREF.

Offices

The head office of Amarc is located at 14th Floor, 1040 West Georgia Street, Vancouver, BC, Canada V6E 4H1, telephone (604) 684-6365, facsimile (604) 639-9209. The Company's registered office is in care of its attorneys, McMillan LLP, 1500 Royal Centre P.O. Box 11117, 1055 West Georgia Street, Vancouver, BC, Canada V6E 4N7, telephone (604) 689-9111, fax (604) 685-7084.

Auditor

The Company’s auditors are DeVisser Gray LLP, Vancouver, BC. PCAOB# 1054.

Company Development

Amarc has been engaged in the acquisition and exploration of mineral properties since its incorporation. The Company is currently actively exploring a number of properties located in BC, Canada. All of the Company's mineral properties are at the exploration stage.

B. BUSINESS OVERVIEW

The following information is compiled from Company files. All referenced news releases are filed as 6K reports on EDGAR. The technical work has been completed under the supervision of qualified person(s). The disclosure has been reviewed by Mark Rebagliati, P.Eng., who is a qualified person. Mr. Rebagliati is Technical Advisor – Consultant to the Company.

Summary

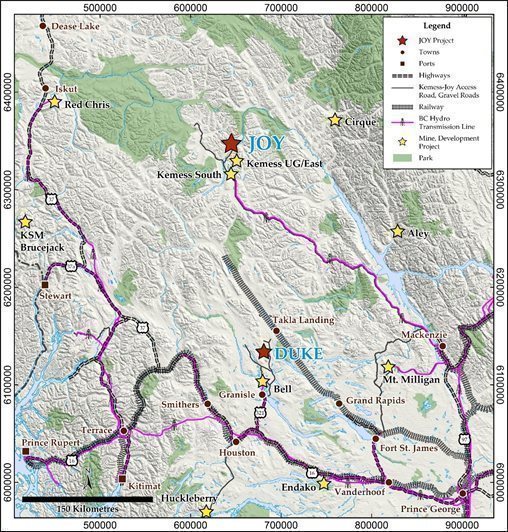

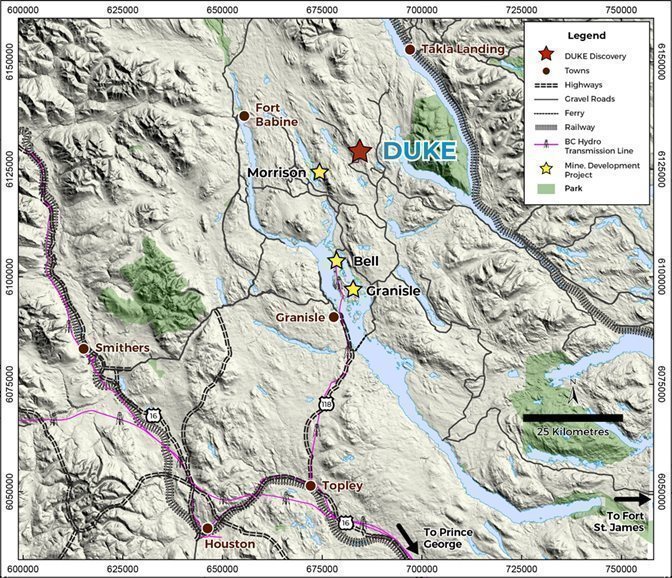

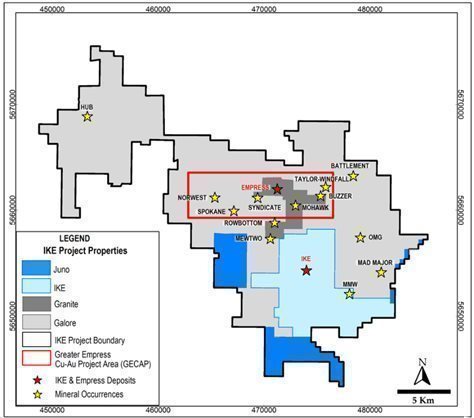

Amarc is focused on advancing its district-scale JOY, DUKE and IKE porphyry Cu±Au±Mo±Ag deposit projects (the “JOY District”, the “DUKE District” and the “IKE District”) in northern, central and southern BC, respectively. Figure 1 shows the location of the Amarc’s three projects in respect to operating and past producing mines, and advanced stage exploration projects held by other operators and focused on porphyry Cu deposits. Each of Amarc’s three districts is situated in proximity to industrial infrastructure – including power, highways and rail.

Figure 1

Note: Only the JOY, DUKE and IKE Districts denoted on the map with a “star” are owned by Amarc.

Amarc is the 100% owner and operator of the JOY, DUKE and IKE Districts. The properties consist of mineral claims (and in the case of IKE, also a few small crown grants1), which were acquired through agreements with previous owners or directly from the Government of BC by on-line staking (“Mineral Titles Online” or “MTO”). To keep mineral claims in good standing, exploration and development work or payment instead of exploration and development must be registered and payment received by MTO before midnight of the good-to-date of the claim. The cost is $5 per hectare in years 1 and 2, $10 per hectare in years 3 and 4, $15 per hectare in years 5 and 6 and $20/hectare in year 7 and thereafter. Excess work can be banked and applied to subsequent years.

The Company has received from the BC Ministry of Energy of Mines & Low Carbon Innovation all required permits for its proposed exploration activities, which include routine exploration permits for both drilling and Induced Polarization (“IP”) ground geophysical surveys.

Amarc works closely with local governments, indigenous groups and other stakeholders in order to advance its mineral projects responsibly, and to do so in a manner that contributes to sustainable community and economic development. The Company pursues early and meaningful engagement to ensure our mineral exploration and development activities are well coordinated and broadly supported, address local priorities and concerns, and optimize opportunities for collaboration. In particular, the Company seeks to establish mutually beneficial partnerships with indigenous groups within whose traditional territories its projects are located, through the provision of jobs, training programs, contract opportunities, capacity funding agreements and sponsorship of community events. All Amarc’s work programs are carefully planned to achieve high levels of environmental and social performance.

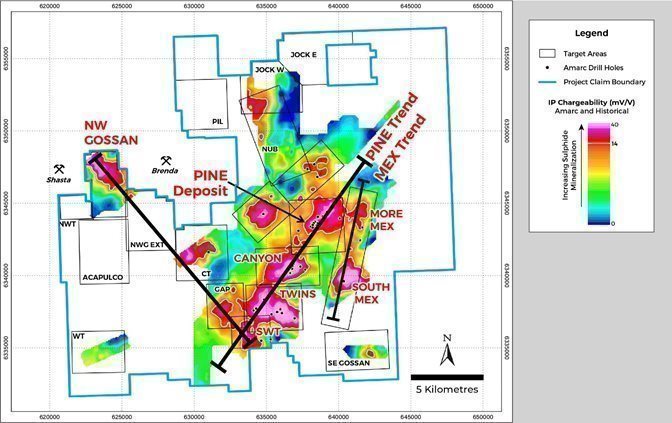

The JOY District covers the northern extension of the prolific Kemess porphyry Cu-Au district (the “Kemess District”) in the Toodoggone region of north-central BC. The JOY claims are located approximately 20 km north of the former Kemess South Mine and the government-approved Kemess Underground project, held by Centerra Gold. JOY is host to the open-ended PINE porphyry Cu-Au deposit (the “PINE Deposit”), the new deposit target discovery at Canyon and a pipeline of other large and high potential porphyry Cu-Au targets.

_____________________

1 Crown Grants are an old form of tenure that are small in area and on which certain mineral rights are granted. An annual rental is paid on the crown grants.

Amarc has entered into an agreement with Freeport-McMoRan Minerals Properties Canada Inc. (“Freeport”), a wholly owned subsidiary of Freeport-McMoRan Inc., to efficiently advance the JOY District. Under the terms of the agreement Freeport may acquire up to a 70% ownership interest by making staged investments totalling $110 million. Freeport increased its Year 1 contribution in the 2021 JOY exploration program by ~50% – from $4 million to $5.94 million (November 15, 2021 news release) and continued its earn-in on the JOY District funding approximately $14 million in 2022. The 2023 program was specifically designed to inform intended District-wide drilling in 2024. Amarc is the project operator.

The Amarc exploration team completed 15,427 m of helicopter-supported drilling at JOY in 2022, identifying several mineralized trends across the JOY District and indicating the potential for clustered porphyry deposits that remain to be fully explored. In addition, the mineralization at the PINE Deposit was expanded over 1,700 m, substantial new porphyry Cu-Au mineralization was discovered at the largely overburden covered Canyon deposit target; and widely spaced initial scout drilling of the Twins sulphide system encountered widespread porphyry Cu-Au mineralization, highlighting significant exploration potential.

In late May 2023, Amarc launched an exploration program that includes extensive airborne and surface surveys focused on the detailed refinement of multiple porphyry Cu-Au deposit targets clustered along the mineralized trends that extend over the property, in preparation for an extensive intended drilling program in 2024. The program will also include rehabilitation of road and bridge access to the PINE Cu-Au Deposit in the centre of the JOY tenure and other deposit targets to facilitate the ongoing detailed work and future drilling.

In July 2024, Amarc announced that a drilling-focused 2024 program, fully funded by Freeport, had commenced. The Company has the required drill and IP permits in hand for the work programs.

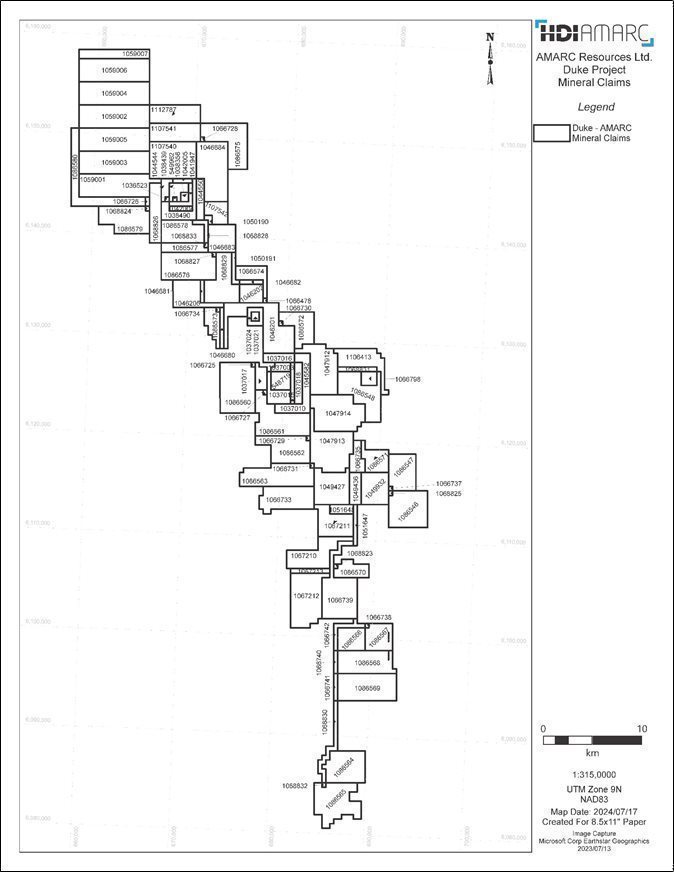

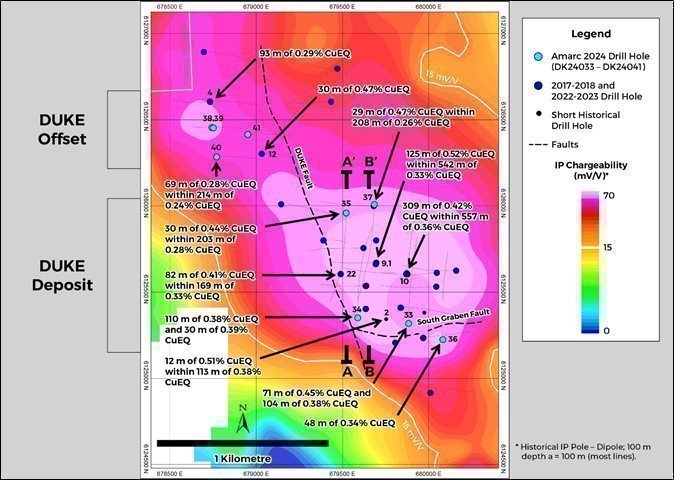

The DUKE District is located 80 km northeast of Smithers within the broader Babine District, a 40 by 100 km north-northwesterly striking mineralized belt that hosts Noranda Mines’ past producing Bell and Granisle Cu-Au mines. The DUKE District includes both the DUKE porphyry Cu-Mo-Au-Ag deposit target (the “DUKE Deposit”) and a series of high potential porphyry Cu-Au±Mo±Ag deposit targets generated from the Company’s comprehensive district-scale targeting programs.

Amarc has entered into a funding agreement on the DUKE District with Boliden Mineral Canada Ltd. (“Boliden”), a wholly owned subsidiary of the Boliden Group. Under the terms of the agreement, Boliden may earn up to a 70% ownership interest, by making staged exploration and development investments totalling $90 million (November 22, 2022 news release). Boliden invested $10 million through to the end of 2023 and will invest an additional $10 million through to the end of 2024. Amarc is the project operator.

Amarc initiated delineation drilling at the DUKE Deposit in late 2022 completing 11,086 m between early December 2022 and mid-March 2023. This drilling increased the size of the DUKE Deposit porphyry Cu–Mo-Au-Ag system, and also Amarc’s understanding of the controls on mineralization in the DUKE District. In May 2023, Amarc remobilized its exploration team to commence extensive airborne and ground exploration surveys designed to assess 16 prioritized porphyry Cu-Au targets across the DUKE District. These surveys defined the highest priority targets for 2024 drill testing, which include the Svea deposit target that shares many attributes with some of the premier deposits and occurrences within the Babine Cu-Au Region.

Amarc initiated an extensive drill program at DUKE in 2024; the winter drilling phase focused on the DUKE Deposit and the surrounding 4.7 km2 DUKE Target. In June 2024, drilling recommenced at site focused on DUKE District targets, beginning with the SVEA Cu-Au Deposit Target and the new JO porphyry Cu-Au discovery. Ground and airborne geophysical surveys are also currently underway. The Company has the required drill and IP permits in hand for the work programs.

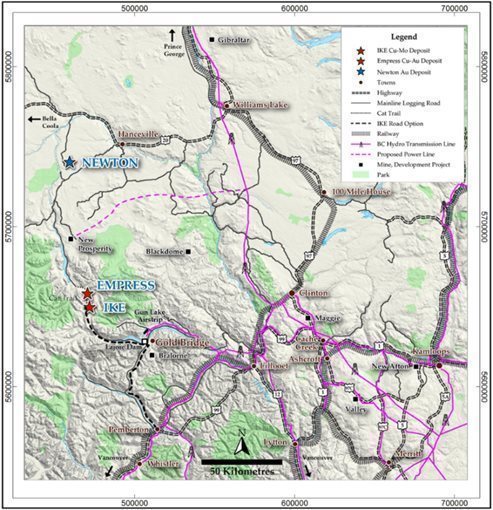

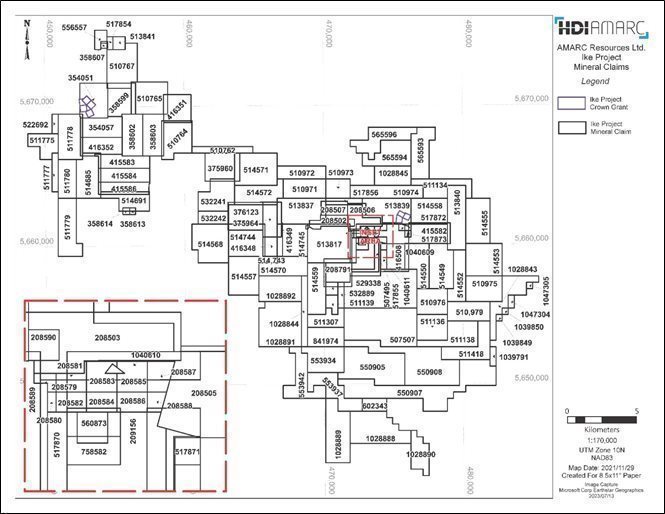

The IKE District is located 33 km northwest of the historical mining community of Gold Bridge near the heartland of BC’s producing porphyry Cu mines. The greater IKE District includes the IKE porphyry Cu-Mo-Ag deposit discovery (the “IKE Deposit”); the high potential Greater Empress Cu-Au Project (the “Greater Empress” area) that hosts the Empress Cu-Au-Ag deposit (the “Empress Deposit”) and other significant porphyry Cu-Au-Mo-Ag and Cu-Au-Ag replacement deposit targets; and also a number of promising epithermal Au-Ag targets. The IKE District geological setting shares many characteristics with porphyry districts around the globe that host major, and commonly multiple, Cu±Au±Mo±Ag deposits and has the potential to become an important mining camp.

It is Amarc’s intent to undertake in 2024 a well-planned core drilling program at the Empress and Empress East Deposits with a goal of expanding the higher grade Cu-Au mineralization which remains open. The Company plans to solo fund the program allocating $2 million from financing completed in late 2023. The Company has the required drill and IP permits in hand for the proposed work programs and is engaging with First Nations in the region.

JOY District

Location and Infrastructure

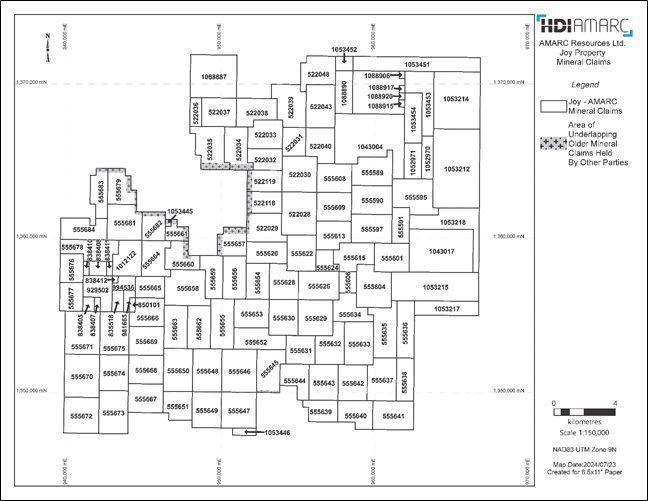

The JOY District is located in the Omineca Mining Division, approximately 310 km north of Mackenzie and 265 km north-northeast of Smithers in northern BC. The area of work is centred approximately at 57º 12’ N Latitude and 126º 43’ W Longitude; or UTM Zone 9 (NAD 83) at 6,343,500 m N and 638,500 m E. Figure 2 shows the location of the JOY District and infrastructure within the region.

Figure 2

Property Description

Amarc owns 100% interest in and is the operator of the JOY District. The project comprises the JOY, PINE and Paula properties acquired from other companies (as described below), and claims staked by Amarc. There are 122 mineral claims, covering an area of 49,519 hectares (122,364 acres) are shown in Figure 3. All of the claims have an expiry date of January 1, 2033.

Figure 3

On November 21, 2017, Amarc acquired 100% interest in the 7,200 hectare JOY property from United Minerals Services Ltd., a private vendor. The JOY property is subject to an underlying NSR royalty from production to a former owner, which is capped at $3.5 million.

On August 29, 2017, Amarc announced that it had concluded option agreements with each of Gold Fields Toodoggone Exploration Corporation (“Gold Fields”) and Cascadero Copper Corporation ("Cascadero"), which at that time held the PINE property in a 51%:49% joint venture that enabled Amarc to purchase 100% of the property. On December 31, 2018, Amarc completed the purchase of Cascadero’s 49% interest in the PINE Property. Further on December 9, 2019, Amarc announced that it had reached an agreement with Gold Fields to amend the option agreement between the parties and purchased outright the remaining 51% of the PINE property from Gold Fields.

Gold Fields retains a 2.5% NPI royalty on mineral claims comprising about 96% of the PINE property and a 1% NSR royalty on the balance of the claims. The NPI royalty can be reduced to 1.25% at any time through the payment to Gold Fields of $2.5 million in cash or shares. The NSR royalty can be reduced to 0.50% through the payment to Gold Fields of $2.5 million in cash or shares.

The PINE property is subject to a 3% underlying NSR royalty payable from production to a former owner and capped at $5 million payable from production.

In November 2019 Amarc entered into a purchase agreement with two prospectors to acquire 100% of a single mineral claim, called the Paula property, located internal to the wider JOY project tenure. The claim is subject to a 1% NSR royalty payable from commercial production that is capped at $0.5 million.

Agreement with Freeport

On May 12, 2021, Amarc announced it entered into an agreement with Freeport pursuant to which Freeport may acquire, through a staged two-stage option up to a 70% ownership interest in the mineral claims comprising the JOY District, plus other rights and interests, over up to a 10-year period.

To earn an initial 60% interest, Freeport is required to fund $35 million of work expenditures over a 5-year term. During the first year of the earn-in, a $4 million work program is required in the JOY District. Annual optional earn-in expenditures can be accelerated by Freeport at its discretion. Amarc will be operator during the initial earn-in period. Once Freeport has acquired such 60% interest, Amarc and Freeport will proceed to explore and develop the JOY District through a jointly owned corporation with Freeport assuming project operatorship.

Upon Freeport earning such 60% interest, it can elect, in its sole discretion, to earn an additional 10% in the mineral claims comprising the JOY District, plus other rights and interests (for a total 70% interest) by sole funding a further $75 million within the following five years.

Once Freeport has finalized its earned ownership interest at either the 60% or 70% level, each party will be responsible for funding its own pro-rata share of project costs on a 60:40 or 70:30 basis.

Project Highlights

The PINE Deposit within the JOY District has seen several phases of historical exploration and drilling. Work by Amarc prior to 2021 identified significant expansion potential at both the PINE Deposit and the MEX deposit target requiring drill testing; and defined seven other large (approximately 1 to 5 km2), high potential porphyry Cu-Au exploration target areas with multiple targets either drill-ready, or which could be rapidly brought up to a drill ready status by the completion of focused surface surveys. A highly effective targeting strategy was initially achieved by combining and interpreting information from the Company’s exploration surveys and extensive historical datasets, including results from soil geochemical sample grids, airborne magnetics and IP geophysical surveys, geological and alteration mapping and historical drilling.

In 2021, Amarc work crews completed a comprehensive exploration program at JOY, designed to advance delineation of the PINE Deposit as well as assess several of the high potential deposit targets (November 15, 2021 news release). This program included the drilling of nine core drill holes (over 4,300 m) and the relogging of over 60 historical core drill holes, mainly from the PINE porphyry Cu-Au deposit, along with completion of 42 line-km of IP geophysical survey, and collection of 684 grid soil geochemical samples and 179 rock geochemical samples during geological traverses over a number of the target areas.

Three long core holes (up to 701 m in length) (March 7, 2022 news release) in the PINE Deposit intercepted significant mineralization over a strike length of 1,100 m and to a vertical depth of at least 550 m. These drill holes intercepted some of the highest grade of Cu-Au mineralization over the longest intervals that had been encountered to date at the PINE Deposit. Highlights from the 2021 PINE drilling include:

| · | 101.90 m of 0.56% CuEQ2 (0.23% Cu, 0.57 g/t Au and 2.4 g/t Ag) (JP21007) |

| · | 29.00 m of 0.46% CuEQ (0.20% Cu, 0.44 g/t Au and 2.1 g/t Ag) (JP21007) |

| · | 66.60 m of 0.40% CuEQ (0.21% Cu, 0.32 g/t Au and 1.5 g/t Ag) (JP21008) |

| · | 244.10 m of 0.35% CuEQ (0.11% Cu, 0.41 g/t Au and 1.2 g/t Ag) (JP21009) |

| · | 135.00 m of 0.44% CuEQ (0.14% Cu, 0.53 g/t Au and 1.2 g/t Ag) (JP21009) |

A majority of the historical core holes drilled at PINE at that time had been collared within a restricted 900 x 600 m area. Reinterpretation of the 60+ mainly short (80% extend to <200 m vertical depth) and largely widely spaced historical drill holes and Amarc’s 2021 holes show good potential to expand the PINE Deposit internally (between the widely spaced drill holes), laterally (beyond the footprint of current drilling) and to depth.

The 2021 work at PINE also indicated significant potential for the discovery of other centres of porphyry Cu-Au mineralization within the area of the overall PINE mineralized system. Amarc's hole JP21009, located 500 m northeast of the PINE Deposit, returned 244.1 m of 0.35% CuEQ (0.11% Cu, 0.41 g/t Au and 1.2 g/t Ag), including 135 m of 0.44% CuEQ (0.14% Cu, 0.53 g/t Au and 1.2 g/t Ag), indicating high potential to the northeast (March 7, 2022 news release). Historical drilling also indicates significant potential to the southwest of the PINE Deposit. For example, the historical hole located furthest away to the southwest but within the current known limits of the PINE system (PIN09-04) returned 105 m at 0.17% CuEQ (0.08% Cu, 0.15 g/t Au and 1.1 g/t Ag).

The JOY District also hosts five deposit-scale porphyry Cu-Au targets (including Canyon, Twins and MEX), which have the potential to form a major cluster of Cu-Au mineralized porphyry systems. In 2021 Amarc drilled five initial scout exploration core holes (271 m to 404 m in length) in 2021 to test four of the porphyry Cu-Au deposit targets confirmed by IP, airborne magnetics, geochemical and geological surveys. Drill results from 2021 and at Canyon and Twins are discussed with those from 2022 under Recent Work – 2022 Program. At the MEX Cu-Au deposit target, a single hole (JP21002) drilled by Amarc in 2021 intersected anomalous Cu and Au concentrations lateral to and below historical drilling, returning 153 m of 0.17% CuEQ (0.09% Cu, 0.13 g/t Au). At the North MEX target, a single hole (JP21003) was drilled to test a multi-element geochemical anomaly. No significant Cu or Au concentrations were encountered in that hole.

___________________

2 See Table 1, Note 4 for CuEQ calculations.

For further 2021 information see Amarc 2022 Form on 20F filed on EDGAR.

In 2022, Amarc completed 37 core holes (15,427 m) that considerably expanded the PINE Deposit to over a 1,700 m strike length, discovered new porphyry Cu-Au mineralization at the 5 km2 Canyon deposit target, and further defined additional deposit-scale porphyry systems requiring exploration drilling.

Highlights from 2022 PINE Deposit Drilling include:

| · | 204 m of 0.42% CuEQ (0.18% Cu, 0.41 g/t Au and 2.3 g/t Ag) (JP22010) |

| · | 105 m of 0.40% CuEQ (0.13% Cu, 0.47 g/t Au and 1.8 g/t Ag) (JP22013) |

| · | 107 m of 0.31% CuEQ (0.09% Cu, 0.37 g/t Au and 1.2 g/t Ag) (JP22015) |

| · | 179 m of 0.32% CuEQ (0.11% Cu, 0.36 g/t Au and 1.2 g/t Ag) (JP22017) |

Highlights from the new Canyon Porphyry Cu-Au Discovery include:

| · | 96 m of 0.51% CuEQ (0.39% Cu, 0.18 g/t Au and 2.6 g/t Ag), within |

| | 296 m of 0.39% CuEQ (0.30% Cu, 0.14 g/t Au and 1.7 g/t Ag) (JP22030) |

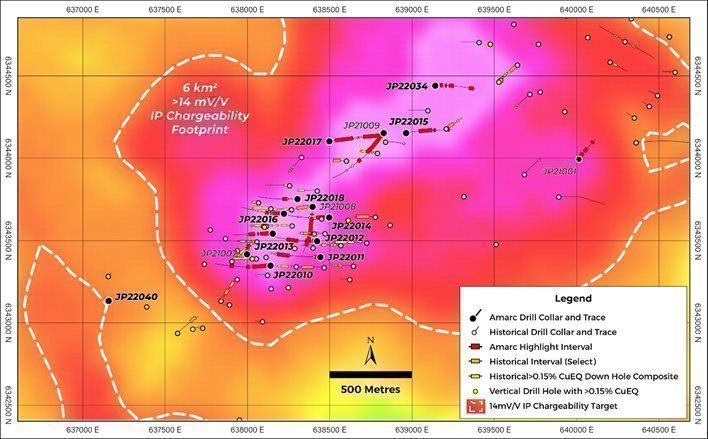

Expansion of the PINE Porphyry Cu-Au Deposit Over 1,700 m of Strike Length: The 11 core holes (up to 781 m in length) completed at the PINE Deposit in 2022 intercepted significant mineralization, extending the footprint of the deposit over a strike length of 1,700 m (Table 1, Figures 4 and 5) with outboard, wider spaced and mainly historical drilling indicating the potential to expand this footprint to over 2,600 m. Drilling is also highlighting the favorable geometry of the PINE Deposit: most of the known mineralization occurs from surface to 300 m depth, and locally extends to 550 m depth. Additionally, the PINE Deposit and its expansion potential is hosted within a larger 6 km2 mineralized system, which remains to be fully explored (March 2, 2023 news release).

Notably, additional centers of higher Cu-Au grade are beginning to emerge along the 1,700 m PINE Deposit trend. For example, Amarc drilling in the northeastern area of this trend intersected significant porphyry mineralization over 600 m of strike length, including:

| · | 63 m of 0.44% CuEQ, within 179 m of 0.32% CuEQ (JP22017)3 |

| · | 57 m of 0.40% CuEQ, within 107 m of 0.31% CuEQ (JP22015) |

| · | 135 m of 0.44% CuEQ, within 244 m of 0.35% CuEQ (JP21009 completed in 2021) |

Discovery At Canyon Deposit Target Highlights Potential for Clustered Deposits: Eight extensive porphyry Cu-Au deposit targets were explored with 26 scout drill holes in 2022, including four targets that had not previously been drill tested. The Canyon (5 km2), Twins (7 km2) and SWT (3 km2) Deposit Targets and the PINE (6 km2) Deposit form the 15.5 km northeast trending PINE Trend. The South Mex (>1.9 km2) open deposit target is located at the south end of the 6 km-long MEX Trend (January 23, 2023 news release).

At Canyon, very limited initial scout drilling of this expansive (5 km2) and largely covered sulphide system by Amarc in 2021 (JP21006: 27 m of 0.18% CuEQ with 0.06% Cu, 0.21 g/t Au) (March 7, 2022 news release) and historical operators (MEX12-013: 49 m of 0.16% CuEQ with 0.05% Cu, 0.20 g/t Au, and PIN09-15: 3 m of 11 g/t Au), intersected promising Cu-Au and Au-only mineralization compatible with the fringes of a potentially important porphyry Cu-Au system. Further reconnaissance drilling at Canyon in 2022 discovered a significant new zone of porphyry Cu-Au mineralization with hole JP22030 intersecting:

| · | 96 m of 0.51% CuEQ (0.39% Cu, 0.18 g/t Au and 2.6 g/t Ag), within 296 m of 0.39% CuEQ (0.30% Cu, 0.14 g/t Au and 1.7 g/t Ag) |

| · | 10.5 m of 0.77% CuEQ (0.61% Cu, 0.25 g/t Au, 2.1 g/t Ag) |

Four other scout drill holes intersected less robust Cu-Au mineralization disrupted by inter-mineral intrusions. The Canyon discovery remains open to expansion and requires substantial drilling, as does the host 5 km2 IP geophysical anomaly which indicates the presence of a large-scale sulphide system.

The highly prospective Twins (7 km2) deposit target is located adjacent and to the southwest along the 15.5 km PINE Trend from Canyon. A single scout drill hole completed by Amarc in 2021 (JP21004), the first ever drilled into the large Twins target, intersected 63 m of 0.18% CuEQ with 0.09% Cu, 0.15 g/t Au, 0.5 g/t Ag, including 39 m of 0.22% CuEQ with 0.11% Cu, 0.19 g/t Au, 0.6 g/t Ag, successfully discovering porphyry-type Cu-Au mineralization (March 7, 2022 news release) within this large mineralized sulphide system. In 2022, very widely spaced follow-up reconnaissance drill holes, ranging in length from 216 m to 384 m, targeted magnetic high features within the extensive IP chargeability footprint (Figure 5) and encountered widespread indications of porphyry Cu-Au mineralization.

________________________

3 Grade for each element that comprises the CuEQ for holes JP22017, JP22015 are shown in Table 1 and for JP21009 is 0.14% Cu, 0.53 g/t Au and 1.2 g/t Ag.

Based on comparisons with the Canyon discovery and the PINE Deposit, intervals of porphyry Cu-Au mineralization, including 27 m of 0.29% CuEQ (0.12% Cu, 0.30 g/t Au, 1.2 g/t Ag) in JP22019 and 204 m of 0.11% CuEQ (0.03% Cu, 0.14 g/t Au, 0.4 g/t Ag) in JP22020, may represent the lateral or upper parts of a yet undiscovered porphyry Cu-Au center (March 2, 2023 news release). The large footprint of this target, its veneer of glacial overburden cover, and Cu-Au intercepts in the widely spaced and relatively shallow drill holes highlight the significant exploration potential for the discovery of another porphyry Cu-Au deposit at Twins.

Systematic Exploration of Emerging Deposit Targets: In 2022, a similar strategy of initial drill testing with single to widely spaced shorter scout drill holes was employed at other overburden-covered targets, including South MEX, South Finlay, North Finlay and CT, with results indicating continued systematic exploration is warranted. At South MEX, a single scout drill hole, the first in this >1.9 km2 IP chargeability anomaly which remains open to expansion, intersected anomalous Au-Cu-Ag (72 m of 0.10% CuEQ (0.02% Cu, 0.10 g/t Au, 3.4 g/t Ag) in JP22041) in volcanics that straddle the prospective Triassic-Jurassic contact: a geological environment similar to that hosting the Kemess District porphyry Cu-Au deposits (January 23, 2023 and March 2, 2023 news releases).

Scout drilling at SWT returned local zones of anomalous Au-Cu compatible with proximity to a porphyry Cu-Au system (e.g. 78 m of 0.08% CuEQ (0.02% Cu, 0.11 g/t Au, 0.4 g/t Ag) in JP22028), as well as local vein-hosted Au-only mineralization (2.7 m of 3.7 g/t Au in JP22024). At the adjacent Wrich occurrence, Au-Ag-Cu mineralization (108 m of 0.20% CuEQ (0.03% Cu, 0.23 g/t Au, 6.4 g/t Ag) in JP22044) is associated with advanced argillic alteration zones and may represent a higher-level signature of a porphyry Cu-Au system (March 2, 2023 news release).

Table 1: JOY 2022 Drill Program Assay Results

Target | Drill Hole5 | Azim (°) | Dip (°) | EOH (m) | Incl. | From (m) | To (m) | Int.123 (m) | CuEQ4 (%) | Cu (%) | Au (g/t) | Ag (g/t) |

PINE | JP22010 | 265 | -60 | 681.00 | | 18.96 | 223.03 | 204.07 | 0.42 | 0.18 | 0.41 | 2.3 |

| | | | | Incl. | 18.96 | 49.35 | 30.39 | 0.44 | 0.12 | 0.55 | 2.0 |

| | | | | Incl. | 84.83 | 223.03 | 138.20 | 0.48 | 0.22 | 0.43 | 2.8 |

| | | | | and | 84.83 | 128.95 | 44.12 | 0.58 | 0.26 | 0.53 | 3.3 |

| | | | | and | 141.82 | 223.03 | 81.21 | 0.51 | 0.24 | 0.45 | 2.9 |

| | | | | | 258.00 | 296.70 | 38.70 | 0.51 | 0.25 | 0.44 | 2.7 |

| | | | | Incl. | 258.00 | 285.81 | 27.81 | 0.62 | 0.29 | 0.54 | 3.3 |

| | | | | | 455.51 | 505.79 | 50.28 | 0.34 | 0.15 | 0.32 | 1.7 |

PINE | JP22011 | 265 | -60 | 637.78 | | 35.00 | 65.00 | 30.00 | 0.22 | 0.06 | 0.27 | 1.5 |

| | | | | | 386.00 | 542.00 | 156.00 | 0.36 | 0.20 | 0.25 | 2.5 |

| | | | | Incl. | 386.00 | 458.00 | 72.00 | 0.44 | 0.23 | 0.35 | 2.9 |

| | | | | Incl. | 494.00 | 539.00 | 45.00 | 0.41 | 0.24 | 0.25 | 2.8 |

PINE | JP22012 | 265 | -60 | 597.00 | | 41.50 | 54.52 | 13.02 | 0.26 | 0.12 | 0.22 | 2.0 |

| | | | | | 73.00 | 141.00 | 68.00 | 0.31 | 0.13 | 0.29 | 2.0 |

| | | | | Incl. | 126.00 | 141.00 | 15.00 | 0.49 | 0.20 | 0.49 | 2.7 |

| | | | | | 221.40 | 354.00 | 132.60 | 0.32 | 0.15 | 0.26 | 2.4 |

| | | | | Incl. | 221.40 | 301.48 | 80.08 | 0.35 | 0.17 | 0.30 | 2.7 |

PINE | JP22013 | 265 | -60 | 516.00 | | 48.00 | 153.00 | 105.00 | 0.40 | 0.13 | 0.47 | 1.8 |

| | | | | Incl. | 59.20 | 96.00 | 36.80 | 0.44 | 0.16 | 0.48 | 2.3 |