Questor Technology Inc. (“Questor” or the “Company”) (TSX-V: QST)

announced today its financial and operating results for the first

quarter of 2020.

FIRST QUARTER 2020 RESULTS

(Stated in Canadian dollars except per share and

unit data)

|

Three Months Ended March 31, |

2020 |

2019 |

Increase |

|

(decrease) |

| |

|

|

|

|

Revenue |

4,489,470 |

7,720,488 |

(3,231,018) |

|

Gross profit |

1,986,946 |

4,418,783 |

(2,431,837) |

|

Earnings for the period |

1,265,452 |

2,336,069 |

(1,070,617) |

|

Gross profit as a percent of revenue |

44% |

57% |

(13)% |

|

Net cash generated from operating activities |

1,360,790 |

1,631,394 |

(270,604) |

|

Earnings per share |

|

|

|

|

Basic |

0.05 |

0.09 |

(0.04) |

|

Diluted |

0.05 |

0.09 |

(0.04) |

|

|

| |

|

|

Increase |

|

As at |

March 31, 2020 |

December 31, 2019 |

(decrease) |

| Total

assets |

41,173,274 |

42,110,012 |

(936,738) |

| Total

equity |

37,046,477 |

35,333,667 |

1,712,810 |

|

Shares outstanding(1) |

|

Basic |

27,348,018 |

27,048,432 |

299,586 |

|

Diluted |

27,815,940 |

27,649,762 |

166,178 |

|

|

|

|

|

| (1) |

Weighted

average shares outstanding during the year. |

Questor’s Audited Consolidated Financial Statements and

Management’s Discussion and Analysis for the three months ended

March 31, 2020 are available on the Company’s website at

www.questortech.com and through SEDAR at www.sedar.com.

PRESIDENT’S MESSAGE

The Questor team delivered $4.5 million of

revenue this quarter, a 42% decline from the same period in 2019.

The results for the three months ended March 31,2020 reflect the

significant impact of the Coronavirus pandemic and the commodity

price collapse that started impacting industry activity in February

2020. In March 2020, we saw a return of rental units and suspension

of sales orders, as our clients cut capital and shut in production

to reduce costs and conserve cash. Gross profit decreased $2.4

million to $2.0 million in this quarter from $4.4 million in Q1

2019. Earnings for this period are $0.05 per share vs. $0.09 per

share in the corresponding period in 2019. We finish this quarter

in strong financial position with $15 million of cash in the bank,

zero debt and $20 million of working capital.

We have and continue to take action to reduce

costs to ensure the long-term strength of the organization. The

Company expects these fixed cost reduction measures will reduce

year over year fixed costs by approximately 20%. While these cost

reductions are significant, the Company will continue to look at

all aspects of its business for further business optimization

opportunities in these uncertain times. The Federal Government of

Canada announced a new wage subsidy program recently, and we will

assess how this and other available programs can be utilized to

reduce the impact of this downturn on our staffing levels going

forward. Audrey

Mascarenhas, Questor’s CEO stated: “Financially, the progress we

have achieved over the last three years leaves Questor well

positioned to navigate this challenging environment. Our balance

sheet demonstrates the financial flexibility of the company and we

will continue to ensure that our liquidity needs are not

compromised. With future industry activity levels uncertain, we

will manage the business accordingly and will continue to operate

at the highest efficiency to further protect the interests of all

our stakeholders. Questor’s strong balance sheet with zero debt,

our substantial cash reserves, and large rental fleet will enable

us to plan and strategize during this challenging market cycle and

emerge as a stronger company. This strong foundation will enable us

to move forward on a series of strategic initiatives and support

our exponential growth when the market’s confidence has returned.

Questor intends to preserve its cash flow through 2020 and continue

to be fiscally responsible, making prudent capital investments

during this challenging period.”

The Company believes that the clean technology

industry will remain an integral component of resource development

over the medium to long term and that Questor will be well

positioned given its focus on top-tier service, quality, logistics

management and our best in class equipment. The Company’s proven,

cost effective technology solutions will play an instrumental role

in enabling our customers to meet their emission goals and

targets.

The Company has focused its strategy to be

positioned to capitalize on opportunities coming out of this

downturn. During this time, we will be focusing our marketing

efforts, educating our customers around our solutions for combating

emissions, diversifying into other industries and expanding our

waste heat to power offering. To support this effort a corporate

rebranding is underway. We will continue to build our digital

capability focused on an emissions platform that will eventually

enable us to credibly quantify emission reductions for our clients

and guarantee a zero emissions site, with the end goal of

monetizing the emission reduction offsets.

In April, the Canadian federal government

announced it will invest $1.7 billion to clean up abandoned and

inactive natural gas and oil wells. In addition, it will establish

a $750 million Emission Reduction Fund, with a focus on methane, to

create and maintain jobs through pollution reduction efforts. This

goes a long way toward indicating the federal government does

understand the importance of this industry and the struggles it

currently faces. The Company currently evaluating opportunities in

this area. The Company believes that it is uniquely positioned

within the market to offer products and services to support these

initiatives.

Our underlying theme for this down cycle is

resilience and we are approaching 2020 with strategic discipline, a

focus on consistent execution, a strong balance sheet, great

products, a clear commitment to environmental, social and

governance leadership and an excellent team that is experienced

with challenge and change. The Company is confident that with our

base, our approach to business and outstanding customer service, we

will emerge from this challenge, poised for continued success.

FIRST QUARTER 2020 OVERVIEW

- The worldwide pandemic and commodity price collapse negatively

impacted the Company’s activity starting in February 2020 with more

significant returns of rental units and suspension of sales orders

occurring during the month of March 2020.

- Revenue decreased $3.2 million (42 percent) for the three

months ending March 31, 2020 versus the same period in 2019:

- Incinerator equipment sales decreased 13 percent from $2.5

million in 2019 to $2.2 million in 2020;

- Revenue from incinerator rentals decreased 54 percent from $4.5

million in 2019 to $2.0 million in 2020;

- Incinerator service revenue decreased 61 percent from $0.8

million in 2019 to $0.3 million in 2020;

- During the first quarter of 2020, the Company sold and

delivered 6 incinerator units to customers.

- Gross profit decreased $2.4 million (55 percent) from $4.4

million in 2019 to $2.0 million in 2020:

- Gross profit as a percentage of revenue decreased from 57

percent in 2019 to 44 percent in 2020;

- The Company implemented a mitigation strategy subsequent to the

first quarter of 2020. The strategy revolves around:

- Managing operations infrastructure ensuring indirect

operational resources are consistent with activity;

- Commitment to supply chain management focused on procuring

quality materials and sourcing materials at competitive

prices.

- Gain on foreign exchange increased $1.0 million from 2019 to

2020:

- The Company recorded a $0.9 million foreign exchange gain

versus a $0.1 million loss in 2019. The Canadian dollar weakened

significantly versus the US dollar in the first three months of

2020 due to the collapse of energy commodity prices and general

financial market uncertainty.

- Earnings decreased $1.0 million (46 percent) from 2019 to

2020.

- The Company continues to be in a strong financial position at

March 31, 2020:

- Cash increased to $14.9 million from $13.5 million at December

31, 2019;

- The Company has an undrawn $1.0 million revolving demand loan

facility and an undrawn $5.0 million capital loan facility;

- Healthy cash reserves provide the working capital to thrive

during tough market cycles;

- Strong balance sheet that will serve as a foundation to launch

into new products and markets once the economy rebounds;

- The Company has suspended capital expansion plans until there

is a sustained commodity price recovery. This strategy preserves

our liquidity while improving capital efficiency;

- The Company applied increased focus on operating efficiencies

and enhancing cash flow by working with our service providers to

further reduce costs.

OUTLOOK

Key Markets

In response to the COVID-19 pandemic,

governmental authorities in Canada and internationally have

introduced various recommendations and measures to try to limit the

spread of the virus, including travel restrictions, border

closures, non-essential business closures, quarantines,

self-isolations, shelters-in-place and social distancing. Those

measures are having a significant impact on the private sector and

individuals, including unprecedented business, employment and

economic disruptions. The continued spread of COVID-19 nationally

and globally has had, and will continue to have, a material adverse

effect on our business, operations and financial results. In

addition, the unprecedented reduction of crude oil prices due to

excessive supply compared to energy consumption, notwithstanding

the recent agreement among OPEC members and other global oil

producing countries to implement supply reductions, will continue

to have a significant impact on our industry for months to come. As

such, overall market conditions are anticipated to remain uncertain

for the foreseeable future. Upstream, midstream and downstream

companies will continue to reduce or carefully manage spending for

capital projects and operations where possible until some sort of

market stability has returned.

The Company feels that a strong balance sheet is

imperative for success and has focused efforts to that strategy for

several years. Having a strong balance sheet not only protects the

Company in economic turmoil but enables growth when the market’s

confidence improves. The Company currently has substantial cash

reserves, a large rental fleet, and no debt.

On April 17, 2020, the Canadian federal

government announced it will invest $1.7 billion to clean up

abandoned and inactive natural gas and oil wells. In addition, it

will establish a $750 million Emission Reduction Fund, with a focus

on methane, to create and maintain jobs through pollution reduction

efforts. This goes a long way toward indicating the federal

government does understand the importance of this industry and the

struggles it currently faces. The Company is currently evaluating

opportunities in this area. The Company believes that it is

uniquely positioned within the market to offer products and

services to support these initiatives.

ABOUT QUESTOR TECHNOLOGY

INC.

Headquartered in Calgary, Alberta, with

operations across North America, the Company provides specialized

waste gas incineration products and services that destroys harmful

pollutants in any waste gas stream at 99.99% efficiency enabling

our clients to meet emission regulations, address community

concerns and improve safety at industrial sites.

There are several methods for handling waste

gases at oil and gas industrial facilities, the most common being

combustion. Flaring and incineration are two methods of combustion

accepted by many provincial and state regulators. Historically, the

most common type of combustion has been flaring which is the

igniting of natural gas at the end of a long metal tube or flare

stack. This action causes the characteristic flame associated with

flaring.

Incineration is the mixing and combusting of

waste gas streams, air, and fuel in an enclosed chamber which are

mixed at a controlled rate and ignited so that no flame is visible

when operating properly. A correctly designed and operated

incinerator can yield higher combustion efficiencies through proper

mixing, gas composition, retention time, and combustion

temperature. Combustion efficiency, generally expressed as a

percentage, is represented by the amount of methane converted to

CO2, or H2S converted to SO2. The more converted, the better the

efficiency.

The Company designs, manufactures and services

proprietary high efficiency waste gas incineration systems.

The Company’s incineration product line is based on clean

combustion technology that was developed by the Company and

initially patented in both Canada and the United States in 1999.

The Company has continued to evolve the technology over the years

making several improvements from the original patent which expired

in November 2019. The Company currently has five new patent filings

that are pending.

The Company’s highly specialized technical team

works with the client to understand the waste gas volume and

composition allowing it to determine the correct incineration

product specification to achieve 99.99 percent combustion

efficiency. The incinerators vary in size to accommodate small to

large amounts of gas handling ranging from 20 mcf/d to 5,000 mcf/d.

The incinerators also vary in automation and instrumentation

depending on the client’s requirements. The Company’s incinerators

are currently used in multiple segments of the Oil and Gas industry

including drilling, completions, production, midstream, downstream,

and transportation and distribution.

The Company has three primary incinerator

related revenue streams: sales, rentals and services. Incinerator

services include hauling, commissioning, repairs, maintenance and

decommissioning. The Company’s current key incineration markets are

Colorado, North Dakota, Mexico, Pennsylvania, Texas,

Alberta and North East BC.

The Company services its key markets with field

offices in Brighton and Fort Lupton, Colorado; Watford City, North

Dakota and Grande Prairie, Alberta. The infrastructure at the field

offices consist of field technicians, maintenance technicians,

technical sales and administration. The facilities generally

include, office space, maintenance shop and a yard to store

incinerators. Personnel based out of the Company’s head office in

Calgary, Alberta include Officers of the Corporation, management,

engineering, technical sales, accounting and administration.

NEW DEVELOPMENTS

In April 2020, Questor became the first

ETV-certified clean combustion company in the world. ISO 14034 is

an internationally recognized certificate that verifies the

performance of innovative environmental technologies. The project

was supported by Standard Council of Canada and the certification

issued by 350Solutions. The organization is the only company

accredited by national accreditation board of ANSI, in the United

States.

The evaluation process of ETV certification,

verifies company’s performance claims according to the procedures

outlined in ISO14034. This certification confirms that Questor’s

performance claims of 99.99% combustion efficiency and H2S

destruction efficiency. Historical data and rigorous statistical

analysis were used to verify the validity of the performance

claims. All data were collected on client sites during operation or

during the unit performance test runs for regulatory

compliance.

QUESTOR TRADES ON THE TSX VENTURE EXCHANGE UNDER THE

SYMBOL ‘QST’.

|

Audrey Mascarenhas |

Dan Zivkusic |

|

President and Chief Executive Officer |

Chief Financial Officer |

|

Phone: (403) 571-1530 |

Phone: (403) 539-4371 |

|

Facsimile: (403) 571-1539 |

Facsimile: (403) 571-1539 |

|

Email: amascarenhas@questortech.com |

Email: dzivkusic@questortech.com |

Certain information in this news release

constitutes forward-looking statements. When used in this news

release, the words "may", "would", "could", "will", "intend",

"plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company,

are intended to identify forward-looking statements. In particular,

this news release contains forward-looking statements with respect

to, among other things, business objectives, expected growth,

results of operations, performance, business projects and

opportunities and financial results. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

based on certain material factors and assumptions and are subject

to certain risks and uncertainties, including without limitation,

changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out

in the Company’s public disclosure documents. Many factors could

cause the Company’s actual results, performance or achievements to

vary from those described in this news release, including without

limitation those listed above. These factors should not be

construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this news release and such

forward-looking statements included in, or incorporated by

reference in this news release, should not be unduly relied upon.

Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to

update these forward-looking statements. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This document is not intended for dissemination

or distribution in the United States.

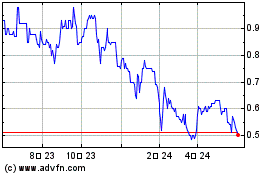

Questor Technology (TSXV:QST)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

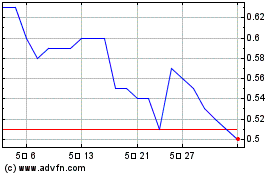

Questor Technology (TSXV:QST)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024