False0001688568AshburnVirginia2014700016885682025-02-042025-02-040001688568us-gaap:CommonStockMember2025-02-042025-02-040001688568dxc:SeniorNotesDue2026Member2025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________

FORM 8-K

_____________________________________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 4, 2025

______________________________________________________________________________

DXC TECHNOLOGY COMPANY

(Exact name of registrant as specified in its charter)

______________________________________________________________________________

| | | | | | | | | | | | | | |

| | | | |

| Nevada | | 001-38033 | | 61-1800317 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| | | | |

| 20408 Bashan Drive, Suite 231 |

Ashburn, Virginia 20147 |

| (Address of Principal Executive Offices and Zip Code) |

Registrant’s telephone number, including area code: (703) 972-7000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | DXC | The New York Stock Exchange |

| 1.750% Senior Notes Due 2026 | DXC 26 | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 4, 2025, DXC Technology Company (the “Company”) issued a press release reporting its financial results for the third quarter of fiscal 2025 ended December 31, 2024. The press release is attached hereto as Exhibit 99.1. The Company will also hold a conference call at 5:00 PM ET, on February 4, 2025, to discuss this matter.

The information contained in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | DXC TECHNOLOGY COMPANY

|

| | | |

| Dated: | February 4, 2025 | By: | /s/ Rob Del Bene |

| | Name: | Rob Del Bene |

| | Title: | Executive Vice President and Chief Financial Officer |

DXC Technology Reports Third Quarter Fiscal Year 2025 Results

•Total revenue of $3.23 billion, down 5.1% (down 4.2% on an organic basis)(1)

•EBIT margin of 4.5%, and adjusted EBIT(2) margin of 8.9%

•Diluted earnings per share was $0.31 vs. $0.81 in the prior year quarter; Non-GAAP diluted earnings per share(3) was $0.92, up 7.0% YoY

•Book to bill of 1.33x

•Increased full year adjusted EBIT(2) margin guidance to ~7.9%

•Increased full-year non-GAAP diluted EPS(3) guidance to ~$3.35

•Increased full year free cash flow(4) guidance to ~$625 million

ASHBURN, VA, February 4, 2025 – DXC Technology (NYSE: DXC) today reported results for the third quarter of fiscal year 2025.

“I am pleased with our third quarter performance. Our operating model changes and focus on disciplined execution is reflected in our third quarter financial results, which were ahead of guidance. The go to market changes we have made are starting to take hold, driving a meaningful improvement in bookings performance,” said DXC Technology President and CEO, Raul Fernandez. "Reflecting on my first year as CEO, I'm very confident that we are on the right path to building a business with profitable and sustainable revenue growth."

Financial Highlights - Third Quarter Fiscal Year 2025

•Total revenue was $3.23 billion, down 5.1% year-over-year (down 4.2% on an organic basis)(1).

•EBIT was $146 million, down 37.6% year-over-year with a corresponding margin of 4.5%. Adjusted EBIT(2) was $286 million, up 11.7% year-over-year, with a corresponding margin(2) of 8.9%.

•Diluted earnings per share was $0.31, down 61.7% year-over-year. Non-GAAP diluted earnings per share(3) was $0.92, up 7.0% year-over-year.

•Cash generated from operations was $650 million, down 7.9% year-over-year. Free cash flow(4) was $483 million in the third quarter of fiscal year 2025, compared to $585 million in the third quarter of fiscal year 2024.

•Book to Bill ratio of 1.33x, compared to 0.99x in the third quarter of fiscal year 2024.

(1) Revenue growth on an organic basis is a non-GAAP measure and is calculated by restating current-period activity using the prior fiscal period's foreign currency exchange rates, adjusted for the impact of acquisitions and divestitures. A reconciliation of GAAP to non-GAAP measure are attached to this release.

(2) Adjusted EBIT and Adjusted EBIT margin are non-GAAP measures. Reconciliations of GAAP Net Income to such measures are attached to this release.

(3) Non-GAAP diluted earnings per share is a non-GAAP measure. A reconciliation of GAAP diluted earnings per share to non-GAAP diluted per share is attached to this release.

(4) Free cash flow is a non-GAAP measure. Free cash flow is calculated by subtracting capital expenditures (Purchase of Property, Plant & Equipment, Transition and Transformation Contract Costs and Software Purchased or Developed) from cash flow from operations. Free cash flow for the third quarter of fiscal year 2025 is calculated by subtracting capital expenditures of $167 million from cash flow from operations of $650 million. Free cash flow for the third quarter of fiscal year 2024 is calculated by subtracting capital expenditures of $121 million from cash flow from operations of $706 million.

1

Segment Highlights - Third Quarter Fiscal Year 2025

Global Business Services ("GBS")

•Revenue was $1.67 billion, down 1.8% year-over-year (down 0.5% on an organic basis).(1)

•Segment profit was $224 million, up 10.9% year-over-year, with a corresponding margin of 13.4%.

•Book to Bill ratio of 1.23x, compared to 1.26x during the third quarter of fiscal 2024.

Global Infrastructure Services ("GIS")

•Revenue was $1.56 billion, down 8.5% year-over-year (down 7.8% on an organic basis).(1)

•Segment profit was $101 million, down 15.1% year-over-year, with a corresponding margin of 6.5%.

•Book to Bill ratio of 1.44x, compared to 0.73x during the third quarter of fiscal 2024.

Full Year Fiscal 2025 and Fourth Quarter Fiscal Year 2025 Guidance

Full Year Fiscal 2025

•Total revenue in the range of $12.80 billion and $12.83 billion, a decline of 4.9% to 4.7% on an organic basis(1) compared to the prior guidance of a decline of 5.5% to 4.5%.

•Adjusted EBIT margin(2) ~7.9%, compared to the prior guidance of 7.0% to 7.5%.

•Non-GAAP diluted EPS(3) of ~$3.35, compared to the prior guidance of $3.00 to $3.25.

•Free Cash Flow(4) of ~$625 million, up from the prior guidance of approximately $550 million.

Fourth Quarter Fiscal 2025

•Total revenue in the range of $3.10 billion and $3.13 billion, a decline of 5.5% to 4.5% year-over-year on an organic basis.(1)

•Adjusted EBIT margin(2) ~7.0%.

•Non-GAAP Diluted EPS(3) of ~$0.75.

Additional metrics for the fourth quarter and full fiscal year 2025 guidance are presented in the table below.

| | | | | | | | | | | | | | | | | | | | |

| Revenue | | Q4 FY25 Guidance | | FY25 Guidance |

| Lower End | Higher End | | Lower End | Higher End |

YoY Organic Revenue % | | (5.5)% | (4.5)% | | (4.9)% | (4.7)% |

| Acquisition & Divestitures Revenues % | | (0.2)% | | (0.2)% |

| Foreign Exchange Impact on Revenues % | | (2.9)% | | (1.2)% |

| Others | | | | |

| Pension Income Benefit* | | ~$27 | | ~$108 |

| Net Interest Expense | | ~$15 | | ~$70 |

| Non-GAAP Tax Rate | | ~29% | | ~33% |

| Weighted Average Diluted Shares Outstanding | | ~185 | | ~184 |

| Restructuring & TSI Expense | | | | ~$200 |

Capital Lease / Asset Financing Payments | | | | ~$290 |

| Foreign Exchange Assumptions | | Current Estimate | | Current Estimate |

$/Euro Exchange Rate | | $1.04 | | $1.07 |

$/GBP Exchange Rate | | $1.25 | | $1.27 |

$/AUD Exchange Rate | | $0.62 | | $0.65 |

*Pension benefit is split between Cost Of Services (COS) & Other Income:

Fiscal year 2025: Net pension benefit of $108 million; $52 million service cost in COS, $160 million pension benefit in Other income

Fiscal year 2024: Net pension benefit of $92 million; $53 million service cost in COS, $145 million pension benefit in Other income

DXC does not provide reconciliations of non-GAAP measures included in its guidance because certain key information necessary for such reconciliations—most notably the impact of significant non-recurring items—is unavailable without unreasonable effort or may not be available at all. As a result, DXC believes any such reconciliation would not be meaningful.

Earnings Conference Call and Webcast

DXC Technology senior management will host a conference call and webcast to discuss third quarter fiscal 2025 results at 5:00 p.m. ET on February 4, 2025. The dial-in number for domestic callers is 888-330-2455. Callers who reside outside of the United States should dial +1-240-789-2717. The passcode for all participants is 4164760#. The webcast audio and any presentation slides will be available through a link posted on DXC Technology’s Investor Relations website.

A replay of the conference call will be available approximately two hours after its conclusion until 11:59 PM ET on February 11, 2025, at 800-770-2030 for domestic callers and at +1-647-362-9199 for international callers. The replay passcode is 4164760#. A transcript of the conference call will be posted on DXC Technology’s Investor Relations website.

About DXC Technology

DXC Technology (NYSE: DXC) helps global companies run their mission critical systems and operations while modernizing IT, optimizing data architectures, and ensuring security and scalability across public, private and hybrid clouds. The world’s largest companies and public sector organizations trust DXC to deploy services to drive new levels of performance, competitiveness, and customer experience across their IT estates. Learn more about how we deliver excellence for our customers and colleagues at DXC.com.

Forward-Looking Statements

All statements and assumptions contained in this press release that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” Forward-looking statements often include words such as “anticipates,” “believes,” “estimates,” “expects,” “forecast,” “goal,” “intends,” “objective,” “plans,” “projects,” “strategy,” “target,” and “will” and words and terms of similar substance in discussions of future operating or financial performance. These statements represent current expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved. Forward-looking statements include, among other things, statements with respect to our future financial condition, results of operations, cash flows, business strategies, operating efficiencies or synergies, divestitures, competitive position, growth opportunities, share repurchases, dividend payments, plans and objectives of management and other matters. Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. Important factors that could cause actual results to differ materially from those described in forward-looking statements include, but are not limited to: our inability to succeed in our strategic objectives; the risk of liability, reputational damages or adverse impact to business due to service interruptions from security breaches, cyber-attacks, other security incidents or disclosure of confidential information or personal data; compliance, or failure to comply, with obligations arising under new or existing laws, regulations, and customer contracts relating to the privacy, security and handling of personal data; our product and service quality issues; our inability to develop and expand our service offerings to address emerging business demands and technological trends, including our inability to sell differentiated services amongst our offerings; our inability to compete in certain markets and expand our capacity in certain offshore locations and risks associated with such offshore locations, such as the on-going conflict between Russia and Ukraine; failure to maintain our credit rating and ability to manage working capital, refinance and raise additional capital for future needs; difficulty in understanding the changes to our business model by financial or industry analysts or our failure to meet our publicly announced financial guidance; public health crises such as the COVID-19 pandemic; our indebtedness and potential material adverse effect on our financial condition and results of operations; the competitive pressures faced by our business; our inability to accurately estimate the cost of services, and the completion timeline of contracts; failure by us or third party partners to deliver on commitments or otherwise breach obligations to our customers; the risks associated with climate change and natural disasters; increased scrutiny of, and evolving expectations for, sustainability and environmental, social, and governance initiatives; our inability to attract and retain key personnel and maintain relationships with key partners; the risks associated with prolonged periods of inflation or current macroeconomic conditions, including the current decline in economic growth rates in the United States and in other countries, the possibility of reduced spending by customers in the areas we serve, the uncertainty related to our cost-takeout efforts, continuing unfavorable foreign exchange rate movements, and our ability to close new deals in the event of an economic slowdown; the risks associated with our international operations, such as risks related to currency exchange rates; our inability to comply with existing and new laws and regulations, including social and environmental responsibility regulations, policies and provisions, as well as customer and investor demands; our inability to achieve the expected benefits of our restructuring plans; our inadvertent infringement of third-party intellectual property rights or infringement of our intellectual property rights by third parties; our inability to procure third-party licenses required for the operation of our products and service offerings; risks associated with disruption of our supply chain; our inability to maintain effective disclosure controls and internal control over financial reporting; potential losses due to asset impairment charges; our inability to pay dividends or repurchase shares of our common stock; pending investigations, claims and disputes and any adverse impact on our profitability and liquidity; disruptions in the credit markets, including disruptions that reduce our customers’ access to credit and increase the costs to our customers of obtaining credit; counterparty default risk in our hedging program; our failure to bid on projects effectively; financial difficulties of our customers and our inability to collect receivables; our inability to maintain and grow our customer relationships over time and to comply with customer contracts or government contracting regulations or requirements; our inability to succeed in our strategic transactions; changes in tax rates, tax laws, and the timing and outcome of tax examinations; risks following the merger of Computer Sciences Corporation (“CSC”) and Enterprise Services business of Hewlett Packard Enterprise Company’s (“HPES”) businesses, including anticipated tax treatment, unforeseen liabilities, and future capital expenditures; risks following the spin-off of our former U.S. Public Sector business (the “USPS”) and its related mergers with Vencore Holding Corp. and KeyPoint Government Solutions in June 2018 to form Perspecta Inc. (including its successors and permitted assigns, “Perspecta”); volatility of the price of our securities, which is subject to market and other conditions. For a written description of these factors, see the section titled “Risk Factors” in DXC’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024, and any updating information in subsequent SEC filings.

No assurance can be given that any goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements which speak only as of the date they are

made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events except as required by law.

About Non-GAAP Measures

In an effort to provide investors with supplemental financial information, in addition to the preliminary and unaudited financial information presented on a GAAP basis, we also disclose in this press release preliminary non-GAAP information including: earnings before interest and taxes ("EBIT"), EBIT margin, adjusted EBIT, adjusted EBIT margin, non-GAAP diluted EPS, organic revenues, organic revenue growth, free cash flow, and non-GAAP tax rate.

We believe EBIT, adjusted EBIT, non-GAAP income before income taxes, non-GAAP net income, non-GAAP net income attributable to DXC common stockholders, and non-GAAP EPS provide investors with useful supplemental information about our operating performance after excluding certain categories of expenses as well as gains and losses on certain dispositions and certain tax adjustments.

We believe constant currency revenues provides investors with useful supplemental information about our revenues after excluding the effect of currency exchange rate fluctuations for currencies other than U.S. dollars in the periods presented. See below for a description of the methodology we use to present constant currency revenues.

One category of expenses excluded from adjusted EBIT, non-GAAP income before income tax, non-GAAP net income, non-GAAP net income attributable to DXC common stockholders, and non-GAAP EPS, incremental amortization of intangible assets acquired through business combinations, if included, may result in a significant difference in period over period amortization expense on a GAAP basis. We exclude amortization of certain acquired intangible assets as these non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Although DXC management excludes amortization of acquired intangible assets, primarily customer-related intangible assets, from its non-GAAP expenses, we believe it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and support revenue generation. Any future transactions may result in a change to the acquired intangible asset balances and associated amortization expense.

Another category of expenses excluded from adjusted EBIT, non-GAAP income before income tax, non-GAAP net income, non-GAAP net income attributable to DXC common stockholders, and non-GAAP EPS is impairment losses, which, if included, may result in a significant difference in period-over-period expense on a GAAP basis. We exclude impairment losses as these non-cash amounts reflect generally an acceleration of what would be multiple periods of expense and are not expected to occur frequently. Further, assets such as goodwill may be significantly impacted by market conditions outside of management’s control.

Selected references are made to revenue growth on an “organic basis” in order that certain financial results can be viewed without the impact of fluctuations in foreign currency rates and without the impacts of acquisitions and divestitures, thereby providing comparisons of operating performance from period to period of the business that we have owned during both periods presented. Organic revenue growth is calculated by dividing the year-over-year change in GAAP revenues attributed to organic growth by the GAAP revenues reported in the prior comparable period. Organic revenue is calculated as constant currency revenue excluding the impact of mergers, acquisitions or similar transactions until the one-year anniversary of the transaction and excluding revenues of divestitures during the reporting period. This approach is used for all results where the functional currency is not the U.S. dollar. We believe organic revenue growth provides investors with useful supplemental information about our revenues after excluding the effect of currency exchange rate fluctuations for currencies other than U.S. dollars and the effects of acquisitions and divestitures in both periods presented.

Free cash flow represents cash flow from operations, less capital expenditures. Free cash flow is utilized by our management, investors, and analysts to evaluate cash available for normal business operations, to pay debt, repurchase shares, and provide further investment in the business.

There are limitations to the use of the non-GAAP financial measures presented in this report. One of the limitations is that they do not reflect complete financial results. We compensate for this limitation by providing a reconciliation between our non-GAAP financial measures and the respective most directly comparable financial measure calculated and presented in accordance with GAAP. Additionally, other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes between companies. Selected references are made on a “constant currency basis” so that certain financial results can be viewed without the impact of fluctuations in foreign currency rates, thereby providing comparisons of operating performance from period to period. Financial results on a “constant currency basis” are non-GAAP measures calculated by translating current period activity into U.S. Dollars using the comparable prior period’s currency conversion rates. This approach is used for all results where the functional currency is not the U.S. Dollar.

# # #

Contact:

Roger Sachs, CFA, Investor Relations, +1-201-259-0801, roger.sachs@dxc.com

Suzanne Cross, Corporate Media Relations, +1-518-506-8848, suzanne.cross@dxc.com

Condensed Consolidated Statements of Operations

(preliminary and unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| (in millions, except per-share amounts) | | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| | | | | | | | |

| Revenues | | $ | 3,225 | | | $ | 3,399 | | | $ | 9,702 | | | $ | 10,281 | |

| | | | | | | | |

| Costs of services | | 2,416 | | | 2,636 | | | 7,369 | | | 7,988 | |

| Selling, general and administrative | | 335 | | | 294 | | | 989 | | | 949 | |

| Depreciation and amortization | | 320 | | | 350 | | | 975 | | | 1,055 | |

| Restructuring costs | | 43 | | | 36 | | | 124 | | | 91 | |

| Interest expense | | 66 | | | 78 | | | 207 | | | 222 | |

| Interest income | | (51) | | | (56) | | | (153) | | | (158) | |

Gain on disposition of businesses | | (7) | | | (103) | | | (7) | | | (96) | |

| Other income, net | | (28) | | | (48) | | | (94) | | | (188) | |

| Total costs and expenses | | 3,094 | | | 3,187 | | | 9,410 | | | 9,863 | |

| | | | | | | | |

| Income before income taxes | | 131 | | | 212 | | | 292 | | | 418 | |

| Income tax expense | | 68 | | | 72 | | | 159 | | | 137 | |

| Net income | | 63 | | | 140 | | | 133 | | | 281 | |

Less: net income (loss) attributable to non-controlling interest, net of tax | | 6 | | | (16) | | | 8 | | | (10) | |

| Net income attributable to DXC common stockholders | | $ | 57 | | | $ | 156 | | | $ | 125 | | | $ | 291 | |

| | | | | | | | |

| Income per common share: | | | | | | | | |

| Basic | | $ | 0.31 | | | $ | 0.82 | | | $ | 0.69 | | | $ | 1.45 | |

| Diluted | | $ | 0.31 | | | $ | 0.81 | | | $ | 0.68 | | | $ | 1.43 | |

| | | | | | | | |

| Weighted average common shares outstanding for: | | | | | | | | |

| Basic EPS | | 181.02 | | | 190.31 | | | 180.54 | | | 200.68 | |

| Diluted EPS | | 184.77 | | | 191.93 | | | 184.65 | | | 203.55 | |

Selected Condensed Consolidated Balance Sheet Data

(preliminary and unaudited)

| | | | | | | | | | | | | | |

| | As of |

| (in millions) | | December 31, 2024 | | March 31, 2024 |

| Assets | | | | |

| Cash and cash equivalents | | $ | 1,723 | | | $ | 1,224 | |

| Receivables, net | | 2,759 | | | 3,253 | |

| Prepaid expenses | | 468 | | | 512 | |

| Other current assets | | 125 | | | 146 | |

| | | | |

| Total current assets | | 5,075 | | | 5,135 | |

| | | | |

| Intangible assets, net | | 1,786 | | | 2,130 | |

| Operating right-of-use assets, net | | 638 | | | 731 | |

Goodwill | | 518 | | | 532 | |

| Deferred income taxes, net | | 917 | | | 804 | |

| Property and equipment, net | | 1,285 | | | 1,671 | |

| Other assets | | 2,812 | | | 2,857 | |

| Assets held for sale - non-current | | 2 | | | 11 | |

| Total Assets | | $ | 13,033 | | | $ | 13,871 | |

| | | | |

| Liabilities | | | | |

| Short-term debt and current maturities of long-term debt | | $ | 193 | | | $ | 271 | |

| Accounts payable | | 563 | | | 846 | |

| Accrued payroll and related costs | | 509 | | | 558 | |

| Current operating lease liabilities | | 235 | | | 282 | |

| Accrued expenses and other current liabilities | | 1,329 | | | 1,437 | |

| Deferred revenue and advance contract payments | | 744 | | | 866 | |

| Income taxes payable | | 215 | | | 134 | |

| | | | |

| Total current liabilities | | 3,788 | | | 4,394 | |

| | | | |

| Long-term debt, net of current maturities | | 3,637 | | | 3,818 | |

| Non-current deferred revenue | | 597 | | | 671 | |

| Non-current operating lease liabilities | | 436 | | | 497 | |

| Non-current income tax liabilities and deferred tax liabilities | | 549 | | | 556 | |

| Other long-term liabilities | | 774 | | | 869 | |

| Total Liabilities | | 9,781 | | | 10,805 | |

| | | | |

| Total Equity | | 3,252 | | | 3,066 | |

| | | | |

| Total Liabilities and Equity | | $ | 13,033 | | | $ | 13,871 | |

Condensed Consolidated Statements of Cash Flows

(preliminary and unaudited)

| | | | | | | | | | | | | | | | | |

| | Nine Months Ended | | | |

| (in millions) | | December 31, 2024 | | December 31, 2023 | | | |

| Cash flows from operating activities: | | | | | | | |

| Net income | | $ | 133 | | | $ | 281 | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | | 995 | | | 1,076 | | | | |

| Operating right-of-use expense | | 235 | | | 269 | | | | |

| Share-based compensation | | 59 | | | 75 | | | | |

| Deferred taxes | | (182) | | | (159) | | | | |

| Loss (gain) on dispositions | | 30 | | | (153) | | | | |

| Provision for losses on accounts receivable | | 9 | | | — | | | | |

| Unrealized foreign currency exchange loss | | 33 | | | 48 | | | | |

| Impairment losses and contract write-offs | | 25 | | | 17 | | | | |

| Other non-cash charges, net | | 3 | | | 3 | | | | |

| Changes in assets and liabilities: | | | | | | | |

| Decrease in assets | | 334 | | | 431 | | | | |

| Decrease in operating lease liability | | (235) | | | (269) | | | | |

| Decrease in other liabilities | | (356) | | | (538) | | | | |

| Net cash provided by operating activities | | 1,083 | | | 1,081 | | | | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property and equipment | | (171) | | | (144) | | | | |

| Payments for transition and transformation contract costs | | (106) | | | (159) | | | | |

| Software purchased and developed | | (230) | | | (177) | | | | |

| Business dispositions | | 26 | | | 31 | | | | |

| Proceeds from sale of assets | | 126 | | | 70 | | | | |

| Other investing activities, net | | 12 | | | 12 | | | | |

| Net cash used in investing activities | | (343) | | | (367) | | | | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| Borrowings of commercial paper | | 367 | | | 1,536 | | | | |

| Repayments of commercial paper | | (369) | | | (1,281) | | | | |

| | | | | | | |

| Payments on finance leases and borrowings for asset financing | | (242) | | | (333) | | | | |

| | | | | | | |

| Taxes paid related to net share settlements of share-based compensation awards | | (18) | | | (34) | | | | |

| Repurchase of common stock | | (14) | | | (755) | | | | |

| Other financing activities, net | | 19 | | | (10) | | | | |

| Net cash used in financing activities | | (257) | | | (877) | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | 16 | | | (4) | | | | |

| | | | | | | |

| | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | 499 | | | (167) | | | | |

| Cash and cash equivalents at beginning of year | | 1,224 | | | 1,858 | | | | |

| Cash and cash equivalents at end of period | | $ | 1,723 | | | $ | 1,691 | | | | |

Segment Profit

We define segment profit as segment revenues less costs of services, segment selling, general and administrative, depreciation and amortization, and other income (excluding the movement in foreign currency exchange rates on our foreign currency denominated assets and liabilities and the related economic hedges). The Company does not allocate to its segments certain operating expenses managed at the corporate level. These unallocated costs generally include certain corporate function costs, stock-based compensation expense, pension and other post-retirement benefits (“OPEB”) actuarial and settlement gains and losses, restructuring costs, transaction, separation and integration-related costs, and amortization of acquired intangible assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| (in millions) | | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| GBS profit | | $ | 224 | | | $ | 202 | | | $ | 619 | | | $ | 607 | |

| GIS profit | | 101 | | | 119 | | | 344 | | | 308 | |

| All other loss | | (39) | | | (65) | | | (174) | | | (190) | |

| Subtotal | | $ | 286 | | | $ | 256 | | | $ | 789 | | | $ | 725 | |

| Interest income | | 51 | | | 56 | | | 153 | | | 158 | |

| Interest expense | | (66) | | | (78) | | | (207) | | | (222) | |

| Restructuring costs | | (43) | | | (36) | | | (124) | | | (91) | |

| Transaction, separation and integration-related costs | | (3) | | | (2) | | | (25) | | | (6) | |

| Amortization of acquired intangible assets | | (87) | | | (88) | | | (263) | | | (266) | |

| Merger related indemnification | | — | | | (2) | | | — | | | (15) | |

| Gains on dispositions | | 8 | | | 104 | | | 13 | | | 132 | |

| (Losses) gains on real estate and facility sales | | (3) | | | 2 | | | (32) | | | 8 | |

| Impairment losses | | (12) | | | — | | | (12) | | | (5) | |

| Income before income taxes | | $ | 131 | | | $ | 212 | | | $ | 292 | | | $ | 418 | |

| | | | | | | | |

| Segment profit margins | | | | | | | | |

| GBS | | 13.4 | % | | 11.9 | % | | 12.3 | % | | 11.9 | % |

| GIS | | 6.5 | % | | 7.0 | % | | 7.3 | % | | 6.0 | % |

Reconciliation of Non-GAAP Financial Measures

Our non-GAAP adjustments include:

•Restructuring costs – includes costs, net of reversals, related to workforce and real estate optimization and other similar charges.

•Transaction, separation and integration-related (“TSI”) costs – includes third party costs related to integration, separation, planning, financing and advisory fees and other similar charges associated with mergers, acquisitions, strategic investments, joint ventures, and dispositions and other similar transactions incurred within one year of such transactions closing, except for costs associated with related disputes, which may arise more than one year after closing.

•Amortization of acquired intangible assets – includes amortization of intangible assets acquired through business combinations.

•Merger related indemnification - in fiscal 2025 and fiscal 2024, represents the Company’s estimate of potential net liability to HPE for tax related indemnifications.

•Gains and losses on dispositions – gains and losses related to dispositions of businesses, strategic assets and interests in less than wholly-owned entities.

•Gains and losses on real estate and facility sales – gains and losses related to dispositions of real property.(1)

•Impairment losses – non-cash charges associated with the permanent reduction in the value of the Company’s assets (e.g., impairment of goodwill and other long-term assets including fixed assets and impairments to deferred tax assets for discrete changes in valuation allowances). Future discrete reversals of valuation allowances are likewise excluded.

•Tax adjustments – discrete tax adjustments to impair or recognize certain deferred tax assets, adjustments for changes in tax legislation and the impact of merger and divestitures. Income tax expense of all other (non-discrete) non-GAAP adjustments is based on the difference in the GAAP annual effective tax rate (AETR) and overall non-GAAP provision (consistent with the GAAP methodology).

(1) Starting in the fiscal quarter ended September 30, 2024, the Company’s reported non-GAAP financial results reflect an adjustment for gains and losses on real estate and facilities dispositions, which the Company’s current management believes are not reflective of the core operating performance of our business. For comparability purposes, historical non-GAAP financial measures set forth herein have been recast to reflect this change, which included gains on dispositions of real property of approximately $2 million and $8 million during the three and nine months ended December 31, 2023, respectively. For the fiscal years ended March 31, 2024 and March 31, 2023, the Company had gains on dispositions of real property of approximately $7 million and $21 million, respectively.

Non-GAAP Results

A reconciliation of reported results to non-GAAP results is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2024 |

| (in millions, except per-share amounts) | | As

Reported | | Restructuring

Costs | | Transaction,

Separation and

Integration-Related Costs | | Amortization

of Acquired

Intangible

Assets | | Impairment Losses | | (Gains) and Losses on Dispositions | | (Gains) and Losses on Real Estate and Facility Sales | | Tax Adjustment | | Non-GAAP

Results |

| Income before income taxes | | $ | 131 | | | $ | 43 | | | $ | 3 | | | $ | 87 | | | $ | 12 | | | $ | (8) | | | $ | 3 | | | $ | — | | | $ | 271 | |

| Income tax expense | | 68 | | | 9 | | | 1 | | | 18 | | | 2 | | | (6) | | | 1 | | | 2 | | | 95 | |

| Net income | | 63 | | | 34 | | | 2 | | | 69 | | | 10 | | | (2) | | | 2 | | | (2) | | | 176 | |

| Less: net income attributable to non-controlling interest, net of tax | | 6 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 6 | |

| Net income attributable to DXC common stockholders | | $ | 57 | | | $ | 34 | | | $ | 2 | | | $ | 69 | | | $ | 10 | | | $ | (2) | | | $ | 2 | | | $ | (2) | | | $ | 170 | |

| | | | | | | | | | | | | | | | | | |

| Effective Tax Rate | | 51.9 | % | | | | | | | | | | | | | | | | 35.1 | % |

| | | | | | | | | | | | | | | | | | |

| Basic EPS | | $ | 0.31 | | | $ | 0.19 | | | $ | 0.01 | | | $ | 0.38 | | | $ | 0.06 | | | $ | (0.01) | | | $ | 0.01 | | | $ | (0.01) | | | $ | 0.94 | |

| Diluted EPS | | $ | 0.31 | | | $ | 0.18 | | | $ | 0.01 | | | $ | 0.37 | | | $ | 0.05 | | | $ | (0.01) | | | $ | 0.01 | | | $ | (0.01) | | | $ | 0.92 | |

| | | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding for: | | | | | | | | | | | | | | | | | | |

| Basic EPS | | 181.02 | | | 181.02 | | | 181.02 | | | 181.02 | | | 181.02 | | | 181.02 | | | 181.02 | | | 181.02 | | | 181.02 | |

| Diluted EPS | | 184.77 | | | 184.77 | | | 184.77 | | | 184.77 | | | 184.77 | | | 184.77 | | | 184.77 | | | 184.77 | | | 184.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended December 31, 2024 |

| (in millions, except per-share amounts) | | As

Reported | | Restructuring

Costs | | Transaction,

Separation and

Integration-Related Costs | | Amortization

of Acquired

Intangible

Assets | | Merger Related

Indemnification | | Impairment Losses | | (Gains) and Losses on Dispositions | | (Gains) and Losses on Real Estate and Facility Sales | | Tax Adjustment | | Non-GAAP

Results |

| Income before income taxes | | $ | 292 | | | $ | 124 | | | $ | 25 | | | $ | 263 | | | $ | — | | | $ | 12 | | | $ | (13) | | | $ | 32 | | | $ | — | | | $ | 735 | |

| Income tax expense | | 159 | | | 25 | | | 5 | | | 53 | | | 5 | | | 2 | | | (5) | | | 8 | | | (3) | | | 249 | |

| Net income | | 133 | | | 99 | | | 20 | | | 210 | | | (5) | | | 10 | | | (8) | | | 24 | | | 3 | | | 486 | |

| Less: net income attributable to non-controlling interest, net of tax | | 8 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 8 | |

| Net income attributable to DXC common stockholders | | $ | 125 | | | $ | 99 | | | $ | 20 | | | $ | 210 | | | $ | (5) | | | $ | 10 | | | $ | (8) | | | $ | 24 | | | $ | 3 | | | $ | 478 | |

| | | | | | | | | | | | | | | | | | | | |

| Effective Tax Rate | | 54.5 | % | | | | | | | | | | | | | | | | | | 33.9 | % |

| | | | | | | | | | | | | | | | | | | | |

| Basic EPS | | $ | 0.69 | | | $ | 0.55 | | | $ | 0.11 | | | $ | 1.16 | | | $ | (0.03) | | | $ | 0.06 | | | $ | (0.04) | | | $ | 0.13 | | | $ | 0.02 | | | $ | 2.65 | |

| Diluted EPS | | $ | 0.68 | | | $ | 0.54 | | | $ | 0.11 | | | $ | 1.14 | | | $ | (0.03) | | | $ | 0.05 | | | $ | (0.04) | | | $ | 0.13 | | | $ | 0.02 | | | $ | 2.59 | |

| | | | | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding for: | | | | | | | | | | | | | | | | | | | | |

| Basic EPS | | 180.54 | | | 180.54 | | | 180.54 | | | 180.54 | | | 180.54 | | | 180.54 | | | 180.54 | | | 180.54 | | | 180.54 | | | 180.54 | |

| Diluted EPS | | 184.65 | | | 184.65 | | | 184.65 | | | 184.65 | | | 184.65 | | | 184.65 | | | 184.65 | | | 184.65 | | | 184.65 | | | 184.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| (in millions, except per-share amounts) | | As

Reported | | Restructuring costs | | Transaction,

Separation and

Integration-Related Costs | | Amortization

of Acquired

Intangible

Assets | | Merger Related Indemnification | | (Gains) and Losses on Dispositions | | (Gains) and Losses on Real Estate and Facility Sales | | Tax Adjustment | | Non-GAAP

Results |

| Income before income taxes | | $ | 212 | | | $ | 36 | | | $ | 2 | | | $ | 88 | | | $ | 2 | | | $ | (104) | | | $ | (2) | | | $ | — | | | $ | 234 | |

| Income tax expense | | 72 | | | 5 | | | — | | | 13 | | | — | | | (10) | | | (1) | | | 5 | | | 84 | |

| Net income | | 140 | | | 31 | | | 2 | | | 75 | | | 2 | | | (94) | | | (1) | | | (5) | | | 150 | |

| Less: net loss attributable to non-controlling interest, net of tax | | (16) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (16) | |

| Net income attributable to DXC common stockholders | | $ | 156 | | | $ | 31 | | | $ | 2 | | | $ | 75 | | | $ | 2 | | | $ | (94) | | | $ | (1) | | | $ | (5) | | | $ | 166 | |

| | | | | | | | | | | | | | | | | | |

| Effective Tax Rate | | 34.0 | % | | | | | | | | | | | | | | | | 35.9 | % |

| | | | | | | | | | | | | | | | | | |

| Basic EPS | | $ | 0.82 | | | $ | 0.16 | | | $ | 0.01 | | | $ | 0.39 | | | $ | 0.01 | | | $ | (0.49) | | | $ | (0.01) | | | $ | (0.03) | | | $ | 0.87 | |

| Diluted EPS | | $ | 0.81 | | | $ | 0.16 | | | $ | 0.01 | | | $ | 0.39 | | | $ | 0.01 | | | $ | (0.49) | | | $ | (0.01) | | | $ | (0.03) | | | $ | 0.86 | |

| | | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding for: | | | | | | | | | | | | | | | | | | |

| Basic EPS | | 190.31 | | | 190.31 | | | 190.31 | | | 190.31 | | | 190.31 | | | 190.31 | | | 190.31 | | | 190.31 | | | 190.31 | |

| Diluted EPS | | 191.93 | | | 191.93 | | | 191.93 | | | 191.93 | | | 191.93 | | | 191.93 | | | 191.93 | | | 191.93 | | | 191.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended December 31, 2023 |

| (in millions, except per-share amounts) | | As

Reported | | Restructuring

Costs | | Transaction,

Separation and

Integration-Related Costs | | Amortization

of Acquired

Intangible

Assets | | Merger Related indemnification | | (Gains) and Losses on Dispositions | | (Gains) and Losses on Real Estate and Facility Sales | | Impairment Losses | | Tax adjustment | | Non-GAAP

Results |

| Income before income taxes | | $ | 418 | | | $ | 91 | | | $ | 6 | | | $ | 266 | | | $ | 15 | | | $ | (132) | | | $ | (8) | | | $ | 5 | | | $ | — | | | $ | 661 | |

| Income tax expense | | 137 | | | 18 | | | 1 | | | 53 | | | 12 | | | (20) | | | (3) | | | 1 | | | 37 | | | 236 | |

| Net income | | 281 | | | 73 | | | 5 | | | 213 | | | 3 | | | (112) | | | (5) | | | 4 | | | (37) | | | 425 | |

| Less: net loss attributable to non-controlling interest, net of tax | | (10) | | | — | | | — | | | — | | | — | | | — | | | — | | | (4) | | | — | | | (14) | |

| Net income attributable to DXC common stockholders | | $ | 291 | | | $ | 73 | | | $ | 5 | | | $ | 213 | | | $ | 3 | | | $ | (112) | | | $ | (5) | | | $ | 8 | | | $ | (37) | | | $ | 439 | |

| | | | | | | | | | | | | | | | | | | | |

| Effective Tax Rate | | 32.8 | % | | | | | | | | | | | | | | | | | | 35.7 | % |

| | | | | | | | | | | | | | | | | | | | |

| Basic EPS | | $ | 1.45 | | | $ | 0.36 | | | $ | 0.02 | | | $ | 1.06 | | | $ | 0.01 | | | $ | (0.56) | | | $ | (0.02) | | | $ | 0.04 | | | $ | (0.18) | | | $ | 2.19 | |

| Diluted EPS | | $ | 1.43 | | | $ | 0.36 | | | $ | 0.02 | | | $ | 1.05 | | | $ | 0.01 | | | $ | (0.55) | | | $ | (0.02) | | | $ | 0.04 | | | $ | (0.18) | | | $ | 2.16 | |

| | | | | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding for: | | | | | | | | | | | | | | | | | | | | |

| Basic EPS | | 200.68 | | | 200.68 | | | 200.68 | | | 200.68 | | | 200.68 | | | 200.68 | | | 200.68 | | | 200.68 | | | 200.68 | | | 200.68 | |

| Diluted EPS | | 203.55 | | | 203.55 | | | 203.55 | | | 203.55 | | | 203.55 | | | 203.55 | | | 203.55 | | | 203.55 | | | 203.55 | | | 203.55 | |

The above tables serve to reconcile the non-GAAP financial measures to the most directly comparable GAAP measures. Please refer to the “About Non-GAAP Measures” section of the press release for further information on the use of these non-GAAP measures.

Year-over-Year Organic Revenue Growth

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Total revenue growth | | (5.1) | % | | (4.7) | % | | (5.6) | % | | (5.1) | % |

| Foreign currency | | 0.7 | % | | (1.7) | % | | 0.7 | % | | (1.0) | % |

| Acquisition and divestitures | | 0.2 | % | | 1.9 | % | | 0.2 | % | | 2.2 | % |

| Organic revenue growth | | (4.2) | % | | (4.5) | % | | (4.7) | % | | (3.9) | % |

| | | | | | | | |

| GBS revenue growth | | (1.8) | % | | (2.4) | % | | (1.8) | % | | (1.9) | % |

| Foreign currency | | 0.9 | % | | (1.4) | % | | 0.9 | % | | (0.7) | % |

| Acquisition and divestitures | | 0.4 | % | | 4.1 | % | | 0.4 | % | | 4.6 | % |

| GBS organic revenue growth | | (0.5) | % | | 0.3 | % | | (0.5) | % | | 2.0 | % |

| | | | | | | | |

| GIS revenue growth | | (8.5) | % | | (6.8) | % | | (9.4) | % | | (8.1) | % |

| Foreign currency | | 0.7 | % | | (2.1) | % | | 0.5 | % | | (1.2) | % |

| Acquisition and divestitures | | — | % | | — | % | | — | % | | — | % |

| GIS organic revenue growth | | (7.8) | % | | (8.9) | % | | (8.9) | % | | (9.3) | % |

EBIT and Adjusted EBIT

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| (in millions) | | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Net income | | $ | 63 | | | $ | 140 | | | $ | 133 | | | $ | 281 | |

| Income tax expense | | 68 | | | 72 | | | 159 | | | 137 | |

| Interest income | | (51) | | | (56) | | | (153) | | | (158) | |

| Interest expense | | 66 | | | 78 | | | 207 | | | 222 | |

| EBIT | | 146 | | | 234 | | | 346 | | | 482 | |

| Restructuring costs | | 43 | | | 36 | | | 124 | | | 91 | |

| Transaction, separation and integration-related costs | | 3 | | | 2 | | | 25 | | | 6 | |

| Amortization of acquired intangible assets | | 87 | | | 88 | | | 263 | | | 266 | |

| Merger related indemnification | | — | | | 2 | | | — | | | 15 | |

| Gains on dispositions | | (8) | | | (104) | | | (13) | | | (132) | |

| Losses (gains) on real estate and facility sales | | 3 | | | (2) | | | 32 | | | (8) | |

| Impairment losses | | 12 | | | — | | | 12 | | | 5 | |

| Adjusted EBIT | | $ | 286 | | | $ | 256 | | | $ | 789 | | | $ | 725 | |

| | | | | | | | |

| EBIT margin | | 4.5 | % | | 6.9 | % | | 3.6 | % | | 4.7 | % |

| Adjusted EBIT margin | | 8.9 | % | | 7.5 | % | | 8.1 | % | | 7.1 | % |

Offerings Details

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Q3 FY25 | | Q2 FY25 | | Q1 FY25 | | Q4 FY24 | | Q3 FY24 |

Consulting & Engineering Services | | $ | 1,270 | | | $ | 1,281 | | | $ | 1,284 | | | $ | 1,317 | | | $ | 1,310 | |

Insurance Software & BPS | | 396 | | | 396 | | | 389 | | | 388 | | | 379 | |

Cloud, ITO & Security | | 1,184 | | | 1,188 | | | 1,206 | | | 1,290 | | | 1,277 | |

| Modern Workplace | | 375 | | | 376 | | | 357 | | | 384 | | | 426 | |

Subtotal | | 3,225 | | | 3,241 | | | 3,236 | | | 3,379 | | | 3,392 | |

M&A and Divestitures | | — | | | — | | | — | | | 7 | | | 7 | |

Total Revenues | | 3,225 | | | 3,241 | | | 3,236 | | | 3,386 | | | 3,399 | |

Source: DXC Technology

Category: Investor Relations

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dxc_SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

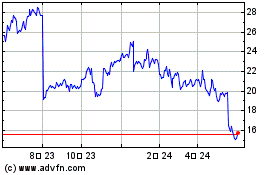

DXC Technology (NYSE:DXC)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

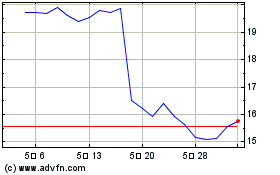

DXC Technology (NYSE:DXC)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025