UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ |

Definitive Proxy Statement |

☒ |

Definitive Additional Materials |

☐ |

Soliciting Material pursuant to Rule 14a-12 |

HEART TEST LABORATORIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

☒ |

No fee required. |

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

5) |

Total fee paid: |

|

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

1) |

Amount Previously Paid: |

|

|

|

|

|

|

|

2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

3) |

Filing Party: |

|

|

|

|

4) |

Date Filed: |

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 17, 2024 |

Heart Test Laboratories, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Texas |

001-41422 |

26-1344466 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

550 Reserve Street, Suite 360 |

|

Southlake, Texas |

|

76092 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 682 237-7781 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

HSCS |

|

The Nasdaq Stock Market LLC |

Warrants |

|

HSCSW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On January 17, 2024, Heart Test Laboratories, Inc. (the “Company”) held its 2024 Annual Meeting of Shareholders (the “Annual Meeting”). At the Annual Meeting, the Company’s shareholders voted on the eight proposals described below. The proposals presented at the Annual Meeting are described in detail in the Company’s definitive proxy statement for its 2024 Annual Meeting of Shareholders filed with the U.S. Securities and Exchange Commission (the “SEC”) on December 8, 2023 (the “Proxy Statement”).

Of the Company’s 53,886,305 shares of common stock, par value $0.001 per share (the “Common Stock”) outstanding, and Series C preferred stock, par value $0.001 per share, on an as converted basis outstanding and entitled to vote at the Annual Meeting, 29,299,177, or 54.37%, of the outstanding shares, were present either in person or by proxy.

The results for each of the proposals submitted to a vote of shareholders at the Annual Meeting are as follows:

Proposal 1: Election of Directors Proposal

The following two Class I nominees will serve for a three-year term expiring on the date of the Company’s 2026 Annual Meeting of Shareholders or until his successor is duly elected or his earlier resignation or removal, and the following two Class II nominees will serve for a three-year term expiring on the date of the Company’s 2027 Annual Meeting of Shareholders or until his successor is duly elected or his earlier resignation or removal. The voting with respect to the election of directors was as follows:

Class I Directors

|

|

|

|

Nominee |

Votes For |

Withheld |

Broker Non-Votes |

Brian Szymczak |

22,817,292 |

437,448 |

6,044,437 |

Bruce Bent |

22,800,131 |

454,609 |

6,044,437 |

Class II Directors

|

|

|

|

Nominee |

Votes For |

Withheld |

Broker Non-Votes |

Mark Hilz |

22,877,208 |

377,532 |

6,044,437 |

David R. Wells |

22,814,389 |

440,351 |

6,044,437 |

Proposal 2: ELOC Issuance Proposal

The Company’s shareholders approved the full issuance of shares of the Company’s Common Stock issuable by the Company pursuant to its purchase agreement, dated as of March 10, 2023, with Lincoln Park Capital Fund, LLC (the “ELOC Issuance Proposal”) for purposes of complying with Nasdaq Listing Rule 5635(d), by voting as follows:

|

|

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

|

|

22,113,326 |

|

928,881 |

|

212,533 |

|

6,044,437 |

|

Proposal 3: Proposal to Approve the Company’s 2023 Employee Stock Purchase Plan, as Amended

The Company’s shareholders approved the Company’s 2023 Equity Incentive Plan, as amended, by voting as follows:

|

|

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

|

|

16,969,611 |

|

5,682,886 |

|

602,244 |

|

6,044,437 |

|

Proposal 4: Auditor Ratification Proposal

The Company’s shareholders ratified the appointment of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2024 by voting as follows:

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

|

28,840,623 |

|

207,972 |

|

250,581 |

|

Proposal 5: Reverse Stock Split Proposal

The Company’s shareholders approved an amendment to the Company’s Amended and Restated Certificate of Formation (the “Certificate of Formation”) to effect, at the sole discretion of the Company’s Board of Directors, a reverse stock split of all outstanding shares of the Company’s Common Stock, at a ratio to be determined by the Company’s Board of Directors in the range of one-for-two (1-for-2) through one-for-one hundred (1-for-100), by voting as follows:

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

|

27,379,571 |

|

1,761,895 |

|

157,711 |

|

Proposal 6: Name Change Proposal

The Company’s shareholders approved an amendment to the Company’s Amended and Restated Certificate of Formation to change the Company’s corporate name from “Heart Test Laboratories, Inc.” to “HeartSciences Inc.” by voting as follows:

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

|

28,852,380 |

|

239,552 |

|

207,243 |

|

Proposal 7: Quorum Reduction Proposal

The Company did not receive sufficient proxies from shareholders to approve an amendment to the Company's Certificate of Formation to decrease the number of shares of the Company’s Common Stock needed to establish a quorum for meetings of the Company’s shareholders. Pursuant to the approval of Proposal 8 (below), the Company adjourned the Annual Meeting with respect to Proposal 7. During the period of the adjournment, the Company will continue to solicit votes from its shareholders with respect to Proposal 7. The voting at the time of the Annual Meeting was as follows:

|

|

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

|

|

26,500,809 |

|

1,415,185 |

|

367,263 |

|

1,015,920 |

|

Proposal 8: Adjournment Proposal

The Company’s shareholders approved the one or more adjournments of the Annual Meeting to a later date or dates to solicit additional proxies if there are insufficient votes to approve any of the proposals at the time of the Annual Meeting by voting as follows:

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

|

28,078,902 |

|

759,077 |

|

461,197 |

|

The Company’s shareholders will be able to attend the reconvened Annual Meeting virtually via live webcast at https://web.lumiagm.com/293046675 on Thursday, February 15, 2024 at 9:00 a.m. Eastern Time. The record date for the Annual Meeting remains the close of business on November 20, 2023. The Company shareholders who have already voted do not need to recast their votes unless they wish to change their votes on Proposal 7. The Company’s shareholders of record who have not already voted or wish to change their vote on the Proposal 7 may do so by following the instructions provided in the voting instruction form or proxy card accompanying the Proxy Statement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

Exhibit No. |

|

Description |

99.1 |

|

Press Release dated January 18, 2024. |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Additional Information and Where to Find It

This Current Report on Form 8-K may be deemed solicitation material in respect of the Annual Meeting. This communication does not constitute a solicitation of any vote or approval. In connection with the Annual Meeting, the Company has filed with the SEC and has mailed or otherwise provided to its stockholders a proxy statement regarding the business to be conducted at the Annual Meeting. The Company may also file other documents with the SEC regarding the business to be conducted at the Annual Meeting. This document is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO IN ITS ENTIRETY AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING.

The Company’s stockholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC (when available) through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge on its investor relations website at ir.heartsciences.com copies of materials it files with, or furnishes to, the SEC.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the business to be conducted at the Annual Meeting. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Proxy Statement. To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Proxy Statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made under the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 and are relating to the Company's future financial and operating performance. All statements, other than statements of historical facts, included herein are "forward-looking statements" including, among other things, statements about the Company’s beliefs and expectations. These statements are based on current expectations, assumptions and uncertainties involving judgments about, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the Company's control. The expectations reflected in these forward-looking statements involve significant assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Potential risks and uncertainties include, but are not limited to, risks discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2023, filed with the SEC on July 18, 2023, Quarterly Report on Form 10-Q for the fiscal quarter ended October 31, 2023, filed with the SEC on December 14, 2023, and in the Company’s other filings with the SEC at www.sec.gov. Other than as required under the securities laws, the Company does not assume a duty to update these forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

HEART TEST LABORATORIES, INC. |

|

|

|

|

Date: |

January 18, 2024 |

By: |

/s/ Andrew Simpson |

|

|

Name: Title: |

Andrew Simpson

President, Chief Executive Officer, and Chairman of the Board of Directors

|

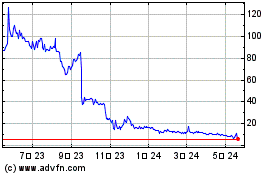

HeartSciences (NASDAQ:HSCS)

과거 데이터 주식 차트

부터 12월(12) 2024 으로 1월(1) 2025

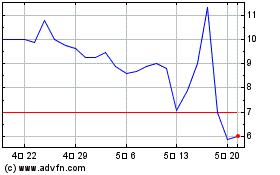

HeartSciences (NASDAQ:HSCS)

과거 데이터 주식 차트

부터 1월(1) 2024 으로 1월(1) 2025