Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-269225

(To

Prospectus dated January 25, 2023)

Up

to $10,000,000

Common

Stock

Oragenics,

Inc.

We

have entered into an At-The-Market Issuance Sales Agreement (the “Sales Agreement”) with Dawson James Securities, Inc. (the

“Sales Agent” or “Dawson James Securities, Inc.”) relating to the sale of shares of our common stock, par value

$0.001 per share, offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Sales Agreement,

we may offer and sell shares of our common stock bearing an aggregate offering price of up to $10,000,000 from time to time through or

to Dawson James Securities, Inc., acting as an agent or principal.

Our

common stock is listed on the NYSE American under the symbol “OGEN”. The last reported sale price of our common stock on

the NYSE American on October 7, 2024, was $0.40 per share.

As

of October 9, 2024, the aggregate market value of our outstanding common stock held by non-affiliates, or the public float, was approximately

$21,215,963.55, which was calculated based on 9,513,885 shares of our outstanding common stock held by non-affiliates and on a price

of $2.23 per share, which is the highest closing price of our common stock on the NYSE American

within the prior 60 days. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our securities in a public

primary offering with a value exceeding one-third of our public float in any 12-month period unless our public float subsequently rises

to $75.0 million or more. During the 12-calendar month period that ends on, and includes, the date

of this prospectus supplement (but excluding this offering), we have offered and sold $3,200,000 of our securities pursuant to General

Instruction I.B.6 of Form S-3.

Sales

of our common stock, if any, under this prospectus supplement will be made in sales deemed to be an “at the market offering”

as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Dawson James

Securities, Inc. is not required to sell any specific amount of securities but will be acting as our sales agent using commercially reasonable

efforts consistent with its normal trading and sales practices, on mutually agreed terms between Dawson James Securities, Inc. and us.

There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The

compensation to Dawson James Securities, Inc. for sales of common stock sold pursuant to the Sales Agreement will be up to 3% of the

gross proceeds of any shares of common stock sold under the Sales Agreement. In connection with the sale of the common stock on our behalf,

Dawson James Securities, Inc. will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation

of Dawson James Securities, Inc. will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification

and contribution to Dawson James Securities, Inc. with respect to certain liabilities, including liabilities under the Securities Act

or the Securities Exchange Act of 1934, as amended (the “Exchange Act”). For additional information regarding compensation

to be received by the Sales Agent, see “Plan of Distribution.”

Investing

in our securities involves significant risks. Please read the information contained in or incorporated by reference under the heading

“Risk Factors” beginning on page S-12 of this prospectus supplement, and under similar headings in other documents filed

after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

Dawson

James Securities, Inc.

The

date of this prospectus supplement is October 11, 2024

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is part of the registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process (Registration File No. 333-269225) and consists of two parts. The first part is this prospectus

supplement describes the specific terms of this offering. The second part, the accompanying prospectus, gives more general information,

some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both

parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents

incorporated by reference into this prospectus supplement or the accompanying prospectus.

If

information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference

that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus

supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us,

the securities being offered and other information you should know before investing in our securities. You should also read and consider

information in the documents we have referred you to in the sections of this prospectus supplement entitled “Where You Can Find

Additional Information” and “Incorporation of Certain Information by Reference”.

You

should rely only on this prospectus supplement, the accompanying prospectus, the documents incorporated or deemed to be incorporated

by reference herein or therein and any free writing prospectus prepared by us or on our behalf. We have not authorized anyone to provide

you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement

and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are

not offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information

contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus, or incorporated by reference herein,

is accurate as of any date other than as of the date of this prospectus supplement or the accompanying prospectus or any free writing

prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the

time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business, financial

condition, liquidity, results of operations and prospects may have changed since those dates.

References

to, “we,” “us,” “our company,” “Oragenics,” the “Company,” and similar terms

refer to Oragenics, Inc., a Florida corporation, unless the context otherwise requires.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution

of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus

supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about, and to

observe, any restrictions as to this offering and the distribution of this prospectus supplement or the accompanying prospectus applicable

to that jurisdiction.

The

industry and market data and other statistical information contained in this prospectus supplement, the accompanying prospectus and the

documents we incorporate by reference are based on management’s estimates, independent publications, government publications, reports

by market research firms or other published independent sources, and, in each case, are believed by management to be reasonable estimates.

Although we believe these sources are reliable, we have not independently verified the information. None of the independent industry

publications used in this prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared

on our or our affiliates’ behalf and none of the sources cited by us consented to the inclusion of any data from its reports, nor

have we sought their consent.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements. These are based on our management’s

current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us.

Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,”

“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

contained in the documents incorporated by reference herein.

Any

statements in this prospectus, or incorporated herein, about our expectations, beliefs, plans, objectives, assumptions or future events

or performance are not historical facts and are forward-looking statements. Within the meaning of Section 27A of the Securities Act and

Section 21E of the Exchange Act, these forward-looking statements include statements regarding:

| |

● |

Our

need to raise additional capital to continue to implement our business strategy; |

| |

|

|

| |

● |

Our

financial capacity and performance, including our ability to obtain funding, non-dilutive or otherwise, necessary to do the research,

development, manufacture, and commercialization of any one or all of our product candidates; |

| |

|

|

| |

● |

Our

ability to maintain our listing on the NYSE American and the trading market of our common stock; |

| |

|

|

| |

● |

The

timing, progress and results of clinical trials of our product candidates; |

| |

|

|

| |

● |

Uncertainties

regarding submission, approval and scope of filings for regulatory approval of our product candidates and our ability to obtain and

maintain regulatory approvals for our product candidates for any indication; |

| |

|

|

| |

● |

Uncertainties

regarding the potential benefits, activity, effectiveness and safety of our product candidates including as to administration, distribution

and storage; |

| |

|

|

| |

● |

Uncertainties

regarding the size of the patient populations, market acceptance and opportunity for and clinical utility of our product candidates,

if approved for commercial use; |

| |

|

|

| |

● |

Our

manufacturing capabilities and strategy, including the scalability and commercial viability of our manufacturing methods and processes,

and those of our contractual partners; |

| |

|

|

| |

● |

Our

ability to successfully commercialize our product candidates; |

| |

|

|

| |

● |

The

potential benefits of, and our ability to maintain, our relationships and collaborations with the NIAID, the NIH, the NRC and other

potential collaboration or strategic relationships; |

| |

|

|

| |

● |

Uncertainties

regarding our expenses, ongoing losses, future revenue, capital requirements; |

| |

|

|

| |

● |

Our

ability to identify, recruit and retain key personnel and consultants, and have them available to dedicate the time necessary to

advance our product candidates; |

| |

|

|

| |

● |

Our

ability to obtain, retain, protect, and enforce our intellectual property position for our product candidates, and the scope of such

protection; |

| |

|

|

| |

● |

Our

ability to advance the development of our new and existing product candidate under the timelines and in accord with the milestones

projected; |

| |

● |

Our

need to comply with extensive and costly regulation by worldwide health authorities, who must approve our product candidates prior

to substantial research and development and could restrict or delay the future commercialization of certain of our product candidates; |

| |

|

|

| |

● |

Our

ability to successfully complete pre-clinical and clinical development of, and obtain regulatory approval of our product candidates

and commercialize any approved products on our expected timeframes or at all; |

| |

|

|

| |

● |

The

safety, efficacy, and benefits of our product candidates; |

| |

|

|

| |

● |

The

effects of government regulation and regulatory developments, and our ability and the ability of the third parties with whom we engage

to comply with applicable regulatory requirements; |

| |

|

|

| |

● |

The

capacities and performance of our suppliers and manufacturers and other third parties over whom we have limited control; and |

| |

|

|

| |

● |

Our

competitive position and the development of and projections relating to our competitors or our industry. |

In

some cases, you can identify forward-looking statements by the words “may,” “might,” “can,” “will,”

“to be,” “could,” “would,” “should,” “expect,” “intend,” “plan,”

“objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “likely,” “continue” and “ongoing,” or the negative of these terms, or other

comparable terminology intended to identify statements about the future, although not all forward-looking statements contain these words.

These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

You

should refer to the “Risk Factors” section contained in this prospectus and any related free writing prospectus, and under

similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of important factors

that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Given these

risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements

in this prospectus will prove to be accurate, and you should not place undue reliance on these forward-looking statements. Furthermore,

if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in

these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that

we will achieve our objectives and plans in any specified time frame, or at all.

Except

as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements

to reflect events or developments occurring after the date of this prospectus, even if new information becomes available in the future.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all

of the information that you should consider before investing in our common stock and it is qualified in its entirety by, and should be

read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our common

stock, you should read the entire prospectus carefully, including “Risk Factors” beginning on page S-12 and the financial statements

and related notes included in this prospectus.

Our

Company

We

are a development-stage company dedicated to the research and development of nasal delivery pharmaceutical medications in neurology and

fighting infectious diseases. Our lead product, the ONP-002 drug, is a fully synthetic, non-naturally occurring neurosteroid, is lipophilic,

and it has been shown in animal models that it can cross the blood-brain barrier rapidly to reduce swelling, oxidative stress and inflammation

while restoring proper blood flow through gene amplification.

On

December 28, 2023, we successfully consummated our previously announced Asset Purchase Agreement with Odyssey Health, Inc. (“Odyssey”),

pursuant to which we purchased all of Odyssey’s assets related to the segment of Odyssey’s

business focused on developing medical products that treat brain related illnesses and diseases (the “Neurology Assets”).

The Neurology Assets include drug candidates for treating mild traumatic brain injury (mTBI), also known as concussion, and for treating

Niemann Pick Disease Type C (NPC), as well as Odyssey’s novel proprietary nasal formulation and its novel breath-powered intranasal

delivery device.

As

a result of the acquisition of the Neurology Assets, we expect that, in the near- and mid-terms, we will focus our resources and efforts

on the continued development of the Neurology Assets and primarily ONP-002, which, as discussed further below, has successfully completed

Phase 1 clinical trials. The acquisition is expected to build on our expertise in intranasal platforms and expand our portfolio into

more areas of unmet medical needs. Nasal delivery offers many advantages over standard systemic delivery systems, such as its non-invasive

character, a fast onset of action and in many cases reduced side effects due to a more targeted delivery.

Accordingly,

given our limited resources, we anticipate, for the time being, placing the development of our nasal COVID-19 product candidate and our

lantibiotics program on hold.

In

conjunction with the Neurology Asset acquisition, we paid Odyssey a total of $1,000,000 in cash, $500,000 of which was paid in October,

2023 and $500,000 of which was paid on December 11, 2023. In addition, at the closing, we issued Odyssey 8,000,000 shares of our newly

created Series F Non-Voting Convertible Preferred Stock, which are convertible into our common stock on a one-to-one basis (subject to

certain adjustments). Odyssey converted 511,308 of those shares into our common stock on December 28, 2023. Pursuant to the Certificate

of Designation creating the Series F Preferred Stock, the remainder of the shares are not convertible until the

occurrence of all of the following: (i) Oragenics’ shall have applied for and been approved for initial listing on the NYSE American

or another national securities exchange or shall have been delisted from the NYSE American, which Oragenics’ does not anticipate

undertaking until it meets the NYSE American’s initial listing standards, and (ii) if required by the rules of the NYSE American,

Oragenics’ shareholders shall have approved any change of control that could be deemed to occur upon the conversion of the Series

F Preferred Stock into common stock, based on the fact and circumstances existing at such time.

About

Mild Traumatic Brain Injury (mTBI)

Concussions

are a serious unmet medical need that affects millions worldwide. Repetitive concussions are thought to increase the risk of developing

Chronic Traumatic Encephalopathy (“CTE”) and other neuropsychiatric disorders. It is estimated that 5 million concussions

occur in the U.S. annually and that as many as 50% go unreported. The worldwide incidence of concussion is estimated at 69 million. The

global market for concussion treatment was valued at $6.9 billion in 2020 and is forecast to reach $8.9 billion by 2027, according to

Grandview Research. Common settings for concussion include contact sports, military training and operations, motor vehicle accidents,

children at play and elderly falls.

Our

ONP-002 Neurology Asset for Brain Related Illness and Injury

Our

lead product and focus is on the development and commercialization of ONP-002 for the treatment of mild traumatic brain injury (“mTBI”

or “concussion”). ONP-002 to date has been shown to be stable up to 104 degrees for 18-months. The ONP-002 drug candidate

is used in conjunction with Oragenic’s novel breath-powered intranasal device. In use, breath power drives the ONP-002 drug candidate

from the novel intranasal device through the nasal passage and directly into the brain for mTBI or concussion treatment. The novel intranasal

device is lightweight and uniquely designed for easy and simple use in the field.

We

believe the proprietary nasal formulation and intranasal administration allows for rapid and direct accessibility to the brain. The novel

intranasal device is breath propelled and is designed to drive and concentrate the ONP-002 drug into the brain, which then easily crosses

the blood brain barrier. In operation, when patients blow into the intranasal device, the soft palate closes in the back of the nasopharynx.

This mechanism is designed to prevent the flow of the ONP-002 drug into the lungs or esophagus, minimize systemic ONP-002 drug exposure

and side effects, and concentrate the ONP-002 drug flow into the brain. In other words, this mechanism is designed to trap the ONP-002

drug in the nasal cavity allowing for more abundant and faster drug availability in the traumatized brain.

Expected

ONP-002 Product Development Timeline:

| Pre-clinical

Animal Studies |

|

Phase

1 |

|

Phase

2a |

|

Phase

2b |

|

Phase

3 |

| Complete |

|

Complete |

|

Estimated

Q3/Q4 2024 start |

|

Estimated

Q1 2025 start |

|

Estimated

Q4 2026 start |

This

product development plan is an estimate and is subject to change based on funding, technical risks and regulatory approvals.

Validation

and Stability of ONP-002

A

Certificate of Analysis (“COA”) was issued by the manufacturer of the drug, indicating that testing methods were standard

and include appearance, identification by 1H NMR, identification by Mass Spectroscopy (MS), optical purity by HPLC, residual solvent

analysis, elemental impurities, percent water, and residue on ignition. The manufacturer has shown both the specifications and the results,

indicating that the material supplied passes all criteria. The ONP-002 drug is supplied in essentially pure form. As such, no excipients

are believed to be present. Stability studies were performed by storing the ONP-002 drug samples under carefully controlled conditions

with respect to temperature and humidity. The stability testing protocol included storage at about 25 °C± 2 °C at about

60% relative humidity ± 5% relative humidity for about 24 months and at about 40 °C± 2 °C at about 75% relative

humidity ± 5% for about 18 months. The ONP-002 drug samples were pulled at essentially the scheduled time and analyzed for appearance,

purity, assay, optical purity, and water content. No changes in ONP-002 were observed.

Intellectual

Property

Domestic

and foreign patents applications on the ONP-002 compound have been filed and to date, several have been issued. Domestic and foreign

patent applications have also been filed on the novel breath-powered intranasal delivery device as follows:

| ● |

New

chemical entity IP filings – USPTO pending, granted in Europe and Canada |

| |

|

| |

○ |

C-20

steroid compounds, compositions and uses thereof to treat traumatic brain injury (TBI), including concussion. |

| |

|

|

| |

○ |

The

invention relates to ONP-002 drug compound, compositions and methods of use thereof to treat, minimize and/or prevent traumatic brain

injury (TBI), including severe TBI, moderate TBI, and mild TBI, including concussions. |

| |

○ |

Patent

expiration with max patent term extension – 9/17/2040 |

| |

|

|

| |

○ |

Patent

expiration with no patent term extension – 9/17/2035 |

| |

|

|

| ● |

Method

of intranasal delivery and device components – Domestic and Foreign patent applications pending |

| |

|

| ● |

Breath-powered

intranasal device and use thereof – Domestic and Foreign patent applications pending |

ONP-002

Pre-Clinical Trials

The

ONP-002 drug has completed toxicology studies in rats and dogs. Those studies show that the ONP-002 drug has a large safety margin of

its predicted efficacious dose. In preclinical animal studies, the ONP-002 drug demonstrated rapid and broad biodistribution throughout

the brain while simultaneously reducing swelling, inflammation, and oxidative stress, along with an excellent safety profile.

Results

from the preclinical studies suggest that the ONP-002 drug has an equivalent, and potentially superior, neuroprotective effect compared

to related neurosteroids. The animals treated with the ONP-002 drug post-concussion showed positive behavioral outcomes using various

testing platforms including improved memory and sensory-motor performance, and reduced depression/anxiety like behavior.

ONP-002

Drug Induction of PXR

The

induction of the human CYP450 enzymes, CYP2B6, and CYP3A4 by ONP-002, as measured by mRNA expression, was tested in human hepatocytes

from 3 donors at 3 concentrations: about 1 μM, about 10 μM and about 100 μM. Results reflected that the ONP-002 drug through

the known PXR-mechanism produced a modest induction of CYP3A4, up to about 17% of the positive control, and a greater induction of CYP2B6,

of up to about 59% of the positive control, both at a concentration of about 100 μM. Past data reflected that the ONP-001 drug candidate

(ent-Progesterone) and Progesterone induce the PXR receptor. Receptor binding studies have been performed showing neither the

ONP-001 drug candidate or the ONP-002 drug activate the classical Progesterone Receptor.

ONP-002

Drug Animal Studies

All

surgical animals (male Sprague-Dawley rats approx. 250 grams) were anesthetized with an initial isoflurane induction for about 4 min-the

minimum time necessary to sedate the animal. The scalp was shaved and cleaned with isopropanol and betadine. During the stereotaxic surgery,

anesthesia was maintained with isoflurane. A medial incision was made, and the scalp was pulled back over the medial frontal cortex.

An approximate 6-mm diameter craniotomy was performed exposing the brain tissue. An electrically controlled injury device using a 5 mm

metal impactor was positioned over the exposed brain. An impact speed of about 1.6 m/s at about a 90-degree angle from vertical was used

to produce an open head injury at a depth of 1mm to create a milder TBI. All treatments were given intranasal (IN) as a liquid solution

with a micro atomizer. Vehicle for all administrations was about 22.5% Hydroxy-Propyl-β-cyclodextrin (HPβCD).

Molecular

Studies - Brain tissue was taken from the penumbral region of injury.

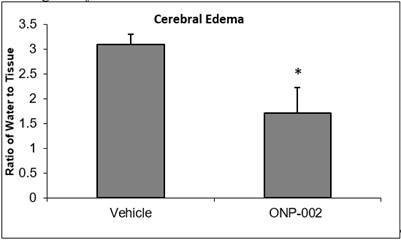

Cerebral

Edema

In

Figure 2, we show that the ONP-002 drug reduces swelling in rats compared to vehicle-treated at 24-hrs after brain injury by measure

of brain water content through speed-vacuum dehydration and tissue weight comparisons. The ONP-002 drug-treated (about 4mg/kg) and vehicle-treated

were compared to sham which was set at zero. Local edema can occur after mTBI. Severe cerebral edema is associated with poor outcomes

including increased mortality after mTBI with Second Impact Syndrome (2). *Denotes significance at p<0.05, n=6

Inflammation

mTBI

causes vascular and neuronal stress. Microglia and reactive astrocytes infiltrate the areas of injury and release inflammatory mediators,

like TNF-alpha. We show that the ONP-002 drug (about 4mg/kg) reduces TNF-alpha-mediated neuroinflammation in brain tissue of rats compared

to vehicle at approximately 24-hrs after mTBI (ELISA).

Pharmacokinetics

and Safety of IN ONP-002 Drug in Dog

This

pivotal GLP 14-day study used repeat dosing of the ONP-002 drug, 3X a day, approximately about 4 hours apart, for approximately 14 consecutive

days at concentrations of about 0, 3, 10 or 23 mg/mL at a volume of about 1 mL/nostril to beagle dogs (both nostrils had drug administered).

The intranasal treatment was given as a liquid solution using a micro atomizer using about 22.5% HPβCD as the vehicle. Intranasal

ONP-002 drug dosing revealed that the ONP-002 drug was well tolerated up to the highest dose of about 23 mg/ml or about 46mg in total

per dosing. Clinical observations were limited to increased salivation in dogs which occurred in a dose-dependent manner. There were

no effects on body weight, food consumption, ophthalmic parameters, clinical chemistry, haematology, or organ weights at any of the doses

tested. Microscopic analysis revealed purulent exudates in the nasal turbinate and evidence of inflammatory infiltrates and fibrin deposition

in the lungs. All of these events were classified as mild, reversed during the recovery period, and did not appear to show any dose dependency.

Similar findings were evident in vehicle control treated dogs indicating the findings were vehicle related. The highest dose of about

23 mg/ml was thus determined to be the NOAEL which is equivalent to a ONP-002 dose of about 1.5mg/kg and about 2.3mg/kg in male and female

dogs, respectively. Testing shows the dose-dependent increase in plasma exposure of the ONP-002 drug in male and female dogs following

IN administration. Plasma exposure levels were similar in males and females and there did not appear to be any evidence of drug accumulation

following multiple doses.

Cardiopulmonary

Safety Pharmacology

The

effect of the ONP-002 drug on the human ether-a-go-go related gene (hERG) tail currents was assessed in a non-Good Laboratory Practice

(GLP) study using manual whole-cell patch clamp. The ONP-002 drug tested at a single concentration of about 10 μM inhibited hERG tail

currents by about 42.6% (n=3). In order to achieve a safety factor of about 30-fold between in vitro hERG IC50 and free plasma levels

of the ONP-002 drug in clinical studies, the Cmax (maximum concentration) should not exceed a free drug concentration of about 0.33 μM

(about 99 ng/ml). The ONP-002 drug is about 97.2% human plasma protein bound and is estimated to reach a plasma Cmax of about 12.5 nM,

the highest dose of about 0.533 mg/kg to be administered in the planned first in human (FIH) study, which provides a safety factor of

about 800-fold. A GLP study has been conducted at Charles River, Inc. and will be incorporated into the IND submission.

ONP-002

Drug Clinical Trials

The

ONP-002 drug has completed a Phase 1 clinical trial in healthy human subjects showing it is safe and well tolerated.

Safety

studies have established a dosing regimen of 2X/day for fourteen days. The Phase 1 clinical trial was performed in Melbourne, Australia

with a Contract Research Organization (CRO), Avance Clinical Pty Ltd and Nucleus Network Pty Ltd. The country of Australia provides a

currency exchange advantage and a tax rebate at the end of our fiscal year from the Australian government on all Research and Development

performed in Australia.

The

Phase 1 study was double-blinded, randomized and placebo controlled (3:1, drug:placebo). Phase 1 used a Single Ascending/Multiple Ascending

(SAD/MAD) drug administration design. The SAD component was a 1X treatment (low, medium, or high dose) and the MAD component was a 1X/day

treatment for five consecutive days (low and medium dose). Blood and urine samples were collected at multiple time points for safety

pharmacokinetics. Standard safety monitoring was provided for each body system.

Forty

human subjects (31 males, 9 females) were successfully enrolled in Phase 1. The Safety Review Board, made up of medical doctors, has

reviewed the trial data and has determined the drug is safe and well tolerated at all dosing levels.

We

anticipate preparing for Phase 2 clinical trials to further evaluate the ONP-002 drug’s safety and efficacy. Based on the Phase

1 data, we plan to apply for an Investigational New Drug application with the FDA and conduct a Phase 2 trial in the United States.

We

anticipate a Phase 2 clinical trial will be performed administering the ONP-002 drug intranasally in concussed patients 2x a day for

up to fourteen days. The Phase 2a feasibility study is expected to be performed in Australia with a target initiation date in the third

quarter of 2024 to be followed closely by a Phase 2b proof of concept study in the US.

We

have entered an agreement with one of the leading Contract Research Organization (CRO) in Australia, to conduct a Phase 2 clinical trial

in Australia. This trial aims to evaluate the ONP-002 drug for TBI. This Australian CRO, renowned for its clinical trial management capabilities

and quality of service in Australia, New Zealand, and North America, brings over two decades of expertise in navigating the Therapeutic

Goods Administration, Food and Drug Administration, and European Medicines Agency regulatory landscapes. Other key third party well-respected

vendors also have been engaged to advance and monitor our progress.

On

July 10, 2024, we announced that we had developed a new proprietary formulation for the novel ONP-002 neurosteroid. We believe the nasal

cavity provides access for our novel neurosteroid formulation to enter the brain in minutes. Given the difficulty of getting neurosteroids

into solution, unique formulations must be developed to achieve therapeutic levels. We believe that our recent work has increased the

final dose levels significantly while also providing for improved intranasal drug delivery and adhesion and, thus, longer absorption

times. We further believe we have successfully completed an improved proprietary formulation of the ONP-002 drug that should significantly

increase the bioavailability of the intranasal drug formulation. The enhanced drug percentages in this novel proprietary formulation

have been developed as part of our platform for acute-field delivery of the drug. Our newly developed proprietary intranasal drug formulation

is intended to reduce the duration of initial concussion symptoms and prevent long-lasting symptoms that can be debilitating after a

concussion.

On

August 8, 2024, we announced our candidate for treating concussion successfully completed a study that indicates the ONP-002 drug does

not cause cardiotoxicity. Prior to conducting a clinical trial, the U.S. Food and Drug Administration (FDA) requires pharmaceuticals

to be tested on cardiac receptors to ensure that they do not show any causes of electrical malformations. Further, on August 30, 2024,

we announced we successfully completed a study that indicates the ONP-002 drug does not cause DNA damage and genotoxicity in an animal

model. Prior to conducting a clinical trial, the U.S. Food and Drug Administration (FDA) requires that pharmaceuticals be tested on cells

and animals to ensure they do not cause damage affecting cell division.

Our

Medical Advisors

Dr.

James “Jim” Kelly, Neurologist, serves as our Chief Medical Officer, and oversees our upcoming Phase 2 clinical trial for

treating concussion. In the recent past, Dr. Kelly served as the Executive Director of the Marcus Institute for Brain Health (MIBH) and

Professor of Neurology at the University of Colorado Anschutz Medical Campus in Aurora, Colorado. The MIBH specialized treatment program

is funded by the Marcus Foundation to care for US military veterans with persistent symptoms of TBI. Dr. Kelly was also National Director

of the Avalon Action Alliance TBI Programs for which the MIBH serves as the clinical coordinating center. Prior to these recent positions,

Dr. Kelly was the Director of the National Intrepid Center of Excellence (NICoE) at Walter Reed National Military Medical Center in Bethesda,

MD. As its founding Director, he led the creation of an innovative interdisciplinary team of healthcare professionals who blended high-tech

diagnosis and treatment with complementary and alternative medical interventions in a holistic, integrative approach to the care of US

military personnel with the complex combination of TBI and psychological conditions, such as post-traumatic stress, depression, and anxiety.

In this role, Dr. Kelly was frequently called upon by leaders of the Military Health System at the Pentagon, the US Congress, the Department

of Veterans Affairs, and numerous military facilities in the continental US and abroad. Dr. Kelly has interacted with the FDA and clinical

trials for brain injury throughout his esteemed career. He is a strong advocate for treatments in the acute phase of brain injury and

understands the value of protecting the brain early on from inflammation, swelling and oxidative stress to gain better clinical outcomes.

Dr.

William “Frank” Peacock serves as our Chief Clinical Officer, and will conduct our anticipated Phase 2 clinical trial for

treating concussion in emergency departments. Dr. Peacock is currently the Vice Chair for Emergency Medicine Research at Baylor College

of Medicine and a past Professor at the Cleveland Clinic Lerner College of Medicine. He is also the Principal Investigator of a trial

for a company developing blood biomarkers for the identification of concussion in the emergency department, which is analyzing acute

blood markers that are elevated after concussion to not only ensure concussion is identified but also as a predictor of potential severity

and longer-term complications. Dr. Peacock is a world-renowned speaker and researcher. He has been instrumental in the approval and use

of high sensitivity blood troponins for acute coronary syndrome failure in emergency settings, which can be seen in the JAMA Cardiology

publication, Efficacy of High-Sensitivity Troponin T in Identifying Very-Low-Risk Patients with Possible Acute Coronary Syndrome,

and he is the editor of the first book of “Biomarkers of Traumatic Brain Injury”.

Our

SARS-CoV-2 Vaccine Product Candidate – NT-CoV2-1

Prior

to the purchase of the Neurology Assets, starting in May 2020 with the acquisition of one hundred percent (100%) of the total issued

and outstanding common stock of Noachis Terra, Inc. (“Noachis Terra”) and through December 31, 2023, we were focused on the

development and commercialization of a vaccine produce candidate to provide long-lasting immunity from SARS-CoV-2, which causes COVID-19.

During that time, we conducted testing in animal models, including SARS-CoV-2 challenge studies in hamsters, using specific formulations

for intramuscular administration and intranasal administration, both based on the NIAID pre-fusion stabilized spike protein antigens.

In

June of 2021, we initiated an immunogenicity study in mice and on August 30, 2021, we announced the successful completion of the mouse

studies that supported further development using either intramuscular or intranasal routes of administration. In September of 2021, we

initiated a hamster challenge to assess inhibition of viral replication using adjuvants specific for intramuscular and intranasal administration.

In December of 2021, we announced that both formulations generated robust immune responses and reduced the SARS-CoV-2 viral loads to

undetectable levels in the nasal passages and lungs five days following a viral challenge. On June 14, 2022, we announced that the results

of these studies were published in Nature Scientific Reports.

In

March of 2022, following a positive assessment of a rabbit-based pilot study, we initiated a Good Laboratory Practice toxicology study

to evaluate the safety profile and immunogenicity of NT-CoV2-1 in rabbits. This preclinical study was designed to provide data required

to advance our intranasal vaccine candidate into human clinical studies.

Following

the successful results of the animal studies previously referenced and a Type B Pre-IND Meeting with the FDA we determined to focus our

development efforts and financial resources on the intranasal delivery vaccine produce candidate, NT-CoV2-1. As part of this intranasal

development focus, during 2023 we entered into strategic license agreements and announced an award of a grant from CQDM.

However,

due to lack of financial resources our research and development activities for our NT-CoV2-1 vaccine product were suspended as of December

31, 2023, and are not currently active. We will continue to evaluate opportunities and funding resources for our SARS-CoV-2 and NT-CoV2-1

candidate products in the future of which there can be no assurances. These opportunities and funding resources could include, without

limitation, sublicensing agreements, joint ventures or partnerships, sales or licensing of technology, government grants and public or

private financings, through the sale of debt or equity securities or by securing a line of credit or other loan. There can be no assurances

that we will be able to secure any such opportunity or funding.

Our

Lantibiotic Product Candidate

Members

of our scientific team discovered that a certain bacterial strain of Streptococcus mutans, produces Mutacin 1140 (MU1140), a molecule

belonging to the novel class of antibiotics known as lantibiotics. Lantibiotics, such as MU1140, are highly modified peptide antibiotics

made by a small group of Gram-positive bacterial species. Over 60 lantibiotics have been discovered, to date. We believe lantibiotics

are generally recognized by the scientific community to be potent antibiotic agents. In nonclinical testing, MU1140 has shown activity

against all Gram-positive bacteria against which it has been tested, including those responsible for a number of healthcare associated

infections, or HAIs. A high percentage of hospital-acquired infections are caused by highly antibiotic-resistant bacteria such as methicillin-resistant

Staphylococcus aureus (MRSA) or multidrug-resistant Gram-negative bacteria. We believe the need for novel antibiotics is increasing because

of the growing resistance of target pathogens to existing FDA approved antibiotics on the market.

While

lantibiotics are promising, in 2023 we concluded we needed to make several changes to reduce the cash used in operations. In September

of 2023, we terminated our lease for the building where some of the research and development activities for the lantibiotic program were

undertaken. The closing of the laboratory was part of the continued focus on preserving cash resources while seeking additional funding

through various mechanisms. As of December 31, 2023, research and development activities related to the lantibiotic program are inactive.

We will evaluate opportunities for the lantibiotic program; however, moving forward our focus is to strengthen our focus and expertise

on developing our intranasal drug delivery platform and drug candidates that treat brain related illnesses and diseases.

Our

Business Development Strategy

Success

in the biopharmaceutical and product development industry relies on the continuous development of novel product candidates. Most product

candidates do not make it past the clinical development stage, which forces companies to look externally for innovation. Accordingly,

we expect, from time to time, to seek strategic opportunities through various forms of business development, which can include strategic

alliances, licensing deals, joint ventures, collaborations, equity or debt-based investments, dispositions, mergers, and acquisitions.

We view these business development activities as a necessary component of our strategies, and we seek to enhance shareholder value by

evaluating business development opportunities both within and complementary to our current business, as well as opportunities that may

be new and separate from the development of our existing product candidates.

As

discuss elsewhere, our current focus is on advancing our ONP-002 product candidate to treat concussion. Work on our other project candidates

currently is not active. As part of the focus on ONP-002, and to conserve resources, we have made several changes to reduce cash used

in operations until additional capital can be obtained. As previously announced, we exercised our

option under our lease with Hawley-Wiggins, LLC (the “Landlord”), for the building located in Progress Park and known as

13700 Progress Boulevard, Alachua, Florida 32615 (the “Lease”) to terminate the Lease by paying nine (9) months of advance

rent, plus prorated rent for the month of September, 2023, plus applicable sales tax. In addition to the termination of the Lease, the

Company eliminated two staff positions and Dr. Martin Handfield transitioned from an employee of the Company to a consultant. Dr. Handfield

continues to be available to provide support services on an hourly basis through a consulting agreement. Dr. Handfield’s employment

agreement was terminated in accordance with its terms. The Alachua lease contained the laboratory where some of the research and development

for the lantibiotic program was undertaken.

Corporate

and Other Information

We

were incorporated in November 1996 and commenced operations in 1999. We consummated our initial public offering in June 2003. Our executive

office is located at, 1990 Main Street, Suite 750, Sarasota, Florida 34236. Our telephone number is (813) 286-7900 and our website is

http://www.oragenics.com. We make available free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file or furnish

such materials to the Securities and Exchange Commission (the “SEC”). The reports are also available at www.sec.gov.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in Rule 10(f)(1) of Regulation S-K. We will remain a smaller reporting company

until the last day of the fiscal year in which (1) the market value of our shares of Common Stock held by non-affiliates exceeds $250

million or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our shares of Common

Stock held by non-affiliates exceeds $700 million, each as determined on an annual basis. A smaller reporting company may take advantage

of relief from some of the reporting requirements and other burdens that are otherwise applicable generally to public companies. These

provisions include:

| |

● |

being

permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure; |

| |

|

|

| |

● |

not

being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting;

and |

| |

|

|

| |

● |

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements. |

SUMMARY

OF RISK FACTORS

Our

business is subject to a number of risks of which you should be aware of before making an investment decision. These risks are discussed

more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. Some of

these risks include the following:

| ● |

We

have incurred significant losses since our inception, have limited financial resources, do not generate any revenues and will need

to raise additional capital in the future. |

| |

|

| ● |

We

may not be able to secure additional funding. |

| |

|

| ● |

Our

auditor has expressed substantial doubt about our ability to continue as a going concern. |

| |

|

| ● |

We

may not be able to satisfy the continued listing standards of the NYSE American and may be delisted from the NYSE American. |

| |

|

| ● |

We

have limited neurology-specific research, development, manufacturing, testing, regulatory, commercialization, sales, distribution,

and marketing experience, and we may need to invest significant financial and management resources to establish these capabilities. |

| |

|

| ● |

None

of our product candidates have been approved for sale and if we are unable to successfully develop our product candidates, we may

not be able to continue as a going concern. |

| |

|

| ● |

Our

product candidates, if approved, will face significant competition; many of our competitors have significantly greater resources

and experience. |

| |

|

| ● |

Our

ONP-002 concussion candidate may face competition from biosimilars approved through an abbreviated regulatory pathway. |

| |

|

| ● |

The

market opportunities for our neurology product candidates may be smaller than we believe them to be and we cannot assure you that

the market and consumers will accept our products or product candidates. |

| |

|

| ● |

If

our manufacturers and suppliers fail to meet our requirements and the requirements of regulatory authorities, our research and development

may be materially adversely affected. |

| |

|

| ● |

We

rely on the significant experience and specialized expertise of our senior management and scientific team and the loss of any of

our key personnel or our inability to successfully hire their successors could harm our business. |

| |

|

| ● |

If

any of our product candidates are shown to be ineffective or harmful in humans, we will be unable to generate revenues from these

product candidates. |

| |

|

| ● |

We

might not be successful at acquiring, investing in or integrating businesses, entering into joint ventures or divesting businesses. |

| |

|

| ● |

Our

concussion and neurology related research and development efforts are to a large extent dependent upon our intellectual property

and biologicals materials licenses. |

| |

|

| ● |

We

may not be able to protect our intellectual property and if we are unable to protect our trademarks or other intellectual property

from infringement, our business prospects may be harmed. |

| |

|

| ● |

We

may be subject to claims challenging the inventorship of our patents and other intellectual property rights. |

| |

|

| ● |

If

we are sued for infringing intellectual property rights of third parties, it will be costly and time-consuming and an unfavorable

outcome in that litigation could have a material adverse effect on our business. |

| |

|

| ● |

Our

success will depend on our ability to partner or sub-license our product candidates. |

| ● |

Security

breaches and other disruptions to our information technology systems or those of the vendors on whom we rely on could compromise

our information and expose us to liability, reputational damage, or other costs. |

| |

|

| ● |

Our

product candidates are subject to substantial government regulation and will be subject to ongoing and continued regulatory review

and we may also be subject to healthcare laws, regulation and enforcement. |

| |

|

| ● |

We

may be unable to obtain regulatory approval for our product candidates under applicable regulatory requirements. |

| |

|

| ● |

Delays

or difficulties in the enrollment of patients in clinical trials may result in additional costs and delays. |

| |

|

| ● |

Our

product candidates may cause serious or undesirable side effects. |

| |

|

| ● |

Our

employees, independent contractors, principal investigators, consultants, vendors and CROs may engage in misconduct or other improper

activities, including noncompliance with regulatory standards and requirements. |

| |

|

| ● |

Even

if our current product candidates or any future product candidates obtain regulatory approval, they may fail to achieve the broad

degree of health care payers, physician and patient adoption and use necessary for commercial success. |

| |

|

| ● |

The

issuance of additional equity securities by us in the future will result in dilution and the conversion of our outstanding preferred

stock will result in significant dilution. |

| |

|

| ● |

Our

Series A and Series B preferred stock, if not converted into common stock, has a distribution and liquidation preference senior to

our common stock in liquidation which could negatively affect the value of our common stock and impair our ability to raise additional

capital. |

| |

|

| ● |

Certain

provisions of our articles of incorporation, bylaws, executive employment agreements and stock option plan may prevent a change of

control of our company that a shareholder may consider favorable. |

| |

|

| ● |

The

price and volume of our common stock has been volatile and fluctuates substantially. |

| |

|

| ● |

The

requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract

and retain qualified members for our Board of Directors. |

| |

|

| ● |

If

we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent

fraud. |

THE

OFFERING

| Common

Stock we are offering |

|

Shares

of common stock having an aggregate price of up to $10,000,000. |

| |

|

|

| Common

stock outstanding prior to this offering |

|

10,535,873

shares of common stock. |

| |

|

|

| Common

stock to be outstanding immediately after this offering |

|

Up

to 35,535,873 shares, assuming sales of 25,000,000 shares of our common stock in this offering at an offering price of $0.40 per

share, which was the last reported sale price of our common stock on the NYSE American on October 7, 2024. The actual number of shares

issued will vary depending on the sales price under this offering. |

| |

|

|

| Plan

of Distribution |

|

“At-The-Market

offering” that may be made from time to time through or to Dawson James Securities, Inc., as our sales agent or principal.

See “Plan of Distribution” in this prospectus supplement. |

| |

|

|

| Use

of Proceeds |

|

We

intend to use the net proceeds from this offering to fund the continued development of ONP-002,

which is a unique neurosteroid drug compound intended to treat mild traumatic brain injuries also known as concussions, and

for general corporate purposes and working capital. See “Use of Proceeds”. |

| |

|

|

| Risk

Factors |

|

Investing

in our securities involves significant risks. Please read the information contained in or incorporated by reference under the heading

“Risk Factors” of this prospectus supplement, and under similar headings in other documents filed after the date hereof

and incorporated by reference into this prospectus supplement and the accompanying prospectus. |

| |

|

|

| NYSE

American Symbol and Listing |

|

Our

common stock is listed on the NYSE American under the symbol “OGEN”. |

The

number of shares of common stock shown above to be outstanding after this offering is based on 10,535,873 shares outstanding as of October

9, 2024 and excludes:

| |

● |

1,022,53

shares of our common stock issuable upon the exercise of outstanding options under our equity incentive plans as of October 7, 2024

at a weighted average exercise price of $4.67 per share; |

| |

● |

747,462

shares of common stock reserved for issuance under outstanding warrants as of October 7, 2024 with a weighted average exercise price

of $22.98 per share; |

| |

● |

2,901,404

shares of common stock reserved for issuance under outstanding pre-funded warrants as of October 7, 2024 with a weighted average

exercise price of $0.001 per share; |

| |

● |

143,664

additional shares of common stock reserved for future issuance under our 2021 equity incentive plan as of October 7, 2024; |

| |

● |

approximately

9,028 shares of common stock reserved for issuance under conversion of our outstanding shares of Series A Non-Voting, Convertible

Preferred Stock; |

| |

● |

approximately

13,500 shares of common stock reserved for issuance under conversion of our outstanding shares of Series B Non-Voting, Convertible

Preferred Stock; and |

| |

● |

approximately

7,488,692 shares of common stock reserved for issuance under conversion of 7,488,692 outstanding shares of Series F Non-Voting, Convertible

Preferred Stock. |

RISK

FACTORS

Before

purchasing our securities you should carefully consider the risk factors set forth below and under the heading “Risk Factors”

included in our most recent Annual Report on Form 10-K as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, each

of which are on file with the SEC and are incorporated herein by reference, as well as all other information contained in this prospectus

supplement and the accompanying prospectus and incorporated by reference and any free writing prospectus that we have authorized for

use in connection with this offering. The risks and uncertainties described below and in our most recent Annual Report on Form 10-K,

as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, are not the only risks and uncertainties we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. Our business,

financial condition and results of operations could suffer as a result of these risks. As a result, the trading price of our stock could

decline, and you could lose all or part of your investment. The risks discussed below and in most recent Annual Report on Form 10-K,

as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, also include forward-looking statements and our actual results

may differ substantially from those discussed in these forward-looking statements. See the section entitled “Forward-Looking Information”.

Risks

Relating to this Offering

The

market price of our common stock has been, and may continue to be volatile and fluctuate significantly, which could result in substantial

losses for investors.

The

trading price for our common stock has been, and we expect it to continue to be, volatile. The price at which our common stock trades

depends upon a number of factors, including our historical and anticipated operating results, our financial situation, announcements

by us or our competitors, our ability or inability to raise the additional capital we may need and the terms on which we raise it, and

general market and economic conditions. Some of these factors are beyond our control. Broad market fluctuations may lower the market

price of our common stock and affect the volume of trading in our stock, regardless of our financial condition, results of operations,

business or prospects. The closing price of our common stock as reported on the NYSE American had a high price of $9.00 and a low price

of $2.62 in the 52-week period ended December 31, 2023, and a high price of $6.84 and a low price of $0.38 from January 1, 2024, through

September 30, 2024. Among the factors that may cause the market price of our common stock to fluctuate are the risks described in this

“Risk Factors” section and other factors, including:

| |

● |

results

of preclinical and clinical studies of our product candidates or those of our competitors; |

| |

|

|

| |

● |

regulatory

or legal developments in the U.S. and other countries, especially changes in laws and regulations applicable to our product candidates; |

| |

|

|

| |

● |

actions

taken by regulatory agencies with respect to our product candidates, clinical studies, manufacturing process or sales and marketing

terms; |

| |

|

|

| |

● |

introductions

and announcements of new products by us or our competitors, and the timing of these introductions or announcements; |

| |

|

|

| |

● |

announcements

by us or our competitors of significant acquisitions or other strategic transactions or capital commitments; |

| |

|

|

| |

● |

fluctuations

in our quarterly operating results or the operating results of our competitors; |

| |

|

|

| |

● |

variance

in our financial performance from the expectations of investors; |

| |

|

|

| |

● |

changes

in the estimation of the future size and growth rate of our markets; |

| |

● |

changes

in accounting principles or changes in interpretations of existing principles, which could affect our financial results; |

| |

|

|

| |

● |

failure

of our products to achieve or maintain market acceptance or commercial success; |

| |

● |

conditions

and trends in the markets we serve; |

| |

|

|

| |

● |

changes

in general economic, industry and market conditions; |

| |

|

|

| |

● |

changes

in legislation or regulatory policies, practices or actions; |

| |

|

|

| |

● |

the

commencement or outcome of litigation involving our company, our general industry or both; |

| |

|

|

| |

● |

recruitment

or departure of key personnel; |

| |

|

|

| |

● |

changes

in our capital structure, such as future issuances of securities, redemption or conversion of preferred stock or the incurrence of

additional debt; |

| |

|

|

| |

● |

actual

or expected sales of our common stock by our stockholders; |

| |

|

|

| |

● |

acquisitions

and financings; and |

| |

|

|

| |

● |

the

trading volume of our common stock. |

In

addition, the stock markets, in general, NYSE American and the market for biotech companies in particular, may experience a loss of investor

confidence. Such loss of investor confidence may result in extreme price and volume fluctuations in our common stock that are unrelated

or disproportionate to the operating performance of our business, financial condition or results of operations. These broad market and

industry factors may materially harm the market price of our common stock and expose us to securities class action litigation. Such litigation,

even if unsuccessful, could be costly to defend and divert management’s attention and resources, which could further materially

harm our financial condition and results of operations.

You

will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

Since

the price per share of our common stock being offered may be higher than the net tangible book value per share of our common stock prior

to this offering, you will suffer immediate dilution in the net tangible book value of the shares of common stock you purchase in this

offering. As of September 30, 2024, our historical net tangible book value was approximately $1,326,396 million, or $0.24 per share.

Assuming that an aggregate of 25,000,000 shares are sold at a price of $0.40 per share, the last reported sale price of our common stock

on the NYSE American Exchange on October 7, 2024, for aggregate gross proceeds of approximately $10,000,000 in this offering, and after

deducting commissions and estimated aggregate offering expenses payable by us, you will suffer immediate dilution of $0.18 per share,

representing the difference between our pro forma as adjusted net tangible book value per share as of September 30, 2024 and the assumed

offering price. The exercise of outstanding stock options and warrants and the conversion of our outstanding preferred stock may result

in further dilution of your investment and, with regard to our Series F Convertible Preferred Stock, will result in a material further

dilution of your investment. See “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase

our securities in the offering.

Our

management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield

a significant return.

Our

management will have broad discretion over the use of proceeds from this offering. We intend to use the net proceeds from this offering

to fund a portion of our ONP-002 research and clinical trials, and for working capital and general corporate purposes. Our management

will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment

decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not

increase our operating results or enhance the value of our common stock. The precise amount and timing of the application of these proceeds

will depend upon a number of factors, such as the timing and progress of our research and development efforts, our funding requirements

and the availability and costs of other funds. As of the date of this prospectus supplement, we cannot specify with certainty all of

the particular uses for the net proceeds to us from this offering. Depending on the outcome of our efforts and other unforeseen events,

our plans and priorities may change and we may apply the net proceeds of this offering in different manners than we currently anticipated.

The failure by our management to apply these funds effectively could harm our business, financial condition and results of operations.

Pending their use, we may invest the net proceeds from this offering in short-term, interest-bearing instruments. These investments may

not yield a favorable return to our stockholders.

Future

sales of our common stock in the public market could cause our stock price to fall.

Sales

of a substantial number of shares of our common stock, or the perception by the market that those sales could occur, could cause the

market price of our common stock to decline or could make it more difficult for us to raise funds through the sale of equity in the future.

Future

issuances of common stock could further depress the market for our common stock. We expect to continue to incur drug development and

selling, general and administrative costs, and to satisfy our funding requirements, we will need to sell additional equity securities,

which may include sales of significant amounts of common stock to strategic investors, and which common stock may be subject to registration

rights and warrants with anti-dilutive protective provisions. The sale or the proposed sale of substantial amounts of our common stock

or other equity securities in the public markets or in private transactions may adversely affect the market price of our common stock

and our stock price may decline substantially. Our stockholders may experience substantial dilution and a reduction in the price that

they are able to obtain upon sale of their shares. Also, new equity securities issued may have greater rights, preferences or privileges

than our existing common stock. In addition, we have a significant number of shares of restricted stock, stock options and warrants outstanding.

To the extent that outstanding stock options or warrants have been or may be exercised or other shares issued, investors purchasing our

common stock in this offering may experience further dilution.

If

we make one or more significant acquisitions in which the consideration includes stock or other securities, our stockholders’ holdings

may be significantly diluted. In addition, stockholders’ holdings may also be diluted if we enter into arrangements with third

parties permitting us to issue shares of common stock in lieu of certain cash payments upon the achievement of milestones.

The

issuance of shares of our common stock under our 2021 Equity Incentive Plan is covered by Form S-8 registration statements we filed with

the Securities and Exchange Commission, or SEC, and upon exercise of the options, such shares may be resold into the market. We have

also issued shares of common stock and warrants in connection with previous private placements. Such shares are available for resale

as well as certain of the shares of common stock issuable upon exercise of the warrants. We have also issued shares of our common stock

in the private placement and financing transaction, which are deemed to be “restricted securities,” as that term is defined

in Rule 144 promulgated under the Securities Act of 1933, as amended, or Securities Act, and such shares may be resold pursuant to the

provisions of Rule 144. The resale of shares acquired from us in private transactions could cause our stock price to decline significantly.

In addition, the conversion of outstanding shares preferred stock into common stock and the subsequent sale of shares of common stock

could also cause our stock price to decline significantly.

In

addition, from time to time, certain of our shareholders may be eligible to sell all or some of their restricted shares of common stock

by means of ordinary brokerage transactions in the open market pursuant to Rule 144, subject to certain limitations. In general, pursuant

to Rule 144, after satisfying a six-month holding period: (i) affiliated shareholders, or shareholders whose shares are aggregated, may,

under certain circumstances, sell within any three-month period a number of securities which does not exceed the greater of 1% of the

then-outstanding shares of common stock or the average weekly trading volume of the class during the four calendar weeks prior to such

sale and (ii) non-affiliated shareholders may sell without such limitations, in each case provided we are current in our public reporting

obligations. Rule 144 also permits the sale of securities by non-affiliates that have satisfied a one-year holding period without any

limitation or restriction.

We

are unable to estimate the number of shares that may be sold because this will depend on the market price for our common stock, the personal

or business circumstances of sellers and other factors.

We

do not intend to pay cash dividends.

We

have not declared or paid any cash dividends on our common stock, and we do not anticipate declaring or paying cash dividends for the

foreseeable future. Any future determination as to the payment of cash dividends on our common stock will be at our Board of Directors’

discretion and will depend on our financial condition, operating results, capital requirements and other factors that our Board of Directors

considers to be relevant.

You

may experience future dilution as a result of future equity offerings.

To

raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable

for our common stock at prices that may not be the same as the prices per share in this offering. We may sell shares or other securities

in any other offering at a price per share that is less than the prices per share paid by investors in this offering, and investors purchasing

shares of our common stock or other securities in the future could have rights superior to existing stockholders. The price per share

at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions

may be higher or lower than the prices per share paid by investors in this offering.

We

cannot assure you that we will continue to be listed on the NYSE American.

Our common

stock commenced trading on the NYSE American (formerly the NYSE MKT) on April 10, 2013, and we are subject to certain NYSE American

continued listing requirements and standards. On April 18, 2024, we received notification (the “Notice”) from the NYSE

American that we were no longer in compliance with NYSE American’s continued listing standards. Specifically, the letter

stated that the Company was not in compliance with the continued listing standards set forth in Sections 1003(a)(ii) and

1003(a)(iii) of the NYSE American Company Guide (the “Company Guide”). Section 1003(a)(ii) requires a listed company to

have stockholders’ equity of $4 million or more if the listed company has reported losses from continuing operations

and/or net losses in three of its four most recent fiscal years. Section 1003(a)(iii) requires a listed company to have

stockholders’ equity of $6 million or more if the listed company has reported losses from continuing operations and/or

net losses in its five most recent fiscal years. On August 13, 2024, we received a second notice from the NYSE American LLC

informing us that us that we also are not in compliance with subsection (i) of Section 1003(a), which requires stockholders’

equity of no less than $2,000,000 if the Company has sustained losses from continuing operations and/or net losses in two of its

three most recent fiscal years. We reported shareholders’ equity of $3.2 million as of December 31, 2023, and losses from

continuing operations and/or net losses in its five most recent fiscal years ended December 31, 2023, and we reported

shareholders’ equity of $1.6 million as of June 30, 2024. On May 17, 2024, we submitted a plan of compliance (the