As filed with the Securities and Exchange Commission

on February 6, 2024

Registration No. 333-276481

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

China Pharma Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

75-1564807 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

Second Floor, No. 17, Jinpan Road

Haikou, Hainan Province, China

+86- 898-6681-1730

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Zhilin Li

President and Chief Executive Officer

2nd Floor, No. 17, Jinpan Road, Haikou,

Hainan Province, China 570216

+86- 898-6681-1730

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

With a copy to:

Elizabeth F. Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 326-0199

Approximate date of commencement of proposed

sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. þ

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section

8(a), may determine.

Explanatory Note

This replacement registration statement on

Form S-3 (the “Registration Statement”, File No. 333-276481) of China Pharma Holdings, Inc. (the “Company”)

filed with the Securities and Exchange Commission (the “Commission”) is filed pursuant to Rule 415(a)(6) under

the Securities Act of 1933, as amended (the “Securities Act”) and includes up to $50,000,000 aggregate initial offering

price of such indeterminate number of shares of common stock and preferred stock, such indeterminate principal amount of debt securities,

such indeterminate number of warrants to purchase common stock, preferred stock or debt securities, such indeterminate number of subscription

rights to purchase common stock, preferred stock or debt securities and such indeterminate number of units (collectively, the “Securities”)

of the Company, $45,000,000 of which was previously offered by the Company and registered on the Company’s registration statement

on Form S-3 (Registration No. 333-251973) (the “Prior Registration Statement”) filed by the Company with the Commission

under the Securities Act on January 8, 2021 and declared effective on January 21, 2021, and not sold thereunder. Under Rule 415(a)(5) under

the Securities Act, the registration regarding the unsold securities under the Prior Registration Statement expires three years

after the effective date of the Prior Registration Statement, or on January 20, 2024. Accordingly, the Company is filing this Registration

Statement to register new Securities and cover the unsold securities under the Prior Registration Statement. Any Securities registered

hereunder may be sold separately or as units with the other Securities registered hereunder.

Under Rule 415(a)(5), the Company may continue

to offer and sell the unsold securities during the grace period permitted by Rule 415(a)(5). In accordance with Rule 415(a)(6),

effectiveness of this Registration Statement will be deemed to terminate the offering of the unsold Securities on the Prior Registration

Statement. If the Company sells any of such unsold securities pursuant to the Prior Registration Statement after the date of filing, and

prior to the date of effectiveness, of this Registration Statement, the Company will file a pre-effective amendment to this registration

statement which will reduce the number of such unsold securities included on this Registration Statement.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE

AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES PUBLICLY UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE

COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES

IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject

to Completion, Dated February 6, 2024

Prospectus

CHINA PHARMA HOLDINGS, INC.

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

China Pharma Holdings, Inc. is a Nevada incorporated

holding company (“China Pharma”, the “Company”, “we”, “our” or “us”) with

all of its operations conducted in China through its subsidiaries. Through this prospectus, we may offer and sell, from time to time in

one or more offerings, any combination of common stock, preferred stock, debt securities (which may be convertible into or exchangeable

for common stock), warrants, rights or units that include any of these securities up to an aggregate offering price not exceeding $50,000,000.

When we decide to sell a particular class or series of securities, we will provide specific terms of the offered securities in a prospectus

supplement. The prospectus supplement may also add, update or change information contained in or incorporated by reference into this prospectus.

You should read both this prospectus and the accompanying prospectus supplement together with the additional information described under

the heading “Where You Can Find More Information” in this prospectus.

We may offer and sell these securities directly

to investors, through agents designated from time to time or to or through underwriters or dealers, including on a continuous or delayed

basis. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus. If any agents or underwriters are involved in the sale of any securities with respect to which this prospectus is

being delivered, the names of such agents or underwriters and any applicable fees, commissions, discounts or over-allotment options will

be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such

sale will also be set forth in a prospectus supplement.

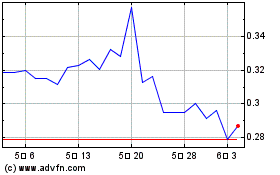

Our common stock is traded on the NYSE American

(formerly known as AMEX) under the symbol “CPHI”. The closing price for our common stock on NYSE American on February 5,

2024 was $0.09 per share. Each prospectus supplement will contain information, where applicable, as to any listing on the NYSE American

or any other securities exchange of the securities covered by the prospectus supplement.

INVESTING IN OUR SECURITIES INVOLVES SUBSTANTIAL

RISKS. CHINA PHARMA IS NOT A CHINESE OPERATING COMPANY, BUT A HOLDING COMPANY INCORPORATED IN NEVADA. AS A HOLDING COMPANY WITH NO MATERIAL

OPERATIONS OF ITS OWN, THE COMPANY CONDUCTS A SUBSTANTIAL MAJORITY OF ITS OPERATIONS THROUGH THE OPERATING ENTITY ESTABLISHED IN THE PEOPLE’S

REPUBLIC OF CHINA (THE “PRC”), PRIMARILY THE COMPANY’S WHOLLY OWNED PRC SUBSIDIARY.

ADDITIONALLY, HELPSON, CHINA PHARMA’S

PRC SUBSIDIARY, IS SUBJECT TO CERTAIN LEGAL AND OPERATIONAL RISKS ASSOCIATED WITH ITS OPERATIONS IN CHINA. PRC LAWS AND REGULATIONS GOVERNING

HELPSON’S CURRENT BUSINESS OPERATIONS ARE SOMETIMES VAGUE AND UNCERTAIN, AND THEREFORE, THESE RISKS MAY RESULT IN A MATERIAL CHANGE

IN HELPSON’S OPERATIONS, SIGNIFICANT DEPRECIATION OF THE VALUE OF OUR COMMON STOCK, OR A COMPLETE HINDRANCE OF THE COMPANY’S

ABILITY TO OFFER OR CONTINUE TO OFFER ITS SECURITIES TO INVESTORS. RECENTLY, THE PRC GOVERNMENT INITIATED A SERIES OF REGULATORY ACTIONS

AND STATEMENTS TO REGULATE BUSINESS OPERATIONS IN CHINA WITH LITTLE ADVANCE NOTICE, INCLUDING CRACKING DOWN ON ILLEGAL ACTIVITIES IN THE

SECURITIES MARKET, ADOPTING NEW MEASURES TO EXTEND THE SCOPE OF CYBERSECURITY REVIEWS, AND EXPANDING THE EFFORTS IN ANTI-MONOPOLY ENFORCEMENT.

SINCE THESE STATEMENTS AND REGULATORY ACTIONS ARE NEW, IT IS HIGHLY UNCERTAIN HOW SOON LEGISLATIVE OR ADMINISTRATIVE REGULATION MAKING

BODIES WILL RESPOND AND WHAT EXISTING OR NEW LAWS OR REGULATIONS OR DETAILED IMPLEMENTATIONS AND INTERPRETATIONS WILL BE MODIFIED OR PROMULGATED,

IF ANY, AND THE POTENTIAL IMPACT OF SUCH MODIFIED OR NEW LAWS AND REGULATIONS WILL HAVE ON THE COMPANY’S DAILY BUSINESS OPERATION,

THE ABILITY TO ACCEPT FOREIGN INVESTMENTS AND LIST ON AN U.S. OR OTHER FOREIGN EXCHANGE.

ON FEBRUARY 17, 2023, THE CHINA SECURITIES

REGULATORY COMMISSION (THE “CSRC”), PROMULGATED THE TRIAL ADMINISTRATIVE MEASURES OF OVERSEAS SECURITIES OFFERING AND LISTING

BY DOMESTIC COMPANIES (THE “TRIAL MEASURES”), WHICH BECAME EFFECTIVE ON MARCH 31, 2023. ON THE SAME DATE, THE CSRC CIRCULATED

SUPPORTING GUIDANCE RULES NO.1 THROUGH NO.5, NOTES ON THE TRIAL MEASURES, NOTICE ON ADMINISTRATION ARRANGEMENTS FOR THE FILING OF OVERSEAS

LISTINGS BY DOMESTIC ENTERPRISES AND RELEVEANT CSRC ANSWERS TO REPORT OR QUESTIONS (COLLECTIVELY, THE “GUIDANCE RULES AND NOTICE”),

ON CSRC’S OFFICIAL WEBSITE. THE TRIAL MEAURES, TOGETHER WITH THE GUIDANCE RULES AND NOTICE REITERATE THE BASIC PRINCIPLES OF DRAFT

ADMINSTRATIVE PROVISIONS AND DRAFT FILING MEASURES AND IMPOSE SUBSTANTIALLY THE SAME REQUIREMENTS FOR THE OVERSEAS SECURITIES OFFERING

AND LISTING BY DOMESTIC ENTERPRISES, AND CLARIFIED AND EMPHASIZED SEVERAL ASPECTS. BECAUSE WE ARE ALREADY PUBLICLY LISTED IN THE U.S.,

THE TRIAL MEASURES AND THE GUIDANCE RULES AND NOTICE DO NOT IMPOSE OBVIOUS ADDITIONAL REGULATORY BURDEN ON US BEYOND THE OBLIGATION TO

REPORT TO THE CSRC AND COMPLY WITH THE FILING REQUIREMENTS ON ANY FUTURE OFFERINGS OF OUR SECURITIES, OR MATERIAL EVENTS SUCH AS A CHANGE

OF CONTROL OR DELISTING. AS THE TRIAL MEASURES AND THE GUIDANCE RULES AND NOTICE ARE NEWLY ISSUED, THERE REMAINS UNCERTAINTY AS TO HOW

THEY WILL BE INTERPRETED OR IMPLEMENTED. THEREFORE, WE ARE SUBJECT TO SUCH FILING REQUIREMENTS UNDER THE TRIAL MEASURES UPON FUTURE SUBSEQUENT

OFFERINGS, AND MAY BE SUBJECT TO ADDITIONAL FILING REQUIREMENTS AND, IF THERE ARE ANY CHANGES TO THE TRIAL MEASURES, AT THAT TIME WE

MAY NOT BE ABLE TO GET CLEARANCE FROM THE CSRC IN A TIMELY FASHION.

ON MAY 20, 2020, THE U.S. SENATE PASSED THE

HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT REQUIRING FOREIGN COMPANIES TO CERTIFY THEY ARE NOT OWNED OR CONTROLLED BY A FOREIGN GOVERNMENT

IF THE PCAOB IS UNABLE TO AUDIT SPECIFIED REPORTS BECAUSE THE COMPANY USES A FOREIGN AUDITOR NOT SUBJECT TO PCAOB INSPECTION. IF THE PCAOB

IS UNABLE TO INSPECT THE COMPANY’S AUDITORS FOR THREE CONSECUTIVE YEARS, THE ISSUER’S SECURITIES ARE PROHIBITED FROM TRADING

ON A U.S. STOCK EXCHANGE. ON DECEMBER 2, 2020, THE U.S. HOUSE OF REPRESENTATIVES APPROVED THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT.

ON DECEMBER 18, 2020, THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT WAS SIGNED INTO LAW. PURSUANT TO THE HOLDING FOREIGN COMPANIES ACCOUNTABLE

ACT, THE PCAOB ISSUED A DETERMINATION REPORT ON DECEMBER 16, 2021 WHICH FOUND THAT THE PCAOB IS UNABLE TO INSPECT OR INVESTIGATE COMPLETELY

REGISTERED PUBLIC ACCOUNTING FIRMS HEADQUARTERED IN: (1) MAINLAND CHINA OF THE PRC BECAUSE OF A POSITION TAKEN BY ONE OR MORE AUTHORITIES

IN MAINLAND CHINA; AND (2) HONG KONG, A SPECIAL ADMINISTRATIVE REGION AND DEPENDENCY OF THE PRC, BECAUSE OF A POSITION TAKEN BY ONE OR

MORE AUTHORITIES IN HONG KONG. ON AUGUST 26, 2022, THE PCAOB ANNOUNCED AND SIGNED A STATEMENT OF PROTOCOL (THE “PROTOCOL”)

WITH THE CHINA SECURITIES REGULATORY COMMISSION AND THE MINISTRY OF FINANCE OF THE PEOPLE’S REPUBLIC OF CHINA. THE PROTOCOL PROVIDES

THE PCAOB WITH: (1) SOLE DISCRETION TO SELECT THE FIRMS, AUDIT ENGAGEMENTS AND POTENTIAL VIOLATIONS IT INSPECTS AND INVESTIGATES, WITHOUT

ANY INVOLVEMENT OF CHINESE AUTHORITIES; (2) PROCEDURES FOR PCAOB INSPECTORS AND INVESTIGATORS TO VIEW COMPLETE AUDIT WORK PAPERS WITH

ALL INFORMATION INCLUDED AND FOR THE PCAOB TO RETAIN INFORMATION AS NEEDED; (3) DIRECT ACCESS TO INTERVIEW AND TAKE TESTIMONY FROM ALL

PERSONNEL ASSOCIATED WITH THE AUDITS THE PCAOB INSPECTS OR INVESTIGATES. OUR AUDITOR IS HEADQUARTERED IN SINGAPORE, SINGAPORE AND WILL

BE INSPECTED BY THE PCAOB ON A REGULAR BASIS.

OUR AUDITOR IS NOT SUBJECT TO THE DETERMINATION.

OUR AUDITOR IS SUBJECT TO LAWS IN THE UNITED STATES PURSUANT TO WHICH THE PCAOB CONDUCTS REGULAR INSPECTIONS TO ASSESS OUR AUDITOR’S

COMPLIANCE WITH THE APPLICABLE PROFESSIONAL STANDARDS. ON JUNE 22, 2021, THE U.S. SENATE PASSED THE ACCELERATING HOLDING FOREIGN COMPANIES

ACCOUNTABLE ACT (“AHFCAA”) WHICH, PROPOSED TO REDUCE THE NUMBER OF CONSECUTIVE NON-INSPECTION YEARS REQUIRED FOR TRIGGERING

THE PROHIBITIONS UNDER THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT FROM THREE YEARS TO TWO. ON DECEMBER 29, 2022, THE CONSOLIDATED APPROPRIATIONS

ACT, 2023 (THE “CAA”) WAS SIGNED INTO LAW, WHICH OFFICIALLY REDUCED THE NUMBER OF CONSECUTIVE NON-INSPECTION YEARS REQUIRED

FOR TRIGGERING THE PROHIBITIONS UNDER THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT FROM THREE YEARS TO TWO, THUS, REDUCING THE TIME BEFORE

AN APPLICABLE ISSUER’S SECURITIES MAY BE PROHIBITED FROM TRADING OR DELISTED. CURRENTLY, OUR AUDITOR IS SUBJECT TO INSPECTION BY

PCAOB. HOWEVER, IF AHFCAA WERE ENACTED INTO LAW, IT MAY POSE MORE RISKS OF POTENTIAL DELISTING AS WELL AS DEPRESS THE PRICE OF COMPANY’S

COMMON STOCK. ON DECEMBER 15, 2022, THE PCAOB ISSUED A NEW DETERMINATION REPORT WHICH CONCLUDED THAT IT WAS ABLE TO INSPECT AND INVESTIGATE

COMPLETELY PCAOB-REGISTERED ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND CHINA AND HONG KONG IN 2022, AND THE PCAOB VACATED THE DECEMBER

16, 2021 DETERMINATION REPORT. SHOULD THE PCAOB AGAIN ENCOUNTER IMPEDIMENTS TO INSPECTIONS AND INVESTIGATIONS IN MAINLAND CHINA OR HONG

KONG AS A RESULT OF POSITIONS TAKEN BY ANY AUTHORITY IN EITHER JURISDICTION, INCLUDING BY THE CSRC OR THE MOF, THE PCAOB WILL MAKE DETERMINATIONS

UNDER THE HFCAA AS AND WHEN APPROPRIATE. HOWEVER, WHETHER THE PCAOB WILL CONTINUE TO CONDUCT INSPECTIONS AND INVESTIGATIONS COMPLETELY

TO ITS SATISFACTION OF PCAOB-REGISTERED PUBLIC ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND CHINA AND HONG KONG IS SUBJECT TO UNCERTAINTY

AND DEPENDS ON A NUMBER OF FACTORS OUT OF CHINA PHARMA’S, AND CHINA PHARMA’S AUDITOR’S, CONTROL, INCLUDING POSITIONS

TAKEN BY AUTHORITIES OF THE PRC. THE PCAOB IS EXPECTED TO CONTINUE TO DEMAND COMPLETE ACCESS TO INSPECTIONS AND INVESTIGATIONS AGAINST

ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND CHINA AND HONG KONG IN THE FUTURE AND STATES THAT IT HAS ALREADY MADE PLANS TO RESUME REGULAR

INSPECTIONS IN EARLY 2023 AND BEYOND. THE PCAOB IS REQUIRED UNDER THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT TO MAKE ITS DETERMINATION

ON AN ANNUAL BASIS WITH REGARDS TO ITS ABILITY TO INSPECT AND INVESTIGATE COMPLETELY ACCOUNTING FIRMS BASED IN THE MAINLAND CHINA AND

HONG KONG. SHOULD THE PCAOB AGAIN ENCOUNTER IMPEDIMENTS TO INSPECTIONS AND INVESTIGATIONS IN MAINLAND CHINA OR HONG KONG AS A RESULT OF

POSITIONS TAKEN BY ANY FOREIGN AUTHORITY INCLUDING BUT IS NOT LIMITED TO MAINLAND CHINA OR HONG KONG JURISDICTION, THE PCAOB WILL ACT

EXPEDITIOUSLY TO CONSIDER WHETHER IT SHOULD ISSUE A NEW DETERMINATION.

THE CHINESE REGULATORY AUTHORITIES COULD DISALLOW

THE COMPANY’S STRUCTURE, WHICH COULD RESULT IN A MATERIAL CHANGE IN THE COMPANY’S OPERATIONS AND THE VALUE OF THE COMPANY’S

SECURITIES COULD DECLINE OR BECOME WORTHLESS. FOR A DESCRIPTION OF THE COMPANY’S CORPORATE STRUCTURE, SEE “PROSPECTUS SUMMARY”

STARTING PAGE 1. SEE ALSO “RISK FACTORS - RISKS RELATED TO DOING BUSINESS IN CHINA” INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

SEE THE SECTION TITLED “RISK FACTORS”

BEGINNING ON PAGE 4 OF THIS PROSPECTUS, AND THE RISK FACTORS IN ANY ACCOMPANYING PROSPECTUS SUPPLEMENT TO READ ABOUT FACTORS YOU SHOULD

CONSIDER BEFORE BUYING SHARES OF CHINA PHARMA’S COMMON STOCK.

OUR SUBSIDIARIES HAVE NEVER ISSUED ANY DIVIDENDS

OR DISTRIBUTIONS TO US, OR TO ANY INVESTORS AS OF THE DATE OF THIS PROSPECTUS. HELPSON, OUR PRC SUBSIDIARY, GENERATES AND RETAINS CASH

GENERATED FROM OPERATING ACTIVITIES AND RE-INVEST IT IN DAILY BUSINESS. IN THE FUTURE, CASH PROCEEDS RAISED FROM OVERSEAS FINANCING ACTIVITIES

AND THE EXERCISE OF WARRANTS BY WARRANT HOLDERS, MAY BE TRANSFERRED BY US TO HELPSON VIA CAPITAL CONTRIBUTION AND SHAREHOLDER LOANS, AS

THE CASE MAY BE.

THE MAJORITY OF OUR INCOME IS RECEIVED IN RENMINBI

(“RMB”) AND RESTRICTIONS IN FOREIGN CURRENCIES MAY LIMIT THE COMPANY’S ABILITY TO PAY DIVIDENDS OR OTHER PAYMENTS, OR

OTHERWISE SATISFY THE COMPANY’S FOREIGN CURRENCY DENOMINATED OBLIGATIONS, IF ANY. UNDER EXISTING PRC FOREIGN EXCHANGE REGULATIONS,

PAYMENTS OF CURRENT ACCOUNT ITEMS, INCLUDING PROFIT DISTRIBUTIONS, INTEREST PAYMENTS AND EXPENDITURES FROM TRADE-RELATED TRANSACTIONS,

CAN BE MADE IN FOREIGN CURRENCIES WITHOUT PRIOR APPROVAL FROM THE STATE ADMINISTRATION OF THE FOREIGN EXCHANGE (“SAFE”) IN

THE PRC AS LONG AS CERTAIN PROCEDURAL REQUIREMENTS ARE MET. APPROVAL FROM APPROPRIATE GOVERNMENT AUTHORITIES IS REQUIRED IF RMB IS CONVERTED

INTO FOREIGN CURRENCY AND REMITTED OUT OF THE PRC TO PAY CAPITAL EXPENSES SUCH AS THE REPAYMENT OF LOANS DENOMINATED IN FOREIGN CURRENCIES.

THE PRC GOVERNMENT MAY, AT ITS DISCRETION, IMPOSE RESTRICTIONS ON ACCESS TO FOREIGN CURRENCIES FOR CURRENT ACCOUNT TRANSACTIONS AND IF

THIS OCCURS IN THE FUTURE, WE MAY NOT BE ABLE TO PAY DIVIDENDS IN FOREIGN CURRENCIES TO OUR STOCKHOLDERS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is February 6,

2024

Table

of Contents

You should rely only on the information contained

or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information

different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that

differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other

person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information

contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information

contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not

an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of

a Registration Statement on Form S-3 that we filed with the Securities and Exchange Commission utilizing a “shelf” registration

process. Under this shelf process, we may sell common stock, preferred stock, debt securities (which may be convertible into or exchangeable

for common stock), warrants, rights or units from time to time in one or more offerings at indeterminate prices, up to an aggregate offering

price for all such securities of $50,000,000. This prospectus provides you with a general description of the securities we may offer.

Each time we sell any securities under this prospectus, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You

should read both this prospectus and any prospectus supplement together with additional information described below under the heading

“Where You Can Find More Information.”

You should rely only on the

information contained in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free

writing prospectus filed by us with the SEC. China Pharma has not authorized anyone to provide you with different information. This prospectus

and the accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other

than the securities described in the accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such

securities in any circumstances in which such offer or solicitation is unlawful. Persons who come into possession of this prospectus in

jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and

the distribution of this prospectus applicable to those jurisdictions. You should assume that the information appearing in this prospectus,

any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their

respective dates, and our business, financial condition, results of operations and prospects may have changed since such date. Other than

as required under the federal securities laws, we undertake no obligation to publicly update or revise such information, whether as a

result of new information, future events or any other reason.

This prospectus and any accompanying

prospectus supplement or other offering materials do not contain all of the information included in the registration statement as permitted

by the rules and regulations of the SEC. For further information, we refer you to the registration statement on Form S-3, including its

exhibits. We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and, therefore, file reports and other information with the SEC. Statements contained in this prospectus and any accompanying prospectus

supplement, or other offering materials about the provisions or contents of any agreement or other document are only summaries. If SEC

rules require that any agreement or document be filed as an exhibit to the registration statement, you should refer to that agreement

or document for its complete contents.

You should not assume that

the information in this prospectus, any prospectus supplement or any other offering materials is accurate as of any date other than the

date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since then.

Unless otherwise stated in

this prospectus, references to:

| |

● |

“China” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this prospectus only, Hong Kong, Macau and Taiwan; |

| |

|

|

| |

● |

“Helpson” refers to Hainan Helpson Medical & Biotechnology Co., Ltd. |

| |

|

|

| |

● |

“Onny” refers to Onny Investment Ltd. |

| |

|

|

| |

● |

“RMB” and “Renminbi” refer to the legal currency of China; and |

| |

|

|

| |

● |

“US$,” “U.S. dollars,” “$,” and “dollars” refer to the legal currency of the United States. |

We use RMB as the functional

currency and U.S. dollars as reporting currency in our financial statements and in this prospectus. Monetary assets and liabilities denominated

in Renminbi are translated into U.S. dollars at the rates of exchange as of the balance sheet date, equity accounts are translated at

historical exchange rates, and revenues, expenses, gains and losses are translated using the average rate for the period. In other parts

of this prospectus, any Renminbi denominated amounts are accompanied by translations. We make no representation that the Renminbi or U.S.

dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be,

at any particular rate or at all. The PRC government restricts or prohibits the conversion of Renminbi into foreign currency and foreign

currency into Renminbi for certain types of transactions.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in

this Form S-3 that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act, and

Section 21E of the Exchange Act. These include statements about the Company’s expectations, beliefs, intentions or strategies for

the future, which are indicated by words or phrases such as “anticipate”, “expect”, “intend”, “plan”,

“will”, “the Company believes”, “management believes” and similar words or phrases. The forward-looking

statements are based on the Company’s current expectations and are subject to certain risks, uncertainties and assumptions. The

Company’s actual results could differ materially from results anticipated in these forward-looking statements. All forward-looking

statements included in this document are based on information available to the Company on the date hereof, and the Company assumes no

obligation to update any such forward-looking statements.

These forward-looking statements

are neither promises nor guarantees of future performance, due to a variety of risks and uncertainties and other factors more fully discussed

in the “Risk Factors” section in this prospectus, the section of any accompanying prospectus supplement entitled “Risk

Factors” and the risk factors and cautionary statements described in other documents that China Pharma files from time to time with

the SEC. Given these uncertainties, readers should not place undue reliance on China Pharma’s forward-looking statements. These

forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Except

as may be required by applicable law, China Pharma does not undertake to update any forward-looking statements after the date of this

prospectus or the respective dates of documents incorporated by reference herein or therein that include forward-looking statements.

Except as required by law,

China Pharma assumes no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements to

reflect events or developments occurring after the date of this prospectus, even if new information becomes available in the future.

PROSPECTUS

SUMMARY

Organization and Nature of Operations

China Pharma, a Nevada corporation,

owns 100% of Onny, a British Virgin Islands corporation, which owns 100% of Helpson, a company organized under the laws of the People’s

Republic of China (the “PRC”).

Onny acquired 100% of the

ownership in Helpson on May 25, 2005, by entering into an Equity Transfer Agreement with Helpson’s three former shareholders. The

transaction was approved by the Commercial Bureau of Hainan Province on June 12, 2005 and Helpson received the Certificate of Approval

for Establishment of Enterprises with Foreign Investment in the PRC on the same day. Helpson received its business license evidencing

its WFOE (Wholly Foreign Owned Enterprise) status on June 21, 2005.

Our corporate organizational

chart is set forth below:

Helpson has acquired and continues

to acquire well-accepted medical formulas to add to its diverse portfolio of Western and Chinese medicines.

Business Overview & Recent Developments

Helpson is principally engaged in the development, manufacture and

marketing of pharmaceutical products for human use in connection with a variety of high-incidence and high-mortality diseases and medical

conditions prevalent in the PRC. As a Nevada holding company without any operations, all of China Pharma’s operations are conducted

in the PRC, where the manufacturing facilities are located, through Helpson, China Pharma’s indirectly wholly owned PRC subsidiary.

Helpson manufactures pharmaceutical products in the form of dry powder injectables, liquid injectables, tablets, capsules, and cephalosporin

oral solutions. The majority of our pharmaceutical products are sold on a prescription basis and all have been approved for at least one

or more therapeutic indications by the National Medical Products Administration (the “NMPA”, formerly China Food and Drug

Administration, CFDA) based upon demonstrated safety and efficacy.

As

of the date of this prospectus, Helpson manufactured 19 pharmaceutical products for a wide variety of diseases and medical indications,

each of which may be classified into one of three general categories:

| |

● |

Basic generic drugs, which are common drugs in the PRC for which there is a very large market demand; |

| |

● |

First-to-market generic drugs, which are generic western drugs that are new to the PRC marketplace; or |

| |

● |

Modern Traditional Chinese Medicines, which are generally comprised of non-synthetic, plant-based medicinal compounds that have been widely used in the PRC for thousands of years. Helpson applies modern production techniques to produce pharmaceutical products in different formulations, such as tablets, capsules or powders. |

In

selecting generic drugs to develop and manufacture, Helpson considers several factors, including the number of other manufacturers currently

producing this particular drug, the size of the market for that drug, the proposed or required method of distribution, the existing and

expected pricing for that particular drug in the marketplace, the costs of manufacturing that drug, and the costs of acquiring or developing

the formula for that drug. Helpson believes that generic drugs that it has selected to manufacture have large addressable markets and

higher profit margins relative to other generic drugs manufactured and distributed in the PRC.

In

addition, Helpson manufactured comprehensive healthcare products and protective products in two production facilities it owns and operates

in Haikou, Hainan Province, PRC. One has a construction area of 663.94 square meters, the other factory has two buildings with production

area of 20,282.42 square meters and 6,593.20 square meters.

China’s consistency

evaluation of generic drugs continued to proceed in 2023. Helpson has always taken the task of promoting the consistency evaluation as

a top priority, and worked on them actively. However, for each drug’s consistency evaluation, due to the continuous dynamic changes

of the detailed consistency evaluation policies, market trends, expected investments, and expected returns of investment (“ROI”),

all companies in this industry have been adjusting to the policies under consistency evaluation. One of the flagship products, Candesartan

tablets, a hypertension product, passed generic-drug-consistency-evaluation in early August 2023.

Helpson has taken a more cautious

and flexible attitude towards the initiating and progressing any project for an existing product’s consistency evaluation and to

cope with the changing macro environment of drug sales in China. Since initiated in 2018, when relevant Chinese authorities decided to

implement trial Centralized Procurement (“CP”) activities in 11 selected pilot cities (including four municipalities and seven

other cities), nine rounds of CP activities have been carried out as of November 6, 2023, which significantly reduced the price of

the drugs that won the bids. In addition, the consistency evaluation has been adopted as one of the qualification standards for participating

in the GPO activities. As a result, Helpson must balance at least the investment of financial resources and time to obtain the qualification

of CP, and the sharp decline in the price of drugs included in CP, before making decisions for any products.

In addition, Helpson continues

to explore the field of comprehensive healthcare. Comprehensive healthcare is a general concept proposed by the Chinese government according

to the development of the times, social needs and changes in disease spectrum. According to the Outline of “Healthy China 2030”

issued by Chinese government in October 2016, the total size of China’s health service industry is expected to reach RMB 16 trillion

(approximately $2.5 trillion) by 2030. This industry focuses on people’s daily life, aging and diseases, pays attention to all kinds

of risk factors and misunderstandings affecting health, calls for self-health management, and advocates the comprehensive care throughout

the entire process of life. It covers all kinds of health-related information, products, and services, as well as actions taken by various

organizations to meet the health needs. In response to this trend, Helpson launched Noni enzyme, a natural, Xeronine-rich antioxidant

food supplement at the end of 2018. Helpson also launched wash-free sanitizers and masks, in 2020, to address the market needs caused

by COVID-19 in China. As Chinese government officially terminated its zero-case policy, now the responsibility to protect people from

the impact of COVID-19 falls more to the citizens themselves, and masks and sanitizers have been more and more popular due to increasing

demand. Helpson has sufficient production capacity for medical masks, surgical masks, KN95 masks, and N95 masks, which meets the personal

needs for protection against the epidemic outbreak. Thanks to the green channel provided by Hainan Medical Products Administration, Helpson

received the Registration Certificate of N95 medical protective mask at the fastest speed by the end of 2022, when the infection of COVID-19

had surged in China.

Helpson plans to continue

to optimize its product structure and actively respond to the current health needs of human beings.

Market Trends

As a generic drug company,

Helpson is presented with a huge domestic market. We believe that through further upgrades and consistency evaluations, which are based

on European and American production standards, Helpson will be able to export the products to overseas markets. In China’s market,

we believe that in the future, cost management and control ability will gradually become an important factor in determining the competitiveness

of generic pharmaceutical enterprises. Although price control leads to a decline in the profitability, the CP’s winning enterprise

has a good chance of achieving price-for-volume in order to increase its market share and support its continuous innovation transformation.

Additionally, rising and advancing consumer demand in China drives increases in discretionary consumption, and with the improvement of

residents’ quality of life, the healthcare demand is also changing. We believe that there are a large number of unmet demands in comprehensive

healthcare and Internet healthcare sectors.

In addition, the Office of

the State Council issued “Pilot Plan for Marketing Authorization Holders” on May 24, 2016, allowing eligible drug research

and development institutions and scientific researchers to become Marketing Authorization Holders (“MAH”) by obtaining drug

marketing authorization and drug approval numbers from the State Council. This policy uses a management model of separating drug marketing

authorization and drug production licenses, thereby allowing MAHs to produce pharmaceuticals themselves or to consign production to other

pharmaceutical manufacturers. This policy not only transitions our production practices to meet the European and United States standards

by separating drug approval and production qualifications, thereby changing the existing model of bundling drug approval numbers to pharmaceutical

manufacturers in China, but also serves as a supplement to the ongoing consistency evaluations policy.

In general, demand for pharmaceutical

products is still experiencing steady growth in China. We believe the ongoing generic drug consistency evaluations and reform of China’s

drug production registration and review policies will have major effects on the future development of our industry and may change its

business patterns. Helpson will continue to actively adapt to the national policy guidance and further evaluate market conditions for

its existing products, and competition in the market in order to optimize its development strategy.

Intercompany activities between the holding company and our subsidiaries

As of the date of this

prospectus, none of our subsidiaries have distributed any dividends to China Pharma, nor has China Pharma distributed any dividends to

its investors. China Pharma currently has no intention to distribute earnings to its stockholders and investors. The tables below present

cash flow transfer between China Pharma and Helpson, through China Pharma’s wholly owned subsidiary Onny for the years ended December

31, 2022 and 2021. China Pharma’s management believes that there are no tax consequences for cash flow transfers between China

Pharma and Helpson through Onny.

| For the year ended December 31, 2022 |

| No. |

|

Transfer from |

|

Transfer to |

|

Approximate value ($) |

|

|

Note |

| 1 |

|

China Pharma (via Onny) |

|

Helpson |

|

|

1,300,000 |

|

|

For Helpson’s operations |

| For the year ended December 31, 2021 |

| No. |

|

Transfer from |

|

Transfer to |

|

Approximate value ($) |

|

|

Note |

| 1 |

|

China Pharma (via Onny) |

|

Helpson |

|

|

3,000,000 |

|

|

For Helpson’s operations |

| 2 |

|

Helpson (via Onny) |

|

China Pharma |

|

|

320,000 |

|

|

For the payment of the agent service fees of China Pharma |

Executive Offices

Our principal executive offices

are located at 2nd Floor, No. 17, Jinpan Road, Haikou, Hainan Province, China. Our telephone number at that address is +86-898-66811730.

RISK FACTORS

Investing in our common stock

involves risk. You should carefully consider the specific risks discussed or incorporated by reference into the applicable prospectus

supplement, together with all the other information contained in the prospectus supplement or incorporated by reference into this prospectus

and the applicable prospectus supplement. You should also consider the risks, uncertainties and assumptions discussed under the caption

“Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2022, and in subsequent filings,

which are incorporated by reference into this prospectus. These risk factors may be amended, supplemented or superseded from time to time

by other reports we file with the SEC in the future or by a prospectus supplement relating to a particular offering of securities. These

risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us,

or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings

or any prospectus supplement or any additional risks and uncertainties actually occur, our business, financial condition and results of

operations could be materially and adversely affected. In that case, the trading price of our securities could decline and you might lose

all or part of your investment.

Risks Related to Doing Business in China

There

are Legal and Operational Risks Associated with Having the Majority of the Company’s Operations in the PRC.

The

PRC legal system is based on written statutes. The laws, regulations and legal requirements of China are relatively new and change often,

and their interpretation and enforcement depend to a large extent on relevant government policy and involve significant uncertainties

that could limit the reliability of the legal protections available to us.

The

PRC government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and

other licenses and requiring actions necessary for compliance. We cannot predict the effect of the interpretation of existing or new PRC

laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation

of any current or future PRC laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required

to restructure our operations or cease to provide certain services.

In

addition, the enforcement of laws and regulations in China can change quickly with little advance notice. In 2021, the PRC government

initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including

cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting

new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements

and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and

what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and

the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign

investments and list on an U.S. or other foreign exchange. Any action by the Chinese government to exert more oversight and control over

foreign investment in China-based companies could result in a material change in our operation, cause the value of our shares to significantly

decline or become worthless, and significantly limit, or completely hinder our ability to offer or continue to offer our shares to investors

and cause the value of such securities to significantly decline or be worthless.

We

cannot predict the effects of future developments in government policy or the PRC legal system in general. We may be required in the future

to procure additional permits, authorizations and approvals for our existing and future operations, which may not be obtainable in a timely

fashion or at all, or may involve substantial costs and unforeseen risks.

Certain PRC regulations may make it more difficult

for us to pursue growth through acquisitions.

Anti-Monopoly

Law of the People’s Republic of China promulgated by the Standing Committee of the National People’s Congress, which became

effective in 2008 and amended in 2022 (“Anti-Monopoly Law”), established additional procedures and requirements that could

make merger and acquisition activities by foreign investors more time-consuming and complex. Such regulation requires, among other things,

that State Administration for Market Regulation (“SAMR”) be notified in advance of any change-of-control transaction in which

a foreign investor acquires control of a PRC domestic enterprise or a foreign company with substantial PRC operations, if certain thresholds

under the Provisions of the State Council on the Standard for Declaration of Concentration of Business Operators, issued by the State

Council in 2008 and amended in 2018, are triggered. Moreover, the Anti-Monopoly Law requires that transactions which involve the national

security, the examination on the national security shall also be conducted according to the relevant provisions of the State. In addition,

PRC Measures for the Security Review of Foreign Investment which became effective in January 2021 require acquisitions by foreign investors

of PRC companies engaged in military-related or certain other industries that are crucial to national security be subject to security

review before consummation of any such acquisition. We may pursue potential strategic acquisitions that are complementary to our business

and operations.

Complying

with the requirements of these regulations to complete such transactions could be time-consuming, and any required approval processes,

including obtaining approval or clearance from the MOFCOM, may delay or inhibit our ability to complete such transactions, which could

affect our ability to expand our business or maintain our market share.

The Chinese government

may intervene or influence our business or operations at any time. Any such intervention or influence may negatively affect our operation

or interfere with our continued listing on a U.S. exchange, and could cause the value of our shares to significantly decline or be worthless,

which would materially affect the interest of our stockholders.

The Chinese central or

local governments may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures

and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, Chinese government actions in

the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy

or regional or local variations in the implementation of economic policies, could have a significant adverse effect on economic conditions

in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As such, our business

segments may be subject to various government and regulatory interference in the provinces in which they operate. We could be subject

to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions.

We may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to

comply. The Chinese government may intervene or influence our operations at any time with little advance notice, which could result in

a material change in our operations and in the value of our shares.

Adverse regulatory developments

in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted

by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies

like us with significant China-based operations, all of which could increase our compliance costs, subject us to additional disclosure

requirements. In addition, uncertainties with respect to the PRC legal system could adversely affect us.

We

conduct all of our business through Helpson, our PRC subsidiary, in China. The operations in China are governed by PRC laws and regulations.

Helpson is generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws and regulations

applicable to wholly foreign-owned enterprises. The PRC legal system is based on statutes. Prior court decisions may be cited for reference

but have limited precedential value.

The

recent regulatory developments in China, in particular with respect to restrictions on China-based companies raising capital offshore,

may lead to additional regulatory review in China over our financing and capital raising activities in the United States. In addition,

we may be subject to industry-wide regulations that may be adopted by the relevant PRC authorities, which may have the effect of limiting

our service offerings, restricting the scope of our operations in China, or causing the suspension or termination of our business operations

in China entirely, all of which will materially and adversely affect our business, financial condition and results of operations. We may

have to adjust, modify, or completely change our business operations in response to adverse regulatory changes or policy developments,

and we cannot assure you that any remedial action adopted by us can be completed in a timely, cost-efficient, or liability-free manner

or at all.

On February 17, 2023, the CSRC promulgated the Trial Administrative

Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), which took effect on March

31, 2023. On the same date, the CSRC circulated Supporting Guidance Rules No. 1 through No. 5, Notes on the Trial Measures, Notice on

Administration Arrangements for the Filing of Overseas Listings by Domestic Enterprises and relevant CSRC Answers to Reporter Questions

(collectively, the “Guidance Rules and Notice”), on CSRC’s official website. The Trial Measures, together with the Guidance

Rules and Notice, reiterate the basic principles for the overseas securities offering and listing by domestic enterprises, and clarified

and emphasized several aspects, which include but are not limited to: (1) criteria to determine whether an issuer will be required to

go through the filing procedures under the Trial Measures; (2) exemptions from immediate filing requirements for issuers including those

that have already been listed in foreign securities markets, including U.S. markets, prior to the effective date of the Trial Measures,

but these issuers shall still be subject to filing procedures if they conduct refinancing or are involved in other circumstances that

require filing with the CSRC; (3) a negative list of types of issuers banned from listing or offering overseas, such as issuers whose

affiliates have been recently convicted of bribery and corruption; (4) issuers’ compliance with web security, data security, and

other national security laws and regulations; (5) issuers’ filing and reporting obligations, such as obligation after offering or

listing overseas to file with the CSRC after it completes subsequent offerings and to report to the CSRC material events including change

of control or voluntary or forced delisting of the issuer; and (6) the CSRC’s authority to fine both issuers and their relevant

shareholders for failure to comply with the Trial Measures, including failure to comply with filing obligations or committing fraud and

misrepresentation. Specifically, pursuant to the Trial Measures, our future securities offerings in the NYSE American where we have previously

offered and listed shall also be filed with the CSRC within 3 working days after the offering is completed. The Trial Measures provide

the CSRC with power to warn, fine, and issue injunctions against both PRC domestic companies, their controlling shareholders, and their

advisors in listing or offering securities (collectively, the “Subject Entities”), as well as individuals directly responsible

for these Subject Entities (the “Subject Individuals”). For failure to comply with the Trial Measures Negative List or the

Trial Measures Filing Obligations, or materially disclose false or misleading statements in the filing and reporting required by the Trial

Measures: (1) PRC domestic companies, and their controlling shareholders if the controlling shareholders induced the PRC domestic companies’

failure to comply, severally, may face warnings, injunctions to comply, and fines between RMB1 million and RMB10 million (approximately

$145,647 and $1,456,473); the Subject Individuals in these entities may severally, face warnings and fines between RMB0.5 million and

RMB5 million (approximately $72,824 and $728,237). (2) Advisors in listing or offering securities that failed to dutifully advise the

PRC domestic companies and their controlling shareholders in complying with the Trial Measures and caused such failures to comply can

face warnings and fines between RMB0.5 million and RMB5 million (approximately $72,824 and $728,237); the Subject Individuals in these

advisor entities may, severally, face warnings and fines between RMB0.2 million and RMB2 million (approximately $29,129 and $291,295).

As the Trial Measures are newly issued, there remain uncertainties regarding its interpretation and implementation. Therefore, we cannot

assure you that we will be able to complete the filings for our future offerings and fully comply with the relevant new rules on a timely

basis, if at all. In addition, we cannot guarantee that we will not be subject to tightened regulatory review and we could be exposed

to government interference in China.

Recent greater oversight by the Cyberspace

Administration of China (the “CAC”) over data security, particularly for companies seeking to list on a foreign exchange,

could adversely impact our business and our offering.

On December 28, 2021,

the CAC and other relevant PRC governmental authorities jointly promulgated the Cybersecurity Review Measures, which took effect on February 15,

2022. The Cybersecurity Review Measures provide that, in addition to critical information infrastructure operators (“CIIOs”)

that intend to purchase Internet products and services, net platform operators engaging in data processing activities that affect or

may affect national security must be subject to cybersecurity review by the Cybersecurity Review Office of the PRC. According to the

Cybersecurity Review Measures, a cybersecurity review assesses potential national security risks that may be brought about by any procurement,

data processing, or overseas listing. The Cybersecurity Review Measures require that an online platform operator which possesses the

personal information of at least one million users must apply for a cybersecurity review by the CAC if it intends to be listed in foreign

countries.

On November 14, 2021,

the CAC promulgated the draft Regulations on the Administration of Cyber Data Security for public comment, pursuant to which data processors

conducting certain activities must apply for cybersecurity review. The draft regulations also require that data processors processing

important data or going public overseas shall conduct an annual data security self-assessment or entrust a data security service institution

to do so, and submit the data security assessment report of the previous year to the local branch of the CAC before January 31 each year.

Further, the draft regulations would require internet platform operators to establish platform rules, privacy policies and algorithm strategies

related to data, and solicit public comments on their official websites and personal information protection related sections for no less

than 30 working days when they formulate platform rules or privacy policies or makes any amendments that may have a significant impact

on users’ rights and interests. In addition, platform rules and privacy policies formulated by operators of large internet platforms

with more than 100 million daily active users, or amendments to such rules or policies by operators of large internet platforms with more

than 100 million daily active users that may have significant impacts on users’ rights and interests shall be evaluated by a third-party

organization designated by the CAC and reported to local branch of the CAC for approval. The CAC has solicited comments on this draft

until December 13, 2021, but there is no definite timetable as to when the draft regulations will be enacted. As such, substantial uncertainties

exist with respect to the enactment timetable, final content, interpretation and implementation of such regulations.

As of the date of this prospectus,

we, and Helpson, our PRC subsidiary, (i) are not required to obtain permissions from the CSRC, CAC or any other government authorities

on Helpson’s operations, and (ii) have not received or been denied such permissions by any PRC government authorities. If the Security

Administration Draft is enacted as proposed, we believe that the operations of Helpson and our listing will not be affected and that we

will not be subject to cybersecurity review by the CAC, given that Helpson possess personal data of fewer than one million individual

clients and do not collect data that affects or may affect national security in their business operations as of the date of this prospectus

and do not anticipate that they will be collecting over one million users’ personal information or data that affects or may affect

national security in the near future. There remains uncertainty, however, as to how the Cybersecurity Review Measures and the Security

Administration Draft will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws,

regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures and the Security Administration

Draft. If any such new laws, regulations, rules, or implementation and interpretation come into effect, we will take all reasonable measures

and actions to comply and to minimize the adverse effect of such laws on us. We cannot guarantee, however, that we will not be subject

to cybersecurity review and network data security review in the future. During such reviews, we may be required to suspend our operation

or experience other disruptions to operations. Cybersecurity review and network data security review could also result in negative publicity

with respect to our Company and diversion of our managerial and financial resources, which could materially and adversely affect our business,

financial conditions, and results of operations.

As of the date of this prospectus,

we have not received any notice from any authorities identifying Helpson as CIIOs. However, given the uncertainties surrounding the interpretation

and implementation of the Cyber Security Law, Data Security Law and relevant regulations, we cannot rule out the possibility that we,

or certain of our customers or suppliers may be deemed as a CIIO, or an operator processing “important data.” First, if we

are deemed as a CIIO, our purchase of network products or services, if deemed to be affecting or may affect national security, will need

to be subject to cybersecurity review, before we can enter into agreements with relevant customers or suppliers, and before the conclusion

of such procedure, these customers will not be allowed to use our products or services, and we are not allowed to purchase products or

services from our suppliers. There can be no assurance that we would be able to complete the applicable cybersecurity review procedures

in a timely manner, or at all, if we are required to follow such procedures. Any failure or delay in the completion of the cybersecurity

review procedures may prevent us from using certain network products and services, and may result in fines of up to ten times the purchase

price of such network products and services being imposed upon us, if we are deemed a CIIO using network products or services without

having completed the required cybersecurity review procedures. If the reviewing authority is of the view that the use of such network

products or services by us, or by certain of our customers or suppliers, involves risk of disruption, is vulnerable to external attacks,

or may negatively affect, compromise, or weaken the protection of national security, we may not be able to provide such products or services

to relevant customers, or purchase products or services from relevant suppliers. This could have a material adverse effect on our results

of operations and business prospects. Second, the notion of “important data” is not clearly defined by the Cyber Security

Law or the Data Security Law. In order to comply with the statutory requirements, we will need to determine whether we possess important

data, monitor the important data catalogs that are expected to be published by local governments and departments, perform risk assessments

and ensure we are complying with reporting obligations to applicable regulators. We may also be required to disclose to regulators business-sensitive

or network security-sensitive details regarding our processing of important data, and may need to pass the government security review

or obtain government approval in order to share important data with offshore recipients, which can include foreign licensors, or share

data stored in China with judicial and law enforcement authorities outside of China. If judicial and law enforcement authorities outside

China require us to provide data stored in China, and we are not able to pass any required government security review or obtain any required

government approval to do so, we may not be able to meet the foreign authorities’ requirements. The potential conflicts in legal

obligations could have adverse impact on our operations in and outside of China.

We May be Required to

Obtain Additional Permissions and Approvals for Business Operations in the PRC.

As of the date of this prospectus,

Helpson has obtained all the required permissions and approvals from PRC authorities that are required to operate its business. Helpson

has never failed to receive or maintain any permissions or approvals, nor have any applications been rejected. However, the PRC regulatory

authorities may in the future promulgate laws, regulations, or implementing rules that require Helpson to obtain additional permissions

or approvals to operate business. If that occurs, we cannot assure you that we will receive such additional permissions and approvals

on time. If we do not receive or maintain the approval, or incorrectly conclude that such approval is not required, or applicable laws,

regulations, or interpretations change such that we are required to obtain approval in the future, we may be subject to an investigation

by competent regulators, fines or penalties, and these risks could result in a material adverse change in our operations and the value

of our common stock, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause

such securities to significantly decline in value or become worthless.

Risks Related to Our Business

We rely on distributors

for all of our revenues and failure to maintain relationships with and collect payment from our distributors or to otherwise expand our

distribution network would materially and adversely affect our business.

We sell our products exclusively

to pharmaceutical distributors in the PRC and rely on distributors for all of our revenues. We have business relationships with over

1,000 distributors in the PRC. For the year ended December 31, 2022, no customer accounted for more than 10.0% of sales, and three customers

accounted for 52.9%, 11.4%, and 10.4% of accounts receivable. In line with industry practices in the PRC, we enter into written sales

agreements with our distributors. However, such sales agreements are not in substance equivalent to a typical distribution agreement

in the United States. Each sales agreement resembles a sales order, and specifies one or several purchases of one or more products without

any continuing obligation to purchase any additional products. There are no written contracts between us and any of its distributors

requiring the distributors to pay us our account receivable upon their receipt of funds from its customers, or state-owned hospitals.

Pharmaceutical distributors typically process the payment of the account receivable to the companies upon their receipt of payment from

their customers, i.e., the state-owned hospitals, as a matter of implied consensus. In the event the length of collection term deviates

from the past pattern of any particular customer, we will adjust its credit term.

Any potential default

in repaying the accounts receivable without recourse by us may materially and negatively affect our profitability and business. In the

event certain distributors choose not to continue their relationship with us after completing their existing sales agreements, they can

do so without breaching any contract or agreement, and our financial results could be adversely affected if we cannot quickly find substantially

similar distributors under such circumstances. In addition, some of our distributors may sell products that compete with our products.

We compete for desired distributors with other pharmaceutical manufacturers, many of which may have higher visibility, greater name recognition,

greater financial resources, and broader product selection than we do. Consequently, maintaining relationships with existing distributors

and replacing distributors may be difficult and time-consuming. Any disruption of our distribution network, including our failure to

renew our existing distribution agreements with our desired distributors, could negatively affect our ability to effectively sell our

products and would materially and adversely affect our business, financial condition and results of operations.

Risks Related to Our Securities and the Offering

Future sales or other

dilution of our equity could depress the market price of our common stock.

Sales of our common stock,

the common stock underlying our preferred stock, warrants, rights or convertible debt securities, or any combination of the foregoing,

in the public market, or the perception that such sales could occur, could negatively impact the price of our common stock.

In addition, the issuance

of additional shares of our common stock, securities convertible into or exercisable for our common stock, other equity-linked securities,

including preferred stock, warrants or rights or any combination of these securities pursuant to this prospectus will dilute the ownership

interest of our common shareholders and could depress the market price of our common stock and impair our ability to raise capital through

the sale of additional equity securities.

We may need to seek additional

capital. If this additional financing is obtained through the issuance of equity securities, debt securities convertible into equity or

options, warrants or rights to acquire equity securities, our existing shareholders could experience significant dilution upon the issuance,

conversion or exercise of such securities.

Our management will

have broad discretion over the use of the proceeds we receive from the sale our securities pursuant to this prospectus and might not apply

the proceeds in ways that increase the value of your investment.

Our management will have broad

discretion to use the net proceeds from any offerings under this prospectus, and you will be relying on the judgment of our management

regarding the application of these proceeds. Except as described in any prospectus supplement or in any related free writing prospectus

that we may authorize to be provided to you, the net proceeds received by us from our sale of the securities described in this prospectus

will be added to our general funds and will be used for general corporate purposes. Our management might not apply the net proceeds from

offerings of our securities in ways that increase the value of your investment and might not be able to yield a significant return, if

any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions on how to use such proceeds.

USE OF PROCEEDS

Except as otherwise provided

in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities covered by this prospectus

for general corporate purposes, which may include working capital, capital expenditures, research and development expenditures, acquisitions

of new technologies or businesses and investments. Additional information on the use of net proceeds from an offering of securities covered

by this prospectus may be set forth in the prospectus supplement relating to the specific offering.

THE SECURITIES WE MAY OFFER

The descriptions of the securities

contained in this prospectus, together with any applicable prospectus supplement, summarize all the material terms and provisions of the

various types of securities that we may offer. We will describe in the applicable prospectus supplement relating to a particular offering

the specific terms of the securities offered by that prospectus supplement. If we indicate in the applicable prospectus supplement, the

terms of the securities may differ from the terms we have summarized below. We will also include in the prospectus supplement information,

where applicable, about material United States federal income tax considerations relating to the securities, and the securities exchange,

if any, on which the securities will be listed.

We may sell from time to time,

in one or more offerings:

| |

● |

shares of our common stock; |

| |

● |

shares of our preferred stock; |

| |

● |

debt securities (which may be convertible into or exchangeable for common stock); |

| |

● |

warrants to purchase our common stock; |

| |

● |

rights to purchase our common stock; and/or |

| |

● |

units consisting of the forgoing. |

This prospectus may not be

used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

DESCRIPTION OF CAPITAL STOCK

General

The following description

of our capital stock together with the additional information we include in any applicable prospectus supplement, summarizes the material

terms and provisions of the capital stock that we may offer under this prospectus but is not complete. For the complete terms of our capital

stock, please refer to our articles of incorporation and our bylaws, as amended from time to time. While the terms we have summarized

below will apply generally to any future capital stock that we may offer, we will describe the specific terms of any series of these securities

in more detail in the applicable prospectus supplement. If we so indicate in a prospectus supplement, the terms of any capital stock we

offer under that prospectus supplement may differ from the terms we describe below.

Our authorized capital stock

consists of five hundred million (500,000,000) shares of common stock, $0.001 par value per share and five million (5,000,000) shares

of preferred stock, $0.001 par value per share. The authorized and unissued shares of capital stock are available for issuance without

further action by our shareholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities

may be listed. Unless approval of our shareholders is so required, our board of directors will not seek shareholder approval for the issuance

and sale of our capital stock.

Common Stock

As of February 5, 2024,

there were 56,981,244 shares of our common stock outstanding. The holders of our common stock are entitled to such dividends as our board

of directors may declare from legally available funds. The holders of our common stock are entitled to one vote per share on any matter

to be voted upon by shareholders. Our articles of incorporation or our bylaws, as amended from time to time, do not provide for cumulative

voting. No holder of our common stock has any preemptive right to subscribe for any shares of capital stock issued in the future under

the Nevada Revised Statutes, our articles of incorporation or our bylaws, as amended from time to time. Our common stock has no preemptive

or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to the common stock.

All shares of common stock

offered hereby will, when issued, be fully paid and non-assessable, including shares of common stock issued upon exercise of common stock

warrants or common stock purchase rights, if any.

Our common stock is quoted on the NYSE American

under the symbol “CPHI”. The transfer agent and registrar for our common stock is Equiniti Trust Company (f/k/a Corporate

Stock Transfer), 1110 Centre Pointe Curve, Suite 101, Mendota Heights, MN 55120.

Preferred Stock

As of February 5, 2024,

no shares of preferred stock had been issued or were outstanding.

Our board of directors has

the authority to issue up to 5,000,000 shares of preferred stock in one or more series and to determine the rights and preferences of

the shares of any such series without stockholder approval. Our board of directors has the authority to fix the designation and powers,

rights and preferences and the qualifications, limitations or restrictions with respect to each class or series of such class without

further vote or action by the stockholders, unless action is required by applicable law or the rules of any stock exchange on which our

securities may be listed. The ability of our board of directors to issue preferred stock without stockholder approval could have the effect

of delaying, deferring or preventing a change of control of us or the removal of existing management. Further, our board of directors

may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights

of the holders of our common stock. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of

our common stock.

We will file as an exhibit

to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the

SEC, the form of any certificate of designation that describes the terms of the series of preferred stock we are offering before the issuance

of that series of preferred stock. This description will include, but not be limited to, the following:

| |

● |