TIDMBYOT

RNS Number : 9269V

Byotrol PLC

07 December 2023

Byotrol Plc

("Byotrol" or the "Company")

Interim results

Byotrol Plc (AIM: BYOT), the specialist infection prevention and

control company, is pleased to announce its unaudited interim

results for the six months ended 30 September 2023. The results are

in line with the trading update of mid-November.

Highlights

-- Headline product sales of GBP2.02m, flat versus the

comparable period (H1, FYE March 2023), reflecting the impact of

discontinued items. No new IP sales, versus GBP0.22m in the

comparable period.

-- Substantial increase (17%) in like-for-like product sales

after allowing for discontinuations.

-- Increasing concentration of activities in our chosen primary

market of animal health (65.0% of product sales versus 47.5% in the

previous year and 38.5% pre-pandemic FYE2020).

-- Underlying gross margin of 44.5% on product sales, versus

42.6% for the year ended 31 March 2023.

-- EBITDA loss of GBP0.45m versus GBP0.3m in the comparable period.

-- Cash in bank of GBP0.51m, versus GBP0.68m at 31 March 2023.

-- Operational KPIs all improving, including OTIF (On Time In

Full delivery) now consistently exceeding 90%.

Projected returns from existing IP agreements remain

encouraging, supported by recent or upcoming product launches of

long-lasting sanitisers in the US, UK and EU. Commission and

royalties are now expected to be material to our finances from FYE

March 2024.

Dr Trevor Francis, Non-Executive Chairman of Byotrol

commented:

"The Directors are pleased with Byotrol's recent progress,

despite the continued difficult economic and market background and

the need to make senior management changes. Byotrol's products are

all now fit for purpose with regulators in our targeted markets and

our product sales efforts are benefiting from the increased focus

and operational efficiencies ."

For further information contact:

Byotrol Plc

Dr Trevor Francis, Non Executive Chairman +44 (0)1925 742 000

David Traynor, Interim Chief Executive

Officer

Chris Sedwell, Chief Financial Officer

finnCap Limited (Nominated Adviser and

Broker) +44 (0)20 7220 0500

Geoff Nash/George Dollemore - Corporate

Finance

Nigel Birks/Harriet Ward - ECM

Flagstaff Strategic and Investor Communications +44 (0)20 7129 1474

Tim Thompson/Andrea Seymour/Fergus Mellon byotrol@flagstaffcomms.com

This announcement is released by Byotrol Plc and, prior to

publication, the information contained herein was deemed to

constitute inside information under the Market Abuse Regulations

(EU) No. 596/2014. Such information is disclosed in accordance with

the Company's obligations under Article 17 of MAR. The person who

arranged for the release of this announcement on behalf of Byotrol

Plc was Chris Sedwell, CFO.

* Adjusted EBITDA is defined as Earnings before Interest, Tax,

Depreciation and Amortisation and exceptional items, share-based

payments, non-trading items such as profit or loss on disposal of

assets, plus revenue recognised as interest under IFRS 15

Notes to editors

Byotrol plc (BYOT.L), quoted on AIM, is a specialist infection

prevention and control company that develops and commercialises

high performance, broad spectrum, low toxicity biocidal

technologies for animal and human healthcare markets. Our products

are designed for domestic and international uses, with regulatory

approval for each market that we operate in, including under the EU

Biocide Products Regulation regime.

Byotrol technologies can be used as stand-alone products or as

ingredients within existing products, especially in surface care,

personal care and odour control uses.

Byotrol develops and commercialises technologies that create

easier, safer and cleaner lives for everyone.

For more information, go to byotrol.com

Chairman's Review

I have been Chairman of Byotrol now for 7 months, having been

with the Company originally in 2008 and then in various roles since

late 2013, which included seven years as Chief Technology Officer

and two as an NED.

In the last year it feels as though we have been through a

lengthy period of turbulence, including raw material inflation,

energy price hikes, political uncertainty, as well as some internal

difficulties. Despite these challenges, we are continuing to make

good progress in positioning our Company for the future.

In my time as Chairman, along with my co-directors, I have

reviewed our strategy, positioning and management team, and we have

reached the following conclusions:

-- Our science and regulatory-led strategy is on-point in a

valuable, global, growing market and we are building a company of

value in both product sales and underlying IP.

-- Historically, we have been strong at commercialising IP, but

less so at selling our own products. We have learned at first-hand

how hard it is to build a product trading business from scratch,

but with the recent increase in focus we are now improving

radically across all functions including sales (where we still need

to do a lot more), customer services and supporting functions,

especially supply chain and quality. I urge stakeholders to review

the detail of the CEO's report, which I believe shows real

development of the Company.

-- Our leadership over the last 12 months has faced some

challenges, with one specifically enforced on us by some serious

(and thankfully in the end temporary) health issues within the

senior team. I am glad to say the changes are now behind us and we

have a very focused and experienced management team.

-- Such issues have been addressed against a highly volatile

economic environment and in our experience an almost complete

disappearance of AIM as a funding solution for micro caps, except

for tax-based investment in new issues. Byotrol has no further

capacity for EIS or VCT investment fund raising, having exhausted

the tax efficient capacity in earlier years. Over recent years we

have needed to finance our development almost completely from

internally generated sources, especially via existing IP

agreements, which has stifled growth and increased our risk

profile.

In spite of these challenges like-for-like product sales over

this review period are up by 17%, underlying product gross margin

is now above 44% despite a 100% outsourced manufacturing model and

our IP agreements are slowly coming to fruition. We now need to

solidify and accelerate these positive developments.

The Board regularly reviews whether we can achieve our targets

as an independent, listed company and has concluded for the time

being that we can. We are now keeping this conclusion under

frequent review and will not hesitate to take a different route if

it will lead to better returns for shareholders.

Dr Trevor Francis

Non-Executive Chairman

Interim CEO's report and financial review

Byotrol's long-term strategy has been to build an IP-based

biocide technology company, founded on strong science, regulatory

approvals and segmental expertise, generating sustainable profits

from its own product sales and from monetizing IP.

Our roots are very much in R&D. Pre-pandemic we used IP

activities to generate cashflow, together with support from

shareholders by way of occasional equity issuance. During this

period we also invested significant resources into building a

product trading business with products that would meet the

challenging regulatory requirements of the EU Biocides Products

Regulations and that would reduce volatility in earnings

projections. This led to us buying Medimark Scientific Limited,

completed in January 2020, which instantly provided a presence in

animal health product sales in the UK and also in some niche human

health categories. The plan at the time was to upgrade Medimark

products using Byotrol technologies and then to expand into Europe

and adjacent product areas.

Covid put those plans on hold for two years, firstly due to the

short period of extraordinary demand for all sanitising products in

all markets, and then due to the extreme oversupply that followed.

Since FYE2022 we have modified the pre-Covid plan as post pandemic

a number of our markets had changed, with a continued clear intent

of upgrading across all areas of the business but now frustratingly

against a backdrop of political and economic turmoil, not least in

financing markets.

Byotrol is now taking the shape that we have been working

towards for many years and the detail of our results in the period

under review show the progression well:

-- 17% increase in like-for-like product sales after allowing

for regulatory-enforced discontinuations.

-- Increasing concentration of activities in our chosen primary

market of animal health (65.0% of product sales versus 47.5% in the

previous year and 38.5% pre-pandemic FYE2020). Human health remains

an area of focus but is yet to fully benefit from the imminent

launch of Cruise-based technologies.

-- Underlying gross margin of 44.5% on product sales, after

stripping out disposal costs for obsolete and discontinued stocks,

versus 42.6% for the year ended 31 March 2023

-- Operational KPIs all improving, including OTIF (On Time In

Full delivery) now consistently exceeding 90%

We recognise that we are reporting headline numbers below

initial guidance, which included some over-ambition on new product

launches and led to senior management change at the end of the

period. However, that should not obscure the fact that the

refocusing programme is now in its final stages and that business

performance is improving in leaps and bounds.

The upside from continuing on our current path remains

substantial as: (a) all of our products have been designed for

export into Europe, while our sales are currently 90% UK; (b) we

have not yet fully launched our new formulations into human health;

and (c) we have temporarily de-prioritised IP commercialization - a

historic strength - to focus on solidifying the products

business.

Results by segment

Professional

H1 product revenues increased by 8% to GBP1.81m versus GBP1.68m

in the comparable period (6 months of September 2022). No royalty

income was received in H1, compared to GBP0.22m in the comparable

period.

Gross profit on product sales was flat at GBP0.74m.

As has been long planned since the acquisition of Medimark, but

delayed by and to some degree a result of the pandemic, our

Professional division has now undergone a reorientation towards

animal and (niche) human healthcare, with continued tightening of

focus on three core technology platforms, reduced skus, regulatory

acceptance across Europe, and operational excellence.

In the period under review Professional product revenue was

split 73% animal health, 22%% human health, 5% FM and other, versus

56%, 32% and 12% in the previous full year. We are very encouraged

by recent successes in the UK, having secured favoured-supplier

status with some of the UK's best known animal welfare charities as

well as leading wholesalers and corporate vet groups.

We have now completed the upgrade of all our core formulations

in animal health surface care, to chemistries based on our

proprietary Cruise formulation and sold under the brands Anigene

and Processus. Next summer we will be launching a ready-to-use

formulation for smaller customers and will then also be able to

look afresh at consumer markets, where we already have some brand

equity.

Our human health product offerings are due for upgrade to the

Cruise platform, to be sold under Chemgene branding. We have

already launched a Cruise-based surface disinfectant product as a

range extension to Processus instrument decontamination products,

which we are selling into animal and human health markets.

Export sales were behind plan in the period under review and we

are now seeking dedicated international sales resource. There is a

substantial upside here for the Company and its existing products

and technologies, almost all of which have been designed to satisfy

UK and EU regulators.

Consumer

H1 revenues decreased to GBP0.21m from GBP0.34m and gross profit

to GBP0.11m from GBP0.14m, with gross margin increasing to 51.4%

from 41.4%, a result (as in the Professional segment) of focusing

on higher margin product areas.

Consumer remains niche for us in product sales at present,

without a dedicated commercial and/or marketing lead except of

course for longstanding customers Boots (alcohol free hand

sanitisers) and Goodsmile (petcare and human healthcare in

Japan).

We are also gradually increasing our presence on Amazon and we

now expect to launch consumer versions of our new technologies,

especially Cruise, direct to consumers on that platform. Sales on

Amazon have grown very rapidly in the last 6 months and are now a

top 3 consumer customer, and a top 10 Byotrol customer overall,

with new listings to come.

Technology Portfolio

Our portfolio continues to strengthen, having now fixed on three

core platforms that we intend to support through the final

regulatory approvals in the EU:

-- 'Cruise' technology platform is now formulated and in-market

in concentrate form and shortly in ready-to-use format. It is a

high performance, regulatory compliant (UK and EU) surface

disinfectant with low cost-in-use for multiple surfaces and

healthcare environments. We would like to think it is leading edge

compared to most competitive products in the market and in various

iterations is already replacing a number of legacy

formulations.

-- Artemis surface disinfection - natural and sustainable

technology with excellent anti-microbial performance, especially

against viruses, which we are now targeting to surface care

environments including humans, animals and specialist food

environments. This technology fits with market trends towards

sustainability and in the near future we will be working hard to

achieve accelerated UK and EU regulatory approval, with faster

roll-out at a significantly lower cost than normal routes. (For

information: accelerated approval routes require that formal

approval is achieved before products can be put into market, a

12-month process).

-- Invirtu hand sanitisers - alcohol free skin sanitisation with

an upgraded and more robust formulation, but with the same germ

kill and dermatological benefits.

Given the Company's current focus on its trading business, we

have temporarily but substantially reduced investment in developing

new IP. We continue to see substantial value in seaweed-based

antivirals and in other natural anti-microbials, but resource

constraints mean we remain early in the dedicated sales cycle.

Intellectual Property Sales and Licensing

The two most active IP-based projects remain live and are

progressing steadily:

-- Actizone - the long-lasting antimicrobial surface sanitiser

IP that Byotrol co-developed and then sold to Solvay SA in 2018,

with an ongoing sales commission payable to Byotrol on Solvay's

sales. This now has multiple global regulatory approvals. To date,

commissions to Byotrol have been non-material, but recent

projections suggest it will become financially material to Byotrol

by FYE 2025, assuming continued customer traction and further

product launches in both retail and institutional segments.

-- Integrated Resources ("IRI")/Byotrol24 - the EPA registered

long-lasting antimicrobial that Byotrol sold to IRI in 2022. This

sale was conditional on IRI paying to Byotrol US$1.4m over 4 years

to February 2026, plus low single-digit royalties and a material

percentage of the additional sales proceeds should IRI onward sell

the formulation. Since the agreement, IRI has sub-licensed the

formulation to a globally recognised US hygiene brand, which is

currently test-marketing and expecting to proceed to a full US

launch in Autumn 2024. Royalties received from IRI have however

been negligible to date.

As reported in recent trading updates, the team's recent efforts

have been focused more on monetizing current IP agreements than

generating new transactions, to (a) support the Company's

investment in growing a sustainable trading business and (b)

reflect current trading at licensee and alliance partners in their

core markets. One such agreement has been reached since period end,

with Byotrol agreeing to terminate by mutual consent a historic

license with Turtle Wax Europe Limited in return for a cash

payment. This was a 5 year license agreement signed in January 2021

over Byotrol long-lasting anti-microbial surface technology for

in-car use, and sold to EU consumers. Turtle Wax has since

de-listed the product due to a change in strategy and agreed with

us a settlement sum for future guaranteed minimum royalties.

Balance sheet

Our balance sheet at the end of the first half shows net assets

of GBP4.9m, down GBP0.7m from GBP5.6m at the end of FY23. Of this

GBP3.2m is held within our intangible assets, in line with the

previous year-end, and represents assets created on the acquisition

of Medimark combined with the value of our own internally generated

IP.

We have continued to develop our technical and operational

capabilities and have invested GBP0.18m in our IP and associated

regulatory costs in the first six months of FY24 (see Note 7). In

addition, we invested in our finished goods to support the Chemgene

Medlab launch as well as other sales initiatives, with inventory

increasing to GBP632k at the end of September, compared to GBP0.49m

at the end of March 2023. We expect our inventory to fall back

again in the second half of the year as these launches and

initiatives gain momentum.

Our cash balance at the end of September was GBP0.51m, down

GBP0.18m from GBP0.69m at the FY23 year-end, reflecting careful

management of our cash balance, despite the investments noted

above.

Management Changes

Byotrol has announced a series of Board changes in the

period:

-- Dr Trevor Francis was appointed Non-Executive Chairman of the Company on 26 April 2023

-- Ashley Head, serial entrepreneur and long-standing Byotrol

shareholder joined the Board as a Non-Executive Director on 13

September 2023

-- Vivan Pinto, CEO since 22 November 2022 left the Company on

26 September 2023 to pursue other interests. David Traynor, Vivan's

predecessor and still on the Company board stepped in as Interim

CEO, with expectations of handing over to a newly hired CEO by

mid-2024.

Outlook

The Directors remain completely focused on Byotrol moving to

sustainable profits. We recognize this has taken longer than

expected and with a level of operating costs to bring about these

improvements that are undoubtedly hurting, but we have done so

during an exceptionally long duration of market volatility, and no

external equity capital raising since 2018. We are encouraged by

the radical improvements in margins, operational KPIs and by the

delivery of a product range that is future-proofed against EU and

UK regulatory environments.

Our challenge now is to improve sales execution further,

especially in export and in niche human health, and to then

reallocate more resources back to monetise our outstanding IP

portfolio.

David Traynor

Interim CEO

Group statement of comprehensive income

6 months 6 months Year to

to to 31 March

30 September 30 September 2023

2023 2022

Note GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

Revenue 2 2,022 2,232 4,592

Cost of sales pre-exceptional

item (1,173) (1,129) (2,475)

_______ _______ _______

Gross profit pre-exceptional

item 849 1,103 2,117

Cost of sales - exceptional

item - - (258)

_______ _______ _______

Gross profit 849 1,103 1,859

Adjusted administrative expenses (1,441) (1,586) (3,383)

_______ _______ _______

Adjusted operating loss (592) (483) (1,524)

Amortisation of acquisition-related

intangibles (114) (169) (300)

Share-based payments (57) (-) (33)

_______ _______ _______

Operating loss (763) (652) (1,857)

Finance income 4 43 50 103

Finance expense 5 (56) (21) (71)

_______ _______ _______

Loss before taxation (776) (623) (1,825)

Income tax credit 34 44 133

_______ _______ _______

Loss for the period (742) (579) (1,692)

Items that may be reclassified

subsequently to profit or loss:

Exchange differences (38) 156 107

_______ _______ _______

Other comprehensive (expense)/income,

net of tax (38) 156 107

Total comprehensive loss for

the period (780) (423) (1,585)

Earnings per share - from

loss for the period

Attributable to the owners

of Byotrol plc (basic) 6 (0.16)p (0.13)p (0.37)p

Attributable to the owners

of Byotrol plc (diluted) 6 (0.16)p (0.13)p (0.37)p

The accompanying notes 1 to 10 are an integral part of these

financial statements.

Group statement of financial position

As at As at As at

30 September 30 September 31 March

2023 2022 2023

Note GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

Assets

Non-current assets

Intangible assets 7 3,201 3,433 3,218

Tangible assets 50 76 61

Right-of-use assets 8 9 17 13

Deferred tax assets 163 134 163

Trade receivables 1,356 1,804 1,436

_______ _______ _______

4,779 5,464 4,891

Current assets

Inventories 632 627 494

Trade and other receivables 1,215 1,649 1,669

Cash and cash equivalents 508 1,158 687

_______ _______ _______

2,355 3,434 2,850

Total assets 7,134 8,898 7,741

Liabilities

Non-current liabilities

Lease liabilities 9 - 8 4

Deferred tax liabilities 266 360 299

Convertible loan stock 962 962 962

_______ _______ _______

1,228 1,330 1,265

Current liabilities

Trade and other payables 1,016 827 863

Lease liabilities 9 8 8 8

_______ _______ _______

1,024 835 871

Total liabilities 2,252 2,165 2,136

NET ASSETS 4,882 6,733 5,605

Issued share capital and

reserves

Share capital 1,135 1,135 1,135

Share premium 457 457 457

Other reserves 856 981 932

Retained earnings 2,434 4,160 3,081

_______ _______ _______

TOTAL EQUITY 4,882 6,733 5,605

The accompanying notes 1 to 10 are an integral part of these

financial statements.

Group statement of cash flows

6 months 6 months Year to

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

Cash flows from operating activities

Loss for the period (742) (579) (1,692)

Adjustments for:

Finance income (43) (50) (103)

Finance costs 56 21 71

Depreciation of tangible non-current

assets 15 18 34

Amortisation of intangible non-current

assets 191 275 642

Loss on disposal of assets 6 1 64

Income tax recognised in profit

or loss (34) (44) (100)

Share-based payments 57 - 33

_______ _______ _______

Operating cash flows before movements

in working capital (494) (358) (1,051)

(Increase)/decrease in trade and

other receivables 392 57 421

(Increase)/decrease in inventories (140) (227) (95)

Increase/(decrease) in trade and

other payables 345 (377) (428)

_______ _______ _______

Cash generated/(used in) from

operating activities 103 (905) (1,153)

Income tax refund received - 21 125

_______ _______ _______

Net cash generated/(used in) from

operating activities 103 (884) (1,028)

Cash flows from investing activities

Development of intangible assets (180) (202) (419)

Acquisition of property, plant

and equipment (4) (20) (22)

_______ _______ _______

Net cash used in investing activities (184) (222) (441)

Cash flows from financing activities

Proceeds from issue of convertible

loan stock - 1,000 1,000

Repayments of principal on lease

liabilities (4) (4) (12)

Finance costs (56) (20) (70)

Interest expense on lease liabilities - - (1)

_______ _______ _______

Net cash (used in)/ generated

by financing activities (60) 976 917

Net decrease in cash and cash

equivalents (141) (130) (552)

Net foreign exchange differences (38) 156 107

Cash and equivalent at beginning

of period 687 1,132 1,132

_______ _______ _______

Cash and cash equivalents at end

of period 508 1,158 687

Group statement of changes in equity

Share Share Other Retained Total

capital premium Exchange reserve profits

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March

2022 1,135 457 787 - 4,739 7,118

Loss after taxation

for the period - - - - (579) (579)

Other comprehensive

income:

Exchange differences - - 156 - - 156

Transactions with

owners:

Convertible Loan

Stock Issue - - - 38 - 38

_____ _____ _____ _____ _____ _____

Balance at 30 September

2022 1,135 457 943 38 4,160 6,733

Loss after taxation

for the period - - - - (1,113) (1,113)

Other comprehensive

income:

Exchange differences - - (49) - - (49)

Transactions with

owners:

Share-based payments - - - - 33 33

Deferred tax on

share-based payment

transactions - - - - 1 1

_____ _____ _____ _____ _____ _____

Balance at 31 March

2023 1,135 457 894 38 3,081 5,605

Loss after taxation

for the period - - - - (742) (742)

Other comprehensive

income:

Exchange differences - - (38) - - (38)

Transactions with

owners:

Share-based payments - - - - 57 57

_____ _____ _____ _____ _____ _____

Balance at 30 September

2023 1,135 457 856 38 2,396 4,882

Reserve Description and purpose

Share capital Nominal value of issued shares

Share premium Amount subscribed for share capital in excess

of nominal value less associated costs

Other Reserve Equity component arising from issue of Convertible

Loan Note

Exchange reserve The difference arising on the translation of

foreign operations denominated in currencies

other than UK Sterling into the presentational

currency of the Group

Merger reserve Amounts arising on the consolidation of historic

acquisitions under merger accounting principles

Retained earnings All other net gains and losses not recognised

elsewhere

The accompanying notes 1 to 10 are an integral part of these

financial statements.

Notes to the Group financial statements

1 Basis of preparation

The Group has prepared its interim financial statements for the

6 months ended 30 September 2023 (the "interim results") in

accordance with the recognition and measurement principles of

International Financial Reporting Standards ("IFRS") as adopted by

the European Union and also in accordance with the recognition and

measurement principles of IFRS issued by the International

Accounting Standards Board, but do not include all the disclosures

that would otherwise be required. They have been prepared under the

historical cost convention as modified to include the revaluation

of certain non-current assets. The accounting policies adopted in

the interim financial statements are consistent with those adopted

in the Group's Annual Report and Financial Statements for the year

ended 31 March 2023 and those which will be adopted in the

preparation of the Annual Report for the year ending 31 March

2024.

As permitted, the interim results have been prepared in

accordance with the AIM Rules of the London Stock Exchange and not

in accordance with IAS34 Interim Financial Reporting. They do not

constitute full statutory accounts within the meaning of section

434 of the Companies Act 2006 and are unaudited.

Going concern

The Directors have considered trading and cash flow forecasts

prepared for the Group, assuming a continued marginal increase in

product sales and some further reasonable reductions in costs.

Based on these, and a continued confidence in being able to

accelerate cash from existing IP agreements or potentially a modest

fundraise, the Directors are satisfied that the Group will continue

to be able to meet its liabilities as they fall due for at least

twelve months from the date of these results. On this basis, they

consider it appropriate to have adopted the going concern basis in

the preparation of the interim results, which were approved by the

Board of Directors on 5 December 2023.

Comparative financial information

The comparative financial information presented herein for the

year ended 31 March 2023 constitute full statutory accounts for

that period. The statutory accounts for the year ended 31 March

2023 carried an unqualified Auditor's Report, did not draw

attention to any matters by way of emphasis and did not contain a

statement under Section 498(2) or 498(3) of the Companies Act

2006.

2 Segmental analysis

Revenue and gross profit by segment

6 months ended 30 September Continuing Total

2023 operations

Professional Consumer

GBP'000 GBP'000 GBP'000

Revenue

Product sales 1,810 212 2,022

Royalty and licensing income - - -

_______ _______ _______

Total revenue 1,810 212 2,022

Gross profit

Product sales 740 109 849

Royalty and licensing income - - -

_______ _______ _______

Total gross profit 740 109 849

6 months ended 30 September Continuing Total

2022 operations

Professional Consumer

GBP'000 GBP'000 GBP'000

Revenue

Product sales 1,678 336 2,014

Royalty and licensing income 218 - 218

_______ _______ _______

Total revenue 1,896 336 2,232

Gross profit

Product sales 746 139 885

Royalty and licensing income 218 - 218

_______ _______ _______

Total gross profit 964 139 1,103

Revenue by geography

The Group recognises revenue in three geographical regions based

on the location of customers, as follows:

6 months ended 30 September Professional Consumer Total

2023

GBP'000 GBP'000 GBP'000

United Kingdom 1,674 88 1,762

North America 15 - 15

Rest of World 121 124 245

_______ _______ _______

Total revenue 1,810 212 2,022

6 months ended 30 September Professional Consumer Total

2022

GBP'000 GBP'000 GBP'000

United Kingdom 1,575 140 1,715

North America 43 - 43

Rest of World 278 196 474

_______ _______ _______

Total revenue 1,896 336 2,232

Management makes no allocation of costs, assets or liabilities

between these segments since all trading activities are operated as

a single business unit.

License revenue and finance income

License contracts (and certain other contracts relating to the

sale of IP) typically provide for fixed payments to be made by

customers over a given term (typically between three and five years

but which may extend longer). Under IFRS 15, in order to reflect

the time value of money, such contracts are recognised as the

capitalised value of the income stream plus notional interest

accruing for the period on the credit deemed to be extended to the

customer (on a reducing balance basis). For the 6 months to 30

September 2023 this figure amounts to license revenue of GBPnil and

notional interest income of GBP42,000.

3 Non-GAAP profit measures and exceptional items

Reconciliation of operating profit to adjusted EBITDA (earnings

before interest, taxation, depreciation and amortisation):

6 months 6 months Year to

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Operating loss (763) (652) (1,857)

Adjusted for:

Amortisation and depreciation 210 301 689

_______ _______ _______

EBITDA (553) (351) (1,168)

Loss on disposal of assets 6 1 64

Revenue recognised as interest

under IFRS 15 42 49 101

Expensed share-based payments 57 - 33

Exceptional items:

-------------- -------------- ----------

- Inventory Provision - - 258

Total exceptional items - - 258

_______ _______ _______

Adjusted EBITDA (448) (301) (712)

The criterion for adjusting items in the calculation of adjusted

EBITDA is operating income or expenses that are material and either

(i) arise from an irregular and significant event or (ii) are such

that the income/cost is recognised in a pattern that is unrelated

to the resulting operational performance. Materiality is defined as

an amount which, to a user, would influence decision-making based

on, and understandability of, the financial statements. Adjustment

for share-based payment expense is made because, once the cost has

been calculated, the Directors cannot influence the share based

payment charge incurred in subsequent years, and the value of the

share option to the employee differs considerably in value and

timing from the actual cash cost to the Group.

Exceptional items are treated as exceptional by reason of their

size or nature and are excluded from the calculation of adjusted

EBITDA (and adjusted earnings per ordinary share) to allow a better

understanding of comparable year-on-year trading and thereby an

assessment of the underlying trends in the Group's financial

performance. These measures also provide consistency with the

Group's internal management reporting.

Adjusted EPS

The calculation of adjusted EPS is shown in Note 6.

4 Finance income

6 months 6 months Year to

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Interest receivable on interest-bearing

deposits 1 1 2

Notional interest accruing on

contracts with a significant

financing component 42 49 101

_______ _______ _______

Total finance income 43 50 103

5 Finance expense

6 months 6 months Year to

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Interest and finance charges 56 21 70

Interest on lease liabilities

under IFRS 16 - - 1

_______ _______ _______

Total finance expense 56 21 71

6 Earnings per share

The following sets out the earnings and share data used in the

basic and diluted earnings per share computations:

Denominator for earnings per share ("EPS") calculations

6 months 6 months Year to

to to 31 March

30 September 30 September 2023

2023 2022

Weighted number of ordinary shares

in issue 453,890,405 453,890,405 453,890,405

Effect of dilutive potential

ordinary shares - Share Options 2,275,340 522,444 2,059,553

_______ _______ _______

456,165,745 454,412,849 455,949,958

The Group has two categories of potentially dilutive ordinary

share. The first is share options granted to employees where the

exercise price (plus the remaining expected charge to profit under

IFRS 2 per option) is less than the average price of the Company's

ordinary shares during the period. The weighted average number of

shares for the calculation of diluted earnings per share is

computed using the treasury share method.

The second relates to the Convertible Bond. The Group issued a

Convertible Bond for GBP1m in July 2022 to new and existing

investors in the Company, including Board directors. The Loan Notes

have a term of five years, are senior in ranking, unsecured and

convertible at investors' option into ordinary shares in the

capital of the Company ("Ordinary Shares") at a price of 3.25 pence

per Ordinary Share, representing a 30% premium to the mid-price of

the Company's share price at close of business on 26 July 2022. The

Loan Notes carry a coupon of 9% per annum, payable quarterly in

arrears. Based on the issue size of GBP1,000,000, the Loan Notes

would, if converted, represent approximately 30,769,230 Ordinary

Shares, amounting to 6.8% of the current issued share capital of

the Company. However, as the average Byotrol share price since the

issue of the Convertible Bond has been below the 3.25p conversion

price, these are currently classed as non-dilutive and do not

feature in the Denominator calculation above.

Numerator for EPS calculations

6 months to 30 September 2023 Total

GBP'000

Profit/(loss) attributable to

ordinary equity holders of the

Company (numerator for basic

EPS calculation) (742)

Adjusting items:

- share-based payments 57

- amortisation of acquisition-related

intangibles 114

- deferred tax credit arising

from acquisition-related intangibles (33)

_______

Adjusted earnings attributable

to owners of the Parent

(numerator for adjusted EPS

calculation) (604)

6 months to 30 September 2022 Total

GBP'000

Profit/(loss) attributable to

ordinary equity holders of the

Company (numerator for basic

earnings per share calculation) (579)

Adjusting items:

- share-based payments -

- amortisation of acquisition-related

intangibles 169

- deferred tax credit arising

from acquisition-related intangibles (24)

_______

Adjusted earnings attributable

to owners of the Parent (434)

Year to 31 March 2022 Total

GBP'000

Profit/(loss) attributable to

ordinary equity holders of the

Company (numerator for basic

earnings per share calculation) (1,692)

Adjusting items:

- share-based payments 33

- exceptional items 258

- amortisation of acquisition-related

intangibles 300

- deferred tax credit arising

from acquisition-related intangibles (85)

_______

Adjusted earnings attributable

to owners of the Parent (1,186)

The criteria for inclusion of adjusting items in the calculation

of adjusted EPS are the same as those relating to the calculation

of adjusted EBITDA as set out in Note 3. Amortisation of

acquisition-related intangibles (and the associated tax credit)

relates to the amortisation of intangible assets in respect of

customer relationships and brands which are recognised on a

business combination and are non-cash in nature.

EPS - reported

6 months to 6 months to Year to

30 September 2023 30 September 2022 31 March

2023

GBP'000 GBP'000 GBP'000

Reported earnings per share attributable to shareholders

- basic (0.16)p (0.13)p (0.37)p

- diluted (0.16)p (0.13)p (0.37)p

EPS - adjusted

6 months to 6 months to Year to

30 September 2023 30 September 2022 31 March

2023

GBP'000 GBP'000 GBP'000

Adjusted earnings per share attributable to shareholders

- basic (0.13)p (0.10)p (0.26)p

- diluted (0.13)p (0.10)p (0.26)p

7 Intangible assets

Intangible assets comprise capitalised development costs,

acquired software, customer relationships and goodwill.

Goodwill Other Total

Intangible

Assets

GBP'000 GBP'000 GBP'000

Cost

At 1 April 2023 502 5,335 5,837

Additions - 179 179

(Disposals) - (8) (8)

_____ _______ _______

At 30 September

2023 502 5,506 6,008

Amortisation

At 1 April 2023 - (2,619) (2,619)

Charge for the

period - (190) (190)

Eliminated on

disposal - 2 2

_______ _______ _______

At 30 September

2023 - (2,807) (2,807)

Net carrying

amount

At 30 September

2023 502 2,699 3,201

At 1 April 2023 502 2,716 3,218

Other Intangible Assets comprise:

Customer Brands Development Patents Total

Relationships Costs and licenses

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 April 2023 1,861 567 2,244 663 5,335

Additions - - 154 25 179

(Disposals) - - - (8) (8)

_______ _______ _______ _______ _______

At 30 September

2023 1,861 567 2,398 680 5,506

Amortisation

At 1 April 2023 (857) (337) (933) (492) (2,619)

Charge for the

period (93) (21) (64) (12) (190)

Eliminated on

disposal - - - 2 2

_______ _______ _______ _______ _______

At 30 September

2023 (950) (358) (997) (502) (2,807)

Net carrying

amount

At 30 September

2023 911 209 1,401 178 2,699

At 1 April 2023 1,004 230 1,311 171 2,716

8 Right-of-use assets

Right-of-use assets comprise leases over office buildings and

vehicles.

Vehicles Total

GBP'000 GBP'000

Cost

At 1 April 2023 26 26

Additions in the period - -

(Disposals) in the period - -

_______ _______

At 30 September 2023 26 26

Depreciation

At 1 April 2023 (13) (13)

Charge for the period (4) (4)

Eliminated on disposal - -

_______ _______

At 30 September 2023 (17) (17)

Net carrying amount

At 30 September 2023 9 9

At 1 April 2023 13 13

9 Lease liabilities

Lease liabilities comprise liabilities arising from the

committed and expected payments on leases over office buildings and

vehicles.

Amounts due in more than one year Vehicles Total

GBP'000 GBP'000

At 1 April 2023 4 4

Transfers from long to short term

liabilities (4) (4)

At 30 September 2023 _______ _______

- -

Amounts due in less than one year Vehicles Total

GBP'000 GBP'000

At 1 April 2023 8 8

Repayments of principal (4) (4)

Transfers from long to short term

liabilities 4 4

_______ _______

At 30 September 2023 8 8

10 Post balance sheet events

There have been no events subsequent to the reporting date which

would have a material impact on these interim financial

results.

[END]

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZMGZVVGGFZM

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

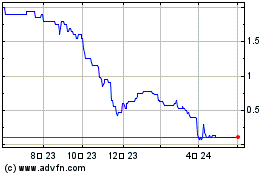

Byotrol (LSE:BYOT)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

Byotrol (LSE:BYOT)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024