0001590496

false

0001590496

2023-07-31

2023-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 2, 2023, (July 31, 2023)

| AERKOMM INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

000-55925 |

|

46-3424568 |

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

| 44043 Fremont Blvd., Fremont,

CA 94538 |

| (Address of principal executive offices) |

| (877) 742-3094 |

| (Registrant’s telephone number, including area code) |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act: None

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| |

|

|

|

|

Item 1.01 Entry into a Material Definitive Agreement.

On July 31, 2023, Aerkomm

Inc., a publicly traded Nevada Corporation (the “Company”) entered into a share purchase agreement (the “Share

Purchase Agreement”) with Mesh Technology Taiwan Limited (“Mesh Tech”) and Mixnet Technology Limited (“Mixnet”).

Mesh Tech is a Taiwan based company that creates products to accelerate data transfer and distribution across different geographical locations

through its hybrid CDN technology.

Pursuant to the terms

of the Share Purchase Agreement, the Company will acquire all of the outstanding capital stock of Mesh Tech and Mixnet. The shares of

Mesh Tech will be held through Mixnet, a Seychelles organized company. As consideration for this acquisition the Company will issue to

the shareholders of Mesh Tech (the “Sellers”) 7,000,448 shares of its common stock (the “Consideration Shares”)

valued at approximately $2.36 per share for an aggregate valuation of $16,500,000. The Company has agreed to register the Consideration

Shares for resale under a Form S-1 registration statement (the “Resale Registration Statement”) and the Sellers have

given the Chief Executive Officer of the Company an irrevocable proxy to vote the Consideration Shares on behalf of the Sellers until

the Consideration Shares are sold through the Resale Registration Statement.

The preceding

summary does not purport to be complete and is qualified in its entirety by reference to the Share Purchase Agreement, a copy of which

is attached as exhibit 10.1 hereto and incorporated by reference herein.

Item 3.02 Unregistered Sales of Equity Securities.

Reference is made to the discussion in Item 1.01

above which is incorporated herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 2, 2023 |

AERKOMM INC. |

| |

|

| |

/s/ Louis Giordimaina |

| |

Name: |

Louis Giordimaina |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.1

Dated July 31, 2023

AERKOMM INC.

AND

MESH TECHNOLOGY TAIWAN LIMITED

AND

MIXNET TECHNOLOGY LIMITED

SHARE PURCHASE AGREEMENT

Relating to the sale and purchase of all of the

issued and outstanding share capital of each of Mesh Technology Taiwan Limited and Mixnet Technology Limited

Table of Contents

This Share Purchase Agreement (this “Agreement”)

is entered into on July 31, 2023

By and Among:

| (1) | Mesh Technology Taiwan Limited, a company incorporated in Tainan of Republic of China (the “ROC”

or “Taiwan”), whose registered address is at 3F., No. 520, Yunong Rd., East Dist., Tainan City 701, Taiwan (R.O.C.) (the “Seller”),

and the initial shareholders listed on Exhibit A attached hereto (each, an “Initial Shareholder” and collectively

the “Initial Shareholders”); |

| (2) | Mixnet Technology Limited, a company incorporated in the Republic of Seychelles, whose registered

address is at Vistra Corporate Services Centre, Suite 23, 1st Floor, Eden Plaza, Eden Island, Mahe, Republic of Seychelles,

(the “Company”, together with Mesh Technology Taiwan Limited, the “Target Companies”); |

| (3) | The shareholders of the capital stock of the Company listed on Exhibit A (the “Company

Shareholders”); and |

| (4) | Aerkomm Incorporation, a company incorporated in the State of Nevada in the United States, whose

registered address is at 44043 Fremont, Blvd Fremont, CA 94538, US (the “Purchaser,” together with Target Companies,

the Initial Shareholders and the other Company Shareholders, the “Parties”) |

Whereas:

| (A) | The Company has been formed to hold and own, and currently does own, all of the outstanding share capital

of the Seller. |

| (B) | The Company, the Seller and the Initial Shareholders have agreed to sell, and the Purchaser has agreed

to purchase (the “Transaction”), all of the outstanding share capital of the Company (the “Sale Shares”)

on the terms and subject to the conditions of this Agreement. |

| (C) | The Purchaser and the Seller desire to appoint an Escrow Agent to act in accordance with and subject to

the terms of this Agreement. |

| (D) | The Initial Shareholders of the Seller have agreed to proceed with the sale of the Sale Shares, as set

forth opposite their respective names in Exhibit A attached hereto, and to deposit into escrow the Sale Shares (the “Escrow Shares”)

as hereinafter provided. |

| (E) | The Target Companies and Initial Shareholders desire that the Escrow Agent accept the Escrow Shares, in

escrow, to be held and disbursed to the Purchaser as hereinafter provided. |

| (F) | The Seller, the Company and the Purchaser have agreed to the execution of this Agreement as soon as practicable

and to effectuate the Closing of the Transaction on or prior to August 9, 2023, or as soon as practicable thereafter. |

It is agreed as follow:

| 1. | Definitions and interpretation |

In this Agreement, unless the context

otherwise requires or otherwise specified, the provisions of this Clause 1 apply.

“Business Day” means any

day (other than a Saturday or Sunday or statutory holidays in Taiwan) on which banks are generally open for business in Taiwan.

“Closing” means the consummation

of the transfer of the Sale Shares.

“Closing Date” means the

date of Closing.

“Encumbrance” means any

mortgage, charge, pledge, hypothec, security interest, assignment, lien (statutory or otherwise), easement, title retention agreement

or arrangement, conditional sale, deemed or statutory trust, restrictive covenant or other encumbrance of any nature which, in substance,

secures payment or performance of an obligation.

“FIA” shall mean the foreign

investment application to be submitted by the Purchaser to the Investment Commission of the Ministry of Economic Affairs for the purchase

of the Sale Shares from the Company as provided herein.

“Law(s)” means any constitutional

provision, statute or other law, rule, regulation, official policy or interpretation of any governmental authority and any injunction,

judgment, order, ruling, assessment or writ issued by any governmental authority.

“Material Adverse Effect”

means any (a) event, occurrence, fact, condition, change or development that has had or reasonably would be expected to have a material

adverse effect on the business, operations, value, financial, operating results, prospects, or other condition, assets or liabilities

of the Company or the Seller, either individually or taken as a whole; (b) material impairment of the ability of the Company or the Seller

to perform their respective obligations hereunder or under any other ancillary agreements, as applicable; or (c) change, event or effect

that is or would reasonably be expected to have a material and adverse effect on the legality, validity or enforceability of this Agreement

or any ancillary agreements.

| 1.2 | Clauses, Schedules, etc. |

References

to this Agreement include any Schedules to the Agreement and references to Clauses and Schedules are to Clauses of and Schedules to this

Agreement.

In this Agreement, the singular includes

the plural and vice versa. Words denoting any gender include the other gender and words denoting natural persons include any other persons.

References to a person includes any

company, corporation, firm, joint venture, partnership or unincorporated association (whether or not having separate legal personality)

and to a company include any company, corporation or anybody corporate, wherever incorporated.

Any reference to books, records or

other information means books, records or other information in any form including paper, electronically-stored data, magnetic media, film

and microfilm.

References to times of the day are

to Taiwan time.

References

to a contract or document are to that contract or document as amended, supplemented, modified, restated or novated from time to time.

The words “including,”

“include” and words of similar effect are made on a non-exhaustive and without limitation basis.

References to any document in the “agreed

form” means that document in a form agreed to by the Parties in writing.

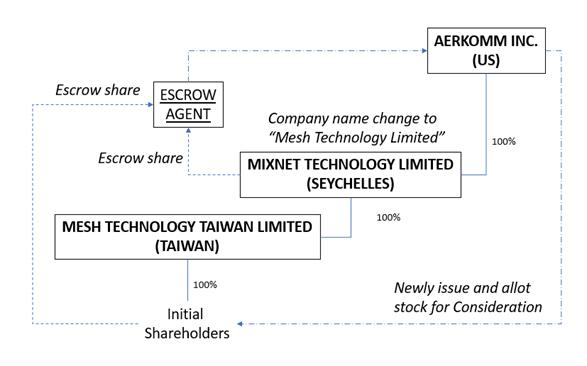

| 2.1 | The Target Companies will sell, and the Purchaser will purchase, the Sale Shares, free and clear of any

liens or other Encumbrances, and in each case on the terms and subject to the conditions set forth in this Agreement. (A detailed Sale

and Purchase Flow Chart is attached hereto as Appendix A.) |

| 2.2 | Appointment of the Escrow Agent. The Seller and the Initial Shareholders hereby hereby agree to appoint

an independent escrow agent (the “Escrow Agent”) to act in accordance with and subject to the terms of this Agreement. The Parties

and the Escrow Agent shall enter into a separate escrow agreement (the “Share Escrow Agreement”) pursuant to which

the Escrow Agent will accept such appointment and agree to act in accordance with and subject to the terms of this Agreement. |

| 2.3 | Deposit of Escrow Shares. On or prior to the date hereof, each of the Initial Shareholders shall have

delivered to the Escrow Agent certificates representing such Initial Shareholder’s respective Escrow Shares, together with applicable

stock powers, to be held and disbursed subject to the terms and conditions of this Agreement. Each of the Initial Shareholders acknowledges

that the certificate(s) representing such Initial Shareholder’s Escrow Shares are legended to reflect the deposit of such Escrow

Shares under this Agreement. |

| 2.4 | Re-organisation of The Target Companies. The Initial Shareholders have agreed to transfer 100% of the

issued and outstanding shares of capital of the Seller to the Company as a completed structure for the Purchaser to acquire the Target

Companies as a whole. Prior to the Closing of the Transaction, the Company will change its company name to Mesh Technology Limited as

is in accordance with the applicable special Taiwan Law requirement. |

| 2.5 | The Target Companies will sell the Sale Shares free from and clear of Encumbrances and together with all

rights and advantages attaching to the Sale Shares at Closing (including the right to receive all dividends or distributions declared,

made or paid on or after Closing). |

| 2.6 | The Seller will procure that on or prior to Closing any and all rights of pre-emption, rights of first

refusal or other third party right with respect to the Sale Shares are waived irrevocably by the persons entitled thereto. |

The aggregate consideration for the

purchase of the Escrow Shares under this Agreement (the “Consideration Amount”) shall be the US$16,500,000.00. The

Parties have agreed that the Consideration Amount shall be paid in the form of 7,000,448 newly issued shares of the Purchaser’s

restricted common stock (the “Consideration Shares”) to be distributed to the Initial Shareholders. The Parties have

agreed that number of Consideration Shares shall be determined by dividing the Consideration Amount by the Euro closing price of the Common

Stock on the Euronext Paris Market on June 30, 2023, converted into the US$ equivalent based on a Euros to US Dollars exchange rate as

of June 30, 2023, as quoted on the Nasdaq Stock Market website (See Appendix B hereto for reference to this Consideration Shares calculation.)

| 3.2 | Reduction of Consideration |

If any payment is made by the Seller

to the Purchaser in respect of any claims for any breach of this Agreement, the payment will (so far as possible) be deemed to be a reduction

of the Consideration paid by the Purchaser.

The Seller shall prepare consolidated

Completion Accounts for the period from January 1, 2023 to the month-end immediately preceding the date of Closing (the “Completion

Accounts Reference Date”), to be audited, and shall deliver a copy of the unqualified audited Completion Accounts (the “Audited

Completion Accounts”) to the Purchaser within 70 days after Closing.

Closing may only take place if the

following conditions precedent have been satisfied or waived in accordance with the terms of this Agreement:

| 4.1.1 | Initial Shareholders shall have deposited the Escrow Shares with the Escrow Agent, and shall have signed

all company documents, but not limited to, the instrument of share transfer and company resolution subject to such terms. |

| 4.1.2 | The Patries and the Escrow Agent shall have fully executed a Share Escrow Agreement. |

| 4.1.3 | All regulatory approvals which are required for Closing to occur having been obtained either: |

(i) without any condition; or

(ii) if conditions have been imposed,

on terms which will not materially adversely affect the Purchaser, the Purchaser’s controlling shareholders and their respective

Subsidiaries and associates (the “Purchaser Group”), or the Target Companies and their respective Subsidiaries (which

would result in the effect set out in (ii) above) or criminal liability having been imposed or dictated on any member of the Purchaser

Group or the Target Companies Group or their respective officers or employees by, relevant regulators and governmental authorities in

Taiwan, including: (x) the clearance of the combination filing, if applicable, from the Taiwan Fair Trade Commission; or (y) any approval,

if applicable, arising from a change of control of any of the Target Companies;

| 4.1.4 | No new laws or amendments to any existing laws shall have been promulgated or issued in Taiwan, and no

draft new law or draft amendment to any existing laws shall have been submitted by the Executive Yuan to the Legislative Yuan for legislation

which would render the transactions contemplated under this Agreement not permissible or illegal; |

| 4.1.5 | No new laws or amendment to any existing laws which would render the sale of the Sale Shares not permissible

or illegal, and no restraining governmental order or permanent injunction or other governmental order preventing any members of the Target

Companies from carrying out their businesses in Taiwan in the ordinary course shall have been enacted or issued; |

| 4.1.6 | No material breach of any of the Seller’s warranties and undertakings set out under Clauses 6.1.2

and 6.1.3 shall have occurred; and |

| 4.1.7 | The sale and purchase of the Sale Shares shall take place remotely via the exchange of documents and signatures

within seven (7) Business Days following the satisfaction or waiver of all the closing conditions set forth herein, or at such other time

and place as the Targeted Companies and the Purchaser mutually agree upon in writing. |

This Agreement shall automatically

terminate if the conditions set out in Clause 4.1 are not satisfied (or, where applicable, are waived) on or before July 31, 2024.

| 5.1 | Following the execution of Share Escrow Agreement and on or prior to the Closing Date, the Purchaser shall

have issued and delivered the Consideration Shares, the Seller shall have delivered the Sale Shares, and each of the parties shall have

delivered any required signed documents including, but not limited to, instruments of share transfer and company resolutions subject to

such terms of this Agreement. |

| 5.2 | At the Closing, the Escrow Agent shall deliver (i) to the Purchaser, the Sale Shares and all required

signed Target Company documents, and (ii) to the Seller, the Consideration Shares. |

| 6. | Conditions to the Purchaser’s Obligations at the Closing |

The obligation of the Purchaser to purchase

the Sale Shares at the Closing, unless otherwise waived by the Purchaser, is subject to the fulfilment, to the satisfaction of the Purchaser

on or prior to the Closing Date, of the following conditions, except for those with a specified date, on or prior to such specified date:

| 6.1 | With respect to the Closing, the representations and warranties made by the Targeted Companies in Section

8 shall be true and correct when made, and shall be true and correct as of the Closing Date with the same force and effect as if they

had been made on and as of the Closing Date or any such date specified in the representations and warranties, subject to changes contemplated

by this Agreement. |

| 6.2 | The Purchaser shall have obtained the FIA approval and all other government approvals, if any, as may

be required in connection with the Transaction. |

| 6.3 | The Purchaser shall have completed a due diligence review on the business, legal (including any compliance

matters related to anti-corruption and anti-bribery), financial and tax aspects of the Company and the results are satisfactory to the

Purchaser as of the Closing Date. |

| 6.4 | No Material Adverse Effect. Since the date of this Agreement and until the Closing Date, there shall have

been no event, change, development, condition or circumstance constituting or giving rise to a Material Adverse Effect. |

| 7. | Conditions to the Targeted Companies’ Obligations at the Closing |

The obligation of the Targeted Companies

to issue and sell the Sale Shares at the Closing, unless otherwise waived by the Targeted Companies, is subject to the fulfilment, to

the satisfaction of the Targeted Companies on or prior to the Closing Date, of the following conditions, except for those with a specified

date, on or prior to such specified date:

| 7.1 | With respect to the Closing, the representations and warranties made by the Purchaser in Section 10 shall

be true and correct when made, and shall be true and correct as of the Closing Date with the same force and effect as if they had been

made on and as of the Closing Date or any such date specified in the representations and warranties, subject to changes contemplated by

this Agreement. |

| 8. | Representations and Warranties of the Targeted Companies |

The Targeted Companies hereby represent

and warrant to the Purchaser that the following statements are true, correct, complete and not misleading as of the date of this Agreement

and will continue to be true, correct, complete and not misleading as of the Closing Date.

| 8.1 | Each of the Seller and the Company is a corporation duly organized, validly existing under the laws of

Taiwan and Republic of Seychelles, respectively, and has all requisite corporate power and authority to carry on its business as presently

conducted and as presently proposed to be conducted. The Targeted Companies are duly qualified to transact business and are in good standing

in applicable jurisdictions. |

| 8.2 | Each of the Targeted Companies has full legal capacity and all requisite power and authority to execute

and deliver this Agreement, and to carry out the provisions of this Agreement and is not under any prohibition or restriction, contractual,

statutory or otherwise against doing so. |

| 8.3 | (i) There are presently no existing circumstances that are likely to result in any violation of or liability

under any applicable Laws or other requirements relating to the assets, liabilities, results of operation, condition, financial or otherwise,

or prospects of the Targeted Companies; and (ii) the Targeted Companies have not received any written or oral notification of any asserted

present or past failure by either of the Targeted Companies to comply with such laws, rules or regulations, or contracts or agreements. |

| 8.4 | There is no pending action, suit, proceeding, arbitration, mediation, complaint, claim, charge or investigation

before any court, arbitrator, mediator or governmental body or, to the Targeted Companies’ knowledge, currently threatened in writing

(a) against either of the Targeted Companies or (b) against any consultant, officer, director or employees of either of the Targeted Companies

arising out of his or her consulting, employment or board relationship with either of the Targeted Companies, that could cause a Material

Adverse Effect to either of the the Targeted Companies, or could otherwise materially impact the validity of this Agreement and the Transaction. |

| 8.5 | Intellectual Property. |

| 8.5.1 | The Seller has not granted to any third party any exclusive license to any of the Seller’s intellectual

property (“Seller Intellectual Property”). |

| 8.5.2 | To the Knowledge of the Seller, the operation of the business of the Seller as it is presently conducted

does not infringe, misappropriate or violate the intellectual property of any third party and the Seller Intellectual Property constitutes

all of the intellectual property necessary for the operation of the Seller’s business as presently conducted. The Seller has not

received any written communication alleging that the Seller has violated any intellectual property rights of a third party. |

| 8.5.3 | The Seller has taken reasonable steps to protect and preserve the Seller Intellectual Property and the

confidentiality of all trade secrets and other confidential or non-public information of the Seller. |

| 8.6 | Litigation. There are no claims, actions, suits, arbitrations, proceedings or investigations pending against

the Seller (nor has the Seller received written notice of any threat thereof) before any court or governmental agency. |

| 8.7.1 | Each of the Targeted Companies has delivered to the Purchaser its latest audited financial statements

(collectively, the “Financial Statements”). Such Financial Statements: (i) are in accordance with the books and records

of the Targeted Companies; and (ii) are true, correct and complete and present fairly the financial condition of each of the Targeted

Companies at the date or dates therein indicated and the results of operations for the period or periods therein specified. |

| 8.7.2 | Except as set forth in the Financial Statements, neither of the Targeted Companies has any material liabilities

or obligations, contingent or otherwise, other than (i) liabilities incurred in the ordinary course of business, and (ii) obligations

under contracts and commitments incurred in the ordinary course of business. |

| 9. | Representations of the Company Shareholders; No Other Representations or Warranties |

| 9.1 | Each of the Company Shareholders has full capacity and authority to enter into this Agreement and any

other agreement or document entered into pursuant to this Agreement and to perform the obligations to which he is bound under this Agreement. |

| 9.2 | This Agreement, upon execution by each of the Company Shareholders, will constitute for each of the Company

Shareholders a valid and binding agreement, enforceable against each of the Company Shareholders in accordance with its terms. |

| 9.3 | No governmental authorization is required to be obtained by the Company Shareholders or the Target Companies

prior to the Closing in connection with the signing of the Agreement or the consummation of the Transaction contemplated by the Agreement. |

| 9.4 | The execution, delivery and performance by each of the Company Shareholders of this Agreement will not: |

| - | result in a breach of, conflict with or constitute a default under, any agreement or arrangement or applicable

Law, or any term under any agreement or deed to which that Company Shareholder is a party or by which he is bound; or |

| - | result in a breach of any Law or order, judgement, writ, injunction or decree of any court, governmental

authority or regulatory body to which that Company Shareholder is a party or by which he is bound. |

| 9.5 | The Sale Shares are legally and beneficially owned only by each of the Company Shareholders in accordance

with the table provided in Exhibit A to this Agreement and are free from all liens or other Encumbrances and no person has claimed to

be entitled to a lien in relation to any of the Sale Shares. The Sale Shares represent 100% of the Company’s share capital and voting

rights. |

| 9.6 | Except as otherwise expressly set forth in Section 8 or in this Section 9 of this Agreement, the Targeted

Companies expressly disclaim any representations or warranties of any kind or nature, statutory, express or implied, including any representation

or warranty as to the accuracy or completeness of any information regarding the Targeted Companies made available to the Purchaser or

its representatives, including its condition (financial or otherwise) or prospects, business, or operation, and any information, documents

or material made available to the Purchaser in the data room, management presentations or in any other form in expectation as the transaction

contemplated hereby or as to the condition, value or quality of the business of the Targeted Companies. |

| 10. | Representations and Warranties of the Purchaser |

The Purchaser hereby represents and

warrants to the Targeted Companies that the following statements are true, correct, complete and not misleading as of the date of this

Agreement and will continue to be true, correct, complete and not misleading as of the Closing Date.

| 10.1 | The Purchaser is a corporation incorporated and validly existing under the laws of the State of Nevada,

and has all requisite corporate power and authority to carry on its business as now conducted and to invest in the Targeted Companies

by purchasing the Sale Shares contemplated hereunder. |

| 10.2 | This Agreement will constitute a valid and legally binding obligation of the Purchaser, subject to, as

to enforcement of remedies, applicable bankruptcy, insolvency, moratorium, reorganization and similar laws affecting creditors’ rights

generally. |

| 11. | Covenants, Undertakings and other Agreements |

| 11.1 | Subject to the terms of this Agreement, each Party shall use best endeavours to take, or cause to be taken,

all actions and do all things necessary, proper or advisable in order to consummate and make effective the transaction contemplated by

this Agreement. |

| 11.2 | During the production, manufacturing and sales process, the Targeted Companies shall comply with all applicable

laws, and shall strike a proper balance between or among the corporate governance, environmental protection, human rights, community engagement,

employees’ welfare, shareholders’ rights, relationship with the upstream and downstream manufacturers, and relationship with the customers.

The Targeted Companies undertakes to, by taking the interest of all stakeholders into account, year by year promote the efficacy of the

corporate governance, sustainable development and environment protection. |

| 11.3 | The representations and warranties contained in Section 8 hereof shall survive the Closing. |

| 11.4 | Resale Registration. No later than thirty (30) days after the filing by the Purchaser

with the Securities and Exchange Commission (the “SEC”) of the Purchaser’s quarterly report on Form 10-Q for

the fiscal quarter ended June 30, 2023 (the “Filing Deadline”), the Purchaser shall prepare and file with the SEC a

registration statement on Form S-1(the “Registration Statement”) covering the resale of all of the Consideration Shares.

The Purchaser will use it best efforts to cause such Registration Statement to be declared effective by the SEC under the Securities Act

of 1933, as amended (the “Securities Act”), as promptly as possible and within 75 days after the Filing Deadline date. |

| 11.5 | Irrevocable Proxy. The Seller, the Company and the Initial

Shareholders, or their designees or assigns (the “Selling Parties”), hereby irrevocably and unconditionally grant a

proxy to the Purchaser appointing the Chief Executive Officer of the Purchaser as such Selling Parties’ attorney-in-fact and proxy,

with full power of substitution, for and in such Selling Parties’ names, to vote, express, consent or dissent, or otherwise to utilize

such voting power as the Purchaser, the Purchaser’s Chief Executive Officer or its proxy or substitute shall, in the Purchaser’s

sole discretion, deem proper with respect to the Consideration Shares. The proxy granted by the Selling Parties pursuant to this Section

11.5 (i) is irrevocable and is granted in consideration of the Purchaser’s entering into this Agreement and issuing its voting common

stock to the Selling Parties and (ii) shall remain in place with respect to any of the Consideration Shares until such time as, except

as set forth in the following sentence, any such Consideration Shares are sold pursuant to the Registration Statement. The Selling Parties

shall ensure that any transferee of Consideration Shares either purchased privately from any of the Selling Parties or through the Registration

Statement where such public sale constitutes ten percent (10%) or more of the Consideration Shares shall grant to the Purchaser a proxy

to the same effect as that contained herein. The Selling Parties shall perform such further acts and execute such further documents as

may be required to vest in the Purchaser the sole power to vote the Consideration Shares during the term of the proxy granted herein |

| 12.1 | Buyer shall pay all the expenses incident to this Agreement and the transactions contemplated hereby and

thereby. |

| 13.1 | This Agreement will be governed by and construed under the laws of Taiwan without giving effect to any

choice of law or conflict of law provision or rule thereof. |

| 13.2 | Any dispute, controversy, difference or claim arising out of, relating to or in connection with this Agreement,

or the breach, termination or invalidity thereof, shall be finally settled by the Taiwan Taipei District Court as the court of the first

instance. |

| 13.3 | Any term of this Agreement may be amended only with the written consent of the Parties. |

| 13.4 | This Agreement may be executed in any number of counterparts, each of which shall be deemed an original,

but all of which together shall constitute one and the same instrument. |

| 13.5 | Restrictive Legend. The Selling Parties understand that the certificates representing the Consideration

Shares, until such time as they have been registered under the Securities Act, shall bear a restrictive legend in substantially the following

form (and a stop-transfer order may be placed against transfer of such certificates or other instruments): |

THE SHARES REPRESENTED

BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 AS AMENDED. THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED

OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO THE SECURITIES UNDER SAID ACT OR AN OPINION OF COUNSEL SATISFACTORY

TO THE CORPORATION THAT SUCH REGISTRATION IS NOT REQUIRED.

THE SHARES REPRESENTED

BY THIS CERTIFICATE ARE SUBJECT TO A RIGHT OF PROXY IN FAVOR OF THE CORPORATION AND/OR ITS ASSIGNEE(S) AS PROVIDED IN THAT CERTAIN SHARE

PURCHASE AGREEMENT BY AND AMONG THE CORPORATION AND THE OTHER PARTIES THERETO.

| 13.6 | Indemnification by Initial Shareholders.

The Initial Shareholders shall indemnify and hold the Purchaser harmless from and against any claims, demands, actions, causes of action,

judgments, damages, losses (which shall include any diminution in value), liabilities, costs or expenses (including interest, penalties

and reasonable attorneys, and experts, fees and disbursements), which may be made against the Purchaser or which it may suffer or incur

as a result of, arising out of, or relating to any violation, contravention or breach of any covenant, agreement, representation or obligation

of any of the Selling parties under or pursuant to this Agreement. |

IN WITNESS WHEREOF, the Parties have executed

this Agreement as of the date first written above.

| Seller: |

Mesh Technology Taiwan Limited |

| |

|

| |

By: |

|

| |

Name: |

Kevin Wong |

| |

Title: |

Chief Executive Officer |

| |

|

| Company: |

Mixnet Technology Limited |

| |

|

| |

By: |

|

| |

Name: |

Kevin Wong |

| |

Title: |

Director |

| |

|

| Purchaser: |

Aerkomm Inc. |

| |

|

| |

By: |

|

| |

Name: |

Louis Giordimaina |

| |

Title: |

Chief Executive Officer |

| |

|

|

| Initial Shareholders |

|

| |

|

| |

By: |

|

| |

Name: |

Ka Kin Kevin Wong |

| |

|

| |

By: |

|

| |

Name: |

Noelia Wang |

| |

|

| |

By: |

|

| |

Name: |

L.Chen |

Exhibit A

Shareholders Table of Mesh Technology Taiwan Limited

May 16th of 112th year of

Republic of China

Serial

number |

Shareholder

name |

Identity

number |

Address |

Number of

shares |

Paid up capital

(TWD) |

Remarks |

| 1 |

Ka Kin Kevin Wong |

D180003152 |

7F.-1, No. 28, Ln. 158, Sec. 2, Dongmen Rd., East Dist., Tainan City 701037, Taiwan (R.O.C.) |

2,144,887 |

2,068,866 |

|

| 2 |

Noelia Wang |

R224110813 |

7F.-1, No. 28, Ln. 158, Sec. 2, Dongmen Rd., East Dist., Tainan City 701037, Taiwan (R.O.C.) |

100 |

1,000 |

|

| 3 |

L.Chen |

J221100293 |

4F., No. 6, Ln. 122, Sec. 4, Ren’ai Rd., Da’an Dist., Taipei City 106064, Taiwan (R.O.C.) |

2,060,773 |

1,987,734 |

|

| |

|

|

Unissued share capital |

5,794,240 |

0 |

|

| |

|

|

Issued share capital |

4,205,760 |

4,057,600 |

|

| |

|

|

Total share capital |

10,000,000 |

0 |

|

Shareholders Table of Mixnet Technology Limited

| Types of shares issued |

Issued to (Applicant(s)) |

Number of shares issued |

Total price of paid |

| Ordinary share(s) |

WONG KA KIN KEVIN |

-1000- |

US$1,0000 |

Appendix A

Sale and Purchase Flow Chart

Appendix B

Calculation of newly issued shares from Purchase.

Close price of common stock on the Euronext market

on 30/6/2023.

https://live.euronext.com/en/product/equities/US00774B2088-XPAR#historical-price

EUR2.16

The last available Euros to Dollars exchange rate

quote on Nasdaq on 30/6/2023.

https://www.nasdaq.com/market-activity/currencies/eurusd/historical

1.0912

Number of newly issued shares:

Consideration / Closing share price of AKOM in

Euronext on 30/6/2023 in Dollars

USD16,500,000 / (EUR2.16 x 1.0912) = 7,000,448

shares

15

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Aerkomm (PK) (USOTC:AKOM)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

Aerkomm (PK) (USOTC:AKOM)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024