Company’s Highly Engaged and Qualified

Directors are Best Positioned to Oversee the Company’s Path

Forward

Thomas Sullivan is Pushing Personal Agenda With

His Board Nominees Given His Ongoing Interest in Buying Company

Urges Shareholders to Vote the Universal

WHITE Proxy Card Today “FOR” ONLY LL

Flooring’s Three Highly Qualified Director Nominees

Visit www.VoteLLFlooring.com for More

Information

LL Flooring Holdings, Inc. (“LL Flooring” or “Company”) (NYSE:

LL) today filed an investor presentation with the U.S. Securities

and Exchange Commission in connection with its 2024 Annual Meeting

of Stockholders on July 10, 2024. The presentation is available at

https://www.votellflooring.com/company-resources.

Highlights of the presentation include:

- The LL Flooring Board (the “Board”) and leadership team have

been taking and continue to take decisive actions to position the

Company for success.

- The Board worked to address product and sourcing issues, taking

steps to repair damage to the Company’s credibility and reputation

that occurred while Thomas Sullivan served as Executive Chair and

Interim CEO and had direct oversight over sourcing

initiatives.

- The Board oversaw the recruitment of a refreshed senior

leadership team to drive transformation and help develop a new

strategy, including recent setting of five strategic priorities to

position the Company to capture market opportunity and drive growth

and value creation.

- The Board and leadership team are working to navigate recent

macroeconomic challenges that have followed a period of consistent,

solid financial performance.

- The Board has been conducting a thorough review of strategic

alternatives to maximize shareholder value, including evaluating

the potential of a sale of the Company.

- Since August 2023, with the assistance of financial and legal

advisors, the Board has been conducting a typical process for the

sale of a public company.

- The Board has approached this process with an open mind and

focus on fairly measuring offers against the Company’s standalone

plan.

- The Board is committing the necessary time and care to

constructively evaluate all alternatives in a complex environment,

and has engaged with potential bidders on a level playing field

since the first receipt of an unsolicited non-binding Indication of

Interest in January 2022, including with Mr. Sullivan’s firm F9

Investments.

- LL Flooring is well-positioned to capitalize on improving

market conditions and continue building on the positive change

underway.

- Under the Board’s oversight, the leadership team is positioning

LL Flooring to capitalize on the anticipated industry tailwinds and

larger market opportunity by expanding further into the

soft-surface market and pursuing Pro customers. This includes

optimizing LL Flooring’s existing retail footprint, relocating

underperforming stores and closing unprofitable stores to drive

profitability.

- The Company has been implementing a strategy to increase brand

awareness and deliver a more consistent end-to-end customer

experience across the omnichannel network, which is gaining

traction and driving profitability.

- The LL Flooring Board has highly qualified and independent

directors; there is no need for further change at this time.

- The LL Flooring Board comprises nine highly qualified and

engaged directors, eight of whom are independent, who have the

right mix of skills and experience to effectively oversee the

strategic direction of LL Flooring.

- The LL Flooring directors that are up for re-election have made

significant contributions to the Company, collectively serving on

all four of the Board's committees and overseeing the development

of the Company's five strategic priorities as well as execution of

the strategic alternatives process.

- Mr. Sullivan and his nominees bring no incremental value to

the Board.

- Electing Mr. Sullivan and his two other nominees would remove

superior talent and critical skills from the LL Flooring Board, and

risk derailing the progress being made in executing the Company’s

strategy and completing the strategic alternatives process.

- The two additional candidates put forth by Mr. Sullivan have

longstanding relationships with him, and currently work for F9

Investments or Cabinets To Go, the latter of which competes with LL

Flooring.

- Mr. Sullivan and his two other candidates have limited to no

demonstrated knowledge of critical current corporate governance

issues, lack critical skills in current business issues facing the

Company and none of Mr. Sullivan's candidates except for Mr.

Sullivan himself have any prior experience serving on the Board of

a public company.

- Mr. Sullivan is conflicted and pushing a personal agenda to

opportunistically acquire LL Flooring.

- Mr. Sullivan may be attempting to force a sale of LL Flooring

to himself at a price that may undervalue the Company by installing

himself and two of his hand-picked employees on the Board.

- During the Company's strategic review process, Mr. Sullivan

refused to enter into a standard confidentiality provision, to

which other interested parties agreed.

- During an attempt by the Board to reach a proposed compromise

in this proxy contest by appointing one of his nominees, Mr.

Sullivan’s representatives requested as part of such compromise

that he receive diligence access to the Company.

- Mr. Sullivan has a track record that shareholders should

question.

- Mr. Sullivan has been involved in litigation with companies he

has founded, including a civil racketeering derivative complaint

and litigation related to violating the terms of a Memorandum of

Understanding signed between Cabinets To Go (CTG) and LL Flooring

under which CTG would not sell flooring in competition with LL

Flooring.

- Mr. Sullivan made public statements about his interest in

acquiring LL Flooring and then reversed those statements while

timing his trades of LL Flooring stock in a manner that benefitted

his own personal portfolio and whipsawed other investors.

- During Mr. Sullivan's tenure as Executive Chairman and/or

Interim CEO, with his direct oversight of sourcing, the Company was

raided by the FBI for potential environmental crimes, pleaded

guilty to charges related to sourcing of illegally logged timber

from Far East Russia and false statements on Lacey Act

declarations, and had products fail testing by the California Air

Resources Board for formaldehyde emissions.

- From the time of the FBI raid in 2013, when Mr. Sullivan was

serving as Executive Chairman, to the time of Mr. Sullivan’s

departure from the Board and Company, LL Flooring’s stock price

declined by ~86%, representing the destruction of ~3 billion in

market capitalization1.

Vote today “FOR” ONLY

LL Flooring’s three highly qualified and engaged director nominees

on the universal WHITE proxy card

Your Board unanimously recommends that you vote “FOR” the

election of each of the three nominees proposed by your Board,

Messrs. Moore and Parmar and Ms. Taylor, on your universal

WHITE proxy card.

Your Board does not endorse Mr. Sullivan and his other two

nominees because, among other reasons, they are conflicted due to

their roles at F9 Investments and Cabinets To Go, the latter of

which competes with LL Flooring. Your Board strongly urges you to

DISCARD and NOT vote using any gold proxy card that may be sent to

you by Mr. Sullivan. If you have already voted using a gold proxy

card sent to you by Mr. Sullivan, you have every right to change

your vote and we strongly encourage you to revoke that proxy by

using the WHITE proxy card to

vote in favor of ONLY the three nominees recommended by your Board

– by Internet or by signing, dating and returning the enclosed

WHITE proxy card in the

postage‐paid envelope provided. Only the latest validly executed

proxy that you submit will be counted – any proxy may be revoked at

any time prior to its exercise at the Annual Meeting.

Your vote is very important. Even if you plan to attend the

Annual Meeting, we request that you read the proxy statement and

vote your shares by signing and dating the enclosed universal

WHITE proxy card and returning it in

the postage‐paid envelope provided or by voting via the Internet by

following the instructions provided on the enclosed universal

WHITE proxy card.

If you have any questions or

require any assistance with voting your shares, please contact our

proxy solicitor, Saratoga, at (888) 368‐0379 or (212) 257‐1311 or

by email at info@saratogaproxy.com.

About LL Flooring

LL Flooring is one of the country’s leading specialty retailers

of hard-surface flooring with more than 435 stores nationwide. The

Company seeks to offer the best customer experience online and in

stores, with more than 500 varieties of hard-surface floors

featuring a range of quality styles and on-trend designs. LL

Flooring's online tools also help empower customers to find the

right solution for the space they've envisioned. LL Flooring's

extensive selection includes waterproof hybrid resilient,

waterproof vinyl plank, solid and engineered hardwood, laminate,

bamboo, porcelain tile, and cork, with a wide range of flooring

enhancements and accessories to complement. LL Flooring stores are

staffed with flooring experts who provide advice, Pro partnership

services and installation options for all of LL Flooring's

products, the majority of which is in stock and ready for

delivery.

Learn More about LL Flooring

- Our commitment to quality, compliance, the communities we serve

and corporate giving: https://llflooring.com/corp/quality.html

- Follow us on social media: Facebook, Instagram and

Twitter.

Forward Looking Statements

Certain statements in this press release may include statements

of the Company’s expectations, intentions, plans and beliefs that

constitute “forward-looking statements” within the meanings of the

Private Securities Litigation Reform Act of 1995. These statements,

which may be identified by words such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “assumes,”

“believes,” “thinks,” “estimates,” “seeks,” “predicts,” “could,”

“projects,” “targets,” “potential,” “will likely result,” and other

similar terms and phrases, are based on the beliefs of the

Company’s management, as well as assumptions made by, and

information currently available to, the Company’s management as of

the date of such statements.

These statements are subject to risks and uncertainties, all of

which are difficult to predict and many of which are beyond the

Company’s control. These risks include, without limitation, the

impact of any of the following: reduced consumer spending due to

slower growth, economic recession, inflation, higher interest

rates, and consumer sentiment; our advertising and overall

marketing strategy, including anticipating consumer trends and

increasing brand awareness; the results of our ongoing strategic

review; a sustained period of inflation impacting consumer

spending; our inability to execute on our key initiatives or if

such key initiatives do not yield desired results; stock price

volatility; competition, including alternative e-commerce

offerings; liquidity and/or capital resources changes and the

impact of any changes or limitations, including, without

limitation, ability to borrow funds and/or renew or roll over

existing indebtedness; transportation availability and costs,

including the impact of the war in Ukraine and the conflict in the

middle east on the Company’s European and Asian suppliers;

potential disruptions to supply chain and product availability

related to forced labor and other trade regulations; including with

respect to the Uyghur Forced Labor Prevention Act; inability to

hire and/or retain employees; inability to staff stores due to

overall pressures in the labor market; the outcomes of legal

proceedings, and the related impact on liquidity; reputational

harm; inability to open new stores with acceptable financial

returns, find suitable locations for our new stores, and fund other

capital expenditures; managing growth; disruption in our ability to

distribute our products, including due to severe weather; operating

an office in China; managing third-party installers and product

delivery companies; renewing store, warehouse, or other corporate

leases; maintaining optimal inventory for consumer demand; our and

our suppliers’ compliance with complex and evolving rules,

regulations, and laws at the federal, state, and local levels

having an overreliance on limited or sole-source suppliers; damage

to our assets; availability of suitable hardwood, carpet and other

products, including disruptions from the impacts of severe weather

and supply chain constraints; product liability claims, marketing

substantiation claims, wage and hour claims, and other labor and

employment claims; sufficient insurance coverage, including

cybersecurity insurance; disruptions due to cybersecurity threats,

including any impacts from a network security incident; the

handling of confidential customer information, including the

impacts from the California Consumer Privacy Act, California

Privacy Rights Act and other applicable data privacy laws and

regulations; management information systems and customer

relationship management system disruptions; obtaining products

domestically and from abroad, including tariffs, the effects of

antidumping and countervailing duties, and delays in shipping and

transportation whether due to international events, such as the Red

Sea shipping crisis, or scenarios outside of the Company’s control;

impact of changes in accounting guidance, including implementation

guidelines and interpretations related to Environmental, Social,

and Governance matters; deficiencies or weaknesses in internal

controls; and anti-takeover provisions.

The Company specifically disclaims any obligation to update

these statements, which speak only as of the dates on which such

statements are made, except as may be required under the federal

securities laws.

Additional factors are set forth in the Company’s Annual Report

on Form 10-K and Form 10-K/A for the year ended December 31, 2023,

under the captions “Risk Factors”, the Company’s quarterly report

on Form 10-Q for the quarter ended March 31, 2024, and subsequent

filings with the SEC.

1 Share price decline and market capitalization calculated from

September 26, 2013 until December 30, 2016; market capitalization

calculated using 30,700,000 shares outstanding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240617255279/en/

LL Flooring Investor Relations ICR Bruce Williams

ir@llflooring.com Tel: 804-420-9801 For media inquiries: Ed

Trissel / Spencer Hoffman Joele Frank, Wilkinson Brimmer Katcher

212-355-4449 For Investors: Saratoga Proxy Consulting LLC:

John Ferguson / Joe Mills info@saratogaproxy.com Tel:

212-257-1311

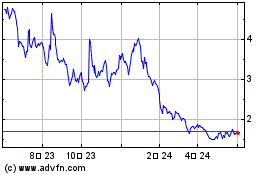

LL Flooring (NYSE:LL)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

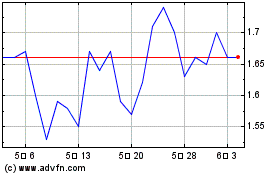

LL Flooring (NYSE:LL)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025