false

0001547546

0001547546

2023-11-13

2023-11-13

0001547546

us-gaap:CommonStockMember

2023-11-13

2023-11-13

0001547546

us-gaap:RedeemablePreferredStockMember

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2023

LUMENT FINANCE TRUST, INC.

(Exact name of registrant as specified in its charter)

| Maryland |

|

001-35845 |

|

45-4966519 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

230 Park Avenue, 20th

Floor

New York, New York 10169

(Address of principal executive offices)

(212) 317-5700

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, $0.01 par value per share |

|

LFT |

|

New York Stock Exchange |

| 7.875% Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share |

|

LFTPrA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 13, 2023, Lument Finance Trust, Inc.

issued a press release and supplemental financial information announcing its financial results for the fiscal quarter ended September

30, 2023. The press release and supplemental financial information are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively,

and are incorporated herein by reference.

The information disclosed in “Item 2.02

Results of Operations and Financial Condition,” including Exhibits 99.1 and 99.2 hereto, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of such section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LUMENT Finance Trust, Inc. |

| |

|

| Date: November 13, 2023 |

By: |

/s/ James A. Briggs |

| |

|

James A. Briggs |

| |

|

Chief Financial Officer |

Exhibit 99.1

Lument Finance Trust Reports Third Quarter Results

NEW YORK, November 13, 2023 /PRNewswire/ — Lument

Finance Trust, Inc. (NYSE: LFT) (“we,” “LFT” or “the Company”) today reported its third

quarter 2023 results. Distributable earnings for the quarter were $6.0 million, or $0.11 per share of common stock. GAAP net income attributable

to common shareholders for the quarter was $5.2 million, or $0.10 per share of common stock. The Company has also issued a detailed presentation

of its results, which can be viewed at www.lumentfinancetrust.com.

Conference Call and Webcast Information

The Company will also host a conference call on Tuesday, November 14,

2023, at 8:30 a.m. ET to provide a business update and discuss the financial results for the third quarter of 2023. The conference call

may be accessed by dialing 1-888-336-7151 (U.S.) or 1-412-902-4251 (international). Note: there is no passcode; please ask the operator

to be joined into the Lument Finance Trust call. A live webcast, on a listen-only basis, is also available and can be accessed through

the URL:

https://app.webinar.net/2jWZbeOxy7m

For those unable to listen to the live broadcast, a recorded

replay will be available for on-demand viewing approximately one hour after the end of the event through the Company’s website https://lumentfinancetrust.com/

and by telephone dial-in. The replay call-in number is 1-877-344-7529 (U.S.) or 1-412-317-0088 (international) with passcode

9222368.

Non-GAAP Financial Measures

In this release, the Company

presents certain financial measures that are not calculated according to generally accepted accounting principles in the United States

(“GAAP”). Specifically, the Company is presenting distributable earnings, which constitutes a non-GAAP financial measure within

the meaning of Item 10(e) of Regulation S-K and is net income under GAAP. While we believe the non-GAAP information included in this press

release provides supplemental information to assist investors in analyzing our results, and to assist investors in comparing our results

with other peer issuers, these measures are not in accordance with GAAP, and they should not be considered a substitute for, or superior

to, our financial information calculated in accordance with GAAP. The methods of calculating non-GAAP financial measures may differ substantially

from similarly titled measures used by other companies. Our GAAP financial results and the reconciliations from these results should be

carefully evaluated.

Distributable Earnings

Distributable Earnings is a non-GAAP measure, which we define as GAAP

net income (loss) attributable to holders of common stock computed in accordance with GAAP, including realized losses not otherwise included

in GAAP net income (loss) and excluding (i) non-cash equity compensation, (ii) depreciation and amortization, (iii) any unrealized gains

or losses or other similar non-cash items that are included in net income for that applicable reporting period, regardless of whether

such items are included in other comprehensive income (loss) or net income (loss), and (iv) one-time events pursuant to changes in GAAP

and certain material non-cash income or expense items after discussions with the Company’s board of directors and approved by a

majority of the Company’s independent directors. Distributable Earnings mirrors how we calculate Core Earnings pursuant to

the terms of our management agreement between our Manager and us, or our Management Agreement, for purposes of calculating the incentive

fee payable to our Manager.

While Distributable Earnings excludes the impact of any unrealized

provisions for credit losses, any loan losses are charged off and realized through Distributable Earnings when deemed non-recoverable.

Non-recoverability is determined (i) upon the resolution of a loan (i.e. when the loan is repaid, fully or partially, or in the case of

foreclosures, when the underlying asset is sold), or (ii) with respect to any amount due under any loan, when such amount is determined

to be non-collectible.

We believe that Distributable Earnings provides meaningful

information to consider in addition to our net income (loss) and cash flows from operating activities determined in accordance with

GAAP. We believe Distributable Earnings is a useful financial metric for existing and potential future holders of our common

stock as historically, over time, Distributable Earnings has been a strong indicator of our dividends per share of common

stock. As a REIT, we generally must distribute annually at least 90% of our taxable income, subject to certain adjustments,

and therefore we believe our dividends are one of the principal reasons stockholders may invest in our common stock.

Furthermore, Distributable Earnings help us to evaluate our performance excluding the effects of certain transactions and GAAP

adjustments that we believe are not necessarily indicative of our current loan portfolio and operations, and is a performance metric

we consider when declaring our dividends.

Distributable Earnings does not represent net income (loss) or cash

generated from operating activities and should not be considered as an alternative to GAAP net income (loss), or an indication of GAAP

cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs.

GAAP to Distributable Earnings Reconciliation

| | |

Three months Ended | |

| | |

September 30, 2023 | |

| Reconciliation of GAAP to non-GAAP Information | |

| | |

| Net Income attributable to common shareholders | |

$ | 5,174,685 | |

| Adjustments for non-Distributable Earnings | |

| | |

| Unrealized losses (gains) on mortgage servicing rights | |

| (1,573 | ) |

| Unrealized provision for credit losses | |

| 791,563 | |

| Subtotal | |

| 789,990 | |

| Other Adjustments | |

| | |

| Recognized compensation expense related to restricted common stock | |

| - | |

| Adjustment for income taxes | |

| 19,803 | |

| Subtotal | |

| 19,803 | |

| | |

| | |

| Distributable Earnings | |

$ | 5,984,478 | |

| | |

| | |

| Weighted average shares outstanding - Basic and Diluted | |

| 52,231,152 | |

| Distributable Earnings per weighted share outstanding - Basic and Diluted | |

$ | 0.11 | |

About LFT

LFT is a Maryland corporation focused

on investing in, financing and managing a portfolio of commercial real estate debt investments. The Company primarily invests in transitional

floating rate commercial mortgage loans with an emphasis on middle-market multi-family assets.

LFT is externally managed and advised by Lument

Investment Management LLC, a Delaware limited liability company.

Additional Information and Where to Find It

Investors, security holders and other interested

persons may find additional information regarding the Company at the SEC’s Internet site at http://www.sec.gov/ or

the Company website www.lumentfinancetrust.com or by directing requests to: Lument Finance Trust, 230 Park Avenue, 20th

Floor, New York, NY 10169, Attention: Investor Relations.

Forward-Looking Statements

Certain statements included in this

press release constitute forward-looking statements intended to qualify for the safe harbor contained in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended. Forward-looking statements are

subject to risks and uncertainties. You can identify forward-looking statements by use of words such as "believe,"

"expect," "anticipate," "project," "estimate," "plan," "continue,"

"intend," "should," "may," "will," "seek," "would," "could,"

or similar expressions or other comparable terms, or by discussions of strategy, plans or intentions. Forward-looking statements are

based on the Company's beliefs, assumptions and expectations of its future performance, taking into account all information

currently available to the Company on the date of this press release or the date on which such statements are first made. Actual

results may differ from expectations, estimates and projections. You are cautioned not to place undue reliance on forward-looking

statements in this press release and should consider carefully the factors described in Part I, Item IA "Risk Factors" in

the Company's Annual Report on Form 10-K for the year ended December 31, 2022, which is available on the SEC’s website at

www.sec.gov, and in other current or periodic filings with the SEC, when evaluating these forward-looking statements.

Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are

generally beyond the Company's control. Except as required by applicable law, the Company disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor

Relations Contact:

James Briggs

Chief Financial Officer

(212) 521-6323

james.briggs@lument.com

Media Contact:

Tyler Howard

Associate Director

(513) 403-1911

tyler.howard@lument.com

Exhibit 99.2

November 2023 Lument Finance Trust Q3 2023 Earnings Supplemental

Disclaimer 2 This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the current views of Lument Finance Trust, Inc. (NYSE: LFT) (“LFT,” the “Company,” “we,” “our,” or “us”) with respect to, among other things, the Company’s operations and financial performance. You can identify these forward - looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “projects,” “intends,” “plans,” “estimates,” or “anticipates,” or the negative version of these words or other comparable words or other statements that do not relate strictly to historical or factual matters. Such forward - looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The Company believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10 - K for the year ended December 31, 2022, which is available on the SEC’s website at www.sec.gov . These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the filings. The forward - looking statements contained in this presentation speak only as of November 13th, 2023. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events or circumstances. This presentation includes non - GAAP financial measures, including Distributable Earnings. While we believe the non - GAAP information included in this presentation provides supplemental information to assist investors in analyzing our operating results and to assist investors in comparing our operating results with other peer issuers, these measures are not in accordance with GAAP, and they should not be considered a substitute for, or superior to, our financial information calculated in accordance with GAAP. Please refer to this presentation’s Appendix for a reconciliation of the non - GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP.

Company Overview 3 Key Investment Highlights Strong Sponsorship/Ownership • Access to extensive loan origination platform through affiliation with Lument, a premier national mortgage originator and asset manager. • Experienced management team with average of 27 years of industry experience across multiple economic cycles. • Affiliation with ORIX Corporation USA, the US subsidiary of ORIX Corporation, the publicly traded Tokyo - based international financial services firm. • The Company is an externally - managed real estate investment trust focused on investing in, financing and managing a portfolio of commercial real estate debt investments. • The Company is externally managed by Lument Investment Management, an affiliate of ORIX Corporation USA. Attractive Investment Profile • Emphasis on middle market multifamily debt investments which are well positioned for the current environment. • Strong credit and asset management capabilities. • Attractive financing source via match term, non - recourse, non mark - to - market, collateralized financing structures.

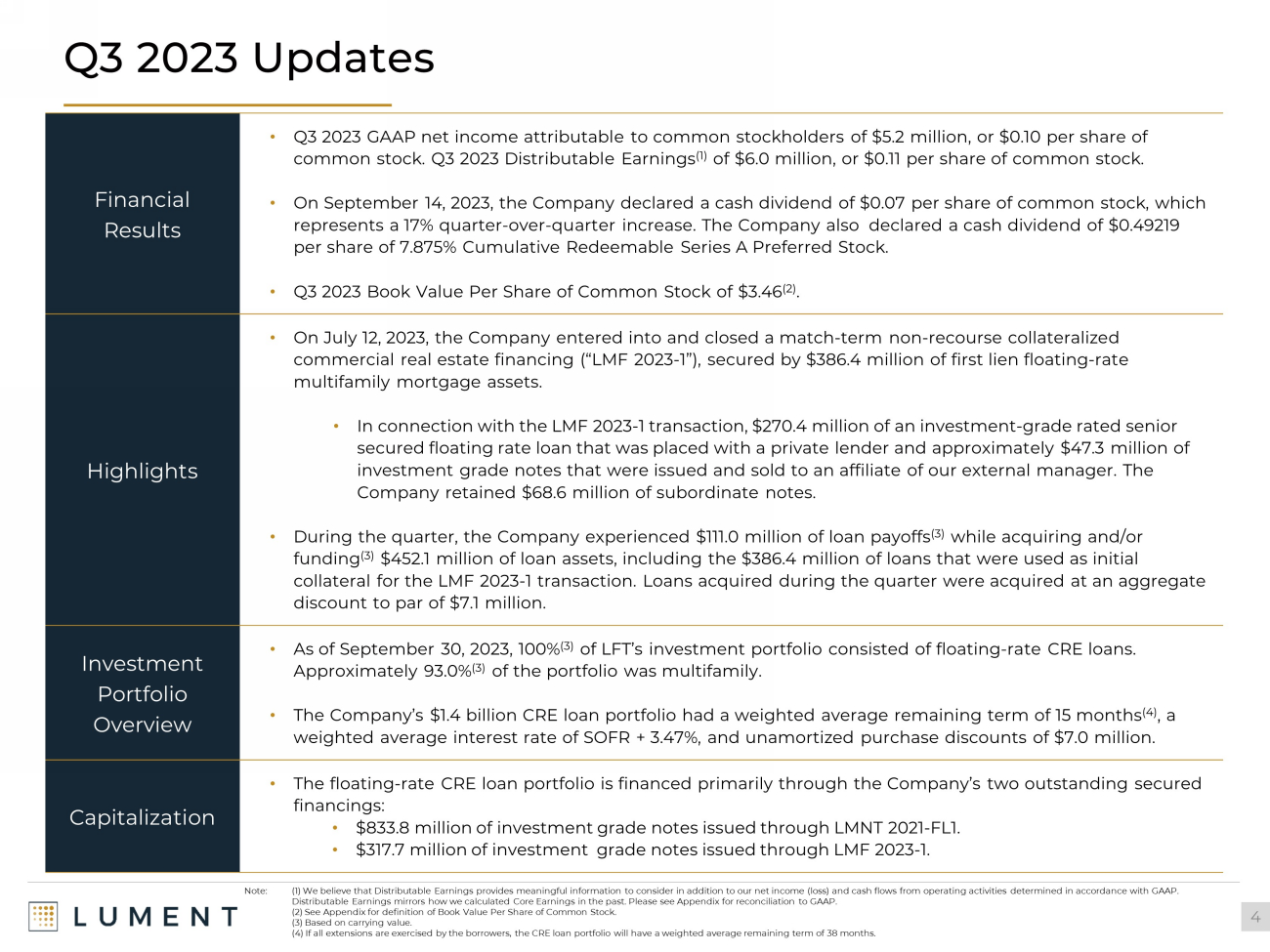

Q3 2023 Updates 4 Note: (1) We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (los s) and cash flows from operating activities determined in accordance with GAAP. Distributable Earnings mirrors how we calculated Core Earnings in the past. Please see Appendix for reconciliation to GAAP. (2) See Appendix for definition of Book Value Per Share of Common Stock. (3) Based on carrying value. (4) If all extensions are exercised by the borrowers, the CRE loan portfolio will have a weighted average remaining term of 3 8 months. Financial Results • Q3 2023 GAAP net income attributable to common stockholders of $5.2 million, or $0.10 per share of common stock. Q3 2023 Distributable Earnings (1) of $6.0 million, or $0.11 per share of common stock. • On September 14, 2023, the Company declared a cash dividend of $0.07 per share of common stock, which represents a 17% quarter - over - quarter increase. The Company also declared a cash dividend of $0.49219 per share of 7.875% Cumulative Redeemable Series A Preferred Stock. • Q3 2023 Book Value Per Share of Common Stock of $3.46 (2) . Highlights • On July 12, 2023, the Company entered into and closed a match - term non - recourse collateralized commercial real estate financing (“LMF 2023 - 1”), secured by $386.4 million of first lien floating - rate multifamily mortgage assets. • In connection with the LMF 2023 - 1 transaction, $270.4 million of an investment - grade rated senior secured floating rate loan that was placed with a private lender and approximately $47.3 million of investment grade notes that were issued and sold to an affiliate of our external manager. The Company retained $68.6 million of subordinate notes. • During the quarter, the Company experienced $111.0 million of loan payoffs (3) while acquiring and/or funding (3) $452.1 million of loan assets, including the $386.4 million of loans that were used as initial collateral for the LMF 2023 - 1 transaction. Loans acquired during the quarter were acquired at an aggregate discount to par of $7.1 million. Investment Portfolio Overview • As of September 30, 2023, 100% (3) of LFT’s investment portfolio consisted of floating - rate CRE loans. Approximately 93.0% (3) of the portfolio was multifamily. • The Company’s $1.4 billion CRE loan portfolio had a weighted average remaining term of 15 months (4) , a weighted average interest rate of SOFR + 3.47%, and unamortized purchase discounts of $7.0 million. Capitalization • The floating - rate CRE loan portfolio is financed primarily through the Company’s two outstanding secured financings: • $833.8 million of investment grade notes issued through LMNT 2021 - FL1. • $317.7 million of investment grade notes issued through LMF 2023 - 1.

Q3 2023 Balance Sheet Summary 5 Balance Sheet (thousands) September 30, 2023 (1) Commercial mortgage loans held - for - investment (net of allowance for credit losses) $1,350,832 Cash and cash equivalents 43,409 Restricted cash (2) 6,225 Accrued interest receivable 8,608 Investment related receivable 31,122 Other assets (3) 3,136 Total assets $1,443,332 Secured financings (4) 1,145,317 Credit facility (4) 47,157 Other liabilities 10,262 Total liabilities $1,202,737 Total equity 240,595 Total liabilities / total equity 5.00x Book Value Per Share of Common Stock (5) $3.46 Note: (1) See Appendix for detailed consolidated balance sheet, including the Company’s consolidated variable interest entities (“VIE’s”). (2) Restricted cash held by LMNT 2021 - FL1 and the LMF 2023 - 1 is available for investment in eligible mortgage assets. (3) Includes mortgage servicing rights, carried at fair value of $0.7 million. (4) Outstanding principal amount of investment grade notes issued by LMNT 2021 - FL1 and LMF 2023 - 1 is $833.8 million and $317.7 million, respectively. The unpaid principal balance of the credit facility is $47.8 million. For GAAP purposes, these liabilities are carried at their outstanding unpaid principal balance, net of any una mor tized discounts and debt issuance costs. (5) See Appendix for definition of Book Value Per Share of Common Stock.

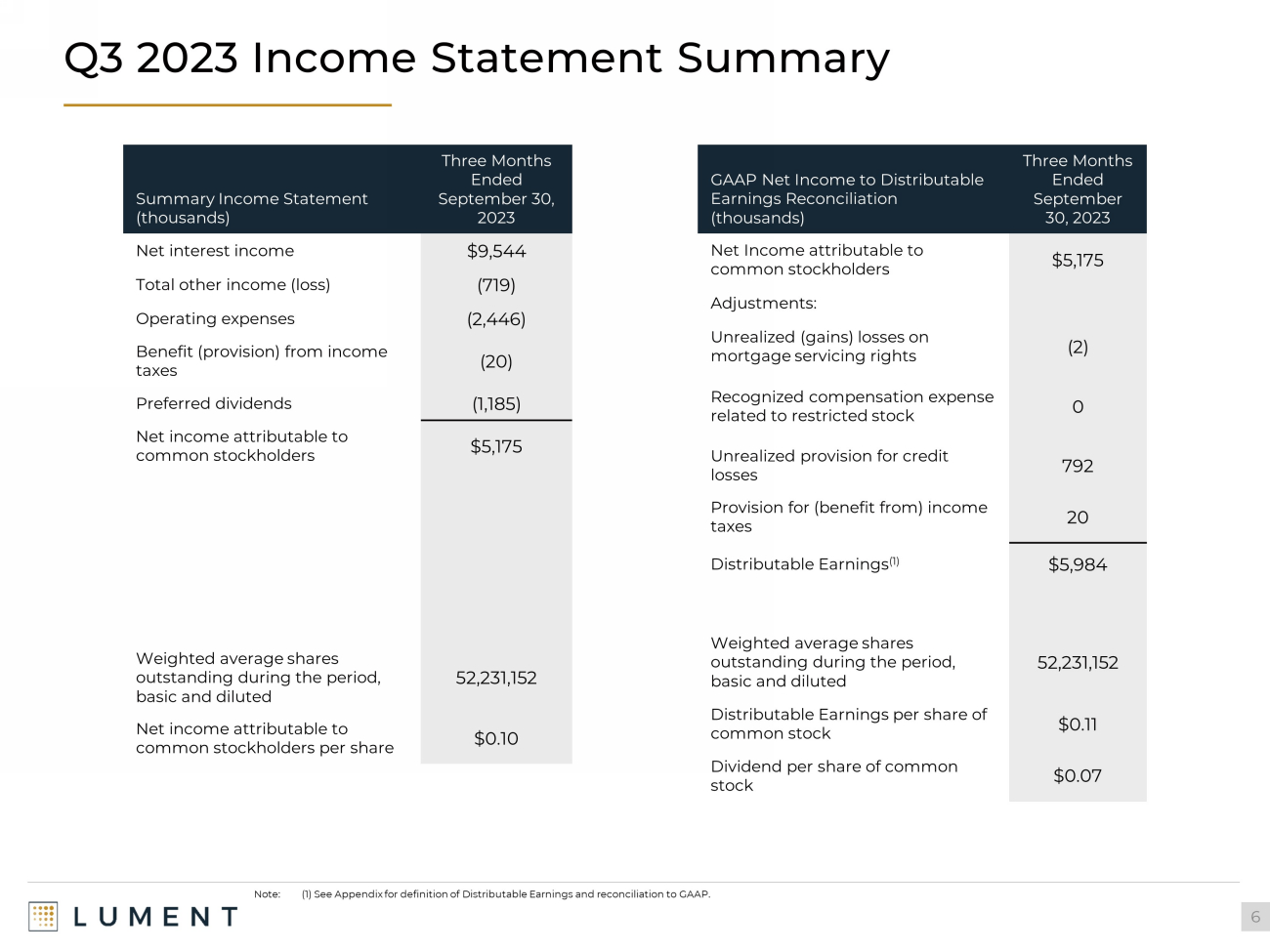

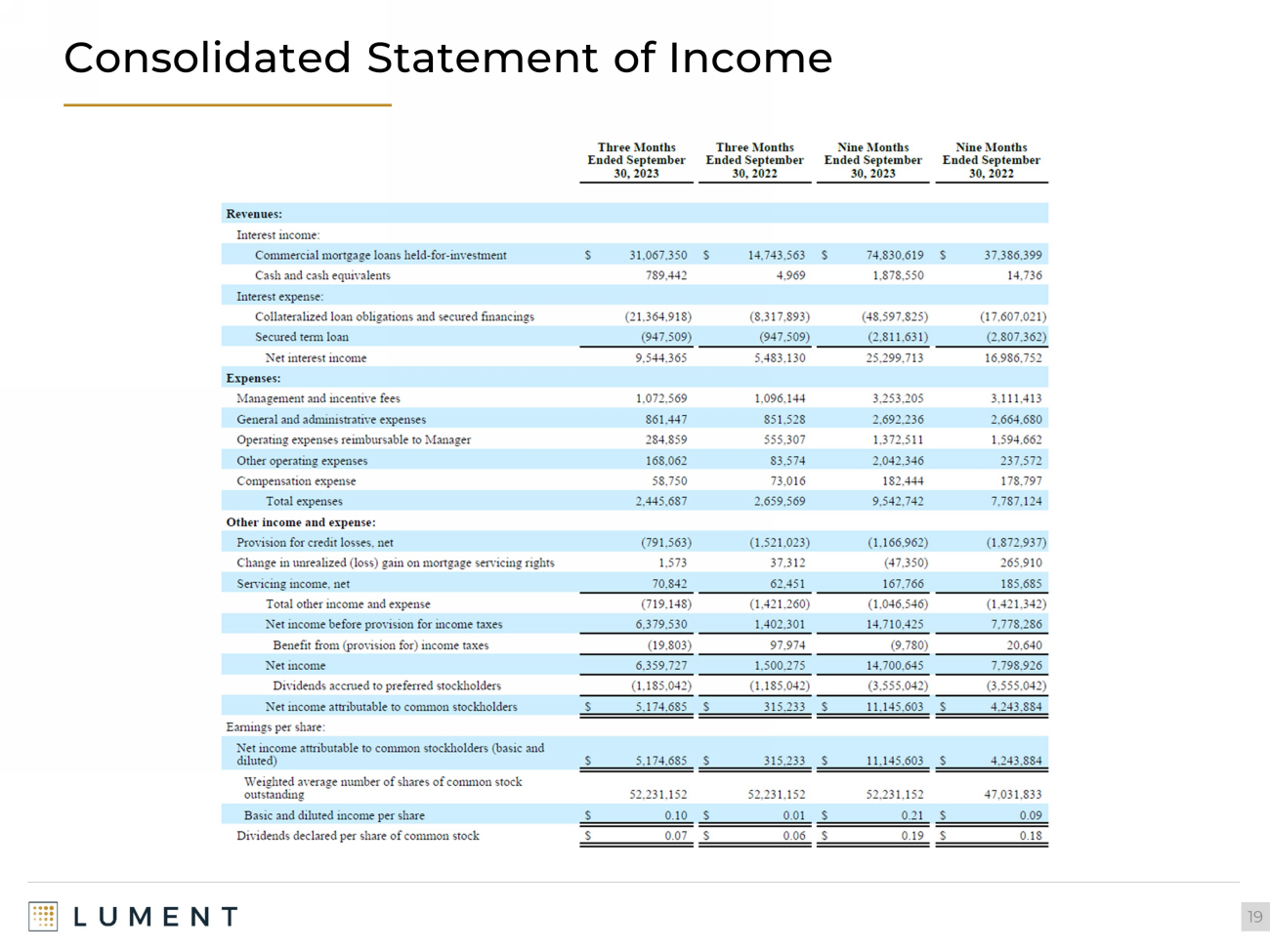

Q3 2023 Income Statement Summary 6 Summary Income Statement (thousands) Three Months Ended September 30, 2023 Net interest income $9,544 Total other income (loss) (719) Operating expenses (2,446) Benefit (provision) from income taxes (20) Preferred dividends (1,185) Net income attributable to common stockholders $5,175 Weighted average shares outstanding during the period, basic and diluted 52,231,152 Net income attributable to common stockholders per share $0.10 GAAP Net Income to Distributable Earnings Reconciliation (thousands) Three Months Ended September 30, 2023 Net Income attributable to common stockholders $5,175 Adjustments: Unrealized (gains) losses on mortgage servicing rights (2) Recognized compensation expense related to restricted stock 0 Unrealized provision for credit losses 792 Provision for (benefit from) income taxes 20 Distributable Earnings (1) $5,984 Weighted average shares outstanding during the period, basic and diluted 52,231,152 Distributable Earnings per share of common stock $0.11 Dividend per share of common stock $0.07 Note: (1) See Appendix for definition of Distributable Earnings and reconciliation to GAAP.

Earnings and Book Value Per Share of Common Stock 7 $0.02 $0.09 $0.03 $0.10 $0.06 $0.00 $0.04 $0.11 Q4 2022 Q1 2023 Q2 2023 Q3 2023 GAAP Earnings/Share Distributable Earnings/Share $3.50 $3.46 $3.43 $3.46 Q4 2022 Q1 2023 Q2 2023 Q3 2023 GAAP Earnings & Distributable Earnings (1) Per Share of Common Stock Book Value Per Share of Common Stock (2) Note: (1) See Appendix for definition of Distributable Earnings and reconciliation to GAAP. (2) See Appendix for definition of Book Value Per Share of Common Stock. CECL implemented on January 1, 2023. BVPS is net of CECL reserve of $0.06 as of 3/31/23.

Investment Portfolio 8 Geographic Concentration (2) Multi - Family , $1,255.9 , 93.0% Seniors Housing & Healthcare , $75.3 , 5.6% Self Storage , $19.6 , 1.5% Property Type (2) $1,350.8 Note: (1) Based on carrying value. (2) $ In millions, based on carrying value. • On September 30, 2023, the Company owned a portfolio of floating - rate CRE loans with a carrying value of $1.4 billion. 93.0% (1) of the portfolio was invested in loans backed by multifamily assets. • The Company anticipates that the majority of loan activity will continue to be related to multifamily assets. The Company does not own any hospitality, retail, or office assets and has limited exposure to self - storage assets. TX , $381.8 , 28.3% FL , $200.5 , 14.8% GA , $157.9 , 11.7% NJ , $99.5 , 7.4% NC , $65.4 , 4.8% Other States , $445.6 , 33.0% $1,350.8

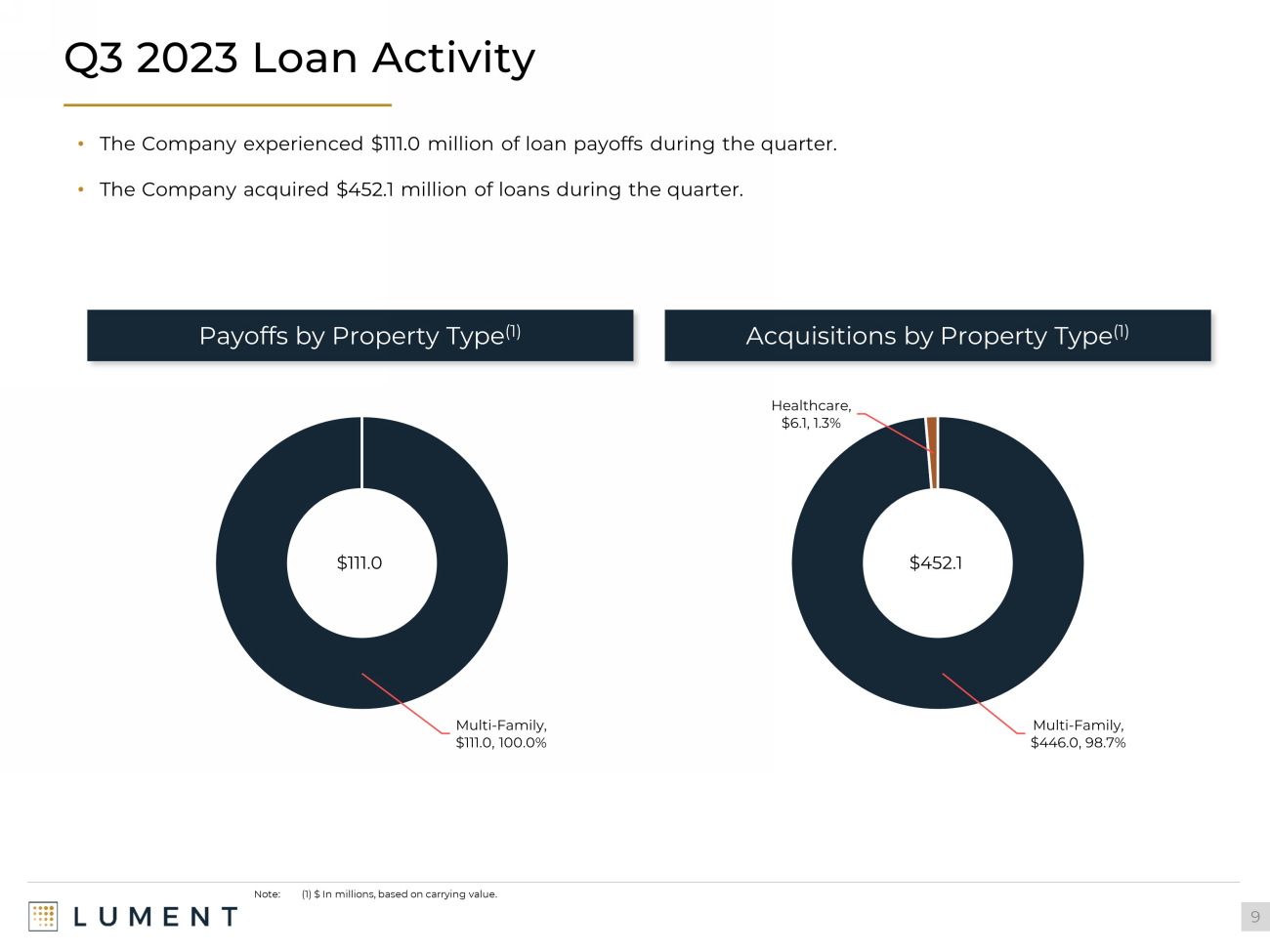

Q3 2023 Loan Activity 9 Multi - Family , $111.0 , 100.0% Payoffs by Property Type (1) $111.0 • The Company experienced $111.0 million of loan payoffs during the quarter. • The Company acquired $ 452.1 million of loans during the quarter. Note: (1) $ In millions, based on carrying value. Acquisitions by Property Type (1) $72.9 Multi - Family , $446.0 , 98.7% Healthcare , $6.1 , 1.3% $452.1

Portfolio Credit 10 • 95.0% of the Company’s portfolio is performing, with 75% of the portfolio rated “3” (Moderate Risk) or better. • Weighted average risk rating remained stable quarter over quarter. 98.9% 99.0% 97.9% 98.8% 98.8% 95.0% 0.9% 2.5% 3.9% 4.6% 5.1% 5.3% -1.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 9/30/2023 % Performing Average 1M SOFR Asset Performance (1) Weighted Average Risk Rating (2) Note: (1) An asset is defined as performing if it is not in default, or not on non - accrual status. (2)Weighted average risk rating is weighted based on carrying value of portfolio assets. 2.3 2.7 3.0 3.2 3.4 3.4 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 9/30/2023 1 2 3 4 5 Weighted Avg Risk Rating

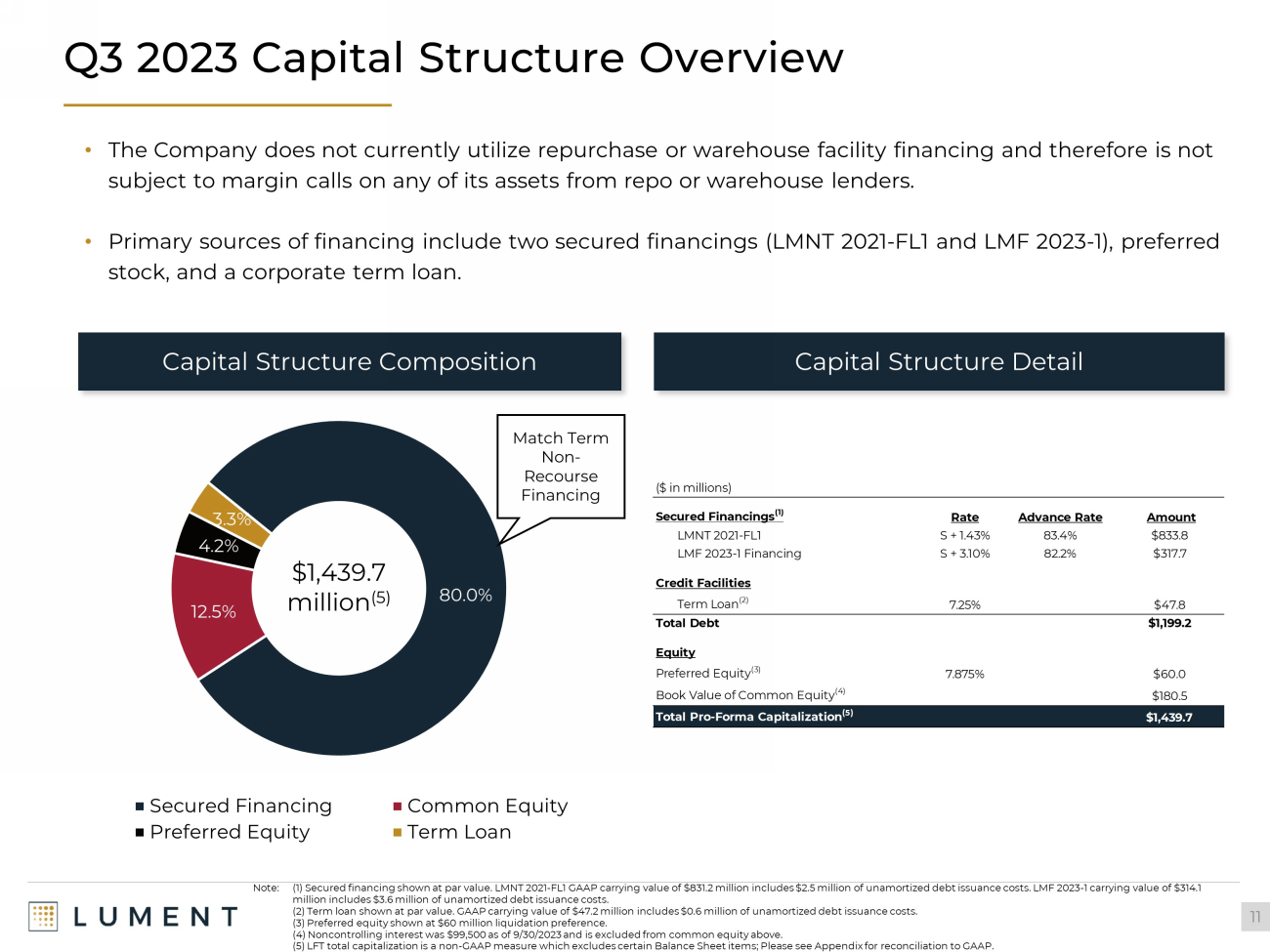

Q3 2023 Capital Structure Overview 11 80.0% 12.5% 4.2% 3.3% Secured Financing Common Equity Preferred Equity Term Loan $1,439.7 million (5) Capital Structure Composition Capital Structure Detail Note: (1) Secured financing shown at par value. LMNT 2021 - FL1 GAAP carrying value of $831.2 million includes $2.5 million of una mortized debt issuance costs. LMF 2023 - 1 carrying value of $314.1 million includes $3.6 million of unamortized debt issuance costs. (2) Term loan shown at par value. GAAP carrying value of $47.2 million includes $0.6 million of unamortized debt issuance cos ts . (3) Preferred equity shown at $60 million liquidation preference. (4) Noncontrolling interest was $99,500 as of 9/30/2023 and is excluded from common equity above. (5) LFT total capitalization is a non - GAAP measure which excludes certain Balance Sheet items; Please see Appendix for reconcil iation to GAAP. Match Term Non - Recourse Financing • The Company does not currently utilize repurchase or warehouse facility financing and therefore is not subject to margin calls on any of its assets from repo or warehouse lenders. • Primary sources of financing include two secured financings (LMNT 2021 - FL1 and LMF 2023 - 1), preferred stock, and a corporate term loan. ($ in millions) Secured Financings (1) Rate Advance Rate Amount LMNT 2021-FL1 S + 1.43% 83.4% $833.8 LMF 2023-1 Financing S + 3.10% 82.2% $317.7 Credit Facilities Term Loan (2) 7.25% $47.8 Total Debt $1,199.2 Equity Preferred Equity (3) 7.875% $60.0 Book Value of Common Equity (4) $180.5 Total Pro-Forma Capitalization (5) $1,439.7

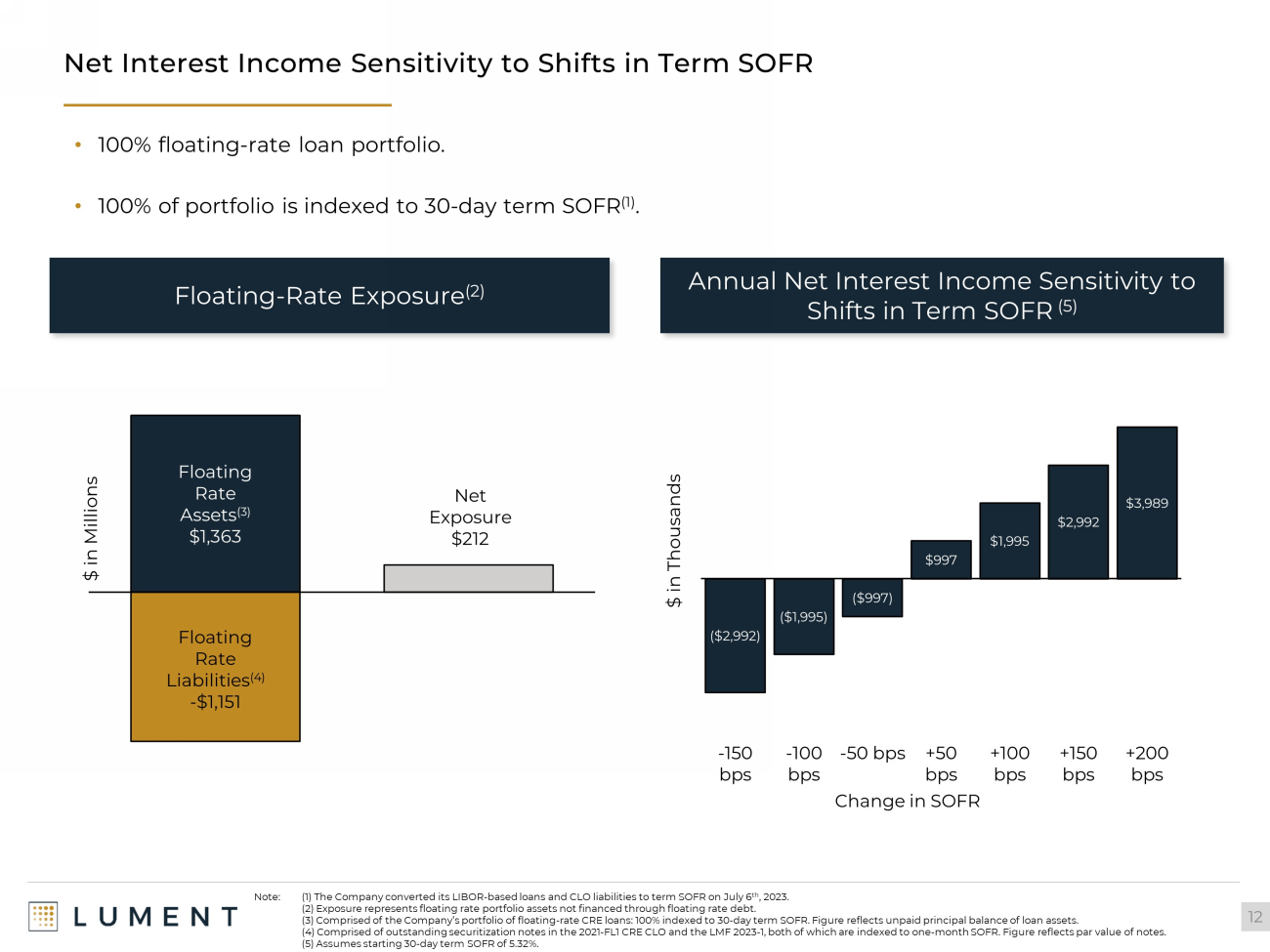

($2,992) ($1,995) ($997) $997 $1,995 $2,992 $3,989 -150 bps -100 bps -50 bps +50 bps +100 bps +150 bps +200 bps $ in Thousands Change in SOFR Net Interest Income Sensitivity to Shifts in Term SOFR 12 Floating Rate Assets (3) $1,363 Floating Rate Liabilities (4) - $1,151 Net Exposure $212 Floating - Rate Exposure (2) Annual Net Interest Income Sensitivity to Shifts in Term SOFR (5) $ in Millions Note: (1) The Company converted its LIBOR - based loans and CLO liabilities to term SOFR on July 6 th , 2023. (2) Exposure represents floating rate portfolio assets not financed through floating rate debt. (3) Comprised of the Company’s portfolio of floating - rate CRE loans: 100% indexed to 30 - day term SOFR. Figure reflects unpaid principal balance of loan assets. (4) Comprised of outstanding securitization notes in the 2021 - FL1 CRE CLO and the LMF 2023 - 1, both of which are indexed to one - month SOFR. Figure reflects par value of notes. (5) Assumes starting 30 - day term SOFR of 5.32%. • 100% floating - rate loan portfolio. • 100% of portfolio is indexed to 30 - day term SOFR (1) .

Appendix

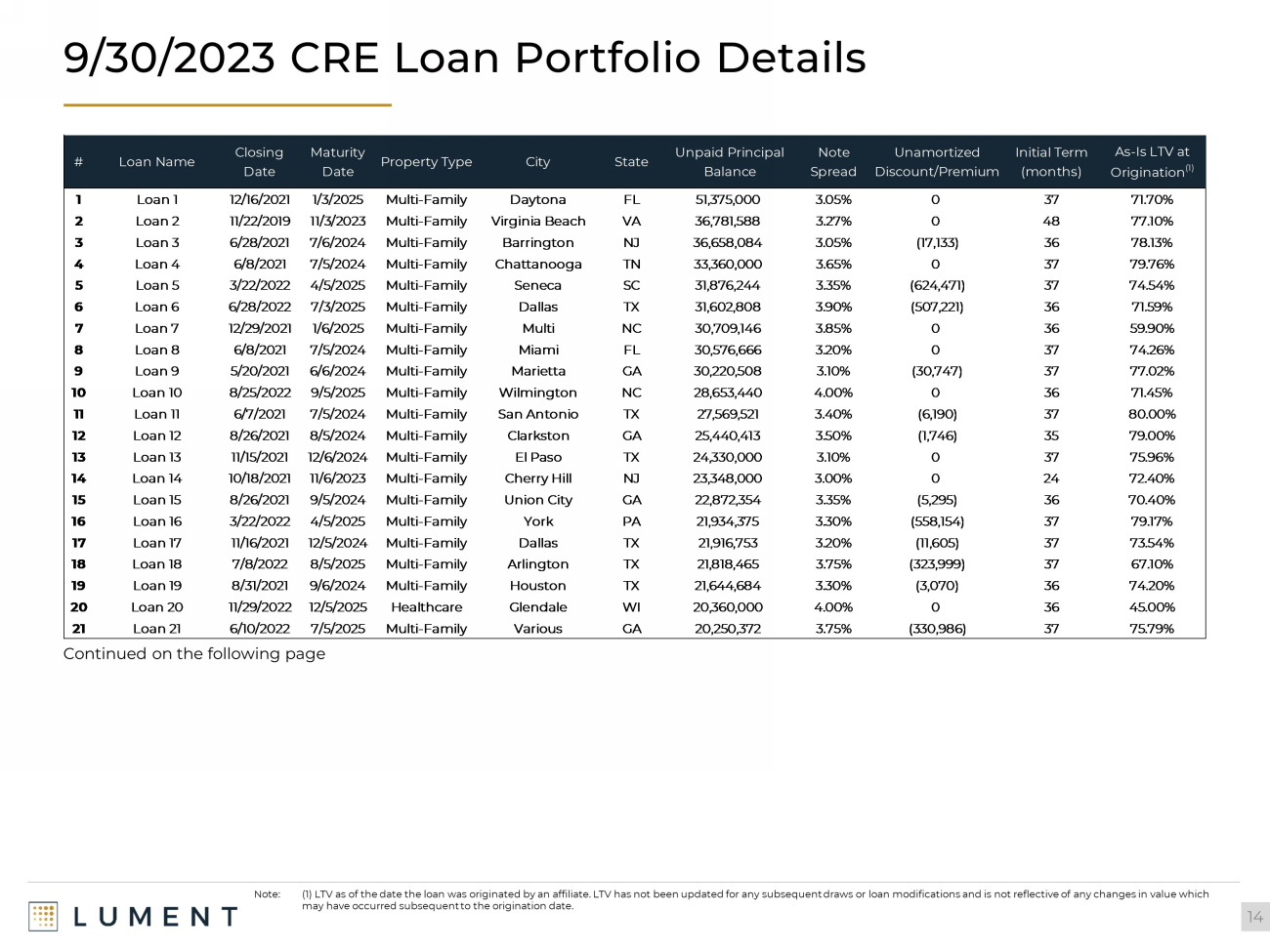

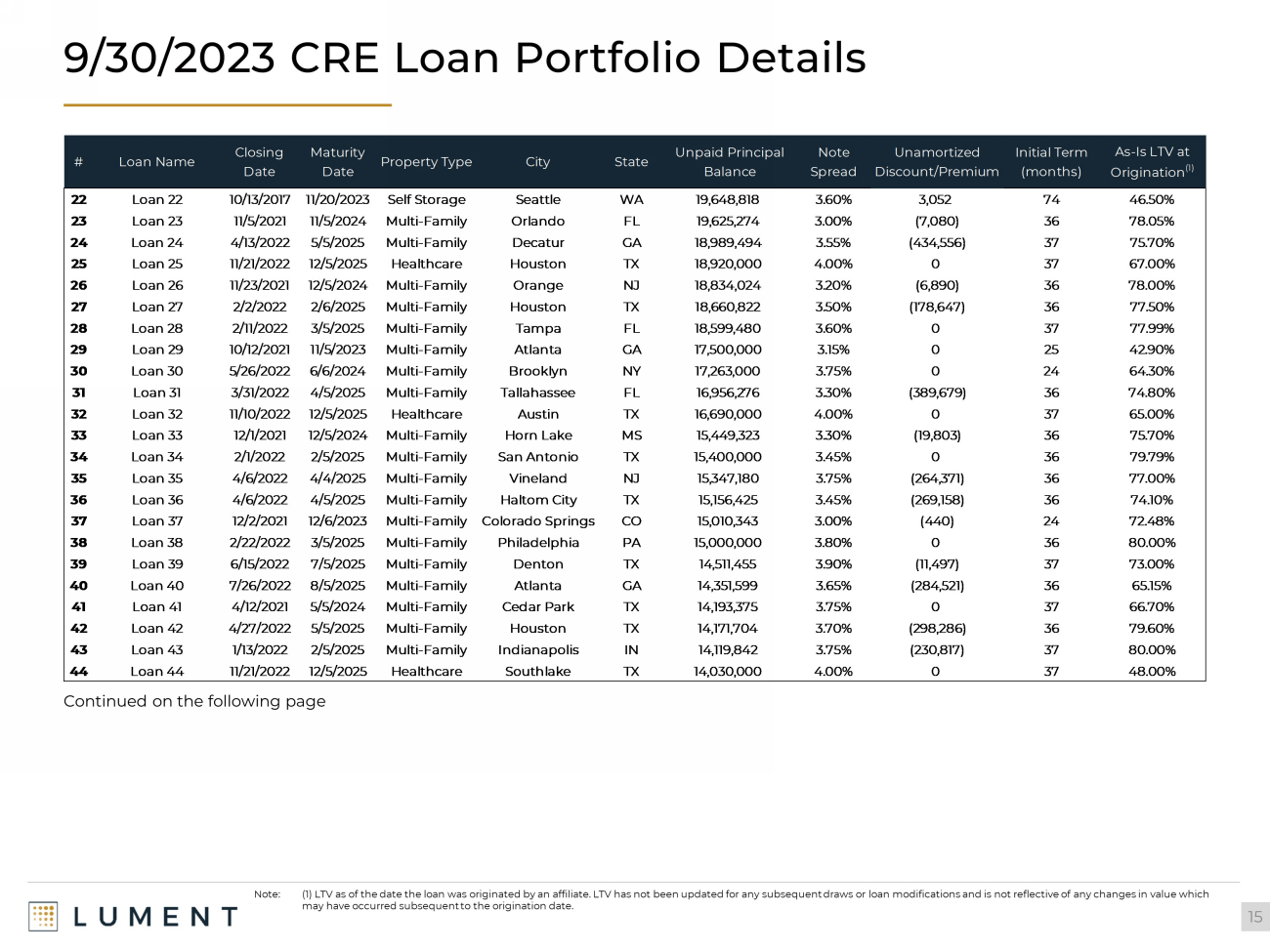

9/30/2023 CRE Loan Portfolio Details 14 Continued on the following page Note: (1) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date. # Loan Name Closing Date Maturity Date Property Type City State Unpaid Principal Balance Note Spread Unamortized Discount/Premium Initial Term (months) As-Is LTV at Origination (1) 1 Loan 1 12/16/2021 1/3/2025 Multi-Family Daytona FL 51,375,000 3.05% 0 37 71.70% 2 Loan 2 11/22/2019 11/3/2023 Multi-Family Virginia Beach VA 36,781,588 3.27% 0 48 77.10% 3 Loan 3 6/28/2021 7/6/2024 Multi-Family Barrington NJ 36,658,084 3.05% (17,133) 36 78.13% 4 Loan 4 6/8/2021 7/5/2024 Multi-Family Chattanooga TN 33,360,000 3.65% 0 37 79.76% 5 Loan 5 3/22/2022 4/5/2025 Multi-Family Seneca SC 31,876,244 3.35% (624,471) 37 74.54% 6 Loan 6 6/28/2022 7/3/2025 Multi-Family Dallas TX 31,602,808 3.90% (507,221) 36 71.59% 7 Loan 7 12/29/2021 1/6/2025 Multi-Family Multi NC 30,709,146 3.85% 0 36 59.90% 8 Loan 8 6/8/2021 7/5/2024 Multi-Family Miami FL 30,576,666 3.20% 0 37 74.26% 9 Loan 9 5/20/2021 6/6/2024 Multi-Family Marietta GA 30,220,508 3.10% (30,747) 37 77.02% 10 Loan 10 8/25/2022 9/5/2025 Multi-Family Wilmington NC 28,653,440 4.00% 0 36 71.45% 11 Loan 11 6/7/2021 7/5/2024 Multi-Family San Antonio TX 27,569,521 3.40% (6,190) 37 80.00% 12 Loan 12 8/26/2021 8/5/2024 Multi-Family Clarkston GA 25,440,413 3.50% (1,746) 35 79.00% 13 Loan 13 11/15/2021 12/6/2024 Multi-Family El Paso TX 24,330,000 3.10% 0 37 75.96% 14 Loan 14 10/18/2021 11/6/2023 Multi-Family Cherry Hill NJ 23,348,000 3.00% 0 24 72.40% 15 Loan 15 8/26/2021 9/5/2024 Multi-Family Union City GA 22,872,354 3.35% (5,295) 36 70.40% 16 Loan 16 3/22/2022 4/5/2025 Multi-Family York PA 21,934,375 3.30% (558,154) 37 79.17% 17 Loan 17 11/16/2021 12/5/2024 Multi-Family Dallas TX 21,916,753 3.20% (11,605) 37 73.54% 18 Loan 18 7/8/2022 8/5/2025 Multi-Family Arlington TX 21,818,465 3.75% (323,999) 37 67.10% 19 Loan 19 8/31/2021 9/6/2024 Multi-Family Houston TX 21,644,684 3.30% (3,070) 36 74.20% 20 Loan 20 11/29/2022 12/5/2025 Healthcare Glendale WI 20,360,000 4.00% 0 36 45.00% 21 Loan 21 6/10/2022 7/5/2025 Multi-Family Various GA 20,250,372 3.75% (330,986) 37 75.79%

9/30/2023 CRE Loan Portfolio Details 15 Continued on the following page Note: (1) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date. # Loan Name Closing Date Maturity Date Property Type City State Unpaid Principal Balance Note Spread Unamortized Discount/Premium Initial Term (months) As-Is LTV at Origination (1) 22 Loan 22 10/13/2017 11/20/2023 Self Storage Seattle WA 19,648,818 3.60% 3,052 74 46.50% 23 Loan 23 11/5/2021 11/5/2024 Multi-Family Orlando FL 19,625,274 3.00% (7,080) 36 78.05% 24 Loan 24 4/13/2022 5/5/2025 Multi-Family Decatur GA 18,989,494 3.55% (434,556) 37 75.70% 25 Loan 25 11/21/2022 12/5/2025 Healthcare Houston TX 18,920,000 4.00% 0 37 67.00% 26 Loan 26 11/23/2021 12/5/2024 Multi-Family Orange NJ 18,834,024 3.20% (6,890) 36 78.00% 27 Loan 27 2/2/2022 2/6/2025 Multi-Family Houston TX 18,660,822 3.50% (178,647) 36 77.50% 28 Loan 28 2/11/2022 3/5/2025 Multi-Family Tampa FL 18,599,480 3.60% 0 37 77.99% 29 Loan 29 10/12/2021 11/5/2023 Multi-Family Atlanta GA 17,500,000 3.15% 0 25 42.90% 30 Loan 30 5/26/2022 6/6/2024 Multi-Family Brooklyn NY 17,263,000 3.75% 0 24 64.30% 31 Loan 31 3/31/2022 4/5/2025 Multi-Family Tallahassee FL 16,956,276 3.30% (389,679) 36 74.80% 32 Loan 32 11/10/2022 12/5/2025 Healthcare Austin TX 16,690,000 4.00% 0 37 65.00% 33 Loan 33 12/1/2021 12/5/2024 Multi-Family Horn Lake MS 15,449,323 3.30% (19,803) 36 75.70% 34 Loan 34 2/1/2022 2/5/2025 Multi-Family San Antonio TX 15,400,000 3.45% 0 36 79.79% 35 Loan 35 4/6/2022 4/4/2025 Multi-Family Vineland NJ 15,347,180 3.75% (264,371) 36 77.00% 36 Loan 36 4/6/2022 4/5/2025 Multi-Family Haltom City TX 15,156,425 3.45% (269,158) 36 74.10% 37 Loan 37 12/2/2021 12/6/2023 Multi-Family Colorado Springs CO 15,010,343 3.00% (440) 24 72.48% 38 Loan 38 2/22/2022 3/5/2025 Multi-Family Philadelphia PA 15,000,000 3.80% 0 36 80.00% 39 Loan 39 6/15/2022 7/5/2025 Multi-Family Denton TX 14,511,455 3.90% (11,497) 37 73.00% 40 Loan 40 7/26/2022 8/5/2025 Multi-Family Atlanta GA 14,351,599 3.65% (284,521) 36 65.15% 41 Loan 41 4/12/2021 5/5/2024 Multi-Family Cedar Park TX 14,193,375 3.75% 0 37 66.70% 42 Loan 42 4/27/2022 5/5/2025 Multi-Family Houston TX 14,171,704 3.70% (298,286) 36 79.60% 43 Loan 43 1/13/2022 2/5/2025 Multi-Family Indianapolis IN 14,119,842 3.75% (230,817) 37 80.00% 44 Loan 44 11/21/2022 12/5/2025 Healthcare Southlake TX 14,030,000 4.00% 0 37 48.00%

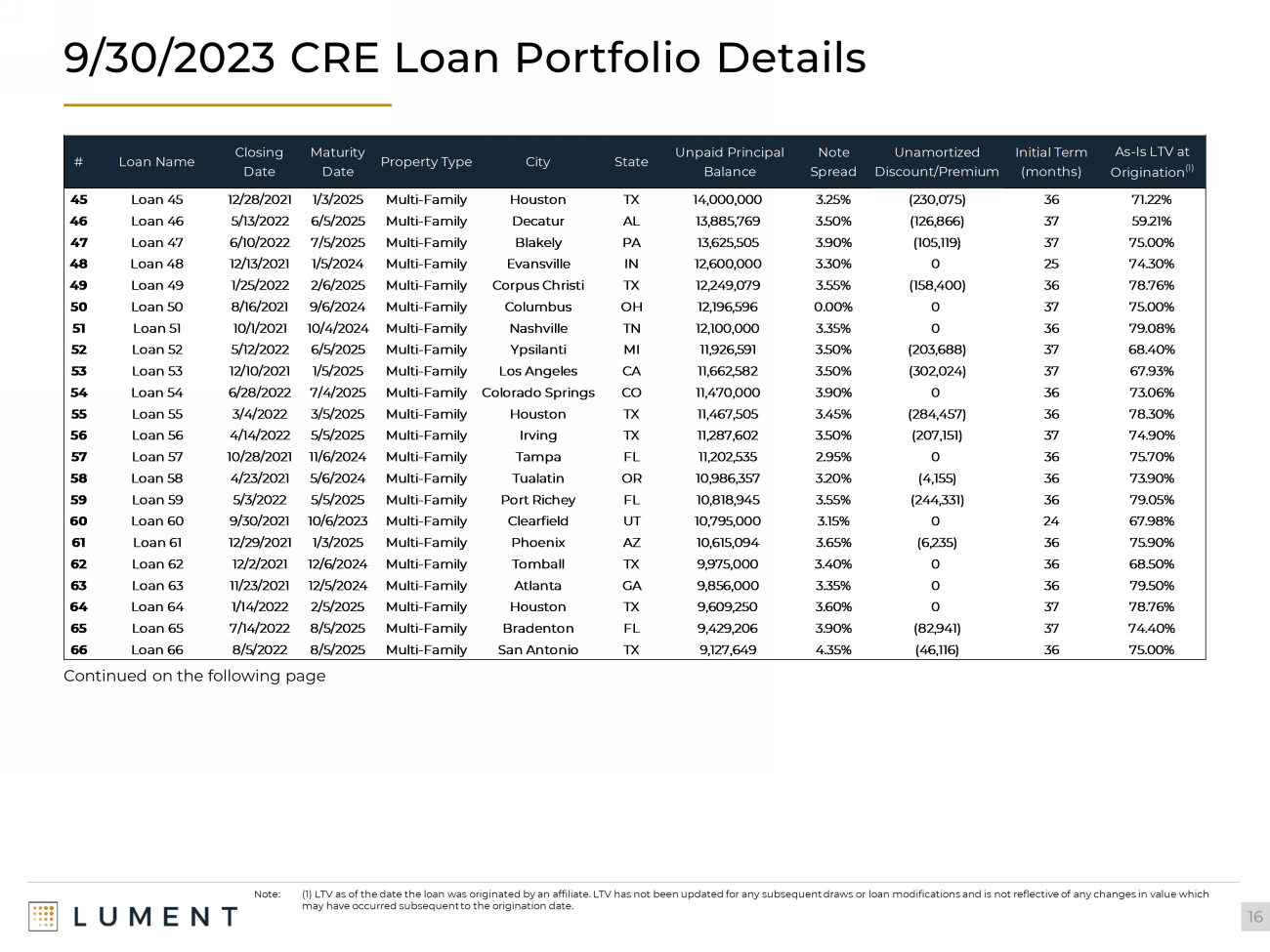

9/30/2023 CRE Loan Portfolio Details 16 Continued on the following page Note: (1) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date. # Loan Name Closing Date Maturity Date Property Type City State Unpaid Principal Balance Note Spread Unamortized Discount/Premium Initial Term (months) As-Is LTV at Origination (1) 45 Loan 45 12/28/2021 1/3/2025 Multi-Family Houston TX 14,000,000 3.25% (230,075) 36 71.22% 46 Loan 46 5/13/2022 6/5/2025 Multi-Family Decatur AL 13,885,769 3.50% (126,866) 37 59.21% 47 Loan 47 6/10/2022 7/5/2025 Multi-Family Blakely PA 13,625,505 3.90% (105,119) 37 75.00% 48 Loan 48 12/13/2021 1/5/2024 Multi-Family Evansville IN 12,600,000 3.30% 0 25 74.30% 49 Loan 49 1/25/2022 2/6/2025 Multi-Family Corpus Christi TX 12,249,079 3.55% (158,400) 36 78.76% 50 Loan 50 8/16/2021 9/6/2024 Multi-Family Columbus OH 12,196,596 0.00% 0 37 75.00% 51 Loan 51 10/1/2021 10/4/2024 Multi-Family Nashville TN 12,100,000 3.35% 0 36 79.08% 52 Loan 52 5/12/2022 6/5/2025 Multi-Family Ypsilanti MI 11,926,591 3.50% (203,688) 37 68.40% 53 Loan 53 12/10/2021 1/5/2025 Multi-Family Los Angeles CA 11,662,582 3.50% (302,024) 37 67.93% 54 Loan 54 6/28/2022 7/4/2025 Multi-Family Colorado Springs CO 11,470,000 3.90% 0 36 73.06% 55 Loan 55 3/4/2022 3/5/2025 Multi-Family Houston TX 11,467,505 3.45% (284,457) 36 78.30% 56 Loan 56 4/14/2022 5/5/2025 Multi-Family Irving TX 11,287,602 3.50% (207,151) 37 74.90% 57 Loan 57 10/28/2021 11/6/2024 Multi-Family Tampa FL 11,202,535 2.95% 0 36 75.70% 58 Loan 58 4/23/2021 5/6/2024 Multi-Family Tualatin OR 10,986,357 3.20% (4,155) 36 73.90% 59 Loan 59 5/3/2022 5/5/2025 Multi-Family Port Richey FL 10,818,945 3.55% (244,331) 36 79.05% 60 Loan 60 9/30/2021 10/6/2023 Multi-Family Clearfield UT 10,795,000 3.15% 0 24 67.98% 61 Loan 61 12/29/2021 1/3/2025 Multi-Family Phoenix AZ 10,615,094 3.65% (6,235) 36 75.90% 62 Loan 62 12/2/2021 12/6/2024 Multi-Family Tomball TX 9,975,000 3.40% 0 36 68.50% 63 Loan 63 11/23/2021 12/5/2024 Multi-Family Atlanta GA 9,856,000 3.35% 0 36 79.50% 64 Loan 64 1/14/2022 2/5/2025 Multi-Family Houston TX 9,609,250 3.60% 0 37 78.76% 65 Loan 65 7/14/2022 8/5/2025 Multi-Family Bradenton FL 9,429,206 3.90% (82,941) 37 74.40% 66 Loan 66 8/5/2022 8/5/2025 Multi-Family San Antonio TX 9,127,649 4.35% (46,116) 36 75.00%

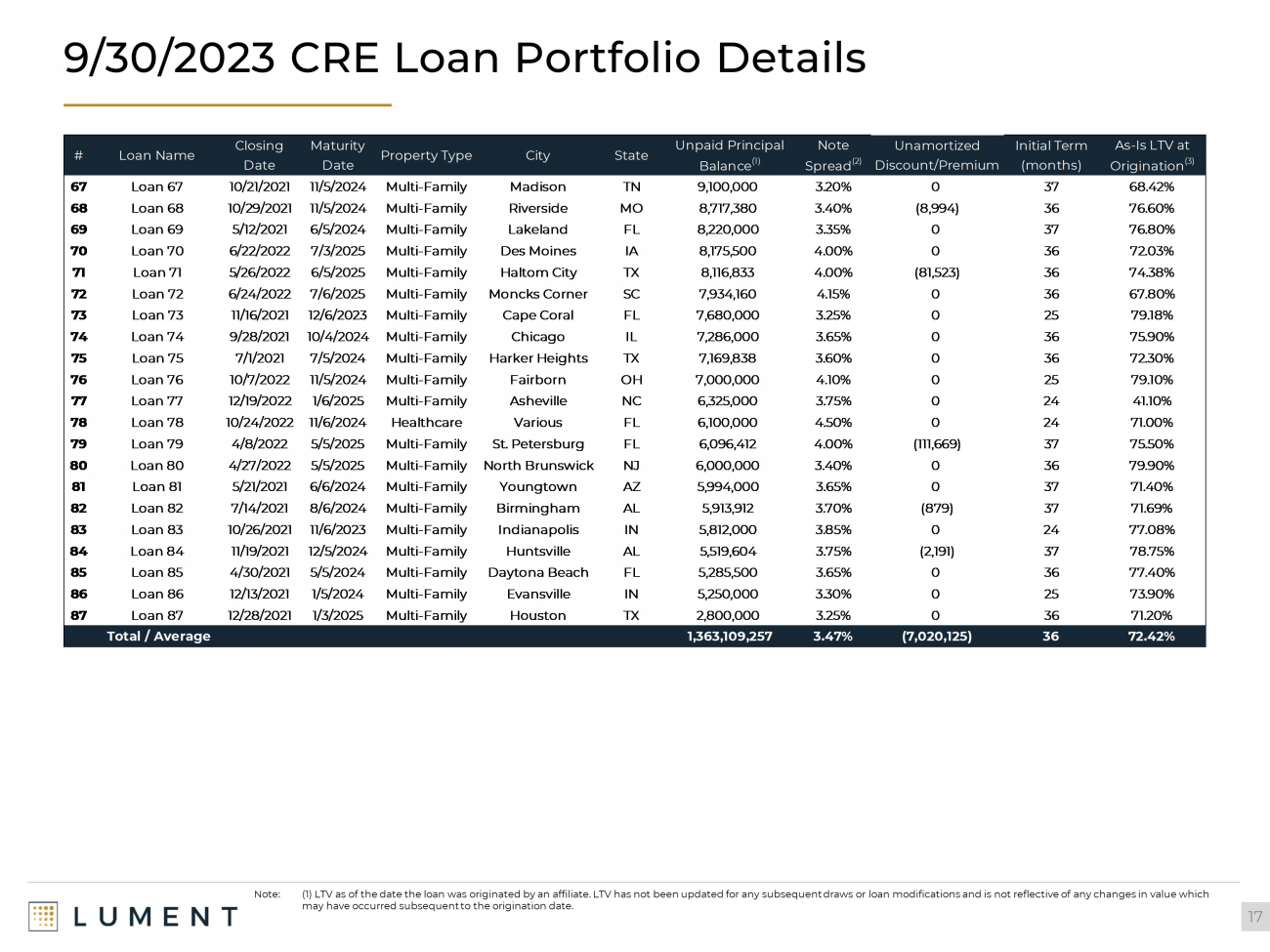

9/30/2023 CRE Loan Portfolio Details 17 Note: (1) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date. # Loan Name Closing Date Maturity Date Property Type City State Unpaid Principal Balance (1) Note Spread (2) Unamortized Discount/Premium Initial Term (months) As-Is LTV at Origination (3) 67 Loan 67 10/21/2021 11/5/2024 Multi-Family Madison TN 9,100,000 3.20% 0 37 68.42% 68 Loan 68 10/29/2021 11/5/2024 Multi-Family Riverside MO 8,717,380 3.40% (8,994) 36 76.60% 69 Loan 69 5/12/2021 6/5/2024 Multi-Family Lakeland FL 8,220,000 3.35% 0 37 76.80% 70 Loan 70 6/22/2022 7/3/2025 Multi-Family Des Moines IA 8,175,500 4.00% 0 36 72.03% 71 Loan 71 5/26/2022 6/5/2025 Multi-Family Haltom City TX 8,116,833 4.00% (81,523) 36 74.38% 72 Loan 72 6/24/2022 7/6/2025 Multi-Family Moncks Corner SC 7,934,160 4.15% 0 36 67.80% 73 Loan 73 11/16/2021 12/6/2023 Multi-Family Cape Coral FL 7,680,000 3.25% 0 25 79.18% 74 Loan 74 9/28/2021 10/4/2024 Multi-Family Chicago IL 7,286,000 3.65% 0 36 75.90% 75 Loan 75 7/1/2021 7/5/2024 Multi-Family Harker Heights TX 7,169,838 3.60% 0 36 72.30% 76 Loan 76 10/7/2022 11/5/2024 Multi-Family Fairborn OH 7,000,000 4.10% 0 25 79.10% 77 Loan 77 12/19/2022 1/6/2025 Multi-Family Asheville NC 6,325,000 3.75% 0 24 41.10% 78 Loan 78 10/24/2022 11/6/2024 Healthcare Various FL 6,100,000 4.50% 0 24 71.00% 79 Loan 79 4/8/2022 5/5/2025 Multi-Family St. Petersburg FL 6,096,412 4.00% (111,669) 37 75.50% 80 Loan 80 4/27/2022 5/5/2025 Multi-Family North Brunswick NJ 6,000,000 3.40% 0 36 79.90% 81 Loan 81 5/21/2021 6/6/2024 Multi-Family Youngtown AZ 5,994,000 3.65% 0 37 71.40% 82 Loan 82 7/14/2021 8/6/2024 Multi-Family Birmingham AL 5,913,912 3.70% (879) 37 71.69% 83 Loan 83 10/26/2021 11/6/2023 Multi-Family Indianapolis IN 5,812,000 3.85% 0 24 77.08% 84 Loan 84 11/19/2021 12/5/2024 Multi-Family Huntsville AL 5,519,604 3.75% (2,191) 37 78.75% 85 Loan 85 4/30/2021 5/5/2024 Multi-Family Daytona Beach FL 5,285,500 3.65% 0 36 77.40% 86 Loan 86 12/13/2021 1/5/2024 Multi-Family Evansville IN 5,250,000 3.30% 0 25 73.90% 87 Loan 87 12/28/2021 1/3/2025 Multi-Family Houston TX 2,800,000 3.25% 0 36 71.20% Total / Average 1,363,109,257 3.47% (7,020,125) 36 72.42%

Consolidated Balance Sheets 18

Consolidated Statement of Income 19

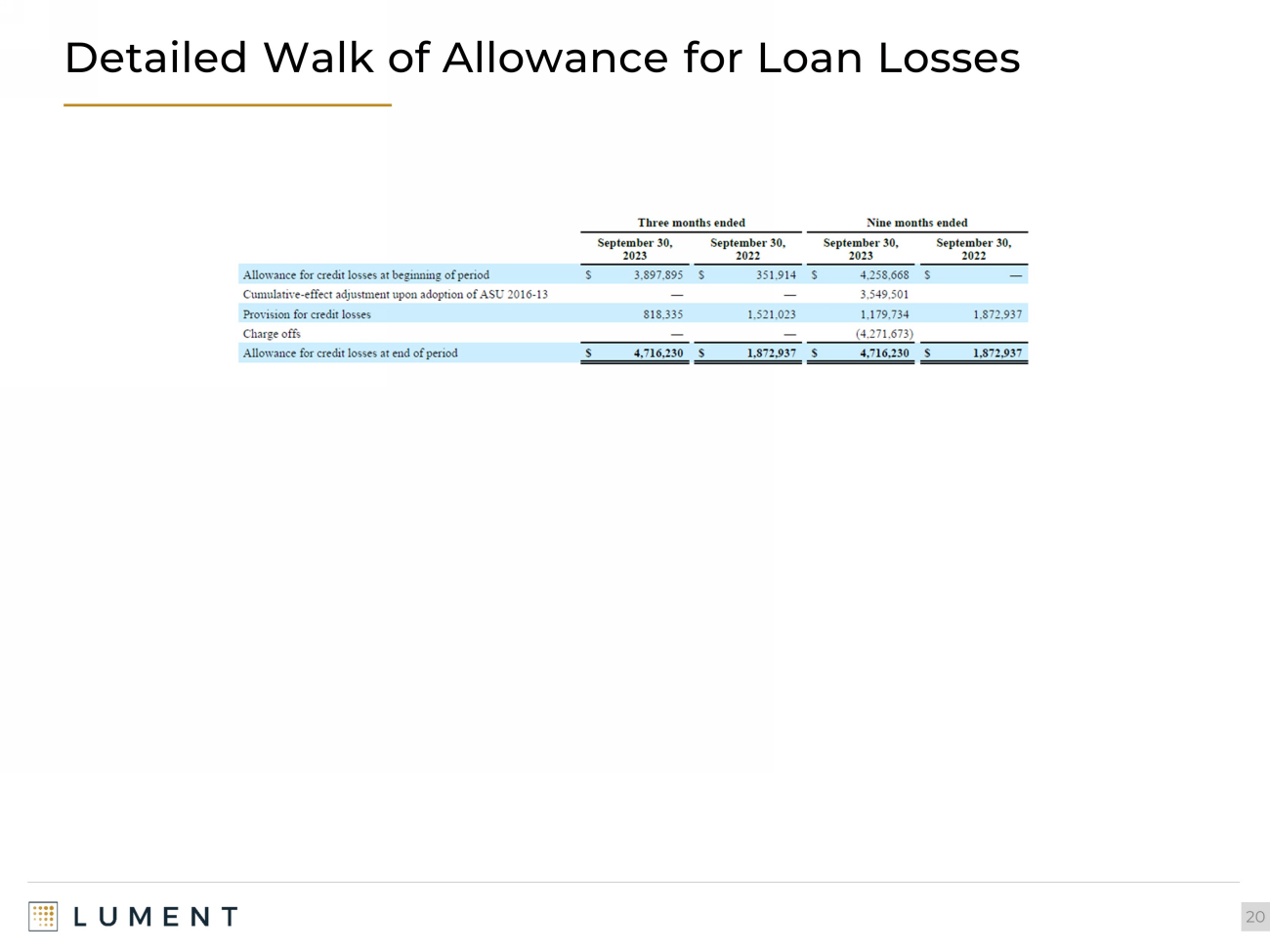

Detailed Walk of Allowance for Loan Losses 20

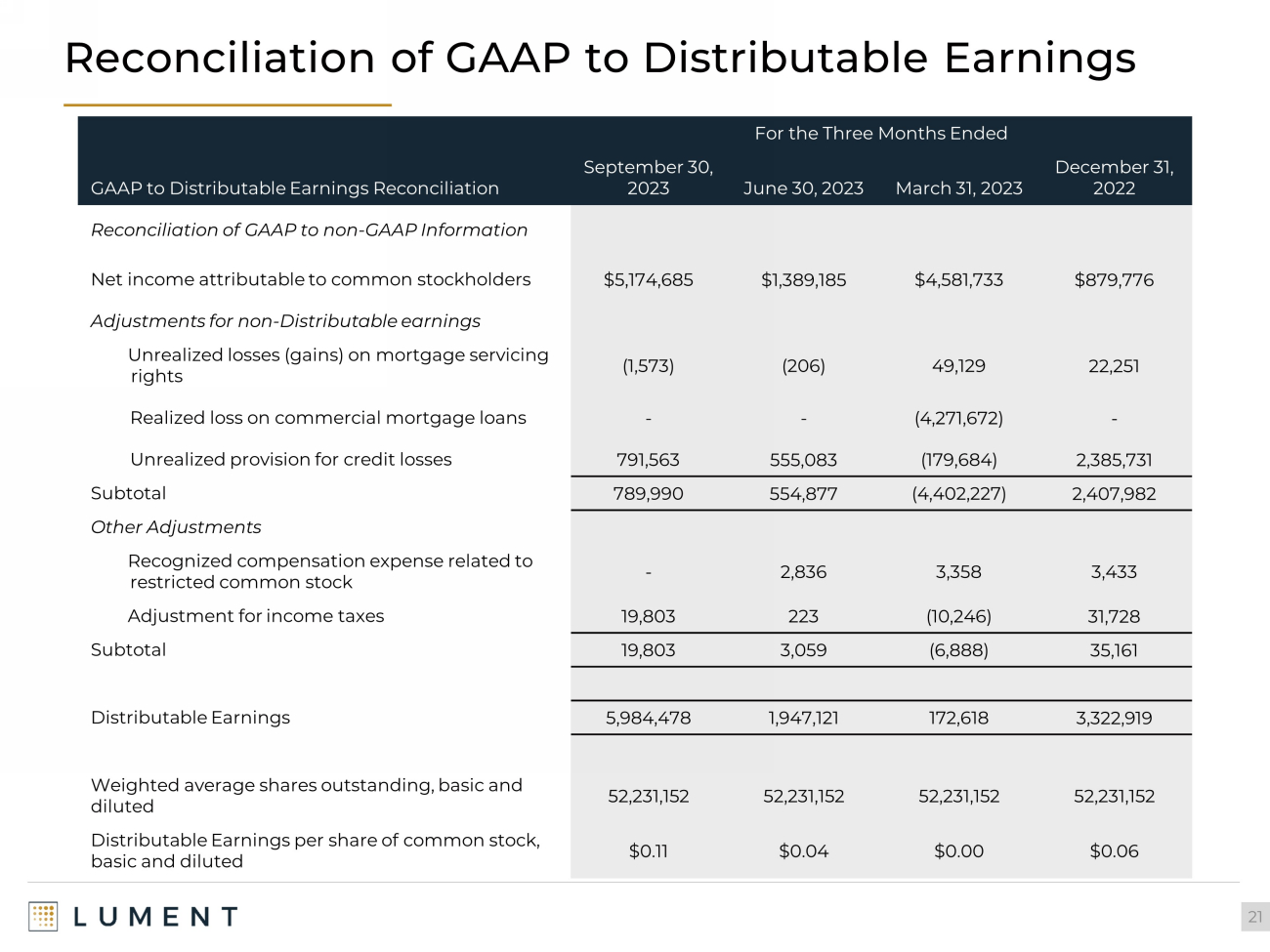

Reconciliation of GAAP to Distributable Earnings 21 For the Three Months Ended GAAP to Distributable Earnings Reconciliation September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Reconciliation of GAAP to non - GAAP Information Net income attributable to common stockholders $5,174,685 $1,389,185 $4,581,733 $879,776 Adjustments for non - Distributable earnings Unrealized losses (gains) on mortgage servicing rights (1,573) (206) 49,129 22,251 Realized loss on commercial mortgage loans - - (4,271,672) - Unrealized provision for credit losses 791,563 555,083 (179,684) 2,385,731 Subtotal 789,990 554,877 (4,402,227) 2,407,982 Other Adjustments Recognized compensation expense related to restricted common stock - 2,836 3,358 3,433 Adjustment for income taxes 19,803 223 (10,246) 31,728 Subtotal 19,803 3,059 (6,888) 35,161 Distributable Earnings 5,984,478 1,947,121 172,618 3,322,919 Weighted average shares outstanding, b asic and diluted 52,231,152 52,231,152 52,231,152 52,231,152 Distributable Earnings per share of common stock , b asic and diluted $0.11 $0.04 $0.00 $0.06

Detailed Walk of Capitalization as of 9/30/2023 22 (in 000's) 9/30/2023 Total GAAP liabilities and stockholders' equity $1,443,232 Adjustments for Capitalization ( - ) Accrued interest payable (3,833) ( - ) Dividends payable (4,657) ( - ) Fees and expenses payable to Manager (1,364) ( - ) Other accounts payable and accrued expenses (407) ( + ) Other capitalized financing & issuance costs 6,725 LFT Capitalization $1,439,696

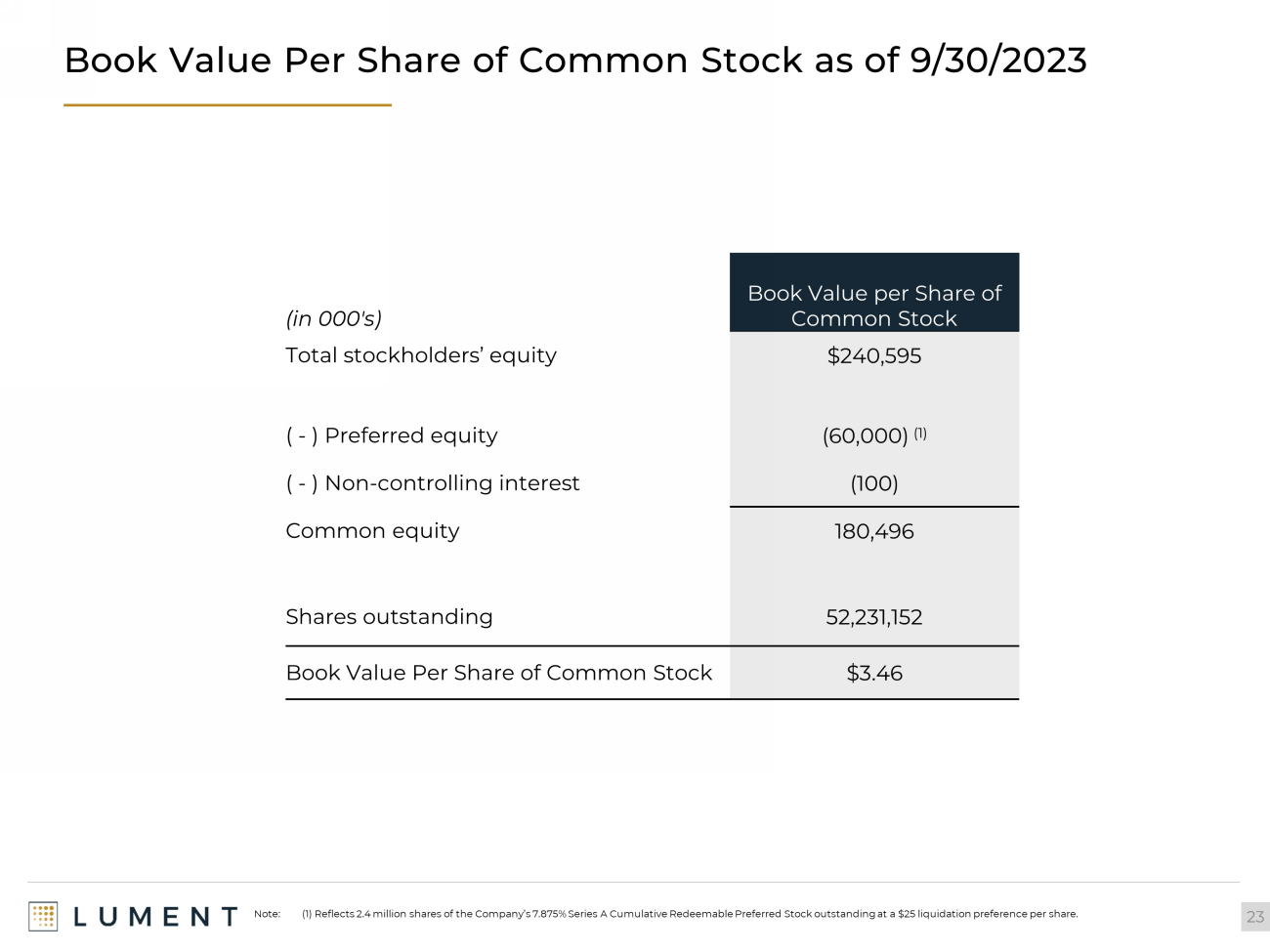

Book Value Per Share of Common Stock as of 9/30/2023 23 (in 000's) Book Value per Share of Common Stock Total stockholders’ equity $240,595 ( - ) Preferred equity (60,000) (1) ( - ) Non - controlling interest (100) Common equity 180,496 Shares outstanding 52,231,152 Book Value Per Share of Common Stock $3.46 Note: (1) Reflects 2.4 million shares of the Company’s 7.875% Series A Cumulative Redeemable Preferred Stock outstanding at a $ 25 liquidation preference per share.

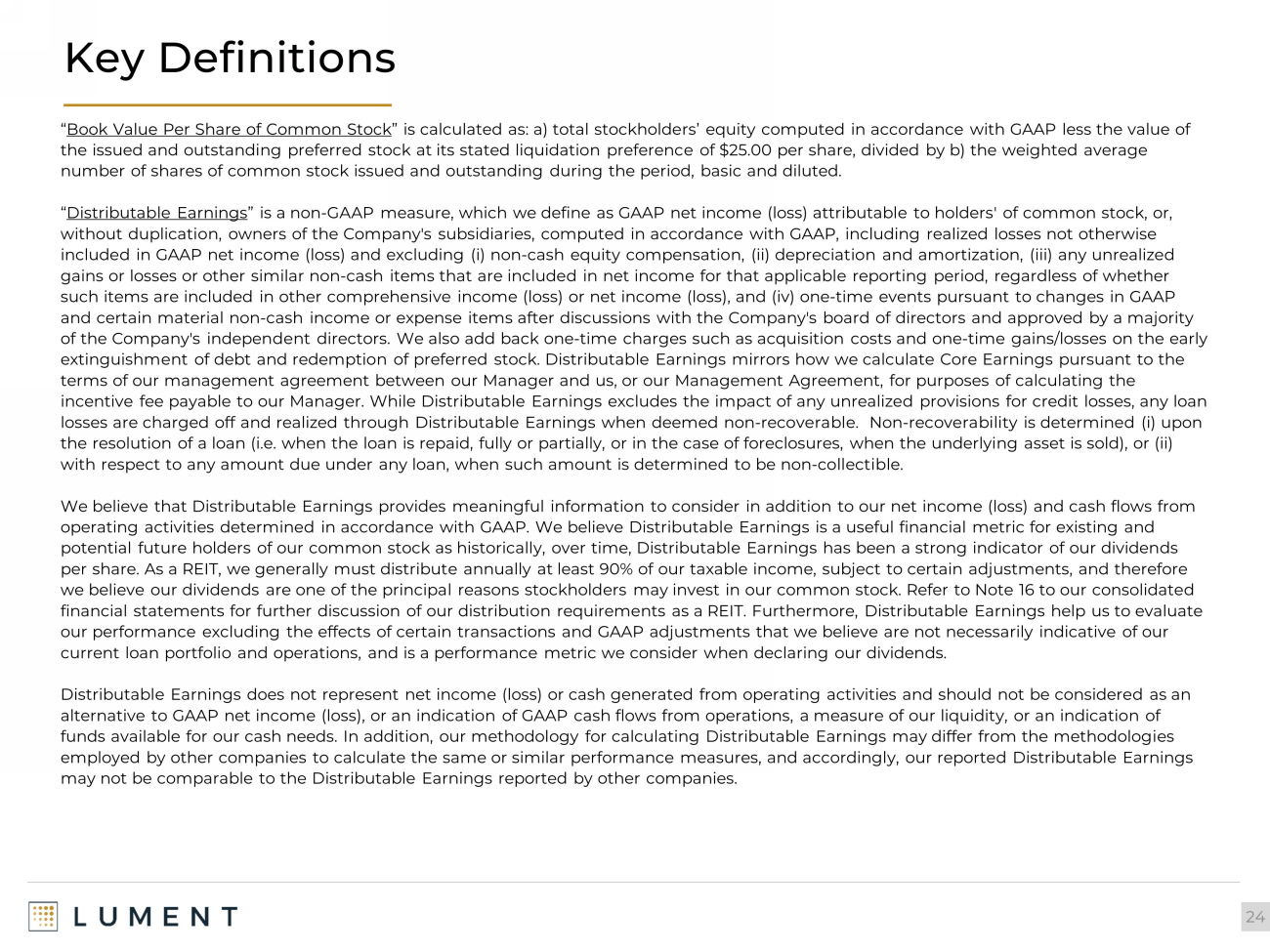

Key Definitions 24 “ Book Value Per Share of Common Stock ” is calculated as: a) total stockholders’ equity computed in accordance with GAAP less the value of the issued and outstanding preferred stock at its stated liquidation preference of $25.00 per share, divided by b) the weight ed average number of shares of common stock issued and outstanding during the period, basic and diluted. “ Distributable Earnings ” is a non - GAAP measure, which we define as GAAP net income (loss) attributable to holders' of common stock, or, without duplication, owners of the Company's subsidiaries, computed in accordance with GAAP, including realized losses not ot her wise included in GAAP net income (loss) and excluding ( i ) non - cash equity compensation, (ii) depreciation and amortization, (iii) any unrealized gains or losses or other similar non - cash items that are included in net income for that applicable reporting period, regardless of whether such items are included in other comprehensive income (loss) or net income (loss), and (iv) one - time events pursuant to changes in GAAP and certain material non - cash income or expense items after discussions with the Company's board of directors and approved by a majority of the Company's independent directors. We also add back one - time charges such as acquisition costs and one - time gains/losses on the early extinguishment of debt and redemption of preferred stock. Distributable Earnings mirrors how we calculate Core Earnings pursu ant to the terms of our management agreement between our Manager and us, or our Management Agreement, for purposes of calculating the incentive fee payable to our Manager. While Distributable Earnings excludes the impact of any unrealized provisions for credi t l osses, any loan losses are charged off and realized through Distributable Earnings when deemed non - recoverable. Non - recoverability is determine d ( i ) upon the resolution of a loan (i.e. when the loan is repaid, fully or partially, or in the case of foreclosures, when the underlyi ng asset is sold), or (ii) with respect to any amount due under any loan, when such amount is determined to be non - collectible. We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (loss) and c ash flows from operating activities determined in accordance with GAAP. We believe Distributable Earnings is a useful financial metric for e xis ting and potential future holders of our common stock as historically, over time, Distributable Earnings has been a strong indicator o f o ur dividends per share. As a REIT, we generally must distribute annually at least 90% of our taxable income, subject to certain adjustment s, and therefore we believe our dividends are one of the principal reasons stockholders may invest in our common stock. Refer to Note 16 to ou r c onsolidated financial statements for further discussion of our distribution requirements as a REIT. Furthermore, Distributable Earnings h elp us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indica tiv e of our current loan portfolio and operations, and is a performance metric we consider when declaring our dividends. Distributable Earnings does not represent net income (loss) or cash generated from operating activities and should not be con sid ered as an alternative to GAAP net income (loss), or an indication of GAAP cash flows from operations, a measure of our liquidity, or an in dication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the m eth odologies employed by other companies to calculate the same or similar performance measures, and accordingly, our reported Distributabl e E arnings may not be comparable to the Distributable Earnings reported by other companies.

November 2023

v3.23.3

Cover

|

Nov. 13, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity File Number |

001-35845

|

| Entity Registrant Name |

LUMENT FINANCE TRUST, INC.

|

| Entity Central Index Key |

0001547546

|

| Entity Tax Identification Number |

45-4966519

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

230 Park Avenue

|

| Entity Address, Address Line Two |

20th

Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10169

|

| City Area Code |

212

|

| Local Phone Number |

317-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

LFT

|

| Security Exchange Name |

NYSE

|

| Redeemable Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.875% Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

LFTPrA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Lument Finance (NYSE:LFT-A)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

Lument Finance (NYSE:LFT-A)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024