Current Report Filing (8-k)

06 4월 2022 - 5:17AM

Edgar (US Regulatory)

0001677576

false

0001677576

2022-04-01

2022-04-01

0001677576

us-gaap:CommonStockMember

2022-04-01

2022-04-01

0001677576

us-gaap:SeriesAPreferredStockMember

2022-04-01

2022-04-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d)

of the Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): April 1, 2022

Innovative Industrial

Properties, Inc.

(Exact name

of registrant as specified in its charter)

| Maryland |

|

001-37949 |

|

81-2963381 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

1389 Center

Drive, Suite 200

Park City, Utah

84098

(Address of

principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (858) 997-3332

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities Registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IIPR |

|

New York Stock Exchange |

| Series A Preferred Stock, par value $0.001 per share |

|

IIPR-PA |

|

New York Stock Exchange |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On April 1, 2022, Innovative

Industrial Properties, Inc. (the “Company”) and IIP Operating Partnership, LP, a Delaware limited partnership (the “Operating

Partnership”), entered into an underwriting agreement (the “Underwriting Agreement”) with BTIG, LLC, as representative

of the several underwriters named therein (collectively, the “Underwriters”), pursuant to which the Company agreed to issue

and sell to the Underwriters 1,578,948 shares of the Company’s common stock, par value $0.001 per share (“Common Stock”),

at a price to the public of $190.00 per share. The offering closed on April 5, 2022.

Pursuant

to the terms of the Underwriting Agreement, the Underwriters were granted a 30-day option to purchase up to an additional 236,842

shares of Common Stock. On April 4, 2022, the Underwriters exercised the option to purchase the additional shares in full. The

offering of the additional shares is expected to close on April 6, 2022.

Gross proceeds from the

sale of Common Stock in the offering were approximately $300.0 million, and upon closing of the offering of the additional shares,

is expected to be approximately $345.0 million in aggregate.

Under the terms of the

Underwriting Agreement, the Company and the Operating Partnership have agreed to jointly and severally indemnify the Underwriters against

certain liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”), the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and other federal or state statutory laws or regulations. The Underwriting

Agreement contains customary representations, warranties, covenants, obligations of the parties and termination provisions. The Underwriting

Agreement is filed as Exhibit 1.1 to this Current Report on Form 8-K and the description of the Underwriting Agreement contained herein

is qualified in its entirety by reference to such exhibit.

The offering is being

conducted pursuant to the Company’s Registration Statement on Form S-3 (File No. 333-262320). The offering was made pursuant to

the prospectus supplement, dated April 1, 2022, and the accompanying prospectus, dated January 24, 2022, filed with the Securities and

Exchange Commission pursuant to Rule 424(b) of the Securities Act.

A copy of the opinion

of Foley & Lardner LLP relating to the legality of the issuance and sale of the Common Stock is attached to this Current Report on

Form 8-K as Exhibit 5.1. A copy of the opinion of Foley & Lardner LLP with respect to certain tax matters is attached to this Current

Report on Form 8-K as Exhibit 8.1.

Item 7.01 Regulation FD Disclosure.

On March 31, 2022, the

Company issued a press release announcing the commencement of the offering; and on April 1, 2022, the Company issued a press release announcing

the pricing of the offering, copies of which are attached hereto as Exhibits 99.1 and 99.2, respectively.

The information contained

in Item 7.01 of this report, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for

purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. Such information shall not be

incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation

language in such filing.

Item 9.01. Financial Statements

and Exhibits.

| |

|

|

|

Exhibit

|

|

Description

of Exhibit

|

| 1.1 |

|

Underwriting Agreement, dated as of April 1, 2022, between Innovative Industrial Properties, Inc., IIP Operating Partnership, LP and BTIG, LLC, as representative of the several Underwriters. |

| 5.1 |

|

Opinion of Foley & Lardner LLP (including consent of such firm). |

| 8.1 |

|

Opinion of Foley & Lardner LLP regarding certain tax matters (including consent of such firm). |

| 23.1 |

|

Consent of Foley & Lardner LLP (included in Exhibit 5.1). |

| 23.2 |

|

Consent of Foley & Lardner LLP (included in Exhibit 8.1). |

| 99.1 |

|

Press release issued

by Innovative Industrial Properties, Inc. on March 31, 2022. |

| 99.2 |

|

Press release issued

by Innovative Industrial Properties, Inc. on April 1, 2022. |

| 104 |

|

Cover Page Interactive

Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: April 5, 2022 |

INNOVATIVE INDUSTRIAL PROPERTIES, INC. |

| |

|

|

| |

By: |

/s/ Catherine Hastings |

| |

Name: |

Catherine Hastings |

| |

Title: |

Chief Financial Officer |

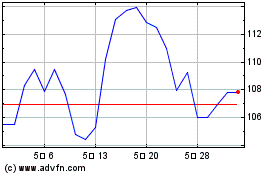

Innovative Industrial Pr... (NYSE:IIPR)

과거 데이터 주식 차트

부터 6월(6) 2024 으로 7월(7) 2024

Innovative Industrial Pr... (NYSE:IIPR)

과거 데이터 주식 차트

부터 7월(7) 2023 으로 7월(7) 2024