As filed with the Securities and Exchange Commission on March 10, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM S-8

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

________________

PRELUDE THERAPEUTICS INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

81-1384762 |

(State or other jurisdiction of |

|

(I.R.S. Employer |

incorporation or organization) |

|

Identification Number) |

|

|

|

175 Innovation Boulevard Wilmington, Delaware |

|

19805 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

|

|

2020 Equity Incentive Plan 2020 Employee Stock Purchase Plan |

|

|

(Full title of the plans) |

|

|

|

|

|

Krishna Vaddi, Ph.D. Chief Executive Officer Prelude Therapeutics Incorporated 175 Innovation Boulevard Wilmington, Delaware 19805 |

|

|

(Name and address of agent for service) |

|

|

|

|

|

(302) 467-1280 |

|

|

(Telephone number, including area code, of agent for service) |

|

|

|

|

|

Copies of correspondence to: Celia A. Soehner Morgan, Lewis & Bockius LLP One Oxford Centre, Thirty-Second Floor Pittsburgh, PA 15219-6401 (412) 560-3300 |

|

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

REGISTRATION OF ADDITIONAL SHARES

PURSUANT TO GENERAL INSTRUCTION E

Prelude Therapeutics Incorporated (the “Registrant”) is filing this Registration Statement with the Securities and Exchange Commission (the “Commission”) to register the offer and sale of (a) 2,757,455 additional shares of the Registrant's common stock, par value $0.0001 per share (the “Common Stock”) available for issuance under the Registrant’s 2020 Equity Incentive Plan (“2020 EIP”), pursuant to the provision of the 2020 EIP providing for an annual 5% automatic increase in the number of shares reserved for issuance and (b) 551,491 additional shares of Common Stock available for issuance under the Registrant’s 2020 Employee Stock Purchase Plan (“2020 ESPP”), pursuant to the provision of the 2020 ESPP providing for an annual 1% automatic increase in the number of shares reserved for issuance.

In accordance with General Instruction E of Form S-8, and only with respect to the Common Stock issuable under the 2020 EIP and 2020 ESPP, this Registration Statement hereby incorporates by reference the contents of the Registrant’s Registration Statement on Form S-8 filed with the Commission on September 25, 2020 (Registration No. 333-249032), March 16, 2021 (Registration No. 333-254349), March 17, 2022 (Registration No. 333-263642), March 15, 2023 (File No. 333-270549), and February 16, 2024 (File No. 333-277122) to the extent not superseded hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant with the Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are incorporated herein by reference:

(a) the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the Commission on March 10, 2025;

(b) our Current Reports on Form 8-K, filed with the Commission on February 5, 2025; and

(c) the description of the Common Stock contained in the Registrant’s registration statement on Form 8-A (File No. 001-39527) filed on September 16, 2020 under Section 12(b) of the Exchange Act, including any amendment or report filed for the purpose of updating such description, including Exhibit 4.5 of the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Commission on February 15, 2024 (File No. 001-39527).

All documents subsequently filed by the Registrant pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the filing of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing such documents, except that information furnished to the Commission under Item 2.02 or Item 7.01 in Current Reports on Form 8-K and any exhibit relating to such information, shall not be deemed to be incorporated by reference in this Registration Statement. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement.

Item 8. Exhibits.

The following exhibits are filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Wilmington, State of Delaware, on this 10th day of March, 2025.

PRELUDE THERAPEUTICS INCORPORATED

|

|

|

|

|

|

|

By: |

/s/ Krishna Vaddi |

|

|

Krishna Vaddi |

|

|

Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Krishna Vaddi and Bryant Lim, and each of them, as his or her true and lawful attorney-in-fact and agent with full power of substitution, for him or her in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement on Form S-8, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully for all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Title |

|

Date |

|

|

|

|

|

|

|

|

/s/ Krishna Vaddi Krishna Vaddi, Ph.D. |

|

Chief Executive Officer and Director (Principal Executive Officer) |

|

March 10, 2025 |

|

|

|

|

|

|

/s/ Bryant Lim Bryant Lim |

|

Chief Financial Officer (Principal Financial and Accounting Officer) |

|

March 10, 2025 |

|

|

|

|

|

|

|

/s/ Paul A. Friedman Paul A. Friedman, M.D. |

|

Director |

|

March 10, 2025 |

|

|

|

|

|

|

|

/s/ Martin Babler Martin Babler |

|

Director |

|

March 10, 2025 |

/s/ Julian Baker Julian Baker |

|

Director |

|

March 10, 2025 |

/s/ David Bonita David Bonita, M.D. |

|

Director |

|

March 10, 2025 |

/s/ Mardi C. Dier Mardi C. Dier |

|

Director |

|

March 10, 2025 |

/s/ Victor Sandor Victor Sandor, M.D.C.M. |

|

Director |

|

March 10, 2025 |

EXHIBIT 5.1

March 10, 2025

Prelude Therapeutics Incorporated

175 Innovation Boulevard

Wilmington, Delaware 19805

Re: Prelude Therapeutics Incorporated Registration Statement on Form S-8:

Prelude Therapeutics Incorporated 2020 Equity Incentive Plan and Prelude Therapeutics Incorporated 2020 Employee Stock Purchase Plan

Ladies and Gentlemen:

We have acted as counsel to Prelude Therapeutics Incorporated, a Delaware corporation (the “Company”), in connection with the Registration Statement on Form S-8 (the “Registration Statement”) to be filed with the Securities and Exchange Commission on the date hereof. The Registration Statement relates to the registration under the Securities Act of 1933, as amended (the “Act”), of an aggregate 3,308,946 shares (the “Shares”) of the Company’s Common Stock, $0.0001 par value per share (the “Common Stock”), including (i) 2,757,455 shares of Common Stock subject to issuance by the Company upon exercise or settlement of awards granted or to be granted under the Company’s 2020 Equity Incentive Plan (the “2020 EIP”) and (ii) 551,491 shares of Common Stock subject to issuance by the Company pursuant to purchase rights to acquire shares of Common Stock granted or to be granted under the Company’s 2020 Employee Stock Purchase Plan (the “ESPP”).

In connection with this opinion letter, we have examined the Registration Statement and originals, or copies certified or otherwise identified to our satisfaction, of (i) the Company’s Restated Certificate of Incorporation, (ii) the Company’s Amended and Restated Bylaws, (iii) the 2020 EIP, (iv) the ESPP and (v) such other documents, records and other instruments as we have deemed appropriate for the purposes of the opinion set forth herein.

We have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of the documents submitted to us as originals, the conformity with the originals of all documents submitted to us as certified, facsimile or photostatic copies and the authenticity of the originals of all documents submitted to us as copies.

Based upon the foregoing, we are of the opinion that the Shares have been duly authorized by the Company and, when issued and delivered by the Company in the manner and on the terms described in the 2020 EIP and ESPP, will be validly issued, fully paid and non-assessable.

The opinions expressed herein are limited to the General Corporation Law of the State of Delaware.

We hereby consent to the use of this opinion as Exhibit 5.1 to the Registration Statement. In giving such opinion, we do not thereby admit that we are acting within the category of persons whose consent is required under Section 7 of the Act or the rules or regulations of the Securities and Exchange Commission thereunder.

Very truly yours,

/s/ Morgan, Lewis & Bockius LLP

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the 2020 Equity Incentive Plan and to the 2020 Employee Stock Purchase Plan of Prelude Therapeutics Incorporated of our report dated March 10, 2025, with respect to the financial statements of Prelude Therapeutics Incorporated included in its Annual Report (Form 10-K) for the year ended December 31, 2024, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Philadelphia, Pennsylvania

March 10, 2025

Calculation Of Filing Fee Tables

Form S-8

Prelude Therapeutics Incorporated

(Exact Name of Registrant as specified in its Charter)

Newly Registered Securities

|

|

|

|

|

|

|

|

Security Type |

Security Class Title |

Fee Calculation Rule |

Amount Registered(1) |

Proposed Maximum Offering Price Per Unit |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee |

Equity |

Common stock, par value $0.0001 per share |

Rule 457(c) and Rule 457(h) |

2,757,455(2) |

$0.71(3) |

$1,957,794 |

0.00015310 |

$299.74 |

Equity |

Common stock, par value $0.0001 per share |

Rule 457(c) and Rule 457(h) |

551,491(4) |

$0.61(5) |

$336,410 |

0.00015310 |

$51.50 |

Total Offering Amounts |

|

|

|

$351.24 |

Total Fee Offsets(6) |

|

|

|

- |

Net Fee Due |

|

|

|

$351.24 |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common stock that becomes issuable pursuant to the provisions of the Registrant’s 2020 Equity Incentive Plan (“2020 EIP”) and 2020 Employee Stock Purchase Plan (“2020 ESPP”) by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the number of the Registrant’s outstanding shares of common stock.

(2) Represents additional shares of Common Stock to be registered and available for grant under the 2020 EIP resulting from the annual 5% automatic increase in the number of authorized shares available for issuance under the 2020 EIP.

(3) Estimated in accordance with Rules 457(c) and 457(h) of the Securities Act solely for the purpose of calculating the registration fee. The proposed maximum offering price per share of $0.71 was computed by averaging the high and low prices of a share of Registrant’s common stock as reported on The Nasdaq Stock Market LLC on March 4, 2025.

(4) Represents additional shares to be registered and available for grant under the 2020 ESPP resulting from the annual 1% automatic increase in the number of authorized shares available for issuance under the 2020 ESPP.

(5) Estimated in accordance with Rules 457(c) and 457(h) of the Securities Act solely for the purpose of calculating the registration fee. The proposed maximum offering price per share of $0.61 was computed by averaging the high and low prices of a share of Registrant’s common stock as reported on The Nasdaq Stock Market LLC on March 4, 2025, multiplied by 85%, which is the percentage of the trading price per share applicable to purchasers under the 2020 ESPP.

(6) The Registrant does not have any fee offsets.

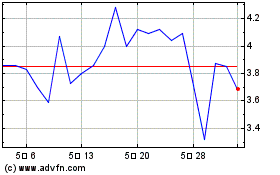

Prelude Therapeutics (NASDAQ:PRLD)

과거 데이터 주식 차트

부터 2월(2) 2025 으로 3월(3) 2025

Prelude Therapeutics (NASDAQ:PRLD)

과거 데이터 주식 차트

부터 3월(3) 2024 으로 3월(3) 2025