0001703057false00017030572024-02-202024-02-2000017030572023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________

FORM 8-K

__________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 20, 2024

__________________________________________

AbCellera Biologics Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

| | | | | | | | |

| British Columbia | 001-39781 | Not Applicable |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | | | | |

2215 Yukon Street Vancouver, BC | V5Y 0A1 |

| (Address of registrant’s principal executive office) | (Zip code) |

(604) 559-9005

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

__________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common shares | ABCL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On February 20, 2024, AbCellera Biologics Inc. (the “Company”), issued a press release announcing its financial and operational results for the year ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure

In connection with its earnings call on February 20, 2024, to discuss its results for the year ended December 31, 2023, the Company will utilize a corporate presentation, a copy of which is furnished herewith as Exhibit 99.2.

The information in Items 2.02 and 7.01 of this Form 8-K (including the exhibits attached hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall such information be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded as Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: February 20, 2024 | ABCELLERA BIOLOGICS INC. |

| | | |

| By: | /s/ Carl L. G. Hansen |

| | Carl L. G. Hansen, Ph.D. |

| | Chief Executive Officer and Director (Principal Executive Officer) |

NEWS RELEASE

AbCellera Reports Full Year 2023 Business Results

2/20/2024

●Total revenue of $38 million, compared to $485 million in FY 2022

●Total cumulative partner-initiated program starts with downstreams of 87, with 12 new starts in the year

●Net loss of $0.51 per share on a basic and diluted basis, compared to earnings of $0.56 (basic) and $0.50 (diluted) per share in 2022

VANCOUVER, British Columbia--(BUSINESS WIRE)-- AbCellera (Nasdaq: ABCL) today announced financial results for the full year 2023. All financial information in this press release is reported in U.S. dollars, unless otherwise indicated.

“In 2023 we began shifting capital allocation from building capabilities to using them, which includes advancement of our first internal programs and strategic partnerships,” said Carl Hansen, Ph.D., founder and CEO of AbCellera. “We are in the final stages of building our platform. We exited the year with approximately $1 billion in available liquidity and are well-positioned to execute on our strategy.”

FY 2023 Business Summary

●Earned $38.0 million in total revenue.

●Generated a net loss of $146.4 million, compared to net earnings of $158.5 million in 2022.

●Reached a cumulative total of 87 partner-initiated program starts with downstreams.

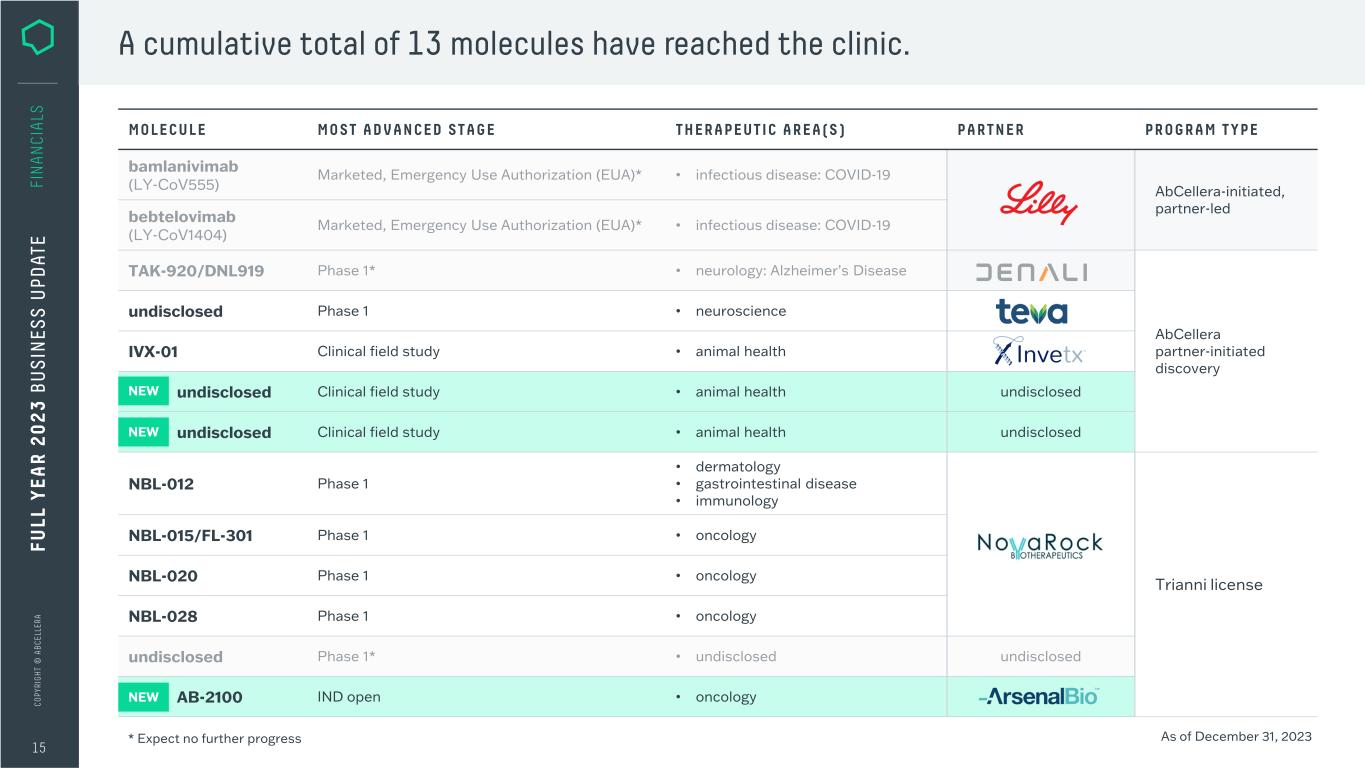

●Reporting the advancement of five additional molecules in the clinic, bringing the cumulative total to thirteen molecules to have reached the clinic.

●Advanced two AbCellera-led programs into IND-enabling studies.

Key Business Metrics

| | | | | | | | | | | | | | |

| Cumulative Metrics | | December 31, 2022 | | December 31, 2023 | | Change % |

| Number of discovery partners | | 40 | | 46 | | 15 | % |

| Programs under contract | | 174 | | 203 | | 17 | % |

| Partner-initiated program starts with downstreams* | | 75 | | 87 | | 16 | % |

| Molecules in the clinic | | 8 | | 13 | | 63 | % |

* Metric adjusted from prior reporting

AbCellera reached a cumulative total of 203 programs under contract (up from 174 on December 31, 2022) that are either completed, in progress, or under contract with 46 different partners as of December 31, 2023 (up from 40 on December 31, 2022). AbCellera started discovery on an additional twelve partner-initiated programs with downstreams to reach a cumulative total of 87 partner-initiated program starts with downstreams in 2023 (up from 75 on December 31, 2022). AbCellera’s partners have advanced a cumulative total of thirteen molecules into the clinic (up from eight on December 31, 2022).

Discussion of FY 2023 Financial Results

●Revenue – Total revenue was $38.0 million, compared to $485.4 million in 2022. The partnership business generated research fees of $35.6 million, compared to $40.8 million in 2022. Licensing revenue was $1.0 million.

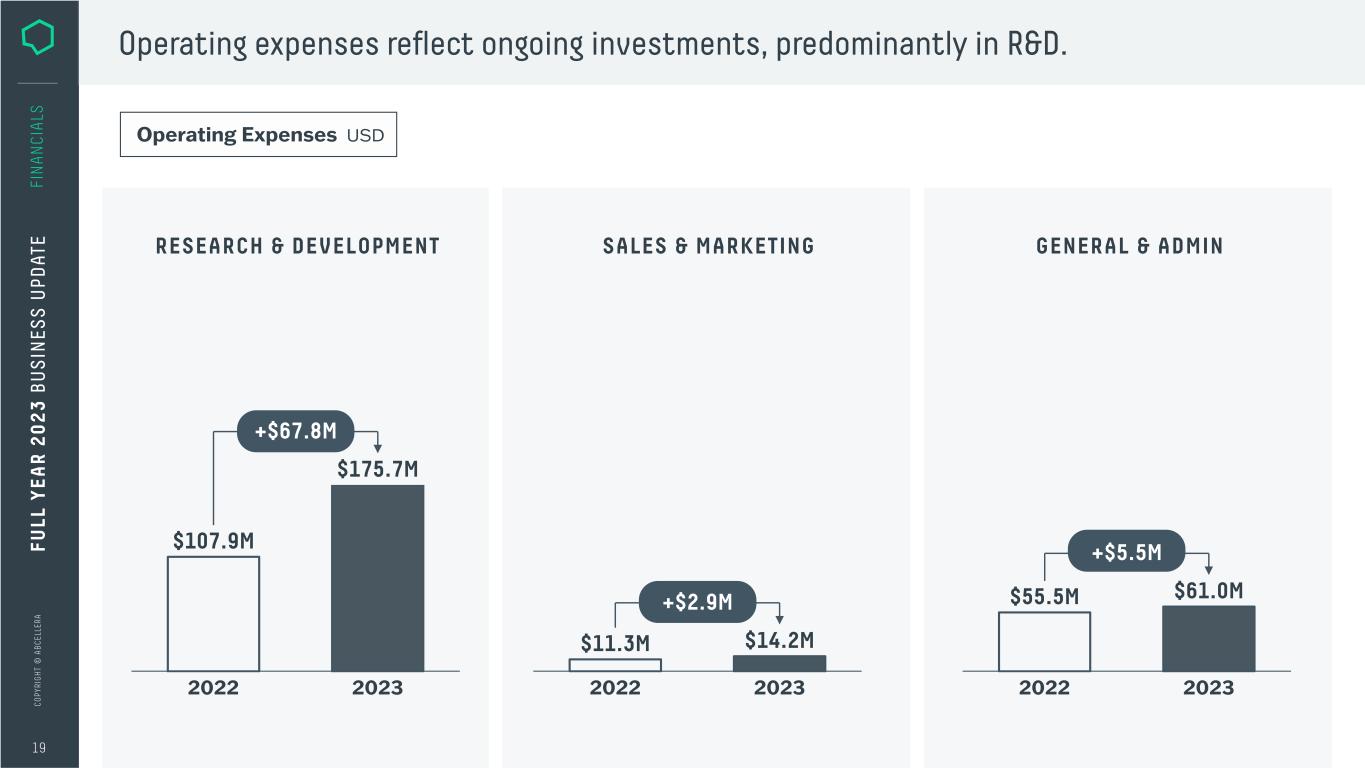

●Research & Development (R&D) Expenses – R&D expenses were $175.7 million, compared to $107.9 million in 2022, reflecting growth in program execution, platform development, and investments in internal programs.

●Sales & Marketing (S&M) Expenses – S&M expenses were $14.2 million, compared to $11.3 million in 2022.

●General & Administrative (G&A) Expenses – G&A expenses were $61.0 million, compared to $55.5 million in 2022.

●Net Loss – Net loss of $146.4 million, or $(0.51) per share on a basic and diluted basis, compared to net earnings of $158.5 million, or $0.56 and $0.50 per share on a basic and diluted basis, respectively, in 2022.

●Liquidity – $787.9 million of total cash, cash equivalents, and marketable securities, including restricted cash.

Q4 Highlights and Financial Results

•Advanced two internal programs into IND-enabling studies, ABCL635 and ABCL575.

•Started three partner-initiated programs with downstreams.

•Reporting the advancement of three additional molecules by partners into the clinic.

Revenue for the fourth quarter of 2023 was $9.2 million, representing 24% of total revenue for 2023. $8.7 million was generated from research fees, representing 25% of the total research fees for 2023.

Operating expenses totaled $75.2 million in the fourth quarter, or 27% of the total for 2023, and included investments made in co-development and internal programs.

The net loss for the fourth quarter was $47.2 million, or $(0.16) per share, on a basic and diluted basis.

Conference Call and Webcast

AbCellera will host a conference call and live webcast to discuss these results today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

The live webcast of the earnings conference call can be accessed on the Events and Presentations section of AbCellera’s Investor Relations website. A replay of the webcast will be available through the same link following the conference call.

About AbCellera Biologics Inc.

AbCellera is breaking the barriers of conventional antibody discovery to bring better medicines to patients, sooner. AbCellera’s engine integrates expert teams, technology, and facilities with the data science and automation needed to propel antibody-based medicines from target to clinic in nearly every therapeutic area with precision and speed. AbCellera provides innovative biotechs and leading pharmaceutical companies with a competitive advantage that empowers them to move quickly, reduce cost, and tackle the toughest problems in drug development. For more information, please visit www.abcellera.com.

Definition of Key Business Metrics

We regularly review the following key business metrics to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections, and make strategic decisions. We believe that the following metrics are important to understand our current business. These metrics may change or may be substituted for additional or different metrics as our business develops. Information on changes is set forth in our Annual Report on Form 10-K for the year ended December 31, 2023.

Number of discovery partners represents the unique number of partners with whom we have executed partnership contracts. We view this metric as an indication of the competitiveness of our engine and our level of market penetration. The metric also relates to our opportunities to secure programs under contract.

Programs under contract represent the number of antibody development programs that are under contract for delivery of discovery research activities. A program under contract is counted when a contract is executed with a partner under which we commit to discover or deliver antibodies against one selected target. A target is any relevant antigen for which a partner seeks our support in developing binding antibodies. We view this metric as an indication of commercial success and technological competitiveness. It further relates to revenue from access fees. The cumulative number of programs under contract with downstream participation is related to our ability to generate future revenue from milestone payments and royalties.

Partner-initiated program starts with downstreams represent the number of unique partner-initiated programs where we stand to participate financially in downstream success for which we have commenced the discovery effort. The discovery effort commences on the later of (i) the day on which we receive sufficient reagents to start discovery of antibodies against a target and (ii) the day on which the kick-off meeting for the program is held. We view this metric as an indication of the selection and initiation of projects by our partners and the resulting potential for near-term payments. Cumulatively, partner-initiated program starts with downstream participation indicate our total opportunities to earn downstream revenue from milestone fees and royalties (or royalty equivalents) in the mid- to long-term.

Molecules in the clinic represent the count of unique molecules for which an Investigational New Drug, or IND, New Animal Drug, or equivalent under other regulatory regimes, application has reached "open" status or has otherwise been approved based on an antibody that was discovered either by us or by a partner using licensed AbCellera technology. Where the date of such application approval is not known to us, the date of the first public announcement of a

clinical trial will be used for the purpose of this metric. We view this metric as an indication of our near- and mid-term potential revenue from milestone fees and potential royalty payments in the long term.

AbCellera Forward-Looking Statements

This press release contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. All statements contained in this release other than statements of historical fact are forward-looking statements, including statements regarding our ability to develop, commercialize and achieve market acceptance of our current and planned products and services, our research and development efforts, and other matters regarding our business strategies, use of capital, results of operations and financial position, and plans and objectives for future operations.

In some cases, you can identify forward-looking statements by the words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks, uncertainties and other factors are described under “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in the documents we file with the Securities and Exchange Commission from time to time. We caution you that forward-looking statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. As a result, the forward-looking statements may not prove to be accurate. The forward-looking statements in this press release represent our views as of the date hereof. We undertake no obligation to update any forward-looking statements for any reason, except as required by law.

Source: AbCellera Biologics Inc.

Inquiries

Media: Kathleen Reid; media@abcellera.com, +1(604)724-1242

Business Development: Murray McCutcheon, Ph.D.; bd@abcellera.com, +1(604)559-9005

Investor Relations: Melanie Solomon; ir@abcellera.com, +1(778)729-9116

AbCellera Biologics Inc.

Consolidated Statements of Income (Loss) and Comprehensive Income (Loss)

(All figures in U.S. dollars. Amounts are expressed in thousands except share and per share data.)

| | | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2021 | | 2022 | | 2023 |

| Revenue: | | | | | | | |

| Research fees | | | $ | 19,076 | | | $ | 40,802 | | | $ | 35,556 | |

| Licensing revenue | | | 20,778 | | | 696 | | | 969 | |

| Milestone payments | | | 8,000 | | | 900 | | | 1,500 | |

| Royalty revenue | | | 327,349 | | | 443,026 | | | — | |

| Total revenue | | | 375,203 | | | 485,424 | | | 38,025 | |

| Operating expenses: | | | | | | | |

| Royalty fees | | | 45,516 | | | 66,436 | | | — | |

Research and development(1) | | | 62,062 | | | 107,879 | | | 175,658 | |

Sales and marketing(1) | | | 6,913 | | | 11,270 | | | 14,180 | |

General and administrative(1) | | | 41,848 | | | 55,485 | | | 60,999 | |

| Depreciation, amortization, and impairment | | | 14,451 | | | 27,843 | | | 24,395 | |

| Total operating expenses | | | 170,790 | | | 268,913 | | | 275,232 | |

| Income (loss) from operations | | | 204,413 | | | 216,511 | | | (237,207) | |

| Other (income) expense | | | | | | | |

| Interest (income) | | | (3,330) | | | (16,079) | | | (42,247) | |

| Grants and incentives | | | (17,486) | | | (10,554) | | | (14,155) | |

| Other | | | 6,080 | | | 4,045 | | | (6,776) | |

| Total other (income) | | | (14,736) | | | (22,588) | | | (63,178) | |

| Net earnings (loss) before income tax | | | 219,149 | | | 239,099 | | | (174,029) | |

| Income tax (recovery) expense | | | 65,685 | | | 80,580 | | | (27,631) | |

| Net earnings (loss) | | | $ | 153,464 | | | $ | 158,519 | | | $ | (146,398) | |

| Foreign currency translation adjustment | | | 280 | | | (1,671) | | | (329) | |

| Comprehensive income (loss) | | | $ | 153,744 | | | $ | 156,848 | | | $ | (146,727) | |

| | | | | | | |

| Net earnings (loss) per share attributable to common shareholders | | | | | | | |

| Basic | | | $ | 0.56 | | | $ | 0.56 | | | $ | (0.51) | |

| Diluted | | | $ | 0.48 | | | $ | 0.50 | | | $ | (0.51) | |

| Weighted-average common shares outstanding | | | | | | | |

| Basic | | | 275,763,745 | | 285,056,606 | | 289,166,486 |

| Diluted | | | 318,294,236 | | 314,827,255 | | 289,166,486 |

(1) Exclusive of depreciation, amortization, and impairment

AbCellera Biologics Inc.

Consolidated Balance Sheet

(All figures in U.S. dollars. Amounts are expressed in thousands except share data.)

| | | | | | | | | |

| December 31, 2022 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 386,535 | | | $ | 133,320 | |

| Marketable securities | 499,950 | | | 627,265 | |

| Total cash, cash equivalents, and marketable securities | 886,485 | | | 760,585 | |

| Accounts and accrued receivable | 38,593 | | | 30,590 | |

| Restricted cash | 25,000 | | | 25,000 | |

| Other current assets | 75,413 | | | 55,810 | |

| Total current assets | 1,025,491 | | | 871,985 | |

| Long-term assets: | | | |

| Property and equipment, net | 217,255 | | | 287,696 | |

| Intangible assets, net | 131,502 | | | 120,425 | |

| Goodwill | 47,806 | | | 47,806 | |

| Investments in and loans to equity accounted investees | 72,522 | | | 65,938 | |

| Other long-term assets | 46,331 | | | 94,244 | |

| Total long-term assets | 515,416 | | | 616,109 | |

| Total assets | $ | 1,540,907 | | | $ | 1,488,094 | |

| Liabilities and shareholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable and other liabilities | $ | 52,497 | | | $ | 49,580 | |

| Contingent consideration payable | 44,211 | | | 50,475 | |

| | | |

| | | |

| Deferred revenue | 21,612 | | | 18,958 | |

| Total current liabilities | 118,320 | | | 119,013 | |

| Long-term liabilities: | | | |

| Operating lease liability | 76,675 | | | 71,222 | |

| Deferred revenue | 19,516 | | | 8,195 | |

| Deferred government contributions | 40,801 | | | 95,915 | |

| Contingent consideration payable | 16,054 | | | 4,913 | |

| Deferred tax liability | 33,178 | | | 30,612 | |

| Other long-term liabilities | 3,086 | | | 5,906 | |

| Total long-term liabilities | 189,310 | | | 216,763 | |

| Total liabilities | 307,630 | | | 335,776 | |

| Commitments and contingencies | | | |

| Shareholders' equity: | | | |

| Common shares: no par value, unlimited authorized shares at December 31, 2022 and December 31, 2023: 286,851,595 and 290,824,970 shares issued and outstanding at December 31, 2022 and December 31, 2023, respectively | 734,365 | | | 753,199 | |

| Additional paid-in capital | 74,118 | | | 121,052 | |

| Accumulated other comprehensive income (loss) | (1,391) | | | (1,720) | |

| Accumulated earnings | 426,185 | | | 279,787 | |

| Total shareholders' equity | 1,233,277 | | | 1,152,318 | |

| Total liabilities and shareholders' equity | $ | 1,540,907 | | | $ | 1,488,094 | |

AbCellera Biologics Inc.

Consolidated Statement of Cash Flows

(Expressed in thousands of U.S. dollars.)

| | | | | | | | | | | | |

| | December 31, 2021 | December 31, 2022 | December 31, 2023 |

| Cash flows from operating activities: | | | | |

| Net earnings (loss) | | $ | 153,464 | | $ | 158,519 | | $ | (146,398) | |

| Cash flows from operating activities: | | | | |

| Depreciation of property and equipment | | 4,403 | | 8,953 | | 12,758 | |

| Amortization and impairment of intangible assets | | 10,062 | | 18,890 | | 11,637 | |

| Amortization of operating lease right-of-use assets | | 2,785 | | 5,259 | | 6,499 | |

| Stock-based compensation | | 30,646 | | 49,481 | | 64,183 | |

| Deferred tax (expense) recovery | | (2,018) | | (2,114) | | 1,960 | |

| Change in fair value of contingent consideration and investments | | 2,284 | | 3,091 | | (8,018) | |

| Other | | 1,286 | | 5,456 | | 277 | |

| Changes in operating assets and liabilities: | | | | |

| Research fee and grant receivable | | (37,386) | | (22,715) | | (45,933) | |

| Accrued royalties receivable | | 59,864 | | 129,171 | | 9,273 | |

| Income taxes (payable) receivable | | (13,530) | | (88,609) | | 30,464 | |

| Accounts payable and other liabilities | | (3,237) | | (2,094) | | (15,104) | |

| Deferred revenue | | 8,624 | | 6,183 | | (13,976) | |

| Deferred grant income | | 30,718 | | 9,264 | | 39,521 | |

| Other assets | | (3,381) | | (1,375) | | 8,980 | |

| Net cash provided by (used in) operating activities | | 244,584 | | 277,360 | | (43,877) | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment | | (58,452) | | (70,660) | | (76,947) | |

| Purchase of intangible assets | | — | | (2,000) | | (560) | |

| Purchase of marketable securities | | (274,710) | | (763,982) | | (1,021,510) | |

| Proceeds from marketable securities | | 27,608 | | 510,631 | | 910,937 | |

| Receipt of grant funding | | 32,621 | | 16,434 | | 25,311 | |

| Acquisitions | | (11,457) | | — | | — | |

| Long-term investments and other assets | | (17,534) | | (17,369) | | (44,649) | |

| Investment in and loans to equity accounted investees | | (30,323) | | (25,679) | | (13,690) | |

| Net cash used in investing activities | | (332,247) | | (352,625) | | (221,108) | |

| Cash flows from financing activities: | | | | |

| Payment of liability for in-licensing agreement, contingent consideration, and other | | (9,373) | | (4,383) | | (1,234) | |

| Proceeds from long-term liabilities and exercise of stock options | | 5,487 | | 2,755 | | 11,590 | |

| Net cash provided by (used in) financing activities | | (3,886) | | (1,628) | | 10,356 | |

| Effect of exchange rate changes on cash and cash equivalents | | (1,425) | | (9,599) | | 589 | |

| Decrease in cash and cash equivalents | | (92,974) | | (86,492) | | (254,040) | |

| Cash and cash equivalents and restricted cash, beginning of period | | 594,116 | | 501,142 | | 414,650 | |

| Cash and cash equivalents and restricted cash, end of period | | $ | 501,142 | | $ | 414,650 | | $ | 160,610 | |

| Restricted cash included in other assets | | — | | 3,115 | | 2,290 | |

| Total cash, cash equivalents, and restricted cash shown on the balance sheet | | $ | 501,142 | | $ | 411,535 | | $ | 158,320 | |

| Supplemental disclosure of non-cash investing and financing activities | | | | |

| Property and equipment in accounts payable | | 5,397 | | 5,868 | | 13,625 | |

| Right-of-use assets obtained in exchange for operating lease obligation | | 36,638 | | 50,694 | | 1,199 | |

C O P YR IG H T © A B C E LL E R A FULL YEAR 2023 BUSINESS UPDATE FEBRUARY 20, 2024

C O PY RI G H T © A B C EL LE RA DISCLAIMER 2 This presentation contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management. All statements contained in this presentation other than statements of historical fact are forward-looking statements, including statements regarding our ability to develop, commercialize and achieve market acceptance of our current and planned products and services, our research and development efforts, and other matters regarding our business strategies, use of capital, results of operations and financial position, and plans and objectives for future operations. In some cases, you can identify forward-looking statements by the words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward- looking statements contain these words. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks, uncertainties and other factors are described under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in the documents we file with the Securities and Exchange Commission from time to time. We caution you that forward-looking statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. As a result, the forward-looking statements may not prove to be accurate. The forward-looking statements in this presentation represent our views as of the date hereof. We undertake no obligation to update any forward-looking statements for any reason, except as required by law. FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

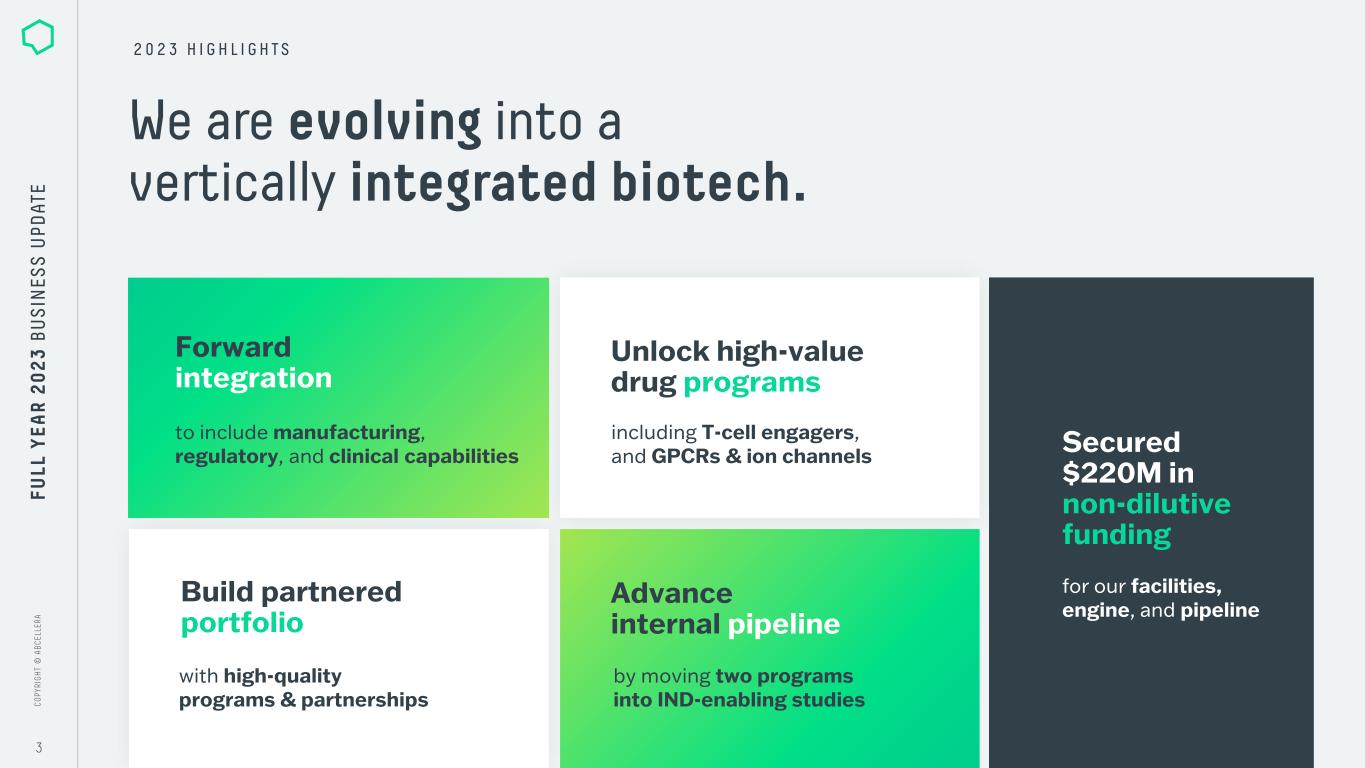

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 3 FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E We are evolving into a vertically integrated biotech. to include manufacturing, regulatory, and clinical capabilities including T-cell engagers, and GPCRs & ion channels by moving two programs into IND-enabling studies 2 0 2 3 H I G H L I G H T S Forward integration Unlock high-value drug programs Build partnered portfolio with high-quality programs & partnerships Advance internal pipeline Secured $220M in non-dilutive funding for our facilities, engine, and pipeline

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 4 O U R E N G I N E . F O R W A R D I N T E G R A T I O N We are completing investments in clinical and manufacturing capabilities. After over a decade of building our platform, we are near completion. Beginning in 2024, we are shifting our capital allocation from building capabilities to using them to advance our pipeline and partnerships. 2024 Late 2025 Manufacturing OnlineMove to New Headquarters FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 5 O U R E N G I N E . P L A T F O R M D E V E L O P M E N T • Hundreds of diverse CD3-binding antibodies to combine to create optimized precision cancer therapies • Clinically-validated OrthoMab bispecifics platform, to pair CD3-targeting and tumor-targeting antibodies • Internal validation of panel through work on three well-recognized and high-value targets T-Cell Engager Platform We are unlocking high-value drug targets. GPCR & Ion Channel Platform • Clinically validated, membrane-protein targets with large commercial potential that have proven largely intractable using traditional methods for antibody discovery • Internal platform integrated across the best of modern data science and biotechnology to generate first-in-class and best-in- class candidates FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 6 Molecule Target Indication Therapeutic Area Potential Differentiation ABCL635 undisclosed GPCR or ion channel undisclosed metabolic & endocrine conditions first in class ABCL575 OX40L atopic dermatitis immunology & inflammation best in class We are advancing an internal pipeline of potential first-in- class and best-in-class assets as a top priority to drive growth. • First two IND submissions anticipated in 2025 • We intend to take additional first-in-class development candidates into IND-enabling studies in 2024 and 2025 • $220M in non-dilutive funding from the governments of Canada and British Columbia O U R P I P E L I N E FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 7 Molecule ABCL635 Status IND-enabling studies (Preclinical) Target Undisclosed - GPCR or ion channel MOA Antagonist Indication Undisclosed Therapeutic Area Metabolic & endocrine conditions Market Opportunity >$2B Potential Differentiation First-in-class Summary Program details and indication will only be disclosed once the molecule reaches the clinic. A potential first-in-class antibody therapy for metabolic and endocrine conditions. ABCL635 is the first AbCellera-led asset derived from our GPCR and ion channel platform. FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E O U R P I P E L I N E . A B C L 6 3 5

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 8 O U R P I P E L I N E . A B C L 5 7 5 Molecule ABCL575 Status IND-enabling studies (Preclinical) Target OX40 ligand (OX40L) MOA Blocking and non-depleting Indication • Atopic dermatitis (AD) • Other indications in autoimmunity and inflammation Therapeutic Area Immunology & inflammation Market Opportunity $17B by 2032* Potential Differentiation ABCL575 has been designed with potency, pharmacokinetics, and developability to enable less frequent dosing, which provides a potential for differentiation. Summary Targeting OX40L has the potential to address a broad range of inflammatory conditions and autoimmune diseases, some of which include colitis/inflammatory bowel disease (IBD), and asthma/atopy1. OX40L blocking is currently under investigation for atopic dermatitis2, asthma2, alopecia areata3, hidradenitis suppurativa (HS)4. *Source: IQVIA ABCL575 is a potential best-in-class and second-in-class antibody therapy for the treatment of atopic dermatitis. 1. Croft M, et al. (2009) Immunol Rev. 229(1):173-91. 2. https://clinicaltrials.gov/search?intr=Amlitelimab 3. https://clinicaltrials.gov/search?intr=IMG-007 4. https://clinicaltrials.gov/search?intr=%20SAR-442970 FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 9 We are increasingly focused on strategic partnerships. We look for partnerships that bring new insights into novel biology or access to unique capabilities to create opportunities in therapeutic areas of shared interest. Expanding relationships with large pharma and large biotech T-cell engager platform deals in oncology and autoimmune conditions Co-development to access new targets and technology AbbVie Company creation with top-tier venture capital groups FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E O U R P A R T N E R S

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 10 We use our capabilities to advance programs and partnerships. Expand high value strategic partnerships, leveraging T-cell engager platform. 2 0 2 4 P R I O R I T I E S Invest in the final stage of our engine, including our manufacturing facility. Engine & capabilities Partnered programs Elect additional first-in-class development candidates from GPCR / ion channel platform and advance ABCL635 and ABCL575 through IND-enabling studies. Internal programs & pipeline Capital Allocation: ~40% ~20% ~40% FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O P Y R IG H T © A B C E LL E R A FULL YEAR 2023 FINANCIALS UPDATE

C O PY RI G H T © A B C EL LE RA C O PY RI G H T © A B C EL LE RA 12 FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E We maintain a strong cash position to focus on strategic investments and execution. in non-dilutive funding to execute on strategy in total cash, cash equivalents, & marketable securities molecules in the clinic internal programs advanced into IND-enabling studies $780M 13 $220M 2

C O PY RI G H T © A B C EL LE RA 87 25 20 40 60 80 100 0 120 16 17 18 19 20 21 22 23 112 2015 Continuing portfolio growth. 13 FI N A N CI A LS 3 Showing year-end figures. Historical results are not necessarily indicative of future results. Partner-Initiated Program Starts2,3 Cumulative # of + WITH downstream participation – WITHOUT downstream participation Molecules in the Clinic3 Cumulative # of Discovery Partners1 Programs Under Contract1 203 Total # of Total # of 46 13 1 2 3 4 5 6 7 8 9 10 13 0 12 11 19 20 21 22 2318172015 16 FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E 1 Will not report either as business metric going forward. 2 Redefined business metric to exclude one AbCellera-initiated program and those without downstream participation.

C O PY RI G H T © A B C EL LE RA Partner-initiated programs continue to progress towards the clinic. 14 FI N A N CI A LS FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E Partner-Initiated Programs with Downstream Participation* Cumulative # of 87 64 23 26 Understood to be progressingStarted Not expected to progressCompletedIn progress 38 Late-stage discovery Clinical development Preclinical development Current stage * Excludes AbCellera-initiated and Trianni-license program. As of Dec 31, 2023. Historical results are not necessarily indicative of future results. 3 5 30 ABCELLERA’S RESPONSIBILITY PARTNERS’ RESPONSIBILITY

C O PY RI G H T © A B C EL LE RA MOLECULE MOST ADVANCED STAGE THERAPEUTIC AREA(S) PARTNER PROGRAM TYPE AbCellera-initiated, partner-led AbCellera partner-initiated discovery undisclosed Phase 1 • neuroscience IVX-01 Clinical field study • animal health undisclosed Clinical field study • animal health undisclosed undisclosed Clinical field study • animal health undisclosed NBL-012 Phase 1 • dermatology • gastrointestinal disease • immunology Trianni license NBL-015/FL-301 Phase 1 • oncology NBL-020 Phase 1 • oncology NBL-028 Phase 1 • oncology AB-2100 IND open • oncology 15 FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E FI N A N CI A LS A cumulative total of 13 molecules have reached the clinic. As of December 31, 2023* Expect no further progress NEW NEW NEW

C O PY RI G H T © A B C EL LE RA Partner-Initiated Programs with Downstream Participation started are diversified across these therapeutic areas 16 Large diversified exposure to next-gen antibody therapies. ophthal- mology 5% other 9%51% oncology 18% neurology 87 AbCellera-Initiated Programs started across these therapeutic areas19 infectious disease 5% 12% immunology 42% oncology & immunology T-cell engagers 53% undisclosed GPCRs & ion channels 5% infectious disease pandemic response FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E FI N A N CI A LS 1 100% human health n = 1990% human health: target antigen known n = 78 9% animal health n = 8 1% human health: target antigen TBD n = 1 n = 10 n = 8

C O PY RI G H T © A B C EL LE RA 17 FI N A N CI A LS Deepening stakes evidenced by strong growth of royalty rates. * showing partner-initiated programs under contract with downstream participation and partnering-out agreements signed in period Includes range of royalty and royalty-equivalent rates in each contract, considering sales tiers and step-downs Royalty on Net Sales mean interquartile range 5th / 95th percentile FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E 5% 0% 4% 7% 3% 8% 2% 9% 1% 6% 2020 – 2023 n=141* 2015 – 2019 n=37*

C O PY RI G H T © A B C EL LE RA 18 FI N A N CI A LS $38M total revenue, predominantly from discovery activity. MILESTONES ROYALTIES LICENSING RESEARCH FEES Revenue USD $35.6M 2022 $485.4M $38.0M 2023 $1.5M $1.0M $40.8M FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA 19 FI N A N CI A LS Operating expenses reflect ongoing investments, predominantly in R&D. RESEARCH & DEVELOPMENT SALES & MARKETING GENERAL & ADMIN Operating Expenses USD 20232022 $11.3M $14.2M +$2.9M 20232022 $55.5M $61.0M +$5.5M 20232022 $107.9M $175.7M +$67.8M FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA 20 FI N A N CI A LS Net loss of $146M; equivalent to ($0.51) per share (basic & diluted). Earnings USD NET EARNINGS EARNINGS PER SHARE: BASIC 2022 2023 $158.5M -$146.4M $0.56 -$0.51 2022 2023 EARNINGS PER SHARE: DILUTED $0.50 -$0.51 2022 2023 FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA 21 FI N A N CI A LS Over $780M in total cash, equivalents, and marketable securities. Cash Flows USD INVESTING FINANCING $111M Other FX $627M Marketable Securities $133M Cash & Equivalents $500M Marketable Securities December 31, 2023 $111M Marketable Securities (net) OPERATINGDecember 31, 2022 $28M* $387M Cash & Equivalents $915M ($44M) ($221M) $10M $1M $788M $27M* FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

C O PY RI G H T © A B C EL LE RA 22 THANK YOU FU LL Y EA R 2 0 2 3 B U S IN ES S U PD AT E

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

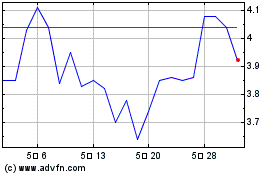

AbCellera Biologics (NASDAQ:ABCL)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

AbCellera Biologics (NASDAQ:ABCL)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024