UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

May, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras signs contracts for Platforms P-84 and P-85

—

Rio de Janeiro, May 24, 2024 –

Petróleo Brasileiro S.A – Petrobras informs that, today, it signed contracts with Seatrium O&G Americas Limited to acquire

the P-84 and P-85 vessel platforms. Both units will be self-owned and installed in the Atapu and Sépia fields, respectively, in

ultra-deep waters of the pre-salt of the Santos Basin, with first oil date between 2029 and 2030.

The model of these two new platforms

is FPSO (Floating, Production, Storage and Offloading unit) and they will be installed in water depths exceeding 2,000 meters. The P-84

(Atapu) and P-85 (Sépia) platforms will have a daily production capacity of 225,000 barrels of oil/day and a processing capacity

of 10 million cubic meters of gas/day, each. The P-84 and P-85 platforms will be constructed in shipyards in Brazil, China and Singapore,

with local content reaching 20% in P-84 and 25% in P-85.

Currently, the Atapu and Sépia

fields are producing with two platforms, being the P-70 in the Atapu Field and the FPSO Carioca in the Sépia field. The new P-84

and P-85 platforms will be the second units in their respective fields.

The P-84 and P-85 projects are expected

to reduce the intensity of greenhouse gas emissions by 30% per barrel of oil equivalent produced, being among the most efficient FPSOs

to operate in Brazil. This reduction is due to the benefits of the All Electric configuration, optimizations in the processing plant to

increase energy efficiency, and the use of several technologies, such as: zero routine ventilation (recovery of ventilated gases from

cargo tanks and the processing plant), capturing of deep seawater, use of speed variators in pumps and compressors, cogeneration (Waste

Heat Recovery Unit), zero routine flaring (torch gas recovery – closed flare), valves with requirements for low fugitive emissions

and capture, use and geological storage of CO2 from gas produced.

Petrobras holds a 65.7% stake in the

shared reservoir of Atapu, in partnership with Shell (16.7%), TotalEnergies (15%), Petrogal Brasil (1.7%) and and Pré-Sal Petróleo

S.A (PPSA) (0,9%), as the Brazilian Government's representative in the non-contracted area. For the shared reservoir of Sépia,

Petrobras holds a 55.3% stake, in partnership with TotalEnergies (16.9%), PETRONAS (12.7%), QatarEnergy (12.7%), Petrogal Brasil (2.4%).

Petrobras is the operator of both reservoirs and PPSA acts as manager of the sharing agreement.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

E-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9o andar

– 20031-030 – Rio de Janeiro, RJ.

Phone.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act), that reflect the expectations of the Company's management. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects", "aims",

"should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not

by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not

rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 24, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Carlos Alberto Rechelo Neto

______________________________

Carlos Alberto Rechelo Neto

Chief Financial Officer and Investor Relations

Officer

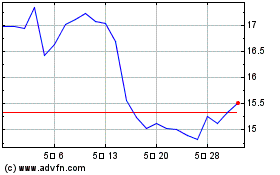

Petroleo Brasileiro ADR (NYSE:PBR)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

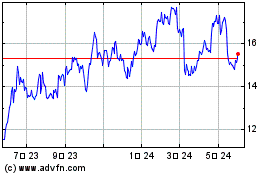

Petroleo Brasileiro ADR (NYSE:PBR)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024