SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of Feb 2024

Commission File Number: 001-14014

CREDICORP LTD.

(Translation of registrant’s name into English)

Of our subsidiary

Banco de Credito del Peru:

Calle Centenario 156

La Molina

Lima 12, Peru

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

The information in this Form 6-K (including any exhibit hereto) shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 9th, 2024 |

|

|

| |

|

|

|

CREDICORP LTD.

(Registrant)

|

|

| |

|

|

| |

By:

|

/s/ Guillermo Morales

|

|

| |

|

Guillermo Morales

|

|

| |

|

Authorized Representative

|

|

Exhibit 99.1

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

Table of Contents

|

Operating and Financial Highlights |

03 |

| |

|

|

|

Senior Management Quotes |

05 |

| |

|

|

|

Fourth Quarter 2023 Earnings Conference Call |

06 |

| |

|

|

|

Summary of Financial Performance and Outlook |

07 |

| |

|

|

|

Financial Overview |

12 |

| |

|

|

|

Credicorp’s Strategy Update |

13 |

| |

|

|

|

Analysis of 4Q23 Consolidated Results |

|

01 |

Loans and Portfolio Quality |

17 |

| |

|

|

|

|

02 |

Deposits |

24 |

| |

|

|

|

|

03 |

Interest Earning Assets and Funding |

27 |

| |

|

|

|

|

04 |

Net Interest Income (NII) |

28 |

| |

|

|

|

|

05 |

Provisions |

32 |

| |

|

|

|

|

06 |

Other Income |

34 |

| |

|

|

|

|

07 |

Insurance Underwriting Results |

37 |

| |

|

|

|

|

08 |

Operating Expenses |

39 |

| |

|

|

|

|

09 |

Operating Efficiency |

41 |

| |

|

|

|

|

10 |

Regulatory Capital |

42 |

| |

|

|

|

|

11 |

Economic Outlook |

44 |

| |

|

|

|

|

12 |

Appendix |

49 |

| |

Datos elaborados por BCP para uso Interno |

2 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Operating and Financial Highlights |

Credicorp Ltd. Reports Financial and Operating Results for 4Q23 and

FY23

Resilient profitability in challenging context supported by Universal

Banking and Insurance. Despite the provision related to El Niño

Phenomenon (FEN) in 4Q23, ROE stood at 10.6% in the quarter and 15.8% in the year.

NIM increased 10 bps QoQ to 6.21% while risk-adjusted NIM declined 35 bps

to 4.10%,

reflecting 45 bps impact from FEN provision.

Prudent provisioning amid controlled delinquency with

Cost of Risk of 3.2%, impacted by 70 bps due to the FEN Provision.

Structural NPL coverage stood at 102.4%

Lima, Peru – February 08, 2024 – Credicorp Ltd. (“Credicorp” or “the

Company”) (NYSE: BAP | BVL: BAP), the leading financial services holding company in Peru with a presence in Chile, Colombia, Bolivia, and Panama today reported its unaudited results for the quarter ended December 31, 2023. Financial results

are expressed in Soles and are presented in accordance with International Financial Reporting Standards (IFRS). Effective 1Q23, the Company reports under IFRS 17 accounting standards for insurance contracts. While the impact on consolidated net

income is not material, the reclassification of line items in the P&L has impacted the efficiency ratio. To facilitate comparability, figures for 4Q22 and FY22 have been restated to reflect IFRS 17.

4Q23 OPERATING AND FINANCIAL HIGHLIGHTS

| ● |

Net Income attributable to Credicorp declined 16.7% YoY to S/841.8 million while shareholders’

equity rose 11.9%. On-going challenges on the macro front led to higher provisions at Mibanco and BCP, which, together with an impairment charge in Mibanco Colombia impacted the bottom line. ROE dropped to 10.6% in 4Q23 from 16.2% in 3Q23 and

14.4% in 4Q22. FY23 ROE stood at 15.8%, 98 bps lower compared to 16.8% in FY22. |

| ● |

Structural Loans measured in average daily balances (ADB) increased 0.4% QoQ and 0.3% YoY. Loan

growth in Retail Banking at BCP was largely offset by drop in loans in Wholesale Banking, which was impacted by a decline in private investment, and by a decrease in Mibanco’s risk appetite due to a challenging context. |

| ● |

Total Deposits declined 0.5% QoQ at year-end, as the contraction of Time Deposits more than

offset the expansion of Low-Cost Deposits. YoY, Deposits increased 0.5%, driven mainly by fund migration from Savings Deposits to Time Deposits as clients sought higher rates. Low-cost Deposits accounted for 68.1% of total deposits at quarter

end, leading the market with a 41.6% share. |

| ● |

The Structural NPL ratio increased 7 bps QoQ to 5.6%, as adverse events and weak macro context

continued to impact client payment performance, albeit to a lesser extent than in past quarters. At BCP, key drivers were (i) SME- Pyme, although new vintages present better performance, (ii) Consumer and Credit Cards, mainly in loans more than

120 days past due. At Mibanco, delinquency increased among clients with higher-ticket loans and those impacted by social conflicts or climatic conditions. |

| ● |

Structural Provisions increased 31.1% QoQ, which reflects the impact of provisions set aside

for El Niño for approximately S/250 million. If we exclude this impact, Structural Provisions rose 2.8% QoQ driven by a base effect in Wholesale Banking while SME-Pyme remains impacted by a recessive environment. The aforementioned dynamics

were partially offset by reversals in Mortgages provisions and by a portfolio contraction at Mibanco. The Cost of Risk increased 71 bps sequentially to 3.2% while the Structural Cost of Risk increased 78 bps sequentially to 3.3%. The Structural

NPL Coverage ratio, in turn, stood at 102.4%. |

| ● |

Core Income increased 2.6% QoQ, mainly driven by a 2.9% increase in Net Interest Income (NII),

proof of the resilience of business operations in a context marked by lower interest rates. Excluding BCP Bolivia, Fee Income and FX transactions were up 2.1% QoQ, reflecting an uptick in FX volumes as BCP leveraged growth in year-end volumes

and higher fee income from Credicorp Capital. For FY23, Core Income rose 11.4%, supported by 16.6% growth in NII. |

| |

Datos elaborados por BCP para uso Interno |

3 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Operating and Financial Highlights |

|

●

|

Net Interest Margin (NIM) increased 10 bps QoQ to 6.21% due to a stable yield on IEA and a decrease in the funding cost. YoY, NIM increased 46 bps

after growth in the yield on IEAs surpassed the expansion registered for the funding cost. Risk-adjusted NIM fell 35 bps QoQ to 4.10%, impacted by provisions set aside for El Niño, which accounted for 45 bps of drop reported this

quarter.

|

|

●

|

Insurance Underwriting Results declined 13.2% QoQ, driven by a higher claims expenses in P&C and Life businesses, but increased 110.0% YoY,

driven by the Life Business.

|

|

●

|

Efficiency Ratio improved 142 bps in 2023 reaching 46.1%, on the back of positive operating leverage at BCP and Pacifico.

|

|

●

|

Yape, continues to scale, reaching 11 million monthly active users. The app continues to add user-friendly features while bolstering engagement and

fee generation. With revenue per monthly active user (MAU) up by 34.5% QoQ, and despite a seasonal uptick in costs, Yape remains on track to reaching cashflow break-even in 2024.

|

|

●

|

Credicorp maintains a solid capital base, with a IFRS CET1 Ratio for BCP of 13.2%, up 16 bps QoQ. Mibanco IFRS CET1 Ratio stood at 18.4%, up 80 bps

QoQ; both these levels are above internal targets of 11% and 15%, respectively.

|

|

●

|

At BCP stand-alone, 30-day local currency Liquidity Coverage Ratio (LCR) currency stood at 170.4% under regulatory standards and 133.6% based on more stringent internal standards, while USD

30-day LCR stood at 171.3% and 108.0% under regulatory and more stringent internal standards, respectively.

|

|

●

|

In December 2023, Credicorp published its Inaugural Task Force on Climate-Related Financial Disclosures (TCFD) Report, building on its environmental commitment to being a local leader in

supporting the transition towards an environmentally sustainable economy by building capabilities and knowledge that encourage sustainable businesses and promptly managing environmental risks.

|

| |

Datos elaborados por BCP para uso Interno |

4 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Senior Management Quotes |

SENIOR MANAGEMENT QUOTES

| |

Datos elaborados por BCP para uso Interno |

5 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Fourth Quarter 2023 Earnings Conference Call |

FOURTH QUARTER 2023 EARNINGS CONFERENCE CALL

Date: Friday February 9th, 2024

Time: 9:30 am ET (9:30 am Lima, Perú)

Hosts: Gianfranco Ferrari – Chief Executive

Officer, Cesar Rios - Chief Financial Officer, Francesca Raffo – Chief Innovation Officer, Reynaldo Llosa - Chief Risk Officer, Diego Cavero – Head of Universal Banking, Cesar Rivera - Head of Insurance and Pensions, Carlos Sotelo - Mibanco CFO and

Investor Relations Team.

To pre-register for the listen-only webcast presentation use the following

link:

https://dpregister.com/DiamondPassRegistration/register?confirmationNumber=10185821&linkSecurityString=fb6ad9

ac89

Callers who pre-register will be given a conference passcode and unique PIN

to gain immediate access to the call and bypass the live operator. Participants may pre-register at any time, including up to and after the call start time.

Those unable to pre-register may dial in by calling:

1 844 435 0321 (U.S. toll free)

1 412 317 5615 (International)

Participant Web Phone: Click Here

Conference ID: Credicorp Conference Call

The webcast will be archived for one year on our investor relations website at:

https://credicorp.gcs-web.com/events-and-presentations/upcoming-events

For a full version of Credicorp´s Third Quarter 2023 Earnings Release, please

visit:

https://credicorp.gcs-web.com/financial-information/quarterly-results

| |

Datos elaborados por BCP para uso Interno |

6 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Summary of Financial Performance and Outlook |

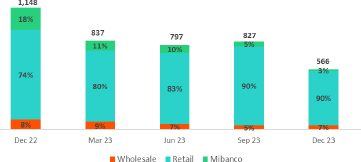

Loans in Average Daily Balances (ADB)

Structural loans measured in ADB increased 0.4% QoQ (+0.7% Neutral Exchange Rate) to stand at S/138,348 million. Growth was mainly attributable

to Retail Banking at BCP, led by an uptick in SME-Pyme and Mortgages. This evolution was partially offset by a drop in balances in Wholesale Banking, which was fueled by a reduction in private investment, and by lower balances at Mibanco, where a

decline reflected tighter lending conditions implemented.

YoY, structural loan growth stood at 0.3% (+0.7% Neutral Exchange Rate). This evolution was driven by Retail Banking at BCP and by SME-Pyme,

Mortgages and Credit Cards in particular, and was offset by a drop in Wholesale Banking balances, which was spurred by the same factors seen QoQ.

The Government Loan Portfolio (GP) represented 2.7% of total loans in average daily balances this quarter (2.5% in quarter-end balances), which

were concentrated in BCP SME-Pyme and BCP SME-Business.

Deposits

Our deposit base measured in quarter-end balances decreased 0.5% QoQ (+0.6% Neutral Exchange Rate). This latter growth was mainly attributable

to a growth in Low-Cost Deposits.

In the YoY comparison, the deposit base increased 0.5% (+1.9% Neutral Exchange Rate). Low-cost deposits, which represented 68.1% of our total

deposit base at the end of the quarter, continued to play a predominant role in our funding mix.

Net Interest Income (NII) and Margin (NIM)

NII rose 2.9% QoQ to stand at S/3,348 million. This evolution was driven by an uptick in financial income, which was primarily fueled by growth

in structural loans, driven by Retail Banking. Interest expenses fell 2.7% QoQ due to liability repricing in a cycle of lower interest rates and to an uptick in Low-Cost Deposits’ share of our funding base. In this context, the drop reported in the

Funding Cost outpaced the reduction registered for the IEA yield; these factors led NIM to stand at 6.21% at quarter-end.

YoY and YTD, Net Interest Income rose 6.6% and 16.6% respectively, driven primarily by the evolution of rates for both currencies and by a

shift in the loan mix toward retail.

| |

Datos elaborados por BCP para uso Interno |

7 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Summary of Financial Performance and Outlook |

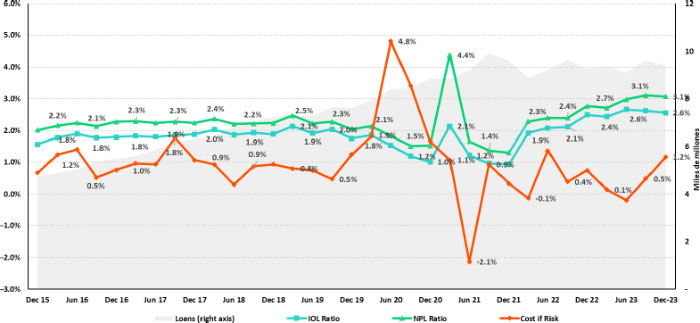

Portfolio Quality and Structural Cost of Risk

QoQ, the structural NPL balance rose 1.7%. This growth was concentrated in: (i) SME-Pyme, where the uptick in delinquency was concentrated in

old vintages while indicators for early delinquency for new vintages improved, (ii) Consumer and Credit Cards, where growth in the NPL volumen was concentrated in loans overdue more than 120 days; and (iii) Mibanco, where early delinquency was

concentrated concentrated in loans with higher tickets; note that in 3Q23, we began implementing stricter credit policies and expect to see improvement down the line. These dynamics were partially offset by Corporate, driven by recoveries associated

to two specific loans.

In this context, the structural NPL ratio stood at 5.6% while the structural NPL Coverage ratio situated at 102.4%

Structural provisions this quarter reflected provisions set aside for the El Niño Phenomenon for approximately S/250 MM, which was based on the

information available at the close of the books. If we exclude this effect, structural provisions rose 2.8% QoQ, driven by Wholesale Banking via a base effect and by SME-Pyme, due to a downturn in client payment performance. These dynamics were

partially offset by reversals for sub-products in Mortgage and by lower provisions at Mibanco.

YTD, structural provisions excluding provisions set aside for El Niño Phenomenon, increased 91.0%, driven by Retail Banking at BCP and

Consumer, Credit Cards and SME-Pyme in particular, which were impacted by an uptick in the deterioration of old vintages. Provisions at Mibanco also rose significantly. The aforementioned dynamics were partially offset by reversals of provisions in

Wholesale Banking during the year, which reflected recoveries of impaired loans.

In this context, the Structural Cost of Risk stood at 3.3% and the Cost of Risk, at 3.2%. YTD, the Structural Cost of Risk situated at 2.5% and

the Cost of Risk, at 2.5%.

| |

Datos elaborados por BCP para uso Interno |

8 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Summary of Financial Performance and Outlook |

Other Income

Other Core Income1 (Fees + Gains on FX transactions),

excluding BCP Bolivia, rose 2.1% QoQ. This evolution was driven mainly by an increase in the net gain on FX transactions at BCP Stand-alone and, to a lesser extent, by an uptick in Fee Income at Credicorp Capital. YoY, excluding BCP Bolivia, the 1.4%

increase was attributable to growth in the balance for fees at Credicorp Capital, driven by an uptick in fees through BCP Stand-alone.

Other Non-core income rose 29.6% and 102.8 % QoQ and YoY respectively. These increases were mainly driven by Other Income, which was up due to

sales of judicial recoveries and, to a lesser extent, due to an uptick in the Net Gain on Securities at BCP. YTD, growth was driven by an increase in the Net gain on Securities, which was attributable to good results for trading strategies at

Credicorp Capital and ASB and growth in income from the investment portfolio at Pacífico.

(1) When analyzing the results for fee income and FX transactions, it is important to note that both lines have

been affected by our operation in BCP Bolivia, where we charge fees to FX clients to offset losses on buy-sell FX transactions.

Insurance Underwriting Result

The Insurance Underwriting Result dropped 13.2% QoQ. This evolution was fueled by higher claims expenses in our P&C and Life businesses.

YTD, the underwriting results were up 43.9% due to an increase in income from Life and a more favorable reinsurance result. These dynamics were

partially attenuated by an increase in expenses for insurance services, primarily in the P&C business.

| |

Datos elaborados por BCP para uso Interno |

9 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Summary of Financial Performance and Outlook |

Efficiency

At the end of 2023, the Efficiency ratio stood at 46.1%, which represents an improvement of 142 bps versus the figure in 2022. This dynamic was

in line with a 13.2% uptick in operating income, where growth outpaced the uptick registered for operating expenses.

Operating expenses rose 9.8% YTD, driven primarily by disruptive initiatives at Credicorp and core expenses (non – disruption) at BCP.

* Operating Expenses and Income have been reformulated due to the application of IFRS 17 and as such, are reported differently than seen in earlier

reports. This reformulation has led to a subsequent change in the way that the Efficiency Ratio is calculated. For more detail, please refer to appendix 12.1

Net earnings attributable to Credicorp

In 4Q23, net income attributable to Credicorp stood at S/841.8 million, down -32.0% QoQ and up -16.7% YoY. Net Shareholders’ Equity was

S/32,460 million (+3.8% QoQ and +11.9% YoY). Consequently, ROE stood at 10.6%.

YTD, in addition to recurring dynamics, this year’s results were impacted by a deterioration in goodwill at Mibanco Colombia and by an increase

in provisions for withholding tax at the holding level, which was attributable to higher expectations for dividend payments.

Consequently, net income attributable to Credicorp rose 4.7% versus the figure in 2022 to stand at S/4,866 million. In this context, ROE stood

at 15.8%, 98 bps below the level reported in 2022.

Contributions and ROE by subsidiary in 4Q23

(S/ millions)

(1) This figure excludes the impact of the goodwill Impairment on Mibanco

Colombia’s performance.

(2) At BCP Stand Alone, the figure is lower than net income because it does

not include gains on investments in other Credicorp subsidiaries (Mibanco).

(3) At Mibanco, the figure is lower than net income because Credicorp owns

99.921% of Mibanco (directly and indirectly).

(4) The Contribution of Grupo Pacífico presented here is higher than the

earnings reported for Pacifico Seguros because it includes 100% of Crediseguros (including 48% under Grupo Credito)

| |

Datos elaborados por BCP para uso Interno |

10 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Summary of Financial Performance and Outlook |

| |

Datos elaborados por BCP para uso Interno |

11 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Financial Overview |

| Credicorp

Ltd. |

Quarter |

%

change |

As of |

% change |

| S/000 |

| |

4Q22 |

3Q23 |

4Q23 |

QoQ |

YoY |

2022 |

2023 |

2023 / 2022 |

| Net interest, similar income and expenses |

3,140,404 |

3,254,043 |

3,347,684 |

2.9% |

6.6% |

11,091,618 |

12,937,972 |

16.6% |

| |

|

|

|

|

|

|

|

|

| Provision for credit losses on loan portfolio, net of recoveries |

(730,681) |

(917,642) |

(1,173,454) |

27.9% |

60.6% |

(1,811,538) |

(3,622,345) |

100.0% |

| |

|

|

|

|

|

|

|

|

| Net

interest, similar income and expenses, after provision for credit losses on loan portfolio |

2,409,723 |

2,336,401 |

2,174,230 |

-6.9% |

-9.8% |

9,280,080 |

9,315,627 |

0.4% |

| |

|

|

|

|

|

|

|

|

| Total other income |

1,327,862 |

1,402,603 |

1,486,823 |

6.0% |

12.0% |

5,066,096 |

5,655,825 |

11.6% |

| Insurance underwriting result |

136,824 |

330,900 |

287,295 |

-13.2% |

110.0% |

841,448 |

1,211,100 |

43.9% |

| Total other expenses |

(2,363,787) |

(2,350,469) |

(2,661,542) |

13.2% |

12.6% |

(8,317,013) |

(9,334,223) |

12.2% |

| Profit before income tax |

1,510,622 |

1,719,435 |

1,286,806 |

-25.2% |

-14.8% |

6,870,611 |

6,848,329 |

-0.3% |

| Income tax |

(476,236) |

(455,865) |

(434,648) |

-4.7% |

-8.7% |

(2,110,501) |

(1,888,451) |

-10.5% |

| Net profit |

1,034,386 |

1,263,570 |

852,158 |

-32.6% |

-17.6% |

4,760,110 |

4,959,878 |

4.2% |

| Non-controlling interest |

24,231 |

25,397 |

10,331 |

-59.3% |

-57.4% |

112,292 |

94,338 |

-16.0% |

| Net profit attributable to Credicorp |

1,010,155 |

1,238,173 |

841,827 |

-32.0% |

-16.7% |

4,647,818 |

4,865,540 |

4.7% |

| Dividends distribution, net of treasury shares effect (S/000) |

- |

- |

- |

- |

- |

1,196,422 |

1,994,037 |

66.7% |

| Net income / share (S/) |

12.7 |

15.5 |

10.6 |

-32.0% |

-16.7% |

58.3 |

61.0 |

4.7% |

| Dividends per Share (S/) |

- |

- |

- |

- |

- |

15.0 |

25.0 |

66.7% |

| Loans |

148,626,374 |

145,129,260 |

144,976,051 |

-0.1% |

-2.5% |

148,626,374 |

144,976,051 |

-2.5% |

| Deposits and obligations |

147,020,787 |

148,471,535 |

147,704,994 |

-0.5% |

0.5% |

147,020,787 |

147,704,994 |

0.5% |

| Net equity |

29,003,644 |

31,267,592 |

32,460,004 |

3.8% |

11.9% |

29,003,644 |

32,460,004 |

11.9% |

| Profitability |

|

|

|

|

|

|

|

|

| Net interest margin(1) |

5.75% |

6.11% |

6.21% |

10 bps |

46 bps |

5.09% |

6.01% |

92 bps |

| Risk-adjusted Net interest margin |

4.45% |

4.45% |

4.10% |

-35 bps |

-35 bps |

4.29% |

4.38% |

9 bps |

| Funding cost(2) |

2.35% |

3.15% |

3.03% |

-12 bps |

68 bps |

1.83% |

2.91% |

108 bps |

| ROE |

14.4% |

16.2% |

10.6% |

-559 bps |

-379 bps |

16.8% |

15.8% |

-98 bps |

| ROA |

2.1% |

2.1% |

1.4% |

-69 bps |

-74 bps |

2.0% |

2.0% |

4 bps |

| Loan portfolio quality |

|

|

|

|

|

|

|

|

| Internal overdue ratio(3) |

4.0% |

4.4% |

4.2% |

-18 bps |

23 bps |

4.0% |

4.2% |

23 bps |

| Internal overdue ratio over 90 days |

3.1% |

3.5% |

3.5% |

-8 bps |

35 bps |

3.1% |

3.5% |

35 bps |

| NPL ratio(4) |

5.4% |

6.0% |

5.9% |

-8 bps |

48 bps |

5.4% |

5.9% |

48 bps |

| Cost of risk(5) |

2.0% |

2.5% |

3.2% |

71 bps |

127 bps |

1.2% |

2.5% |

128 bps |

| Coverage ratio of IOLs |

132.5% |

125.8% |

135.1% |

937 bps |

258 bps |

132.5% |

135.1% |

258 bps |

| Coverage ratio of NPLs |

97.9% |

93.0% |

97.0% |

399 bps |

-91 bps |

97.9% |

97.0% |

-91 bps |

| Operating efficiency |

|

|

|

|

|

|

|

|

| Efficiency ratio(6) |

49.5% |

46.3% |

49.0% |

265 bps |

-57 bps |

47.5% |

46.1% |

-142 bps |

| Operating expenses / Total average assets |

3.8% |

3.8% |

4.0% |

26 bps |

22 bps |

4.4% |

4.9% |

50 bps |

| Capital adequacy - BCP Stand-alone |

|

|

|

|

|

|

|

|

| Global Capital ratio(7) |

n.a |

17.5% |

17.5% |

-5 bps |

n.a |

n.a |

17.5% |

n.a |

| Tier 1 ratio(8) |

n.a |

13.0% |

13.1% |

8 bps |

n.a |

n.a |

13.1% |

n.a |

| Common equity tier 1 ratio(9)(11) |

12.6% |

13.0% |

13.2% |

16 bps |

61 bps |

12.6% |

13.2% |

61 bps |

| Capital adequacy - Mibanco |

|

|

|

|

|

|

|

|

| Global Capital ratio(7) |

n.a |

19.8% |

20.6% |

81 bps |

n.a |

n.a |

20.6% |

n.a |

| Tier 1 ratio(8) |

n.a |

17.4% |

18.2% |

79 bps |

n.a |

n.a |

18.2% |

n.a |

| Common equity tier 1 ratio(9)(11) |

16.5% |

17.6% |

18.4% |

80 bps |

191 bps |

16.5% |

18.4% |

191 bps |

| Employees |

36,968 |

37,161 |

37,074 |

-0.2% |

0.3% |

36,968 |

37,074 |

0.3% |

| Share

Information |

|

|

|

|

|

|

|

|

| Issued Shares |

94,382 |

94,382 |

94,382 |

0.0% |

0.0% |

94,382 |

94,382 |

0.0% |

| Treasury Shares (10) |

14,849 |

14,847 |

14,847 |

0.0% |

0.0% |

14,849 |

14,847 |

0.0% |

| Outstanding Shares |

79,533 |

79,535 |

79,535 |

0.0% |

0.0% |

79,533 |

79,535 |

0.0% |

| (1) Net Interest Margin = Net Interest Income (Excluding Net Insurance Financial Expenses) / Average Interest Earning Assets |

|

| (2) Funding Cost = Interest Expense (Does not include Net Insurance Financial Expenses) / Average Funding |

|

|

| (3) Internal Overdue Loans: includes overdue loans and loans under legal collection, according to our internal policy for overdue loans. Internal Overdue Ratio:

Internal overdue loans / Total loans |

| (4) Non-performing loans (NPL): Internal overdue loans + Refinanced loans. NPL ratio: NPL / Total loans. |

|

|

| (5) Cost of risk = Annualized provision for loan losses, net of recoveries / Total loans. |

| (6) Efficiency Ratio = (Salaries and employee benefits + Administrative expenses + Depreciation and amortization + Association in participation) / (Net

interest, similar income and expenses + Fee Income + Net gain on foreign exchange transactions + Net Gain From associates + Net gain on derivatives held for trading + Result on exchange differences + Insurance Underwriting Result) |

| (7) Regulatory Capital / Risk-weighted assets (legal minimum = 10% since July 2011). |

|

|

|

|

| (8) Tier 1 = Capital + Legal and other capital reserves + Accumulated earnings with capitalization agreement + (0.5 x Unrealized profit and net income in

subsidiaries) - Goodwill - (0.5 x Investment in subsidiaries) + Perpetual subordinated debt (maximum amount that can be included is 17.65% of Capital + Reserves + Accumulated earnings with capitalization agreement + Unrealized profit and net

income in subsidiaries - Goodwill). |

(9) Common Equity Tier I = Capital + Reserves – 100% of applicable deductions (investment in subsidiaries, goodwill, intangibles and net deferred taxes that

rely on future profitability) + retained earnings + unrealized gains.

|

| (10) Consider shares held by Atlantic Security Holding Corporation (ASHC) and stock awards. |

| (11) Common Equity Tier I calculated based on IFRS Accounting |

| |

Datos elaborados por BCP para uso Interno |

12 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Credicorp’s Strategy Update |

Credicorp’s Strategy

Credicorp has demonstrated resilience in a challenging context. The

company has leveraged its financial strength, prudent approach to risk management, client-centered focus, and digital capacities developed over the last decade to navigate complex junctures and bolster its leadership. In 2023, Credicorp anticipated

the credit cycle and revised its appetite for risk while proactively offering financial assistance to clients. The company has developed its proposition for transaction value and increased its insurance offerings to reach more clients while improving

its performance indicators for user experience and frequency of use.

Credicorp continues to invest in technology and disruptive initiatives

to maintain a competitive advantage and ensure sustainability down the line. By understanding market trends and satisfying clients’ needs, Credicorp aims to solidify its position and expand into new markets.

Main KPIs of Credicorp’s Strategy

| Traditional Business Transformation (1) |

Subsidiary |

4Q22 |

3Q23 |

4Q23 |

| Day to Day |

|

|

|

|

| Digital monetary

transactions (2) |

BCP |

67% |

76% |

80% |

| Transactional cost by unit |

BCP |

0.11 |

0.07 |

0.07 |

| Disbursements through

leads (3) |

Mibanco |

76% |

70% |

71% |

| Disbursements through

alternative channels (4) |

Mibanco |

45% |

44% |

41% |

| Mibanco Productivity (5) |

Mibanco |

25.9 |

22.1 |

21.6 |

| Cashless |

|

|

|

|

| Cashless transactions (6) |

BCP |

48% |

51% |

56% |

| Mobile Banking rating iOS |

BCP |

4.7 |

4.7 |

4.7 |

| Mobile Banking rating Android |

BCP |

3.7 |

4.2 |

4.7 |

Digital Acquisition

Digital sales (7) |

BCP |

61% |

58% |

61% |

(1) Figures for December 2022, September 2023, and

December 2023

(2) Monetary Transactions conducted through Retail

Banking, Internet Banking, Yape and Telecredito/Total Retail Monetary Transactions in Retail Banking.

(3) Disbursements generated through leads/Total

disbursements.

(4) Disbursements conducted through alternative

channels/Total disbursements.

(5) Number of loans disbursed/ Total relationship

managers

(6) Amount transacted through Mobile Banking,

Internet Banking, Yape y POS/ Total amount transacted through Retail Banking Minorista.

(7) Units sold by Retail Banking through digital

channels/ Total number of units sold by Retail Banking.

| |

Datos elaborados por BCP para uso Interno |

13 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Credicorp’s Strategy Update |

Disruptive Initiatives: Yape

The year 2023 has been a great one for Yape, which is well on track to

reaching breakeven in 2024. At the end of 2023, thanks to the new functionalities that have been added to the application, Yape hit the 14.2-million user mark and 10.7 of this pool (75%) engage in transactions at least once a month (MAU). In 4Q23,

1.027 million transactions were conducted, which represents a growth of 29% versus the figure in 3Q23 and 133% compared to the print in 4Q22. This year, 2,918 million transactions were recorded, which represents a growth of 143% over the figure

posted in 2022. In the aforementioned context, Yape achieved a TPV of S/137,830 million soles for 2023, which reflects a growth of 108% with regard to 2022. At the end of December, Yape reported an average of 35 transactions per month per MAU, which

represents an improvement of 22% with regard to the figure in September and 72% compared to the print at the end of December 2022.

The different functionalities launched in 2022 have allowed 7.9 million

users to engage in transactions that generate income for Yape (73% of active users), where the monthly revenue per active yapero stood at S/3.9. These new functionalities have improved the client experience, which was reflected in an NPS of 80 points

at the end of the quarter; this represents a 4-point improvement over the figure reported in September and is 9 points above the print at the end of December 2022.

In 4Q23, the drivers of monetization that stood out for each of Yape’s

ambitions were:

Be the main payment venue in the country:

|

● |

Mobile top-ups: In 4Q23, 4.6 million Yape users made more than 50.7 million top-ups, which

represents growth of 20.6% QoQ, 93.3% YoY and 500% with regard to 2022. |

|

● |

Payment services: In 4Q23, Yaperos made 18.1 million service payments through Yape, which

represents growth of 70% versus the print in 3Q23 and is 2.5 times above the number of transactions reported in 2Q23 and 28 times that posted in 1Q23- the quarter when this functionality was launched. |

|

● |

FX transactions: In September 2023, Yape launched a new Exchange-rate functionality. In 4Q23,

more than 139 thousand transactions were reported. |

Be present in the day-to-day of all Yaperos:

|

● |

Yape Promos: In 4Q23, 2.6 million transactions were conducted through Yape Promos, which

represents growth of 20% over the figure reported for 3Q23 and is 89 times above the print in 4Q22. This transaction level translates into a GMV of S/40.9 million (+6% QoQ and 68.7 times the YoY figure) in 4Q23 and 114.9 million for the year. |

|

● |

Store: In October, Yape launched its Marketplace, where Yaperos can purchase appliances and

technology devices. In 4Q23, more than 24 thousand transactions were reported. |

Resolve Yaperos’ financial needs:

|

● |

This quarter, more than 285.5 thousand single installment loans were disbursed (+30 QoQ and +170% YoY)

for a total of S/65.3 million. This represents an increase of 29.5% versus the disbursement level in 3Q23 and is 2.2 higher than 4Q23’s figure. In 4Q23, 5 thousand single installment loan was disbursed for a total of 5.5 million. |

| |

Datos elaborados por BCP para uso Interno |

14 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Credicorp’s Strategy Update |

Main KPIs of Yape

| Disruptive Initiatives: Yape |

4Q22 |

3Q23 |

4Q23 |

| Users |

|

|

|

| Users (millions) |

11.9 |

13.4 |

14.2 |

| Monthly Active Users (MAU) (millions) (1) |

7.9 |

9.8 |

10.7 |

| Fee Income Generating MAU

(millions) |

3.4 |

6.5 |

7.9 |

| Engagement |

|

|

|

| # Monthly Transactions (millions) |

162.5 |

285.8 |

378.3 |

| TPV (3) (S/, millions) |

66.2 |

90.7 |

137.8 |

| Experience |

|

|

|

| NPS (2) |

71 |

76 |

80 |

| Metric per Monthly Active User (MAU) |

|

|

|

| Monthly Transactions / MAU |

21 |

29 |

35 |

| Monthly Revenues / MAU |

1.8 |

2.9 |

3.9 |

| Monthly Cash Cost / MAU |

6.8 |

4.3 |

5.1 |

| Monetization Drivers |

|

|

|

| Payments |

|

|

|

| # Mobile Top-Ups transactions (millions) |

26.2 |

42 |

50.7 |

| # Bill Payments transactions (millions) |

- |

10.6 |

18.1 |

| Yape Promos |

|

|

|

| GMV (4) (S/, millions) |

5.2 |

38.6 |

40.9 |

| Microloans |

|

|

|

| # Disbursements (thousands) |

105.7 |

219.8 |

290.5 |

(1) Yape users that have made at least one transaction over the last month.

(2) Net Promoting Score

(3) Total Payment Volume

(4) Gross Merchant Volume

| |

Datos elaborados por BCP para uso Interno |

15 |

| |

|

|

|

|

| |

Earnings Release 4Q / 2023 |

|

| |

|

|

|

| Credicorp’s Strategy Update |

Integrating Sustainability in Our Businesses

For more information on our sustainability strategy, program and

initiatives, please review: “Sustainability Strategy 2020-25” and “Sustainability and Annual Report 2022”. The following stand out among the milestones hit in the

framework of the Sustainability Program in the 4Q23:

Governance Front – Aligning our corporate governance to best

practice and international standards

|

● |

Board Composition: An external assessment of the board and its committees was conducted, and we already have an action plan based on the recommendations of

the analysis. |

Environmental Front – Driving environmental sustainability from the

financial sector and ESG Risk Management

|

● |

Credicorp publishes its first TCFD report: The TCFD report (Task force on Climate-Related Financial Disclosures)

describes the measures adopted to June 2023 under our environmental strategy and addresses issues related to climate change in the ambits of corporate governance, business strategy, operations, risks, metrics at both the corporate level and at

subsidiaries. |

|

● |

Business Opportunities: At the end of 4Q23, BCP approved 59 green transactions for US$ 585.8MM, which represents almost double the figure reported at the end

of the 3Q23 (32 transactions for US$ 309.9MM). YTD, 43 transactions were conducted for S/8.6MM for Sustainable Car Loans and 83 Green Mortgage Loan transactions were completed for S/50MM. |

|

● |

Carbon Footprint Measurement: At BCP, after having built capacities in 3Q23, we developed a map of our initiatives to reduce our Carbon Footprint.

Additionally, we reviewed the mitigation activities that have been implemented and those that are under exploration. Data was compiled on the footprints of prioritized sectors of the Wholesale Banking portfolio. |

|

● |

Risks: Within the platform for the ESG Risk Enabler, BCP defined the appetite indicators that will be applied to assessments of Investment Portfolios and

Financing. ESG risk training for the Financing portfolio was conducted as part of an on-going effort to strengthen the capacities of the Wholesale Banking teams. |

Social Front – Expanding financial inclusion and educating about

finance and entrepreneurship

|

● |

Financial Inclusion: The “Agente Móvil” Chaski has reached 50 rural areas and 10 urban locations in the departments of Arequipa, Cuzco, and Moquegua. |

|

● |

Financial Education: BCP continued to drive improvements in financial behavior (preventing Overindebtedness/Overdraws on Credit Cards/Late payments

and Promoting Savings) and trained 214 thousand clients through its Education Initiatives for Business. Through its “Mujeres Poderosas” program, Mibanco Perú trained more than 13 thousand representatives from approximately one thousand

social organizations at the national level. Prima AFP relaunched its educational web page “Ahorrando a Fondo,” and had reached more than 4 million people by year-end via approximately 485 thousand sessions. Pacifico, in turn,

provided training to public employees from Disaster Risk management and Brigades in the regions of Libertad and Piura, which are at higher risk under El Nino scenarios. The company rolled out communications campaigns and strengthened capacities

to manage humanitarian efforts. |

The progress made on other initiatives in these and other platforms on

the social front are summarized in the table below:

|

Progress on Initiatives

|

Company

|

1Q23

|

2Q23

|

3Q23

|

4Q23

|

|

Financial Inclusion

|

|

|

|

|

|

|

Financially included through BCP(1) – cumulative since 2020

|

BCP

|

2.6 million

|

3.1 million

|

3.6 million

|

4.1 million

|

|

Stock of inclusive insurance policies – YTD

|

Pacífico Seguros

|

2.8 million

|

2.9 million

|

3.1 million

|

3.2 million

|

|

Financial Education

|

|

|

|

|

|

|

Trained through online courses via ABC at BCP (ABC del BCP) – YTD 2023

|

BCP

|

117.5 thousand

|

230.3 thousand

|

397.9 thousand

|

614.1 thousand

|

|

Individuals trained in risk prevention via Safe Community (Comunidad Segura) – YTD 2023

|

Pacífico Seguros

|

0.3 thousand

|

24.6 thousand

|

33.2 thousand

|

38.4 thousand

|

|

Young people trained through the ABC of the Pension Culture (ABC de la Cultura Previsional) – YTD 2023

|

Prima AFP

|

5.6 thousand

|

24.6 thousand

|

59.9 thousand

|

138.0 thousand

|

|

Clients trained through the Basic Program for Digital Guidance (Programa Básico de Asesoría Digital) – YTD 2023

|

Mibanco Perú

|

108.0 thousand

|

184.0 thousand

|

227.0 thousand

|

272.0 thousand

|

|

Opportunities and Products for Women

|

|

|

|

|

|

|

Number of disbursements through Loans for Women (2)

|

Mibanco Perú

|

12.9 thousand

|

17.0 thousand

|

17.0 thousand

|

12.0 thousand

|

|

Helping small businesses grow

|

|

|

|

|

|

|

Trained via Accompanying Entrepreneurs (Contigo Emprendedor) – YTD 2023

|

BCP

|

13.1 thousand

|

44 thousand

|

80.7 thousand

|

121.0 thousand

|

|

SME-Pymes financially included through loans (working capital and invoice discounting) – YTD 2023

|

BCP

|

7.7 thousand

|

14.5 thousand

|

23.6 thousand

|

34.5 thousand(3)

|

|

Microbusiness affiliated to Yape – YTD 2023

|

BCP

|

1.6 thousand

|

3.9 thousand

|

13.0 thousand

|

26.9 thousand

|

(1) Stock of financially included clients through BCP since 2020: (i)

New clients with savings accounts or affiliated to Yape. (ii) New clients without debt in the financial system or BCP products in the last twelve months. (iii) Clients with 3 monthly average transactions in the last three months.

(2) Non-cumulative. Figure for the period.

(3) Real information up to November (extrapolated through December)

| |

Datos elaborados por BCP para uso Interno |

16 |

| |

|

|

|

|

| |

Earning Release 4Q / 2023 |

Analysis of 4Q23 Consolidated Results |

| |

|

|

|

| |

QoQ, structural loans in average daily balances

(ADB) ADBs increased 0.4% (neutral FX +0.7%), driven primarily by the SME-Pyme and Middle-Market Banking. This growth was partially offset by a drop in i) Corporate Banking, in a context marked by low private investment and a weak

macroeconomic environment and ii) Mibanco, due to changes towards stricter credit guidelines. YoY, structural loan balances rose 0.3% (neutral FX +0.7%), due to growth in balances in Retail Banking, except for Consumer. YTD, loans in ADBs

grew 4.1%, driven by loan growth across Retail banking segments.

QoQ, growth in structural NPLs was driven by (i)

SME-Pyme, which continued to present deterioration in old vintages; (ii) Consumer and Credit Cards, where growth in NPLs was concentrated in tranches for loans overdue more than 120 days.; and (iii) Mibanco, where delinquency was concentrated

mainly among clients with high ticket loans and those who continued to be affected by social conflicts or climatic anomalies. YoY growth in NPLs was driven mainly by the same factors explained in the QoQ analysis for Individuals and SME-Pyme,

and, to a lesser extent, by refinancing of debt in Wholesale Banking for clients in the commercial real estate and tourism sectors throughout 1Q23. The aforementioned dynamics led the Structural NPL ratio to rise QoQ and YoY to stand at 5.6%.

|

|

1.1. Loans

Structural Loans (in Average Daily Balances) (1)(2)(3)

| Structural Loans |

As of |

Year |

Volume Change |

% Change |

% Part. in total structural loans |

| (S/ millions) |

Dec 22 |

Sep 23 |

Dec 23 |

2022 |

2023 |

QoQ |

YoY |

FY |

QoQ |

YoY |

FY |

Dec 22 |

Sep 23 |

Dec 23 |

2022 |

2023 |

| BCP Stand-alone |

112,566 |

111,857 |

112,644 |

107,607 |

111,749 |

787 |

78 |

4,141 |

0.7% |

0.1% |

3.8% |

81.6% |

81.2% |

81.4% |

81.5% |

81.3% |

| Wholesale Banking |

55,622 |

52,090 |

51,880 |

53,735 |

52,442 |

-210 |

-3,742 |

-1,293 |

-0.4% |

-6.7% |

-2.4% |

40.3% |

37.8% |

37.5% |

40.7% |

38.2% |

| Corporate |

33,400 |

31,036 |

30,472 |

32,343 |

31,504 |

-563 |

-2,927 |

-839 |

-1.8% |

-8.8% |

-2.6% |

24.2% |

22.5% |

22.0% |

24.5% |

22.9% |

| Middle - Market |

22,222 |

21,055 |

21,407 |

21,392 |

20,938 |

353 |

-814 |

-454 |

1.7% |

-3.7% |

-2.1% |

16.1% |

15.3% |

15.5% |

16.2% |

15.2% |

| Retail Banking |

56,944 |

59,767 |

60,764 |

53,872 |

59,307 |

997 |

3,820 |

5,434 |

1.7% |

6.7% |

10.1% |

41.3% |

43.4% |

43.9% |

40.8% |

43.1% |

| SME - Business |

5,827 |

6,172 |

6,245 |

5,323 |

6,022 |

73 |

418 |

699 |

1.2% |

7.2% |

13.1% |

4.2% |

4.5% |

4.5% |

4.0% |

4.4% |

| SME - Pyme |

13,180 |

14,380 |

14,902 |

12,466 |

14,178 |

523 |

1,722 |

1,712 |

3.6% |

13.1% |

13.7% |

9.6% |

10.4% |

10.8% |

9.4% |

10.3% |

| Mortgage |

20,073 |

20,712 |

21,061 |

19,484 |

20,626 |

349 |

989 |

1,142 |

1.7% |

4.9% |

5.9% |

14.6% |

15.0% |

15.2% |

14.8% |

15.0% |

| Consumer |

12,738 |

12,654 |

12,604 |

12,000 |

12,753 |

-50 |

-134 |

753 |

-0.4% |

-1.0% |

6.3% |

9.2% |

9.2% |

9.1% |

9.1% |

9.3% |

| Credit Card |

5,126 |

5,848 |

5,951 |

4,599 |

5,728 |

102 |

825 |

1,129 |

1.7% |

16.1% |

24.5% |

3.7% |

4.2% |

4.3% |

3.5% |

4.2% |

| Mibanco |

13,121 |

13,642 |

13,102 |

12,407 |

13,452 |

-539 |

-19 |

1,045 |

-4.0% |

-0.1% |

8.4% |

9.5% |

9.9% |

9.5% |

9.4% |

9.8% |

| Mibanco Colombia |

1,174 |

1,557 |

1,667 |

1,142 |

1,454 |

110 |

493 |

312 |

7.0% |

41.9% |

27.3% |

0.9% |

1.1% |

1.2% |

0.9% |

1.1% |

| Bolivia |

9,034 |

8,957 |

9,186 |

8,813 |

8,982 |

229 |

152 |

170 |

2.6% |

1.7% |

1.9% |

6.5% |

6.5% |

6.6% |

6.7% |

6.5% |

| ASB |

2,039 |

1,733 |

1,749 |

2,056 |

1,818 |

16 |

-290 |

-239 |

0.9% |

-14.2% |

-11.6% |

1.5% |

1.3% |

1.3% |

1.6% |

1.3% |

| BAP’s total loans |

137,934 |

137,745 |

138,348 |

132,025 |

137,454 |

602 |

413 |

5,429 |

0.4% |

0.3% |

4.1% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

|

For consolidation purposes. Loans generated in Foreign Currency (FC) are converted

into Local Currency (LC).

(1) Includes Workout unit and other banking. For Quarter-end balance figures, please

refer to “12. Annexes – 12.2 Loan Portfolio Quality”

(2) Structural Portfolio excludes the Loan offered through Reactiva Peru, FAE Mype,

and Impulso MyPeru Government Programs (GP).

(3) Internal Management Figures.

|

|

QoQ, if we exclude the impact of a reduction in the Exchange

rate (USDPEN: -2.2%), structural loans increased 0.7% in average daily balances. Loans grew 0.4%, driven by:

|

● |

SME-Pyme, which reported sustained growth throughout the year, driven by an uptick at year-end in both short-term loans (working capital) with better risk

profiles and by long-term loans (for fixed asset purchases). |

|

● |

Middle Market Banking, where loans were up due to the growth in working capital disbursements and, to a lesser extent, due to favorable results from the second

fishing and agricultural campaigns. |

|

● |

Mortgage, due to an uptick in the last quarter of the year, due to new product offerings that are tailored to meet a broader cross-section of needs in the

market. |

The aforementioned was partially offset by a reduction in loans

through:

|

● |

Corporate Banking, where loan disbursements fell due to a drop in demand for long-term financing in a context marked by low private investment and a weak

macroeconomic environment. |

|

● |

Mibanco, after credit guidelines were tightened and emphasis was placed on lending to clients with better risk profiles. |

YoY, structural loans in average daily balances grew 0.3%

(+0.7 Neutral FX). Expansion was mainly driven by:

|

● |

Retail Banking, where all segments evolved positively in comparison to 4Q22 with the exception of Consumer, which registered changes to credit guidelines to

improve the portfolio’s credit quality. Noteworthy growth in SME-Business in YoY terms was attributable to an uptick in working capital loans through year-end campaigns. |

| |

Datos elaborados por BCP para uso Interno |

17 |

| |

|

|

|

|

| |

Earning Release 4Q / 2023 |

Analysis of 4Q23 Consolidated Results |

| |

|

|

|

| 01. Loan Portfolio |

The aforementioned was partially offset by a reduction in loan

disbursements via:

|

● |

Wholesale Banking, where lending declined due to a macroeconomic context marked by low private investment and less appetite for long-term debt. |

|

● |

Mibanco, where a drop in loans was driven by the same dynamics as those seen QoQ. |

YTD, loans in average daily balances rose 4.1%. Growth was

driven mainly by Retail Banking and reflected the same dynamics as those in play YoY. At Mibanco, YTD loan growth was primarily attributable to a significant uptick in lending in 2Q23 following a difficult 1Q23, which was marked by social protests

and climate anomalies. The focus in subsequent quarters was on lending to clients with better risk profiles.

Government Program Loans

(in Average Daily Balances - S/ millions)

Government Program Loans (GP) in average daily balances (GP) fell 9.8%

QoQ and 6.4% YoY, which was mainly attributable to an uptick in amortizations at BCP and Mibanco. GP loans represent 2.7% of total loans in average daily balances (vs 3.0% in Sept 23 and 7.2% in December 22).

| |

Datos elaborados por BCP para uso Interno |

18 |

| |

|

|

|

|

| |

Earning Release 4Q / 2023 |

Analysis of 4Q23 Consolidated Results |

| |

|

|

|

| 01. Loan Portfolio |

Total Loans (in Average Daily Balances) (1)(2)

Total Loans

(S/ millions) |

As of |

Year |

Volume Change |

% Change |

% Part. in

total loans |

| |

Dec 22 |

Sep 23 |

Dec 23 |

2022 |

2023 |

QoQ |

YoY |

FY |

QoQ |

YoY |

FY |

Dec 22 |

Sep 23 |

Dec 23 |

2022 |

2023 |

| BCP

Stand-alone |

121,963 |

115,851 |

115,997 |

120,364 |

116,582 |

145 |

-5,966 |

-3,782 |

0.1% |

-4.9% |

-3.1% |

82.1% |

81.5% |

81.5% |

82.2% |

81.6% |

| Wholesale

Banking |

57,497 |

52,796 |

52,469 |

56,441 |

53,338 |

-328 |

-5,028 |

-3,103 |

-0.6% |

-8.7% |

-5.5% |

38.7% |

37.1% |

36.9% |

38.5% |

37.3% |

| Corporate |

33,617 |

31,134 |

30,554 |

32,648 |

31,625 |

-580 |

-3,062 |

-1,023 |

-1.9% |

-9.1% |

-3.1% |

22.6% |

21.9% |

21.5% |

22.3% |

22.1% |

| Middle -

Market |

23,881 |

21,662 |

21,914 |

23,793 |

21,713 |

252 |

-1,966 |

-2,080 |

1.2% |

-8.2% |

-8.7% |

16.1% |

15.2% |

15.4% |

16.2% |

15.2% |

| Retail

Banking |

64,465 |

63,055 |

63,528 |

63,923 |

63,244 |

473 |

-938 |

-679 |

0.7% |

-1.5% |

-1.1% |

43.4% |

44.3% |

44.7% |

43.6% |

44.3% |

| SME - Business |

8,583 |

7,292 |

7,168 |

9,135 |

7,441 |

-124 |

-1,415 |

-1,694 |

-1.7% |

-16.5% |

-18.5% |

5.8% |

5.1% |

5.0% |

6.2% |

5.2% |

| SME - Pyme |

17,947 |

16,549 |

16,744 |

18,705 |

16,696 |

195 |

-1,203 |

-2,009 |

1.2% |

-6.7% |

-10.7% |

12.1% |

11.6% |

11.8% |

12.8% |

11.7% |

| Mortgage |

20,073 |

20,712 |

21,061 |

19,484 |

20,626 |

349 |

989 |

1,142 |

1.7% |

4.9% |

5.9% |

13.5% |

14.6% |

14.8% |

13.3% |

14.4% |

| Consumer |

12,738 |

12,654 |

12,604 |

12,000 |

12,753 |

-50 |

-134 |

753 |

-0.4% |

-1.0% |

6.3% |

8.6% |

8.9% |

8.9% |

8.2% |

8.9% |

| Credit Card |

5,126 |

5,848 |

5,951 |

4,599 |

5,728 |

102 |

825 |

1,129 |

1.7% |

16.1% |

24.5% |

3.5% |

4.1% |

4.2% |

3.1% |

4.0% |

| Mibanco |

14,261 |

14,121 |

13,665 |

14,075 |

14,029 |

-456 |

-596 |

-46 |

-3.2% |

-4.2% |

-0.3% |

9.6% |

9.9% |

9.6% |

9.6% |

9.8% |

| Mibanco

Colombia |

1,174 |

1,557 |

1,667 |

1,142 |

1,454 |

110 |

493 |

312 |

7.0% |

41.9% |

27.3% |

0.8% |

1.1% |

1.2% |

0.8% |

1.0% |

| Bolivia |

9,034 |

8,957 |

9,186 |

8,813 |

8,982 |

229 |

152 |

170 |

2.6% |

1.7% |

1.9% |

6.1% |

6.3% |

6.5% |

6.0% |

6.3% |

| ASB |

2,039 |

1,733 |

1,749 |

2,056 |

1,818 |

16 |

-290 |

-239 |

0.9% |

-14.2% |

-11.6% |

1.4% |

1.2% |

1.2% |

1.4% |

1.3% |

| BAP’s total loans |

148,471 |

142,219 |

142,263 |

146,449 |

142,864 |

44 |

-6,208 |

-3,585 |

0.0% |

-4.2% |

-2.4% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

|

For consolidation purposes. Loans generated in Foreign Currency (FC) are converted into

Local Currency (LC).

(1) Includes Workout unit and other banking. For Quarter-end balance figures, please

refer to “12. Annexes – 12.2 Loan Portfolio Quality”.

(2) Internal Management Figures

|

|

Total loans rose QoQ by fell YoY and YTD, after growth in structural loans was insufficient

to offset the drop in GP loans.

Evolution of Loan Dollarization (in Average Daily Balances) (1)(2)

Total

Loans

(S/ millions) |

Local Currency (LC) |

%

change |

%

change Structural |

Foreign Currency (FC) |

%

change |

% part. by currency |

| Total |

|

Structural |

Total |

Sep 23 |

| Back to index |

Dec 22 |

Sep 23 |

Dec 23 |

|

Dec 22 |

Sep 23 |

Dec 23 |

QoQ |

YoY |

QoQ |

YoY |

Dec 22 |

Sep 23 |

Dec 23 |

QoQ |

YoY |

LC |

FC |

| BCP Stand-alone |

85,106 |

79,896 |

79,423 |

|

75,709 |

75,902 |

76,070 |

-0.6% |

-6.7% |

0.2% |

0.5% |

9,490 |

9,722 |

9,725 |

0.0% |

2.5% |

69.6% |

30.4% |

| Wholesale Banking |

28,351 |

24,341 |

23,452 |

|

26,475 |

23,634 |

22,863 |

-3.7% |

-17.3% |

-3.3% |

-13.6% |

7,505 |

7,695 |

7,716 |

0.3% |

2.8% |

47.3% |

52.7% |

| Corporate |

16,044 |

14,592 |

14,017 |

|

15,827 |

14,494 |

13,935 |

-3.9% |

-12.6% |

-3.9% |

-12.0% |

4,525 |

4,475 |

4,397 |

-1.7% |

-2.8% |

47.6% |

52.4% |

| Middle-Market |

12,307 |

9,748 |

9,434 |

|

10,648 |

9,141 |

8,927 |

-3.2% |

-23.3% |

-2.3% |

-16.2% |

2,980 |

3,220 |

3,318 |

3.1% |

11.4% |

47.0% |

53.0% |

| Retail Banking |

56,755 |

55,555 |

55,972 |

|

49,233 |

52,267 |

53,208 |

0.7% |

-1.4% |

1.8% |

8.1% |

1,985 |

2,028 |

2,009 |

-0.9% |

1.2% |

88.3% |

11.7% |

| SME - Business |

5,530 |

4,302 |

4,242 |

|

2,775 |

3,183 |

3,320 |

-1.4% |

-23.3% |

4.3% |

19.6% |

786 |

809 |

778 |

-3.8% |

-1.0% |

60.5% |

39.5% |

| SME - Pyme |

17,779 |

16,378 |

16,589 |

|

13,013 |

14,209 |

14,747 |

1.3% |

-6.7% |

3.8% |

13.3% |

43 |

46 |

41 |

-10.6% |

-4.3% |

99.0% |

1.0% |

| Mortgage |

18,005 |

18,768 |

19,095 |

|

18,005 |

18,768 |

19,095 |

1.7% |

6.0% |

1.7% |

6.0% |

532 |

526 |

523 |

-0.5% |

-1.7% |

90.4% |

9.6% |

| Consumer |

11,192 |

11,210 |

11,075 |

|

11,192 |

11,210 |

11,075 |

-1.2% |

-1.0% |

-1.2% |

-1.0% |

398 |

390 |

407 |

4.1% |

2.2% |

89.2% |

10.8% |

| Credit Card |

4,249 |

4,898 |

4,971 |

|

4,249 |

4,898 |

4,971 |

1.5% |

17.0% |

1.5% |

17.0% |

226 |

257 |

260 |

1.3% |

15.3% |

84.3% |

15.7% |

| Mibanco |

13,784 |

13,633 |

13,181 |

|

12,644 |

13,153 |

12,618 |

-3.3% |

-4.4% |

-4.1% |

-0.2% |

123 |

132 |

129 |

-2.6% |

4.7% |

96.6% |

3.4% |

| Mibanco Colombia |

- |

- |

- |

|

- |

- |

- |

- |

- |

- |

- |

303 |

421 |

443 |

5.3% |

46.6% |

- |

100.0% |

| Bolivia |

- |

- |

- |

|

- |

- |

- |

- |

- |

- |

- |

2,326 |

2,422 |

2,443 |

0.9% |

5.0% |

- |

100.0% |

| ASB |

- |

- |

- |

|

- |

- |

- |

- |

- |

- |

- |

525 |

469 |

465 |

-0.8% |

-11.4% |

- |

100.0% |

| Total loans |

98,890 |

93,529 |

92,604 |

|

88,353 |

89,055 |

88,689 |

-1.0% |

-6.4% |

-0.4% |

0.4% |

12,766 |

13,166 |

13,204 |

0.3% |

3.4% |

66.4% |

33.6% |

|

For consolidation purposes. Loans generated in Foreign Currency (FC) are converted

into Local Currency (LC).

(1) Includes Workout unit and other banking. For Quarter-end balance figures, please

refer to “12. Annexes – 12.2 Loan Portfolio Quality”.

(2) Internal Management Figures

|

|

At the end of December 2023, the dollarization level of structural loans

rose 55 bps QoQ (35.9% in Dec 23). This result was driven mainly by loan growth via Middle Market Banking, which was attributable to the same dynamics as those seen QoQ.

YoY, the dollarization level of the structural portfolio fell

5bps, spurred by growth in Retail Banking products, where disbursements are generally made in soles, and by a reduction in loans via Wholesale Banking, whose disbursements are typically in US Dollars. The decline in Wholesale loans was attributable

to a drop in the demand for loans in a context marked by les private investment.

| |

Datos elaborados por BCP para uso Interno |

19 |

| |

|

|

|

|

| |

Earning Release 4Q / 2023 |

Analysis of 4Q23 Consolidated Results |

| |

|

|

|

| 01. Loan Portfolio |

Evolution of the Dollarization Level of Structural Loans (in Average

Daily Balances)

(1) The FC share of Credicorp’s loan portfolio is calculated including

BCP Bolivia and ASB Bank Corp., however the chart shows only the loan books of BCP Stand-alone and Mibanco.

(2) The year with the historic maximum level of dollarization for

Wholesale Banking was 2012, for Mibanco was 2016, for Credit Card was in 2021 and for the rest of segments was 2009.

* For dollarization figures in the quarter-end period, please refer to

“12. Annexes – 12.2 Loan Portfolio Quality

Evolution of Loans in Quarter-end Balances

Structural loans rose 0.3% in quarter-end balances, driven by the same

factors as those seen in the analysis of loans in average daily balances. If we incorporate the contraction in the PG portfolio in the analysis, total loans decreased 0.1% QoQ, given that amortizations in government programs were not offset by the

growth in structural loans.

In the YoY evolution, structural loans rose 1.6% and total loans fell

2.5%, respectively, due to amortizations in government programs.

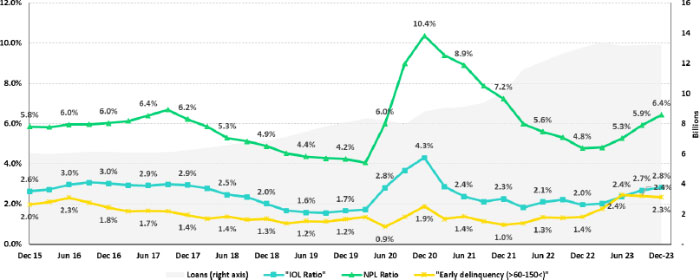

1.2. Portfolio Quality

Quality of the Structural Portfolio (In Quarter-end Balances)

| Structural Portfolio quality and Delinquency ratios |

As of |

% change |

| S/000 |

| Back to index |

Dec 22 |

Sep 23 |

Dec 23 |

QoQ |

YoY |

| Structural loans

(Quarter-end balance) |

139,115,242 |

140,949,490 |

141,380,548 |

0.3% |

1.6% |

| Structural Allowance for loan

losses |

7,733,575 |

7,941,933 |

8,158,704 |

2.7% |

5.5% |

| Structural Write-offs |

754,326 |

1,018,084 |

879,401 |

-13.6% |

16.6% |

| Structural IOLs |

4,791,245 |

5,578,985 |

5,560,513 |

-0.3% |

16.1% |

| Structural Refinanced loans |

2,098,748 |

2,253,098 |

2,406,058 |

6.8% |

14.6% |

| Structural NPLs |

6,889,993 |

7,832,083 |

7,966,571 |

1.7% |

15.6% |

| Structural IOL ratio |

3.4% |

4.0% |

3.9% |

-3 bps |

49 bps |

| Structural NPL ratio |

5.0% |

5.6% |

5.6% |

7 bps |

68 bps |

| Structural Allowance for loan losses over Structural loans |

5.6% |

5.6% |

5.8% |

14 bps |

21 bps |

| Structural

Coverage ratio of NPLs |

112.2% |

101.4% |

102.4% |

101 bps |

-983 bps |

(1) The Structural Portfolio excludes Government Programs (GP) effects.

In 4Q23, Structural Non-Performing Loans (NPL) registered slight

growth of 1.7% QoQ. This evolution was primarily driven by SME-Pyme, which registered further deterioration of old vintages. Throughout the year, payment capacity of clients in Personal Banking was impacted by a recessive

environment, which led to growth in delinquency that was concentrated primarily in tranches for loans overdue more than 120 days in Consumer and Credit Cards.

YoY, Structural NPLs rose 15.6%, driven by the same factores seen in the

QoQ evolution; a deterioration in loans with higher tickets at Mibanco; as well as newly delinquent loans and refinancing for some clients in Wholesale Banking.

| |

Datos elaborados por BCP para uso Interno |

20 |

| |

|

|

|

|

| |

Earning Release 4Q / 2023 |

Analysis of 4Q23 Consolidated Results |

| |

|

|

|

| 01. Loan Portfolio |

Structural NPL Ratio

In the QoQ analysis, the Structural NPL volume increased due to a

deterioration in client payment capacity in an adverse macroeconomic scenario. The segments that contributed to this uptick were:

|

● |

SME-Pyme, which continued to register deterioration in vintages prior to adjustments in credit guidelines; this deterioration was concentrated in profiles with

higher risk. For loans disbursed after adjustments were made, indicators of early delinquency began to improve in the last few months of the year. |

|

● |

Consumer and Credit Cards, where growth in NPLs was concentrated in tranches for loans overdue more than 120 days. |

|

● |

Mibanco, where delinquency was concentrated in loans with higher tickets. This quarter, credit guidelines were further tightened. |

The aforementioned was partially offset by payments of overdue loans and

recovery of judicial loans, both associated with corporate clients in Wholesale Banking.

YoY, growth in the NPL volume was driven by:

|

● |

SME-Pyme, driven by the same factors as those seen QoQ, where delinquency was concentrated in clients with smaller tickets (< a S/90 mil) and higher risk. |

|

○ |

Consumer and Credit Cards, due to the same dynamics as those seen QoQ. |

|

○ |

Mortgage, attributable to the growth in refinanced loans disbursed in 3Q23 that had benefitted from loan reprogramming during the pandemic. |

|

● |

Wholesale Banking, due to growth in overdue loans and an uptick in refinancing throughout the year for clients in the commercial real estate and tourism sectors,

both of which were severely impacted by the pandemic and continued to experience distress due to an adverse marcoeconomic context. It is important to note that these loans are backed by extensive guarantees (collateral) and were previously

provisioned. |

|

● |

Mibanco, due to the same dynamics seen QoQ and impacted by a recessive environment and the consequent impact on payment capacities. |

In the aforementioned context, the Structural NPL ratio rose 7 bps QoQ

and 68 bps YoY to stand at 5.6%.

| |

Datos elaborados por BCP para uso Interno |

21 |

| |

|

|

|

|

| |

Earning Release 4Q / 2023 |

Analysis of 4Q23 Consolidated Results |

| |

|

|

|

| 01. Loan Portfolio |

Write-offfs in the Structural Loan Portfolio

(in Quarter-end balances– S/ millions)

QoQ, write-offs of structural loans remained at

high levels but nonetheless fell 13.6%. This reflects the fact that a higher number of write-offs were reported last quarter in the SME-Pyme, Consumer and Credit Card segments as well as at Mibanco.

YTD, growth in write-offs of structural loans

(+16.6%) was driven by Credit Cards, Consumer and SME-Pyme. This increase corresponds to write-offs of loans from the highest-risk segments.

Coverage Ratio of Structural NPL Loans

QoQ, the Coverage Ratio for NPL loans rose 101

bps. This evolution was driven primarily by provisions set aside for the El Niño Phenomenon.

YoY, the Coverage Ratio for NPL loans fell 9.83

pp, driven primarily by Wholesale Banking, where the structural NPL volume rose significantly over the year due to an uptick in refinanced and overdue loans. Nevertheless, these loans did not trigger higher provisions because they are

backed by collateral whose value far exceeds the borrower’s total debt.

NPL Loans in the Government Loan Portfolio

(in Quarter-end balances– S/ millions)

QoQ, NPLs in the Government Loan portfolio (GP)

dropped due to an increase in the execution of loan honoring processes for Reactiva loans, mainly in SME-Pyme. These loans are backed by State guarantees. To execute payment processes, loans must be more than 90 days past due. Average

guarantees stand at 84%, 91% and 97% for Wholesale Banking, Retail Banking and Mibanco respectively. At the end of December 2023, a total S/ 1,769 million was collected through honoring processes to execute State guarantees.

| |

Datos elaborados por BCP para uso Interno |

22 |

| |

|

|

|

|

| |

Earning Release 4Q / 2023 |

Analysis of 4Q23 Consolidated Results |

| |

|

|

|

| 01. Loan Portfolio |

Total Portfolio Quality (in Quarter-end Balances)

| Loan

Portfolio quality and Delinquency ratios |

As of |

%

change |

| S/ 000 |

Dec

22 |

Sep 23 |

Dec

23 |

QoQ |

YoY |

| Total loans (Quarter-end balance) |

148,626,374 |

145,129,260 |

144,976,051 |

-0.1% |

-2.5% |

| Allowance for loan losses |

7,872,402 |

8,056,216 |

8,277,916 |

2.8% |

5.2% |

| Write-offs |

754,326 |

1,018,084 |

879,401 |

-13.6% |

16.6% |

| Internal overdue loans (IOLs) (1)(2) |

5,939,744 |

6,406,345 |

6,126,487 |

-4.4% |

3.1% |

| Internal overdue loans over 90-days (1) |

4,620,461 |

5,133,832 |

5,018,489 |

-2.2% |

8.6% |

| Refinanced Loans (2) |

2,098,748 |

2,253,098 |

2,406,058 |

6.8% |

14.6% |

| Non-performing loans (NPLs) (3) |

8,038,492 |

8,659,443 |

8,532,545 |

-1.5% |

6.1% |

| IOL ratio |

4.0% |

4.4% |

4.2% |

-18 bps |

23 bps |

| IOL over 90-days ratio |

3.1% |

3.5% |

3.5% |

-8 bps |

35 bps |

| NPL ratio |

5.4% |

6.0% |

5.9% |

-8 bps |

48 bps |

| Allowance for loan losses over Total loans |

5.3% |

5.6% |

5.7% |

16 bps |

41 bps |

| Coverage ratio of IOLs |

132.5% |

125.8% |

135.1% |

937 pbs |

258 bps |

| Coverage ratio of IOL 90-days |

170.4% |

156.9% |

164.9% |

803 pbs |

-543 pbs |

| Coverage ratio of

NPLs |

97.9% |

93.0% |

97.0% |

399 bps |

-91

bps |

|

(1) |

Includes Overdue Loans and Loans under legal collection (Quarter-end balances net of deferred earnings). |

|

(2) |

Figures net of deferred earnings. |

|

(3) |

Non-performing Loans include Internal Overdue Loans and Refinanced Loans (Quarter-end balances net of deferred earnings) |

In the aforementioned context, Credicorp’s NPL ratio fell 8 bps QoQ but rose 48 bps to stand