Form 8-K - Current report

15 8월 2024 - 8:15PM

Edgar (US Regulatory)

false

0001477845

0001477845

2024-08-15

2024-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 15, 2024

ANNOVIS BIO, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-39202 |

26-2540421 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

101

Lindenwood Drive, Suite 225

Malvern, PA

19355

(Address of Principal Executive Offices, and

Zip Code)

(484) 875-3192

Registrant’s Telephone Number, Including

Area Code

Not

Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

ANVS |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communication pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition

On August 15, 2024,

Annovis Bio, Inc. issued a press release announcing its financial results for the quarter ended June 30, 2024 and providing

a corporate update. A copy of the press release is furnished herewith as Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits.

The following exhibits

are being furnished herewith:

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANNOVIS BIO, INC. |

| |

|

|

| Date: August 15, 2024 |

By: |

/s/ Maria Maccecchini |

| |

|

Name: Maria Maccecchini |

| |

|

Title: President and Chief Executive Officer |

Exhibit 99.1

Annovis Bio Reports Second Quarter Financial Results and Provides

Business Update

MALVERN,

Pa., August 15, 2024 (GLOBE NEWSWIRE) -- via IBN – Annovis Bio Inc. (NYSE: ANVS) (“Annovis” or the “Company”),

a clinical-stage drug platform company developing novel therapies for neurodegenerative diseases such as Alzheimer’s disease (AD)

and Parkinson’s disease (PD), today announced financial results for the second quarter ended June 30, 2024, and provided a

business update.

"The recent months have been productive for our company,”

said Maria Maccecchini, Ph.D., Founder, President, and CEO of Annovis Bio. “We've completed pivotal Phase 2/3 Alzheimer's and Phase

3 Parkinson's studies, both of which revealed very encouraging data for buntanetap. Additionally, we’ve introduced a new crystalline

form of buntanetap with improved properties, further strengthening our IP portfolio. These milestones position us strongly as we move

closer to providing much-needed treatments to patients.”

Clinical Trial Updates

Alzheimer’s Disease (AD)

| · | On April 29, 2024, Annovis Bio reported data from its completed Phase 2/3 AD study. The results

showed that buntanetap significantly improved cognition in patients with early AD, with a 3.3-point improvement on the ADAS-Cog11 test

after three months of treatment, compared to a 0.3-point improvement in the placebo group. |

| · | The study also indicated a trend toward reduced plasma tau protein levels, consistent with previous

findings, suggesting a potential disease-modifying effect of buntanetap. |

| · | A follow-up analysis, on June 11, 2024, demonstrated that buntanetap was particularly effective

in improving cognition among high-risk APOE4 carriers, showing a 3.15-point improvement. |

| · | Buntanetap was found to be equally safe in both APOE4 carriers and non-carriers, with no instances of

Amyloid-Related Imaging Abnormalities (ARIA) observed. |

Parkinson’s Disease (PD)

| · | On July 2, 2024, Annovis Bio announced the Phase 3 PD study data, which revealed that buntanetap

led to significant improvements in both the Unified Parkinson's Disease Rating Scale (MDS-UPDRS) and cognition across several PD subpopulations. |

| · | Buntanetap showed a particularly strong response in individuals diagnosed with PD for more than three

years as well as in those with postural instability and gait disorder (PIGD). |

| · | Moreover, buntanetap halted cognitive decline in all enrolled patients and improved cognition in those

with mild dementia, mirroring the positive results observed in our AD studies. |

Second Quarter 2024 Financial Results

| · | Annovis Bio received $7.1 million net cash from exercises of Canaccord warrants in July 2024. |

| · | Cumulatively to date, received $7.0 million net cash from ELOC facility announced in April 2024. |

| · | The Company’s cash and cash equivalents totaled $4.0 million as of June 30, 2024, compared

to $5.7 million as of December 31, 2023. The Company had 11.7 million shares of common stock outstanding as of June 30, 2024. |

| · | After recent warrant exercises and ELOC share placements, as of August 14, 2024, Annovis had cash

and cash equivalents of $12.1 million, which we believe is sufficient to support operations through the planned AD and PD FDA meetings

in Fall and continuing until the initiation of the two pivotal studies planned. |

| · | Total operating expenses for the three months ended June 30, 2024, were $7.8 million, which included

research and development expenses of $5.8 million and general and administrative expenses of $2.0 million. This compares to total operating

expenses for the three months ended June 30, 2023, of $9.8 million, which included research and development expenses of $8.2 million

and general and administrative expenses of $1.5 million. |

| · | Annovis Bio reported a $0.44 basic and diluted net loss per common share for the three months ended

June 30, 2024. This compares to a $1.07 basic and diluted net loss per common share for the three months ended June 30, 2023. |

Patents

| · | The Company filed a new composition of matter patent covering a novel crystal form of buntanetap and

its use for treating and/or preventing various neurodegenerative conditions. The new crystalline form offers significant advantages over

the less structured, old semi-crystalline form, including better solubility and stability as well as an additional 20 years of patent

life |

| · | The Company has filed a provisional patent for the methods of manufacturing this new crystalline form,

covering the entire synthesis process—from basic starting materials to finished GMP product—suitable for large-scale manufacturing

at ton quantities. |

| · | On July 16, 2024, Annovis Bio received FDA approval to continue the phase 3 development with the

new crystal form. |

| · | Additionally, the Company was granted a U.S. patent for the use of buntanetap in the treatment of acute

traumatic brain injury. |

Team Updates

| · | On July 9, 2024, Annovis Bio announced the expansion of its team with several key appointments:

Mark White as Chief Business Officer, Alexander Morin as Director of Strategic Communications, Hilda Maibach as Senior Vice President

of Statistics, and Blake Jensen as Head of Quality. |

Other Achievements

| · | On May 21, 2024, the Company shared a new scientific article focused on the similarities and differences

in buntanetap’s pharmacokinetic behavior between several animal models and humans, summarizing years of research. |

| · | On August 6, 2024, Annovis Bio revealed new preclinical data showing a synergistic improvement

on cognition when combining buntanetap with the GLP-1 agonist Trulicity®. |

About Annovis

Bio, Inc. Headquartered in Malvern, Pennsylvania, Annovis Bio Inc. is dedicated to addressing neurodegeneration in diseases

such as AD and PD. The company’s innovative approach targets multiple neurotoxic proteins, aiming to restore brain function and

improve the quality of life for patients. For more information, visit www.annovisbio.com and follow us on LinkedIn, YouTube, and X.

Investor

Alerts Interested investors and shareholders are encouraged to sign up for press releases and industry updates by registering

for Email Alerts at https://www.Annovisbio.com/email-alerts.

Forward-Looking

Statements This press release contains "forward-looking" statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include,

but are not limited to, the Company's plans related to clinical trials. Forward-looking statements are based on current expectations and

assumptions and are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Such

risks and uncertainties include, but are not limited to, those related to patient enrollment, the effectiveness of Buntanetap, and the

timing, effectiveness, and anticipated results of the Company's clinical trials evaluating the efficacy, safety, and tolerability of Buntanetap.

Additional risk factors are detailed in the Company's periodic filings with the SEC, including those listed in the "Risk Factors"

section of the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. All forward-looking statements in this

press release are based on information available to the Company as of the date of this release. The Company expressly disclaims any obligation

to update or revise its forward-looking statements, whether as a result of new information, future events, or otherwise, except as required

by law.

Contacts

Annovis Bio, Inc.

101 Lindenwood Drive

Suite 225

Malvern, PA 19355

www.annovisbio.com

Investor

Contact

Scott McGowan

InvestorBrandNetwork (IBN)

Phone: 310.299.1717

IR@annovisbio.com

Investor Website

v3.24.2.u1

Cover

|

Aug. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 15, 2024

|

| Entity File Number |

001-39202

|

| Entity Registrant Name |

ANNOVIS BIO, INC.

|

| Entity Central Index Key |

0001477845

|

| Entity Tax Identification Number |

26-2540421

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

101

Lindenwood Drive

|

| Entity Address, Address Line Two |

Suite 225

|

| Entity Address, City or Town |

Malvern

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19355

|

| City Area Code |

484

|

| Local Phone Number |

875-3192

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ANVS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

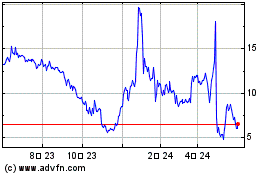

Annovis Bio (NYSE:ANVS)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

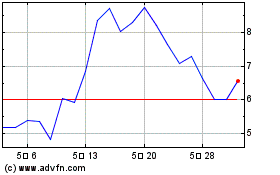

Annovis Bio (NYSE:ANVS)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025