Service Properties Trust Second Quarter 2023 Financial Results and Supplemental Information August 7, 2023 Exhibit 99.2Sonesta Philadelphia Downtown Philadelphia, PA

2RETURN TO TABLE OF CONTENTS Table of Contents QUARTERLY RESULTS Service Properties Trust Announces Second Quarter 2023 Financial Results ............................................................................................................................................ 4 Second Quarter 2023 Highlights ......................................................................................................................................................................................................................... 5 Second Quarter 2023 Results ............................................................................................................................................................................................................................... 6 FINANCIALS Key Financial Data .................................................................................................................................................................................................................................................. 8 Condensed Consolidated Statements of Income (Loss) ................................................................................................................................................................................. 9 Condensed Consolidated Balance Sheets ........................................................................................................................................................................................................ 10 Debt Summary ......................................................................................................................................................................................................................................................... 11 Debt Maturity Schedule ......................................................................................................................................................................................................................................... 12 Leverage Ratios, Coverage Ratios and Public Debt Covenants .................................................................................................................................................................... 13 Capital Expenditures and Restricted Cash Activity .......................................................................................................................................................................................... 14 Property Acquisitions and Dispositions Information Since January 1, 2023 ............................................................................................................................................... 15 PORTFOLIO INFORMATION Portfolio Summary .................................................................................................................................................................................................................................................. 17 Consolidated Portfolio Diversification by Industry ........................................................................................................................................................................................... 18 Consolidated Portfolio Geographical Diversification ...................................................................................................................................................................................... 19 Hotel Portfolio by Brand ........................................................................................................................................................................................................................................ 20 Hotel Operating Statistics by Service Level - Comparable Hotels - three months ended June 30, 2023 ............................................................................................. 21 Hotel Operating Statistics by Service Level - Comparable Hotels - six months ended June 30, 2023 .................................................................................................. 22 Hotel Operating Statistics by Service Level - All Hotels - three months ended June 30, 2023 ............................................................................................................... 23 Hotel Operating Statistics by Service Level - All Hotels - six months ended June 30, 2023 .................................................................................................................... 24 Net Lease Portfolio by Brand ................................................................................................................................................................................................................................ 25 Net Lease Portfolio by Industry ............................................................................................................................................................................................................................ 26 Net Lease Portfolio by Tenant (Top 10) .............................................................................................................................................................................................................. 27 Net Lease Portfolio - Expiration Schedule ......................................................................................................................................................................................................... 28 Net Lease Portfolio - Occupancy Summary ....................................................................................................................................................................................................... 29 APPENDIX Company Profile and Research Coverage ......................................................................................................................................................................................................... 31 Governance Information ....................................................................................................................................................................................................................................... 32 Non-GAAP Financial Measures and Certain Definitions ................................................................................................................................................................................. 33 Calculation of FFO and Normalized FFO ........................................................................................................................................................................................................... 35 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre ............................................................................................................................................................................ 36 Calculation and Reconciliation of Hotel EBITDA - Comparable Hotels ...................................................................................................................................................... 37 Calculation and Reconciliation of Hotel EBITDA - All Hotels.......................................................................................................................................................................... 38 Notes to Condensed Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre and Hotel EBITDA ...................................................................................................................................................................................................................................................... 39 WARNING CONCERNING FORWARD-LOOKING STATEMENTS .............................................................................................................................................................................................. 40 SVC Nasdaq Listed Trading Symbols: Common Shares: SVC Investor Relations Contact: Stephen Colbert, Director (617) 231-3223 scolbert@svcreit.com Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458-1634 All amounts in this presentation are unaudited. Additional information and reconciliations of Non-GAAP measures to amounts determined in accordance with U.S. GAAP appear in the appendix to this presentation. Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this presentation. Dollar amounts in thousands, unless otherwise noted.

3RETURN TO TABLE OF CONTENTS Quarterly Results

4RETURN TO TABLE OF CONTENTS Newton, MA (August 7, 2023): Service Properties Trust (Nasdaq: SVC) today announced its financial results for the quarter ended June 30, 2023. Dividend: SVC has declared a quarterly distribution on its common shares of $0.20 per share to shareholders of record as of the close of business on July 24, 2023. This distribution will be paid on or about August 17, 2023. Conference Call: A conference call to discuss SVC's second quarter results will be held on Tuesday, August 8, 2023 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (877) 329-3720 or (412) 317-5434 (if calling from outside the United States and Canada); a pass code is not required. A replay will be available for one week by dialing (412) 317-0088; the replay pass code is 7508126. A live audio webcast of the conference call will also be available in a listen-only-mode on SVC’s website, at www.svcreit.com. The archived webcast will be available for replay on SVC’s website after the call. The transcription, recording and retransmission in any way of SVC's second quarter conference call are strictly prohibited without the prior written consent of SVC. About Service Properties Income Trust: Service Properties Trust (Nasdaq: SVC) is a real estate investment trust, or REIT, with over $11 billion invested in two asset categories: hotels and service-focused retail net lease properties. As of June 30, 2023, SVC owned 221 hotels with over 37,000 guest rooms throughout the United States and in Puerto Rico and Canada, the majority of which are extended stay and select service. As of June 30, 2023, SVC also owned 763 retail service-focused net lease properties totaling approximately 13.5 million square feet throughout the United States. SVC is managed by The RMR Group (Nasdaq: RMR), an alternative asset management company with approximately $36 billion in assets under management as of June 30, 2023 and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. SVC is headquartered in Newton, MA. For more information, visit www.svcreit.com. Service Properties Trust Announces Second Quarter 2023 Financial Results "Second quarter results continued solid year over year growth seen in our hotel portfolio along with the ongoing strength in the net lease business. Our largest tenant is now backed by an investment grade company in BP and with our new long term revolving credit facility and the cash we received from the TA transaction, we currently have over $1 billion in total liquidity." Todd Hargreaves, President and Chief Investment Officer

5RETURN TO TABLE OF CONTENTS Second Quarter 2023 Highlights Financial Results • Net loss of $11.3 million, or $(0.07) per common share. • Normalized FFO of $95.1 million, or $0.58 per common share. • Adjusted EBITDAre of $185.3 million. Portfolio Update • Comparable Hotel RevPAR of $97.07. • Comparable Hotel EBITDA of $93.4 million. • Net Lease occupancy of 96.1%. • Net Lease rent coverage of 2.94x. Investment Activity • Purchased one hotel with 250 keys for a purchase price of $165.4 million, excluding closing costs. • Sold two net lease properties with 2,384 square feet for an aggregate sales price of $620.0 thousand, excluding closing costs. Liquidity and Financing Activities • As of June 30, 2023, SVC had over $1.0 billion of liquidity, including $434.9 million of cash and cash equivalents and $650.0 million available to borrow under its revolving credit facility. • SVC entered into a new $650.0 million secured revolving credit facility. The maturity date of the new facility is June 29, 2027, and includes two six-month extensions at the borrower’s option. Interest paid on drawings under the new facility is based on SOFR plus a margin (currently 2.50%). The new facility is secured by 69 properties (66 hotels and three net lease properties). TA Agreement • As previously announced, SVC amended its leases and guarantees with TravelCenters of America Inc. (Nasdaq: TA) effective upon the completion of the acquisition of TA by BP p.l.c. (NYSE: BP) on May 15, 2023 for cash consideration of $86.00 per share of TA common stock outstanding. • SVC received a total of $379.2 million in cash for the TA shares it owned, the sale of the TA tradenames and trademarks to BP and rent prepaid by BP.

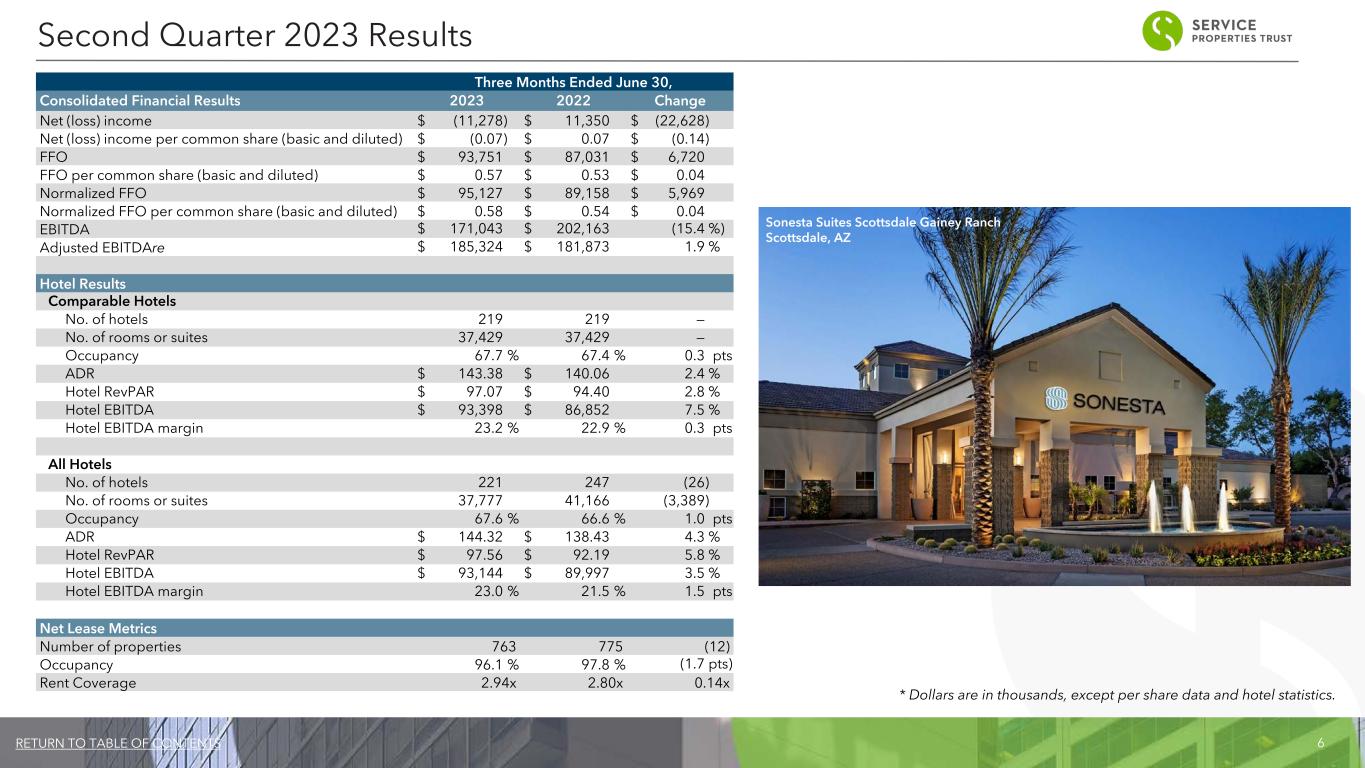

6RETURN TO TABLE OF CONTENTS Second Quarter 2023 Results Three Months Ended June 30, Consolidated Financial Results 2023 2022 Change Net (loss) income $ (11,278) $ 11,350 $ (22,628) Net (loss) income per common share (basic and diluted) $ (0.07) $ 0.07 $ (0.14) FFO $ 93,751 $ 87,031 $ 6,720 FFO per common share (basic and diluted) $ 0.57 $ 0.53 $ 0.04 Normalized FFO $ 95,127 $ 89,158 $ 5,969 Normalized FFO per common share (basic and diluted) $ 0.58 $ 0.54 $ 0.04 EBITDA $ 171,043 $ 202,163 (15.4 %) Adjusted EBITDAre $ 185,324 $ 181,873 1.9 % Hotel Results Comparable Hotels No. of hotels 219 219 — No. of rooms or suites 37,429 37,429 — Occupancy 67.7 % 67.4 % 0.3 pts ADR $ 143.38 $ 140.06 2.4 % Hotel RevPAR $ 97.07 $ 94.40 2.8 % Hotel EBITDA $ 93,398 $ 86,852 7.5 % Hotel EBITDA margin 23.2 % 22.9 % 0.3 pts All Hotels No. of hotels 221 247 (26) No. of rooms or suites 37,777 41,166 (3,389) Occupancy 67.6 % 66.6 % 1.0 pts ADR $ 144.32 $ 138.43 4.3 % Hotel RevPAR $ 97.56 $ 92.19 5.8 % Hotel EBITDA $ 93,144 $ 89,997 3.5 % Hotel EBITDA margin 23.0 % 21.5 % 1.5 pts Net Lease Metrics Number of properties 763 775 (12) Occupancy 96.1 % 97.8 % (1.7 pts) Rent Coverage 2.94x 2.80x 0.14x Sonesta Suites Scottsdale Gainey Ranch Scottsdale, AZ * Dollars are in thousands, except per share data and hotel statistics.

7RETURN TO TABLE OF CONTENTS Financials

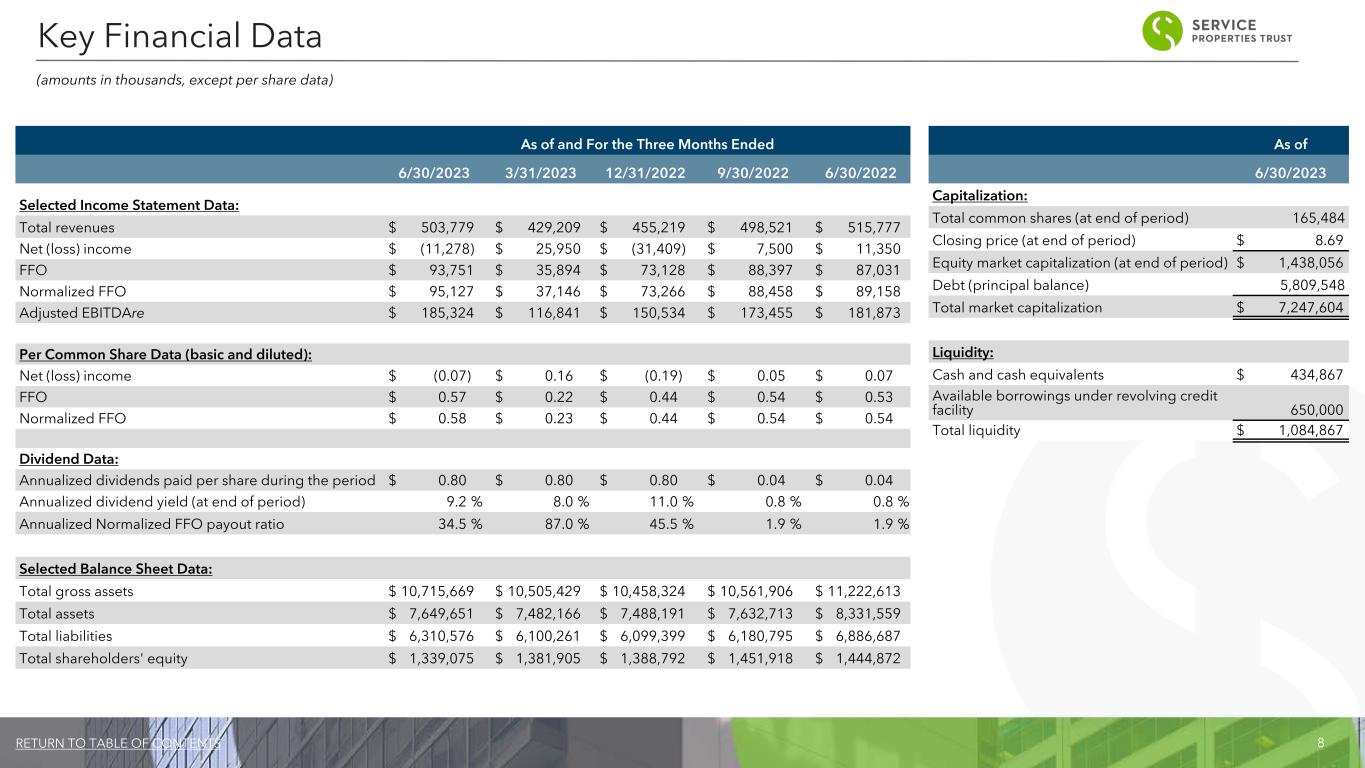

8RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 Selected Income Statement Data: Total revenues $ 503,779 $ 429,209 $ 455,219 $ 498,521 $ 515,777 Net (loss) income $ (11,278) $ 25,950 $ (31,409) $ 7,500 $ 11,350 FFO $ 93,751 $ 35,894 $ 73,128 $ 88,397 $ 87,031 Normalized FFO $ 95,127 $ 37,146 $ 73,266 $ 88,458 $ 89,158 Adjusted EBITDAre $ 185,324 $ 116,841 $ 150,534 $ 173,455 $ 181,873 Per Common Share Data (basic and diluted): Net (loss) income $ (0.07) $ 0.16 $ (0.19) $ 0.05 $ 0.07 FFO $ 0.57 $ 0.22 $ 0.44 $ 0.54 $ 0.53 Normalized FFO $ 0.58 $ 0.23 $ 0.44 $ 0.54 $ 0.54 Dividend Data: Annualized dividends paid per share during the period $ 0.80 $ 0.80 $ 0.80 $ 0.04 $ 0.04 Annualized dividend yield (at end of period) 9.2 % 8.0 % 11.0 % 0.8 % 0.8 % Annualized Normalized FFO payout ratio 34.5 % 87.0 % 45.5 % 1.9 % 1.9 % Selected Balance Sheet Data: Total gross assets $ 10,715,669 $ 10,505,429 $ 10,458,324 $ 10,561,906 $ 11,222,613 Total assets $ 7,649,651 $ 7,482,166 $ 7,488,191 $ 7,632,713 $ 8,331,559 Total liabilities $ 6,310,576 $ 6,100,261 $ 6,099,399 $ 6,180,795 $ 6,886,687 Total shareholders' equity $ 1,339,075 $ 1,381,905 $ 1,388,792 $ 1,451,918 $ 1,444,872 (amounts in thousands, except per share data) Key Financial Data Sonesta ES Suites Fort Lauderdale, FL As of 6/30/2023 Capitalization: Total common shares (at end of period) 165,484 Closing price (at end of period) $ 8.69 Equity market capitalization (at end of period) $ 1,438,056 Debt (principal balance) 5,809,548 Total market capitalization $ 7,247,604 Liquidity: Cash and cash equivalents $ 434,867 Available borrowings under revolving credit facility 650,000 Total liquidity $ 1,084,867

9RETURN TO TABLE OF CONTENTS Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Revenues: Hotel operating revenues (1) $ 404,327 $ 418,984 $ 739,123 $ 716,390 Rental income (2) 99,452 96,793 193,865 193,151 Total revenues 503,779 515,777 932,988 909,541 Expenses: Hotel operating expenses (1)(3) 309,100 325,194 608,666 615,537 Other operating expenses 4,372 3,179 8,277 5,650 Depreciation and amortization 94,571 100,520 194,610 204,633 General and administrative 12,420 12,665 23,331 24,452 Transaction related costs (4) 931 743 1,818 1,920 Loss on asset impairment, net (5) 9,005 3,048 9,005 8,548 Total expenses 430,399 445,349 845,707 860,740 (Loss) gain on sale of real estate, net (6) (62) 38,851 41,836 44,399 (Loss) gain on equity securities, net (7) (593) (10,059) 48,837 (20,319) Interest income 3,468 1,021 6,254 1,294 Interest expense (including amortization of debt issuance costs and debt discounts and premiums of $6,804, $5,021, $12,036 and $10,934, respectively) (82,503) (89,820) (164,083) (182,164) Loss on early extinguishment of debt (8) (238) (791) (282) (791) (Loss) income before income taxes and equity in earnings of an investee (6,548) 9,630 19,843 (108,780) Income tax expense (5,247) (473) (1,467) (1,168) Equity in earnings (losses) of an investee (9) 517 2,193 (3,704) 1,476 Net (loss) income $ (11,278) $ 11,350 $ 14,672 $ (108,472) Weighted average common shares outstanding (basic and diluted) 164,902 164,677 164,884 164,672 Net (loss) income per common share (basic and diluted) $ (0.07) $ 0.07 $ 0.09 $ (0.66) (amounts in thousands, except per share data) Condensed Consolidated Statements of Income (Loss) See accompanying notes on page 39. Sonesta Simply Suites Jacksonville Jacksonville, FL

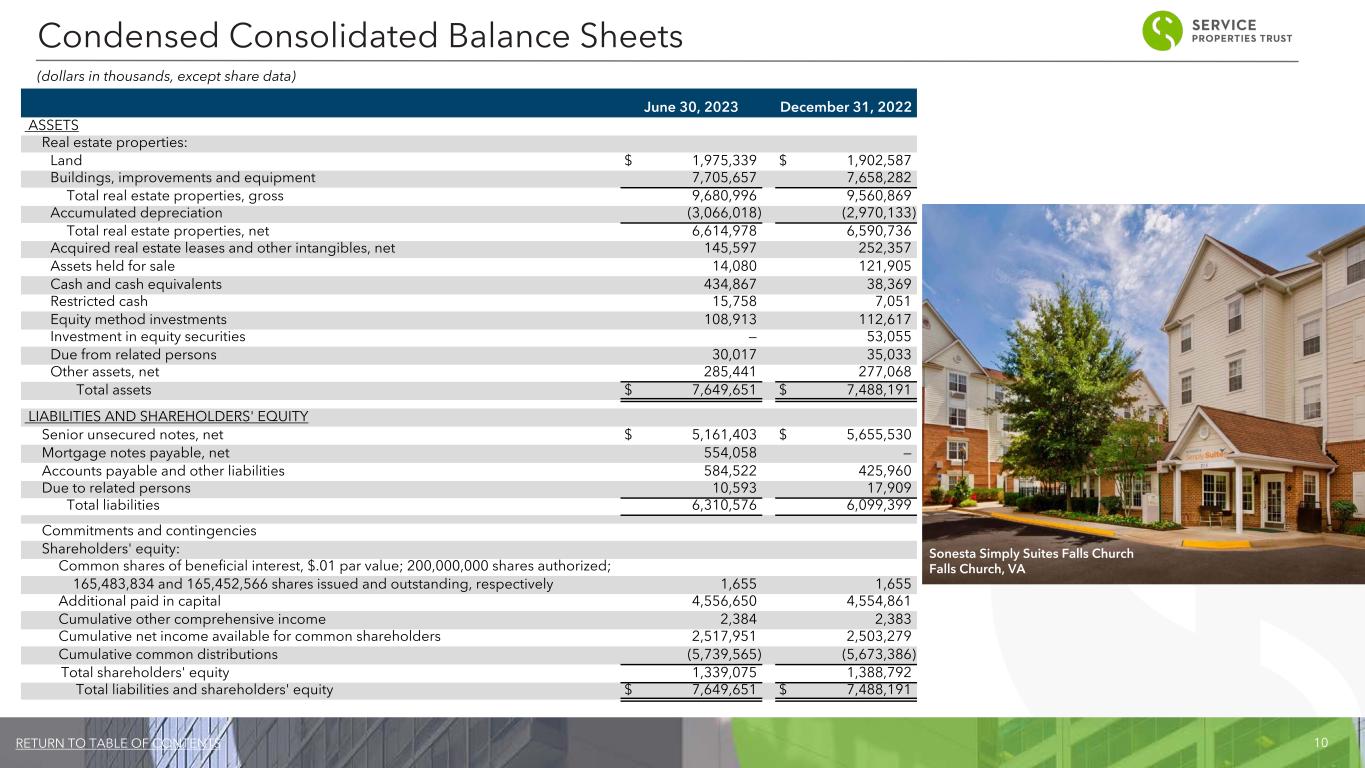

10RETURN TO TABLE OF CONTENTS June 30, 2023 December 31, 2022 ASSETS Real estate properties: Land $ 1,975,339 $ 1,902,587 Buildings, improvements and equipment 7,705,657 7,658,282 Total real estate properties, gross 9,680,996 9,560,869 Accumulated depreciation (3,066,018) (2,970,133) Total real estate properties, net 6,614,978 6,590,736 Acquired real estate leases and other intangibles, net 145,597 252,357 Assets held for sale 14,080 121,905 Cash and cash equivalents 434,867 38,369 Restricted cash 15,758 7,051 Equity method investments 108,913 112,617 Investment in equity securities — 53,055 Due from related persons 30,017 35,033 Other assets, net 285,441 277,068 Total assets $ 7,649,651 $ 7,488,191 LIABILITIES AND SHAREHOLDERS' EQUITY Senior unsecured notes, net $ 5,161,403 $ 5,655,530 Mortgage notes payable, net 554,058 — Accounts payable and other liabilities 584,522 425,960 Due to related persons 10,593 17,909 Total liabilities 6,310,576 6,099,399 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 165,483,834 and 165,452,566 shares issued and outstanding, respectively 1,655 1,655 Additional paid in capital 4,556,650 4,554,861 Cumulative other comprehensive income 2,384 2,383 Cumulative net income available for common shareholders 2,517,951 2,503,279 Cumulative common distributions (5,739,565) (5,673,386) Total shareholders' equity 1,339,075 1,388,792 Total liabilities and shareholders' equity $ 7,649,651 $ 7,488,191 Condensed Consolidated Balance Sheets (dollars in thousands, except share data) Sonesta Simply Suites Falls Church Falls Church, VA

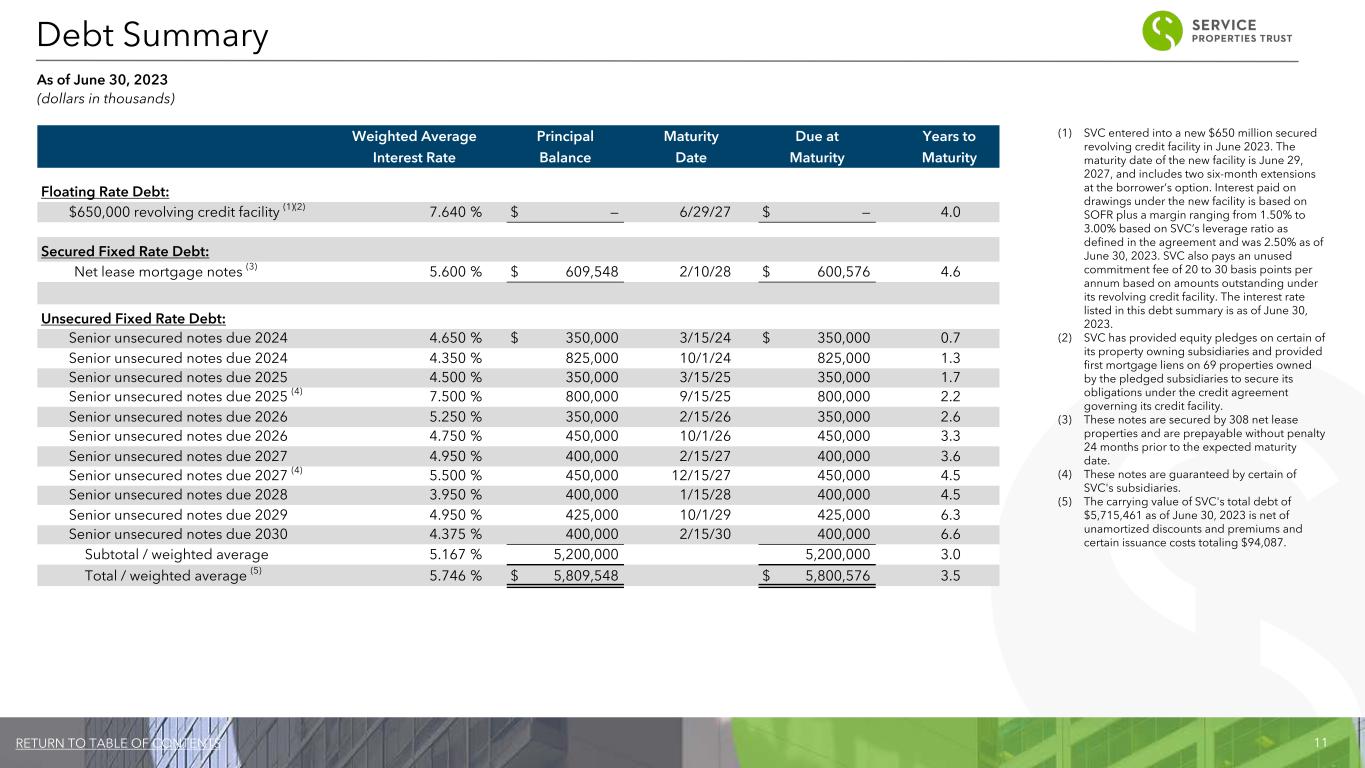

11RETURN TO TABLE OF CONTENTS (1) SVC entered into a new $650 million secured revolving credit facility in June 2023. The maturity date of the new facility is June 29, 2027, and includes two six-month extensions at the borrower’s option. Interest paid on drawings under the new facility is based on SOFR plus a margin ranging from 1.50% to 3.00% based on SVC’s leverage ratio as defined in the agreement and was 2.50% as of June 30, 2023. SVC also pays an unused commitment fee of 20 to 30 basis points per annum based on amounts outstanding under its revolving credit facility. The interest rate listed in this debt summary is as of June 30, 2023. (2) SVC has provided equity pledges on certain of its property owning subsidiaries and provided first mortgage liens on 69 properties owned by the pledged subsidiaries to secure its obligations under the credit agreement governing its credit facility. (3) These notes are secured by 308 net lease properties and are prepayable without penalty 24 months prior to the expected maturity date. (4) These notes are guaranteed by certain of SVC's subsidiaries. (5) The carrying value of SVC's total debt of $5,715,461 as of June 30, 2023 is net of unamortized discounts and premiums and certain issuance costs totaling $94,087. Weighted Average Principal Maturity Due at Years to Interest Rate Balance Date Maturity Maturity Floating Rate Debt: $650,000 revolving credit facility (1)(2) 7.640 % $ — 6/29/27 $ — 4.0 Secured Fixed Rate Debt: Net lease mortgage notes (3) 5.600 % $ 609,548 2/10/28 $ 600,576 4.6 Unsecured Fixed Rate Debt: Senior unsecured notes due 2024 4.650 % $ 350,000 3/15/24 $ 350,000 0.7 Senior unsecured notes due 2024 4.350 % 825,000 10/1/24 825,000 1.3 Senior unsecured notes due 2025 4.500 % 350,000 3/15/25 350,000 1.7 Senior unsecured notes due 2025 (4) 7.500 % 800,000 9/15/25 800,000 2.2 Senior unsecured notes due 2026 5.250 % 350,000 2/15/26 350,000 2.6 Senior unsecured notes due 2026 4.750 % 450,000 10/1/26 450,000 3.3 Senior unsecured notes due 2027 4.950 % 400,000 2/15/27 400,000 3.6 Senior unsecured notes due 2027 (4) 5.500 % 450,000 12/15/27 450,000 4.5 Senior unsecured notes due 2028 3.950 % 400,000 1/15/28 400,000 4.5 Senior unsecured notes due 2029 4.950 % 425,000 10/1/29 425,000 6.3 Senior unsecured notes due 2030 4.375 % 400,000 2/15/30 400,000 6.6 Subtotal / weighted average 5.167 % 5,200,000 5,200,000 3.0 Total / weighted average (5) 5.746 % $ 5,809,548 $ 5,800,576 3.5 Debt Summary As of June 30, 2023 (dollars in thousands)

12RETURN TO TABLE OF CONTENTS $ (M ill io ns ) $1,175 $1,150 $800 $850 $400 $425 $400 $1 $2 $2 $2 $2 $601 Unsecured Fixed Rate Debt Secured Fixed Rate Debt Revolving Credit Facility 2023 2024 2025 2026 2027 2028 2029 2030 0 250 500 750 1,000 1,250 Debt Maturity Schedule As of June 30, 2023 (1) (1) SVC's net lease mortgage notes are partially amortizing and require balloon payments at maturity. These notes are prepayable without penalty 24 months prior to the expected maturity date. (2) As of June 30, 2023, SVC had no amounts outstanding under its $650 million revolving credit facility. (2) 1093 Blowing Rock Road Boone, NC

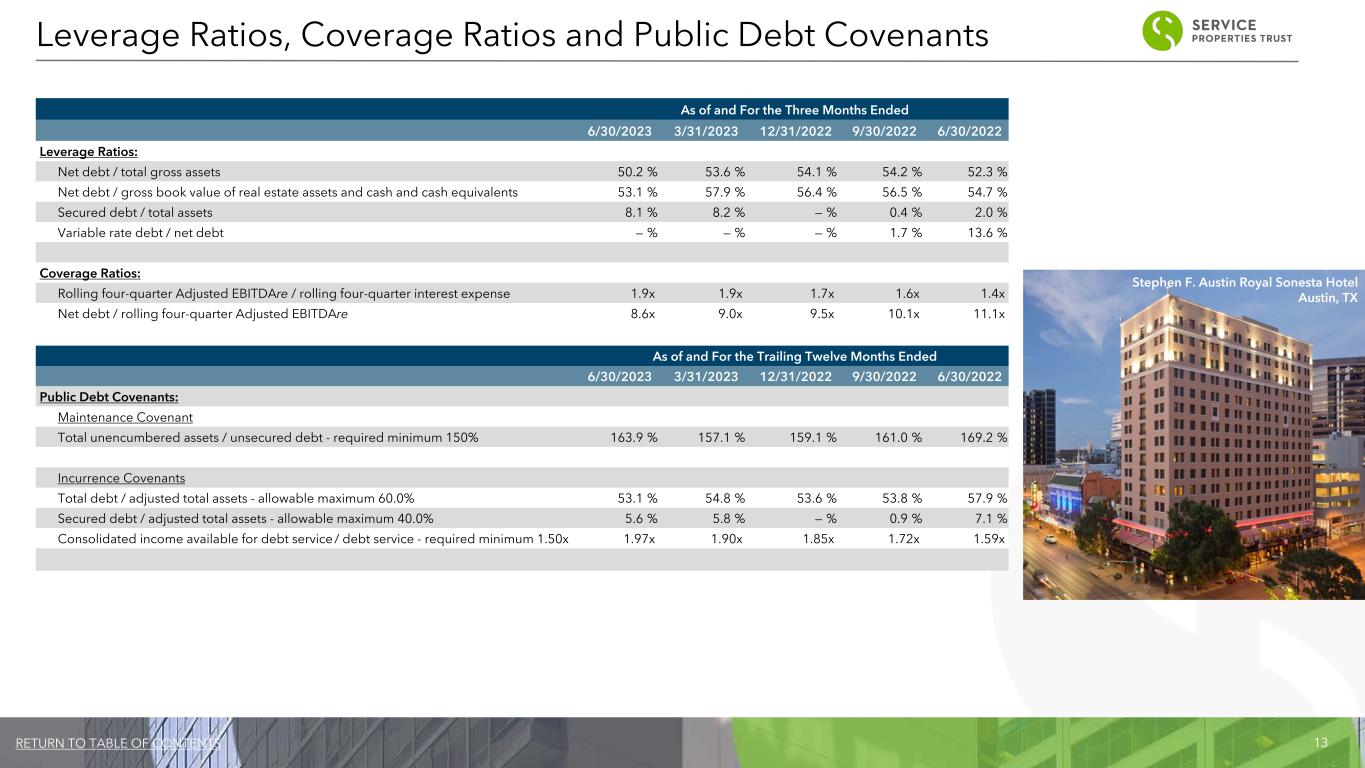

13RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 Leverage Ratios: Net debt / total gross assets 50.2 % 53.6 % 54.1 % 54.2 % 52.3 % Net debt / gross book value of real estate assets and cash and cash equivalents 53.1 % 57.9 % 56.4 % 56.5 % 54.7 % Secured debt / total assets 8.1 % 8.2 % — % 0.4 % 2.0 % Variable rate debt / net debt — % — % — % 1.7 % 13.6 % Coverage Ratios: Rolling four-quarter Adjusted EBITDAre / rolling four-quarter interest expense 1.9x 1.9x 1.7x 1.6x 1.4x Net debt / rolling four-quarter Adjusted EBITDAre 8.6x 9.0x 9.5x 10.1x 11.1x As of and For the Trailing Twelve Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 Public Debt Covenants: Maintenance Covenant Total unencumbered assets / unsecured debt - required minimum 150% 163.9 % 157.1 % 159.1 % 161.0 % 169.2 % Incurrence Covenants Total debt / adjusted total assets - allowable maximum 60.0% 53.1 % 54.8 % 53.6 % 53.8 % 57.9 % Secured debt / adjusted total assets - allowable maximum 40.0% 5.6 % 5.8 % — % 0.9 % 7.1 % Consolidated income available for debt service / debt service - required minimum 1.50x 1.97x 1.90x 1.85x 1.72x 1.59x Leverage Ratios, Coverage Ratios and Public Debt Covenants Stephen F. Austin Royal Sonesta Hotel Austin, TX

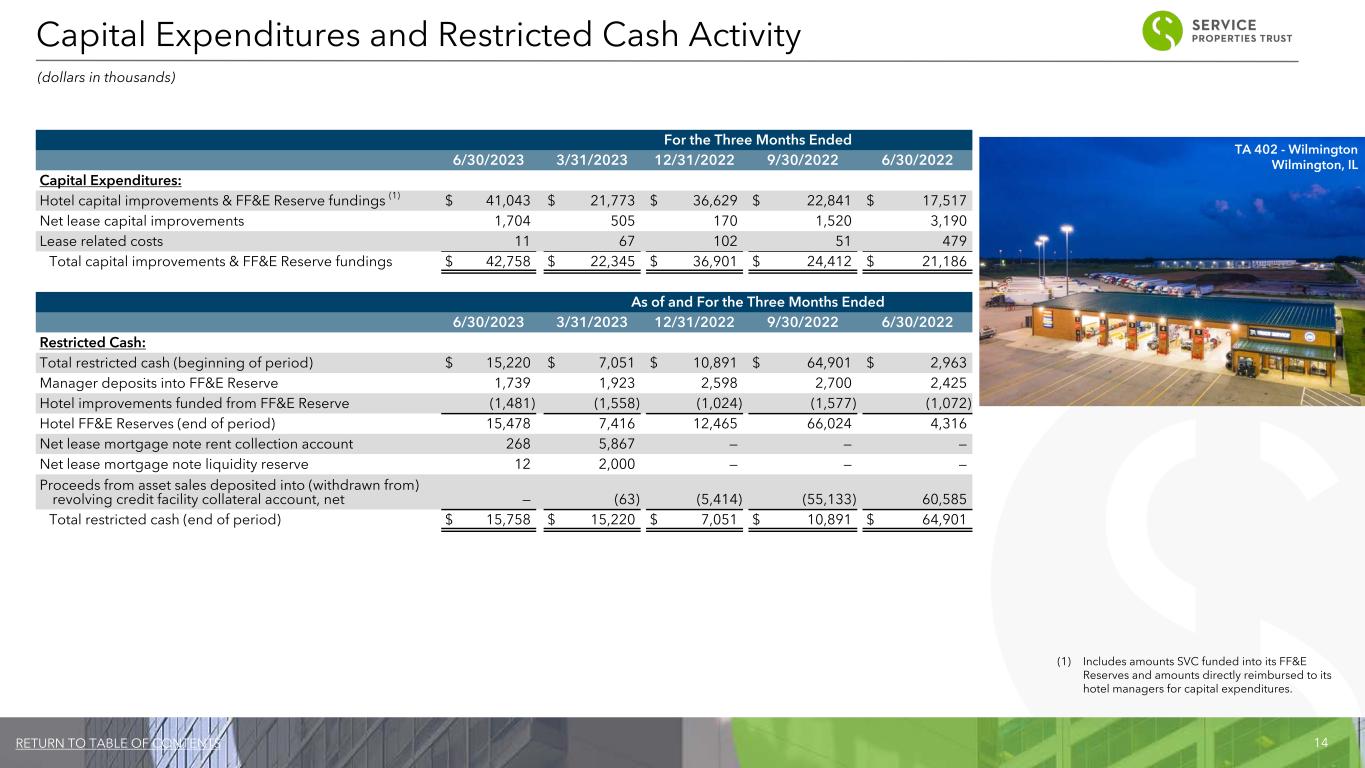

14RETURN TO TABLE OF CONTENTS For the Three Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 Capital Expenditures: Hotel capital improvements & FF&E Reserve fundings (1) $ 41,043 $ 21,773 $ 36,629 $ 22,841 $ 17,517 Net lease capital improvements 1,704 505 170 1,520 3,190 Lease related costs 11 67 102 51 479 Total capital improvements & FF&E Reserve fundings $ 42,758 $ 22,345 $ 36,901 $ 24,412 $ 21,186 As of and For the Three Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 Restricted Cash: Total restricted cash (beginning of period) $ 15,220 $ 7,051 $ 10,891 $ 64,901 $ 2,963 Manager deposits into FF&E Reserve 1,739 1,923 2,598 2,700 2,425 Hotel improvements funded from FF&E Reserve (1,481) (1,558) (1,024) (1,577) (1,072) Hotel FF&E Reserves (end of period) 15,478 7,416 12,465 66,024 4,316 Net lease mortgage note rent collection account 268 5,867 — — — Net lease mortgage note liquidity reserve 12 2,000 — — — Proceeds from asset sales deposited into (withdrawn from) revolving credit facility collateral account, net — (63) (5,414) (55,133) 60,585 Total restricted cash (end of period) $ 15,758 $ 15,220 $ 7,051 $ 10,891 $ 64,901 (1) Includes amounts SVC funded into its FF&E Reserves and amounts directly reimbursed to its hotel managers for capital expenditures. (dollars in thousands) Capital Expenditures and Restricted Cash Activity TA 402 - Wilmington Wilmington, IL

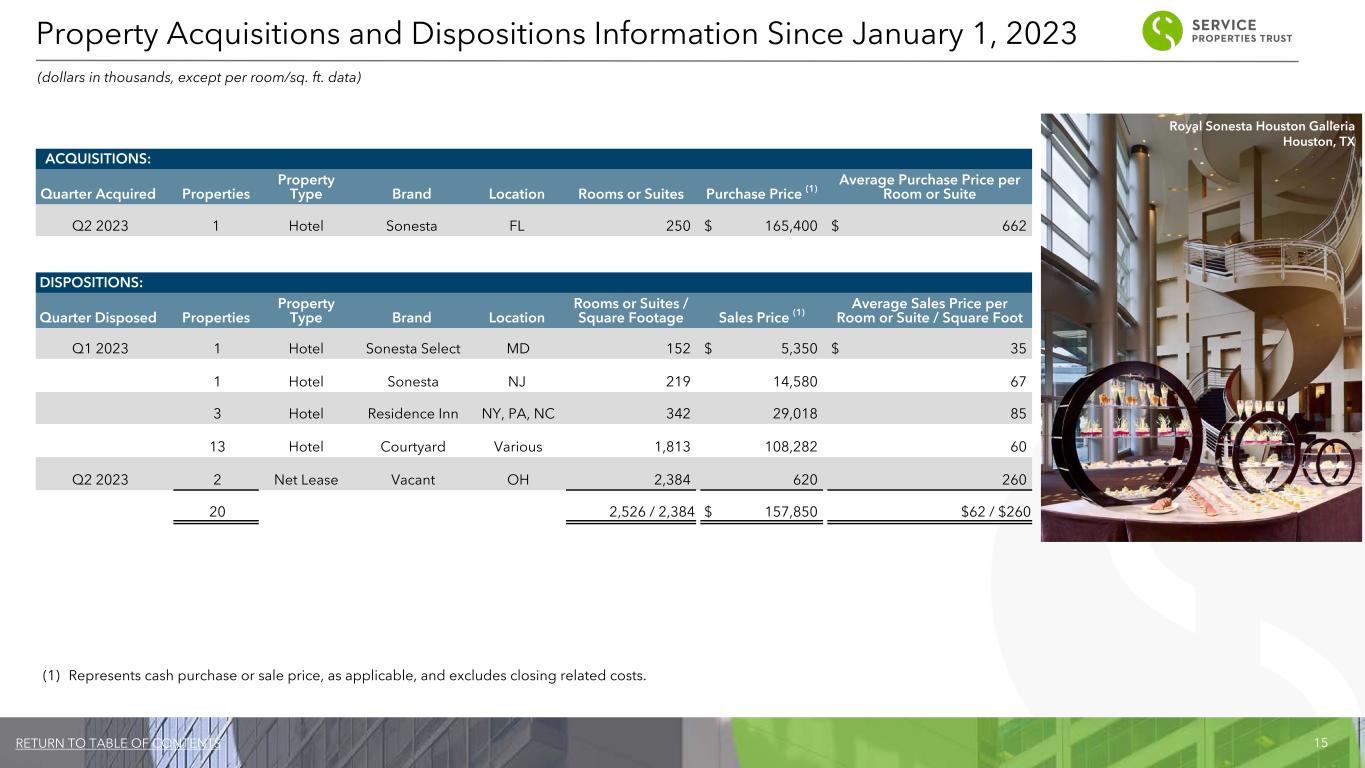

15RETURN TO TABLE OF CONTENTS ACQUISITIONS: Quarter Acquired Properties Property Type Brand Location Rooms or Suites Purchase Price (1) Average Purchase Price per Room or Suite Q2 2023 1 Hotel Sonesta FL 250 $ 165,400 $ 662 DISPOSITIONS: Quarter Disposed Properties Property Type Brand Location Rooms or Suites / Square Footage Sales Price (1) Average Sales Price per Room or Suite / Square Foot Q1 2023 1 Hotel Sonesta Select MD 152 $ 5,350 $ 35 1 Hotel Sonesta NJ 219 14,580 67 3 Hotel Residence Inn NY, PA, NC 342 29,018 85 13 Hotel Courtyard Various 1,813 108,282 60 Q2 2023 2 Net Lease Vacant OH 2,384 620 260 20 2,526 / 2,384 $ 157,850 $62 / $260 Property Acquisitions and Dispositions Information Since January 1, 2023 (dollars in thousands, except per room/sq. ft. data) (1) Represents cash purchase or sale price, as applicable, and excludes closing related costs. Royal Sonesta Houston Galleria Houston, TX

16RETURN TO TABLE OF CONTENTS Portfolio Information

17RETURN TO TABLE OF CONTENTS Portfolio Composition Net lease 45.3% Hotel 54.7% Number of Properties Hotel Properties 221 Number of hotel rooms 37,777 Net Lease Properties 763 Net lease square feet 13,469,478 Total Properties 984 Average hotel property size 171 rooms Average net lease property size 17,653 sq. feet Investments Diversification Facts Hotels $ 6,144,279 Tenants/Operators 177 Net Lease Properties 5,080,732 Brands 143 Total Investments $ 11,225,011 Industries 22 States 46 Geographical Diversification CA 12% TX 8% IL 6% FL 6% GA 6% AZ 4% OH 4%LA 3% PA 3% MO 3% Other 44% (36 States, DC, PR, ON) Portfolio Summary As of June 30, 2023 (dollars in thousands) (1) Based on investment. (1) (1) Royal Sonesta Boston Cambridge, MA

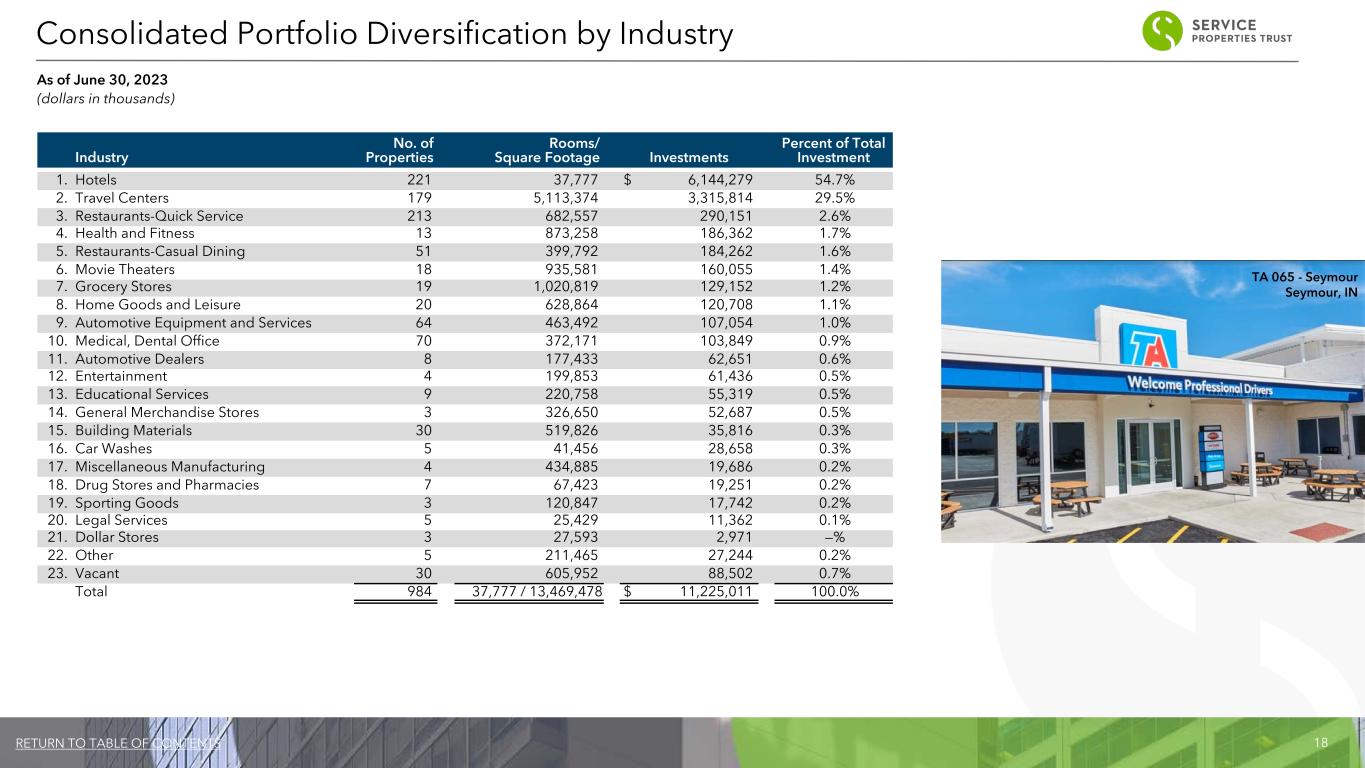

18RETURN TO TABLE OF CONTENTS Industry No. of Properties Rooms/ Square Footage Investments Percent of Total Investment 1. Hotels 221 37,777 $ 6,144,279 54.7% 2. Travel Centers 179 5,113,374 3,315,814 29.5% 3. Restaurants-Quick Service 213 682,557 290,151 2.6% 4. Health and Fitness 13 873,258 186,362 1.7% 5. Restaurants-Casual Dining 51 399,792 184,262 1.6% 6. Movie Theaters 18 935,581 160,055 1.4% 7. Grocery Stores 19 1,020,819 129,152 1.2% 8. Home Goods and Leisure 20 628,864 120,708 1.1% 9. Automotive Equipment and Services 64 463,492 107,054 1.0% 10. Medical, Dental Office 70 372,171 103,849 0.9% 11. Automotive Dealers 8 177,433 62,651 0.6% 12. Entertainment 4 199,853 61,436 0.5% 13. Educational Services 9 220,758 55,319 0.5% 14. General Merchandise Stores 3 326,650 52,687 0.5% 15. Building Materials 30 519,826 35,816 0.3% 16. Car Washes 5 41,456 28,658 0.3% 17. Miscellaneous Manufacturing 4 434,885 19,686 0.2% 18. Drug Stores and Pharmacies 7 67,423 19,251 0.2% 19. Sporting Goods 3 120,847 17,742 0.2% 20. Legal Services 5 25,429 11,362 0.1% 21. Dollar Stores 3 27,593 2,971 —% 22. Other 5 211,465 27,244 0.2% 23. Vacant 30 605,952 88,502 0.7% Total 984 37,777 / 13,469,478 $ 11,225,011 100.0% Consolidated Portfolio Diversification by Industry As of June 30, 2023 (dollars in thousands) TA 065 - Seymour Seymour, IN

19RETURN TO TABLE OF CONTENTS Investments State Total Property Count Hotel Count Net Lease Count Total ($000s) % of Total Hotel ($000s) Hotel % of Total Net Lease ($000s) Net Lease % of Total California 58 36 22 $ 1,381,216 12.3 % $ 1,108,151 18.0 % $ 273,065 5.4 % Texas 76 20 56 872,392 7.8 % 356,248 5.8 % 516,144 10.2 % Illinois 66 10 56 704,394 6.3 % 413,924 6.7 % 290,470 5.7 % Florida 58 12 46 687,259 6.1 % 441,020 7.2 % 246,239 4.8 % Georgia 90 16 74 668,867 6.0 % 398,733 6.5 % 270,134 5.3 % Arizona 39 14 25 473,947 4.2 % 225,575 3.7 % 248,372 4.9 % Ohio 44 5 39 450,222 4.0 % 120,597 2.0 % 329,625 6.5 % Louisiana 15 3 12 380,229 3.4 % 248,524 4.0 % 131,705 2.6 % Pennsylvania 33 5 28 336,777 3.0 % 132,663 2.2 % 204,114 4.0 % Missouri 29 4 25 285,668 2.5 % 156,518 2.5 % 129,150 2.5 % Top 10 508 125 383 6,240,971 55.6 % 3,601,953 58.6 % 2,639,018 51.9 % Other (1) 476 96 380 4,984,040 44.4 % 2,542,326 41.4 % 2,441,714 48.1 % Total 984 221 763 $ 11,225,011 100.0 % $ 6,144,279 100.0 % $ 5,080,732 100.0 % (1) Consists of properties in 36 different states, the District of Columbia, Puerto Rico and Ontario, Canada with an average investment of $10,511 per property. Consolidated Portfolio by Geographic Diversification As of June 30, 2023 (dollars in thousands) The Allegro Royal Sonesta Hotel Chicago, IL

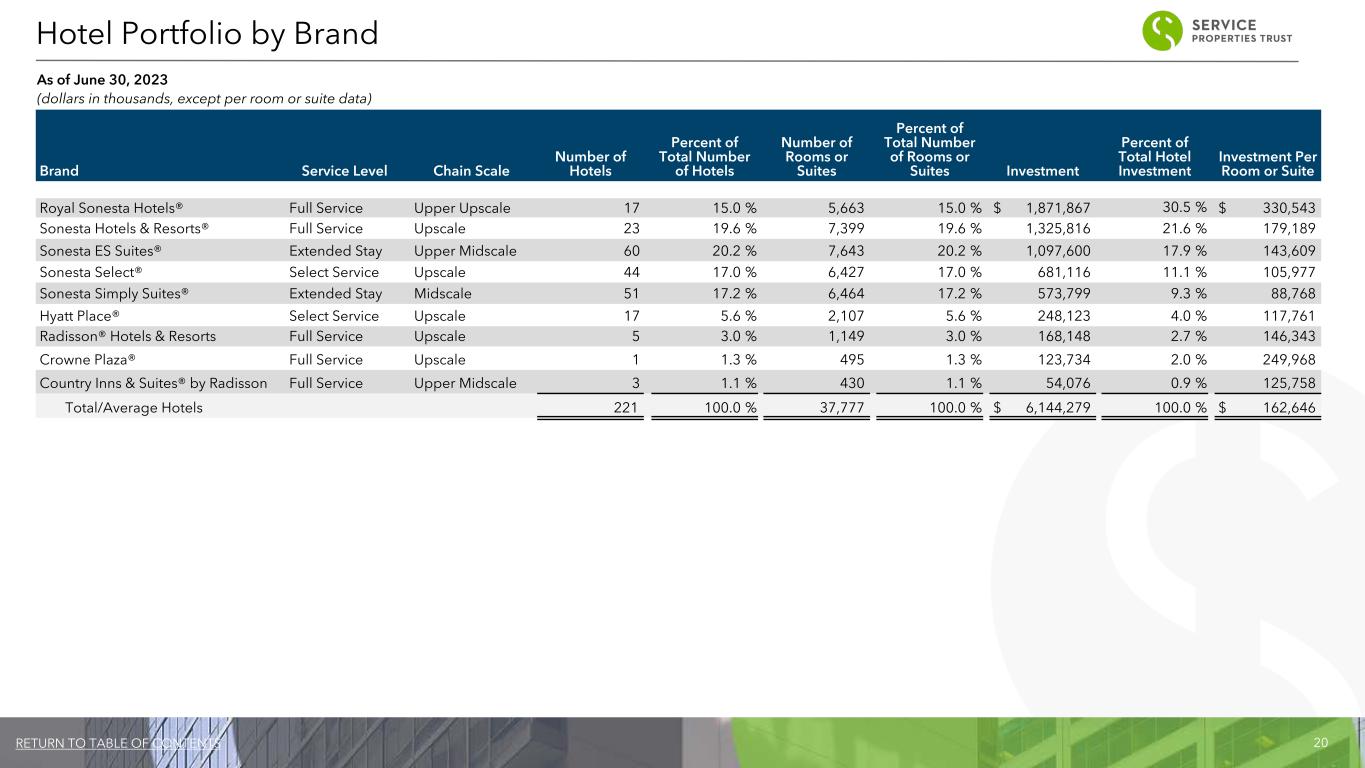

20RETURN TO TABLE OF CONTENTS Brand Service Level Chain Scale Number of Hotels Percent of Total Number of Hotels Number of Rooms or Suites Percent of Total Number of Rooms or Suites Investment Percent of Total Hotel Investment Investment Per Room or Suite Royal Sonesta Hotels® Full Service Upper Upscale 17 15.0 % 5,663 15.0 % $ 1,871,867 30.5 % $ 330,543 Sonesta Hotels & Resorts® Full Service Upscale 23 19.6 % 7,399 19.6 % 1,325,816 21.6 % 179,189 Sonesta ES Suites® Extended Stay Upper Midscale 60 20.2 % 7,643 20.2 % 1,097,600 17.9 % 143,609 Sonesta Select® Select Service Upscale 44 17.0 % 6,427 17.0 % 681,116 11.1 % 105,977 Sonesta Simply Suites® Extended Stay Midscale 51 17.2 % 6,464 17.2 % 573,799 9.3 % 88,768 Hyatt Place® Select Service Upscale 17 5.6 % 2,107 5.6 % 248,123 4.0 % 117,761 Radisson® Hotels & Resorts Full Service Upscale 5 3.0 % 1,149 3.0 % 168,148 2.7 % 146,343 Crowne Plaza® Full Service Upscale 1 1.3 % 495 1.3 % 123,734 2.0 % 249,968 Country Inns & Suites® by Radisson Full Service Upper Midscale 3 1.1 % 430 1.1 % 54,076 0.9 % 125,758 Total/Average Hotels 221 100.0 % 37,777 100.0 % $ 6,144,279 100.0 % $ 162,646 Hotel Portfolio by Brand As of June 30, 2023 (dollars in thousands, except per room or suite data)

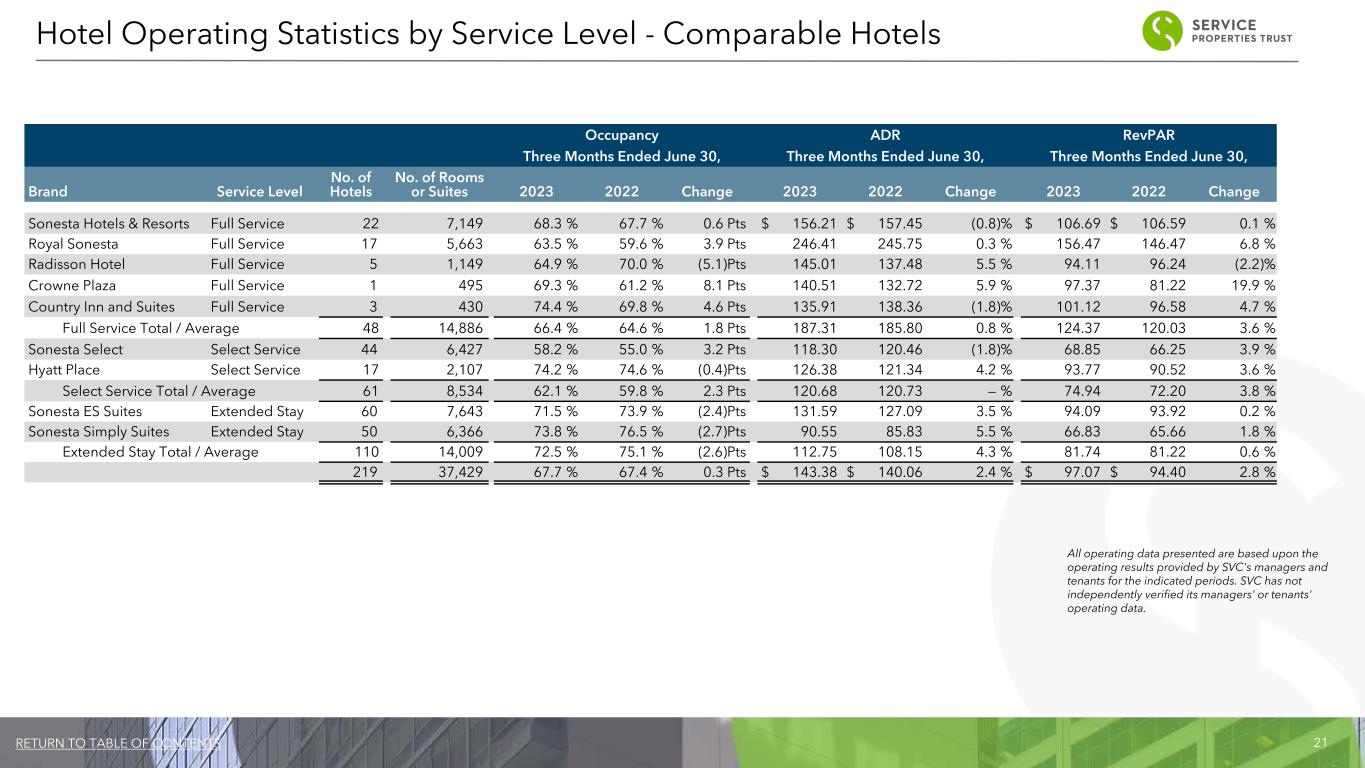

21RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Three Months Ended June 30, Three Months Ended June 30, Three Months Ended June 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 22 7,149 68.3 % 67.7 % 0.6 Pts $ 156.21 $ 157.45 (0.8) % $ 106.69 $ 106.59 0.1 % Royal Sonesta Full Service 17 5,663 63.5 % 59.6 % 3.9 Pts 246.41 245.75 0.3 % 156.47 146.47 6.8 % Radisson Hotel Full Service 5 1,149 64.9 % 70.0 % (5.1)Pts 145.01 137.48 5.5 % 94.11 96.24 (2.2) % Crowne Plaza Full Service 1 495 69.3 % 61.2 % 8.1 Pts 140.51 132.72 5.9 % 97.37 81.22 19.9 % Country Inn and Suites Full Service 3 430 74.4 % 69.8 % 4.6 Pts 135.91 138.36 (1.8) % 101.12 96.58 4.7 % Full Service Total / Average 48 14,886 66.4 % 64.6 % 1.8 Pts 187.31 185.80 0.8 % 124.37 120.03 3.6 % Sonesta Select Select Service 44 6,427 58.2 % 55.0 % 3.2 Pts 118.30 120.46 (1.8) % 68.85 66.25 3.9 % Hyatt Place Select Service 17 2,107 74.2 % 74.6 % (0.4)Pts 126.38 121.34 4.2 % 93.77 90.52 3.6 % Select Service Total / Average 61 8,534 62.1 % 59.8 % 2.3 Pts 120.68 120.73 — % 74.94 72.20 3.8 % Sonesta ES Suites Extended Stay 60 7,643 71.5 % 73.9 % (2.4)Pts 131.59 127.09 3.5 % 94.09 93.92 0.2 % Sonesta Simply Suites Extended Stay 50 6,366 73.8 % 76.5 % (2.7)Pts 90.55 85.83 5.5 % 66.83 65.66 1.8 % Extended Stay Total / Average 110 14,009 72.5 % 75.1 % (2.6)Pts 112.75 108.15 4.3 % 81.74 81.22 0.6 % 219 37,429 67.7 % 67.4 % 0.3 Pts $ 143.38 $ 140.06 2.4 % $ 97.07 $ 94.40 2.8 % Hotel Operating Statistics by Service Level - Comparable Hotels All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data.

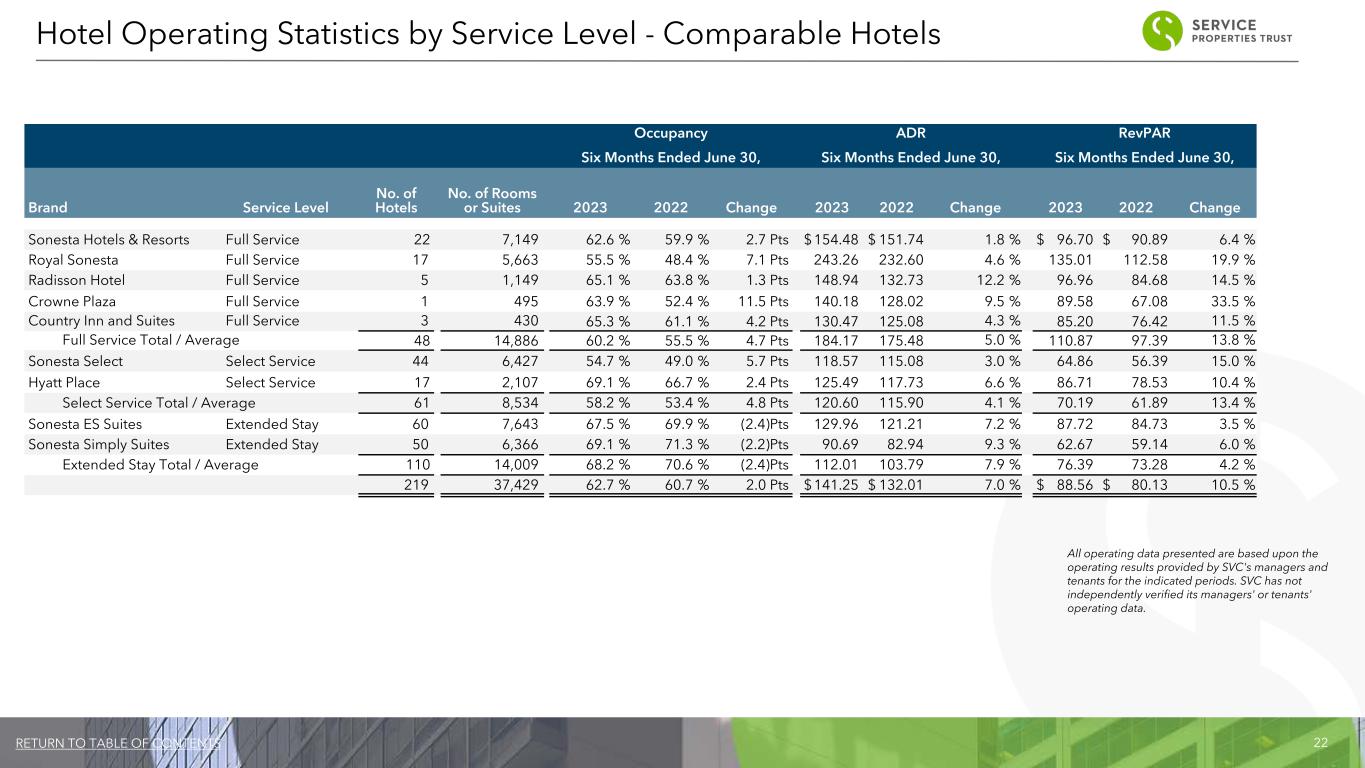

22RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Six Months Ended June 30, Six Months Ended June 30, Six Months Ended June 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 22 7,149 62.6 % 59.9 % 2.7 Pts $ 154.48 $ 151.74 1.8 % $ 96.70 $ 90.89 6.4 % Royal Sonesta Full Service 17 5,663 55.5 % 48.4 % 7.1 Pts 243.26 232.60 4.6 % 135.01 112.58 19.9 % Radisson Hotel Full Service 5 1,149 65.1 % 63.8 % 1.3 Pts 148.94 132.73 12.2 % 96.96 84.68 14.5 % Crowne Plaza Full Service 1 495 63.9 % 52.4 % 11.5 Pts 140.18 128.02 9.5 % 89.58 67.08 33.5 % Country Inn and Suites Full Service 3 430 65.3 % 61.1 % 4.2 Pts 130.47 125.08 4.3 % 85.20 76.42 11.5 % Full Service Total / Average 48 14,886 60.2 % 55.5 % 4.7 Pts 184.17 175.48 5.0 % 110.87 97.39 13.8 % Sonesta Select Select Service 44 6,427 54.7 % 49.0 % 5.7 Pts 118.57 115.08 3.0 % 64.86 56.39 15.0 % Hyatt Place Select Service 17 2,107 69.1 % 66.7 % 2.4 Pts 125.49 117.73 6.6 % 86.71 78.53 10.4 % Select Service Total / Average 61 8,534 58.2 % 53.4 % 4.8 Pts 120.60 115.90 4.1 % 70.19 61.89 13.4 % Sonesta ES Suites Extended Stay 60 7,643 67.5 % 69.9 % (2.4)Pts 129.96 121.21 7.2 % 87.72 84.73 3.5 % Sonesta Simply Suites Extended Stay 50 6,366 69.1 % 71.3 % (2.2)Pts 90.69 82.94 9.3 % 62.67 59.14 6.0 % Extended Stay Total / Average 110 14,009 68.2 % 70.6 % (2.4)Pts 112.01 103.79 7.9 % 76.39 73.28 4.2 % 219 37,429 62.7 % 60.7 % 2.0 Pts $ 141.25 $ 132.01 7.0 % $ 88.56 $ 80.13 10.5 % Hotel Operating Statistics by Service Level - Comparable Hotels All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data.

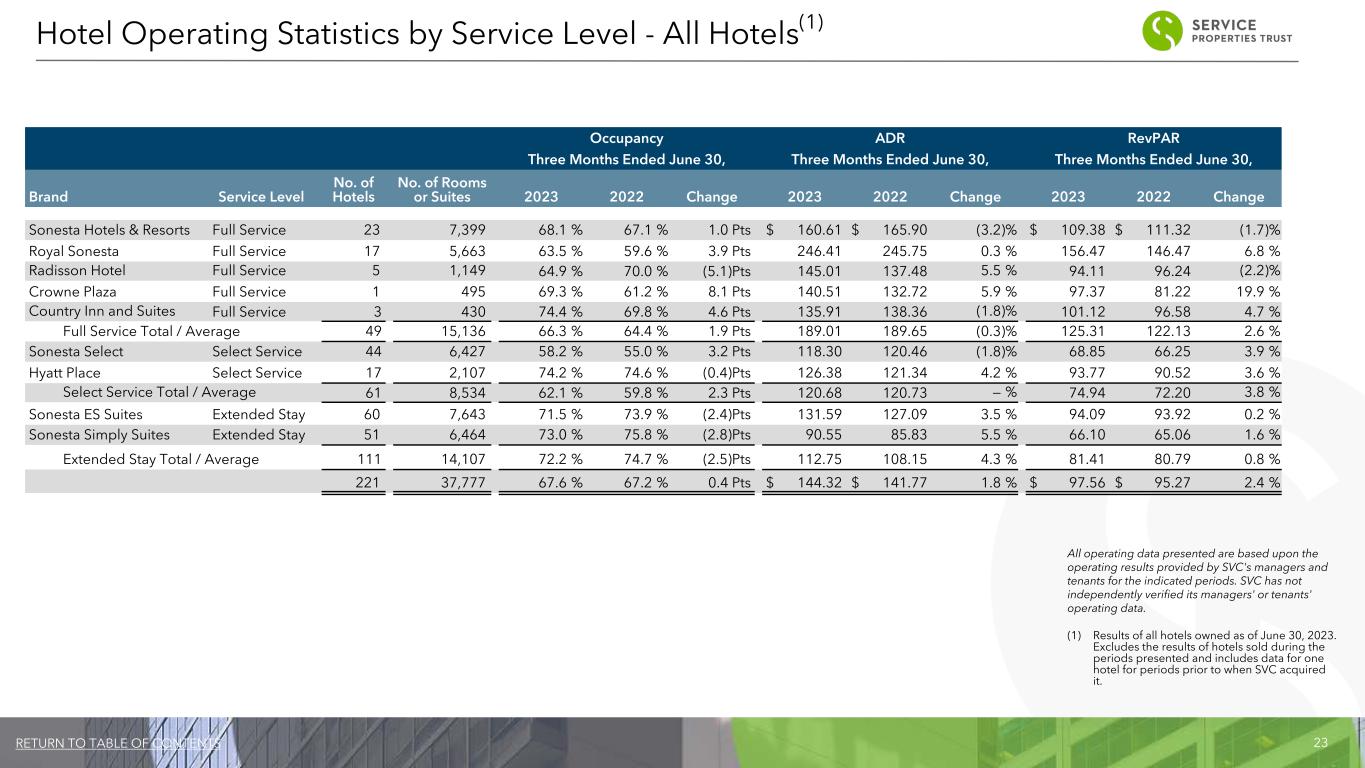

23RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Three Months Ended June 30, Three Months Ended June 30, Three Months Ended June 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 23 7,399 68.1 % 67.1 % 1.0 Pts $ 160.61 $ 165.90 (3.2) % $ 109.38 $ 111.32 (1.7) % Royal Sonesta Full Service 17 5,663 63.5 % 59.6 % 3.9 Pts 246.41 245.75 0.3 % 156.47 146.47 6.8 % Radisson Hotel Full Service 5 1,149 64.9 % 70.0 % (5.1)Pts 145.01 137.48 5.5 % 94.11 96.24 (2.2) % Crowne Plaza Full Service 1 495 69.3 % 61.2 % 8.1 Pts 140.51 132.72 5.9 % 97.37 81.22 19.9 % Country Inn and Suites Full Service 3 430 74.4 % 69.8 % 4.6 Pts 135.91 138.36 (1.8) % 101.12 96.58 4.7 % Full Service Total / Average 49 15,136 66.3 % 64.4 % 1.9 Pts 189.01 189.65 (0.3) % 125.31 122.13 2.6 % Sonesta Select Select Service 44 6,427 58.2 % 55.0 % 3.2 Pts 118.30 120.46 (1.8) % 68.85 66.25 3.9 % Hyatt Place Select Service 17 2,107 74.2 % 74.6 % (0.4)Pts 126.38 121.34 4.2 % 93.77 90.52 3.6 % Select Service Total / Average 61 8,534 62.1 % 59.8 % 2.3 Pts 120.68 120.73 — % 74.94 72.20 3.8 % Sonesta ES Suites Extended Stay 60 7,643 71.5 % 73.9 % (2.4)Pts 131.59 127.09 3.5 % 94.09 93.92 0.2 % Sonesta Simply Suites Extended Stay 51 6,464 73.0 % 75.8 % (2.8)Pts 90.55 85.83 5.5 % 66.10 65.06 1.6 % Extended Stay Total / Average 111 14,107 72.2 % 74.7 % (2.5)Pts 112.75 108.15 4.3 % 81.41 80.79 0.8 % 221 37,777 67.6 % 67.2 % 0.4 Pts $ 144.32 $ 141.77 1.8 % $ 97.56 $ 95.27 2.4 % Hotel Operating Statistics by Service Level - All Hotels(1) All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data. (1) Results of all hotels owned as of June 30, 2023. Excludes the results of hotels sold during the periods presented and includes data for one hotel for periods prior to when SVC acquired it.

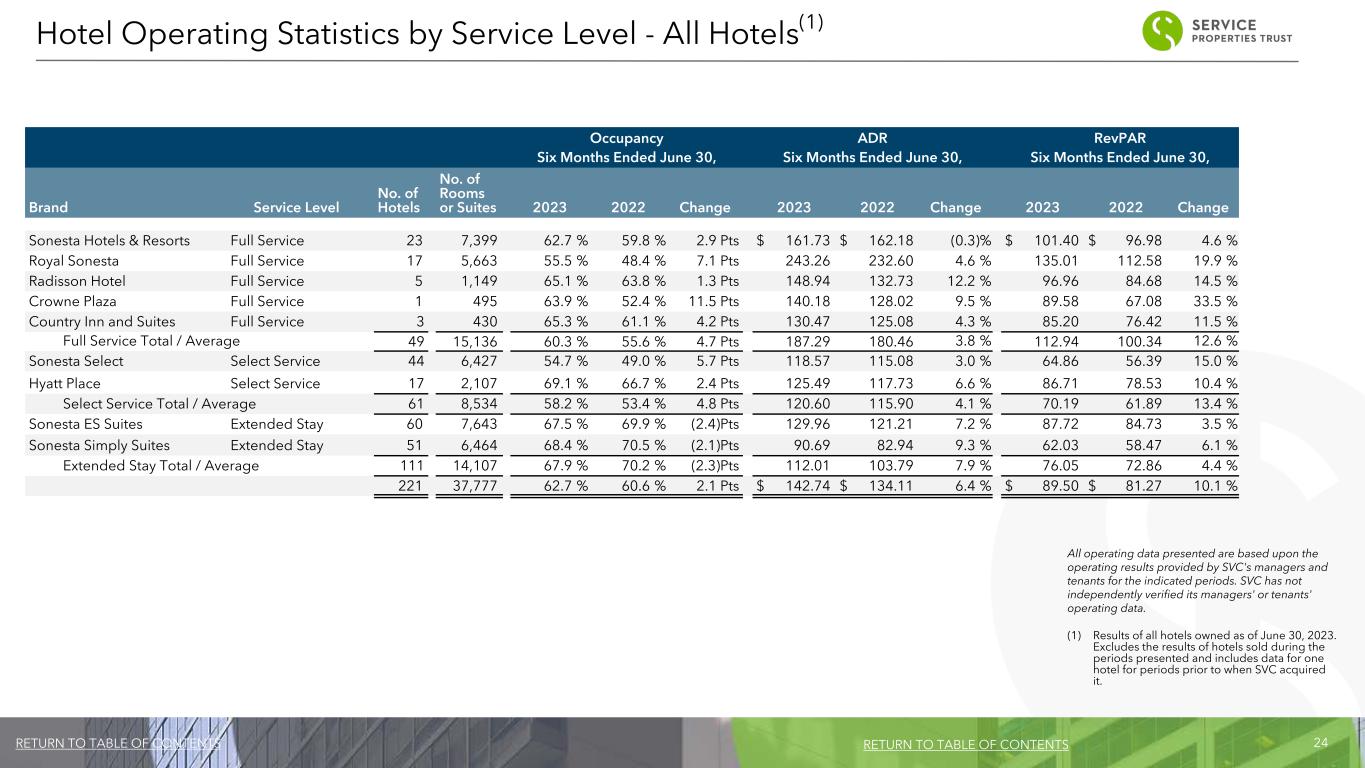

24RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Six Months Ended June 30, Six Months Ended June 30, Six Months Ended June 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 23 7,399 62.7 % 59.8 % 2.9 Pts $ 161.73 $ 162.18 (0.3) % $ 101.40 $ 96.98 4.6 % Royal Sonesta Full Service 17 5,663 55.5 % 48.4 % 7.1 Pts 243.26 232.60 4.6 % 135.01 112.58 19.9 % Radisson Hotel Full Service 5 1,149 65.1 % 63.8 % 1.3 Pts 148.94 132.73 12.2 % 96.96 84.68 14.5 % Crowne Plaza Full Service 1 495 63.9 % 52.4 % 11.5 Pts 140.18 128.02 9.5 % 89.58 67.08 33.5 % Country Inn and Suites Full Service 3 430 65.3 % 61.1 % 4.2 Pts 130.47 125.08 4.3 % 85.20 76.42 11.5 % Full Service Total / Average 49 15,136 60.3 % 55.6 % 4.7 Pts 187.29 180.46 3.8 % 112.94 100.34 12.6 % Sonesta Select Select Service 44 6,427 54.7 % 49.0 % 5.7 Pts 118.57 115.08 3.0 % 64.86 56.39 15.0 % Hyatt Place Select Service 17 2,107 69.1 % 66.7 % 2.4 Pts 125.49 117.73 6.6 % 86.71 78.53 10.4 % Select Service Total / Average 61 8,534 58.2 % 53.4 % 4.8 Pts 120.60 115.90 4.1 % 70.19 61.89 13.4 % Sonesta ES Suites Extended Stay 60 7,643 67.5 % 69.9 % (2.4)Pts 129.96 121.21 7.2 % 87.72 84.73 3.5 % Sonesta Simply Suites Extended Stay 51 6,464 68.4 % 70.5 % (2.1)Pts 90.69 82.94 9.3 % 62.03 58.47 6.1 % Extended Stay Total / Average 111 14,107 67.9 % 70.2 % (2.3)Pts 112.01 103.79 7.9 % 76.05 72.86 4.4 % 221 37,777 62.7 % 60.6 % 2.1 Pts $ 142.74 $ 134.11 6.4 % $ 89.50 $ 81.27 10.1 % Hotel Operating Statistics by Service Level - All Hotels(1) RETURN TO TABLE OF CONTENTS All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data. (1) Results of all hotels owned as of June 30, 2023. Excludes the results of hotels sold during the periods presented and includes data for one hotel for periods prior to when SVC acquired it.

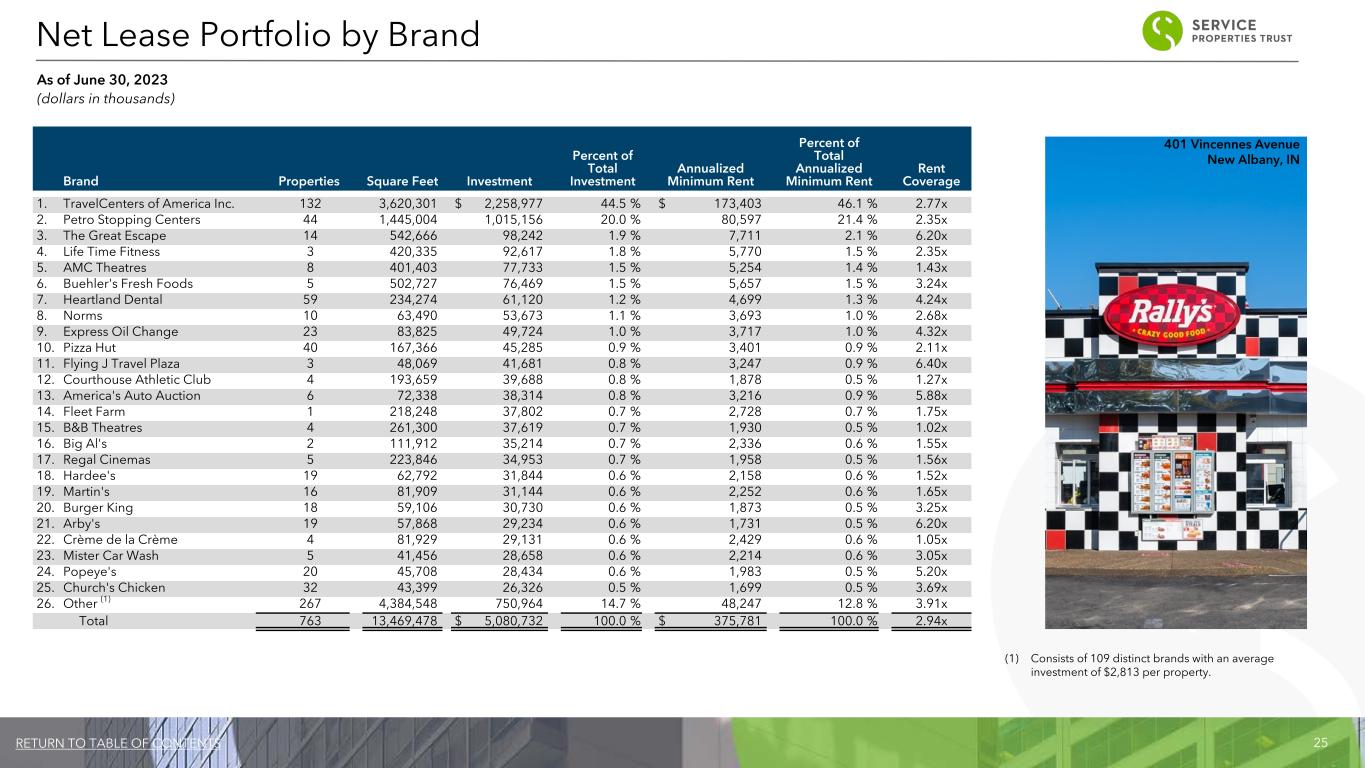

25RETURN TO TABLE OF CONTENTS Brand Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. TravelCenters of America Inc. 132 3,620,301 $ 2,258,977 44.5 % $ 173,403 46.1 % 2.77x 2. Petro Stopping Centers 44 1,445,004 1,015,156 20.0 % 80,597 21.4 % 2.35x 3. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.1 % 6.20x 4. Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.5 % 2.35x 5. AMC Theatres 8 401,403 77,733 1.5 % 5,254 1.4 % 1.43x 6. Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 3.24x 7. Heartland Dental 59 234,274 61,120 1.2 % 4,699 1.3 % 4.24x 8. Norms 10 63,490 53,673 1.1 % 3,693 1.0 % 2.68x 9. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 4.32x 10. Pizza Hut 40 167,366 45,285 0.9 % 3,401 0.9 % 2.11x 11. Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,247 0.9 % 6.40x 12. Courthouse Athletic Club 4 193,659 39,688 0.8 % 1,878 0.5 % 1.27x 13. America's Auto Auction 6 72,338 38,314 0.8 % 3,216 0.9 % 5.88x 14. Fleet Farm 1 218,248 37,802 0.7 % 2,728 0.7 % 1.75x 15. B&B Theatres 4 261,300 37,619 0.7 % 1,930 0.5 % 1.02x 16. Big Al's 2 111,912 35,214 0.7 % 2,336 0.6 % 1.55x 17. Regal Cinemas 5 223,846 34,953 0.7 % 1,958 0.5 % 1.56x 18. Hardee's 19 62,792 31,844 0.6 % 2,158 0.6 % 1.52x 19. Martin's 16 81,909 31,144 0.6 % 2,252 0.6 % 1.65x 20. Burger King 18 59,106 30,730 0.6 % 1,873 0.5 % 3.25x 21. Arby's 19 57,868 29,234 0.6 % 1,731 0.5 % 6.20x 22. Crème de la Crème 4 81,929 29,131 0.6 % 2,429 0.6 % 1.05x 23. Mister Car Wash 5 41,456 28,658 0.6 % 2,214 0.6 % 3.05x 24. Popeye's 20 45,708 28,434 0.6 % 1,983 0.5 % 5.20x 25. Church's Chicken 32 43,399 26,326 0.5 % 1,699 0.5 % 3.69x 26. Other (1) 267 4,384,548 750,964 14.7 % 48,247 12.8 % 3.91x Total 763 13,469,478 $ 5,080,732 100.0 % $ 375,781 100.0 % 2.94x (1) Consists of 109 distinct brands with an average investment of $2,813 per property. Net Lease Portfolio by Brand As of June 30, 2023 (dollars in thousands) 401 Vincennes Avenue New Albany, IN

26RETURN TO TABLE OF CONTENTS Industry No. of Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. Travel Centers 179 5,113,374 $ 3,315,814 65.4% $ 257,248 68.5% 2.69x 2. Restaurants-Quick Service 213 682,557 290,151 5.7% 19,727 5.2% 3.22x 3. Health and Fitness 13 873,258 186,362 3.7% 11,026 2.9% 2.00x 4. Restaurants-Casual Dining 51 399,792 184,262 3.6% 11,465 3.0% 2.73x 5. Movie Theaters 18 935,581 160,055 3.2% 9,742 2.6% 1.52x 6. Grocery Stores 19 1,020,819 129,152 2.5% 9,223 2.5% 3.76x 7. Home Goods and Leisure 20 628,864 120,708 2.4% 9,699 2.6% 5.55x 8. Automotive Equipment and Services 64 463,492 107,054 2.1% 7,691 2.0% 4.34x 9. Medical, Dental Office 70 372,171 103,849 2.0% 8,362 2.2% 2.95x 10. Automotive Dealers 8 177,433 62,651 1.2% 4,964 1.3% 5.41x 11. Entertainment 4 199,853 61,436 1.2% 4,319 1.1% 2.97x 12. Educational Services 9 220,758 55,319 1.1% 4,462 1.2% 1.40x 13. General Merchandise Stores 3 326,650 52,687 1.0% 3,672 1.0% 2.53x 14. Building Materials 30 519,826 35,816 0.7% 3,033 0.8% 6.87x 15. Car Washes 5 41,456 28,658 0.6% 2,214 0.6% 3.05x 16. Miscellaneous Manufacturing 4 434,885 19,686 0.4% 1,360 0.4% 17.04x 17. Drug Stores and Pharmacies 7 67,423 19,251 0.4% 1,258 0.3% 0.55x 18. Sporting Goods 3 120,847 17,742 0.3% 1,092 0.3% 5.55x 19. Legal Services 5 25,429 11,362 0.2% 1,054 0.3% 2.42x 20. Dollar Stores 3 27,593 2,971 0.1% 189 0.1% 2.61x 21. Other (1) 5 211,465 27,244 0.5% 3,981 1.1% 5.90x 22. Vacant 30 605,952 88,502 1.7% — —% —x Total 763 13,469,478 $ 5,080,732 100.0% $ 375,781 100.0% 2.94x (1) Consists of miscellaneous businesses with an average investment of $5,449 per property. Net Lease Portfolio by Industry As of June 30, 2023 (dollars in thousands) 1055 Sugarbush Drive Ashland, OH

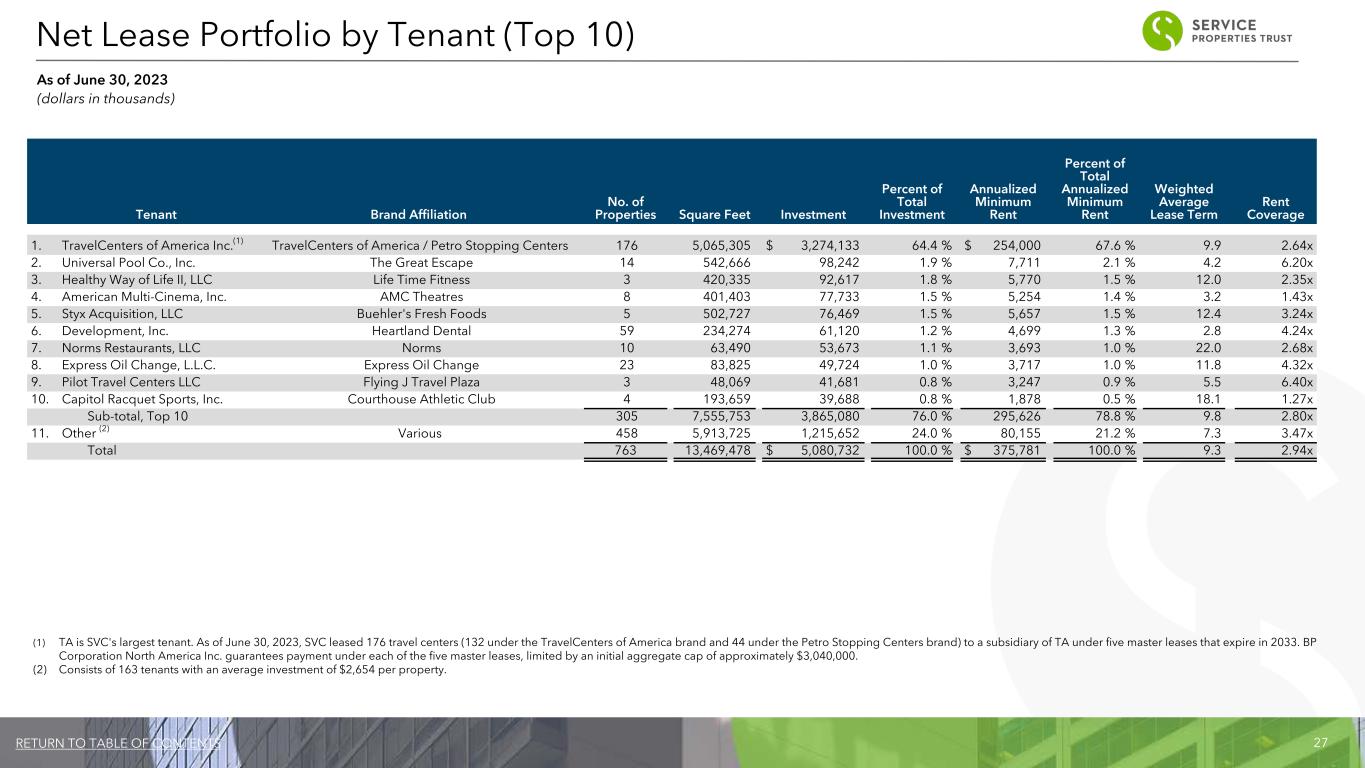

27RETURN TO TABLE OF CONTENTS Tenant Brand Affiliation No. of Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Weighted Average Lease Term Rent Coverage 1. TravelCenters of America Inc.(1) TravelCenters of America / Petro Stopping Centers 176 5,065,305 $ 3,274,133 64.4 % $ 254,000 67.6 % 9.9 2.64x 2. Universal Pool Co., Inc. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.1 % 4.2 6.20x 3. Healthy Way of Life II, LLC Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.5 % 12.0 2.35x 4. American Multi-Cinema, Inc. AMC Theatres 8 401,403 77,733 1.5 % 5,254 1.4 % 3.2 1.43x 5. Styx Acquisition, LLC Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 12.4 3.24x 6. Professional Resource Development, Inc. Heartland Dental 59 234,274 61,120 1.2 % 4,699 1.3 % 2.8 4.24x 7. Norms Restaurants, LLC Norms 10 63,490 53,673 1.1 % 3,693 1.0 % 22.0 2.68x 8. Express Oil Change, L.L.C. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 11.8 4.32x 9. Pilot Travel Centers LLC Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,247 0.9 % 5.5 6.40x 10. Capitol Racquet Sports, Inc. Courthouse Athletic Club 4 193,659 39,688 0.8 % 1,878 0.5 % 18.1 1.27x Sub-total, Top 10 305 7,555,753 3,865,080 76.0 % 295,626 78.8 % 9.8 2.80x 11. Other (2) Various 458 5,913,725 1,215,652 24.0 % 80,155 21.2 % 7.3 3.47x Total 763 13,469,478 $ 5,080,732 100.0 % $ 375,781 100.0 % 9.3 2.94x (1) TA is SVC's largest tenant. As of June 30, 2023, SVC leased 176 travel centers (132 under the TravelCenters of America brand and 44 under the Petro Stopping Centers brand) to a subsidiary of TA under five master leases that expire in 2033. BP Corporation North America Inc. guarantees payment under each of the five master leases, limited by an initial aggregate cap of approximately $3,040,000. (2) Consists of 163 tenants with an average investment of $2,654 per property. Net Lease Portfolio by Tenant (Top 10) As of June 30, 2023 (dollars in thousands)

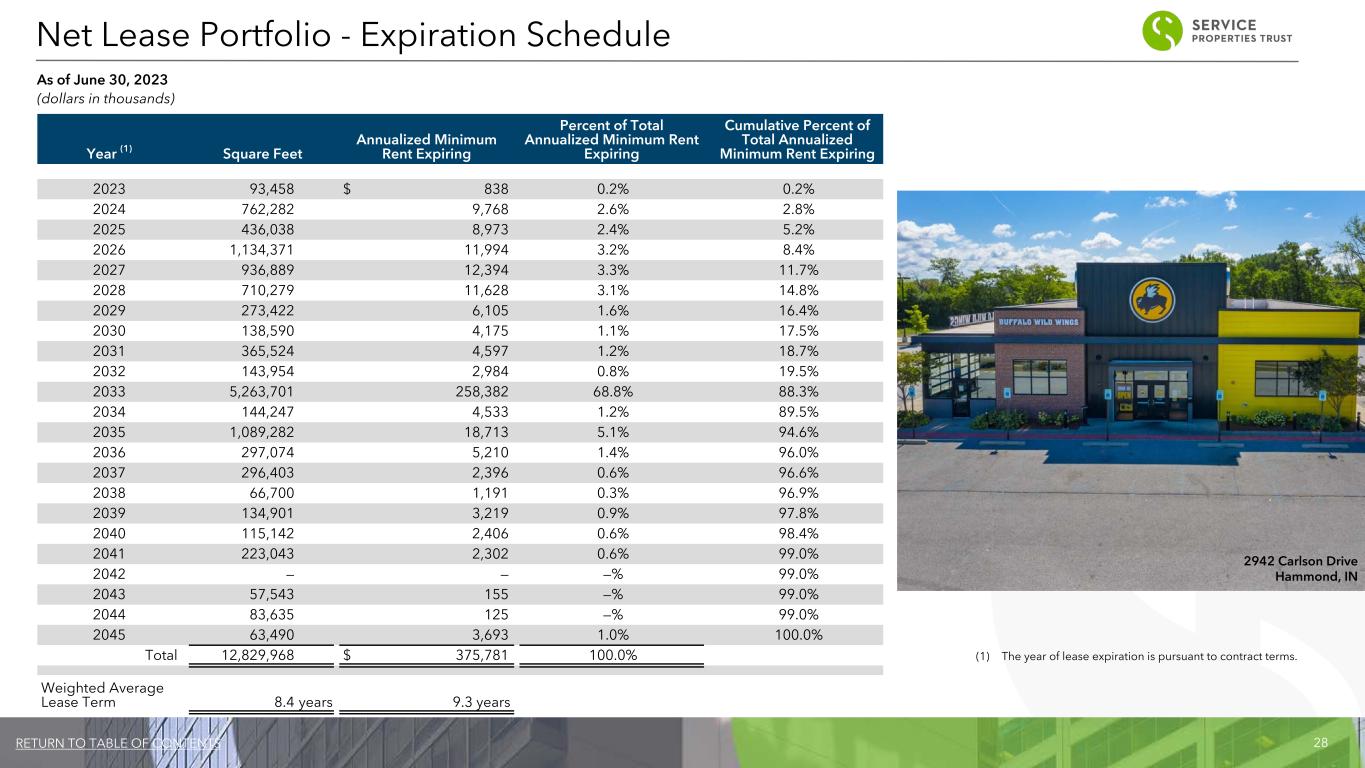

28RETURN TO TABLE OF CONTENTS Year (1) Square Feet Annualized Minimum Rent Expiring Percent of Total Annualized Minimum Rent Expiring Cumulative Percent of Total Annualized Minimum Rent Expiring 2023 93,458 $ 838 0.2% 0.2% 2024 762,282 9,768 2.6% 2.8% 2025 436,038 8,973 2.4% 5.2% 2026 1,134,371 11,994 3.2% 8.4% 2027 936,889 12,394 3.3% 11.7% 2028 710,279 11,628 3.1% 14.8% 2029 273,422 6,105 1.6% 16.4% 2030 138,590 4,175 1.1% 17.5% 2031 365,524 4,597 1.2% 18.7% 2032 143,954 2,984 0.8% 19.5% 2033 5,263,701 258,382 68.8% 88.3% 2034 144,247 4,533 1.2% 89.5% 2035 1,089,282 18,713 5.1% 94.6% 2036 297,074 5,210 1.4% 96.0% 2037 296,403 2,396 0.6% 96.6% 2038 66,700 1,191 0.3% 96.9% 2039 134,901 3,219 0.9% 97.8% 2040 115,142 2,406 0.6% 98.4% 2041 223,043 2,302 0.6% 99.0% 2042 — — —% 99.0% 2043 57,543 155 —% 99.0% 2044 83,635 125 —% 99.0% 2045 63,490 3,693 1.0% 100.0% Total 12,829,968 $ 375,781 100.0% Weighted Average Lease Term 8.4 years 9.3 years (1) The year of lease expiration is pursuant to contract terms. Net Lease Portfolio - Expiration Schedule As of June 30, 2023 (dollars in thousands) 2942 Carlson Drive Hammond, IN

29RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 Properties (end of period) 763 765 765 769 775 Vacant properties beginning of period 27 23 21 17 29 Vacant property sales / leased (2) (1) (1) (7) (12) Lease terminations 5 5 3 11 — Vacant properties end of the period 30 27 23 21 17 Percentage of properties leased 96.1 % 96.5 % 97.0 % 97.3 % 97.8 % Net Lease Portfolio - Occupancy Summary As of June 30, 2023 10642 S. Memorial Drive Bixby, OK

30RETURN TO TABLE OF CONTENTS Appendix

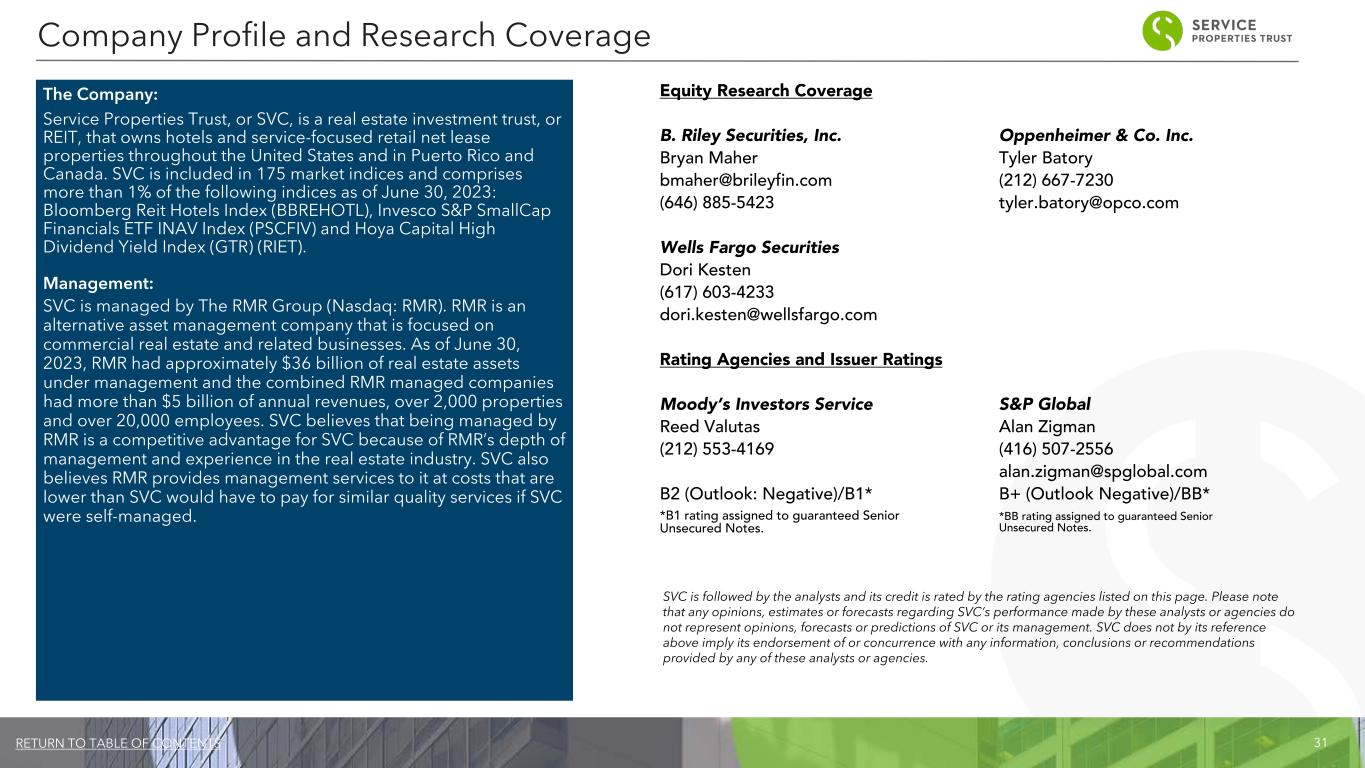

31RETURN TO TABLE OF CONTENTS Company Profile and Research Coverage The Company: Service Properties Trust, or SVC, is a real estate investment trust, or REIT, that owns hotels and service-focused retail net lease properties throughout the United States and in Puerto Rico and Canada. SVC is included in 175 market indices and comprises more than 1% of the following indices as of June 30, 2023: Bloomberg Reit Hotels Index (BBREHOTL), Invesco S&P SmallCap Financials ETF INAV Index (PSCFIV) and Hoya Capital High Dividend Yield Index (GTR) (RIET). Management: SVC is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. As of June 30, 2023, RMR had approximately $36 billion of real estate assets under management and the combined RMR managed companies had more than $5 billion of annual revenues, over 2,000 properties and over 20,000 employees. SVC believes that being managed by RMR is a competitive advantage for SVC because of RMR’s depth of management and experience in the real estate industry. SVC also believes RMR provides management services to it at costs that are lower than SVC would have to pay for similar quality services if SVC were self-managed. Equity Research Coverage B. Riley Securities, Inc. Oppenheimer & Co. Inc. Bryan Maher Tyler Batory bmaher@brileyfin.com (212) 667-7230 (646) 885-5423 tyler.batory@opco.com Wells Fargo Securities Dori Kesten (617) 603-4233 dori.kesten@wellsfargo.com Rating Agencies and Issuer Ratings Moody’s Investors Service S&P Global Reed Valutas Alan Zigman (212) 553-4169 (416) 507-2556 alan.zigman@spglobal.com B2 (Outlook: Negative)/B1* B+ (Outlook Negative)/BB* *B1 rating assigned to guaranteed Senior Unsecured Notes. *BB rating assigned to guaranteed Senior Unsecured Notes. SVC is followed by the analysts and its credit is rated by the rating agencies listed on this page. Please note that any opinions, estimates or forecasts regarding SVC’s performance made by these analysts or agencies do not represent opinions, forecasts or predictions of SVC or its management. SVC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

32RETURN TO TABLE OF CONTENTS Board of Trustees Laurie B. Burns Robert E. Cramer Donna D. Fraiche Independent Trustee Independent Trustee Lead Independent Trustee John L. Harrington William A. Lamkin John G. Murray Independent Trustee Independent Trustee Managing Trustee Rajan C. Penkar Adam D. Portnoy Independent Trustee Chair of the Board & Managing Trustee Executive Officers Todd W. Hargreaves Brian E. Donley President and Chief Investment Officer Chief Financial Officer and Treasurer Governance Information Royal Sonesta Kaua'i Resort Lihue, HI

33RETURN TO TABLE OF CONTENTS Non-GAAP Financial Measures SVC presents certain “non-GAAP financial measures” within the meaning of the applicable Securities and Exchange Commission, or SEC, rules, including FFO, Normalized FFO, EBITDA, Hotel EBITDA, EBITDAre and Adjusted EBITDAre. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net (loss) income as indicators of SVC's operating performance or as measures of its liquidity. These measures should be considered in conjunction with net (loss) income as presented in SVC's condensed consolidated statements of income (loss). SVC considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net (loss) income. SVC believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of its operating performance between periods and with other REITs and, in the case of Hotel EBITDA, reflecting only those income and expense items that are generated and incurred at the hotel level may help both investors and management to understand the operations of its hotels. FFO and Normalized FFO: SVC calculates funds from operations, or FFO, and Normalized FFO as shown on page 35. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net (loss) income, calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, less any gains and losses on equity securities, as well as adjustments to reflect SVC's share of FFO attributable to an investee and certain other adjustments currently not applicable to SVC. In calculating Normalized FFO, SVC adjusts for the items shown on page 35. FFO and Normalized FFO are among the factors considered by SVC's Board of Trustees when determining the amount of distributions to SVC's shareholders. Other factors include, but are not limited to, requirements to satisfy its REIT distribution requirements, the availability to SVC of debt and equity capital, SVC's distribution rate as a percentage of the trading price of its common shares, or dividend yield, and to the dividend yield of other REITs, SVC's expectation of its future capital requirements and operating performance and its expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than SVC does. EBITDA, EBITDAre and Adjusted EBITDAre: SVC calculates earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 36. EBITDAre is calculated on the basis defined by Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, and adjustments to reflect SVC's share of EBITDAre attributable to an investee. In calculating Adjusted EBITDAre, SVC adjusts for the items shown on page 36. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than SVC does. Hotel EBITDA: SVC calculates Hotel EBITDA as hotel operating revenues less hotel operating expenses of all managed and leased hotels, prior to any adjustments required for presentation in its condensed consolidated statements of income (loss) in accordance with GAAP. SVC believes that Hotel EBITDA provides useful information to management and investors as a key measure of the profitability of its hotel operations. Other Definitions Adjusted Total Assets and Total Unencumbered Assets: Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment write- downs, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. Annualized Dividend Yield: Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of SVC's common shares at the end of the period. Annualized Minimum Rent: Generally, SVC's lease agreements with its net lease tenants require payment of minimum rent to SVC. Certain of these minimum rent payment amounts are secured by full or limited guarantees. Annualized minimum rent represents cash amounts and excludes adjustments, if any, necessary to record scheduled rent changes on a straight line basis or any expense reimbursements. Annualized minimum rent for TA excludes the impact of rents prepaid by TA. Average Daily Rate: ADR represents rooms revenue divided by the total number of room nights sold in a given period. ADR provides useful insight on pricing at SVC's hotels and is a measure widely used in the hotel industry. Chain Scale: As characterized by STR Global Limited, a data benchmark and analytics provider for the lodging industry. Comparable Hotels Data: SVC presents RevPAR, ADR and occupancy for the periods presented on a comparable basis to facilitate comparisons between periods. SVC generally defines comparable hotels as those that it owned on June 30, 2023 and were open and operating since the beginning of the earliest period being compared. For the periods presented, SVC's comparable results excluded two hotels, one of which was not owned for the entirety of the periods and the other of which had suspended operations during part of the periods presented. Consolidated Income Available for Debt Service: Consolidated income available for debt service, as defined in SVC's debt agreements, is earnings from operations excluding interest expense, unrealized gains and losses on equity securities, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. Debt: Debt amounts reflect the principal balance as of the date reported. Net debt means total debt less unrestricted cash and cash equivalents as of the date reported. Non-GAAP Financial Measures and Certain Definitions

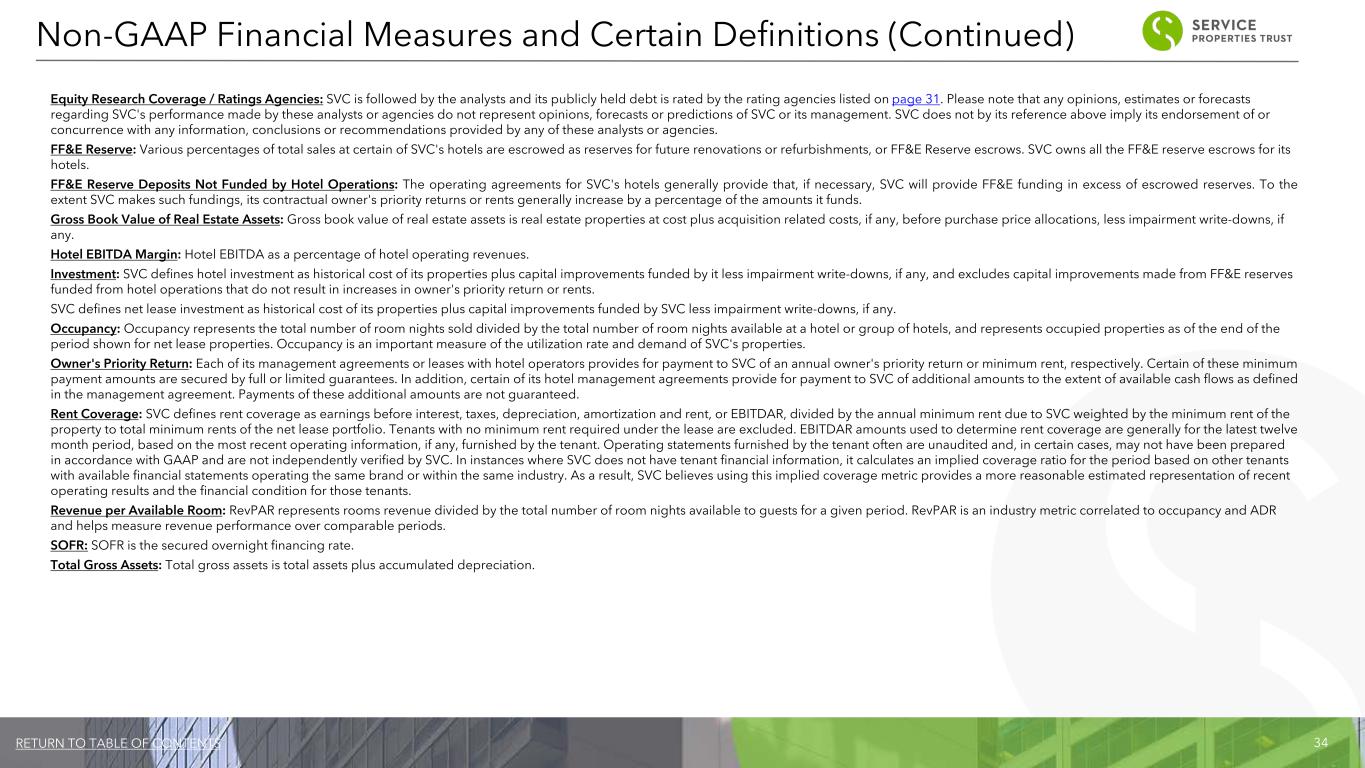

34RETURN TO TABLE OF CONTENTS Equity Research Coverage / Ratings Agencies: SVC is followed by the analysts and its publicly held debt is rated by the rating agencies listed on page 31. Please note that any opinions, estimates or forecasts regarding SVC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of SVC or its management. SVC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. FF&E Reserve: Various percentages of total sales at certain of SVC's hotels are escrowed as reserves for future renovations or refurbishments, or FF&E Reserve escrows. SVC owns all the FF&E reserve escrows for its hotels. FF&E Reserve Deposits Not Funded by Hotel Operations: The operating agreements for SVC's hotels generally provide that, if necessary, SVC will provide FF&E funding in excess of escrowed reserves. To the extent SVC makes such fundings, its contractual owner's priority returns or rents generally increase by a percentage of the amounts it funds. Gross Book Value of Real Estate Assets: Gross book value of real estate assets is real estate properties at cost plus acquisition related costs, if any, before purchase price allocations, less impairment write-downs, if any. Hotel EBITDA Margin: Hotel EBITDA as a percentage of hotel operating revenues. Investment: SVC defines hotel investment as historical cost of its properties plus capital improvements funded by it less impairment write-downs, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations that do not result in increases in owner's priority return or rents. SVC defines net lease investment as historical cost of its properties plus capital improvements funded by SVC less impairment write-downs, if any. Occupancy: Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels, and represents occupied properties as of the end of the period shown for net lease properties. Occupancy is an important measure of the utilization rate and demand of SVC's properties. Owner's Priority Return: Each of its management agreements or leases with hotel operators provides for payment to SVC of an annual owner's priority return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees. In addition, certain of its hotel management agreements provide for payment to SVC of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed. Rent Coverage: SVC defines rent coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the annual minimum rent due to SVC weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. Tenants with no minimum rent required under the lease are excluded. EBITDAR amounts used to determine rent coverage are generally for the latest twelve month period, based on the most recent operating information, if any, furnished by the tenant. Operating statements furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by SVC. In instances where SVC does not have tenant financial information, it calculates an implied coverage ratio for the period based on other tenants with available financial statements operating the same brand or within the same industry. As a result, SVC believes using this implied coverage metric provides a more reasonable estimated representation of recent operating results and the financial condition for those tenants. Revenue per Available Room: RevPAR represents rooms revenue divided by the total number of room nights available to guests for a given period. RevPAR is an industry metric correlated to occupancy and ADR and helps measure revenue performance over comparable periods. SOFR: SOFR is the secured overnight financing rate. Total Gross Assets: Total gross assets is total assets plus accumulated depreciation. Non-GAAP Financial Measures and Certain Definitions (Continued)

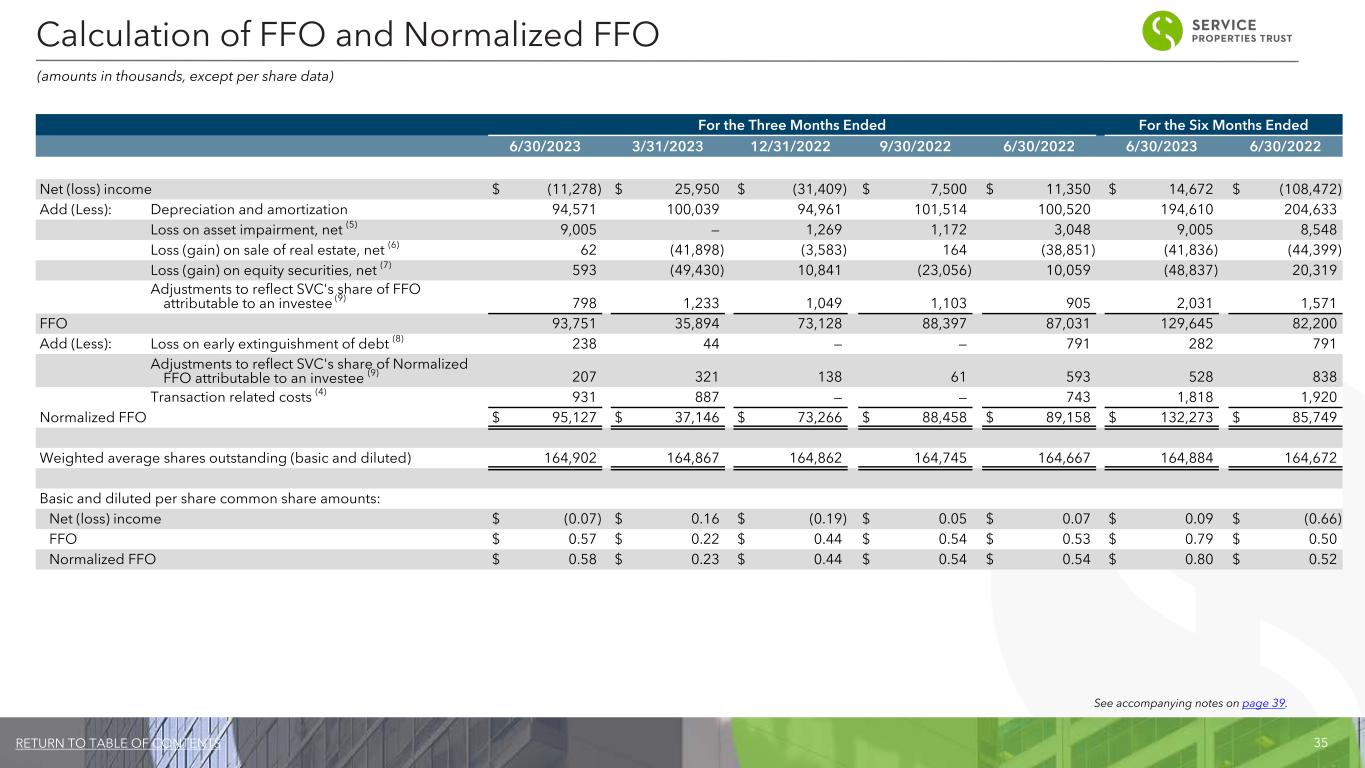

35RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Six Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 6/30/2023 6/30/2022 Net (loss) income $ (11,278) $ 25,950 $ (31,409) $ 7,500 $ 11,350 $ 14,672 $ (108,472) Add (Less): Depreciation and amortization 94,571 100,039 94,961 101,514 100,520 194,610 204,633 Loss on asset impairment, net (5) 9,005 — 1,269 1,172 3,048 9,005 8,548 Loss (gain) on sale of real estate, net (6) 62 (41,898) (3,583) 164 (38,851) (41,836) (44,399) Loss (gain) on equity securities, net (7) 593 (49,430) 10,841 (23,056) 10,059 (48,837) 20,319 Adjustments to reflect SVC's share of FFO attributable to an investee (9) 798 1,233 1,049 1,103 905 2,031 1,571 FFO 93,751 35,894 73,128 88,397 87,031 129,645 82,200 Add (Less): Loss on early extinguishment of debt (8) 238 44 — — 791 282 791 Adjustments to reflect SVC's share of Normalized FFO attributable to an investee (9) 207 321 138 61 593 528 838 Transaction related costs (4) 931 887 — — 743 1,818 1,920 Normalized FFO $ 95,127 $ 37,146 $ 73,266 $ 88,458 $ 89,158 $ 132,273 $ 85,749 Weighted average shares outstanding (basic and diluted) 164,902 164,867 164,862 164,745 164,667 164,884 164,672 Basic and diluted per share common share amounts: Net (loss) income $ (0.07) $ 0.16 $ (0.19) $ 0.05 $ 0.07 $ 0.09 $ (0.66) FFO $ 0.57 $ 0.22 $ 0.44 $ 0.54 $ 0.53 $ 0.79 $ 0.50 Normalized FFO $ 0.58 $ 0.23 $ 0.44 $ 0.54 $ 0.54 $ 0.80 $ 0.52 Calculation of FFO and Normalized FFO (amounts in thousands, except per share data) See accompanying notes on page 39.

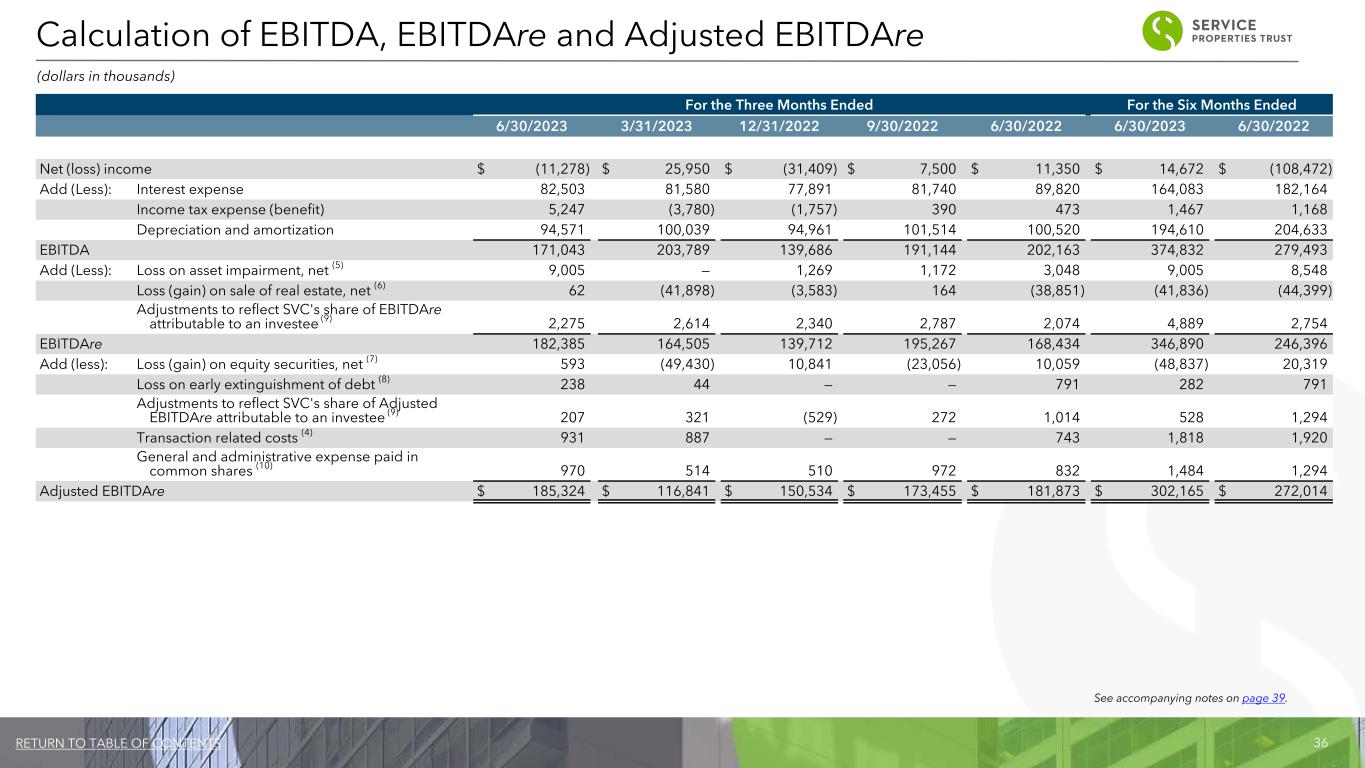

36RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Six Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 6/30/2023 6/30/2022 Net (loss) income $ (11,278) $ 25,950 $ (31,409) $ 7,500 $ 11,350 $ 14,672 $ (108,472) Add (Less): Interest expense 82,503 81,580 77,891 81,740 89,820 164,083 182,164 Income tax expense (benefit) 5,247 (3,780) (1,757) 390 473 1,467 1,168 Depreciation and amortization 94,571 100,039 94,961 101,514 100,520 194,610 204,633 EBITDA 171,043 203,789 139,686 191,144 202,163 374,832 279,493 Add (Less): Loss on asset impairment, net (5) 9,005 — 1,269 1,172 3,048 9,005 8,548 Loss (gain) on sale of real estate, net (6) 62 (41,898) (3,583) 164 (38,851) (41,836) (44,399) Adjustments to reflect SVC's share of EBITDAre attributable to an investee (9) 2,275 2,614 2,340 2,787 2,074 4,889 2,754 EBITDAre 182,385 164,505 139,712 195,267 168,434 346,890 246,396 Add (less): Loss (gain) on equity securities, net (7) 593 (49,430) 10,841 (23,056) 10,059 (48,837) 20,319 Loss on early extinguishment of debt (8) 238 44 — — 791 282 791 Adjustments to reflect SVC's share of Adjusted EBITDAre attributable to an investee (9) 207 321 (529) 272 1,014 528 1,294 Transaction related costs (4) 931 887 — — 743 1,818 1,920 General and administrative expense paid in common shares (10) 970 514 510 972 832 1,484 1,294 Adjusted EBITDAre $ 185,324 $ 116,841 $ 150,534 $ 173,455 $ 181,873 $ 302,165 $ 272,014 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) See accompanying notes on page 39.

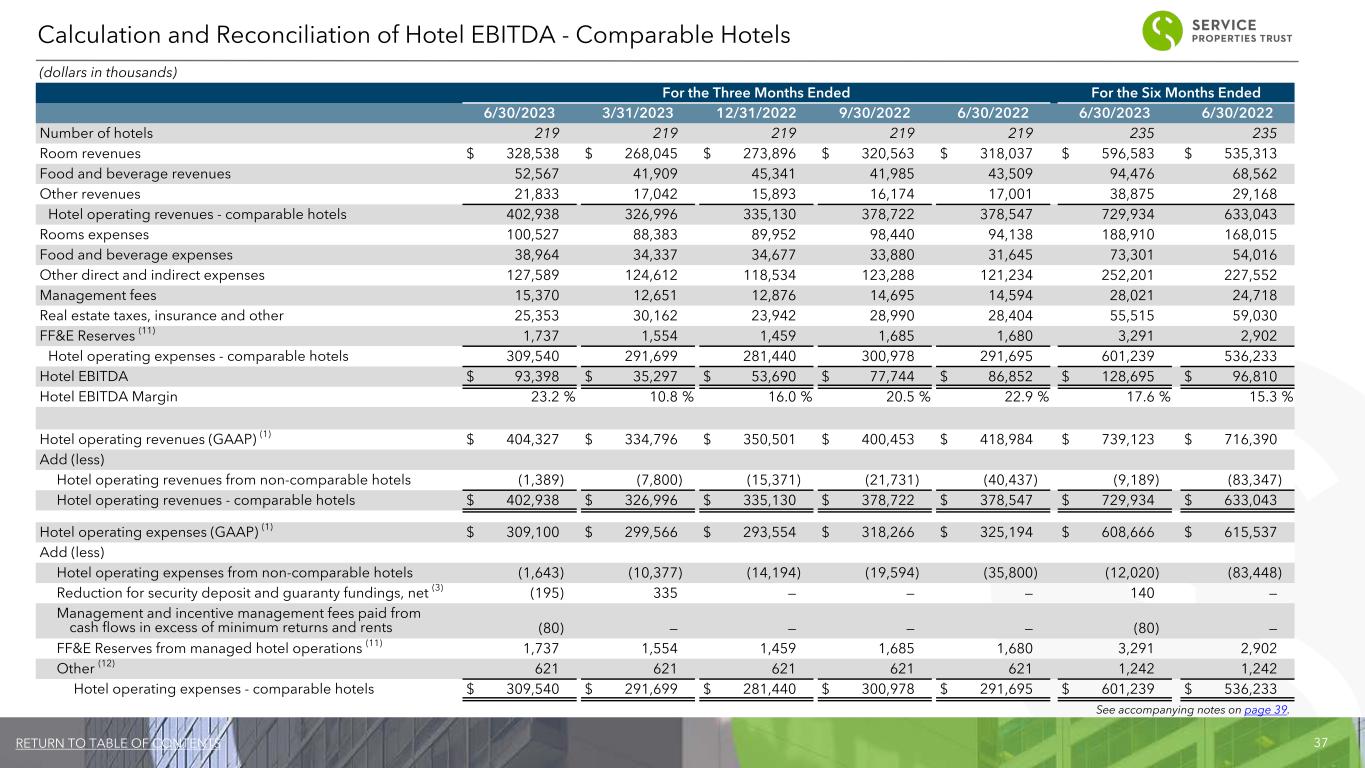

37RETURN TO TABLE OF CONTENTS (dollars in thousands) For the Three Months Ended For the Six Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 6/30/2023 6/30/2022 Number of hotels 219 219 219 219 219 235 235 Room revenues $ 328,538 $ 268,045 $ 273,896 $ 320,563 $ 318,037 $ 596,583 $ 535,313 Food and beverage revenues 52,567 41,909 45,341 41,985 43,509 94,476 68,562 Other revenues 21,833 17,042 15,893 16,174 17,001 38,875 29,168 Hotel operating revenues - comparable hotels 402,938 326,996 335,130 378,722 378,547 729,934 633,043 Rooms expenses 100,527 88,383 89,952 98,440 94,138 188,910 168,015 Food and beverage expenses 38,964 34,337 34,677 33,880 31,645 73,301 54,016 Other direct and indirect expenses 127,589 124,612 118,534 123,288 121,234 252,201 227,552 Management fees 15,370 12,651 12,876 14,695 14,594 28,021 24,718 Real estate taxes, insurance and other 25,353 30,162 23,942 28,990 28,404 55,515 59,030 FF&E Reserves (11) 1,737 1,554 1,459 1,685 1,680 3,291 2,902 Hotel operating expenses - comparable hotels 309,540 291,699 281,440 300,978 291,695 601,239 536,233 Hotel EBITDA $ 93,398 $ 35,297 $ 53,690 $ 77,744 $ 86,852 $ 128,695 $ 96,810 Hotel EBITDA Margin 23.2 % 10.8 % 16.0 % 20.5 % 22.9 % 17.6 % 15.3 % Hotel operating revenues (GAAP) (1) $ 404,327 $ 334,796 $ 350,501 $ 400,453 $ 418,984 $ 739,123 $ 716,390 Add (less) Hotel operating revenues from non-comparable hotels (1,389) (7,800) (15,371) (21,731) (40,437) (9,189) (83,347) Hotel operating revenues - comparable hotels $ 402,938 $ 326,996 $ 335,130 $ 378,722 $ 378,547 $ 729,934 $ 633,043 Hotel operating expenses (GAAP) (1) $ 309,100 $ 299,566 $ 293,554 $ 318,266 $ 325,194 $ 608,666 $ 615,537 Add (less) Hotel operating expenses from non-comparable hotels (1,643) (10,377) (14,194) (19,594) (35,800) (12,020) (83,448) Reduction for security deposit and guaranty fundings, net (3) (195) 335 — — — 140 — Management and incentive management fees paid from cash flows in excess of minimum returns and rents (80) — — — — (80) — FF&E Reserves from managed hotel operations (11) 1,737 1,554 1,459 1,685 1,680 3,291 2,902 Other (12) 621 621 621 621 621 1,242 1,242 Hotel operating expenses - comparable hotels $ 309,540 $ 291,699 $ 281,440 $ 300,978 $ 291,695 $ 601,239 $ 536,233 Calculation and Reconciliation of Hotel EBITDA - Comparable Hotels See accompanying notes on page 39.

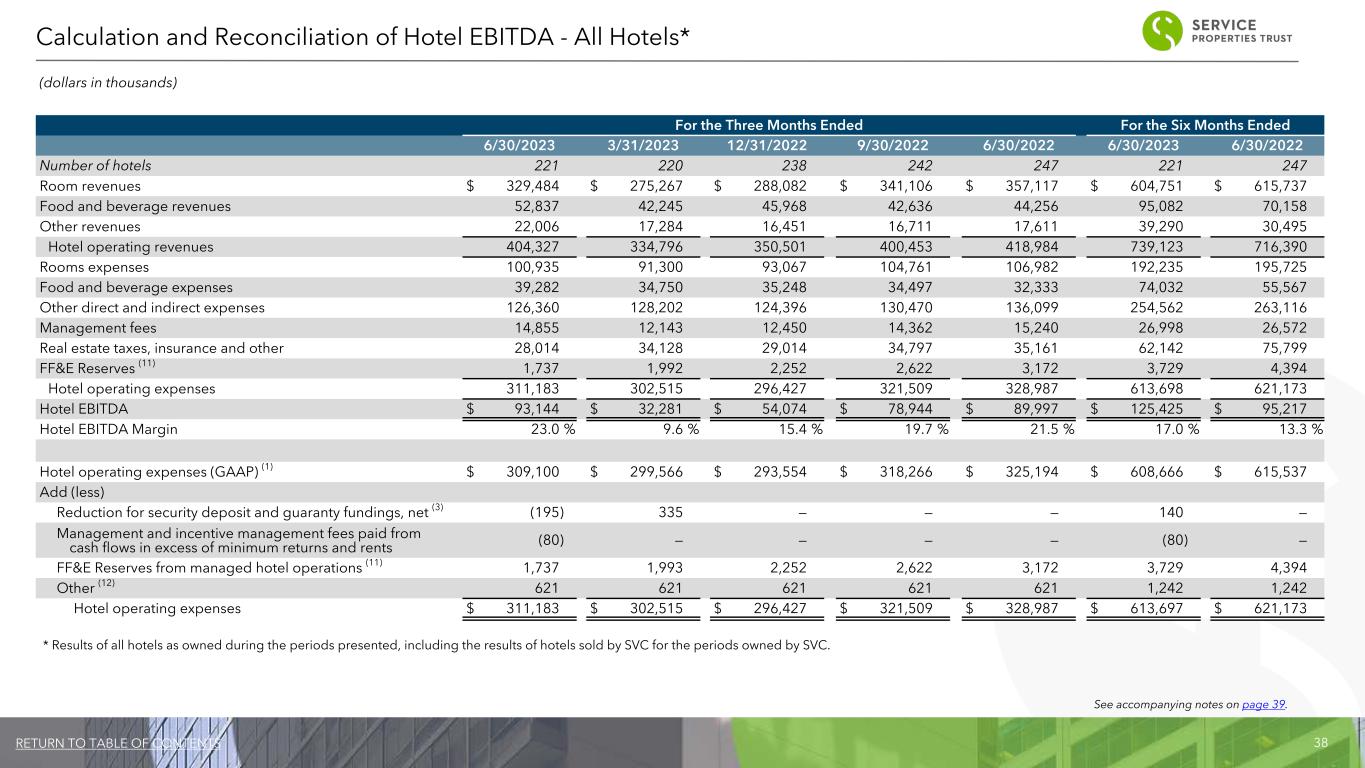

38RETURN TO TABLE OF CONTENTS (dollars in thousands) For the Three Months Ended For the Six Months Ended 6/30/2023 3/31/2023 12/31/2022 9/30/2022 6/30/2022 6/30/2023 6/30/2022 Number of hotels 221 220 238 242 247 221 247 Room revenues $ 329,484 $ 275,267 $ 288,082 $ 341,106 $ 357,117 $ 604,751 $ 615,737 Food and beverage revenues 52,837 42,245 45,968 42,636 44,256 95,082 70,158 Other revenues 22,006 17,284 16,451 16,711 17,611 39,290 30,495 Hotel operating revenues 404,327 334,796 350,501 400,453 418,984 739,123 716,390 Rooms expenses 100,935 91,300 93,067 104,761 106,982 192,235 195,725 Food and beverage expenses 39,282 34,750 35,248 34,497 32,333 74,032 55,567 Other direct and indirect expenses 126,360 128,202 124,396 130,470 136,099 254,562 263,116 Management fees 14,855 12,143 12,450 14,362 15,240 26,998 26,572 Real estate taxes, insurance and other 28,014 34,128 29,014 34,797 35,161 62,142 75,799 FF&E Reserves (11) 1,737 1,992 2,252 2,622 3,172 3,729 4,394 Hotel operating expenses 311,183 302,515 296,427 321,509 328,987 613,698 621,173 Hotel EBITDA $ 93,144 $ 32,281 $ 54,074 $ 78,944 $ 89,997 $ 125,425 $ 95,217 Hotel EBITDA Margin 23.0 % 9.6 % 15.4 % 19.7 % 21.5 % 17.0 % 13.3 % Hotel operating expenses (GAAP) (1) $ 309,100 $ 299,566 $ 293,554 $ 318,266 $ 325,194 $ 608,666 $ 615,537 Add (less) Reduction for security deposit and guaranty fundings, net (3) (195) 335 — — — 140 — Management and incentive management fees paid from cash flows in excess of minimum returns and rents (80) — — — — (80) — FF&E Reserves from managed hotel operations (11) 1,737 1,993 2,252 2,622 3,172 3,729 4,394 Other (12) 621 621 621 621 621 1,242 1,242 Hotel operating expenses $ 311,183 $ 302,515 $ 296,427 $ 321,509 $ 328,987 $ 613,697 $ 621,173 Calculation and Reconciliation of Hotel EBITDA - All Hotels* See accompanying notes on page 39. * Results of all hotels as owned during the periods presented, including the results of hotels sold by SVC for the periods owned by SVC.

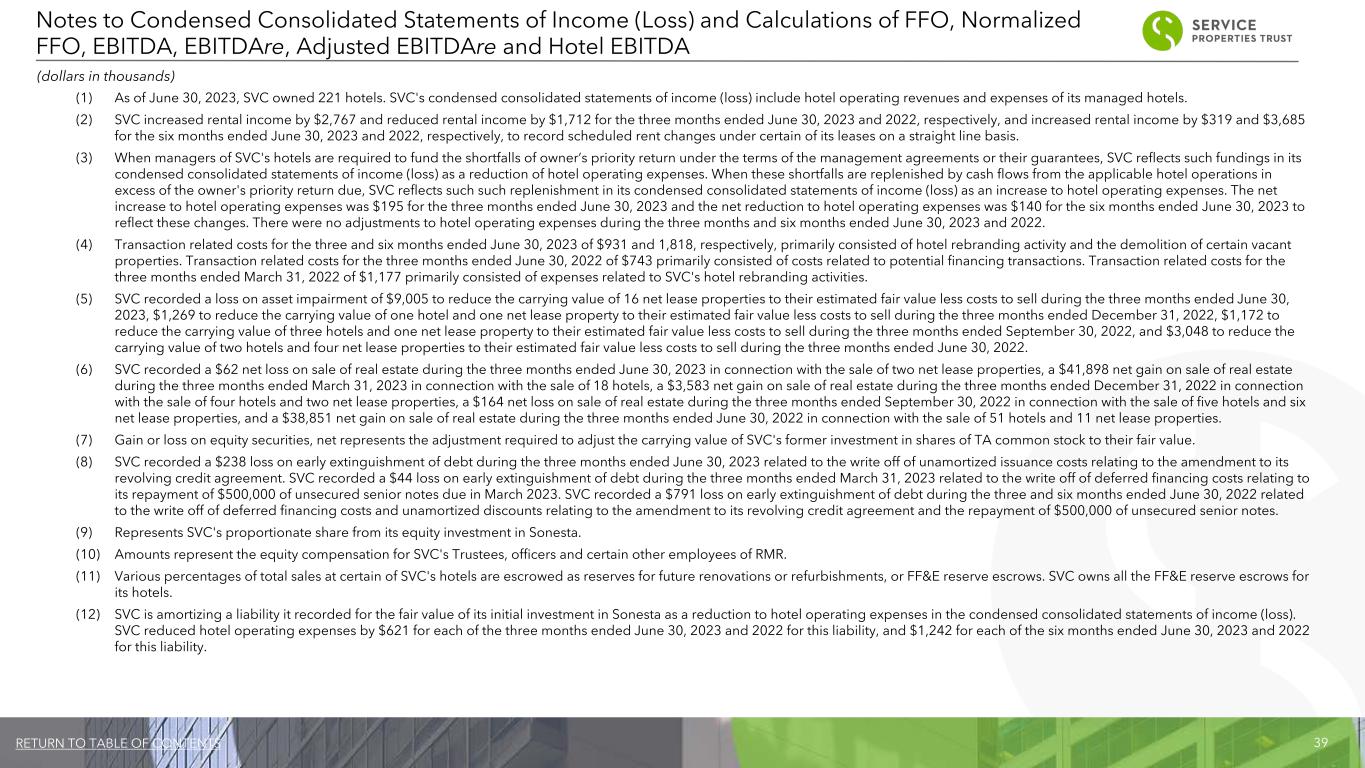

39RETURN TO TABLE OF CONTENTS Notes to Condensed Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre and Hotel EBITDA (dollars in thousands) (1) As of June 30, 2023, SVC owned 221 hotels. SVC's condensed consolidated statements of income (loss) include hotel operating revenues and expenses of its managed hotels. (2) SVC increased rental income by $2,767 and reduced rental income by $1,712 for the three months ended June 30, 2023 and 2022, respectively, and increased rental income by $319 and $3,685 for the six months ended June 30, 2023 and 2022, respectively, to record scheduled rent changes under certain of its leases on a straight line basis. (3) When managers of SVC's hotels are required to fund the shortfalls of owner’s priority return under the terms of the management agreements or their guarantees, SVC reflects such fundings in its condensed consolidated statements of income (loss) as a reduction of hotel operating expenses. When these shortfalls are replenished by cash flows from the applicable hotel operations in excess of the owner's priority return due, SVC reflects such such replenishment in its condensed consolidated statements of income (loss) as an increase to hotel operating expenses. The net increase to hotel operating expenses was $195 for the three months ended June 30, 2023 and the net reduction to hotel operating expenses was $140 for the six months ended June 30, 2023 to reflect these changes. There were no adjustments to hotel operating expenses during the three months and six months ended June 30, 2023 and 2022. (4) Transaction related costs for the three and six months ended June 30, 2023 of $931 and 1,818, respectively, primarily consisted of hotel rebranding activity and the demolition of certain vacant properties. Transaction related costs for the three months ended June 30, 2022 of $743 primarily consisted of costs related to potential financing transactions. Transaction related costs for the three months ended March 31, 2022 of $1,177 primarily consisted of expenses related to SVC's hotel rebranding activities. (5) SVC recorded a loss on asset impairment of $9,005 to reduce the carrying value of 16 net lease properties to their estimated fair value less costs to sell during the three months ended June 30, 2023, $1,269 to reduce the carrying value of one hotel and one net lease property to their estimated fair value less costs to sell during the three months ended December 31, 2022, $1,172 to reduce the carrying value of three hotels and one net lease property to their estimated fair value less costs to sell during the three months ended September 30, 2022, and $3,048 to reduce the carrying value of two hotels and four net lease properties to their estimated fair value less costs to sell during the three months ended June 30, 2022. (6) SVC recorded a $62 net loss on sale of real estate during the three months ended June 30, 2023 in connection with the sale of two net lease properties, a $41,898 net gain on sale of real estate during the three months ended March 31, 2023 in connection with the sale of 18 hotels, a $3,583 net gain on sale of real estate during the three months ended December 31, 2022 in connection with the sale of four hotels and two net lease properties, a $164 net loss on sale of real estate during the three months ended September 30, 2022 in connection with the sale of five hotels and six net lease properties, and a $38,851 net gain on sale of real estate during the three months ended June 30, 2022 in connection with the sale of 51 hotels and 11 net lease properties. (7) Gain or loss on equity securities, net represents the adjustment required to adjust the carrying value of SVC's former investment in shares of TA common stock to their fair value. (8) SVC recorded a $238 loss on early extinguishment of debt during the three months ended June 30, 2023 related to the write off of unamortized issuance costs relating to the amendment to its revolving credit agreement. SVC recorded a $44 loss on early extinguishment of debt during the three months ended March 31, 2023 related to the write off of deferred financing costs relating to its repayment of $500,000 of unsecured senior notes due in March 2023. SVC recorded a $791 loss on early extinguishment of debt during the three and six months ended June 30, 2022 related to the write off of deferred financing costs and unamortized discounts relating to the amendment to its revolving credit agreement and the repayment of $500,000 of unsecured senior notes. (9) Represents SVC's proportionate share from its equity investment in Sonesta. (10) Amounts represent the equity compensation for SVC's Trustees, officers and certain other employees of RMR. (11) Various percentages of total sales at certain of SVC's hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. SVC owns all the FF&E reserve escrows for its hotels. (12) SVC is amortizing a liability it recorded for the fair value of its initial investment in Sonesta as a reduction to hotel operating expenses in the condensed consolidated statements of income (loss). SVC reduced hotel operating expenses by $621 for each of the three months ended June 30, 2023 and 2022 for this liability, and $1,242 for each of the six months ended June 30, 2023 and 2022 for this liability.

40RETURN TO TABLE OF CONTENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, "anticipate", “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: the continued growth in SVC's hotel portfolio and ongoing strength in the net lease business; the credit quality of TA following the BP acquisition; SVC's current liquidity; and the amount and timing of future distributions. Forward-looking statements reflect management's current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause SVC's actual results, performance, or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward-looking statements. Some of the risks, uncertainties and other factors that may cause SVC's actual results, performance or achievements to differ materially from the expressed or implied forward-looking statements include, but are not limited to, the following: Sonesta Holdco Corporation and its subsidiaries, or Sonesta’s, ability to successfully operate the hotels it manages for SVC; SVC’s ability and the ability of SVC’s managers and tenants to operate under unfavorable market and economic conditions, rising or sustained high interest rates, high inflation, labor market challenges, dislocation and volatility in the public equity and debt markets, geopolitical instability and economic recessions or downturns; if and when business transient hotel business will return to historical pre-COVID-19 pandemic levels and whether any improved hotel industry conditions will continue, increase or be sustained; whether and the extent to which SVC’s managers and tenants will pay the contractual amounts of returns, rents or other obligations due to SVC; competition within the commercial real estate, hotel, transportation and travel center and other industries in which SVC's managers and tenants operate, particularly in those markets in which SVC’s properties are located; SVC’s ability to repay or refinance its debts as they mature or otherwise become due; SVC’s ability to maintain sufficient liquidity, including the availability of borrowings under its revolving credit facility; SVC’s ability to pay interest on and principal of its debt; SVC’s ability to acquire properties that realize its targeted returns; SVC’s ability to sell properties at prices it targets; SVC’s ability to raise or appropriately balance the use of debt or equity capital; potential defaults of SVC’s management agreements and leases by its managers and tenants; SVC’s ability to increase hotel room rates and rents at its leased properties as SVC’s leases expire in excess of its operating expenses and to grow its business; SVC’s ability to increase and maintain hotel room and net lease property occupancy at its properties; SVC’s ability to pay distributions to its shareholders and to increase or sustain the amount of such distributions; the impact of increasing labor costs and shortages and commodity and other price inflation due to supply chain challenges or other market conditions; SVC’s ability to make cost-effective improvements to SVC’s properties that enhance its appeal to hotel guests and net lease tenants; SVC’s ability to engage and retain qualified managers and tenants for its hotels and net lease properties on satisfactory terms; SVC’s ability to diversify its sources of rents and returns that improve the security of its cash flows; SVC’s credit ratings; the ability of SVC’s manager, The RMR Group LLC, or RMR, to successfully manage SVC; actual and potential conflicts of interest with SVC’s related parties, including its Managing Trustees, Sonesta, RMR and others affiliated with them; SVC’s qualification for taxation as a REIT under the Internal Revenue Code of 1986, as amended; SVC’s ability to realize benefits from the scale, geographic diversity, strategic locations and variety of service levels of its hotels; changes in federal or state tax laws; limitations imposed on SVC’s business and its ability to satisfy complex rules in order for it to maintain its qualification for taxation as a REIT for U.S. federal income tax purposes; compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters; acts of terrorism, outbreaks or continuation of pandemics or other significant adverse public health safety events or conditions, war or other hostilities, supply chain disruptions, climate change or other man-made or natural disasters beyond its control; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in SVC's periodic filings. The information contained in SVC's filings with the SEC including under the caption "Risk Factors" in its periodic reports, or incorporated therein, identifies important factors that could cause differences from the forward-looking statements in this presentation. SVC's filings with the SEC are available on its website and at www.sec.gov. You should not place undue reliance on forward-looking statements. Except as required by law, SVC undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements