Current Report Filing (8-k)

13 6월 2023 - 7:01PM

Edgar (US Regulatory)

0001043186FALSE00010431862023-06-122023-06-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 9, 2023

Stabilis Solutions, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Florida | | 001-40364 | | 59-3410234 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

11750 Katy Freeway Suite 900

Houston, Texas | | 77079 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 832-456-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $.001 par value | | SLNG | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On June 9, 2023 Stabilis Solutions, Inc. (the “Company”) along with its subsidiaries, Stabilis LNG Eagle Ford LLC, Stabilis GDS, Inc. and Stabilis LNG Port Allen, LLC (collectively, the “Borrowers”) entered into a Loan Agreement (the “Loan Agreement”) with Cadence Bank (the “Lender”).

The Loan Agreement provides for a revolving credit facility that matures on June 9, 2026. The maximum aggregate amount of availability under the revolving credit facility is $10 million, subject to a borrowing base of 80% of eligible accounts receivable. None of the funds available under the Loan were drawn as of June 12, 2023. The Borrowers may request an increase in the maximum aggregate amount of availability under the revolving credit facility by up to $5 million, subject to the approval of the Lender.

Borrowings under the Loan Agreement generally bear interest at a variable rate equal to the Prime Rate published by the Wall Street Journal. The Borrowers must also pay (1) a quarterly unused commitment fee of 0.5% per annum of the amount of the difference between (i) $10 million and (ii) the average daily outstanding principal balance of the loan during the applicable quarter, and (2) an upfront fee of $50,000.

All borrowings under the Loan Agreement are secured by the Borrowers’ accounts receivable and deposit accounts.

The Loan Agreement contains various restrictions and covenants applicable to the Borrowers. Among other requirements, the Borrowers must maintain consolidated net worth of at least $50 million as of June 30, 2023, increasing by 50% of the Borrowers’ net income as of the end of each year ended December 31. Additionally, commencing with the fiscal quarter ending June 30, 2023, Borrowers must maintain, on a consolidated basis, a minimum Fixed Charge Coverage Ratio of 1.20 to 1.0, as defined in the Loan Agreement, as of the last day of each fiscal quarter of Borrowers, on a trailing twelve (12) months basis.

The Loan Agreement also contains customary events of default. If an event of default under the Loan Agreement occurs and is continuing, then the Lender may declare any outstanding obligations under the Loan Agreement to be immediately due and payable. In addition, if any of the Borrowers become the subject of voluntary or involuntary proceedings under any bankruptcy, insolvency or similar law, then any outstanding obligations under the Loan Agreement will automatically become immediately due and payable.

The foregoing description of the Loan Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Loan Agreement filed herewith as Exhibit 4.1 and incorporated herein by reference.

On June 12, 2023 the Company issued a news release relating to the execution of the Loan Agreement. A copy of the news release is filed herewith as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

Exhibits:

| | | | | | | | |

Exhibit

No. | | Description |

| 4.1 | | |

| 4.2 | | |

| 4.3 | | |

| 99.1 | | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| STABILIS SOLUTIONS, INC. |

| By: /s/Andrew L. Puhala |

| Andrew L. Puhala |

| Chief Financial Officer |

| | |

| Date: June 12, 2023 | | |

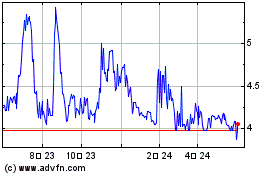

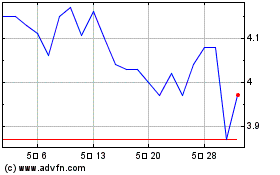

Stabilis Solutions (NASDAQ:SLNG)

과거 데이터 주식 차트

부터 5월(5) 2024 으로 6월(6) 2024

Stabilis Solutions (NASDAQ:SLNG)

과거 데이터 주식 차트

부터 6월(6) 2023 으로 6월(6) 2024