false000091276600009127662023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 2, 2023

Laureate Education, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38002 | | 52-1492296 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

PMB 1158, 1000 Brickell Avenue, Suite 715

Miami, FL 33131

(Address of principal executive offices, including zip code)

(786) 209-3368

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.004 per share

| LAUR | The NASDAQ Stock Market LLC |

| (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, Laureate Education, Inc. (the “Company”) issued an earnings release announcing its financial results for the quarter ended September 30, 2023. A copy of the earnings release is furnished herewith as Exhibit 99.1 and incorporated in this Item 2.02 by reference.

Item 7.01 Regulation FD Disclosure.

On November 2, 2023, the Company made available on the investor relations section of its website its third quarter of 2023 Earnings Presentation (the “Presentation”). A copy of the Presentation is furnished herewith as Exhibit 99.2 and incorporated in this Item 7.01 by reference.

Item 8.01. Other Events.

On November 2, 2023, the Company announced that its Board of Directors approved the payment of a special cash dividend (the “Dividend”) equal to $0.70 per each share of the Company's common stock, par value $0.004 per share, to each holder of record on November 15, 2023. The Dividend is scheduled to be paid on November 30, 2023. Based on the current number of shares outstanding, the aggregate amount of the Dividend is expected to be approximately $110 million.

The Company expects that the entire amount of the Dividend will be in excess of its current and accumulated earnings and profits (as determined for U.S. federal income tax purposes) and therefore will be treated as a taxable dividend for U.S. federal income tax purposes. All holders of Company common stock should consult their own tax advisors to determine the particular tax consequences to them of the Dividend, including the applicability and effect of any U.S. federal, state, local, non-U.S. and other tax laws.

In connection with the Dividend, the Board approved certain required adjustments under the Company’s equity award compensation plans. Subject to the payment of the Dividend, the exercise price of the Company’s options will be reduced by $0.70 per share, and holders of restricted and performance stock units will receive an amount in cash equal to $0.70 per unvested stock unit held payable when such unit vests. If all outstanding stock units vest, the aggregate amount to be paid in respect of the units will be approximately $700,000.

On November 2, 2023, the Company issued an earnings release announcing the Dividend. A copy of the earnings release is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

The information contained in Item 2.02, including Exhibit 99.1 hereto, and Item 7.01, including Exhibit 99.2 hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Such information in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| LAUREATE EDUCATION, INC. |

| | |

| | |

| By: | /s/ Richard M. Buskirk |

| Name: | Richard M. Buskirk |

| Title: | Senior Vice President and Chief Financial Officer |

Date: November 2, 2023

Exhibit 99.1

LAUREATE EDUCATION REPORTS FINANCIAL RESULTS FOR THE THIRD QUARTER AND NINE MONTHS ENDED SEPTEMBER 30, 2023

Company announces a special cash dividend of $0.70 per common share declared by its Board of Directors

MIAMI - November 2, 2023 (GLOBE NEWSWIRE) - Laureate Education, Inc. (NASDAQ: LAUR), which operates five higher education institutions across Mexico and Peru, today announced financial results for the third quarter and nine months ended September 30, 2023. It also announced that its Board of Directors has declared a special cash dividend of $0.70 per common share.

Third Quarter 2023 Highlights (compared to third quarter 2022):

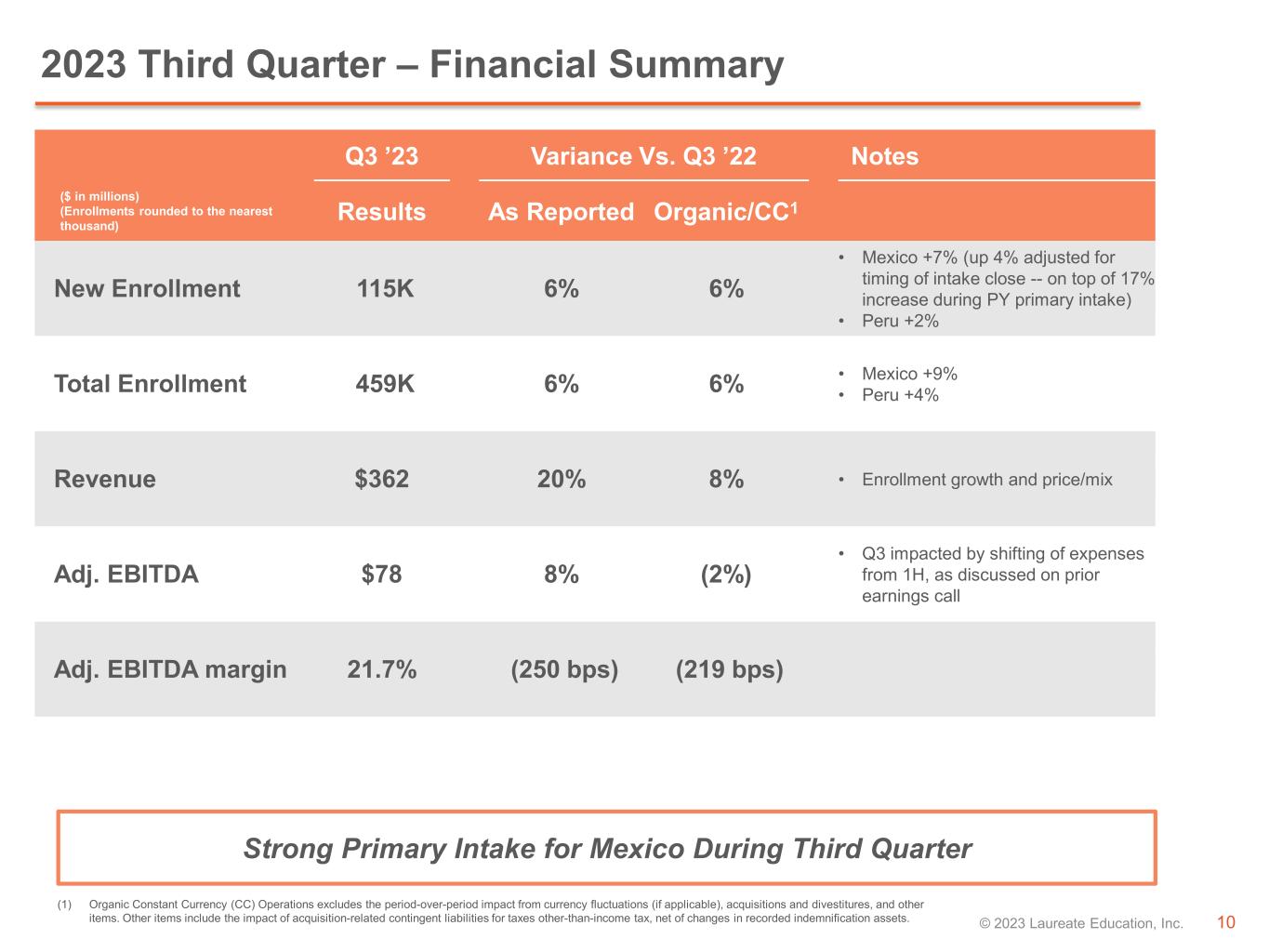

•On a reported basis, revenue increased 20% to $361.5 million. On an organic constant currency basis1, revenue increased 8%.

•Operating income for the third quarter of 2023 was $58.7 million, compared to operating income of $56.3 million for the third quarter of 2022.

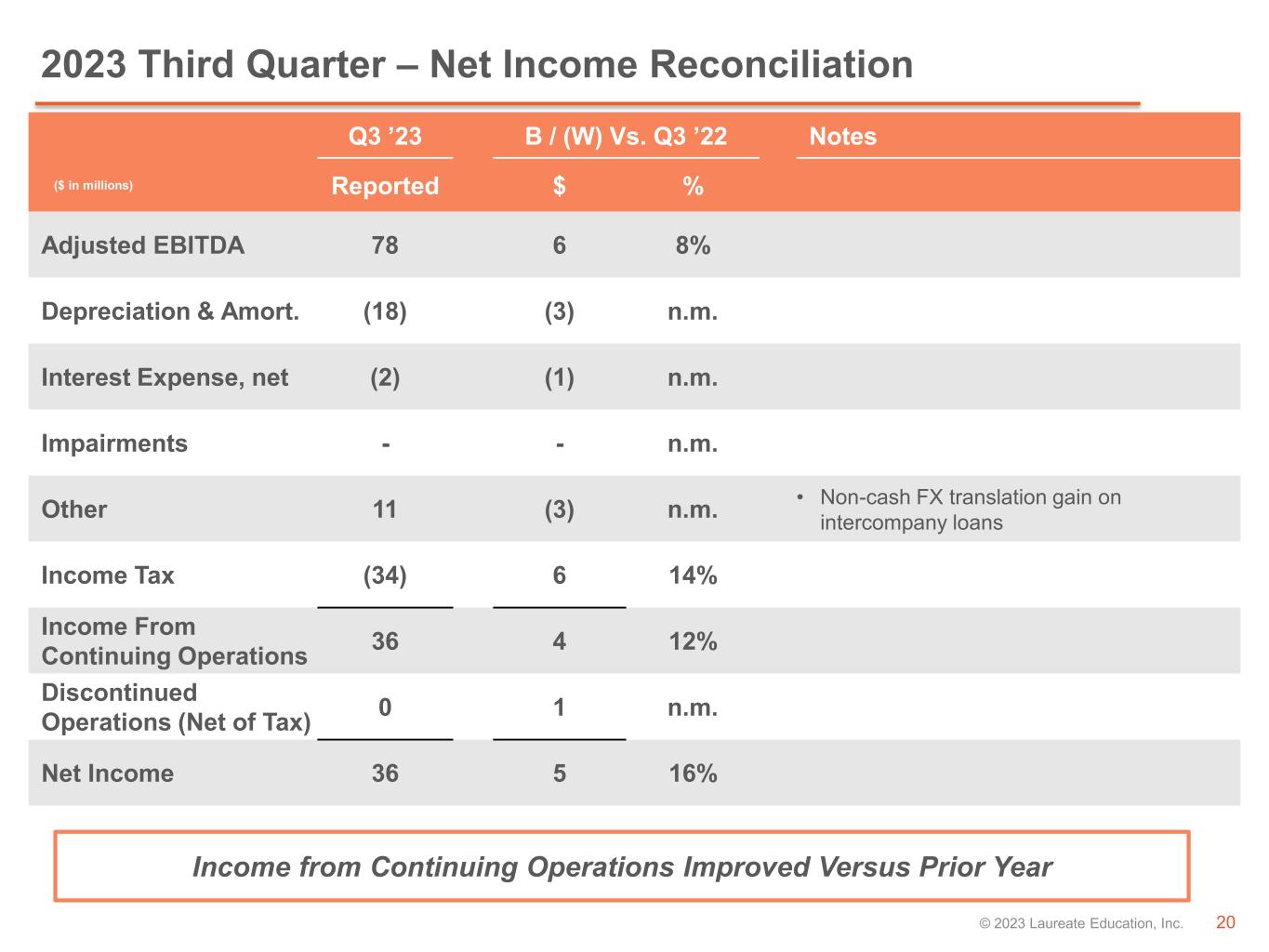

•Net income for the third quarter of 2023 was $36.0 million, compared to net income of $31.0 million for the third quarter of 2022,

•Adjusted EBITDA for the third quarter of 2023 was $78.4 million, compared to Adjusted EBITDA of $72.8 million for the third quarter of 2022.

Nine Months Ended September 30, 2023 Highlights (compared to nine months ended September 30, 2022):

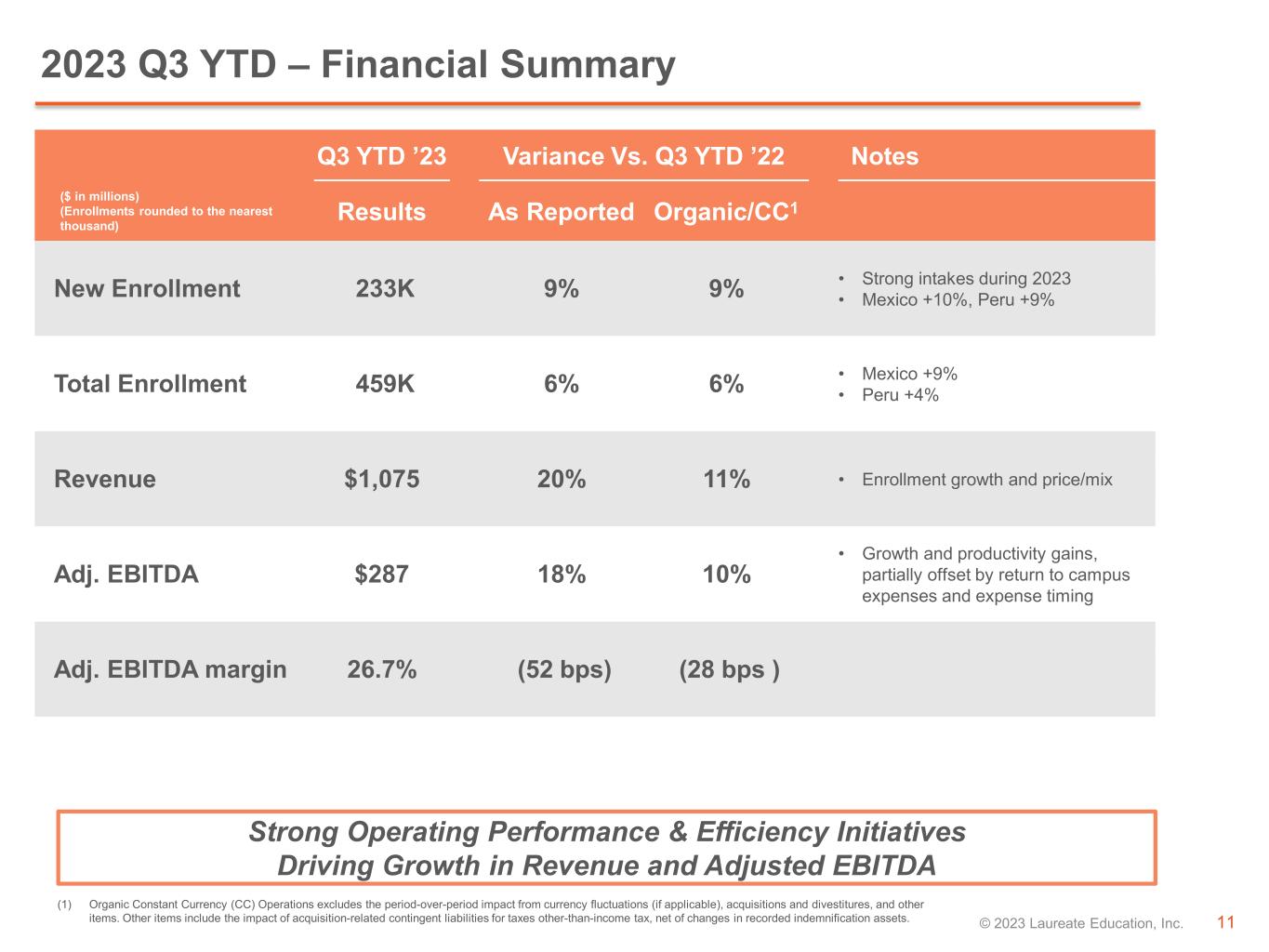

•New enrollments increased 9%.

•Total enrollments increased 6%.

•On a reported basis, revenue increased 20% to $1,074.9 million. On an organic constant currency basis1, revenue increased 11%.

•Operating income for the nine months ended September 30, 2023 was $228.8 million, compared to operating income of $192.0 million for the nine months ended September 30, 2022.

•Net income for the nine months ended September 30, 2023 was $65.5 million, compared to net income of $29.9 million for the nine months ended September 30, 2022.

•Adjusted EBITDA for the nine months ended September 30, 2023 was $287.3 million, compared to Adjusted EBITDA of $244.1 million for the nine months ended September 30, 2022.

Eilif Serck-Hanssen, President and Chief Executive Officer, said, “Laureate’s strong third quarter results were in line with expectations. Our operating performance reflects a robust macroeconomic backdrop in Mexico, including early signs of increased investments related to nearshoring, and a more subdued backdrop in Peru given recent softness in its economy. The financial results we delivered for the first nine months of the year demonstrate the unique value of Laureate’s diverse business model, which is based on a broad mix of product offerings at a range of price points. Our balance sheet remains strong, and today we are pleased to be announcing a special cash dividend of $0.70 per share, continuing our commitment to returning capital to our shareholders.”

1 Organic constant currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items.

Third Quarter 2023 Results

For the third quarter of 2023, revenue on a reported basis was $361.5 million, an increase of $60.5 million, or 20%, compared to the third quarter of 2022. On an organic constant currency basis, revenue increased 8%. Operating income for the third quarter of 2023 was $58.7 million, compared to $56.3 million for the third quarter of 2022, an increase of $2.4 million. Net income for the third quarter of 2023 was $36.0 million, compared to net income of $31.0 million for the third quarter of 2022. Basic and diluted earnings per share for the third quarter of 2023 were $0.23.

Adjusted EBITDA for the third quarter of 2023 was $78.4 million, compared to Adjusted EBITDA of $72.8 million for the third quarter of 2022.

Nine Months Ended September 30, 2023 Results

New enrollments for the nine months ended September 30, 2023 increased 9%, compared to new enrollment activity for the nine months ended September 30, 2022, and total enrollments were up 6% compared to the prior-year period. New and total enrollments in Peru increased 9% and 4%, respectively, compared to the prior-year period. New enrollments in Mexico were up 10% compared to the prior-year period, and total enrollment in Mexico was up 9%.

For the nine months ended September 30, 2023, revenue on a reported basis was $1,074.9 million, an increase of $179.0 million, or 20%, compared to the nine months ended September 30, 2022. On an organic constant currency basis, revenue increased 11%. Operating income for the nine months ended September 30, 2023 was $228.8 million, compared to $192.0 million for the nine months ended September 30, 2022, an increase of $36.8 million. The increase in operating income versus the 2022 period resulted from growth in revenue, partially offset by higher costs associated with the annualized impact of return to campus operations. Net income for the nine months ended September 30, 2023 was $65.5 million, compared to net income of $29.9 million for the nine months ended September 30, 2022. Basic and diluted earnings per share for the nine months ended September 30, 2023 were $0.42.

Adjusted EBITDA for the nine months ended September 30, 2023 was $287.3 million, compared to Adjusted EBITDA of $244.1 million for the nine months ended September 30, 2022.

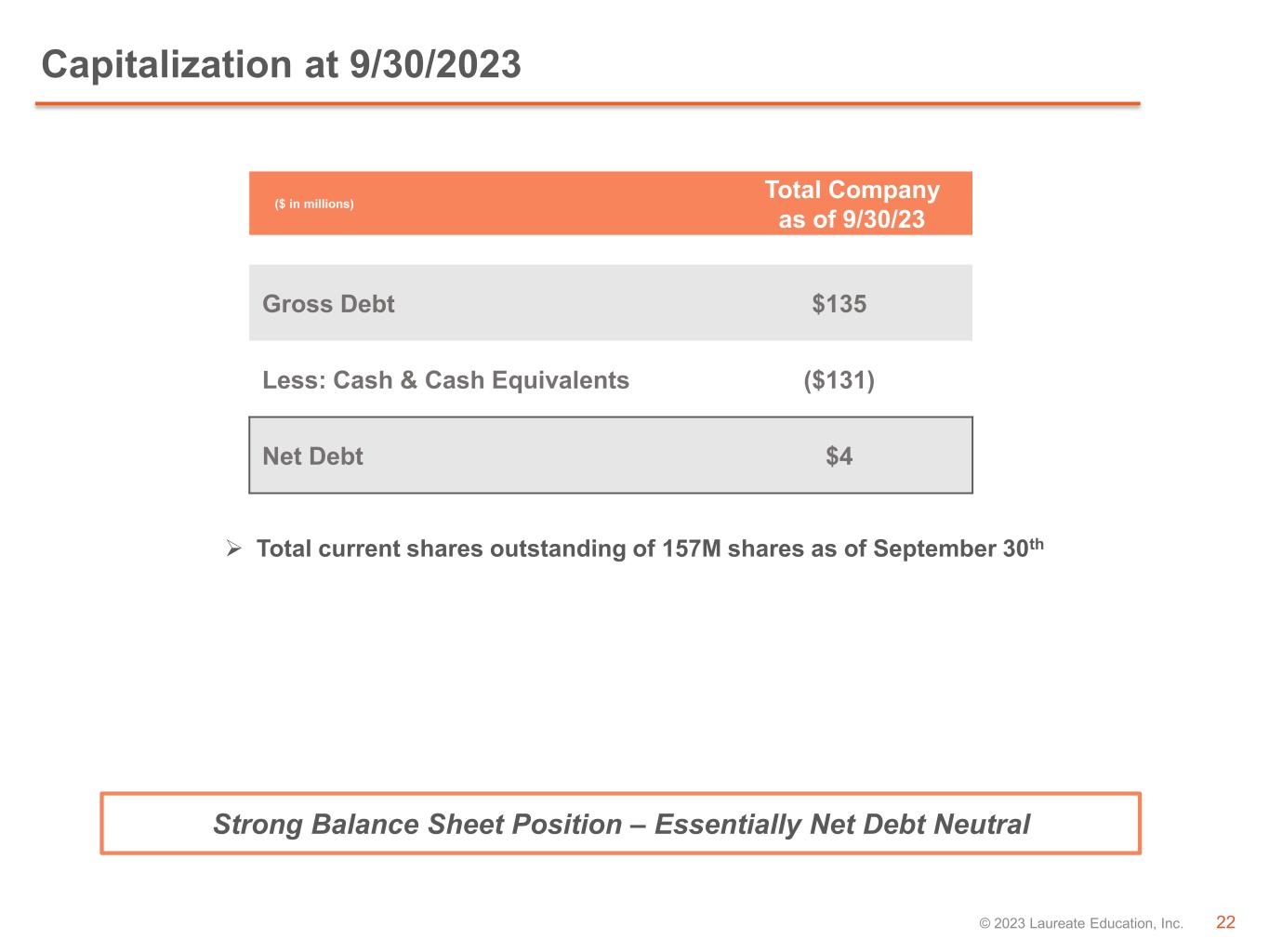

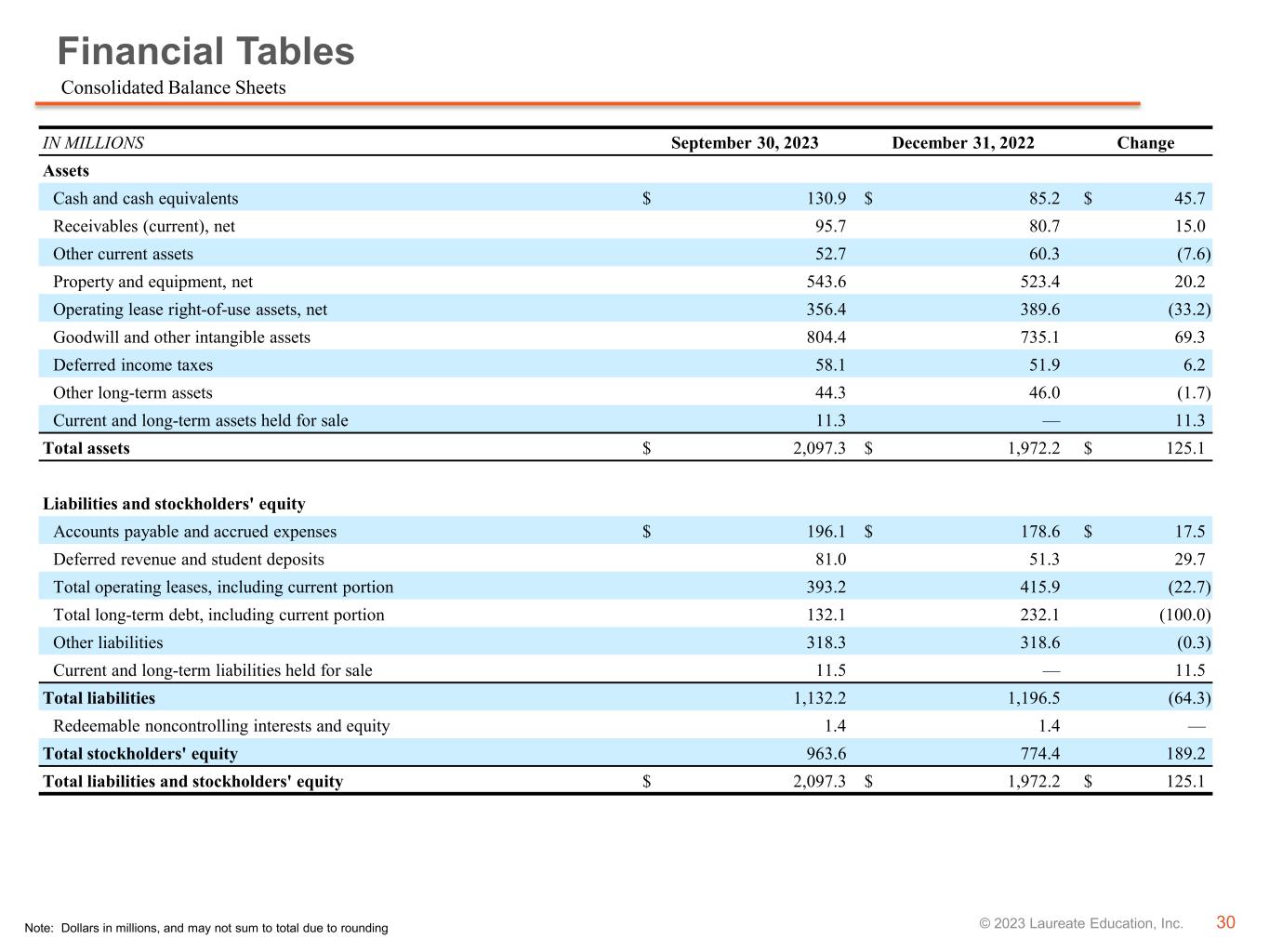

Balance Sheet and Capital Structure

Laureate has a strong balance sheet position. As of September 30, 2023, Laureate had $130.9 million of cash and gross debt of $134.7 million. Accordingly, net debt was $3.8 million as of September 30, 2023.

As of September 30, 2023, Laureate had 157.4 million total shares outstanding.

Special Cash Dividend

Laureate today announced that its Board of Directors approved the payment of a special cash dividend (the "Dividend") equal to $0.70 per each share of the Company's common stock, par value $0.004 per share, to each holder of record on November 15, 2023. The Dividend is scheduled to be paid on November 30, 2023. Based on the current number of shares outstanding, the aggregate amount of the Dividend is expected to be approximately $110 million.

The Company expects that the entire amount of the Dividend will be in excess of its current and accumulated earnings and profits (as determined for U.S. federal income tax purposes) and therefore will be treated as a taxable dividend for U.S. federal income tax purposes. All holders of Company common stock should consult their own tax advisors to determine the particular tax consequences to them of the Dividend, including the applicability and effect of any U.S. federal, state, local, non-U.S. and other tax laws.

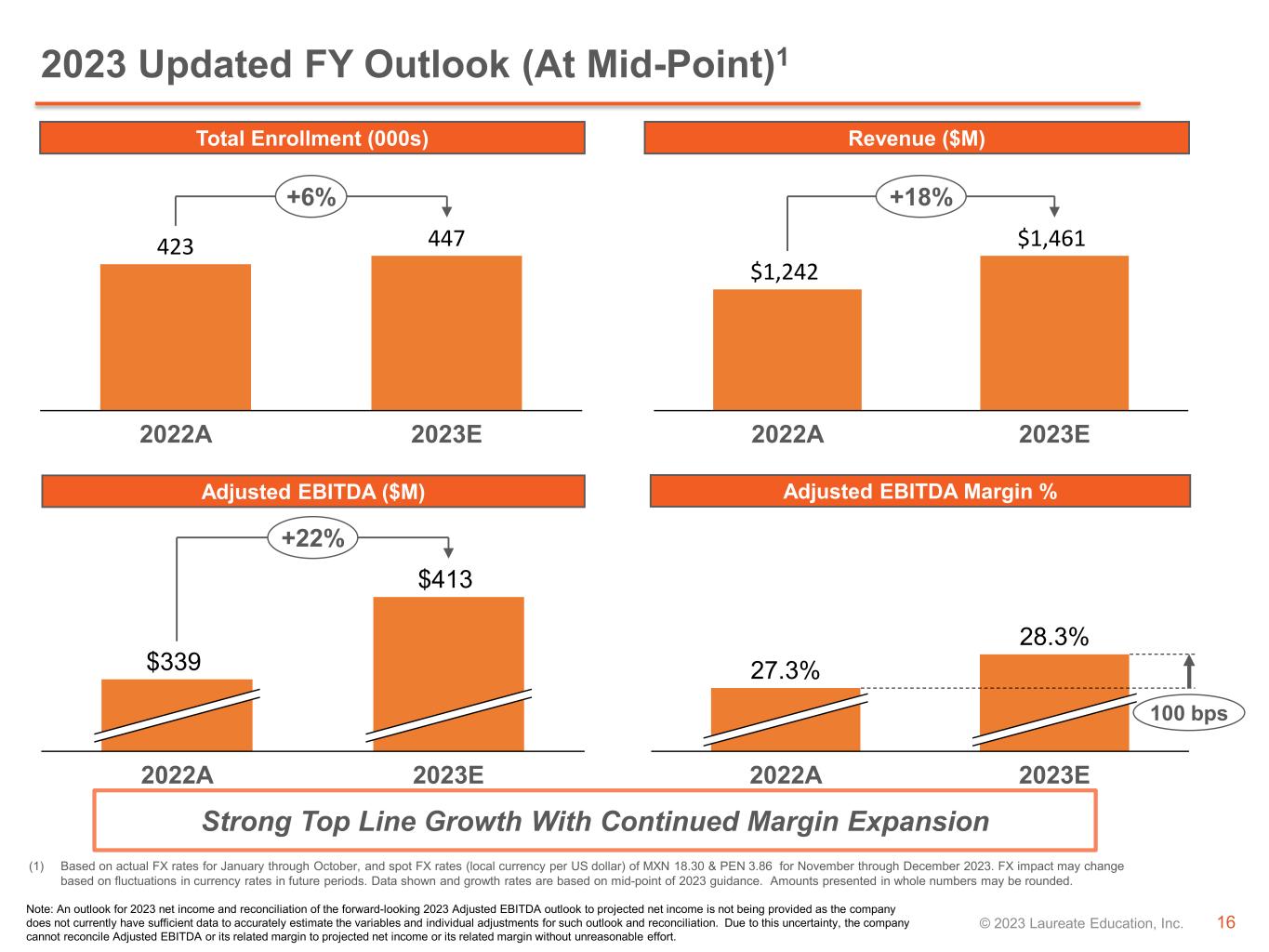

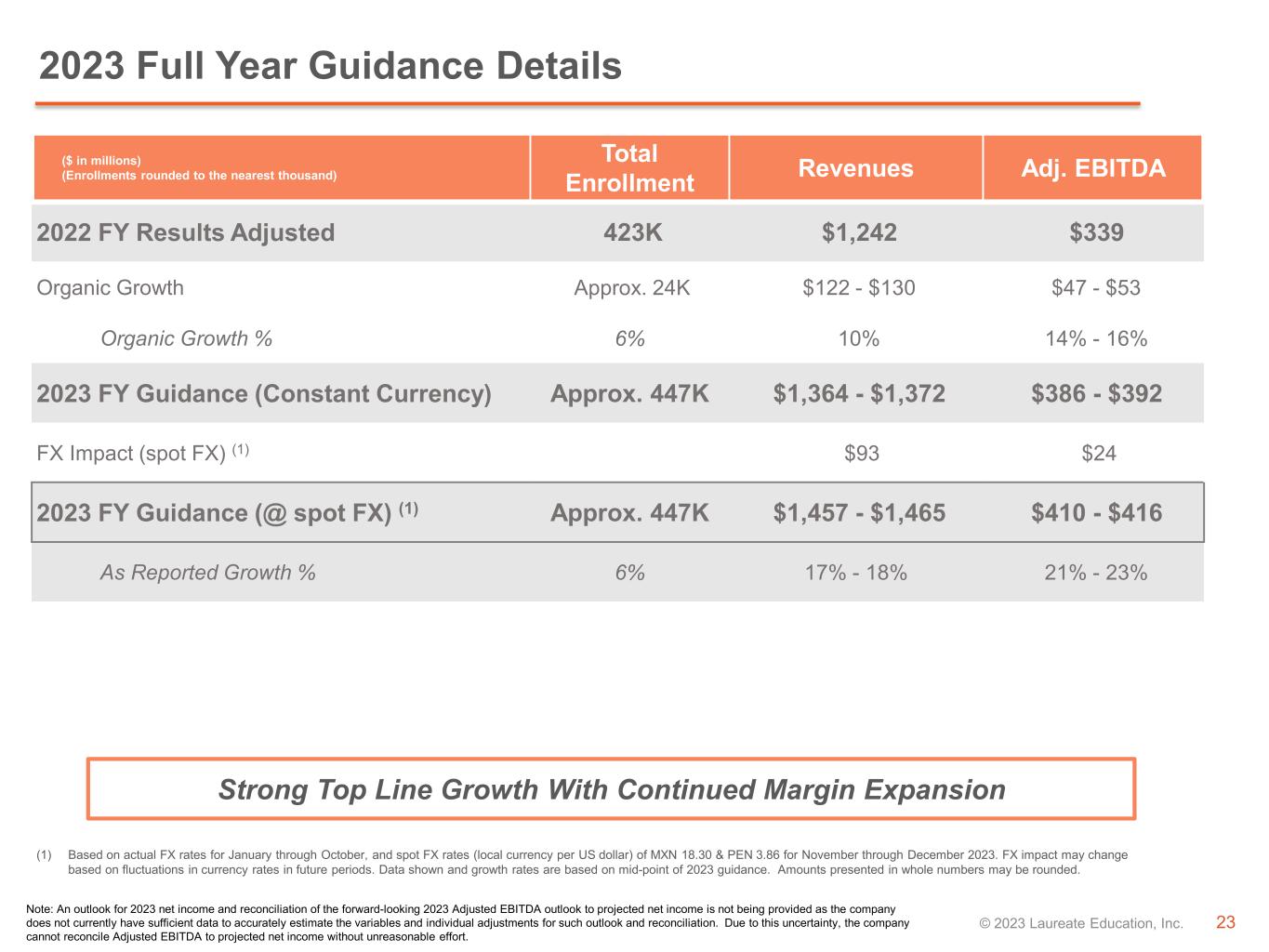

Outlook for Fiscal 2023

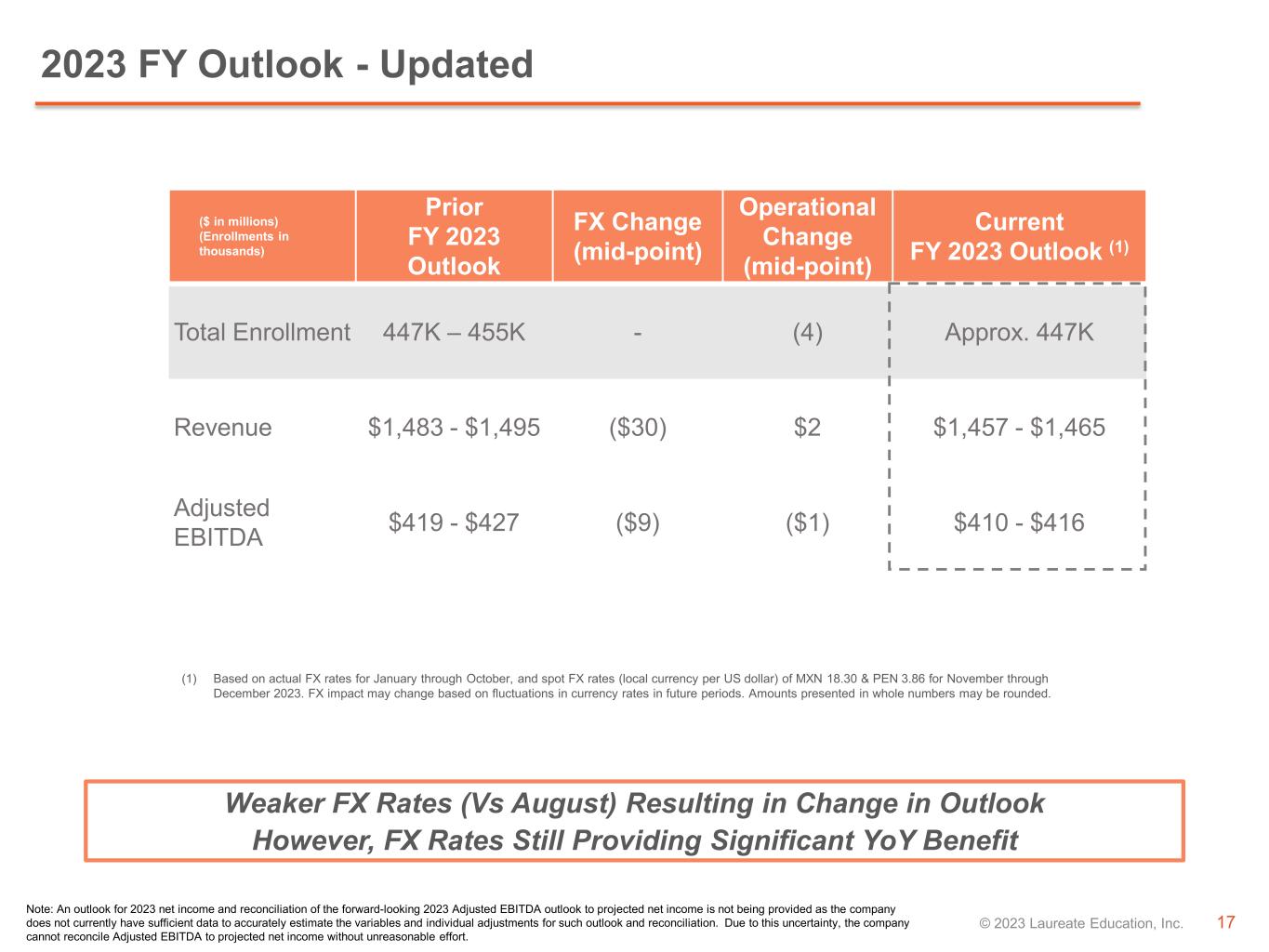

Laureate is updating its full-year 2023 guidance, reflecting a narrower range on an organic constant currency basis as well as the impact of weaker foreign currency rates.

Based on the current foreign exchange spot rates2, Laureate currently expects its full-year 2023 results to be as follows:

•Total enrollments are now expected to be approximately 447,000 students, reflecting growth of approximately 6% versus 2022;

•Revenues are now expected to be in the range of $1,457 million to $1,465 million, reflecting growth of 17%-18% on an as-reported basis and 10% on an organic constant currency basis versus 2022; and

•Adjusted EBITDA is now expected to be in the range of $410 million to $416 million, reflecting growth of 21%-23% on an as-reported basis and 14%-16% on an organic constant currency basis versus 2022.

Reconciliations of forward-looking non-GAAP measures, specifically the 2023 Adjusted EBITDA outlook, to the relevant forward-looking GAAP measures are not being provided, as Laureate does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlooks and reconciliations. Due to this uncertainty, the Company cannot reconcile projected Adjusted EBITDA to projected net income without unreasonable effort.

Please see the “Forward-Looking Statements” section in this release for a discussion of certain risks related to this outlook.

Conference Call

Laureate will host an earnings conference call today at 8:30 am ET. Interested parties are invited to listen to the earnings call by registering at https://bit.ly/LAURQ32023 to receive dial in information. The webcast of the conference call, including replays, and a copy of this press release and the related slides will be made available through the Investor Relations section of Laureate’s website at www.laureate.net.

2 Based on actual FX rates for January-October 2023, and current spot FX rates (local currency per U.S. Dollar) of MXN 18.30 and PEN 3.86 for November 2023 - December 2023. FX impact may change based on fluctuations in currency rates in future periods.

Forward-Looking Statements

This press release includes statements that express Laureate’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, ‘‘forward-looking statements’’ within the meaning of the federal securities laws, which involve risks and uncertainties. Laureate’s actual results may vary significantly from the results anticipated in these forward-looking statements. You can identify forward-looking statements because they contain words such as ‘‘believes,’’ ‘‘expects,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘seeks,’’ ‘‘approximately,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘estimates’’ or ‘‘anticipates’’ or similar expressions that concern our strategy, plans or intentions. In particular, statements regarding the amount, timing, process, tax treatment and impact of any future dividends represent forward-looking statements. All statements we make relating to guidance (including, but not limited to, total enrollments, revenues, and Adjusted EBITDA), and all statements we make relating to our current growth strategy and other future plans, strategies or transactions that may be identified, explored or implemented and any litigation or dispute resulting from any completed transaction are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, including with respect to our current growth strategy and the impact of any completed divestiture or separation transaction on our remaining businesses. Accordingly, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations are disclosed in our Annual Report on Form 10-K filed with the SEC on February 23, 2023, our subsequent Quarterly Reports on Form 10-Q filed, and to be filed, with the SEC and other filings made with the SEC. These forward-looking statements speak only as of the time of this release and we do not undertake to publicly update or revise them, whether as a result of new information, future events or otherwise, except as required by law.

Presentation of Non-GAAP Measures

In addition to the results provided in accordance with U.S. generally accepted accounting principles (GAAP) throughout this press release, Laureate provides the non-GAAP measurements of Adjusted EBITDA, and total debt, net of cash and cash equivalents (or net debt). We have included these non-GAAP measurements because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans.

Adjusted EBITDA consists of net income (loss), adjusted for the items included in the accompanying reconciliation. The exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, Adjusted EBITDA is a key input into the formula used by the compensation committee of our board of directors and our Chief Executive Officer in connection with the payment of incentive compensation to our executive officers and other members of our management team. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Total debt, net of cash and cash equivalents (or net debt) consists of total gross debt, less total cash and cash equivalents. Net debt provides a useful indicator about Laureate’s leverage and liquidity.

Laureate’s calculations of Adjusted EBITDA, and total debt, net of cash and cash equivalents (or net debt) are not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Adjusted EBITDA is reconciled from the GAAP measure in the attached table “Non-GAAP Reconciliation.”

We evaluate our results of operations on both an as reported and an organic constant currency basis. The organic constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates, acquisitions and divestitures, and other items. We believe that providing organic constant currency information provides valuable supplemental information regarding our results of operations, consistent with how we evaluate our performance. We calculate organic constant currency amounts using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period, and then exclude the impact of acquisitions and divestitures and other items described in the accompanying presentation.

About Laureate Education, Inc.

Laureate Education, Inc. operates five higher education institutions across Mexico and Peru, enrolling approximately 450,000 students in high-quality undergraduate, graduate, and specialized degree programs through campus-based and online learning. Our universities have a deep commitment to academic quality and innovation, strive for market-leading employability outcomes, and work to make higher education more accessible. At Laureate, we know that when our students succeed, countries prosper, and societies benefit. Learn more at laureate.net.

Key Metrics and Financial Tables

(Dollars in millions, except per share amounts, and may not sum due to rounding)

New and Total Enrollments by segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| New Enrollments | | Total Enrollments |

| YTD 3Q 2023 | | YTD 3Q 2022 | | Change | | As of 09/30/2023 | | As of 09/30/2022 | | Change |

| | | | | | | | | | | | | | | | | |

| Mexico | 146,600 | | | 133,700 | | | 10 | % | | | | | 248,500 | | | 228,000 | | | 9 | % | | | |

| Peru | 86,200 | | | 79,100 | | | 9 | % | | | | | 210,200 | | | 202,900 | | | 4 | % | | | |

| Laureate | 232,800 | | | 212,800 | | | 9 | % | | | | | 458,700 | | | 430,900 | | | 6 | % | | | |

Consolidated Statements of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| IN MILLIONS | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Revenues | $ | 361.5 | | | $ | 301.0 | | | $ | 60.5 | | | $ | 1,074.9 | | | $ | 895.9 | | | $ | 179.0 | |

| Costs and expenses: | | | | | | | | | | | |

| Direct costs | 291.1 | | | 229.4 | | | 61.7 | | | 810.4 | | | 655.1 | | | 155.3 | |

| General and administrative expenses | 11.8 | | | 15.3 | | | (3.5) | | | 34.0 | | | 48.8 | | | (14.8) | |

| Loss on impairment of assets | — | | | — | | | — | | | 1.6 | | | 0.1 | | | 1.5 | |

| Operating income | 58.7 | | | 56.3 | | | 2.4 | | | 228.8 | | | 192.0 | | | 36.8 | |

| Interest income | 2.8 | | | 2.0 | | | 0.8 | | | 6.9 | | | 5.6 | | | 1.3 | |

| Interest expense | (5.2) | | | (3.7) | | | (1.5) | | | (17.3) | | | (11.6) | | | (5.7) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other income, net | 0.1 | | | 1.4 | | | (1.3) | | | 0.2 | | | 0.4 | | | (0.2) | |

| Foreign currency exchange gain (loss), net | 9.8 | | | 15.1 | | | (5.3) | | | (51.6) | | | (2.9) | | | (48.7) | |

| Gain on disposal of subsidiaries, net | 3.3 | | | — | | | 3.3 | | | 3.6 | | | 1.5 | | | 2.1 | |

| Income from continuing operations before income taxes and equity in net income of affiliates | 69.5 | | | 71.1 | | | (1.6) | | | 170.7 | | | 185.0 | | | (14.3) | |

| Income tax expense | (33.7) | | | (39.3) | | | 5.6 | | | (101.4) | | | (159.2) | | | 57.8 | |

| Equity in net income of affiliates, net of tax | — | | | — | | | — | | | — | | | 0.1 | | | (0.1) | |

| Income from continuing operations | 35.7 | | | 31.9 | | | 3.8 | | | 69.3 | | | 25.9 | | | 43.4 | |

| Income (loss) from discontinued operations, net of tax | 0.2 | | | (0.8) | | | 1.0 | | | (3.8) | | | 4.1 | | | (7.9) | |

| Net income | 36.0 | | | 31.0 | | | 5.0 | | | 65.5 | | | 29.9 | | | 35.6 | |

| Net loss attributable to noncontrolling interests | 0.2 | | | 0.1 | | | 0.1 | | | 0.2 | | | 0.4 | | | (0.2) | |

| Net income attributable to Laureate Education, Inc. | $ | 36.2 | | | $ | 31.1 | | | $ | 5.1 | | | $ | 65.7 | | | $ | 30.3 | | | $ | 35.4 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted earnings per share: | | | | | | | | | | | |

| Basic weighted average shares outstanding | 157.3 | | | 164.6 | | | (7.3) | | | 157.2 | | | 169.9 | | | (12.7) | |

| Diluted weighted average shares outstanding | 157.8 | | | 165.0 | | | (7.2) | | | 157.7 | | | 170.4 | | | (12.7) | |

| | | | | | | | | | | |

| Basic and diluted earnings per share | $ | 0.23 | | | $ | 0.19 | | | $ | 0.04 | | | $ | 0.42 | | | $ | 0.17 | | | $ | 0.25 | |

Revenue and Adjusted EBITDA by segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| IN MILLIONS | |

| | | | | % Change | | $ Variance Components |

| For the three months ended September 30, | 2023 | | 2022 | | Reported | | Organic Constant Currency(1) | | Total | | Organic Constant

Currency | | Other | | Acq/Div. | | FX |

| Revenues | | | | | | | | | | | | | | | | | |

| Mexico | $ | 185.4 | | | $ | 147.8 | | | 25% | | 6% | | $ | 37.6 | | | $ | 8.8 | | | $ | — | | | $ | — | | | $ | 28.8 | |

| Peru | 176.2 | | | 152.5 | | | 16% | | 10% | | 23.7 | | | 14.7 | | | — | | | — | | | 9.0 | |

| Corporate & Eliminations | — | | | 0.7 | | | (100)% | | (100)% | | (0.7) | | | (0.7) | | | — | | | — | | | — | |

| Total Revenues | $ | 361.5 | | | $ | 301.0 | | | 20% | | 8% | | $ | 60.5 | | | $ | 22.7 | | | $ | — | | | $ | — | | | $ | 37.8 | |

| | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | |

| Mexico | $ | 21.9 | | | $ | 23.4 | | | (6)% | | (23)% | | $ | (1.5) | | | $ | (5.4) | | | $ | 0.3 | | | $ | — | | | $ | 3.6 | |

| Peru | 66.3 | | | 61.2 | | | 8% | | 3% | | 5.1 | | | 1.8 | | | — | | | — | | | 3.3 | |

| Corporate & Eliminations | (9.9) | | | (11.9) | | | 17% | | 17% | | 2.0 | | | 2.0 | | | — | | | — | | | — | |

| Total Adjusted EBITDA | $ | 78.4 | | | $ | 72.8 | | | 8% | | (2)% | | $ | 5.6 | | | $ | (1.6) | | | $ | 0.3 | | | $ | — | | | $ | 6.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

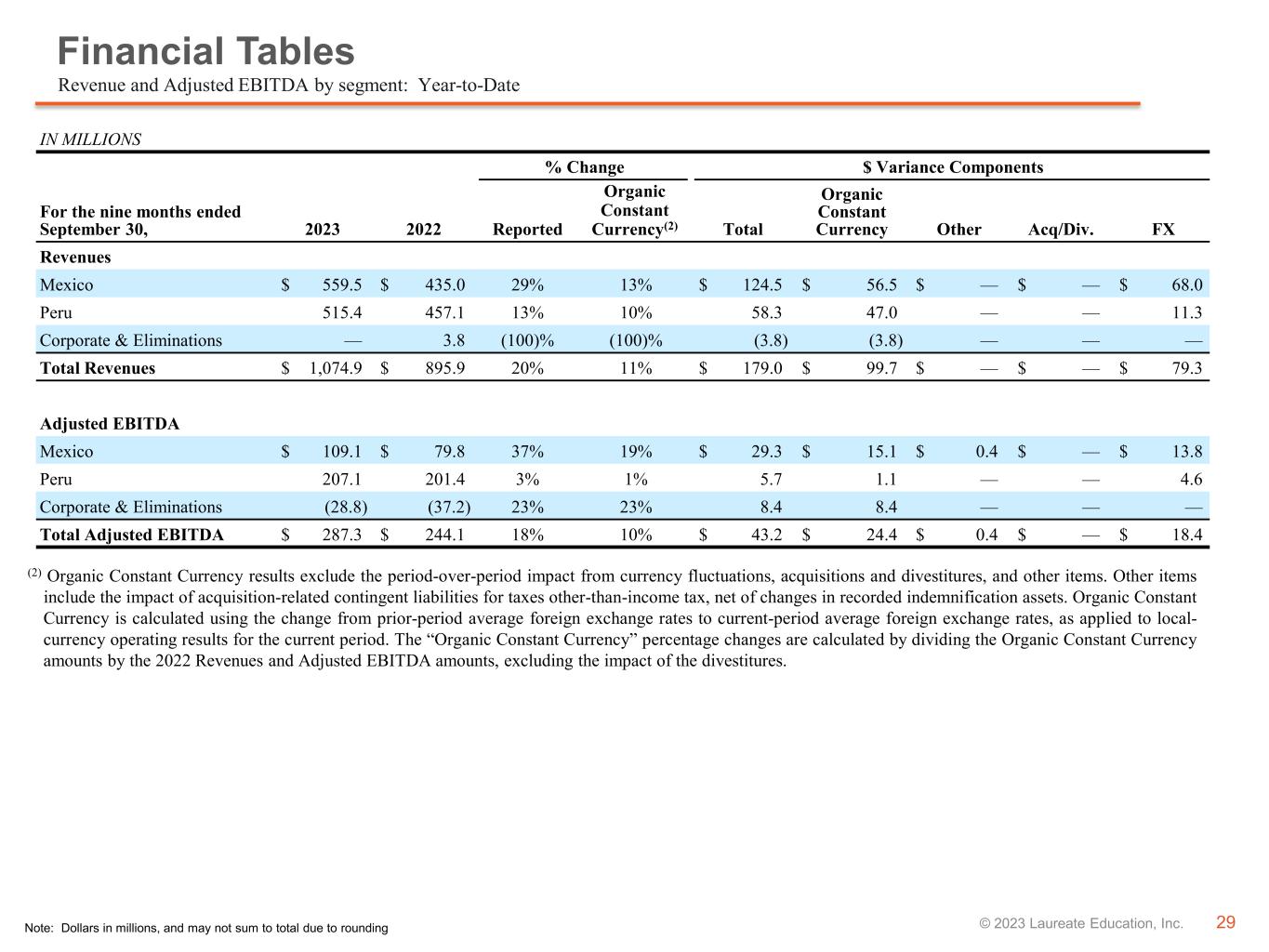

| | | | | % Change | | $ Variance Components |

| For the nine months ended September 30, | 2023 | | 2022 | | Reported | | Organic Constant Currency(1) | | Total | | Organic Constant

Currency | | Other | | Acq/Div. | | FX |

| Revenues | | | | | | | | | | | | | | | | | |

| Mexico | $ | 559.5 | | | $ | 435.0 | | | 29% | | 13% | | $ | 124.5 | | | $ | 56.5 | | | $ | — | | | $ | — | | | $ | 68.0 | |

| Peru | 515.4 | | | 457.1 | | | 13% | | 10% | | 58.3 | | | 47.0 | | | — | | | — | | | 11.3 | |

| Corporate & Eliminations | — | | | 3.8 | | | (100)% | | (100)% | | (3.8) | | | (3.8) | | | — | | | — | | | — | |

| Total Revenues | $ | 1,074.9 | | | $ | 895.9 | | | 20% | | 11% | | $ | 179.0 | | | $ | 99.7 | | | $ | — | | | $ | — | | | $ | 79.3 | |

| | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | |

| Mexico | $ | 109.1 | | | $ | 79.8 | | | 37% | | 19% | | $ | 29.3 | | | $ | 15.1 | | | $ | 0.4 | | | $ | — | | | $ | 13.8 | |

| Peru | 207.1 | | | 201.4 | | | 3% | | 1% | | 5.7 | | | 1.1 | | | — | | | — | | | 4.6 | |

| Corporate & Eliminations | (28.8) | | | (37.2) | | | 23% | | 23% | | 8.4 | | | 8.4 | | | — | | | — | | | — | |

| Total Adjusted EBITDA | $ | 287.3 | | | $ | 244.1 | | | 18% | | 10% | | $ | 43.2 | | | $ | 24.4 | | | $ | 0.4 | | | $ | — | | | $ | 18.4 | |

(1) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period. The “Organic Constant Currency” percentage changes are calculated by dividing the Organic Constant Currency amounts by the 2022 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures.

Consolidated Balance Sheets | | | | | | | | | | | | | | | | | |

| IN MILLIONS | September 30, 2023 | | December 31, 2022 | | Change |

| Assets | | | | | |

| Cash and cash equivalents | $ | 130.9 | | | $ | 85.2 | | | $ | 45.7 | |

| Receivables (current), net | 95.7 | | | 80.7 | | | 15.0 | |

| Other current assets | 52.7 | | | 60.3 | | | (7.6) | |

| Property and equipment, net | 543.6 | | | 523.4 | | | 20.2 | |

| Operating lease right-of-use assets, net | 356.4 | | | 389.6 | | | (33.2) | |

| Goodwill and other intangible assets | 804.4 | | | 735.1 | | | 69.3 | |

| Deferred income taxes | 58.1 | | | 51.9 | | | 6.2 | |

| Other long-term assets | 44.3 | | | 46.0 | | | (1.7) | |

| Current and long-term assets held for sale | 11.3 | | | — | | | 11.3 | |

| Total assets | $ | 2,097.3 | | | $ | 1,972.2 | | | $ | 125.1 | |

| | | | | |

| Liabilities and stockholders' equity | | | | | |

| Accounts payable and accrued expenses | $ | 196.1 | | | $ | 178.6 | | | $ | 17.5 | |

| Deferred revenue and student deposits | 81.0 | | | 51.3 | | | 29.7 | |

| Total operating leases, including current portion | 393.2 | | | 415.9 | | | (22.7) | |

| Total long-term debt, including current portion | 132.1 | | | 232.1 | | | (100.0) | |

| | | | | |

| Other liabilities | 318.3 | | | 318.6 | | | (0.3) | |

| Current and long-term liabilities held for sale | 11.5 | | | — | | | 11.5 | |

| Total liabilities | 1,132.2 | | | 1,196.5 | | | (64.3) | |

| Redeemable equity | 1.4 | | | 1.4 | | | — | |

| Total stockholders' equity | 963.6 | | | 774.4 | | | 189.2 | |

| Total liabilities and stockholders' equity | $ | 2,097.3 | | | $ | 1,972.2 | | | $ | 125.1 | |

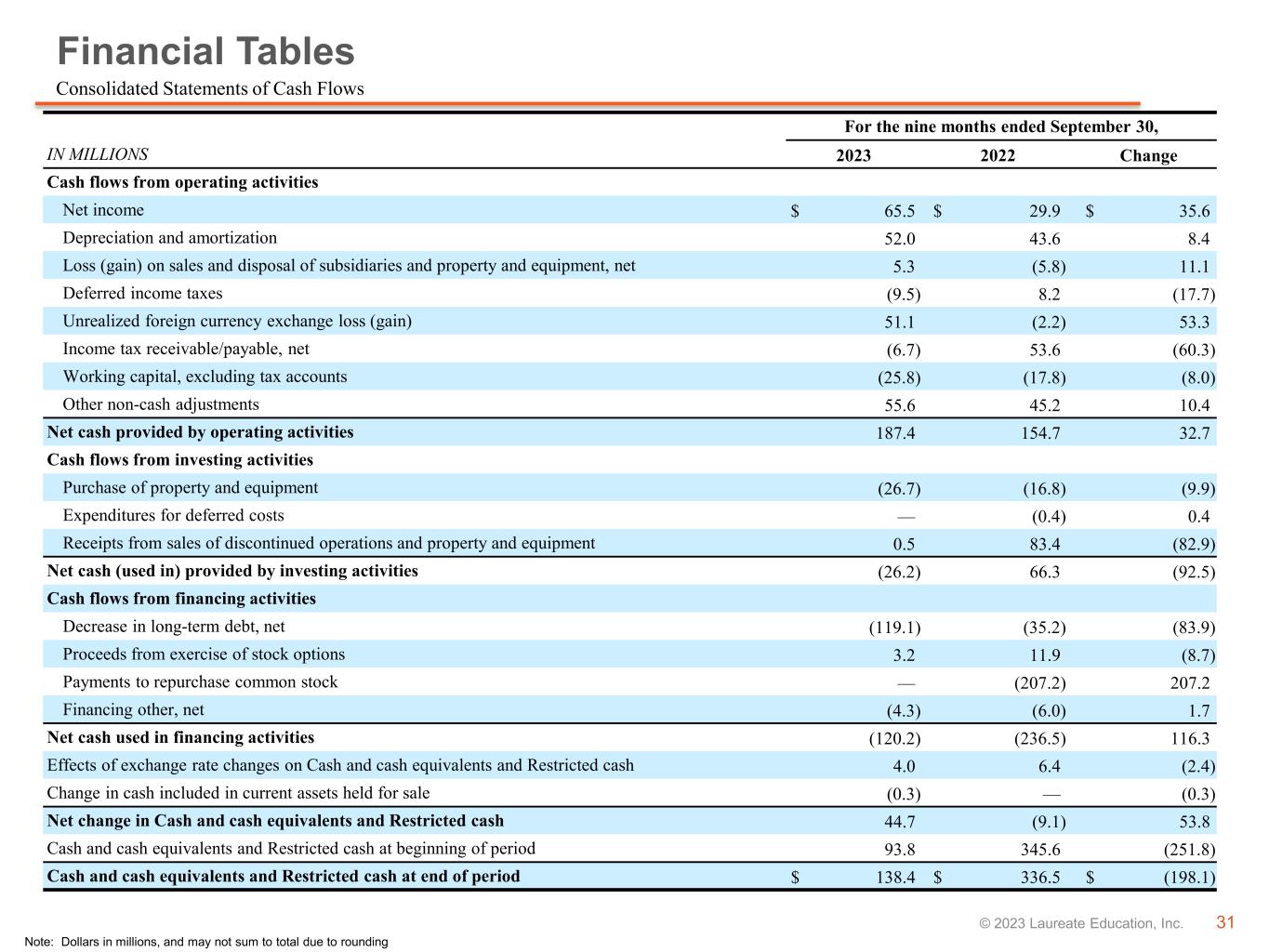

Consolidated Statements of Cash Flows | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, |

| IN MILLIONS | 2023 | | 2022 | | Change |

| Cash flows from operating activities | | | | | |

| Net income | $ | 65.5 | | | $ | 29.9 | | | $ | 35.6 | |

| Depreciation and amortization | 52.0 | | | 43.6 | | | 8.4 | |

| Loss (gain) on sales and disposal of subsidiaries and property and equipment, net | 5.3 | | | (5.8) | | | 11.1 | |

| | | | | |

| | | | | |

| Deferred income taxes | (9.5) | | | 8.2 | | | (17.7) | |

| Unrealized foreign currency exchange loss (gain) | 51.1 | | | (2.2) | | | 53.3 | |

| Income tax receivable/payable, net | (6.7) | | | 53.6 | | | (60.3) | |

| Working capital, excluding tax accounts | (25.8) | | | (17.8) | | | (8.0) | |

| Other non-cash adjustments | 55.6 | | | 45.2 | | | 10.4 | |

| Net cash provided by operating activities | 187.4 | | | 154.7 | | | 32.7 | |

| Cash flows from investing activities | | | | | |

| Purchase of property and equipment | (26.7) | | | (16.8) | | | (9.9) | |

| Expenditures for deferred costs | — | | | (0.4) | | | 0.4 | |

| Receipts from sales of discontinued operations and property and equipment | 0.5 | | | 83.4 | | | (82.9) | |

| | | | | |

| | | | | |

| | | | | |

| Net cash (used in) provided by investing activities | (26.2) | | | 66.3 | | | (92.5) | |

| Cash flows from financing activities | | | | | |

| Decrease in long-term debt, net | (119.1) | | | (35.2) | | | (83.9) | |

| Proceeds from exercise of stock options | 3.2 | | | 11.9 | | | (8.7) | |

| Payments to repurchase common stock | — | | | (207.2) | | | 207.2 | |

| Financing other, net | (4.3) | | | (6.0) | | | 1.7 | |

| Net cash used in financing activities | (120.2) | | | (236.5) | | | 116.3 | |

| Effects of exchange rate changes on Cash and cash equivalents and Restricted cash | 4.0 | | | 6.4 | | | (2.4) | |

| Change in cash included in current assets held for sale | (0.3) | | | — | | | (0.3) | |

| Net change in Cash and cash equivalents and Restricted cash | 44.7 | | | (9.1) | | | 53.8 | |

| Cash and cash equivalents and Restricted cash at beginning of period | 93.8 | | | 345.6 | | | (251.8) | |

| Cash and cash equivalents and Restricted cash at end of period | $ | 138.4 | | | $ | 336.5 | | | $ | (198.1) | |

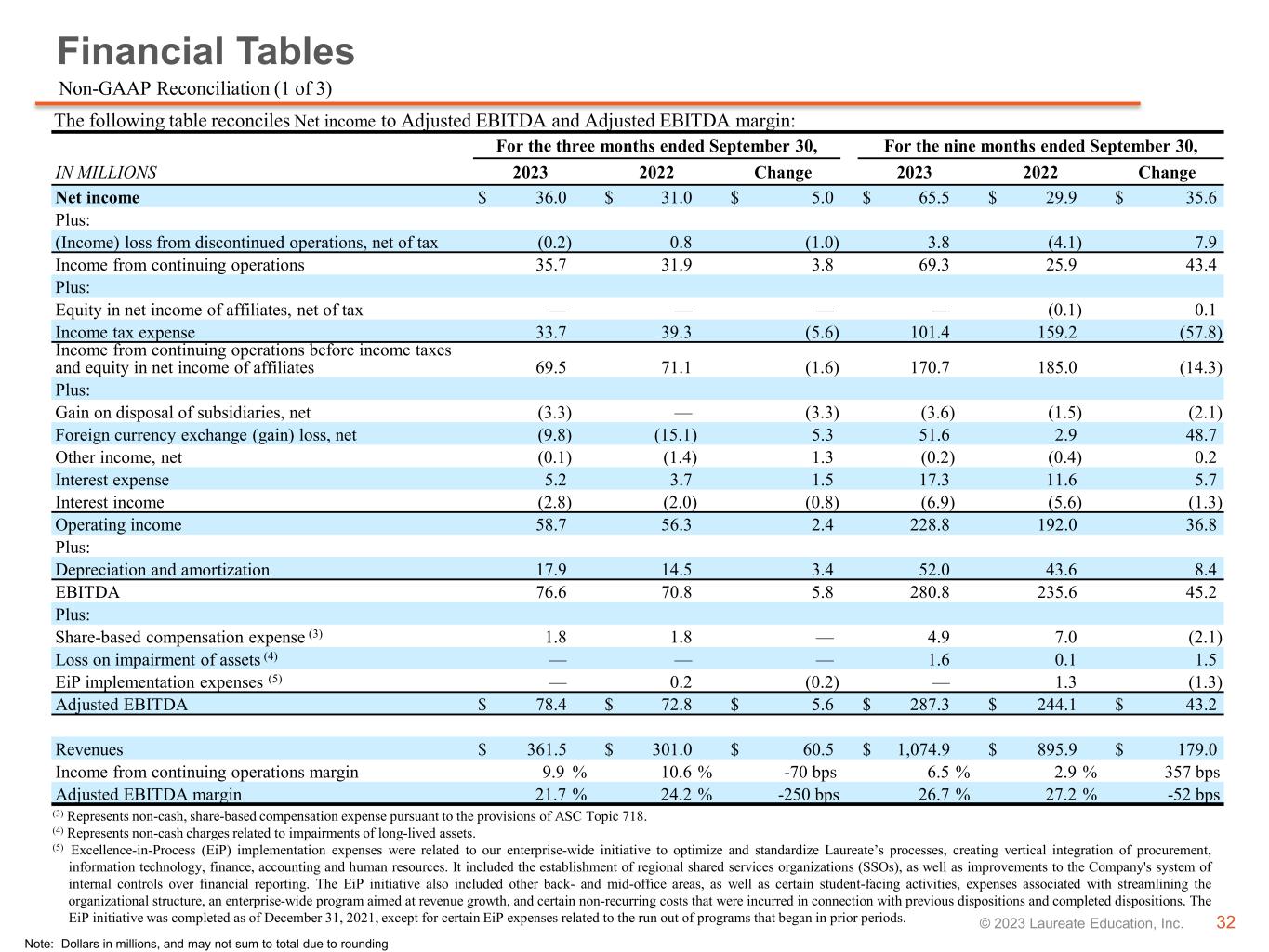

Non-GAAP Reconciliation

The following table reconciles Net income to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, | | For the nine months ended September 30, |

| IN MILLIONS | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Net income | $ | 36.0 | | | $ | 31.0 | | | $ | 5.0 | | | $ | 65.5 | | | $ | 29.9 | | | $ | 35.6 | |

| Plus: | | | | | | | | | | | |

| (Income) loss from discontinued operations, net of tax | (0.2) | | | 0.8 | | | (1.0) | | | 3.8 | | | (4.1) | | | 7.9 | |

| Income from continuing operations | 35.7 | | | 31.9 | | | 3.8 | | | 69.3 | | | 25.9 | | | 43.4 | |

| Plus: | | | | | | | | | | | |

| Equity in net income of affiliates, net of tax | — | | | — | | | — | | | — | | | (0.1) | | | 0.1 | |

| Income tax expense | 33.7 | | | 39.3 | | | (5.6) | | | 101.4 | | | 159.2 | | | (57.8) | |

| Income from continuing operations before income taxes and equity in net income of affiliates | 69.5 | | | 71.1 | | | (1.6) | | | 170.7 | | | 185.0 | | | (14.3) | |

| Plus: | | | | | | | | | | | |

| Gain on disposal of subsidiaries, net | (3.3) | | | — | | | (3.3) | | | (3.6) | | | (1.5) | | | (2.1) | |

| Foreign currency exchange (gain) loss, net | (9.8) | | | (15.1) | | | 5.3 | | | 51.6 | | | 2.9 | | | 48.7 | |

| Other income, net | (0.1) | | | (1.4) | | | 1.3 | | | (0.2) | | | (0.4) | | | 0.2 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Interest expense | 5.2 | | | 3.7 | | | 1.5 | | | 17.3 | | | 11.6 | | | 5.7 | |

| Interest income | (2.8) | | | (2.0) | | | (0.8) | | | (6.9) | | | (5.6) | | | (1.3) | |

| Operating income | 58.7 | | | 56.3 | | | 2.4 | | | 228.8 | | | 192.0 | | | 36.8 | |

| Plus: | | | | | | | | | | | |

| Depreciation and amortization | 17.9 | | | 14.5 | | | 3.4 | | | 52.0 | | | 43.6 | | | 8.4 | |

| EBITDA | 76.6 | | | 70.8 | | | 5.8 | | | 280.8 | | | 235.6 | | | 45.2 | |

| Plus: | | | | | | | | | | | |

Share-based compensation expense (2) | 1.8 | | | 1.8 | | | — | | | 4.9 | | | 7.0 | | | (2.1) | |

Loss on impairment of assets (3) | — | | | — | | | — | | | 1.6 | | | 0.1 | | | 1.5 | |

EiP implementation expenses (4) | — | | | 0.2 | | | (0.2) | | | — | | | 1.3 | | | (1.3) | |

| Adjusted EBITDA | $ | 78.4 | | | $ | 72.8 | | | $ | 5.6 | | | $ | 287.3 | | | $ | 244.1 | | | $ | 43.2 | |

(2) Represents non-cash, share-based compensation expense pursuant to the provisions of ASC Topic 718, "Stock Compensation."

(3) Represents non-cash charges related to impairments of long-lived assets.

(4) Excellence-in-Process (EiP) implementation expenses were related to our enterprise-wide initiative to optimize and standardize Laureate’s processes, creating vertical integration of procurement, information technology, finance, accounting and human resources. It included the establishment of regional shared services organizations (SSOs), as well as improvements to the Company's system of internal controls over financial reporting. The EiP initiative also included other back- and mid-office areas, as well as certain student-facing activities, expenses associated with streamlining the organizational structure, an enterprise-wide program aimed at revenue growth, and certain non-recurring costs that were incurred in connection with previous dispositions. The EiP initiative was completed as of December 31, 2021, except for certain EiP expenses related to the run out of programs that began in prior periods.

Investor Relations Contact:

ir@laureate.net

Media Contacts: | | | | | | | | |

| Laureate Education | | |

| Adam Smith | | |

| adam.smith@laureate.net | | |

| U.S.: +1 (443) 255 0724 | | |

| Source: Laureate Education, Inc. | | |

1© 2023 Laureate Education, Inc. Third Quarter 2023 Earnings Presentation November 2, 2023 Exhibit 99.2

2© 2023 Laureate Education, Inc. This presentation includes statements that express Laureate’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, ‘‘forward-looking statements’’ within the meaning of the federal securities laws, which involve risks and uncertainties. Laureate’s actual results may vary significantly from the results anticipated in these forward-looking statements. You can identify forward-looking statements because they contain words such as ‘‘believes,’’ ‘‘expects,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘seeks,’’ ‘‘approximately,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘estimates’’ or ‘‘anticipates’’ or similar expressions that concern our strategy, plans or intentions. All statements we make relating to guidance (including, but not limited to, total enrollments, revenues, and Adjusted EBITDA), and all statements we make relating to our current growth strategy and other future plans, strategies or transactions that may be identified, explored or implemented and any litigation or dispute resulting from any completed transaction are forward- looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, including with respect to our current growth strategy and the impact of any completed divestiture or separation transaction on our remaining businesses. Accordingly, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations are disclosed in our Annual Report on Form 10-K filed with the SEC on February 23, 2023, our subsequent Quarterly Reports on Form 10-Q filed, and to be filed, with the SEC and other filings made with the SEC. These forward-looking statements speak only as of the time of this release and we do not undertake to publicly update or revise them, whether as a result of new information, future events or otherwise, except as required by law. In addition, this presentation contains various operating data, including market share and market position, that are based on internal company data and management estimates. While management believes that our internal company research is reliable and the definitions of our markets which are used herein are appropriate, neither such research nor these definitions have been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources, including those discussed under “Industry and Market Data” in Laureate’s filings with the SEC. Forward Looking Statements

3© 2023 Laureate Education, Inc. In addition to the results provided in accordance with U.S. generally accepted accounting principles (GAAP) throughout this presentation, Laureate provides the non-GAAP measurements of Adjusted EBITDA and its related margin, Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total debt, net of cash and cash equivalents (or net debt), and Free Cash Flow. We have included these non-GAAP measurements because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. Adjusted EBITDA consists of net income (loss), adjusted for the items included in the accompanying reconciliation. The exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, Adjusted EBITDA is a key input into the formula used by the compensation committee of our board of directors and our Chief Executive Officer in connection with the payment of incentive compensation to our executive officers and other members of our management team. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margin, which is calculated by dividing Adjusted EBITDA by revenue, provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. Adjusted EBITDA to Unlevered Free Cash Flow Conversion consists of Unlevered Free Cash Flow (which is defined as cash flows from operating activities, less capital expenditures, plus net cash interest expense) divided by Adjusted EBITDA. Adjusted EBITDA to Unlevered Free Cash Flow provides useful information to investors and others in understanding and evaluating our ability to generate cash flows. Total debt, net of cash and cash equivalents (or net debt) consists of total gross debt, less total cash and cash equivalents. Net debt provides a useful indicator about Laureate’s leverage and liquidity. Free Cash Flow consists of operating cash flow minus capital expenditures. Free Cash Flow provides a useful indicator about Laureate’s ability to fund its operations and repay its debt. Laureate’s calculations of Adjusted EBITDA and its related margin, Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total debt, net of cash and cash equivalents (or net debt), and Free Cash Flow are not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Adjusted EBITDA and Free Cash Flow are reconciled from their respective GAAP measures in the attached tables “Non-GAAP Reconciliation”. We evaluate our results of operations on both an as reported and an organic constant currency basis. The organic constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates, acquisitions and divestitures, and other items. We believe that providing organic constant currency information provides valuable supplemental information regarding our results of operations, consistent with how we evaluate our performance. We calculate organic constant currency amounts using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local- currency operating results for the current period, and then exclude the impact of acquisitions and divestitures and other items described in the accompanying presentation. . Presentation of Non-GAAP Measures

4© 2023 Laureate Education, Inc. SUMMARY OVERVIEW Note: Throughout this presentation amounts may not sum to totals due to rounding

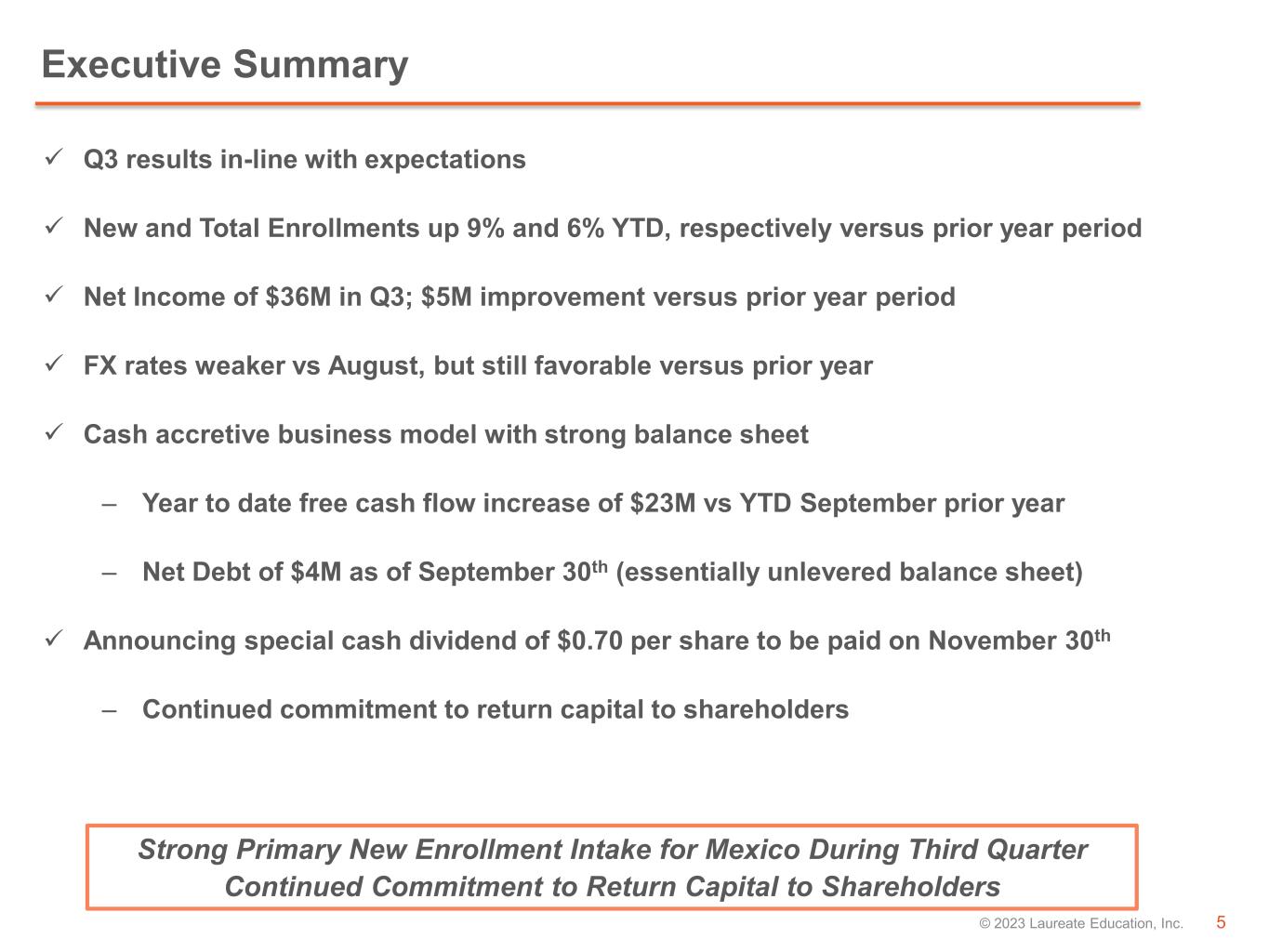

5© 2023 Laureate Education, Inc. Executive Summary Q3 results in-line with expectations New and Total Enrollments up 9% and 6% YTD, respectively versus prior year period Net Income of $36M in Q3; $5M improvement versus prior year period FX rates weaker vs August, but still favorable versus prior year Cash accretive business model with strong balance sheet – Year to date free cash flow increase of $23M vs YTD September prior year – Net Debt of $4M as of September 30th (essentially unlevered balance sheet) Announcing special cash dividend of $0.70 per share to be paid on November 30th – Continued commitment to return capital to shareholders Strong Primary New Enrollment Intake for Mexico During Third Quarter Continued Commitment to Return Capital to Shareholders

6© 2023 Laureate Education, Inc. COMPELLING INVESTMENT CHARACTERISTICS

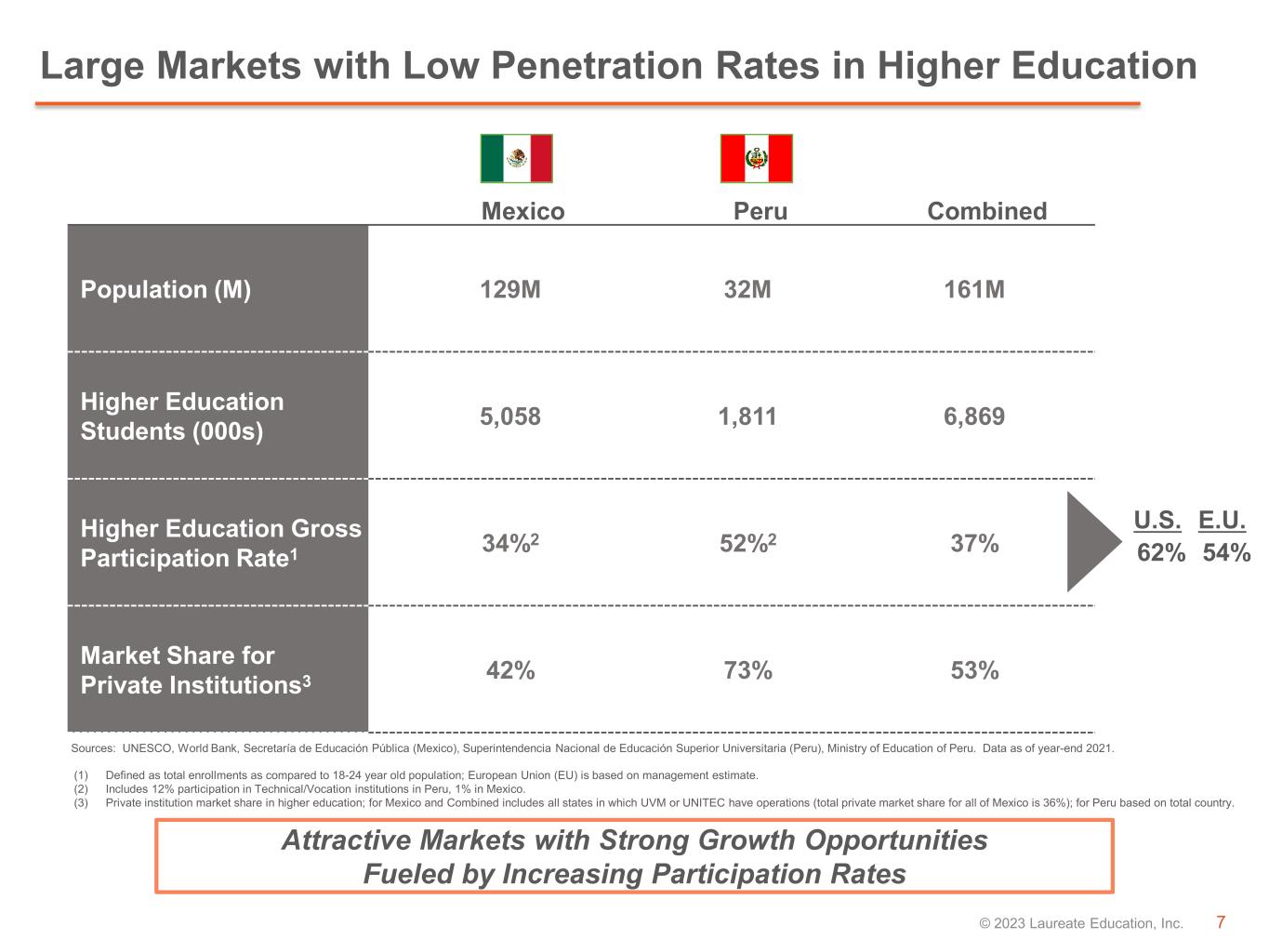

7© 2023 Laureate Education, Inc. Mexico Peru Combined Population (M) 129M 32M 161M Higher Education Students (000s) 5,058 1,811 6,869 Higher Education Gross Participation Rate1 34%2 52%2 37% Market Share for Private Institutions3 42% 73% 53% Large Markets with Low Penetration Rates in Higher Education Sources: UNESCO, World Bank, Secretaría de Educación Pública (Mexico), Superintendencia Nacional de Educación Superior Universitaria (Peru), Ministry of Education of Peru. Data as of year-end 2021. Attractive Markets with Strong Growth Opportunities Fueled by Increasing Participation Rates (1) Defined as total enrollments as compared to 18-24 year old population; European Union (EU) is based on management estimate. (2) Includes 12% participation in Technical/Vocation institutions in Peru, 1% in Mexico. (3) Private institution market share in higher education; for Mexico and Combined includes all states in which UVM or UNITEC have operations (total private market share for all of Mexico is 36%); for Peru based on total country. U.S. E.U. 62% 54%

8© 2023 Laureate Education, Inc. Leading University Portfolio in Mexico & Peru Operating Leading Brands in Attractive Market Segments • 1960 Brand Founded Market Segment Ratings / Rankings Ranked Top 10 university in Mexico 5-Stars rated by QS Stars™ in categories of Employability & Inclusiveness QS StarsTM Overall Universidad del Valle de México (UVM) Premium/ Traditional Enrollment @ 9/30/23 114,200 1966 Largest private university in Mexico 5-Stars rated by QS Stars™ in categories of Employability & InclusivenessUniversidad Tecnológica de México (UNITEC) Value/ Teaching134,300 1994 Ranked Top 5 university in Peru 5-Stars rated by QS Stars™ in categories of Employability & Inclusiveness Premium/ Traditional69,700 1994 3rd largest private university in Peru 5-Stars rated by QS Stars™ in categories of Employability & Inclusiveness Value/ Teaching118,500 1983 2nd largest private technical / vocational institute in PeruTechnical/ Vocational22,000 Universidad Peruana de Ciencias Aplicadas (UPC) Universidad Privada del Norte (UPN) CIBERTEC M ex ic o Pe ru Sources: QS Stars™, Guía Universitaria (UVM), AmericaEconomia (UPC)

9© 2023 Laureate Education, Inc. Q3 & YTD 2023 PERFORMANCE RESULTS

10© 2023 Laureate Education, Inc. 2023 Third Quarter – Financial Summary Q3 ’23 Variance Vs. Q3 ’22 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 115K 6% 6% • Mexico +7% (up 4% adjusted for timing of intake close -- on top of 17% increase during PY primary intake) • Peru +2% Total Enrollment 459K 6% 6% • Mexico +9% • Peru +4% Revenue $362 20% 8% • Enrollment growth and price/mix Adj. EBITDA $78 8% (2%) • Q3 impacted by shifting of expenses from 1H, as discussed on prior earnings call Adj. EBITDA margin 21.7% (250 bps) (219 bps) Strong Primary Intake for Mexico During Third Quarter (1) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets.

11© 2023 Laureate Education, Inc. 2023 Q3 YTD – Financial Summary Q3 YTD ’23 Variance Vs. Q3 YTD ’22 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 233K 9% 9% • Strong intakes during 2023 • Mexico +10%, Peru +9% Total Enrollment 459K 6% 6% • Mexico +9% • Peru +4% Revenue $1,075 20% 11% • Enrollment growth and price/mix Adj. EBITDA $287 18% 10% • Growth and productivity gains, partially offset by return to campus expenses and expense timing Adj. EBITDA margin 26.7% (52 bps) (28 bps ) (1) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Strong Operating Performance & Efficiency Initiatives Driving Growth in Revenue and Adjusted EBITDA

12© 2023 Laureate Education, Inc. SEGMENT RESULTS

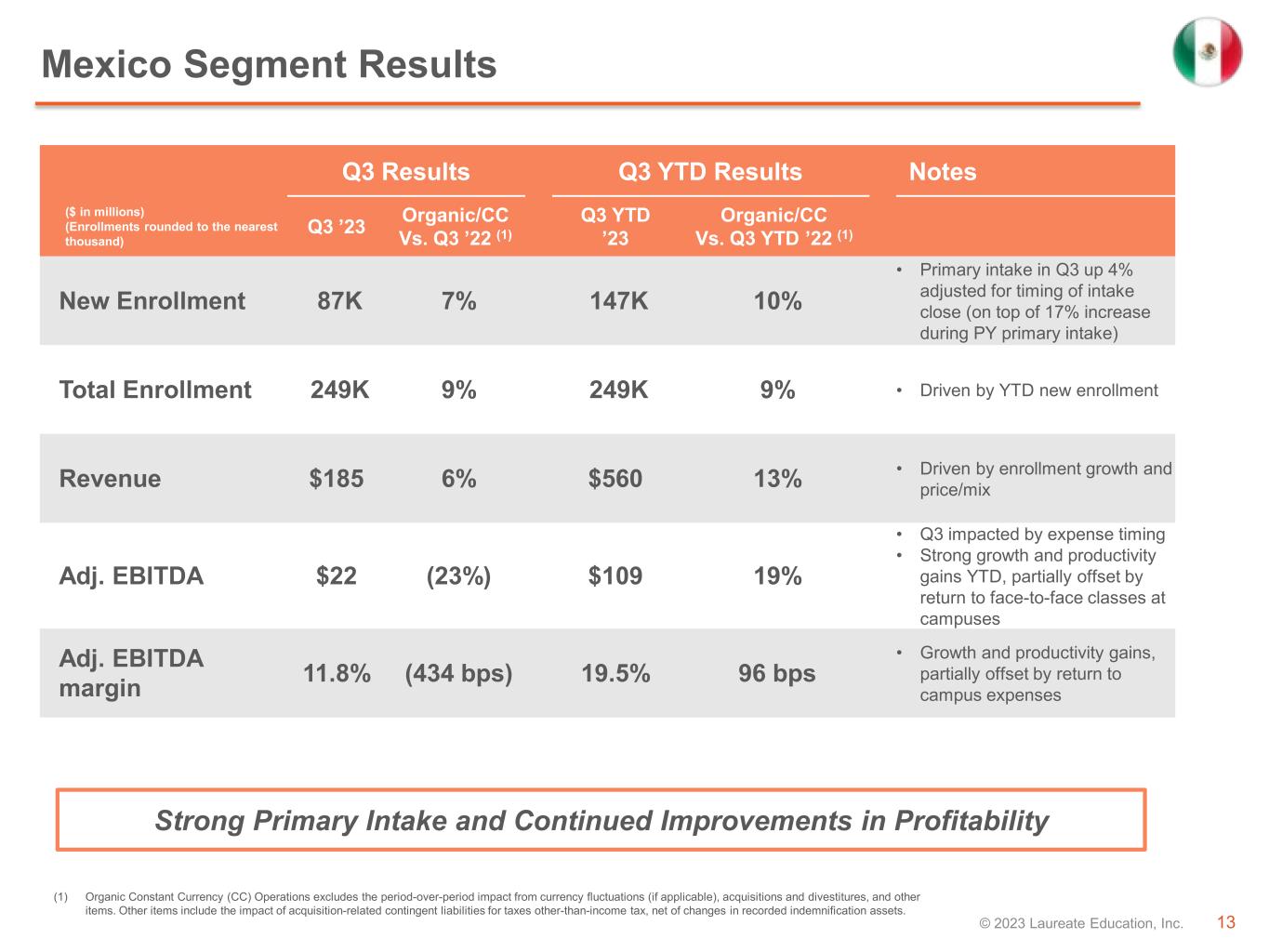

13© 2023 Laureate Education, Inc. (1) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Mexico Segment Results Q3 Results Q3 YTD Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q3 ’23 Organic/CC Vs. Q3 ’22 (1) Q3 YTD ’23 Organic/CC Vs. Q3 YTD ’22 (1) New Enrollment 87K 7% 147K 10% • Primary intake in Q3 up 4% adjusted for timing of intake close (on top of 17% increase during PY primary intake) Total Enrollment 249K 9% 249K 9% • Driven by YTD new enrollment Revenue $185 6% $560 13% • Driven by enrollment growth and price/mix Adj. EBITDA $22 (23%) $109 19% • Q3 impacted by expense timing • Strong growth and productivity gains YTD, partially offset by return to face-to-face classes at campuses Adj. EBITDA margin 11.8% (434 bps) 19.5% 96 bps • Growth and productivity gains, partially offset by return to campus expenses Strong Primary Intake and Continued Improvements in Profitability

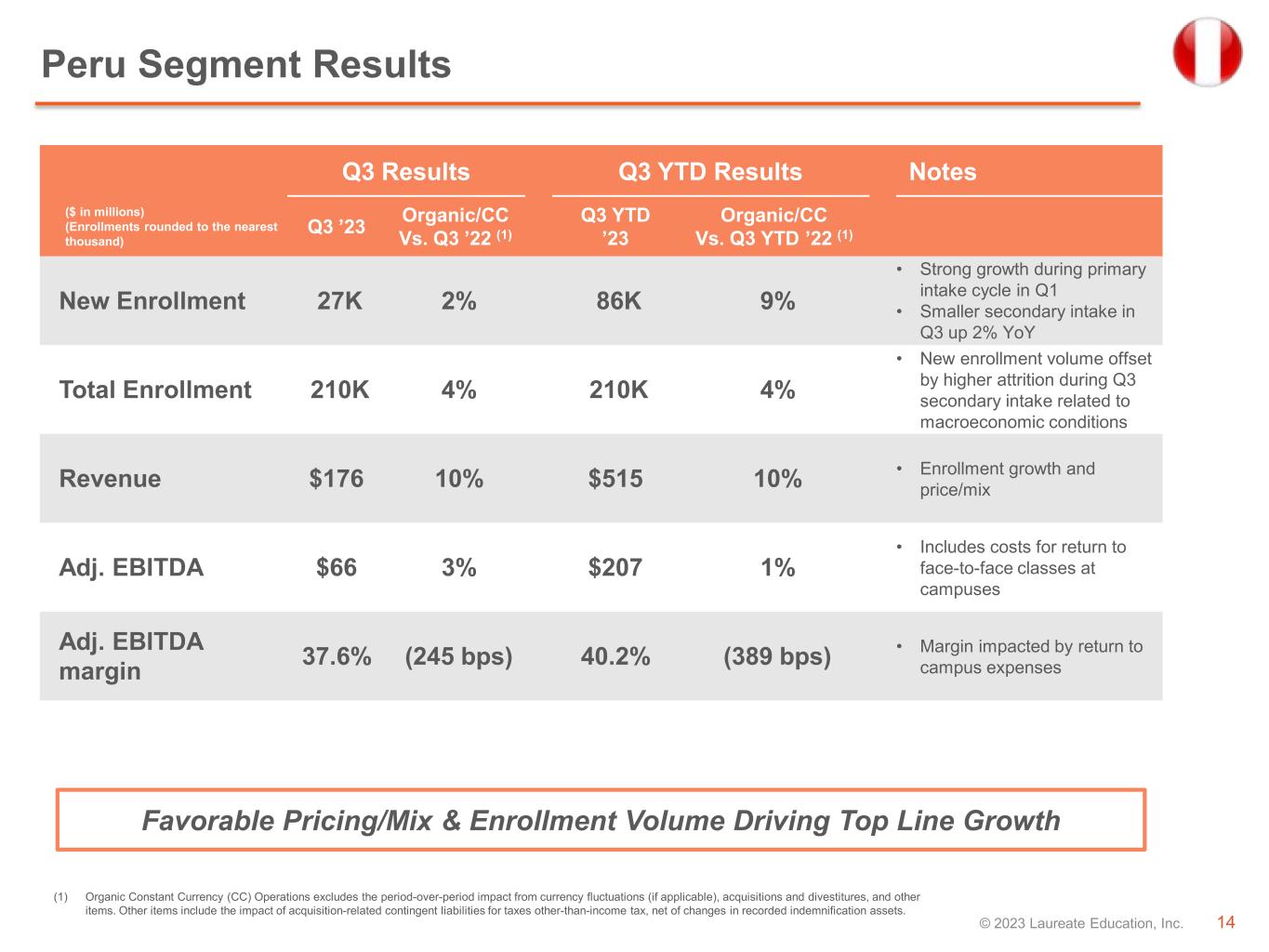

14© 2023 Laureate Education, Inc. Peru Segment Results (1) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Q3 Results Q3 YTD Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q3 ’23 Organic/CC Vs. Q3 ’22 (1) Q3 YTD ’23 Organic/CC Vs. Q3 YTD ’22 (1) New Enrollment 27K 2% 86K 9% • Strong growth during primary intake cycle in Q1 • Smaller secondary intake in Q3 up 2% YoY Total Enrollment 210K 4% 210K 4% • New enrollment volume offset by higher attrition during Q3 secondary intake related to macroeconomic conditions Revenue $176 10% $515 10% • Enrollment growth and price/mix Adj. EBITDA $66 3% $207 1% • Includes costs for return to face-to-face classes at campuses Adj. EBITDA margin 37.6% (245 bps) 40.2% (389 bps) • Margin impacted by return to campus expenses Favorable Pricing/Mix & Enrollment Volume Driving Top Line Growth

15© 2023 Laureate Education, Inc. OUTLOOK

16© 2023 Laureate Education, Inc. 2023 Updated FY Outlook (At Mid-Point)1 Strong Top Line Growth With Continued Margin Expansion (1) Based on actual FX rates for January through October, and spot FX rates (local currency per US dollar) of MXN 18.30 & PEN 3.86 for November through December 2023. FX impact may change based on fluctuations in currency rates in future periods. Data shown and growth rates are based on mid-point of 2023 guidance. Amounts presented in whole numbers may be rounded. Note: An outlook for 2023 net income and reconciliation of the forward-looking 2023 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA or its related margin to projected net income or its related margin without unreasonable effort. Total Enrollment (000s) Revenue ($M) Adjusted EBITDA ($M) 423 447 2022A 2023E +6% $1,242 $1,461 2022A 2023E +18% 2022A 2023E $339 $413 +22% Adjusted EBITDA Margin % 2022A 2023E 27.3% 28.3% 100 bps

17© 2023 Laureate Education, Inc. 2023 FY Outlook - Updated (1) Based on actual FX rates for January through October, and spot FX rates (local currency per US dollar) of MXN 18.30 & PEN 3.86 for November through December 2023. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2023 net income and reconciliation of the forward-looking 2023 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Weaker FX Rates (Vs August) Resulting in Change in Outlook However, FX Rates Still Providing Significant YoY Benefit ($ in millions) (Enrollments in thousands) Prior FY 2023 Outlook FX Change (mid-point) Operational Change (mid-point) Current FY 2023 Outlook (1) Total Enrollment 447K – 455K - (4) Approx. 447K Revenue $1,483 - $1,495 ($30) $2 $1,457 - $1,465 Adjusted EBITDA $419 - $427 ($9) ($1) $410 - $416

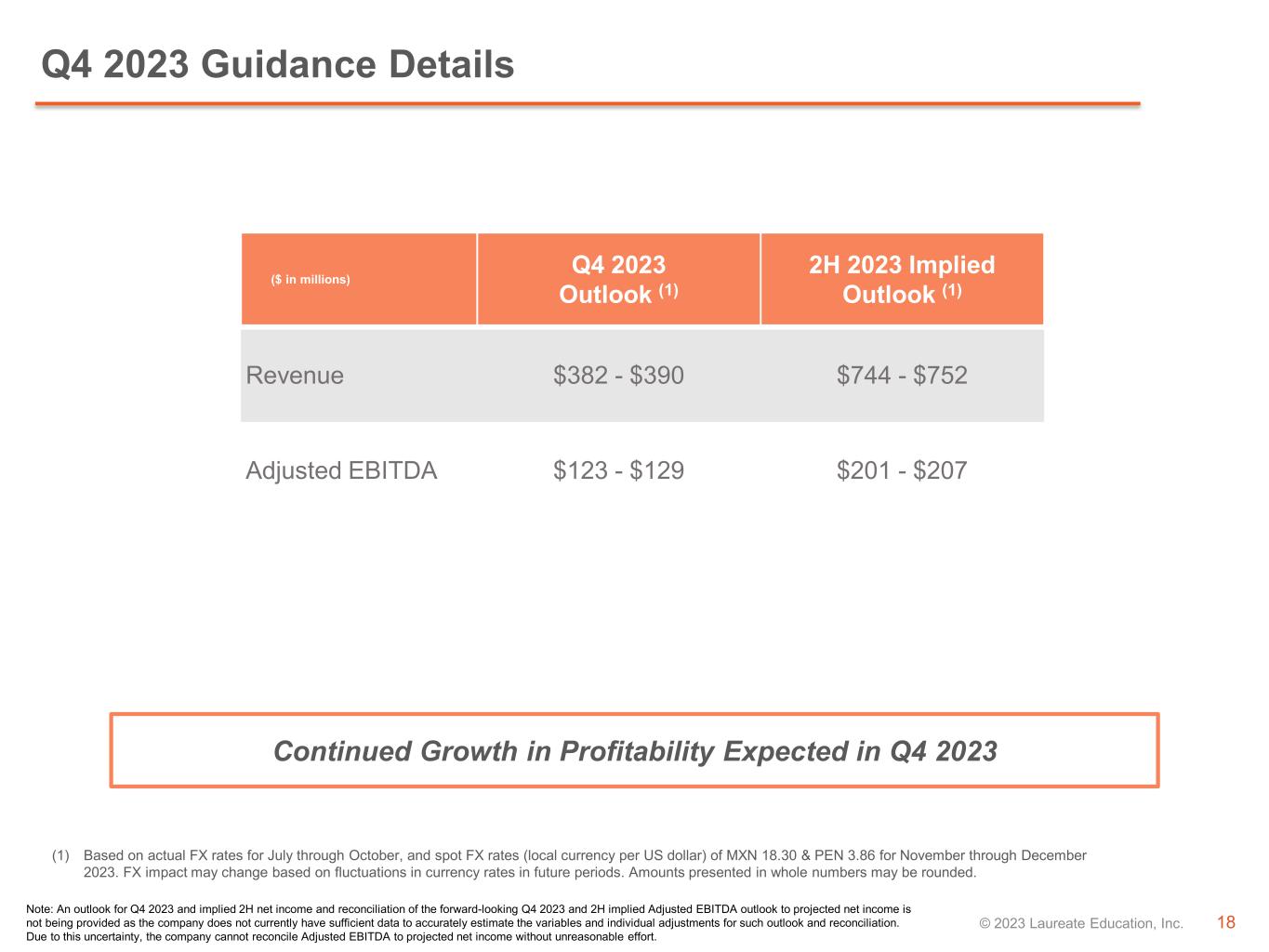

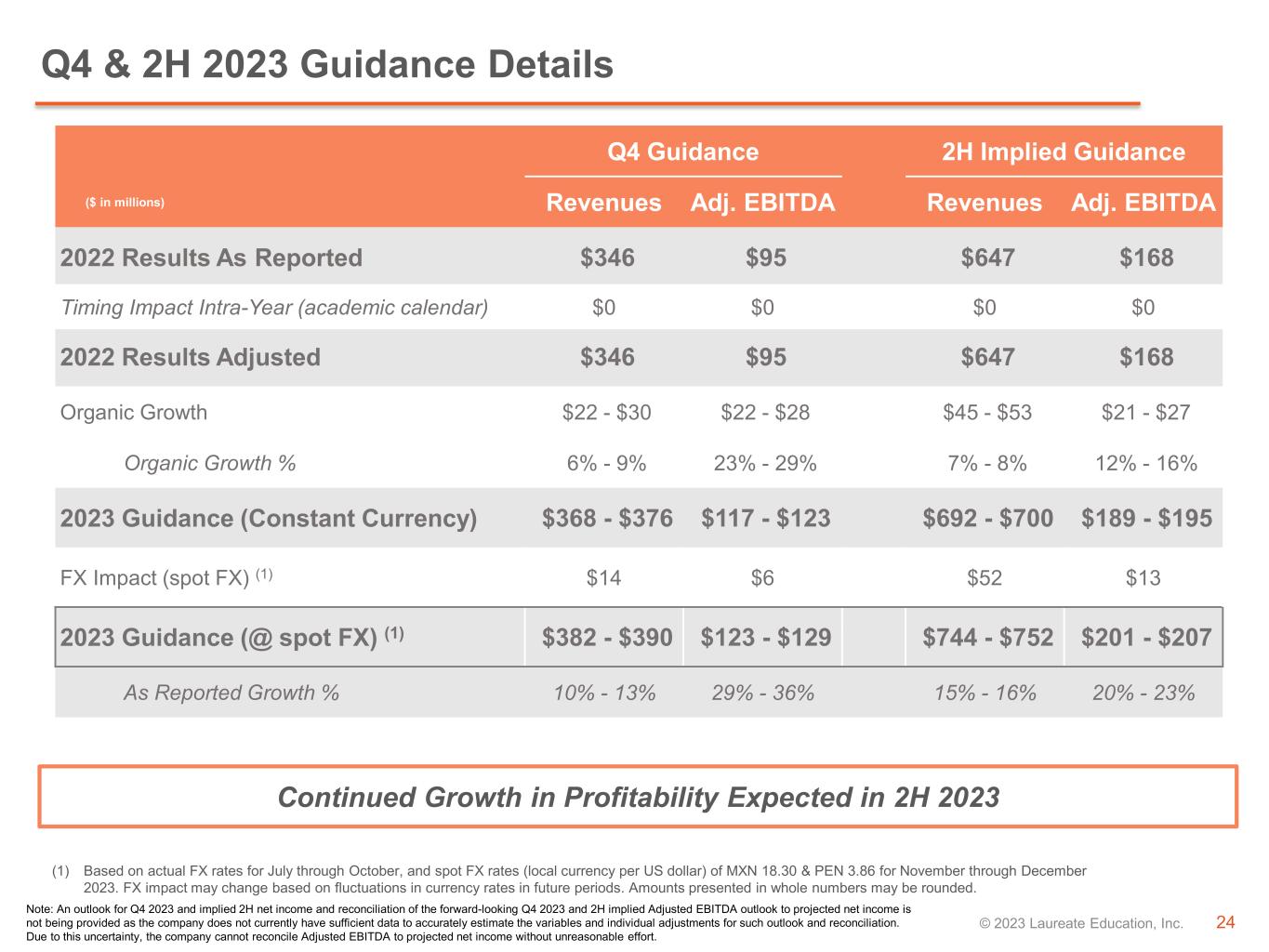

18© 2023 Laureate Education, Inc. Q4 2023 Guidance Details Note: An outlook for Q4 2023 and implied 2H net income and reconciliation of the forward-looking Q4 2023 and 2H implied Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. (1) Based on actual FX rates for July through October, and spot FX rates (local currency per US dollar) of MXN 18.30 & PEN 3.86 for November through December 2023. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. ($ in millions) Q4 2023 Outlook (1) 2H 2023 Implied Outlook (1) Revenue $382 - $390 $744 - $752 Adjusted EBITDA $123 - $129 $201 - $207 Continued Growth in Profitability Expected in Q4 2023

19© 2023 Laureate Education, Inc. APPENDIX

20© 2023 Laureate Education, Inc. Q3 ’23 B / (W) Vs. Q3 ’22 Notes ($ in millions) Reported $ % Adjusted EBITDA 78 6 8% Depreciation & Amort. (18) (3) n.m. Interest Expense, net (2) (1) n.m. Impairments - - n.m. Other 11 (3) n.m. • Non-cash FX translation gain on intercompany loans Income Tax (34) 6 14% Income From Continuing Operations 36 4 12% Discontinued Operations (Net of Tax) 0 1 n.m. Net Income 36 5 16% Income from Continuing Operations Improved Versus Prior Year 2023 Third Quarter – Net Income Reconciliation

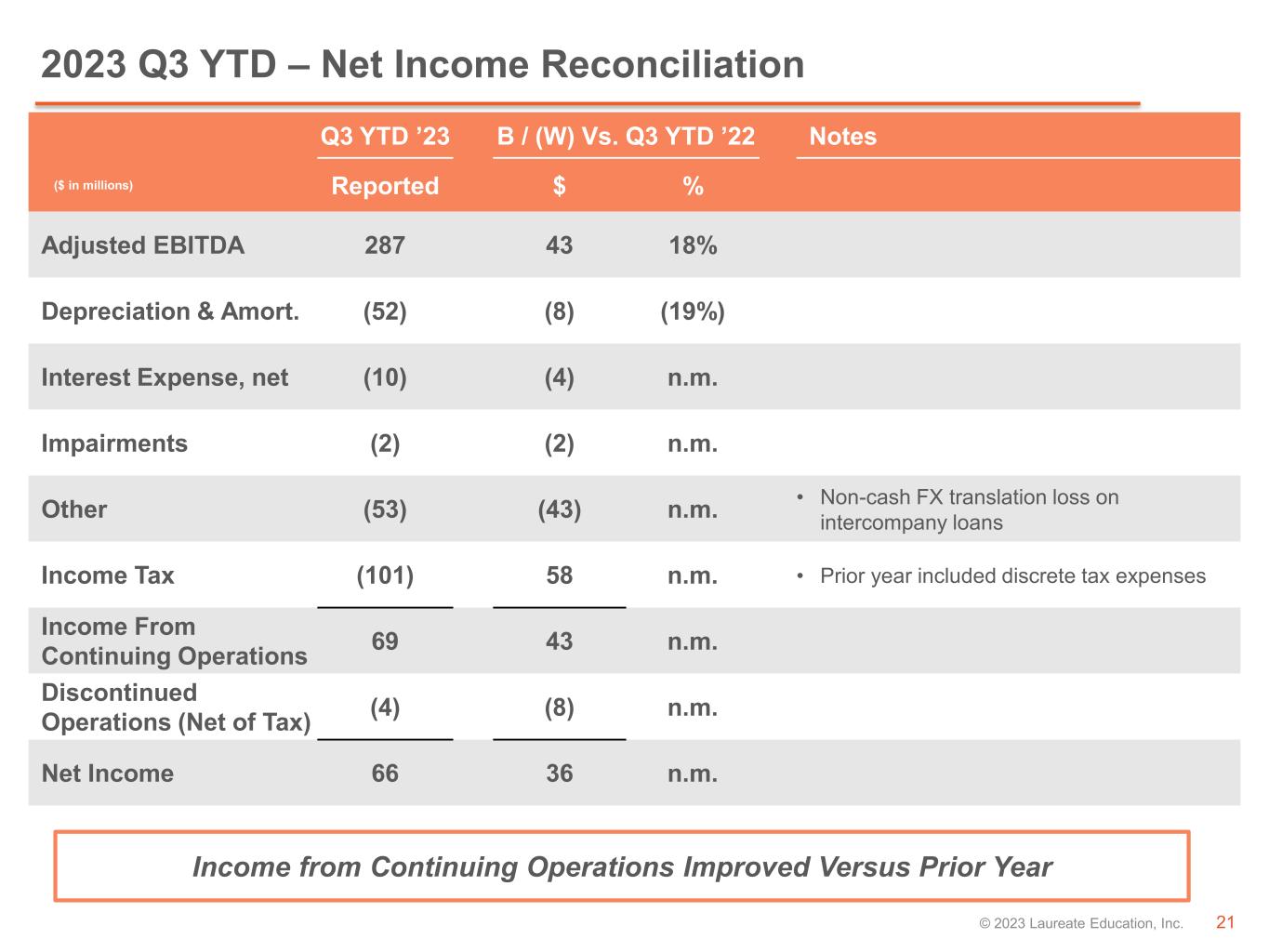

21© 2023 Laureate Education, Inc. Q3 YTD ’23 B / (W) Vs. Q3 YTD ’22 Notes ($ in millions) Reported $ % Adjusted EBITDA 287 43 18% Depreciation & Amort. (52) (8) (19%) Interest Expense, net (10) (4) n.m. Impairments (2) (2) n.m. Other (53) (43) n.m. • Non-cash FX translation loss on intercompany loans Income Tax (101) 58 n.m. • Prior year included discrete tax expenses Income From Continuing Operations 69 43 n.m. Discontinued Operations (Net of Tax) (4) (8) n.m. Net Income 66 36 n.m. 2023 Q3 YTD – Net Income Reconciliation Income from Continuing Operations Improved Versus Prior Year

22© 2023 Laureate Education, Inc. Capitalization at 9/30/2023 Total current shares outstanding of 157M shares as of September 30th Strong Balance Sheet Position – Essentially Net Debt Neutral ($ in millions) Total Company as of 9/30/23 Gross Debt $135 Less: Cash & Cash Equivalents ($131) Net Debt $4

23© 2023 Laureate Education, Inc. 2023 Full Year Guidance Details Strong Top Line Growth With Continued Margin Expansion ($ in millions) (Enrollments rounded to the nearest thousand) Total Enrollment Revenues Adj. EBITDA 2022 FY Results Adjusted 423K $1,242 $339 Organic Growth Approx. 24K $122 - $130 $47 - $53 Organic Growth % 6% 10% 14% - 16% 2023 FY Guidance (Constant Currency) Approx. 447K $1,364 - $1,372 $386 - $392 FX Impact (spot FX) (1) $93 $24 2023 FY Guidance (@ spot FX) (1) Approx. 447K $1,457 - $1,465 $410 - $416 As Reported Growth % 6% 17% - 18% 21% - 23% (1) Based on actual FX rates for January through October, and spot FX rates (local currency per US dollar) of MXN 18.30 & PEN 3.86 for November through December 2023. FX impact may change based on fluctuations in currency rates in future periods. Data shown and growth rates are based on mid-point of 2023 guidance. Amounts presented in whole numbers may be rounded. Note: An outlook for 2023 net income and reconciliation of the forward-looking 2023 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort.

24© 2023 Laureate Education, Inc. Q4 & 2H 2023 Guidance Details Note: An outlook for Q4 2023 and implied 2H net income and reconciliation of the forward-looking Q4 2023 and 2H implied Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Q4 Guidance 2H Implied Guidance ($ in millions) Revenues Adj. EBITDA Revenues Adj. EBITDA 2022 Results As Reported $346 $95 $647 $168 Timing Impact Intra-Year (academic calendar) $0 $0 $0 $0 2022 Results Adjusted $346 $95 $647 $168 Organic Growth $22 - $30 $22 - $28 $45 - $53 $21 - $27 Organic Growth % 6% - 9% 23% - 29% 7% - 8% 12% - 16% 2023 Guidance (Constant Currency) $368 - $376 $117 - $123 $692 - $700 $189 - $195 FX Impact (spot FX) (1) $14 $6 $52 $13 2023 Guidance (@ spot FX) (1) $382 - $390 $123 - $129 $744 - $752 $201 - $207 As Reported Growth % 10% - 13% 29% - 36% 15% - 16% 20% - 23% (1) Based on actual FX rates for July through October, and spot FX rates (local currency per US dollar) of MXN 18.30 & PEN 3.86 for November through December 2023. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Continued Growth in Profitability Expected in 2H 2023

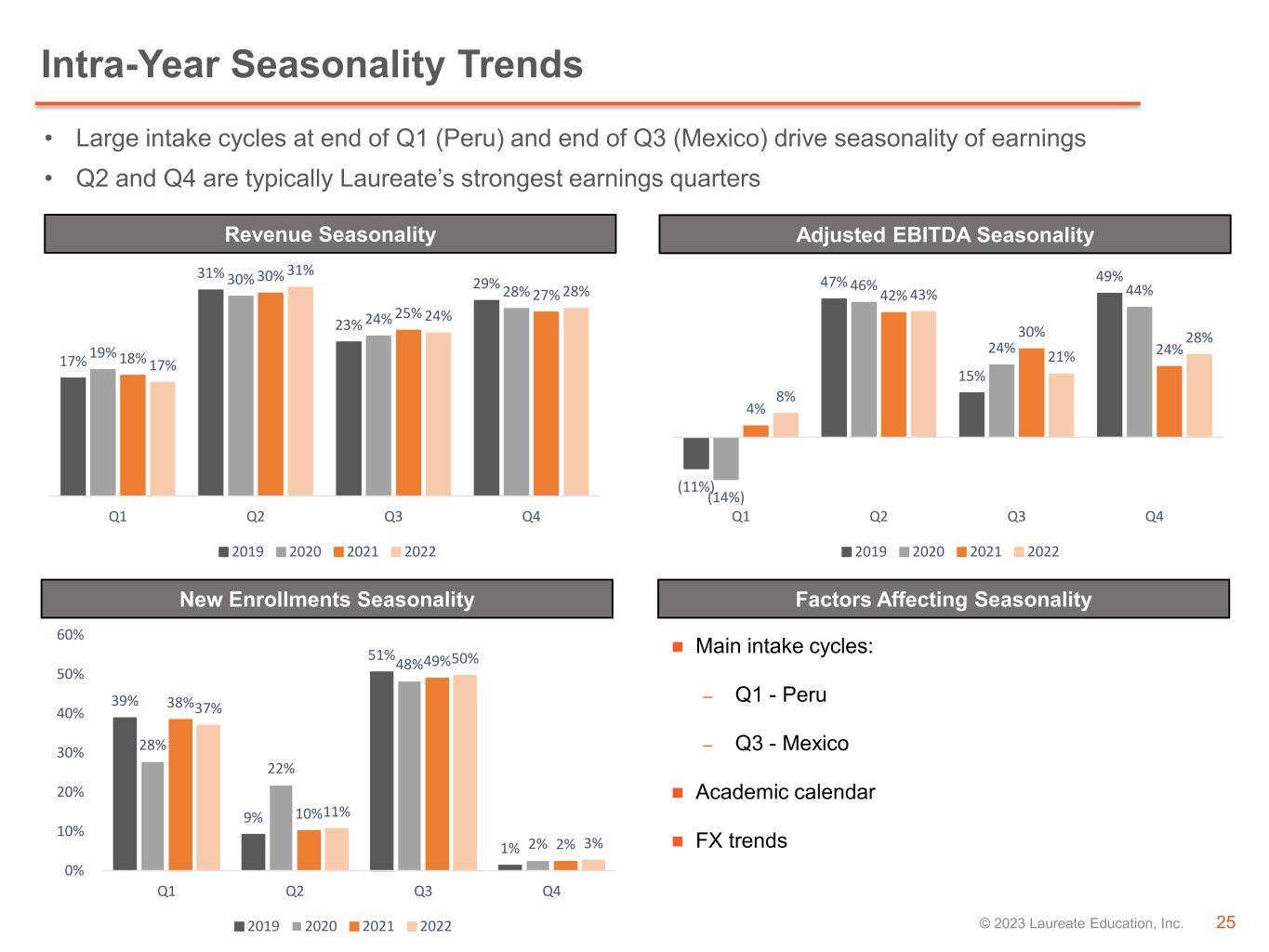

25© 2023 Laureate Education, Inc. • Large intake cycles at end of Q1 (Peru) and end of Q3 (Mexico) drive seasonality of earnings • Q2 and Q4 are typically Laureate’s strongest earnings quarters Revenue Seasonality Adjusted EBITDA Seasonality New Enrollments Seasonality Reported FCF Intra-Year Seasonality Trends Factors Affecting Seasonality Main intake cycles: – Q1 - Peru – Q3 - Mexico Academic calendar FX trends 17% 31% 23% 29% 19% 30% 24% 28% 18% 30% 25% 27% 17% 31% 24% 28% Q1 Q2 Q3 Q4 2019 2020 2021 2022 (11%) 47% 15% 49% (14%) 46% 24% 44% 4% 42% 30% 24% 8% 43% 21% 28% Q1 Q2 Q3 Q4 2019 2020 2021 2022 39% 9% 51% 1% 28% 22% 48% 2% 38% 10% 49% 2% 37% 11% 50% 3% 0% 10% 20% 30% 40% 50% 60% Q1 Q2 Q3 Q4 2019 2020 2021 2022

26© 2023 Laureate Education, Inc. Financial Results & Tables

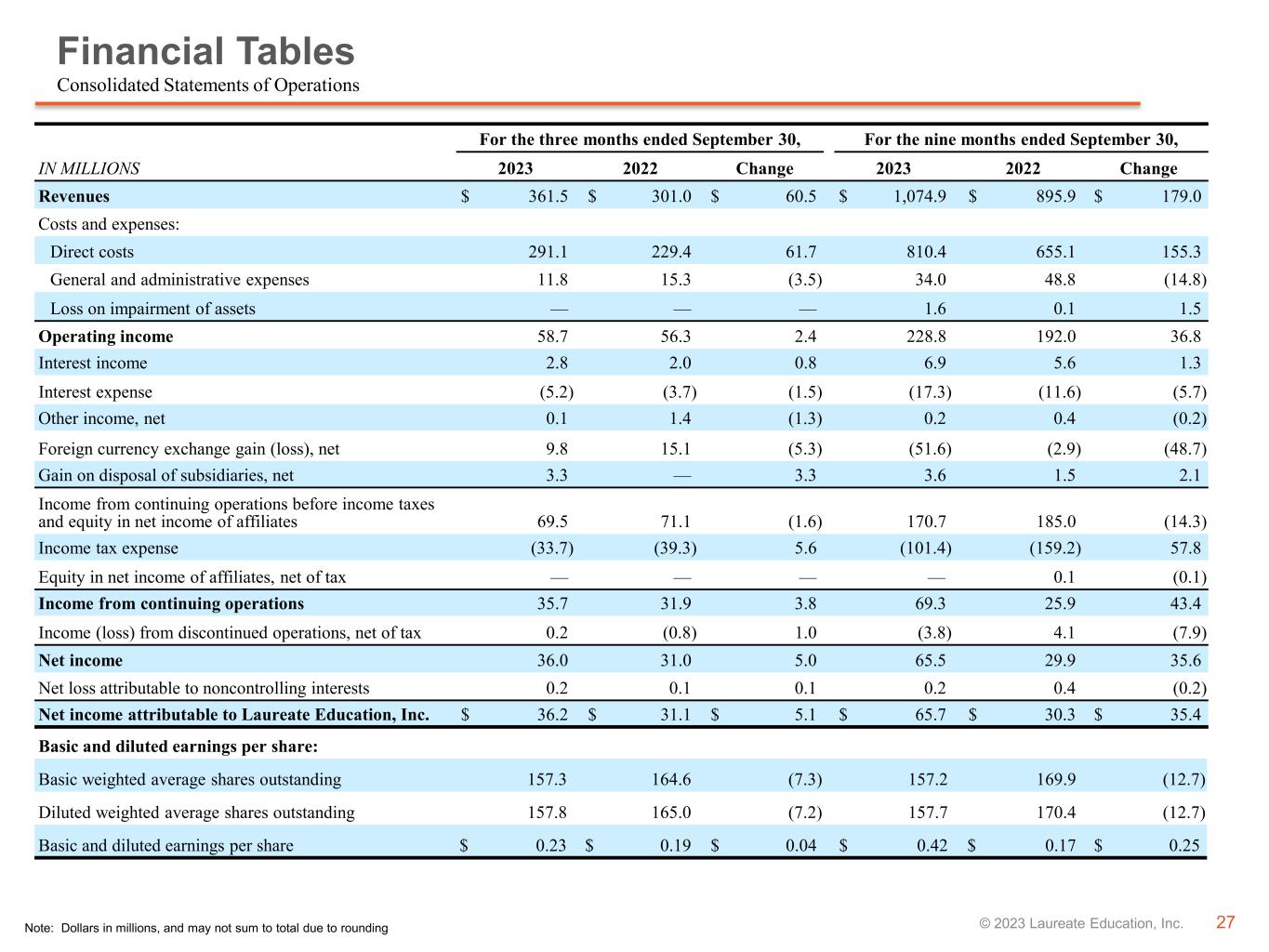

27© 2023 Laureate Education, Inc. Financial Tables Note: Dollars in millions, and may not sum to total due to rounding Consolidated Statements of Operations For the three months ended September 30, For the nine months ended September 30, IN MILLIONS 2023 2022 Change 2023 2022 Change Revenues $ 361.5 $ 301.0 $ 60.5 $ 1,074.9 $ 895.9 $ 179.0 Costs and expenses: Direct costs 291.1 229.4 61.7 810.4 655.1 155.3 General and administrative expenses 11.8 15.3 (3.5) 34.0 48.8 (14.8) Loss on impairment of assets — — — 1.6 0.1 1.5 Operating income 58.7 56.3 2.4 228.8 192.0 36.8 Interest income 2.8 2.0 0.8 6.9 5.6 1.3 Interest expense (5.2) (3.7) (1.5) (17.3) (11.6) (5.7) Other income, net 0.1 1.4 (1.3) 0.2 0.4 (0.2) Foreign currency exchange gain (loss), net 9.8 15.1 (5.3) (51.6) (2.9) (48.7) Gain on disposal of subsidiaries, net 3.3 — 3.3 3.6 1.5 2.1 Income from continuing operations before income taxes and equity in net income of affiliates 69.5 71.1 (1.6) 170.7 185.0 (14.3) Income tax expense (33.7) (39.3) 5.6 (101.4) (159.2) 57.8 Equity in net income of affiliates, net of tax — — — — 0.1 (0.1) Income from continuing operations 35.7 31.9 3.8 69.3 25.9 43.4 Income (loss) from discontinued operations, net of tax 0.2 (0.8) 1.0 (3.8) 4.1 (7.9) Net income 36.0 31.0 5.0 65.5 29.9 35.6 Net loss attributable to noncontrolling interests 0.2 0.1 0.1 0.2 0.4 (0.2) Net income attributable to Laureate Education, Inc. $ 36.2 $ 31.1 $ 5.1 $ 65.7 $ 30.3 $ 35.4 Basic and diluted earnings per share: Basic weighted average shares outstanding 157.3 164.6 (7.3) 157.2 169.9 (12.7) Diluted weighted average shares outstanding 157.8 165.0 (7.2) 157.7 170.4 (12.7) Basic and diluted earnings per share $ 0.23 $ 0.19 $ 0.04 $ 0.42 $ 0.17 $ 0.25

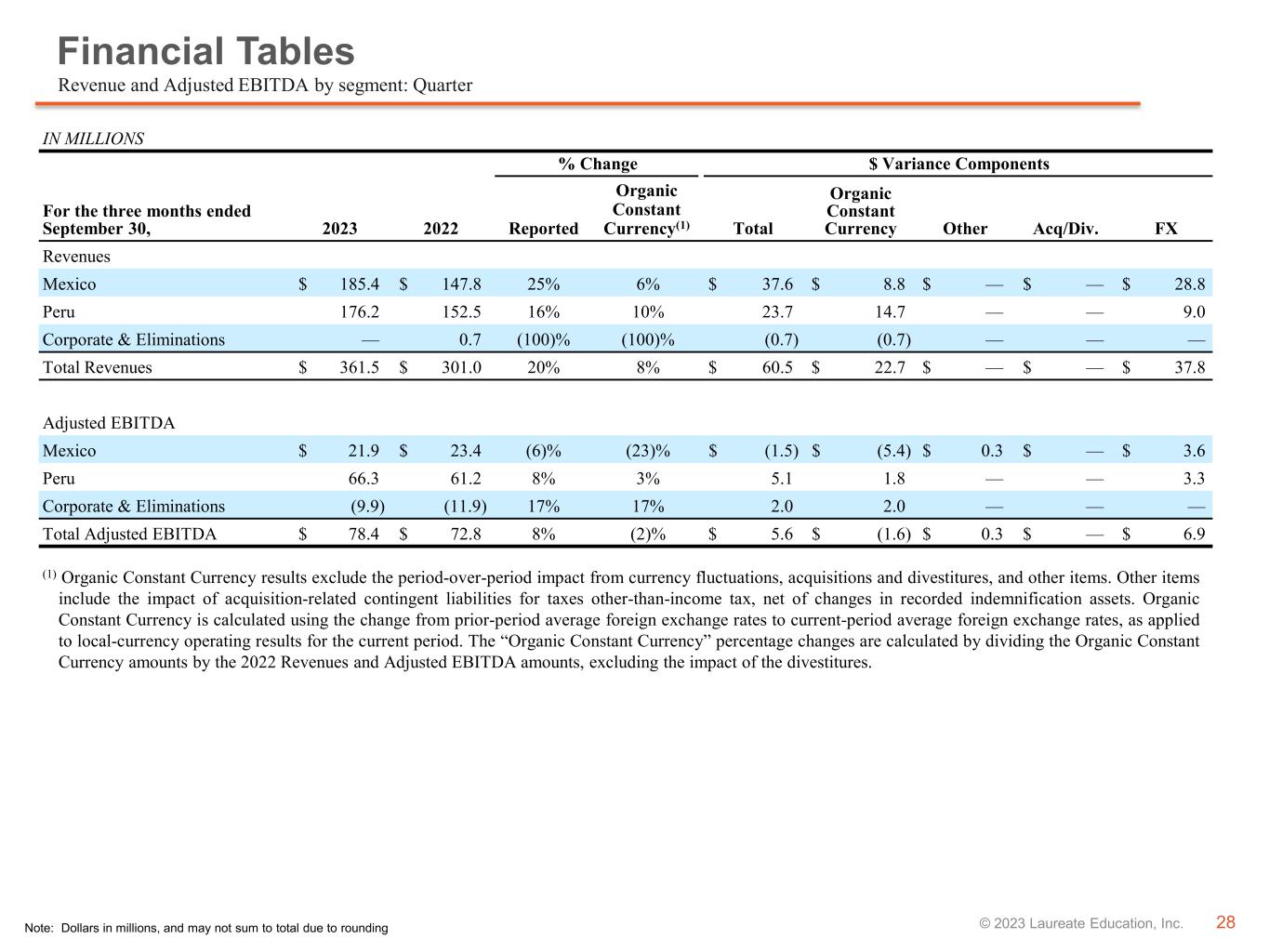

28© 2023 Laureate Education, Inc. Financial Tables Note: Dollars in millions, and may not sum to total due to rounding Revenue and Adjusted EBITDA by segment: Quarter IN MILLIONS % Change $ Variance Components For the three months ended September 30, 2023 2022 Reported Organic Constant Currency(1) Total Organic Constant Currency Other Acq/Div. FX Revenues Mexico $ 185.4 $ 147.8 25% 6% $ 37.6 $ 8.8 $ — $ — $ 28.8 Peru 176.2 152.5 16% 10% 23.7 14.7 — — 9.0 Corporate & Eliminations — 0.7 (100)% (100)% (0.7) (0.7) — — — Total Revenues $ 361.5 $ 301.0 20% 8% $ 60.5 $ 22.7 $ — $ — $ 37.8 Adjusted EBITDA Mexico $ 21.9 $ 23.4 (6)% (23)% $ (1.5) $ (5.4) $ 0.3 $ — $ 3.6 Peru 66.3 61.2 8% 3% 5.1 1.8 — — 3.3 Corporate & Eliminations (9.9) (11.9) 17% 17% 2.0 2.0 — — — Total Adjusted EBITDA $ 78.4 $ 72.8 8% (2)% $ 5.6 $ (1.6) $ 0.3 $ — $ 6.9 (1) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period. The “Organic Constant Currency” percentage changes are calculated by dividing the Organic Constant Currency amounts by the 2022 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures.

29© 2023 Laureate Education, Inc. Financial Tables Note: Dollars in millions, and may not sum to total due to rounding Revenue and Adjusted EBITDA by segment: Year-to-Date IN MILLIONS % Change $ Variance Components For the nine months ended September 30, 2023 2022 Reported Organic Constant Currency(2) Total Organic Constant Currency Other Acq/Div. FX Revenues Mexico $ 559.5 $ 435.0 29% 13% $ 124.5 $ 56.5 $ — $ — $ 68.0 Peru 515.4 457.1 13% 10% 58.3 47.0 — — 11.3 Corporate & Eliminations — 3.8 (100)% (100)% (3.8) (3.8) — — — Total Revenues $ 1,074.9 $ 895.9 20% 11% $ 179.0 $ 99.7 $ — $ — $ 79.3 Adjusted EBITDA Mexico $ 109.1 $ 79.8 37% 19% $ 29.3 $ 15.1 $ 0.4 $ — $ 13.8 Peru 207.1 201.4 3% 1% 5.7 1.1 — — 4.6 Corporate & Eliminations (28.8) (37.2) 23% 23% 8.4 8.4 — — — Total Adjusted EBITDA $ 287.3 $ 244.1 18% 10% $ 43.2 $ 24.4 $ 0.4 $ — $ 18.4 (2) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local- currency operating results for the current period. The “Organic Constant Currency” percentage changes are calculated by dividing the Organic Constant Currency amounts by the 2022 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures.

30© 2023 Laureate Education, Inc. Financial Tables Consolidated Balance Sheets Note: Dollars in millions, and may not sum to total due to rounding IN MILLIONS September 30, 2023 December 31, 2022 Change Assets Cash and cash equivalents $ 130.9 $ 85.2 $ 45.7 Receivables (current), net 95.7 80.7 15.0 Other current assets 52.7 60.3 (7.6) Property and equipment, net 543.6 523.4 20.2 Operating lease right-of-use assets, net 356.4 389.6 (33.2) Goodwill and other intangible assets 804.4 735.1 69.3 Deferred income taxes 58.1 51.9 6.2 Other long-term assets 44.3 46.0 (1.7) Current and long-term assets held for sale 11.3 — 11.3 Total assets $ 2,097.3 $ 1,972.2 $ 125.1 Liabilities and stockholders' equity Accounts payable and accrued expenses $ 196.1 $ 178.6 $ 17.5 Deferred revenue and student deposits 81.0 51.3 29.7 Total operating leases, including current portion 393.2 415.9 (22.7) Total long-term debt, including current portion 132.1 232.1 (100.0) Other liabilities 318.3 318.6 (0.3) Current and long-term liabilities held for sale 11.5 — 11.5 Total liabilities 1,132.2 1,196.5 (64.3) Redeemable noncontrolling interests and equity 1.4 1.4 — Total stockholders' equity 963.6 774.4 189.2 Total liabilities and stockholders' equity $ 2,097.3 $ 1,972.2 $ 125.1

31© 2023 Laureate Education, Inc. Financial Tables Consolidated Statements of Cash Flows Note: Dollars in millions, and may not sum to total due to rounding For the nine months ended September 30, IN MILLIONS 2023 2022 Change Cash flows from operating activities Net income $ 65.5 $ 29.9 $ 35.6 Depreciation and amortization 52.0 43.6 8.4 Loss (gain) on sales and disposal of subsidiaries and property and equipment, net 5.3 (5.8) 11.1 Deferred income taxes (9.5) 8.2 (17.7) Unrealized foreign currency exchange loss (gain) 51.1 (2.2) 53.3 Income tax receivable/payable, net (6.7) 53.6 (60.3) Working capital, excluding tax accounts (25.8) (17.8) (8.0) Other non-cash adjustments 55.6 45.2 10.4 Net cash provided by operating activities 187.4 154.7 32.7 Cash flows from investing activities Purchase of property and equipment (26.7) (16.8) (9.9) Expenditures for deferred costs — (0.4) 0.4 Receipts from sales of discontinued operations and property and equipment 0.5 83.4 (82.9) Net cash (used in) provided by investing activities (26.2) 66.3 (92.5) Cash flows from financing activities Decrease in long-term debt, net (119.1) (35.2) (83.9) Proceeds from exercise of stock options 3.2 11.9 (8.7) Payments to repurchase common stock — (207.2) 207.2 Financing other, net (4.3) (6.0) 1.7 Net cash used in financing activities (120.2) (236.5) 116.3 Effects of exchange rate changes on Cash and cash equivalents and Restricted cash 4.0 6.4 (2.4) Change in cash included in current assets held for sale (0.3) — (0.3) Net change in Cash and cash equivalents and Restricted cash 44.7 (9.1) 53.8 Cash and cash equivalents and Restricted cash at beginning of period 93.8 345.6 (251.8) Cash and cash equivalents and Restricted cash at end of period $ 138.4 $ 336.5 $ (198.1)

32© 2023 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliation (1 of 3) Note: Dollars in millions, and may not sum to total due to rounding The following table reconciles Net income to Adjusted EBITDA and Adjusted EBITDA margin: For the three months ended September 30, For the nine months ended September 30, IN MILLIONS 2023 2022 Change 2023 2022 Change Net income $ 36.0 $ 31.0 $ 5.0 $ 65.5 $ 29.9 $ 35.6 Plus: (Income) loss from discontinued operations, net of tax (0.2) 0.8 (1.0) 3.8 (4.1) 7.9 Income from continuing operations 35.7 31.9 3.8 69.3 25.9 43.4 Plus: Equity in net income of affiliates, net of tax — — — — (0.1) 0.1 Income tax expense 33.7 39.3 (5.6) 101.4 159.2 (57.8) Income from continuing operations before income taxes and equity in net income of affiliates 69.5 71.1 (1.6) 170.7 185.0 (14.3) Plus: Gain on disposal of subsidiaries, net (3.3) — (3.3) (3.6) (1.5) (2.1) Foreign currency exchange (gain) loss, net (9.8) (15.1) 5.3 51.6 2.9 48.7 Other income, net (0.1) (1.4) 1.3 (0.2) (0.4) 0.2 Interest expense 5.2 3.7 1.5 17.3 11.6 5.7 Interest income (2.8) (2.0) (0.8) (6.9) (5.6) (1.3) Operating income 58.7 56.3 2.4 228.8 192.0 36.8 Plus: Depreciation and amortization 17.9 14.5 3.4 52.0 43.6 8.4 EBITDA 76.6 70.8 5.8 280.8 235.6 45.2 Plus: Share-based compensation expense (3) 1.8 1.8 — 4.9 7.0 (2.1) Loss on impairment of assets (4) — — — 1.6 0.1 1.5 EiP implementation expenses (5) — 0.2 (0.2) — 1.3 (1.3) Adjusted EBITDA $ 78.4 $ 72.8 $ 5.6 $ 287.3 $ 244.1 $ 43.2 Revenues $ 361.5 $ 301.0 $ 60.5 $ 1,074.9 $ 895.9 $ 179.0 Income from continuing operations margin 9.9 % 10.6 % -70 bps 6.5 % 2.9 % 357 bps Adjusted EBITDA margin 21.7 % 24.2 % -250 bps 26.7 % 27.2 % -52 bps (3) Represents non-cash, share-based compensation expense pursuant to the provisions of ASC Topic 718. (4) Represents non-cash charges related to impairments of long-lived assets. (5) Excellence-in-Process (EiP) implementation expenses were related to our enterprise-wide initiative to optimize and standardize Laureate’s processes, creating vertical integration of procurement, information technology, finance, accounting and human resources. It included the establishment of regional shared services organizations (SSOs), as well as improvements to the Company's system of internal controls over financial reporting. The EiP initiative also included other back- and mid-office areas, as well as certain student-facing activities, expenses associated with streamlining the organizational structure, an enterprise-wide program aimed at revenue growth, and certain non-recurring costs that were incurred in connection with previous dispositions and completed dispositions. The EiP initiative was completed as of December 31, 2021, except for certain EiP expenses related to the run out of programs that began in prior periods.

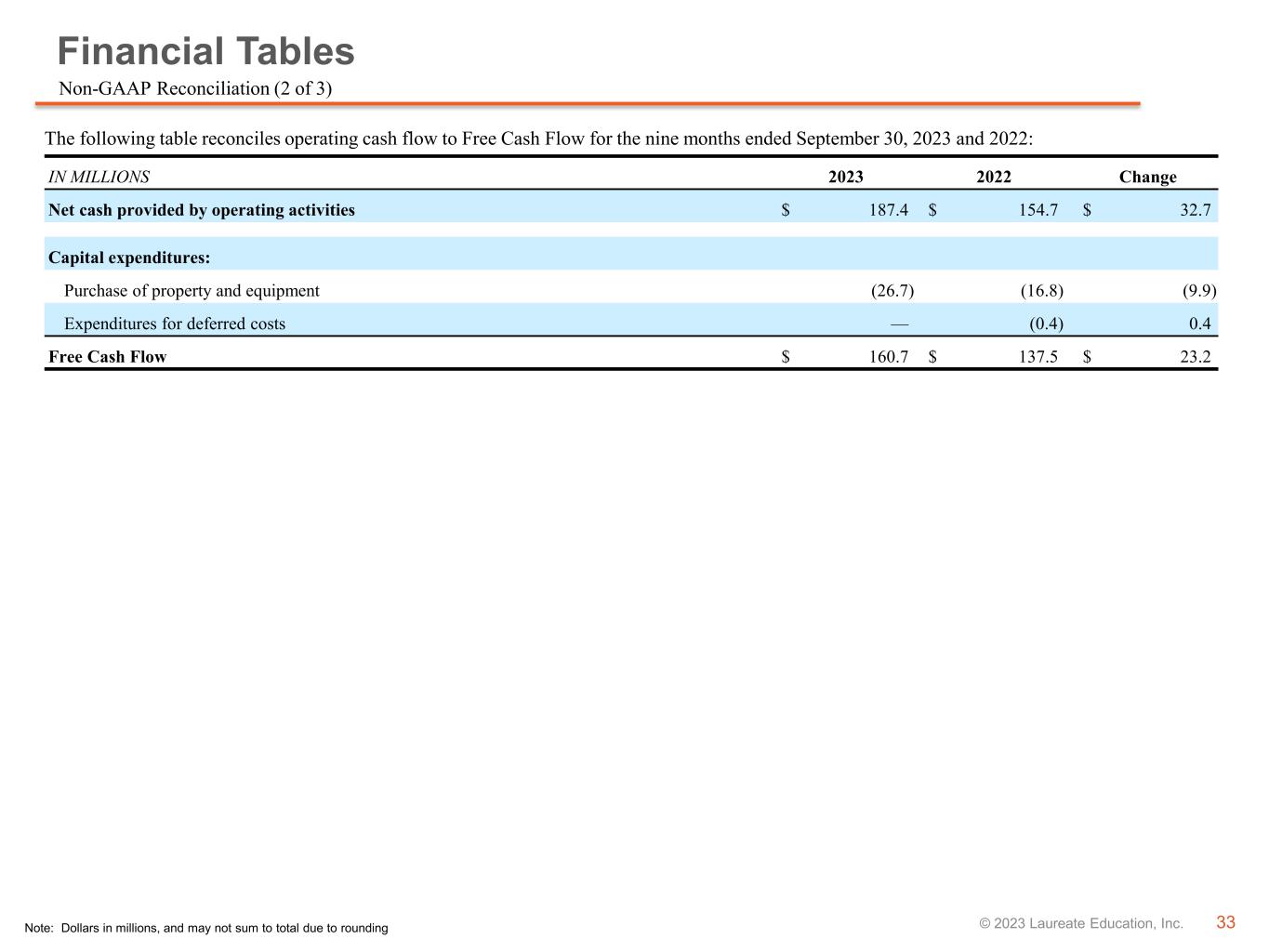

33© 2023 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliation (2 of 3) Note: Dollars in millions, and may not sum to total due to rounding The following table reconciles operating cash flow to Free Cash Flow for the nine months ended September 30, 2023 and 2022: IN MILLIONS 2023 2022 Change Net cash provided by operating activities $ 187.4 $ 154.7 $ 32.7 Capital expenditures: Purchase of property and equipment (26.7) (16.8) (9.9) Expenditures for deferred costs — (0.4) 0.4 Free Cash Flow $ 160.7 $ 137.5 $ 23.2

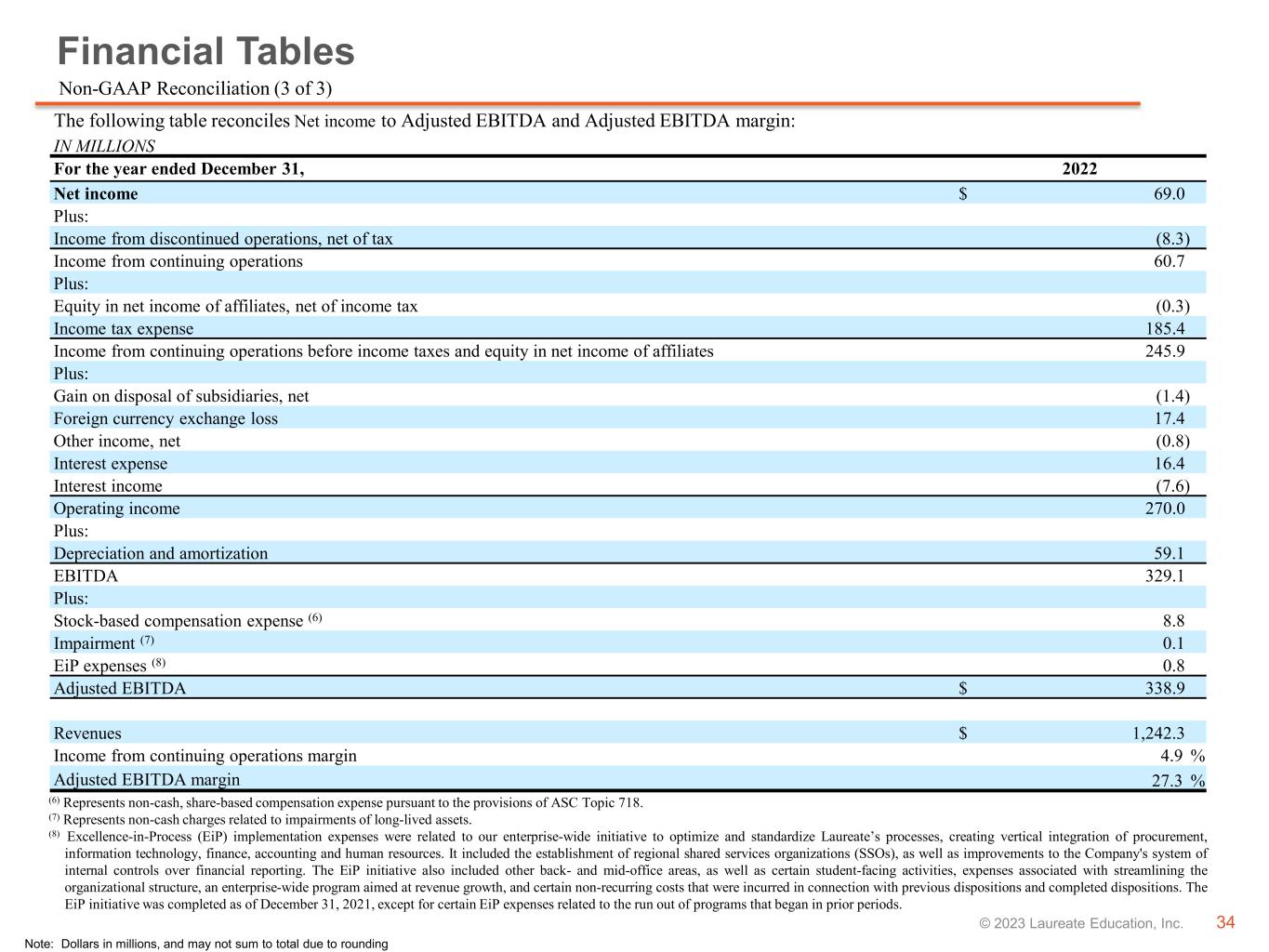

34© 2023 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliation (3 of 3) Note: Dollars in millions, and may not sum to total due to rounding The following table reconciles Net income to Adjusted EBITDA and Adjusted EBITDA margin: IN MILLIONS For the year ended December 31, 2022 Net income $ 69.0 Plus: Income from discontinued operations, net of tax (8.3) Income from continuing operations 60.7 Plus: Equity in net income of affiliates, net of income tax (0.3) Income tax expense 185.4 Income from continuing operations before income taxes and equity in net income of affiliates 245.9 Plus: Gain on disposal of subsidiaries, net (1.4) Foreign currency exchange loss 17.4 Other income, net (0.8) Interest expense 16.4 Interest income (7.6) Operating income 270.0 Plus: Depreciation and amortization 59.1 EBITDA 329.1 Plus: Stock-based compensation expense (6) 8.8 Impairment (7) 0.1 EiP expenses (8) 0.8 Adjusted EBITDA $ 338.9 Revenues $ 1,242.3 Income from continuing operations margin 4.9 % Adjusted EBITDA margin 27.3 % (6) Represents non-cash, share-based compensation expense pursuant to the provisions of ASC Topic 718. (7) Represents non-cash charges related to impairments of long-lived assets. (8) Excellence-in-Process (EiP) implementation expenses were related to our enterprise-wide initiative to optimize and standardize Laureate’s processes, creating vertical integration of procurement, information technology, finance, accounting and human resources. It included the establishment of regional shared services organizations (SSOs), as well as improvements to the Company's system of internal controls over financial reporting. The EiP initiative also included other back- and mid-office areas, as well as certain student-facing activities, expenses associated with streamlining the organizational structure, an enterprise-wide program aimed at revenue growth, and certain non-recurring costs that were incurred in connection with previous dispositions and completed dispositions. The EiP initiative was completed as of December 31, 2021, except for certain EiP expenses related to the run out of programs that began in prior periods.

35© 2023 Laureate Education, Inc.

v3.23.3

Cover Page

|

Nov. 02, 2023 |

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common Stock, par value $0.004 per share

|

| Soliciting Material |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 02, 2023

|

| Entity Emerging Growth Company |

false

|

| Entity Registrant Name |

Laureate Education, Inc.

|

| Entity File Number |

001-38002

|

| Entity Tax Identification Number |

52-1492296

|

| Entity Address, Address Line One |

PMB 1158, 1000 Brickell Avenue, Suite 715

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33131

|

| City Area Code |

786

|

| Local Phone Number |

209-3368

|

| Written Communications |

false

|

| Trading Symbol |

LAUR

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000912766

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |