Atreca Reports Third Quarter 2021 Financial Results and Recent Corporate Developments

02 11월 2021 - 9:30PM

Atreca, Inc. (Atreca) (NASDAQ: BCEL), a clinical-stage

biotechnology company focused on developing novel therapeutics

generated through a unique discovery platform based on

interrogation of the active human immune response, today announced

financial results for the third quarter ended September 30, 2021,

and provided an overview of recent developments.

"In the third quarter, we continued to advance our lead program,

ATRC-101, following the release of initial summary data from the

dose escalation portion of the Phase 1b trial, which supports the

further evaluation of ATRC-101 in multiple solid tumor types,” said

John Orwin, Chief Executive Officer. “We plan to share additional

monotherapy data and initial combination data with pembrolizumab in

2022, and are in a strong position to advance our pipeline with

cash runway through mid-2023.”

“Our earlier-stage programs are progressing well, highlighted by

our recently announced licensing agreement with the Bill &

Melinda Gates Medical Research Institute for the development and

commercialization of MAM01/ATRC-501, a novel monoclonal antibody

entering preclinical development for the prevention of malaria,”

said Tito Serafini, Ph.D., Chief Strategy Officer. “We look forward

to sharing more information on our EphA2 program and other pipeline

assets at an R&D day early next year.”

Recent Developments and Highlights

- Atreca announced a licensing

agreement with the Bill & Melinda Gates Medical Research

Institute (“Gates MRI”) for development and commercialization of

MAM01/ATRC-501, a monoclonal antibody for malaria prophylaxis.

Under the agreement, Gates MRI will lead the development of

MAM01/ATRC-501 and receive commercial rights in GAVI-eligible

countries located in malaria-endemic regions of the world, while

Atreca will retain commercial rights in the U.S., Europe and parts

of Asia. Potential product development opportunities for Atreca

include developing MAM01/ATRC-501 for prevention of malaria for

those traveling to regions where the infection may be

circulating.

- Enrollment in the monotherapy

portion of the Phase 1b trial of ATRC-101 is ongoing at 30 mg/kg

and Atreca plans to report additional monotherapy data in

mid-2022.

- Enrollment has commenced in a Phase

1b combination cohort evaluating ATRC-101 with pembrolizumab.

Another combination cohort with pegylated liposomal doxorubicin

(“PLD”) is expected to begin enrolling patients following

completion of ongoing monotherapy cohorts, including those

following a Q2W dosing schedule which better aligns with the

standard PLD regimen. Atreca plans to report additional monotherapy

data in mid-2022 and pembrolizumab combination data in 3Q22.

Third Quarter 2021 Financial Results

- As of September 30, 2021, cash and cash equivalents and

short-term investments totaled $152.9 million.

- Research and development expenses for the three months ended

September 30, 2021 were $18.7 million, including non-cash

share-based compensation expense of $1.9 million.

- General and administrative expenses for the three months ended

September 30, 2021 were $8.8 million, including non-cash

share-based compensation expense of $1.9 million.

- Atreca reported a net loss of $27.4 million, or basic and

diluted net loss per share attributable to common stockholders of

$0.74, for the three months ended September 30, 2021.

About Atreca, Inc.

Atreca is a biopharmaceutical company developing novel

antibody-based immunotherapeutics generated by its differentiated

discovery platform. Atreca's platform allows access to an

unexplored landscape in oncology through the identification of

unique antibody-target pairs generated by the human immune system

during an active immune response against tumors. These antibodies

provide the basis for first-in-class therapeutic candidates, such

as our lead product candidate ATRC-101. A Phase 1b study evaluating

ATRC-101 in multiple solid tumor cancers is currently enrolling

patients. For more information on Atreca, please visit

www.atreca.com.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements include, but are not

limited to, statements about our plans, objectives, representations

and contentions and typically are identified by use of terms such

as “will,” “expect,” “potential,” “plan,” “continue,” and similar

words, although some forward-looking statements are expressed

differently. These statements include those related to our strategy

and future plans, including statements regarding the development of

ATRC-101 and our preclinical, clinical and regulatory plans and the

timing thereof, the availability and timing of ATRC-101 monotherapy

and initial combination data with pembrolizumab and enrollment in,

and timing of, a combination cohort with pegylated liposomal

doxorubicin, our cash runway and the timing thereof, the

development of MAM01/ATRC-501, its potential for prevention of

malaria, our potential product development opportunities to develop

MAM01/ATRC-501 for prevention of malaria for those traveling to

regions where the infection may be circulating, and the status of

our earlier-stage programs and our plan to share information

regarding our EphA2 program and other pipeline assets and the

timing thereof. Our actual results may differ materially from those

indicated in these forward-looking statements due to risks and

uncertainties related to the initiation, timing, progress and

results of our research and development programs, preclinical

studies, clinical trials, regulatory submissions, and other matters

that are described in our filings with the Securities and Exchange

Commission (SEC) and available on the SEC’s website

at www.sec.gov, including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of our most recently filed annual

report on Form 10-K and quarterly report on Form 10-Q. Investors

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release,

and we undertake no obligation to update any forward-looking

statement in this press release, except as required by law.

Atreca, Inc.Condensed

Consolidated Balance Sheets(in thousands, except share and

per share data)

|

|

|

|

|

|

| |

|

September 30, |

|

December 31, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

(unaudited) |

|

|

|

ASSETS |

|

|

|

|

| |

|

|

|

|

| Current Assets |

| Cash and cash equivalents |

|

$ |

113,189 |

|

|

$ |

60,789 |

|

| Investments |

|

|

39,697 |

|

|

|

179,296 |

|

| Prepaid expenses and other

current assets |

|

|

9,180 |

|

|

|

9,037 |

|

|

Total current assets |

|

|

162,066 |

|

|

|

249,122 |

|

| Property and equipment,

net |

|

|

44,291 |

|

|

|

19,831 |

|

| Long-term investments |

|

|

10,824 |

|

|

|

- |

|

| Deposits and other |

|

|

3,080 |

|

|

|

3,111 |

|

|

Total assets |

|

$ |

220,261 |

|

|

$ |

272,064 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current Liabilities |

| Accounts payable |

|

$ |

5,238 |

|

|

$ |

5,216 |

|

| Accrued expenses |

|

|

9,286 |

|

|

|

10,302 |

|

| Other current liabilities |

|

|

1,631 |

|

|

|

1,900 |

|

|

Total current liabilities |

|

|

16,155 |

|

|

|

17,418 |

|

| Capital lease obligations, net

of current portion |

|

|

- |

|

|

|

4 |

|

| Deferred rent |

|

|

28,677 |

|

|

|

12,585 |

|

|

Total liabilities |

|

|

44,832 |

|

|

|

30,007 |

|

|

|

|

|

|

|

| |

|

|

|

|

| Stockholders’ equity |

| Common stock |

|

|

4 |

|

|

|

4 |

|

| Additional paid-in

capital |

|

|

505,680 |

|

|

|

492,436 |

|

| Accumulated other

comprehensive income (loss) |

|

|

(6 |

) |

|

|

58 |

|

| Accumulated deficit |

|

|

(330,249 |

) |

|

|

(250,441 |

) |

|

Total stockholders’ equity |

|

|

175,429 |

|

|

|

242,057 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

220,261 |

|

|

$ |

272,064 |

|

Atreca, Inc.Condensed

Consolidated Statements of Operations(in thousands, except

share and per share data)(unaudited)

| ($ amounts in

000's, except per share amounts) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

| |

Research and development |

|

$ |

18,721 |

|

|

$ |

16,808 |

|

|

$ |

56,145 |

|

|

$ |

45,198 |

|

| |

General and

administrative |

|

|

8,796 |

|

|

|

6,614 |

|

|

|

24,648 |

|

|

|

20,195 |

|

| |

Total expenses |

|

|

27,517 |

|

|

|

23,422 |

|

|

|

80,793 |

|

|

|

65,393 |

|

| Interest and other

income (expense) |

|

|

|

|

|

|

|

|

| |

Other income |

|

|

158 |

|

|

|

353 |

|

|

|

851 |

|

|

|

987 |

|

| |

Interest income |

|

|

36 |

|

|

|

142 |

|

|

|

183 |

|

|

|

1,082 |

|

| |

Interest expense |

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

|

|

(3 |

) |

| |

Loss on disposal of property

and equipment |

|

|

(34 |

) |

|

|

- |

|

|

|

(45 |

) |

|

|

- |

|

| Loss before Income

tax expense |

|

|

(27,358 |

) |

|

|

(22,928 |

) |

|

|

(79,807 |

) |

|

|

(63,327 |

) |

| Income tax

expense |

|

|

- |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(1 |

) |

| Net loss |

|

$ |

(27,358 |

) |

|

$ |

(22,929 |

) |

|

$ |

(79,808 |

) |

|

$ |

(63,328 |

) |

| Net loss per

share, basic and diluted |

|

$ |

(0.74 |

) |

|

$ |

(0.66 |

) |

|

$ |

(2.16 |

) |

|

$ |

(2.09 |

) |

| Weighted-average

shares used in computing |

|

|

|

|

|

|

|

|

|

net loss per share, basic and diluted |

|

|

36,918,255 |

|

|

|

34,723,888 |

|

|

|

36,884,665 |

|

|

|

30,313,047 |

|

Contacts

Atreca, Inc.Herb CrossChief Financial

Officerinfo@atreca.comInvestors:Alex Gray,

650-779-9251agray@atreca.com

Media:Rachel Ford Hutman,

301-801-5540Rachel@fordhutmanmedia.com

Source: Atreca, Inc.

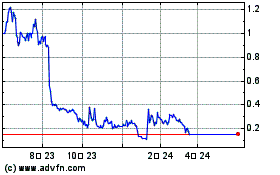

Atreca (NASDAQ:BCEL)

과거 데이터 주식 차트

부터 6월(6) 2024 으로 7월(7) 2024

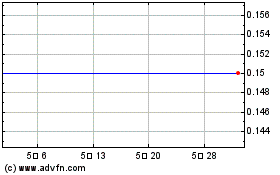

Atreca (NASDAQ:BCEL)

과거 데이터 주식 차트

부터 7월(7) 2023 으로 7월(7) 2024