ARCA biopharma, Inc. (Nasdaq: ABIO), (the “Company”) a

biopharmaceutical company applying a precision medicine approach to

developing genetically targeted therapies for cardiovascular

diseases, today reported second quarter 2024 financial results and

provided a corporate update.

In April 2022, ARCA established a Special

Committee of the board of directors (the “Board”) of ARCA to

conduct a comprehensive review of strategic alternatives. As part

of the strategic review process, the Company explored potential

strategic alternatives that included, without limitation, an

acquisition, merger, business combination or other transactions.

The Company has and is continuing to explore strategic alternatives

related to its product candidates and related assets, including,

without limitation, licensing transactions and asset sales.

On April 3, 2024, following a comprehensive

review of strategic alternatives, the Company, Atlas Merger Sub

Corp., a Delaware corporation and a wholly-owned subsidiary of ARCA

(“Merger Sub I”), Atlas Merger Sub II LLC, a Delaware limited

liability company and a wholly-owned subsidiary of ARCA (“Merger

Sub II”) and Oruka Therapeutics, Inc., a Delaware corporation

(“Oruka”), entered into an Agreement and Plan of Merger and

Reorganization (the “Merger Agreement”), pursuant to which, among

other matters, and subject to the satisfaction or waiver of the

conditions set forth in the Merger Agreement, Merger Sub I will

merge with and into Oruka, with Oruka continuing as a wholly owned

subsidiary of ARCA and the surviving corporation of such merger

(the “First Merger”) and as part of the same overall transaction,

the surviving corporation in the First Merger will merge with and

into Merger Sub II with Merger Sub II continuing as a wholly owned

subsidiary of ARCA and the surviving entity of such merger (the

“Second Merger” and together with the First Merger, the “Merger”).

The Merger is intended to qualify for federal income tax purposes

as a tax-free reorganization under the provisions of Section 368(a)

of the Internal Revenue Code of 1986, as amended.

Additional descriptions about the Merger

Agreement and related agreements were previously disclosed on a

Current Report on Form 8-K filed with the U.S. Securities and

Exchange Commission (the “SEC”) on April 3, 2024. In connection

with the proposed Merger, the Company has filed relevant materials

with the SEC, including a registration statement on Form S-4 that

contains a definitive proxy statement and prospectus of the

Company.

In connection with the Merger, the Company will

dispose of (or is in the process of disposing of) its legacy

technology and intellectual property, including those related to

Gencaro™ (bucindolol hydrochloride) and Recombinant Nematode

Anticoagulant Protein c2 (“rNAPc2”). Any such disposal of legacy

technology and intellectual property will be contingent upon

obtaining stockholder approval for the Merger and is expected to

occur immediately prior to or concurrently with the closing of the

Merger. In the event that the Company shall enter into an agreement

for any such sale or other disposition of its legacy assets at or

prior to the closing of the Merger, the net proceeds received at or

prior to the closing of the Merger will be included in the

calculation of the net cash of the Company as of the closing.

The Company’s future operations are highly

dependent on the success of the Merger and there can be no

assurances that the Merger will be successfully consummated. In the

event that the Company does not complete the Merger, the Company

may explore strategic alternatives, including, without limitation,

another strategic transaction and/or pursue a dissolution and

liquidation of the Company.

Second Quarter 2024 Summary Financial

Results

Cash and cash equivalents were

$33.3 million as of June 30, 2024, compared to $37.4 million as of

December 31, 2023. ARCA believes that its current cash and cash

equivalents, consisting primarily of money market funds, will be

sufficient to fund its operations through the end of 2025. Our

future viability beyond that point is dependent on the results of

the strategic review process and our ability to raise additional

capital to fund our operations. We expect to continue to incur

costs and expenditures in connection with the process of evaluating

strategic alternatives. There can be no assurance, however, that we

will be able to successfully consummate any particular strategic

transaction, including the Merger. The process of continuing to

evaluate these strategic options may be very costly, time-consuming

and complex and we have incurred, and may in the future incur,

significant costs related to this continued evaluation, such as

legal, accounting and advisory fees and expenses and other related

charges.

General and administrative (G&A)

expenses were $3.0 million for the quarter ended

June 30, 2024, compared to $1.7 million for the

corresponding period in 2023, an increase of approximately $1.3

million. During the three months ended June 30, 2024, we recorded

$370,000 for one-time termination benefits related to the

separation of Dr. Michael Bristow, the former Chief Executive

Officer of ARCA, effective April 3, 2024. The increase for the

three month period was primarily the result of a $0.9 million

increase in professional fees primarily related to the Merger

Agreement discussed above and $0.4 million higher one-time

termination benefits from the termination discussed above in 2024.

G&A expenses in 2024 are expected to be higher than those in

2023 as we incur professional fees related to the Merger Agreement

discussed above and maintain administrative activities to support

our ongoing operations. We expect to incur significant costs

related to our exploration of strategic alternatives and the

Merger, including legal, accounting and advisory expenses and other

related charges.

Research and development (R&D)

expenses were $0.1 million for the quarter ended

June 30, 2024, compared to $0.3 million for the

corresponding period in 2023. Of the $0.2 million decrease in

R&D expenses in the second quarter of 2024 as compared to the

second quarter of 2023, $0.1 million was primarily related to

decreased headcount and $0.1 million was primarily related to the

unrestricted research grants with ARCA’s former President and Chief

Executive Officer’s academic research laboratory at the University

of Colorado. There was no expense under these arrangements for the

three months ended June 30, 2024. Total expense under

these arrangements for the three months ended June 30, 2023

was $0.1 million. In December 2023, the Company made a payment of

$125,000 for the grant period July 2022 through December 2023 under

these arrangements. As discussed above, the former President and

Chief Executive Officer resigned in April 2024. R&D expense in

2024 is expected to be lower than 2023 while we explore strategic

alternatives. Should we resume clinical trials of product

candidates, we expect research and development costs to increase

significantly for the foreseeable future as our product candidate

development programs progress.

Total operating expenses for

the quarter ended June 30, 2024 were $3.1 million compared to $2.0

million for the second quarter of 2023.

Net loss for the quarter ended

June 30, 2024 was $2.7 million, or $0.18 per basic and diluted

share, compared to $1.5 million, or $0.10 per basic and diluted

share in the second quarter of 2023.

About ARCA biopharmaARCA

biopharma is dedicated to developing genetically and other targeted

therapies for cardiovascular diseases through a precision medicine

approach to drug development. For more information, please visit

www.arcabio.com or follow the Company on LinkedIn.

Safe Harbor Statement

This press release contains "forward-looking

statements" for purposes of the safe harbor provided by the Private

Securities Litigation Reform Act of 1995 concerning ARCA, Oruka,

the proposed pre-closing financing and the proposed merger between

ARCA and Oruka (collectively, the “Proposed Transactions”) and

other matters. These statements include, but are not limited to,

express or implied statements relating to ARCA’s or Oruka’s

management team’s expectations, hopes, beliefs, intentions or

strategies regarding the future including, without limitation,

statements regarding: the Proposed Transactions and the expected

effects, perceived benefits or opportunities, including investment

amounts from investors and expected proceeds, and related timing

with respect thereto, expectations regarding or plans for

discovery, preclinical studies, clinical trials and research and

development programs, in particular with respect to ORKA-001 and

ORKA-002, and any developments or results in connection therewith,

including the target product profile of each of ORKA-001 and

ORKA-002; the anticipated timing of the commencement of and results

from those studies and trials; expectations regarding the use of

proceeds, the sufficiency of post-transaction resources to support

the advancement of Oruka’s pipeline through certain milestones and

the time period over which Oruka’s post-transaction capital

resources will be sufficient to fund its anticipated operations;

the cash balance of the combined entity at closing; expectations

regarding the treatment of psoriasis and associated diseases;

expectations related to ARCA’s contribution and payment of

dividends in connection with the Merger, including the timing

thereof; the expected trading of the combined company’s stock on

Nasdaq under the ticker symbol “ORKA;” potential future development

plans for Gencaro, including ARCA’s ability to continue development

of Gencaro; ARCA’s ability to secure sufficient financing to

support any clinical trials for Gencaro: and the ability of ARCA’s

financial resources to support its operations at the current levels

through the end of fiscal year 2025, ARCA’s ability to obtain

additional funding when needed or enter into a strategic or other

transaction, the extent to which ARCA’s issued and pending patents

may protect ARCA’s products and technology, the potential of such

product candidates to lead to the development of safe or effective

therapies, ARCA’s ability to enter into collaborations, or ARCA’s

ability to maintain listing of its common stock on a national

exchange. These and other factors are identified and described in

more detail in ARCA’s filings with the Securities and Exchange

Commission, including without limitation ARCA’s annual report on

Form 10-K for the year ended December 31, 2023 and the registration

statement on Form S-4, as amended, filed with the SEC, and

subsequent filings. ARCA disclaims any intent or obligation to

update these forward-looking statements.

All forward-looking statements in this press

release are current only as of the date hereof and, except as

required by applicable law, ARCA undertakes no obligation to revise

or update any forward-looking statement, or to make any other

forward-looking statements, whether as a result of new information,

future events or otherwise. All forward-looking statements are

qualified in their entirety by this cautionary statement.

No Offer or Solicitation

This press release and the information contained

herein is not intended to and does not constitute (i) a

solicitation of a proxy, consent or approval with respect to any

securities or in respect of the Proposed Transactions or

(ii) an offer to sell or the solicitation of an offer to

subscribe for or buy or an invitation to purchase or subscribe for

any securities pursuant to the Proposed Transactions or otherwise,

nor shall there be any sale, issuance or transfer of securities in

any jurisdiction in contravention of applicable law. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act of 1933, as amended, or an

exemption therefrom. Subject to certain exceptions to be approved

by the relevant regulators or certain facts to be ascertained, the

public offer will not be made directly or indirectly, in or into

any jurisdiction where to do so would constitute a violation of the

laws of such jurisdiction, or by use of the mails or by any means

or instrumentality (including without limitation, facsimile

transmission, telephone and the internet) of interstate or foreign

commerce, or any facility of a national securities exchange, of any

such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR

DETERMINED IF THIS PRESS RELEASE IS TRUTHFUL OR COMPLETE.

Important Additional Information About the Proposed

Transactions Will be Filed with the SEC

This press release is not a substitute for the

registration statement on Form S-4 or any other document that ARCA

has filed or may file with the SEC in connection with the Proposed

Transactions. In connection with the Proposed Transactions, ARCA

has filed with the SEC a registration statement on

Form S-4, which contains a proxy statement/prospectus of

ARCA. ARCA URGES INVESTORS AND STOCKHOLDERS TO READ THE

REGISTRATION STATEMENT ON FORM S-4, PROXY STATEMENT/PROSPECTUS AND

ANY OTHER RELEVANT DOCUMENTS THAT ARE OR MAY BE FILED WITH THE SEC,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY DO AND WILL CONTAIN

IMPORTANT INFORMATION ABOUT ARCA, ORUKA, THE PROPOSED TRANSACTIONS

AND RELATED MATTERS. Investors and stockholders can obtain free

copies of the proxy statement/prospectus and other documents filed

by ARCA with the SEC through the website maintained by the SEC at

www.sec.gov. Stockholders are urged to read the proxy

statement/prospectus and the other relevant materials filed with

the SEC before making any voting or investment decision with

respect to the Proposed Transactions. In addition, investors and

stockholders should note that ARCA communicates with investors and

the public using its website (https://arcabio.com/investors/).

Participants in the Solicitation

ARCA, Oruka and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from stockholders in connection with the

Proposed Transactions. Information about ARCA’s directors and

executive officers including a description of their interests in

ARCA is included in ARCA’s most recent Annual Report on

Form 10-K, including any information incorporated therein

by reference, as filed with the SEC. Information about ARCA’s and

Oruka’s respective directors and executive officers and their

interests in the Proposed Transactions is included in the proxy

statement/prospectus relating to the Proposed Transactions filed

with the SEC.

Investor & Media

Contact:Jeff Dekker720.940.2122ir@arcabio.com

|

ARCA BIOPHARMA, INC.BALANCE SHEET

DATA(in

thousands)(unaudited) |

|

|

June 30, 2024 |

December 31, 2023 |

| Cash and cash equivalents |

$33,283 |

$37,431 |

| Working capital |

$32,549 |

$36,955 |

| Total assets |

$33,844 |

$37,861 |

| Total stockholders’ equity |

$32,573 |

$37,020 |

|

ARCA BIOPHARMA, INC. STATEMENTS OF

OPERATIONS(unaudited) |

| |

Three Months EndedJune 30, |

|

|

Six Months EndedJune 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

(in thousands, except share and per share

amounts) |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

$ |

2,992 |

|

|

$ |

1,719 |

|

|

$ |

5,309 |

|

|

$ |

3,125 |

|

|

Research and development |

|

130 |

|

|

|

254 |

|

|

|

295 |

|

|

|

644 |

|

|

Total costs and expenses |

|

3,122 |

|

|

|

1,973 |

|

|

|

5,604 |

|

|

|

3,769 |

|

|

Loss from operations |

|

(3,122 |

) |

|

|

(1,973 |

) |

|

|

(5,604 |

) |

|

|

(3,769 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest and other income |

|

444 |

|

|

|

493 |

|

|

|

917 |

|

|

|

943 |

|

|

Net loss |

$ |

(2,678 |

) |

|

$ |

(1,480 |

) |

|

$ |

(4,687 |

) |

|

$ |

(2,826 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.18 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.20 |

) |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

14,506,879 |

|

|

|

14,410,143 |

|

|

|

14,504,011 |

|

|

|

14,410,143 |

|

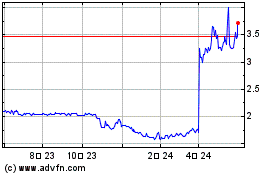

ARCA Biopharma (NASDAQ:ABIO)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

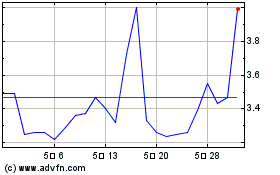

ARCA Biopharma (NASDAQ:ABIO)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024