Enel to Boost Investments, Cash Generation as Part of 2024-26 Strategy

22 11월 2023 - 4:42PM

Dow Jones News

By Giulia Petroni

Enel plans to increase investments, boost cash generation and

carry out cost reductions as part of its strategic plan for the

2024-26 period.

The Rome-based energy company said Wednesday that it plans for

total gross capital expenditure of around 35.8 billion euros

($39.07 billion), with approximately EUR18.6 billion allocated

toward grids and around EUR12.1 billion toward renewables. Net

capex is expected to amount to around EUR26.2 billion.

Enel aims for around EUR43.8 billion of funds from operations to

fully cover investments and dividends, and achieve a total cost

reduction of around EUR1.2 billion in 2026. The company said it

will implement a disposal plan set to have an estimated positive

impact on net debt of around EUR11.5 billion between 2023 and

2024.

Ordinary earnings before interest, taxes, depreciation and

amortization are seen between EUR23.6 billion and EUR24.3 billion

in 2026, while net ordinary income is expected between EUR7.1

billion and EUR7.3 billion.

Enel said its dividend policy comprises a EUR0.43 fixed minimum

dividend per share for the 2024-26 period, with a potential

increase up to a 70% payout on net ordinary income, if cash flow

neutrality is achieved.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 22, 2023 02:27 ET (07:27 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

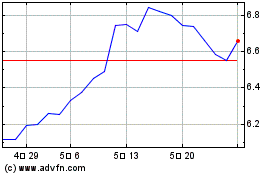

Enel (BIT:ENEL)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

Enel (BIT:ENEL)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024