0001527599false00015275992023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 9, 2023 |

SYNLOGIC, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37566 |

26-1824804 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

301 Binney St. Suite 402 |

|

Cambridge, Massachusetts |

|

02142 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 401-9975 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

SYBX |

|

The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Synlogic, Inc. (the “Company”) announced its financial results for the quarter ended September 30, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

Date: November 9, 2023 |

Synlogic, Inc. |

|

|

By: |

/s/ Michael Jensen |

|

|

Name: Title: |

Michael Jensen

Chief Financial Officer |

Exhibit 99.1

Synlogic Reports Third Quarter 2023 Financial Results and Provides Corporate Update

- Underwritten public offering of $21.0 million and earned $2.5 million milestone payment from Roche collaboration extended cash runway into the first half of 2025 -

- Progress of the Synpheny-3 pivotal trial in phenylketonuria (PKU) supports enrollment completion in 2024, with top-line data in the first half of 2025 -

- Company received Fast Track Designation from the FDA for labafenogene marselecobac (SYNB1934) as a potential treatment for PKU -

Cambridge, Mass. November 9, 2023 – Synlogic, Inc. (Nasdaq: SYBX), a clinical-stage biotechnology company advancing novel, oral, non-systemically absorbed biotherapeutics to transform the care of serious diseases, today reported financial results for the third quarter ended September 30, 2023, and provided a corporate update.

“This quarter brought us important progress on multiple fronts, including the closing of a significant financing which extended our cash runway into the first half of 2025,” said Aoife Brennan, M.B. Ch.B., Synlogic President and Chief Executive Officer. “We are pleased with our progress in Synpheny-3, our ongoing pivotal study in PKU, which is also expected to readout in the first half of 2025, and we are grateful to our investigators and their staff at our clinical trial sites, as well as the PKU community for their continued support and partnership as we execute this landmark trial.”

Recent Business Highlights

•Closing of $21.0 million underwritten public offering, extending the Company’s cash runway into the first half of 2025.

•Progress with Synpheny-3, the pivotal study of labafenogene marselecobac for PKU, with operations across the United States and Canada, with additional countries expected before year-end 2023 and in early 2024.

•Receipt of Fast Track Designation from the FDA for labafenogene marselecobac for the treatment of phenylketonuria.

•Publication of Synpheny-1 Phase 2 study results for the PKU program in the journal Nature Metabolism.

•Presentation of Synpheny-1 Phase 2 study results by lead investigator Dr. Jerry Vockley of the University of Pittsburgh at the 37th E.S.PKU Conference 2023.

•Granting of an important US Patent (US Pat. No. 11,766,463), specifically covering the mutant PAL enzyme expressed by labafenogene marselecobac and extending the patent term exclusivity for SYNB1934 to 2041.

Page 1 of 6

•Earning of $2.5 million milestone payment for the achievement of prespecified success criteria under the research collaboration agreement with Roche for the discovery of a novel Synthetic Biotic for the treatment of inflammatory bowel disease (IBD).

Anticipated Milestones for Synpheny-3 Pivotal Study in PKU

•Data safety monitoring board review of initial subset of data in the first half of 2024, potentially supporting study expansion to include 12- to 18-year-olds.

•Completion of full study enrollment in the second half of 2024.

•Release of top-line data in the first half of 2025.

Upcoming Scientific & Industry Presentations

•Caroline Kurtz, Ph.D., Chief Development Officer at Synlogic, will present “Development of labafenogene marselecobac (SYNB1934), an engineered probiotic designed for the treatment of phenylketonuria (PKU),” on Thursday, November 16th at the 20th Orphan Drugs & Rare Diseases Global Congress 2023 Americas, held in Boston on November 16th and 17th.

•David Lubkowicz, M.S., Head, Strain Engineering & Characterization and HCU Program Lead at Synlogic, will present “Improvements of SYNB1353, an Engineered Bacteria for the Treatment of Homocystinuria Lead to Increased in Vitro and In Vivo Degradation of Methionine,” at the International Conference on Microbiome Engineering 2023, held in Berkley, California on December 8th to 10th.

Third Quarter 2023 Financial Results and Financial Outlook

As of September 30, 2023, Synlogic had cash, cash equivalents and short-term investments of $33.4 million, not inclusive of the October financing of $19.6 million (net), and an additional $2.5 million earned from the Roche research collaboration announced in November.

Revenue for the three months ended September 30, 2023 was $0.4 million compared to $0.7 million for the corresponding period in 2022. Revenue in both periods was primarily associated with the ongoing research collaboration with Roche for the discovery of a novel Synthetic Biotic for the treatment of inflammatory bowel disease.

For the three months ended September 30, 2023, Synlogic reported a consolidated net loss of $12.1 million, or $2.57 per share, compared to a consolidated net loss of $17.9 million, or $3.73 per share, for the corresponding period in 2022.

Research and development expenses were $9.6 million for the three months ended September 30, 2023, compared to $14.6 million for the corresponding period in 2022.

General and administrative expenses were $3.4 million for the three months ended September 30, 2023, compared to $4.4 million for the corresponding period in 2022.

Page 2 of 6

Based upon its current operating plan and inclusive of the net cash proceeds from the October financing and milestone payment from Roche, Synlogic expects to have sufficient cash to be able to fund operations further into the first half of 2025.

Investor Conference Participation

Synlogic leadership will participate in The H.C. Wainwright Global Investment Conference, being held September 11-13, 2023 in-person in New York City. Participation will include both investor meetings and a company presentation. A live webcast of the presentation, if available, will be accessible under the “Event Calendar” in the Investors & Media section of the Synlogic website. An archived version will be available afterwards at the same location.

About Synlogic

Synlogic is a clinical-stage biotechnology company advancing novel, oral, non-systemically absorbed biotherapeutics to transform the care of serious diseases in need of new treatment options. The Company’s late-stage pipeline is focused on rare metabolic diseases, led by labafenogene marselecobac (SYNB1934), currently being studied as a potential treatment for phenylketonuria (PKU) in Synpheny-3, a global, pivotal Phase 3 study. Additional product candidates address diseases including homocystinuria (HCU), enteric hyperoxaluria, gout, and cystinuria. This pipeline is fueled by the Synthetic Biotic platform, which applies precision genetic engineering to well-characterized probiotics. This enables Synlogic to create GI-restricted, oral medicines designed to consume or modify disease-specific metabolites – an approach well suited for PKU and HCU, both inborn errors of metabolism, as well as other disorders in which the disease–specific metabolites transit through the GI tract, providing validated targets for these Synthetic Biotics. Research activities include a partnership with Roche focused on inflammatory bowel disease (IBD), and a collaboration with Ginkgo Bioworks in synthetic biology, which has contributed to two pipeline programs to date. For more information, please visit www.synlogictx.com or follow us on Twitter, LinkedIn, Facebook or Instagram.

Forward Looking Statements

This press release contains "forward-looking statements" that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this press release regarding strategy, future operations, clinical development plans, future financial position, future revenue, projected expenses, prospects, plans and objectives of management are forward-looking statements. In addition, when or if used in this press release, the words "may," "could," "should," "anticipate," "believe," "look forward, " "estimate," "expect," “focused on,” "intend," "on track, " "plan," "predict" and similar expressions and their variants, as they relate to Synlogic, may identify forward-looking statements. Examples of forward-looking statements, include, but are

Page 3 of 6

not limited to, statements regarding the potential of Synlogic's approach to Synthetic Biotics to develop therapeutics to address a wide range of diseases including: inborn errors of metabolism and inflammatory and immune disorders; our expectations about sufficiency of our existing cash balance; the future clinical development of Synthetic Biotics; the approach Synlogic is taking to discover and develop novel therapeutics using synthetic biology; and the expected timing of Synlogic's clinical trials of labafenogene marselecobac (previously known as SYNB1934), SYNB1353, SYNB8802 and SYNB2081 and availability of clinical trial data. Actual results could differ materially from those contained in any forward-looking statements as a result of various factors, including: the uncertainties inherent in the clinical and preclinical development process; the ability of Synlogic to protect its intellectual property rights; and legislative, regulatory, political and economic developments, as well as those risks identified under the heading "Risk Factors" in Synlogic's filings with the U.S. Securities and Exchange Commission. The forward-looking statements contained in this press release reflect Synlogic's current views with respect to future events. Synlogic anticipates that subsequent events and developments will cause its views to change. However, while Synlogic may elect to update these forward-looking statements in the future, Synlogic specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Synlogic's view as of any date subsequent to the date hereof.

----

Media Contact: media@synlogictx.com

Investor Relations: investor@synlogictx.com

Page 4 of 6

Synlogic, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands except share and per share data) |

|

For the Three Months Ended

September 30 |

|

|

For the Nine Months Ended

September 30 |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

393 |

|

|

$ |

678 |

|

|

$ |

602 |

|

|

$ |

1,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

9,616 |

|

|

|

14,610 |

|

|

|

33,831 |

|

|

|

38,405 |

|

General and administrative |

|

|

3,400 |

|

|

|

4,402 |

|

|

|

11,291 |

|

|

|

12,785 |

|

Total operating expenses |

|

|

13,016 |

|

|

|

19,012 |

|

|

|

45,122 |

|

|

|

51,190 |

|

Loss from operations |

|

|

(12,623 |

) |

|

|

(18,334 |

) |

|

|

(44,520 |

) |

|

|

(50,116 |

) |

Other income, net |

|

|

548 |

|

|

|

422 |

|

|

|

1,784 |

|

|

|

665 |

|

Loss before income taxes |

|

|

(12,075 |

) |

|

|

(17,912 |

) |

|

|

(42,736 |

) |

|

|

(49,451 |

) |

Income tax expense |

|

|

(3 |

) |

|

|

- |

|

|

|

(12 |

) |

|

|

- |

|

Net loss |

|

$ |

(12,078 |

) |

|

$ |

(17,912 |

) |

|

$ |

(42,748 |

) |

|

$ |

(49,451 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

|

$ |

(2.57 |

) |

|

$ |

(3.73 |

) |

|

$ |

(9.17 |

) |

|

$ |

(10.29 |

) |

Weighted-average common shares used in computing net loss per share - basic and diluted |

|

|

4,699,847 |

|

|

|

4,807,207 |

|

|

|

4,662,444 |

|

|

|

4,804,127 |

|

Page 5 of 6

Synlogic, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

|

|

|

|

|

|

|

|

|

(in thousands, except share data) |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents, & marketable securities |

|

$ |

33,415 |

|

|

$ |

77,629 |

|

Property and equipment, net |

|

|

5,949 |

|

|

|

7,323 |

|

Other assets |

|

|

26,890 |

|

|

|

25,913 |

|

Total assets |

|

$ |

66,254 |

|

|

$ |

110,865 |

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

Current liabilities |

|

$ |

9,144 |

|

|

$ |

12,122 |

|

Long-term liabilities |

|

|

13,706 |

|

|

|

16,133 |

|

Total liabilities |

|

|

22,850 |

|

|

|

28,255 |

|

Total stockholders' equity |

|

|

43,404 |

|

|

|

82,610 |

|

Total liabilities and stockholders' equity |

|

$ |

66,254 |

|

|

$ |

110,865 |

|

|

|

|

|

|

|

|

Common stock and common stock equivalents |

|

|

|

|

|

|

Common stock |

|

|

4,598,297 |

|

|

|

4,449,082 |

|

Common stock warrants (pre-funded) |

|

|

169,874 |

|

|

|

169,874 |

|

Total common stock |

|

|

4,768,171 |

|

|

|

4,618,956 |

|

Page 6 of 6

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

SYNLOGIC, INC.

|

| Entity Central Index Key |

0001527599

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37566

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

26-1824804

|

| Entity Address, Address Line One |

301 Binney

|

| Entity Address, Address Line Two |

St.

|

| Entity Address, Address Line Three |

Suite 402

|

| Entity Address, City or Town |

Cambridge

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02142

|

| City Area Code |

(617)

|

| Local Phone Number |

401-9975

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SYBX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

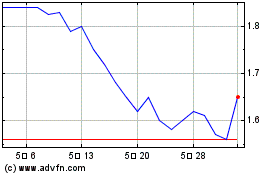

Synlogic (NASDAQ:SYBX)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

Synlogic (NASDAQ:SYBX)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024