Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-275112

PROSPECTUS

SUPPLEMENT No. 3

(To Prospectus Dated October 30, 2023

and Prospectus

Supplement dated May 28, 2024)

8,749,940

Shares of Common Stock

Pursuant

to this prospectus supplement, the accompanying prospectus supplement and the accompanying base prospectus, we are offering 8,749,940

shares of our common stock, par value $0.0001 per share, to Triton Funds LP (“Triton”) pursuant to our previously announced

Common Stock Purchase Agreement with Triton dated May 28, 2024, as amended by Amendment No. 1 thereto dated June 3, 2024 (the “CSPA”).

These shares are being issued as in connection with the commitment by Triton to purchase from time to time up to $5,000,000 of shares

of our common stock pursuant to the CSPA.

The

sale we request under the CSPA may be for a number of shares of our common stock that does not exceed 9.9% of our outstanding shares

immediately prior to the issuance of shares of our common stock issuable pursuant to such request. Each such request creates a binding

agreement to sell such shares on the part of the Company and to acquire such shares on the part of Triton (a “Purchase Notice”).

Triton

also committed to purchase a number of additional shares such that the total proceeds to be received by us on or before June 7, 2024

pursuant to the CSPA exceeded $3,000,000, including those shares that are the subject of the Purchase Notices (such shares, the “Backstop

Shares”). The Backstop Shares, totaling 26,259,020 shares, were purchased at a price per share of $0.0759 resulting in further

gross proceeds of $1,993,059.62.

Subject

to receiving shareholder approval for the CSPA and issuances thereunder, which occurred on July 16, 2024, we also agreed to issue

8,749,940 additional shares of our common stock to Triton (the “True-Up Shares” and together with the Backstop Shares

“the Shares”) of a value such that it will receive the number of shares that it would have received had the purchase

price for the Backstop Shares been the Purchase Price (e.g. $0.05175) rather than the Minimum

Price (e.g. 0.0759). The final amount of True-Up Shares to be issued was to be based on the Minimum Price three trading days

following the receipt of shareholder approval. The proceeds from the issuance of the Shares were used for working capital and

general corporate purposes.

This

prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus also cover the sale of these shares by

Triton to the public. Triton is deemed to be an “underwriter” within the meaning of the Securities Act of 1933, as amended

(the “Securities Act”), and the compensation and discounts received by Triton will be deemed to be underwriting commissions

or discounts. We will pay for expenses of this offering. For additional information on the methods of sale that may be used by Triton,

see the section entitled “Plan of Distribution” on page S-15 of the accompanying prospectus supplement.

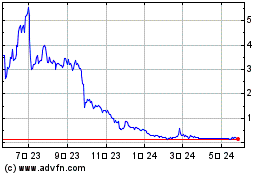

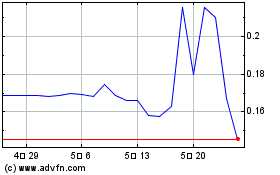

Our

common stock is listed on the Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “PRST”. On August 6, 2024,

the closing price of our common stock, as reported on the Nasdaq, was $0.03 per share.

Investing

in our common stock involves a high degree of risk. Before making an investment decision, please read carefully the discussion of material

risks of investing in our common stock under the heading “Risk Factors” beginning on page S-6 of the accompanying prospectus

supplement and in the documents incorporated by reference into the accompanying prospectus supplement.

In

particular, you should note that the Company is required to raise $2.0 million on or before each of August 1, 2024, August 15, 2024 and

August 29, 2024 (each, a “Forbearance Date”) for a cumulative total of $6.0 million in order to prevent its senior secured

lender from exercising remedies against the Company, including but not limited to an Article 9 foreclosure, which would result in the

Company’s common stock, including the common stock offered hereby, becoming worthless. There is no guarantee from any third-party

for such amounts. The Company received a waiver from the Lenders with respect to the August 1, 2024 Forbearance Date requiring it to

raise $4.0 million by August 15, 2024. Accordingly, you will lose all of your investment if the Company does not raise the amounts described

above.

The

Company is required to raise an additional $32.0 million by no later than the Forbearance Date in order to facilitate negotiations with

its senior secured lender for the assignment and restructuring of its loan. The Company has received no indications of interest from

outside investors to make such investment since the opportunity to seek such an investment was granted on May 16, 2024. While there exists

a possibility that such an investment may be secured, the Company considers this outcome to be extremely unlikely. Accordingly, the Company

believes that it is extremely likely that you will lose all of your investment in this offering because the senior secured lender will

be free to exercise remedies at that time.

The

direct use of proceeds for this offering is working capital and other general corporate purposes. However, indirectly the funds raised

in this offering may solely benefit our senior secured lender with whom we are currently cooperating to find a potential purchaser for

our business in the event of an Article 9 foreclosure. By funding our business through this offering until such a purchaser is located,

the date on which our lender would need to fund our business and operations prior to any such sale is deferred.

On

August 6, 2024, the Company received a letter from Nasdaq informing the Company that its shares of common stock and its warrants will

be suspended at the open of business on August 8, 2024 and that Nasdaq will file a Form 25-NSE with the Securities and Exchange Commission

(the “SEC”), which will remove the Company’s securities from listing and registration on Nasdaq. The Company expects

that the trading of its common stock will transition to the OTC Bulletin Board or “pink sheets” market shortly. The transition

to over-the-counter markets is not expected to affect the Company’s operations or business and does not change its reporting requirements

under SEC rules. The Company cannot predict what the impact of the transition will be on the liquidity in its Common Stock.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

This

prospectus supplement is dated August 7, 2024.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

SUPPLEMENT DATED MAY 28, 2024

PROSPECTUS

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

supplement and the accompanying prospectus. We have not authorized anyone to provide you with information different from that contained

or incorporated by reference into this prospectus. If any person does provide you with information that differs from what is contained

or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other person is authorized to give

any information or to represent anything not contained in this prospectus supplement, the accompanying prospectus supplement and the

accompanying prospectus. You should assume that the information contained in this prospectus supplement, the accompanying prospectus

supplement and the accompanying prospectus is accurate only as of the date on the front of the document and that any information contained

in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless

of the time of delivery of this prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus or any

sale of a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities by anyone in any jurisdiction

in which such offer or solicitation is not authorized, or in which the person is not qualified to do so or to any person to whom it is

unlawful to make such offer or solicitation.

THE

OFFERING

| Securities

Offered |

8,749,940 shares

of common stock of Presto Automation Inc. |

| |

|

| Purchaser |

Triton Funds LP pursuant

to the Common Stock Purchase Agreement dated May 28, 2024, as amended by Amendment No.1 thereto dated June 3, 2024. |

| |

|

| Purchase price |

$0.0569 |

| |

|

| Gross proceeds |

$1,993,059.62 |

| |

|

| Use of Proceeds |

The proceeds from this

offering will be used for working capital and general corporate purposes. |

| |

|

| Symbol for our common stock

on Nasdaq |

“PRST” |

| |

|

| Resale |

This prospectus supplement,

the accompanying prospectus supplement and the accompanying prospectus also cover the resale of shares by Triton Funds LP to the

public. See “Plan of Distribution” in the accompanying prospectus supplement. |

PROSPECTUS

SUPPLEMENT

(To Prospectus Dated October 30, 2023)

Up

to $5,000,000 of Common Stock

We

entered into a Common Stock Purchase Agreement with Triton Funds LP (“Triton”) on May 28, 2024 (the “CSPA”).

Pursuant to the CSPA, we have the right, but not the obligation, to sell to Triton up to $5,000,000 of our shares of common stock, par

value $0.0001 per share, offered by this prospectus supplement and the

accompanying prospectus at our request any time during the commitment period commencing on May

28, 2024 and terminating on the earlier of (i) December 31, 2024 or (ii) the date on which Triton shall have purchased shares

of our common stock pursuant to the CSPA equal to the investment amount of $5,000,000 (the “Commitment Period”).

Each

sale we request under the CSPA (a “Purchase Notice”) may be for a number of shares of our common stock that does not exceed

9.9% of our outstanding shares, which 9.9% amount is currently 9,988,465 shares as of the date of the CSPA (the “Commitment Shares”).

Triton has committed to purchase the Commitment Shares at the lowest of (i)

the official closing price of our common stock on the Nasdaq Stock Market on the trading

day immediately preceding our submission of a Purchase Notice to Triton, (ii) the average official closing price of our common stock

on the Nasdaq Stock Market for the five consecutive trading days ending on the business

day immediately preceding our submission of a Purchase Notice to Triton, and (iii) 75% of the lowest traded price of the common stock

five days prior to the closing date for that tranche of shares. The price in (i) and (ii) is referred

to as the “Minimum Price” and the price in (i), (ii) and (iii) is referred to as the “Purchase Price”.

Triton

has committed to purchase a number of additional shares such that the total proceeds to be received by us on or before June 7, 2024 pursuant

to the CSPA will exceed $3,000,000, including those shares that are the subject of the Purchase

Notices (such shares, the “Backstop Shares”). The Backstop Shares will be purchased

at (x) the Purchase Price, if relief provided by Nasdaq Rule 5635(f) (the “Financial Viability Relief”) has been sought

and granted to us and such relief permits the receipt of proceeds from the sale of common stock on or before June 7, 2024, or (y) the

Minimum Price, if the Financial Viability Relief has not been sought or granted or cannot generate such proceeds on or before June 7,

2024. Triton’s obligation with respect to purchasing the Backstop Shares is conditioned on (i) us having timely delivered a first

Purchase Notice for 9.9% of our outstanding shares within one business day of the execution of the CSPA,

and (ii) us having timely delivered a second Purchase Notice for 9.9% of our outstanding shares to Triton within one business day after

the closing related to such first Purchase Notice unless Triton has failed to comply with its obligation, in which case we are not obligated

to deliver such second Purchase Notice.

This

prospectus supplement and the accompanying prospectus also cover the sale of these shares by Triton to the public. Triton is deemed to

be an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and

the compensation and discounts received by Triton will be deemed to be underwriting commissions or discounts. We will pay for expenses

of this offering. For additional information on the methods of sale that may be used by Triton, see the section entitled “Plan

of Distribution” on page S-15.

Our

common stock is listed on the Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “PRST”. On May 24, 2024,

the closing price of our common stock, as reported on the Nasdaq, was $0.15 per share.

Investing

in our common stock involves a high degree of risk. Before making an investment decision, please read carefully the discussion of material

risks of investing in our common stock under the heading “Risk Factors” beginning on page S-6 of this prospectus supplement

and in the documents incorporated by reference into this prospectus supplement.

In

particular, you should note that we must raise $3.0 million before June 7, 2024 and a further $32.0 million before July 15, 2024 in order

to avoid a default under our existing credit agreement and the likely exercise of remedies by our senior secured lender. We cannot give

you any assurance that will be successful in raising these funds and, if we fail to do so, you will lose your investment. Please see

“Risk Factors” beginning on page S-6 of this prospectus supplement for addition information on these risks.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus supplement is dated May 28, 2024

TABLE

OF CONTENTS

Prospectus

Supplement

PROSPECTUS

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

We have not authorized anyone to provide you with information different from that contained or incorporated by reference into this prospectus.

If any person does provide you with information that differs from what is contained or incorporated by reference in this prospectus,

you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not

contained in this prospectus supplement and the accompanying prospectus. You should assume that the information contained in this prospectus

supplement and the accompanying prospectus is accurate only as of the date on the front of the document and that any information contained

in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless

of the time of delivery of this prospectus supplement, the accompanying prospectus or any sale of a security. These documents are not

an offer to sell or a solicitation of an offer to buy these securities by anyone in any jurisdiction in which such offer or solicitation

is not authorized, or in which the person is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a “shelf” registration statement on Form S-3 (File

No. 333-275112) that we initially filed with the SEC on October 20, 2023, and was declared

effective on October 30, 2023. Under this shelf registration process, we may, from time to time, sell any combination of the securities

described in the accompanying prospectus in one or more offerings up to a total dollar amount of $75,000,000.

This

prospectus supplement provides specific details regarding the issuance of up to $5,000,000 of shares of our common stock pursuant to

the CSPA. To the extent there is a conflict between the information contained in this prospectus supplement and accompanying prospectus,

you should rely on the information in this prospectus supplement. Generally, when we refer to this prospectus supplement, we are referring

to both parts of this document combined together with all documents incorporated by reference. This prospectus supplement, the accompanying

prospectus and the documents we incorporate by reference herein and therein include important information about us and our common stock,

and other information you should know before investing. You should read this prospectus supplement, the accompanying prospectus and the

documents incorporated by reference in this prospectus supplement and the accompanying prospectus before making an investment decision.

You should also read and consider the information in the documents referred to in the sections of this prospectus supplement entitled

“Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering (this “Offering”)

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information

about the shares of our common stock and other securities we may offer from time to time under our shelf registration statement, some

of which does not apply to the common stock offered by this prospectus supplement.

You

should rely only on the information contained in or incorporated by reference into this prospectus supplement or contained in or incorporated

by reference into the accompanying prospectus to which we have referred you. We have not authorized anyone to provide you with information

that is different. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained

in, or incorporated by reference into, this prospectus supplement and contained in, or incorporated by reference into, the accompanying

prospectus is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and

the accompanying prospectus or of any sale of securities.

We

are offering to sell, and are seeking offers to buy, the shares of common stock only in jurisdictions where such offers and sales are

permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the shares of common stock

in certain states or jurisdictions or to certain persons within such states and jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about

and observe any restrictions relating to the offering of the shares of common stock and the distribution of this prospectus supplement

and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute,

and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus

supplement and the accompanying prospectus by any person in any state or jurisdiction in which it is unlawful for such person to make

such an offer or solicitation.

Unless

the context requires otherwise, references in this prospectus to “Presto,” “we,” “us” and “our”

refer to Presto Automation Inc. and its consolidated subsidiaries, unless otherwise specified.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933,

as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange

Act, and are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking

statements include information concerning our possible or assumed future results of our business and statements regarding our financial

condition, results of operations, liquidity, plans and objectives. Forward-looking statements include all statements that are not historical

facts and in some cases can be identified by terminology such as “believe,” “may,” “anticipate,”

“estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,”

“expect,” “predict,” “project,” “potential,” “will,” or the negative of these

terms or other similar expressions that convey uncertainty of future events or outcomes.

These

statements are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking

statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain

events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or

contribute to such differences are discussed in the section titled “Risk Factors” included in our Annual Report on Form 10-K for

the year ended June 30, 2023 filed with the SEC on October 11, 2023, as amended by Amendment No. 1 on Form 10-K/A filed with

the SEC on October 12, 2023 (the “2023 Form 10-K”), and other risk factors detailed from time to time in filings

with the SEC. Our ability to predict the results of our operations or the effects of various events on our operating results is inherently

uncertain. Therefore, we caution you to consider carefully the matters described under the caption “Risk Factors” and certain

other matters discussed in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein, and other publicly available sources. Such factors and many other factors beyond the control of our management could cause

our actual results, performance or achievements to differ materially from any future results, performance or achievements that may be

expressed or implied by the forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other

applicable laws, we do not intend to update or revise any forward-looking statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere in this prospectus supplement. This summary does not contain all of the information

that you should consider before deciding whether to invest in our common stock. You should read this entire prospectus supplement carefully,

including accompanying prospectus, the “Risk Factors” section in this prospectus supplement, the risks set forth under the

heading “Risk Factors” in the 2023 Form 10-K, and the other documents incorporated by reference in this prospectus supplement

and the accompanying prospectus, prior to making an investment decision. References in this prospectus supplement to “we,”

“us,” “our,” the “Company,” and “Presto” refer to Presto Automation Inc. unless otherwise

stated or the context otherwise requires.

Our

Business

Overview

Presto

provides enterprise-grade AI and automation solutions to the restaurant industry. Presto’s solutions are designed to decrease labor

costs, improve staff productivity, increase revenue and enhance the guest experience. We offer our industry-leading AI solution, Presto

Voice, to quick service restaurants (QSR), and we have some of the most recognized restaurant names in the United States as our customers.

Following

our founding in 2008, we initially focused exclusively on Presto Touch, a pay-at-table tablet solution. As

a result of the Presto Voice opportunities, we have taken decisive action to focus on this solution and, as has been disclosed previously,

to wind down our Presto Touch pay-at-table product. Presto will exit this business line with the expiration of our final customer contracts

at the end of June 2024. Our Presto Voice product line addresses the pressing needs of drive-thru restaurant operators by improving

order accuracy, reducing labor costs and increasing revenue through menu upselling, while also providing guests with an improved drive-thru

experience.

Cooperation

Agreement

On

May 16, 2024, we and Presto Automation LLC (the “Borrower”), our wholly owned subsidiary (the “Loan Parties”),

entered into a Cooperation Agreement (the “Cooperation Agreement”) with Metropolitan Partners Group Administration, LLC,

the administrative, payment and collateral agent (the “Agent”) under the Credit Agreement, dated as of September 21, 2022

(as amended, the “Credit Agreement”), Metropolitan Levered Partners Fund VII, LP, Metropolitan Partners Fund VII, LP, Metropolitan

Offshore Partners Fund VII, LP and CEOF Holdings LP (collectively, the “Lenders”), and certain significant stockholders.

Extension

to Forbearance Date and Related Terms

The

Cooperation Agreement provides that the Lenders will not exercise remedies as a result of certain continuing events of default under

the Credit Agreement, if we raise $3,000,000 or more of working capital by June 7, 2024 (the “Capital Raise”), in which event

the Agent and the Lenders agree to extend the Forbearance termination date to July 15, 2024 (“Forbearance”). The CSPA and

this Offering are intended to enable us to satisfy that requirement.

Assuming

continued Forbearance, the Lenders have agreed to engage in good faith discussions with a view to concluding a binding agreement with

a third party based on a binding written offer (the “Offer”) from such third party submitted by any Loan Party or Significant

Stakeholder (as defined in the Cooperation Agreement) to purchase all of the Lenders’ rights and obligations under the Loan Documents,

provided that such Offer is (A) for a cash purchase price of at least $20.0 million, (B) accompanied by a binding commitment by

the Borrower to issue one or more promissory notes to the Lenders (the “Convertible Notes”) in an aggregate principal amount

equal to fifty percent (50%) of the outstanding balance of the Obligations (as defined in the Credit Agreement) less the proposed cash

purchase price, which Convertible Notes shall be convertible into equity of the Company of the same class and on the same terms as are

set out in that certain convertible subordinated note issued to Remus Capital Series B II, L.P. on January 30, 2024, and (C) accompanied

by evidence, in form and substance satisfactory to Lenders in their sole discretion, reflecting that the Offer will provide us with operating

capital of not less than $18.0 million, not including the cash purchase price described in subparagraph (A) above. To the extent that

the operating capital is less than $18.0 million but greater than $12.0 million, the amount of the convertible note set forth above will

be increased by a dollar amount equal the reduction in operating capital below $18.0 million

Cooperation

in Connection with Sale of the Company

In

the event of termination of Forbearance, the Loan Parties have agreed to cooperate and not impede in the exercise of the Agent’s

and Lenders’ rights and remedies under the Loan Documents (as defined in the Credit Agreement), including, among other things,

the realization of their collateral and a potential sale process under Article 9 of the Uniform Commercial Code. In the event of such

outcome, it is likely that the holders of shares of our common stock, including the shares purchased in this Offering, will receive no

value and the shares will become worthless.

Development

of Alternative Path

We

have agreed to maintain a committee of independent directors to work with the Lenders on the development and execution of a strategic

plan (the “Alternative Path”) to address our obligations under the Credit Agreement in the event that Forbearance ends, including

directing our professional advisors to work with the Agent in the development and execution of the Alternative Path, including the identification

and solicitation of additional financing sources. We have agreed to provide access to properties, systems and our access to various types

of information as the Lenders reasonably request and make reasonably available its directors, officers, employees and advisors.

Release

from Claims

We,

together with our past, present and future successors, assigns, managers, members, officers, directors, agents, employees, professionals

and other representatives (in their capacities as such and not in any other capacity), and entities affiliated with Remus Capital Series

B II, L.P. and Presto CA LLC (an affiliate of Cleveland Avenue, LLC) together

with their respective past, present and future successors and assigns released the Agent and the Lenders from any claims related to our

forbearance agreement, the Credit Agreement and any Loan Documents.

Update

Regarding Liquidity

As

of May 24, 2024, we had $2.8 million of cash and cash equivalents.

Assuming

that we raise $3,000,000 from the transactions contemplated by the CSPA including this Offering, we expect to be able to sustain our

operations through July 15, 2024, which is the same date that the Forbearance terminates. After that time, absent a further capital raise,

and assuming the Lenders have not previously sold their loan, the Agent and Lenders will no longer be required to forbear from exercising

rights and remedies against us under the Credit Agreement as a result of defaults under the Credit Agreement, and the Note will be due

and payable. See “—Cooperation Agreement— Cooperation in Connection with Sale of the Company.”

Potential

Anti-Dilution Impact of this Offering

If

the Purchase Price of our common stock in this Offering is less than $0.14 per share, the Offering will trigger anti-dilution adjustment

provisions pursuant to the following instruments:

(1)

the securities purchase agreement, dated October 10, 2023, between the Company and Presto CA (the “CA Purchase Agreement”);

(2)

the common stock purchase agreements, dated November 17, 2023, between the Company and several investors (the “November 2023 Purchase

Agreements”) solely with respect to those parties that also participated in our offering of common stock set forth under subparagraph

(5) below;

(3)

the warrants to purchase shares of common stock of the Company initially issued to the Lenders on October 16, 2023 (as amended and restated,

the “Third Amendment Conversion Warrants”);

(4)

the warrants to purchase shares of common stock of the Company initially issued to the Lenders on January 30, 2024 (as amended and restated,

the “Fifth Amendment Conversion Warrants”);

(5)

the subordinated convertible notes issued on January 30, 2024 (the “January 2024 Notes”); and

(6)

the securities purchase agreement, dated as of May 20, 2024, between the Company and the purchasers thereto (the “May 2024 Purchase

Agreement”).

For

illustrative purposes, assuming the above amendments, extensions and reinstatements are effective, if we were to undertake an offering

in the future at a purchase price of $0.10 per share, we would be required to issue approximately 8.6 million additional shares to Presto

CA under the CA Purchase Agreement, 16.8 million additional shares to the November 2023 purchasers under the November 2023 Purchase Agreements,

approximately 15.9 million additional shares underlying the Third Amendment Conversion Warrants, approximately 6.0 million additional

shares underlying the Fifth Amendment Conversion Warrants, approximately 25.7 million additional shares underlying the principal of the

January 2024 Notes and approximately 4.4 million additional shares underlying the May 2024 Purchase Agreement.

Corporate

Information

Our

principal executive office is located at 985 Industrial Road, San Carlos, CA 94070. Our telephone number is (650) 817-9012. Our website

address is www.presto.com. Information on or connected to our website is not a part of or incorporated by reference into this prospectus

supplement.

THE

OFFERING

| Common stock offered by us |

Up to $5.0 million of shares

of common stock. |

| |

|

| Common stock outstanding after this Offering |

134,226,924 shares of common stock, which

assumes the sale of shares our common stock at a price of $0.15 per share, which was the closing price of our common stock, for the

up to $5,000,000 of shares of our common stock we may sell to Triton from time to time. The actual sale price will likely be lower.

The actual number of shares of our common stock issued will vary depending on the sales prices under this Offering. |

| |

|

| Commitment Shares |

Each sale we request

under the CSPA (a “Purchase Notice”) may be for a number of shares of our common stock that does not exceed 9.9% of our

outstanding shares, which 9.9% amount is currently 9,988,465 shares as of the date of the CSPA (the “Commitment Shares”). Triton

has committed to purchase the Commitment Shares at the lowest of (i) the official closing price of our common stock on the Nasdaq

Stock Market on the trading day immediately preceding our submission of a Purchase Notice to Triton, (ii) the average official closing

price of our common stock on the Nasdaq Stock Market for the five consecutive trading days ending on the business day immediately

preceding our submission of a Purchase Notice to Triton, and (iii) 75% of the lowest traded price of the common stock five days prior

to the closing date for that tranche of shares. The price in (i) and (ii) is referred to as the “Minimum Price”

and the price in (i), (ii) and (iii) is referred to as the Purchase Price. |

| |

|

| Backstop Shares |

Triton has committed to purchase a number

of additional shares such that the total proceeds to be received by us on or before June 7, 2024 pursuant to the CSPA

will exceed $3,000,000, including those shares that are the subject of the Purchase Notices (such shares, the “Backstop

Shares”). The Backstop Shares will be purchased at (x) the Purchase Price, if

relief provided by Nasdaq Rule 5635(f) (the “Financial Viability Relief”) has been sought and granted to us and such

relief permits the receipt of proceeds from the sale of common stock on or before June 7, 2024, or (y) the Minimum Price, if the

Financial Viability Relief has not been sought or granted or cannot generate such proceeds on or before June 7, 2024. Triton’s

obligation with respect to purchasing the Backstop Shares is conditioned on (i) us having timely delivered a first Purchase Notice

for 9.9% of our outstanding shares within one business day of the execution of the CSPA,

and (ii) us having timely delivered a second Purchase Notice for 9.9% of our outstanding shares to Triton within one business day

after the closing related to such first Purchase Notice unless Triton has failed to comply with its obligation in which case we are

not obligated to deliver such second Purchase Notice. |

| |

|

| Use of proceeds |

We intend to use the net proceeds from this

Offering for working capital and general corporate purposes. See “Use of Proceeds.” |

| |

|

| Listing |

Our common stock is listed on Nasdaq under

the trading symbol “PRST.” |

| |

|

| Anti-dilution issuance |

If the Purchase Price of our common stock

in this Offering is less than $0.14 per share, the Offering will trigger anti-dilution adjustment provisions in our existing agreements. See

“Summary — Potential Anti-Dilution Impact of this Offering.” See the information below for the

number of shares issued or issuable. |

| Risk factors |

Investing

in our common stock involves a high degree of risk. In particular, you should note that we must raise $3.0 million before June 7,

2024 and a further $32.0 million before July 15, 2024 in order to avoid a default under our existing credit agreement and the likely

exercise of remedies by our senior secured lender. We cannot give you any assurance that will be successful in raising these funds

and, if we fail to do so, you will lose your investment.

You

should read the section titled “Risk Factors,” and the other information included, or incorporated by reference, in this

prospectus supplement for a discussion of some of the risks and uncertainties you should carefully consider before deciding to invest

in our common stock. |

Unless

otherwise indicated, all information in this prospectus relating to the number of shares of our common stock outstanding is based on

100,893,591 shares of common stock outstanding as of May 24, 2024 and does not include:

| ● | approximately

5.0 million shares of common stock pending issuance pursuant to the May 2024 Purchase Agreement; |

| ● | shares

of common stock issuable upon the exercise of certain outstanding warrants outstanding as

of May 20, 2024 as follows: |

| Shares

Underlying Warrants | |

Exercise

Price | |

| 35,847,239 | |

$ | 0.01 | |

| 639,026 | |

$ | 0.37 | |

| 294,725 | |

$ | 6.53 | |

| 71,101 | |

$ | 7.80 | |

| 584,648 | |

$ | 8.16 | |

| 8,625,000 | |

$ | 8.21 | |

| 170,993 | |

$ | 9.25 | |

| 7,625,000 | |

$ | 11.50 | |

| ● | 3,284,075

shares of common stock underlying outstanding restricted stock units (“RSUs”)

as of May 20, 2024 and 5,638,810 shares issuable upon the exercise of stock options outstanding

as of May 20, 2024 previously granted under the Company’s equity incentive plans; |

| ● | 60,991,568

shares of common stock underlying warrants with an exercise price of $0.01 per share held

by the Agent and the Lenders in connection with anti-dilution protections under the warrants

that were triggered by the February 2024 Offering (as defined below), but that may only

be issued following receipt of shareholder approval pursuant to Nasdaq Rule 5635(d); |

| ● | 13,928,571

shares of common stock issuable to Presto CA pursuant to anti-dilution protections previously

granted to Presto CA, an affiliate of our shareholder, Cleveland Avenue, but that may only

be issued following receipt of shareholder approval pursuant to Nasdaq Listing Rule 5635(d); |

| |

● |

4,500,000 shares of common stock issuable

to investors who participated in the Company’s registered direct offering dated November 17, 2023, but that may only be

issued following receipt of shareholder approval pursuant to Nasdaq Listing Rule 5635(d); and |

| |

|

|

| |

● |

28,285,714 shares of common stock issuable

to the January 2024 Noteholders pursuant to anti-adjustment provisions in the January 2024 Notes, but that may only be issued following

receipt of shareholder approval pursuant to Nasdaq Listing Rule 5635(d). |

Unless

otherwise indicated, all information in this prospectus reflects or assumes no exercise, vesting or termination of options, RSUs or warrants

outstanding as of May 20, 2024.

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should carefully consider and evaluate all of the information included

and incorporated by reference in this prospectus, including the risk factors below, in the 2023 Form 10-K (which is incorporated

by reference into this prospectus supplement), and other filings we make with the SEC, which are incorporated by reference into this

prospectus supplement. It is possible that our business, financial condition, liquidity or results of operations could be materially

adversely affected by any of these risks.

Risks

Related to our Financial Position and Liquidity

There

is a significant likelihood that you will lose all of your investment if we are unable to raise an additional $3.0 million in funding

by June 7, 2024.

The

CSPA is intended to enable us to raise $3.0 million by June 7, 2024; however, we cannot offer any assurance that Triton will be successful

in executing sufficient sales under the CSPA in order to achieve that goal. We will have limited recourse against Triton if it is unable

to do so. In such circumstance, the Forbearance granted to us by our Lenders will terminate on June 14, 2024 and we will be required

to cooperate with our Lenders in a potential sale of our business in connection with the realization of their collateral. In the event

of such a sale, our holders of our common stock are unlikely to receive any recovery.

There

is a significant likelihood that you will lose all of your investment if we are unable to raise an additional $32 million in funding

by July 15, 2024 from an investor who is willing to purchase our senior secured loan and invest in our company.

The

Cooperation Agreement with our Lenders requires them to enter into good faith discussions regarding the transfer of their debt if we

or our significant shareholders present them with a binding cash offer for $20 million to purchase $40 million of their indebtedness.

We are also required to demonstrate that we have at least $12 million of operating capital pursuant to such offer. We will face significant

challenges finding an investor to invest these funds and, even if our existing lenders negotiate transfer of the loan, we will still

have $40 million of debt outstanding under this facility following its transfer.

Our

sales of shares in this offering may become subject to limitations under Nasdaq Rule 5635 as a result of aggregation with prior offerings

of securities in which case we will have no alternative other than to continue selling shares and address Nasdaq’s requirements

by seeking shareholder approval after such sales.

Nasdaq

Rule 5635 places a limit on the number of shares that a company may issue at below the Minimum Price other than in a public offering.

Such limit is 20% of a company’s outstanding voting power or outstanding common stock. Our transaction with Triton is intended

to comply with this Nasdaq rule provided sales of shares pursuant to the CSPA are not aggregated with prior capital raising transactions.

We have committed to seek shareholder approval for the issuance of the Backstop Shares at the Purchase Price and we intend to seek shareholder

approval preemptively of all issuances pursuant to the CSPA. We cannot provide any assurance that Nasdaq will agree that this offering

should be viewed separately from prior offerings and we cannot provide any assurance that we will receive shareholder approval. If not,

then Nasdaq will take steps to delist our securities and we may be unable to address all of Nasdaq’s requests on a timely basis

or at all to prevent that outcome.

We

need additional capital to sustain our operations, and to the extent additional financing is unavailable or is only available on unfavorable

terms, or if certain investors exercise their veto rights and block us from raising additional capital, we will be forced to initiate

insolvency proceedings.

If

we are unable to raise additional financing in the near term, we will become insolvent and investors will lose the entirety of their

investment. Further, as described in our Current Report on Form 8-K filed with the SEC on November 16, 2023, pursuant to a contractual

arrangement, KKG Enterprises LLC and CA, each affiliates of certain significant stockholders and directors of the Company, have veto

rights over our ability to issue shares of our common stock or of our subsidiaries, or securities convertible into or exercisable for

common stock, subject to certain limited exceptions, which could have a material adverse effect on our ability to raise additional financing

if such veto rights are exercised.

Risks

Related to this Offering

The

issuance and sale of our common stock under the CSPA will result in dilution to our stockholders and any future sales of our common stock

may depress our stock price.

The

sale of shares of our common stock to Triton will have a dilutive impact on our existing shareholders. Triton may resell some or all

of the shares we issue to it pursuant to draw-downs under the CSPA and such sales could cause the market price of our common stock to

decline.

We

granted anti-dilution protection to certain of our investors, which will cause additional significant dilution to our stockholders

and may have a material adverse impact on the market price of our common stock and make it more difficult for us to raise funds through

future equity offerings.

In

addition to the immediate dilutive effects described in “The Offering”, we have granted anti-dilution protections to holders

of our shares, warrants and convertible notes that will result in the issuance of additional shares if the purchase price per share in

this Offering is below $0.14. Moreover, the perceived risk of dilution and the resulting downward pressure on our common stock price

could encourage investors to engage in short sales of our common stock, which could further contribute to price declines in our common

stock. The fact that certain of our stockholders and our warrantholders can sell substantial amounts of our common stock in

the public market, whether or not sales have occurred or are occurring, as well as the existence of anti-dilution provisions granted

in most of our recent equity financings, could make it more difficult for us to raise additional funds through the sale of equity or

equity-related securities in the future at a time and price that we deem reasonable or appropriate, or at all.

Our

stock price and trading volume have and may in the future experience volatility, and at times shares of our common stock have been, and

may continue to be, thinly traded, which may contribute to volatility in our stock price and less liquidity for investors.

The

trading volume of our common stock has varied greatly in the past and may continue to do so in the future. At times our trading volume

may be characterized as thinly traded. As a result of this thin trading market or “float” for our common stock, our

common stock has been, and may continue to be, less liquid than the common stock of companies with broader public ownership. If our common

stock is thinly traded, the trading of a relatively small volume of our common stock may have a greater impact on the trading price of

our common stock than would be the case if our float were larger. As a result, the trading prices of our common stock may be more volatile

than the common stock of companies with broader public ownership, and an investor be unable to liquidate an investment in our common

stock at attractive prices.

We

cannot predict the prices at which our common stock will trade in the future. Variations in financial results, announcements of material

events, changes in our dividend policy, technological innovations or new products by us or our competitors, our quarterly operating results,

changes in general conditions in the economy or government spending on law enforcement and military, other developments affecting us

or our competitors or general price and volume fluctuations in the market are among the many factors that could cause the market price

of our common stock to fluctuate substantially.

We

have broad discretion to determine how to use the funds raised in this Offering, and may use them in ways that may not enhance our operating

results or the price of our common stock.

We

currently intend to use the net proceeds from this Offering for working capital and general corporate purposes. Accordingly, we will

have broad discretion as to how we use the net proceeds that we receive from this Offering. We could spend the proceeds that we receive

from this Offering in ways that our shareholders may not agree with or that do not yield a favorable return. You will not have the opportunity

as part of your investment decision to assess whether the net proceeds are being used appropriately. Investors in this Offering will

need to rely upon the judgment of our board of directors and management with respect to the use of proceeds. If we do not use the net

proceeds that we receive in this Offering effectively, our business, financial condition, results of operations and prospects could be

harmed, and the market price of our shares of common stock could decline.

Sales

of substantial amounts of our common stock in the public market, or the perception that these sales may occur, could cause the market

price of our common stock to decline.

Sales

of substantial amounts of our common stock in the public market, or the perception that these sales may occur, could cause the market

price of our common stock to decline. This could also impair our ability to raise additional capital through the sale of our equity securities.

We may issue additional shares of common stock, which may dilute existing shareholders, including purchasers of the common stock offered

hereby. We cannot predict the size of future issuances of our shares, or the effect, if any, that future sales and issuances of securities

would have on the market price of our shares of common stock. See “Plan of Distribution.”

We

are currently listed on the Nasdaq Stock Market. If we are unable to maintain listing of our securities on the Nasdaq Stock Market or

any stock exchange, our stock price could be adversely affected and the liquidity of our stock and our ability to obtain financing could

be impaired and it may be more difficult for our shareholders to sell their securities.

Although

our common stock is currently listed on Nasdaq, in addition to the risks associated with the CSPA set forth above, we may not be able

to continue to meet the exchange’s minimum listing requirements or those of any other national exchange. For example, on February

23, 2024, we received the notice from Nasdaq stating that the Company is not in compliance with the requirement to maintain a MVPHS

of $15 million, as set forth in Nasdaq Listing Rule 5450(b)(2)(C) because the MVPHS of the Company was below $15 million for the 35 consecutive

business days prior to the date of the Notice. The Notice was in addition to the previously disclosed letters received on February 6,

2024, notifying the Company that it was not in compliance with the requirement to maintain a minimum Market Value of Listed Securities

of $50 million, as set forth in Nasdaq Listing Rule 5450(b)(2)(A), and on December 28, 2023, notifying the Company that it was not in

compliance with the requirement to maintain a minimum bid price of $1.00 per share, as set forth in Nasdaq Listing Rule 5450(a)(1). The

delisting of our common stock from Nasdaq may make it more difficult for us to raise capital on favorable terms in the future. Such a

delisting would likely a result in a reduction in some or all of the following may occur, each of which could have a material adverse

effect on our shareholders and may impair your ability to sell or purchase our common stock when you wish to do so:

| ● | the

liquidity of our common stock; |

| | | |

| ● | the

market price of our common stock; |

| ● | our

ability to obtain financing for the continuation of our operations; |

| ● | the

number of investors that will consider investing in our common stock; |

| | | |

| ● | the

number of market makers in our common stock; |

| | | |

| ● | the

availability of information concerning the trading prices and volume of our common stock;

and |

| | | |

| ● | the

number of broker-dealers willing to execute trades in shares of our common stock. |

Further,

if we were to be delisted from the Nasdaq Stock Market and we are unable to obtain listing on another national securities exchange, our

common stock would cease to be recognized as covered securities and we would be subject to regulation in each state in which we offer

our securities.

USE

OF PROCEEDS

We

intend to use the net proceeds from this Offering for working capital purposes and other general corporate purposes.

MATERIAL

U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK

The

following is a summary of the material U.S. federal income tax consequences applicable to Non-U.S. holders (as defined below)

of the acquisition, ownership and disposition of our common stock purchased in accordance with this prospectus supplement, but does not

purport to be a complete analysis of all potential tax consequences related thereto. This discussion applies only to our common stock

that is held as a capital asset within the meaning of Section 1221 of the U.S. Internal Revenue Code of 1986, as amended (the

“Code”). This discussion assumes that any distributions made (or deemed made) by us on our common stock and any consideration

received (or deemed received) by a holder in consideration for the sale or other disposition of our common stock will be in U.S. dollars.

This

discussion does not address the U.S. federal income tax consequences to our founders, sponsors, officers or directors. This discussion

is a summary only and does not describe all of the tax consequences that may be relevant to you in light of your particular circumstances,

including but not limited to the alternative minimum tax, the Medicare tax on certain net investment income and the different consequences

that may apply if you are subject to special rules that apply to certain types of investors, including but not limited to:

| ● | banks,

financial institutions or financial services entities; |

| ● | traders

in securities that elect to use a mark-to-market method of accounting for their securities

holdings; |

| ● | governments

or agencies or instrumentalities thereof; |

| ● | regulated

investment companies; |

| ● | real

estate investment trusts; |

| ● | expatriates

or former long-term residents of the United States; |

| ● | except

as specifically provided below, persons that actually or constructively own five percent

or more (by vote or value) of our shares; |

| ● | persons

that acquired our common stock pursuant to an exercise of employee share options, in connection

with employee share incentive plans or otherwise as compensation; |

| ● | tax-qualified

retirement plans; |

| ● | “qualified

foreign pension funds” as defined in Section 897(l)(2) of the Code and entities

all of the interests of which are held by qualified foreign pension funds; |

| ● | dealers

or traders subject to a mark-to-market method of accounting with respect to our common stock; |

| ● | persons

holding our common stock as part of a “straddle,” constructive sale, hedge, wash

sale, conversion or other integrated or similar transaction; |

| ● | persons

deemed to sell our common stock under the constructive sale provisions of the Code; |

| ● | persons

subject to special tax accounting rules as a result of any item of gross income with respect

to our common stock being taken into account in an applicable financial statement; |

| ● | Non-U.S.

holders (as defined below) whose functional currency is not the U.S. dollar; |

| ● | partnerships

(or entities or arrangements classified as partnerships or other pass-through entities for

U.S. federal income tax purposes) and any beneficial owners of such partnerships; |

| ● | corporations

that accumulate earnings to avoid U.S. federal income tax; |

| ● | controlled

foreign corporations; and |

| ● | passive

foreign investment companies. |

If

a partnership (including an entity or arrangement treated as a partnership or other pass-thru entity for U.S. federal income

tax purposes) holds our common stock, the tax treatment of a partner, member or other beneficial owner in such partnership will generally

depend upon the status of the partner, member or other beneficial owner, the activities of the partnership and certain determinations

made at the partner, member or other beneficial owner level. If you are a partner, member or other beneficial owner of a partnership

holding our common stock, you are urged to consult your tax advisor regarding the tax consequences of the acquisition, ownership and

disposition of our common stock.

This

discussion is based on the Code, and administrative pronouncements, judicial decisions and final, temporary and proposed Treasury regulations

as of the date hereof, which are subject to change, possibly on a retroactive basis, and changes to any of which subsequent to the date

of this prospectus may affect the tax consequences described herein. This discussion does not address any aspect of state, local or non-U.S.

taxation, or any U.S. federal taxes other than income taxes (such as gift and estate taxes).

We

have not sought, and do not expect to seek, a ruling from the U.S. Internal Revenue Service (the “IRS”) as to any U.S. federal

income tax consequence described herein. The IRS may disagree with the discussion herein, and its determination may be upheld by a court.

Moreover, there can be no assurance that future legislation, regulations, administrative rulings or court decisions will not adversely

affect the accuracy of the statements in this discussion. You are urged to consult your tax advisor with respect to the application of

U.S. federal tax laws to your particular situation, as well as any tax consequences arising under the laws of any state, local or

foreign jurisdiction.

THIS

DISCUSSION IS ONLY A SUMMARY OF CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS ASSOCIATED WITH THE ACQUISITION, OWNERSHIP AND DISPOSITION

OF OUR COMMON STOCK. EACH PROSPECTIVE INVESTOR IN OUR COMMON STOCK IS URGED TO CONSULT ITS OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR

TAX CONSEQUENCES TO SUCH INVESTOR OF THE ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK, INCLUDING THE APPLICABILITY AND

EFFECT OF ANY U.S. FEDERAL NON-INCOME, STATE, LOCAL, AND NON-U.S. TAX LAWS.

Definition

of Non-U.S. Holder

As

used herein, the term “Non-U.S. holder” means a beneficial owner of our common stock (other than a partnership or entity

or arrangement classified as a partnership for U.S. federal income tax purposes) that is, for U.S. federal income tax purposes,

not a U.S. person.

A

“U.S. person” is any person that, for U.S. federal income tax purposes, is or is treated as any of the following:

| ● | an

individual citizen or resident of the United States; |

| ● | a

corporation, or other entity taxable as a corporation for U.S. federal income tax purposes,

created or organized under the laws of the United States, any state thereof or the District

of Columbia; |

| ● | an

estate, the income of which is subject to U.S. federal income tax regardless of its source;

or |

| ● | a

trust if (a) a court within the United States is able to exercise primary supervision

over the administration of the trust and one or more U.S. persons have the authority to control

all substantial decisions of the trust or (b) it has in effect a valid election under

applicable Treasury regulations to be treated as a U.S. person. |

Taxation

of Distributions

In

general, any distributions (including constructive distributions, but not including certain distributions of our stock or rights to acquire

our stock) we make to a Non-U.S. holder of shares of our common stock, to the extent paid out of our current or accumulated earnings

and profits (as determined under U.S. federal income tax principles), will constitute dividends for U.S. federal income tax

purposes and, provided such dividends are not effectively connected with the Non-U.S. holder’s conduct of a trade or business

within the United States, we will be required to withhold tax from the gross amount of the dividend at a rate of 30%, unless such

Non-U.S. holder is eligible for a reduced rate of withholding tax under an applicable income tax treaty and provides proper certification

of its eligibility for such reduced rate (usually on an IRS Form W-8BEN or W-8BEN-E). These certifications must be provided

to the applicable withholding agent prior to the payment of dividends and must be updated periodically. A Non-U.S. holder that does

not timely furnish the required documentation, but is eligible for a reduced rate of withholding tax under an income tax treaty may obtain

a refund or credit of any excess amounts withheld by filing an appropriate claim for refund with the IRS. In the case of any constructive

dividend, it is possible that this tax would be withheld from any amount owed to a Non-U.S. holder by us or the applicable withholding

agent, including from other property subsequently paid or credited to such holder.

Dividends

that are effectively connected with a Non-U.S. holder’s conduct of a trade or business within the United States and,

if such Non-U.S. holder is entitled to claim treaty benefits (and the Non-U.S. holder complies with applicable certification

and other requirements), that are attributable to a permanent establishment (or, for an individual, a fixed base) maintained by such

Non-U.S. holder within the United States are not subject to the withholding tax described above but instead are subject to

U.S. federal income tax on a net income basis at applicable graduated U.S. federal income tax rates. In order for its effectively

connected dividends to be exempt from the withholding tax described above, a Non-U.S. holder will be required to provide a duly

completed and properly executed IRS Form W-8ECI, certifying that the dividends are effectively connected with the Non-U.S. holder’s

conduct of a trade or business within the United States. Dividends received by a Non-U.S. holder that is a corporation that

are effectively connected with its conduct of a trade or business within the United States may be subject to an additional branch

profits tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty.

Any

distribution in excess of current and accumulated earnings and profits will constitute a return of capital that will be treated first

as reducing (but not below zero) the Non-U.S. holder’s adjusted tax basis in its shares of our common stock and, to the extent

such distribution exceeds the Non-U.S. holder’s adjusted tax basis, as gain realized from the sale or other disposition of

common stock, which will be treated as described under “Gain on Sale, Taxable Exchange or Other Taxable Disposition of Common

Stock” below. In addition, if we determine that we are likely to be classified as a “United States real property

holding corporation” (see “Gain on Sale, Taxable Exchange or Other Taxable Disposition of Common Stock” below),

we generally will withhold 15% of any distribution that exceeds our current and accumulated earnings and profits.

Gain

on Sale, Taxable Exchange or Other Taxable Disposition of Common Stock

Subject

to the discussion below regarding backup withholding and FATCA, a Non-U.S. holder generally will not be subject to U.S. federal

income or withholding tax in respect of gain recognized on a sale, taxable exchange or other taxable disposition of our common stock,

unless:

| ● | the

gain is effectively connected with the conduct by the Non-U.S. holder of a trade or business

within the United States (and, under certain income tax treaties, is attributable to a United

States permanent establishment or fixed base maintained by the Non-U.S. holder); |

| ● | the

Non-U.S. holder is an individual present in the United States for 183 days or more in the

taxable year of disposition and certain other requirements are met; or |

| ● | we

are or have been a “United States real property holding corporation” (as defined

below) for U.S. federal income tax purposes at any time during the shorter of the five-year

period ending on the date of disposition or the Non-U.S. holder’s holding period for

the applicable common stock, except, in the case where shares of our common stock are “regularly

traded on an established securities market” (within the meaning of applicable Treasury

Regulations, referred to herein as “regularly traded”), and the Non-U.S. holders

has owned, directly or constructively, 5% or less of our common stock at all times within

the shorter of the five-year period preceding such disposition of common stock or such Non-U.S.

holder’s holding period for such common stock. It is unclear how the rules for determining

the 5% threshold for this purpose would be applied with respect to our common stock, including

how a Non-U.S. holder’s ownership of our warrants, if any, impacts the 5% threshold

determination with respect to its common stock. We can provide no assurance as to our future

status as a United States real property holding corporation or as to whether our common stock

will be considered to be regularly traded. Non-U.S. holders should consult their own tax

advisors regarding the application of the foregoing rules in light of their particular facts

and circumstances. |

Unless

an applicable treaty provides otherwise, gain described in the first bullet point above will be subject to tax at generally applicable

U.S. federal income tax rates as if the Non-U.S. holder were a U.S. resident. Any gains described in the first bullet

point above of a Non-U.S. holder that is treated as a corporation for U.S. federal income tax purposes may also be subject

to an additional “branch profits tax” imposed at a 30% rate (or such lower rate as may be specified by an applicable income

tax treaty) on a portion of its effectively connected earnings and profits for the taxable year that are attributable to such gain, as

adjusted for certain items.

Gain

described in the second bullet point above will be subject to U.S. federal income tax at a 30% rate (or such lower rate as may be

specified by an applicable income tax treaty), but may be offset by U.S. source capital losses realized during the same taxable

year (even though the individual is not considered a resident of the United States), provided the Non-U.S. holder has timely

filed U.S. federal income tax returns with respect to such losses. Non-U.S. holders should consult any applicable income tax treaties

that may provide for different rules.

If

the third bullet point above applies to a Non-U.S. holder, gain recognized by such holder on the sale, exchange or other disposition

of our common stock will be subject to tax at generally applicable U.S. federal income tax rates as if the Non-U.S. holder

were a U.S. resident. In addition, a buyer of our common stock from such holder may be required to withhold U.S. federal income

tax at a rate of 15% of the amount realized upon such disposition. Any amounts withheld may be refunded or credited against a Non-U.S. holder’s

U.S. federal income tax liability, provided that the required information is timely provided to the IRS.

We

would be classified as a United States real property holding corporation if the fair market value of our “United States

real property interests” equals or exceeds 50% of the sum of the fair market value of our worldwide real property interests plus

our other assets used or held for use in a trade or business, as determined for U.S. federal income tax purposes. We believe that

we are not currently a United States real property holding corporation; however, there can be no assurance that we will not become

a United States real property holding corporation in the future.

Information

Reporting and Backup Withholding

Payments

of distributions on our common stock will not be subject to backup withholding, provided the applicable withholding agent does not have

actual knowledge or reason to know the holder is a U.S. person and the holder either certifies its non-U.S. status, such as

by furnishing a valid IRS Form W-8BEN, W-8BEN-E, W-8ECI, or W-8EXP, or otherwise establishes an exemption. However, information

returns are required to be filed with the IRS in connection with any distributions on our common stock paid to the Non-U.S. holder,

regardless of whether any tax was actually withheld. In addition, proceeds of the sale or other taxable disposition of our common stock

within the United States or conducted through certain U.S.-related brokers generally will not be subject to backup withholding or

information reporting, if the applicable withholding agent receives the certification described above and does not have actual knowledge

or reason to know that such holder is a U.S. person, or the holder otherwise establishes an exemption. Proceeds of a disposition

of our common stock conducted through a non-U.S. office of a non-U.S. broker generally will not be subject to backup withholding

or information reporting.

Copies

of information returns that are filed with the IRS may also be made available under the provisions of an applicable treaty or agreement

to the tax authorities of the country in which the Non-U.S. Holder resides or is established or organized.

Backup

withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit

against a Non-U.S. holder’s U.S. federal income tax liability, provided the required information is timely furnished

to the IRS.

FATCA

Withholding Taxes

Provisions

commonly referred to as “FATCA” impose withholding of 30% on payments of dividends (including constructive dividends) on

our common stock to “foreign financial institutions” (which is broadly defined for this purpose and in general includes investment

vehicles) and certain other non-U.S. entities unless various U.S. information reporting and due diligence requirements (generally

relating to ownership by United States persons of interests in or accounts with those entities) have been satisfied by, or an exemption

applies to, the payee (typically certified as to by the delivery of a properly completed IRS Form W-8BEN-E). Foreign financial institutions

located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different

rules. Under certain circumstances, a Non-U.S. holder might be eligible for refunds or credits of such withholding taxes, and a

Non-U.S. holder might be required to file a U.S. federal income tax return to claim such refunds or credits.

Thirty

percent withholding under FATCA was scheduled to apply to payments of gross proceeds from the sale or other disposition of property that

produces U.S.-source interest or dividends beginning on January 1, 2019, but on December 13, 2018, the IRS released proposed

regulations that, if finalized in their proposed form, would eliminate the obligation to withhold on gross proceeds. Such proposed regulations

also delayed withholding on certain other payments received from other foreign financial institutions that are allocable, as provided

for under final Treasury Regulations, to payments of U.S.-source dividends, and other fixed or determinable annual or periodic income.

Although these proposed Treasury Regulations are not final, taxpayers generally may rely on them until final Treasury Regulations are

issued. However, there can be no assurance that final Treasury Regulations will provide the same exceptions from FATCA withholding as

the proposed Treasury Regulations. Non-U.S. holders should consult their tax advisors regarding the effects of FATCA on their investment

in our common stock.

PLAN

OF DISTRIBUTION

Pursuant

to the CSPA, we have the right, but not the obligation, to sell to Triton up to $5,000,000 of our shares of common stock, par value $0.0001

per share, offered by this prospectus supplement and the accompanying prospectus at our request any time during the Commitment Period.

Each

sale we request pursuant to a Purchase Notice under the CSPA may be for a number of shares of our common stock that does not exceed 9.9%

of our outstanding shares, which 9.9% amount is currently 9,988,465 shares as of the date of the

CSPA (the “Commitment Shares”). Triton has committed to purchase the Commitment Shares at the lowest of (i) the official

closing price of our common stock on the Nasdaq Stock Market on the trading day immediately preceding our submission of a Purchase Notice

to Triton, (ii) the average official closing price of our common stock on the Nasdaq Stock Market for the five consecutive trading days

ending on the business day immediately preceding our submission of a Purchase Notice to Triton, and (iii) 75% of the lowest traded price

of the common stock five days prior to the closing date. The price in (i) and (ii) is referred to as the “Minimum Price”

and the price in (i), (ii) and (iii) is referred to as the “Purchase Price”.

Subject

to completing the purchase of 18.9% of our outstanding shares, Triton has committed to purchase a number of additional shares such that

the total proceeds to be received by us on or before June 7, 2024 pursuant to the CSPA will exceed $3,000,000, including those shares

that are the subject of the Purchase Notices (such shares, the “Backstop Shares”). The Backstop Shares will be purchased

at (x) the Purchase Price, if the Financial Viability Relief has been sought and granted to us and such relief permits the receipt of

proceeds from the sale of common stock on or before June 7, 2024, or (y) the Minimum Price, if the Financial Viability Relief has not

been sought or granted or cannot generate such proceeds on or before June 7, 2024. Triton’s obligation with respect to purchasing

the Backstop Shares is conditioned on (i) us having timely delivered a first Purchase Notice for 9.9% of our outstanding shares within

one business day of the execution of the CSPA, and (ii) us having timely delivered a second Purchase Notice for 9.9% of our outstanding

shares to Triton within one business day after the closing related to such first Purchase Notice.

The

shares of common stock that we may from time to time issue to Triton under this prospectus supplement may be subsequently sold or distributed

from time to time by Triton, as a selling stockholder, directly to one or more purchasers or through brokers, dealers, or underwriters

who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated

prices, or at fixed prices, which may be changed. Any resale of the shares of our common stock offered by this prospectus supplement

could be effected in one or more of the following methods:

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block

trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| | purchases