Registration No. 333-276367

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PANBELA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

2834

(Primary Standard Industrial

Classification Code Number)

|

88-2805017

(I.R.S. Employer

Identification No.)

|

712 Vista Blvd, Suite 305

Waconia, Minnesota 55387

(952) 479-1196

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jennifer K. Simpson

Chief Executive Officer

712 Vista Blvd, Suite 305

Waconia, Minnesota 55387

(952) 479-1196

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| |

W. Morgan Burns

Joshua L. Colburn

W. Jason Deppen

Faegre Drinker Biddle & Reath LLP

90 South Seventh Street

2200 Wells Fargo Center

Minneapolis, Minnesota 55402-3901

(612) 766-7000

|

|

M. Ali Panjwani

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 421-4100

|

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☑

|

Smaller reporting company ☑

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED JANUARY 25, 2024 |

Up to 8,000,000 Shares of Common Stock

Up to 8,000,000 Class E Common Warrants to purchase up to 2,660,000 Shares of Common Stock

Up to 8,000,000 Class F Common Warrants to purchase up to 14,000,000 Shares of Common Stock

Up to 8,000,000 Pre-Funded Warrants to purchase up to 8,000,000 Shares of Common Stock

Up to 24,660,000 Shares of Common Stock Underlying Warrants

This is a best efforts public offering of (a) up to 8,000,000 shares of our common stock, $0.001 par value per share, (b) up to 8,000,000 Class E Common Warrants to purchase up to 2,660,000 shares of our common stock (the “Class E Warrants”), and (c) up to 8,000,000 Class F Common Warrants to purchase up to 14,000,000 shares of our common stock (the “Class F Warrants” and, together with the Class E Warrants, the “common warrants”) at an assumed combined public offering price of $3.77 per share of common stock and accompanying warrants (equal to the last sale price of our common stock as reported by the Nasdaq Capital Market on January 23, 2024). Each share of our common stock is being sold together with a Class E Warrant to purchase 0.25 shares of our common stock and a Class F Warrant to purchase 1.75 shares of our common stock. Each common warrant is assumed to have an exercise price of $3.77 per share (100% of the public offering price per share and common warrants), will be exercisable upon issuance, and will expire five years from the date of issuance. After five business days, holders of Class E Warrants will have a separate option to elect an “alternative cashless exercise” pursuant to which they would receive an aggregate number of shares equal 1.33 times the number of shares of common stock that would be issuable upon a cash exercise.

We are also offering to those purchasers, if any, whose purchase of common stock in this offering would otherwise result in any such purchaser, together with its affiliates, beneficially owning more than 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase pre-funded warrants in lieu of shares of our common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding common stock. The purchase price for each pre-funded warrant will equal the per share public offering price for the common stock in this offering less the $0.001 per share exercise price of each such pre-funded warrant. Each pre-funded warrant will be exercisable upon issuance and will not expire prior to exercise. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis.

For purposes of clarity, each share of common stock or pre-funded warrant to purchase one share of common stock is being sold together with a Class E Warrant to purchase one share of common stock and a Class F Warrant to purchase one share of common stock.

Our common stock is listed on the Nasdaq Capital Market under the symbol “PBLA.” On January 23, 2024, the last reported sale price of our common stock on the Nasdaq Capital Market was $3.77 per share. The combined public offering prices per share and accompanying warrant or per pre-funded warrant and accompanying warrant will be determined between us and investors based on market conditions at the time of pricing and may be at a discount to the current market price of our common stock. Therefore, the recent market price and resulting assumed price used throughout this prospectus may differ substantially from the actual offering price. None of the common warrants or pre-funded warrants are listed on a national securities exchange. We do not intend to apply to list the common warrants or pre-funded warrants on any national securities exchange. Without an active trading market, the liquidity of the common warrants and pre-funded warrants may be limited.

Effective January 18, 2024, we effected a 1-for-20 reverse stock split of our outstanding shares of common stock. Unless specifically provided herein, the share and per share information that follows in this prospectus, other than in the historical financial statements and related notes included elsewhere in this prospectus, assumes the effect of the reverse stock split.

We have requested and been granted a hearing to appeal the staff determination letter we received from The Nasdaq Stock Market, LLC (“Nasdaq”) on November 28, 2023, which letter communicated that Nasdaq would suspend trading in our common stock and file a Form 25-NSE with the Securities and Exchange Commission, which would remove our common stock from listing and registration on Nasdaq, unless we appealed its delisting determination by requesting a hearing before the Nasdaq Hearings Panel. The suspension of trading and delisting of the company’s common stock has been stayed pending the conclusion of the hearing process. Consequently, the company’s common stock is expected to remain listed on the Nasdaq Capital Market at least until the panel renders a decision following the hearing. There can be no assurance that the panel will grant the company’s appeal for continued listing on The Nasdaq Capital Market. The determination letter communicated that our company (i) has not maintained a minimum closing bid price of $1.00 per share as required by Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”) and (ii) was no longer in compliance with the minimum stockholders’ equity requirement for continued listing as required by Nasdaq Listing Rule 5550(b) (the “Minimum Stockholders’ Equity Requirement”). Effective January 18, 2024, we completed a 1-for-20 reverse stock split of our outstanding shares of common stock. The primary reason we effected a reverse stock split is to potentially increase the per share market price of our common stock to satisfy the Minimum Bid Price Requirement. On January 22, 2024, we received notice from Nasdaq indicating that, as of effective date of the reverse stock split, we were no longer in compliance with Nasdaq Listing Rule 5550(a)(4) (the “Minimum Float Requirement”), which requires a minimum of 500,000 publicly held shares, which serves as an additional basis for delisting the Company’s common stock. Additionally, it is our intention that the issuance of additional shares and net proceeds from this public offering will allow us to regain compliance with the Minimum Float Requirement and the Minimum Stockholders’ Equity Requirement. We believe that if we are unable to regain compliance with all applicable Nasdaq continued listing requirements, it is likely that our common stock will be delisted from the Nasdaq Capital Market.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 8 of this prospectus, and under similar headings in any amendments or supplements to this prospectus, including our most recent annual report on Form 10-K and any similar section contained in any documents that are incorporated by reference into this prospectus.

This offering will terminate on February 15, 2024, unless completed sooner or unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date, except that the shares of Common Stock underlying the Class E Warrants, Class F Warrants, and the pre-funded warrants will be offered on a continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended. We will deliver all securities to be issued in connection with this offering delivery versus payment upon receipt of investor funds received by us. Accordingly, there is no arrangement to receive or place investor funds in an escrow, trust or any similar account.

We have engaged Roth Capital Partners, LLC as our exclusive placement agent (“Roth” or the “placement agent”) to use its reasonable best efforts to solicit offers to purchase our securities in this offering. The placement agent has no obligation to purchase any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering the actual public offering amount, placement agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and throughout this prospectus. We have agreed to pay the placement agent the placement agent fees set forth in the table below and to provide certain other compensation to the placement agent. See “Plan of Distribution” beginning on page 27 of this prospectus for more information regarding these arrangements.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| |

|

Per Share and

Common

Warrant

|

|

|

Per Pre-Funded

Warrant and

Common

Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Placement Agent fees

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Net proceeds to us, before expenses(1)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

The above summary of offering proceeds does not give effect to any proceeds from the exercise of the common warrants or pre-funded warrants being issued in this offering.

|

Delivery of the shares of our common stock and pre-funded warrants to certain of the investors, together with accompanying common warrants, is expected to be made on or about , 2024, subject to customary closing conditions.

Roth Capital Partners

The date of this prospectus is , 2024

TABLE OF CONTENTS

| |

Page

|

|

ABOUT THIS PROSPECTUS

|

ii

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

iii

|

|

PROSPECTUS SUMMARY

|

1

|

|

THE OFFERING

|

8

|

|

RISK FACTORS

|

10

|

|

USE OF PROCEEDS

|

22

|

|

MARKET INFORMATION

|

23 |

|

CAPITALIZATION

|

23

|

|

DILUTION

|

24

|

|

DIVIDEND POLICY

|

25 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

25 |

|

BUSINESS

|

36 |

|

MANAGEMENT

|

65 |

|

EXECUTIVE COMPENSATION

|

69 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

71 |

|

DESCRIPTION OF SECURITIES

|

72 |

|

PLAN OF DISTRIBUTION

|

78 |

|

LEGAL MATTERS

|

83 |

|

EXPERTS

|

83 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

84 |

|

FINANCIAL STATEMENTS

|

F-1

|

ABOUT THIS PROSPECTUS

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Information Incorporated by Reference,” before deciding to invest in our securities.

You should rely only on the information contained in this prospectus. We have not, and the placement agent has not, authorized anyone to provide you with any information other than that contained in this prospectus. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the placement agent is not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not and the placement agent has not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable. We are ultimately responsible for all disclosure included in this prospectus.

You should rely only on the information contained in this prospectus, as supplemented and amended. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the securities being offered.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this prospectus other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, projected costs and our objectives for future operations, are forward-looking statements.

In some cases, you can identify forward-looking statements by the following words: “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this prospectus. These factors include:

| |

●

|

our lack of diversification and the corresponding risk of an investment in our company;

|

| |

●

|

potential deterioration of our financial condition and results due to failure to diversify;

|

| |

●

|

our ability to successfully complete acquisitions;

|

| |

●

|

our ability to integrate acquired companies and operations for new product candidates;

|

| |

●

|

our ability to obtain additional capital, on acceptable terms or at all, required to implement our business plan;

|

| |

●

|

final results of our Phase I clinical trial;

|

| |

●

|

progress and success of our randomized Phase II/III clinical trial;

|

| |

●

|

our ability to demonstrate safety and effectiveness of our product candidate;

|

| |

●

|

our ability to obtain regulatory approvals for our product candidate in the United States, the European Union, or other international markets;

|

| |

●

|

the market acceptance and future sales of our product candidate;

|

| |

●

|

the cost and delays in product development that may result from changes in regulatory oversight applicable to our product candidate;

|

| |

●

|

the rate of progress in establishing reimbursement arrangements with third-party payors;

|

| |

●

|

the effect of competing technological and market developments;

|

| |

●

|

the costs involved in filing and prosecuting patent applications and enforcing or defending patent claims;

|

| |

●

|

our ability to maintain the listing of our common stock on a national securities exchange; and

|

| |

●

|

other risk factors included under the caption “Risk Factors” starting on page 8 of this prospectus.

|

You should read the matters described in “Risk Factors” and the other cautionary statements made in this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus. We cannot assure you that the forward-looking statements in this prospectus will prove to be accurate and therefore you are encouraged not to place undue reliance on forward-looking statements. You should read this prospectus completely. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

We caution readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results due to the risks and uncertainties described under the heading “Risk Factors” in this prospectus, as well as others that we may consider immaterial or do not anticipate at this time. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. Our expectations reflected in our forward-looking statements can be affected by inaccurate assumptions that we might make or by known or unknown risks and uncertainties, including those described under the heading “Risk Factors” in this prospectus. The risks and uncertainties described under the heading “Risk Factors” in this prospectus are not exclusive and further information concerning us and our business, including factors that potentially could materially affect our financial results or condition, may emerge from time to time. We assume no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. We advise stockholders and investors to consult any further disclosures we may make on related subjects in our subsequent annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K that we file with or furnish to the U.S. Securities and Exchange Commission (the “SEC”).

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus. Unless otherwise stated or the context requires otherwise, references in this prospectus to “Panbela,” the “Company,” “we,” “us,” “our” and similar references refer to Panbela Therapeutics, Inc. and its subsidiaries.

Business Overview

Panbela is a clinical stage biopharmaceutical company developing disruptive therapeutics for the treatment of patients with urgent unmet medical needs. We are currently enrolling patients in our randomized double-blind placebo controlled clinical trial for the treatment of pancreatic cancer and we are a regulatory and commercial collaborator in a Phase III clinical trial funded by the National Cancer Institute (the “NCI”) for the study of colon cancer risk reduction and colon adenoma therapy (“CAT”), a preventative treatment approach for survivors of colorectal cancer or those who have high-risk colon polyps. In addition, the Company is designing a global protocol for a Phase III registration trial for familial adenomatous polyposis (“FAP”), a rare inherited condition that can cause the growth of thousands of colorectal adenomas (i.e., adenomatous polyps), which are recognized as a key risk factor for colon cancer. The global protocol will be submitted to the Federal Drug Administration (FDA) and European Medicines Agency (EMA) for agreement on the registration pathway. By leveraging Panbela’s extensive experience with FAP and in designing global registration trials, the team can develop a high-quality trial protocol that meets the standards of regulatory agencies and is designed to demonstrate the potential safety and efficacy of Flynpovi ™ efficiently and effectively in the treatment of FAP. We also support several investigator initiated trials and company sponsored preclinical trials including: (1) Phase II clinical trial for the treatment of early-onset type 1 diabetes funded by the Juvenile Diabetes Research Foundation; (2) Phase II clinical trial for treatment of gastric cancer funded by the NCI; (3) Phase I/II clinical trial for the treatment of non-small cell lung cancer (NSCLC) possessing the STK11 mutation; (4) Phase II program for the treatment of Metastatic Castration-Resistant Prostate Cancer; and (5) preclinical studies that we have sponsored in the orphan disease and cancer fields.

The Company’s lead assets are ivospemin (SBP-101), FlynpoviTM (eflornithine (CPP-1X) and sulindac), and eflornithine (CPP-1X) which provides a multi-targeted approach to reset dysregulated biology present in many types of diseases such as cancer and autoimmune disorders. Many tumors require greatly elevated levels of polyamines to support their growth and survival. These agents target the polyamine pathway at complementary junctions, which have been shown to be altered in disease. In particular, our lead assets have the potential to suppress and prevent tumor growth, enhance anti-tumor activity of other anti-cancer agents, and modulate the immune system.

Ivospemin is a proprietary polyamine analogue designed to induce polyamine metabolic inhibition. Ivospemin has demonstrated encouraging activity against metastatic disease in a clinical trial of patients with pancreatic cancer. The efficacy and safety results demonstrated in our completed Phase I clinical trial of ivospemin in combination with gemcitabine and nab-paclitaxel in the first line treatment of metastatic pancreatic cancer provides support for the current randomized, double-blind, placebo-controlled study of ivospemin in combination with gemcitabine and nab-paclitaxel in patients previously untreated for metastatic pancreatic cancer. We believe that ivospemin, if successfully developed, may represent a novel approach that effectively treats patients with pancreatic cancer and could become a dominant product in that market. Only three first-line treatment combinations, a single maintenance treatment for a subset (3-7%) of patients, and one second-line drug have been approved by the U.S. Food and Drug Administration (“FDA”) for pancreatic cancer in the last 25 years. Ivospemin has received Fast Track status and orphan drug designation status for pancreatic cancer in the United States as well as Europe.

On June 15, 2022 Panbela acquired Cancer Prevention Pharmaceuticals, Inc. (“CPP”), which added the Company’s second lead asset, eflornithine in multiple forms. First, an investigational new drug product, Flynpovi is a combination of the polyamine synthesis inhibitor eflornithine and the non-steroidal anti-inflammatory drug sulindac and then eflornithine as a single agent. Eflornithine is an enzyme-activated, irreversible inhibitor of the enzyme ornithine decarboxylase, the first rate-limiting enzyme in the biosynthesis of polyamines. Sulindac, a non-steroidal anti-inflammatory drug, facilitates the export and catabolism of polyamines. Flynpovi has a unique dual mechanism of action whereby it suppresses the synthesis of new polyamines and increases the export and catabolism of polyamines from the diet and microbiome. We believe Flynpovi is unique in that it is designed to treat the risk factors (e.g., polyps) that are hypothesized to lead to Familial Adenomatous Polyposis (“FAP”) surgeries and colon cancer and therefore may have the ability to prevent various types of colon cancer. In the FAP-310 Phase III trial, the efficacy and safety of the combination of Flynpovi (eflornithine and sulindac), as compared with either drug alone, in adults with FAP was conducted. While the study missed the primary composite endpoint (Burke et al. 2020), a post-hoc analysis showed that none of the patients in the combination arm progressed to a need for lower gastrointestinal (“LGI”) surgery for up to 48 months compared to 13.2% and 15.7% of patients in the sulindac and eflornithine arms (Balaguer et al. 2022). This data corresponded to risk reductions for the need for LGI surgery approaching 100% between combination and either monotherapy. Given the statistical significance of the LGI group, a new drug application (“NDA”) was filed with the FDA; however, since this was based on the results of an exploratory analysis, a complete response letter (“CRL”) was issued. To address the CRL, the Company is designing a Phase III registration trial and will advance this program while not increasing our current cash requirements. There are no currently approved pharmaceutical therapies for FAP

Additional programs are evaluating a single agent tablet eflornithine or high dose powder eflornithine sachet for several indications including prevention of gastric cancer, recent onset Type 1 diabetes, and STK-11 mutant NSCLC. Preclinical studies as well as Phase I or Phase II investigator-initiated trials suggest that eflornithine treatment is well tolerated and has potential activity. In December, US WorldMeds®, a Kentucky-based specialty pharmaceutical company to whom Panbela divested certain assets in its eflornithine pediatric neuroblastoma program, received FDA approval of their NDA for the use of eflornithine as a maintenance therapy for neuroblastoma in remission. This approval marks the first approval for eflornithine and any polyamine targeted therapy in a cancer indication.

Flynpovi has received Fast Track designation in the United States and orphan drug designation status for FAP in the United States and Europe. In addition, we have received orphan drug designation status for eflornithine as a single agent for Neuroblastoma in the United States and Europe and for gastric cancer in the United States.

Clinical Trials

Ivospemin (SBP-101)

In August 2015, the FDA accepted our Investigational New Drug (“IND”) application for our ivospemin product candidate. We have completed an initial clinical trial of ivospemin in patients with previously treated locally advanced or metastatic pancreatic cancer. This was a Phase I, first-in-human, dose-escalation, safety study. From January 2016 through September 2017, we enrolled twenty-nine patients into six cohorts, or groups, in the dose-escalation phase of the Phase I trial. No drug-related bone marrow toxicity or peripheral neuropathy was observed at any dose level. In addition to being evaluated for safety, 23 of the 29 patients were evaluable for preliminary signals of efficacy prior to or at the eight-week conclusion of their first cycle of treatment using the Response Evaluation Criteria in Solid Tumors (“RECIST”), the currently accepted standard for evaluating change in the size of tumors.

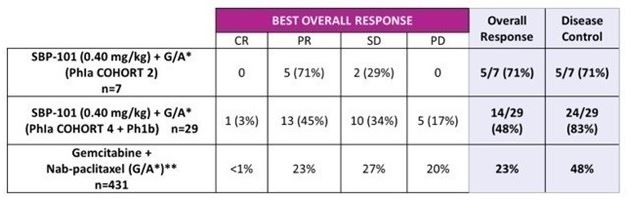

In 2018, we began enrolling patients in our second clinical trial, a Phase Ia/Ib study of the safety, efficacy, and pharmacokinetics of ivospemin administered in combination with two standard-of-care chemotherapy agents, gemcitabine and nab-paclitaxel. A total of 25 subjects were enrolled in four cohorts to evaluate the dosage level and schedule. An additional 25 subjects were enrolled in the expansion phase of the trial. Interim results were presented in January of 2022. Best response in evaluable subjects (cohorts 4 and Ib N=29) was a Complete Response in 1 (3%), Partial Response in 13 (45%), Stable Disease in 10 (34%) and Progressive Disease in 5 (17%). One subject did not have post baseline scans with RECIST tumor assessments. Median Progression Free Survival (“PFS”), now final at 6.5 months may have been negatively impacted by drug dosing interruptions to evaluate potential toxicity. Median overall survival in Cohort 4 + Phase Ib was 12.0 months when data was presented in January 2022 and is now final at 14.6 months. Two patients from cohort 2 have demonstrated long term survival. One at 30.3 months (final data) and one at 33.0 months and still alive. Seven subjects are still alive at this time, one from cohort 2 and six from cohort 4 plus Ib.

In January of 2022, the Company announced the initiation of a new pancreatic cancer clinical trial. Referred to as ASPIRE, the trial is a randomized double-blind placebo-controlled trial in combination with gemcitabine and nab-paclitaxel, a standard pancreatic cancer treatment regimen, in patients previously untreated for metastatic pancreatic cancer. The trial will be conducted globally at approximately 93 sites in the United States, Europe and Asia – Pacific.

The Aspire trial commenced early in 2022, while opening of clinical sites in the US and the rest of the world has been slower than originally anticipated, due in part to resource fatigue in the medical community, the Company expects all countries and sites to be open by in early 2024.

The trial was originally designed as a Phase II/III with a smaller sample size (150) to support the events required for interim analysis based on PFS and a primary endpoint of overall survival. In response to European and FDA regulatory feedback the study was amended to include the total trial sample size (600) and the design modified to utilize overall survival as the primary endpoint to be examined at interim analysis. PFS will also be analyzed to provide additional efficacy evidence. This amendment was supported by the final data from the Phase Ia/b first line metastatic pancreatic cancer trial which completed enrollment in December of 2020. The study will enroll 600 subjects and is anticipated to take 36 months for complete enrollment with the interim analysis available in mid-2024. The Independent Data Safety Monitoring Board (“DSMB”) has met twice, the most recently in November 2023, which evaluated the safety of 214 patients. Both meetings resulted in no safety concerns and the trial continuing without modification. On January 25, 2024, the Company announced that the trial had exceeded 50% enrollment. The Company projects that full enrollment will be completed by the first quarter of 2025 and that interim data analysis based on overall survival should be available by the middle of 2024.

If we can successfully complete all FDA recommended clinical studies, we intend to seek marketing authorization from the FDA, the European Medicines Agency (“EMA”) (European Union), Ministry of Health and Welfare (Japan) and TGA (Australia). The submission fees may be waived when ivospemin has been designated an orphan drug in each geographic region.

Additionally, in early April 2023, the Company announced a poster presentation highlighting the results for ivospemin as a polyamine metabolism modulator in ovarian cancer at the American Association for Cancer Research Annual Conference The poster concludes that the ivospemin treatment of C57Bl/6 mice injected with VDID8+ ovarian cancer cells significantly prolonged survival and decreased overall tumor burden. The results suggest that ivospemin may have a role in the clinical management of ovarian cancer, and the Company intends to continue pre-clinical and clinical studies in ovarian cancer.

Additional preclinical work is underway evaluating ivospemin (also known as SBP-101) and eflornithine (also known as CPP-1X or DFMO) in multiple myeloma (cell lines). Data published in the November 2023, supplemental issue of the Journal Blood investigated the effects of polyamine inhibition by ivospemin and CPP-1X on myeloma cell lines growth and viability in vitro. Results showed that ivospemin and CPP-1X treatment significantly decreased cell proliferation and induced apoptosis in a panel of multiple myeloma cell lines. When ivospemin and CPP-1X were combined an almost complete abolition of cell growth occurred. These results demonstrate the anti-neoplastic potential of ivospemin and CPP-1X and offer a compelling rationale for its clinical development as a potentially promising treatment option for multiple myeloma. The work reflects the Company’s on-going collaboration with researchers from The University of Texas MD Anderson Cancer Center for the evaluation of polyamine metabolic inhibitor therapies in combination with CAR-T cell therapies in preclinical models.

FLYNPOVI

In December 2009, the FDA accepted our IND application for the combination product, Flynpovi. Flynpovi showed promising results in an NCI supported randomized, placebo-controlled Phase IIb/III clinical trial to prevent recurrent colon adenomas, particularly high-risk pre-cancerous polyps in which 375 subjects who had resected sporadic adenoma were treated for 3 years with eflornithine (500 mg once a day) + sulindac (150 mg once a day [N = 191]) or matched placebo/placebo (N = 184). Results demonstrated a marked risk reduction (70%) in developing metachronous adenomas, 92% risk reduction in developing advanced adenomas, and 95% risk reduction in developing multiple adenomas with the active combination regimen compared to placebo (Meyskens et al. 2008). This combination regimen was generally well tolerated.

Given the similar mechanism of disease in sporadic and FAP-associated adenomatous polyposis, and the mechanism of action of Flynpovi in prevention of progressive polyposis in both the general population with sporadic adenomas and in patients with FAP, a Phase III program in FAP, and a Phase III program to study colon cancer risk reduction in partnership with the Southwest Oncology Group (SWOG) and the NCI were initiated.

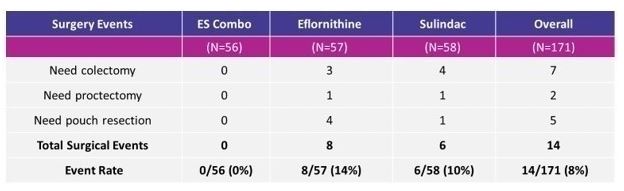

In the FAP-310 Phase III study completed in 2019, the efficacy and safety of the combination of eflornithine and sulindac, as compared with either drug alone, in adults with familial adenomatous polyposis was conducted (Burke et al. 2020). The patients were randomly assigned in a 1:1:1 ratio to receive eflornithine, sulindac, or both once daily for up to 48 months. The primary end point, assessed in a time-to-event analysis, was disease progression, defined as a composite of major surgery, endoscopic excision of advanced adenomas, diagnosis of high-grade dysplasia in the rectum or pouch, or progression of duodenal disease. A total of 171 patients underwent randomization. Disease progression occurred in 18 of 56 patients (32%) in the eflornithine-sulindac group, 22 of 58 (38%) in the sulindac group, and 23 of 57 (40%) in the eflornithine group, with a hazard ratio of 0.71 (95% confidence interval [CI], 0.39 to 1.32) for eflornithine-sulindac as compared with sulindac (P = 0.29) and 0.66 (95% CI, 0.36 to 1.23) for eflornithine-sulindac as compared with eflornithine (Burke et al. 2020). Adverse and serious adverse events were similar across the treatment groups. In a post-hoc analysis, none of the patients in the combination arm progressed to a need for LGI surgery for up to 48 months compared with 7 (13.2%) and 8 (15.7%) patients in the sulindac and eflornithine arms (Balaguer et al. 2022). These data corresponded to risk reductions for the need for LGI surgery approaching 100% between combination and either monotherapy with HR = 0.00 (95% CI, 0.00-0.48; p = 0.005) for combination versus sulindac and HR = 0.00 (95% CI, 0.00-0.44; p = 0.003) for combination versus eflornithine. Given the statistical significance of the LGI group, an NDA was filed with the FDA. As the study failed to meet the primary endpoint, and the NDA was based on the results of an exploratory analysis, a complete response letter was issued. To address this deficiency concern, the Company must submit the results of one or more adequate and well-controlled clinical trials which demonstrate an effect on a clinical endpoint.

In collaboration with the NCI, and SWOG, a Phase III clinical trial has been initiated to study the benefits of Flynpovi as a therapeutic treatment for use by colon cancer survivors. The trial is named PACES for “Prevention of Adenomas and Cancer with eflornithine and sulindac.” The PACES trial is funded by the NCI and managed by the Southwest Oncology Group (“SWOG”). This is an ongoing double-blind placebo-controlled trial of Flynpovi to prevent recurrence of high risk adenomas and second primary colorectal cancers in patients with stage 0-III colon or rectal cancer, Phase III – Preventing Adenomas of the Colon With Eflornithine and Sulindac (“PACES”). The purpose of this study is to assess whether Flynpovi (compared to corresponding placebos) has a reduced rate of cancer or high-risk adenoma recurrence compared to comparator arms after three years of daily dosing. We have exclusive rights to the data that comes from the trial for regulatory and commercial purposes. The Company is evaluating its options for CAT in the European Union and Asia.

In April 2023, the Company announced that it regained the North American rights to develop and commercialize Flynpovi in patients with FAP, as a result of the termination of the license agreement between CPP and One-Two Therapeutics Assets Limited effective July 4, 2023.

Eflornithine (CPP-1X) and eflornithine sachets (CPP-1X-S)

For the single agent eflornithine, there is a Phase I/II trial in STK11 mutation patients with non-small cell lung cancer and Phase II trial in Recent Onset Type I diabetes with eflornithine have been initiated and are enrolling. Recently, a phase II trial evaluating eflornithine and High Dose Testosterone With Enzalutamide in Metastatic Castration-Resistant Prostate Cancer started enrolling. Lastly, a Phase II trial evaluating eflornithine for the prevention of gastric cancer was completed in 2021 with data analysis ongoing.

Recent Developments

Nasdaq Staff Determination Letters

We have requested and been granted a hearing to appeal the staff determination letter we received from The Nasdaq Stock Market, LLC (“Nasdaq”) on November 28, 2023, which letter communicated that Nasdaq would suspend trading in our common stock and file a Form 25-NSE with the Securities and Exchange Commission, which would remove our common stock from listing and registration on Nasdaq, unless we appealed its delisting determination by requesting a hearing before the Nasdaq Hearings Panel. The suspension of trading and delisting of the company’s common stock has been stayed pending the conclusion of the hearing process. Consequently, the company’s common stock is expected to remain listed on the Nasdaq Capital Market at least until the panel renders a decision following the hearing. There can be no assurance that the panel will grant the company’s appeal for continued listing on The Nasdaq Capital Market. The determination letter communicated that our company (i) has not maintained a minimum closing bid price of $1.00 per share as required by Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”) and (ii) was no longer in compliance with the minimum stockholders’ equity requirement for continued listing as required by Nasdaq Listing Rule 5550(b) (the “Minimum Stockholders’ Equity Requirement”). Effective January 18, 2024, we completed a 1-for-20 reverse stock split of our outstanding shares of common stock. The primary reason we effected a reverse stock split is to potentially increase the per share market price of our common stock to satisfy the Minimum Bid Price Requirement. On January 22, 2024, we received notice from Nasdaq indicating that, as of effective date of the reverse stock split, we were no longer in compliance with Nasdaq Listing Rule 5550(a)(4) (the “Minimum Float Requirement”), which requires a minimum of 500,000 publicly held shares, which serves as an additional basis for delisting the Company’s common stock. Additionally, it is our intention that the issuance of additional shares and net proceeds from this public offering will allow us to regain compliance with the Minimum Float Requirement and the Minimum Stockholders’ Equity Requirement. We believe that if we are unable to regain compliance with all applicable Nasdaq continued listing requirements, it is likely that our common stock will be delisted from the Nasdaq Capital Market.

Warrant Exercise Inducements & Private Placement of Class C Warrants

On November 2, 2023, we entered into warrant exercise inducement offer letters with certain holders of existing warrants to purchase our common stock, pursuant to which the holders agreed to exercise for cash their existing warrants to purchase 106,500 shares of our common stock, in the aggregate, at a reduced exercise price of $15.60 per share, in exchange for our agreement to issue new Class C common stock purchase warrants to purchase up to an aggregate of 213,000 shares of our common stock. The Company received aggregate gross proceeds of approximately $1.9 million from the exercise of the existing warrants and purchase of the new warrants. The new warrants had an initial exercise price of $15.60 per share and were exercisable upon the date of stockholder approval through the date that is five years from the date of any stockholder approvals necessary under the listing rules of Nasdaq. Our stockholders approved the issuance of the underlying shares of common stock at a special meeting held on December 19, 2023. We agreed to file a registration statement covering the resale of the shares issued or issuable upon the exercise of the new warrants and a registration statement on Form S-1 (File No. 333-275733) was declared effective by the SEC on December 20, 2023. As of January 23, 2024 there are 75,200 Class C Warrants outstanding.

Reverse Stock Split

Effective January 18, 2024, we completed a 1-for-20 reverse split of our outstanding shares of common stock. Unless specifically provided herein, the share and per-share information that follows in this prospectus, other than in the historical financial statements and related notes included elsewhere in this prospectus, assumes the effect of the reverse stock split.

Our primary objective in effecting the reverse stock split has been to attempt to raise the per-share trading price of our common stock to regain compliance with the Minimum Bid Price Requirement.

Because our Company has effectuated reverse stock splits over the prior two-year period with a cumulative ratio in excess of 250 shares to one, we are not eligible for any compliance cure period specified in Nasdaq Marketplace Rule 5810(c)(3)(A) and the Nasdaq staff issued a delisting determination letter in November 2023. While we intend to continue to actively monitor the bid price for our common stock and consider available options regain compliance with the Minimum Bid Price Requirement, there is no assurance that we will not be delisted from Nasdaq even though the reverse stock split has been effected.

Although we expect that the reverse stock split will allow us to maintain the bid price per share of our common stock above the $1.00 per share minimum price for any required number of days, thereby regaining compliance with the Minimum Bid Price Requirement, there can be no assurance that any reverse stock split will have that effect, initially or in the future, or that it would enable us to maintain the listing of our common stock on The Nasdaq Capital Market for any particular duration.

There can be no assurance that any reverse stock split will achieve any of the desired results. There also can be no assurance that the price per share of our common stock immediately after any reverse stock split would increase proportionately with the reverse stock split, or that any increase would be sustained for any period of time, as evidenced by the Company’s past reverse stock splits.

Warrant Exercise Inducements & Private Placement of Class D Warrants

On December 21, 2023, we entered into warrant exercise inducement offer letters with certain holders of existing warrants to purchase our common stock, pursuant to which the holders agreed to exercise for cash their existing warrants to purchase 127,800 shares of our common stock, in the aggregate, at their existing exercise price of $15.60 per share, in exchange for our agreement to issue new Class D common stock purchase warrants to purchase up to an aggregate of 255,600 shares of our common stock. The Company received aggregate gross proceeds of approximately $2.0 million from the exercise of the existing warrants. The new warrants had an initial exercise price of $19.00 per share and will only be exercisable contingent upon and after receiving stockholder approval as required by listing rules of Nasdaq and may be exercised until five years from the date of such stockholder approval, if any. The exercise price is separately subject to reduction in the event of certain future dilutive issuances of shares of our common stock by the Company, including pursuant to common stock equivalents and convertible or derivative securities, upon any intervening reverse stock splits, and upon receipt of the stockholder approval. As of January 23, 2024 all of the new warrants remained outstanding but unexercisable pending stockholder approval. We have agreed to call a meeting to seek stockholder approval of the issuance of the shares of our common stock underlying the new warrants within six months and to file a registration statement covering the resale of the shares underlying the new warrants within sixty calendar days of December 21, 2023. Additionally, the Company agreed not to effect or agree to effect any variable rate transaction (as defined in the inducement letters) for one year, other than an at-the-market offering, which may be effected after six months.

Product Developments

Through January 23, 2024, we had:

| |

●

|

secured an orphan drug designation for ivospemin from the FDA;

|

| |

●

|

submitted and received acceptance from the FDA for an IND application for ivospemin;

|

| |

●

|

received Country approvals for the ASPIRE Trial in Australia, France, Italy and Spain; |

| |

●

|

completed a Phase Ia monotherapy safety study of ivospemin in the treatment of patients with metastatic pancreatic ductal adenocarcinoma;

|

| |

●

|

received “Fast Track” designation from the FDA for ivospemin for metastatic pancreatic cancer;

|

| |

●

|

completed enrollment and released interim results in our second trial a Phase Ia /Ib clinical study of ivospemin, a first-line study with ivospemin given in combination with a current standard of care in patients with pancreatic ductal adenocarcinoma who were previously untreated for metastatic disease; a total of 50 subjects were enrolled in this study, 25 in the Phase Ia and 25 in the Phase Ib or expansion phase;

|

| |

●

|

secured a two-year research agreement with Johns Hopkins School of Medicine led by Professor Robert Casero, an internationally recognized researcher in polyamine biology;

|

| |

●

|

completed process improvement measures expected to be scalable for commercial use and received issue notification for a patent covering this new shorter synthesis of ivospemin;

|

| |

●

|

initiated a randomized, double-blind, placebo-controlled study with ivospemin given in combination with gemcitabine and nab-paclitaxel in patients with pancreatic ductal adenocarcinoma who are previously untreated for metastatic disease;

|

| |

●

|

completed preclinical evaluation of ivospemin for use as neoadjuvant therapy in resectable pancreatic cancer prior to surgery;

|

| |

●

|

obtained early, preclinical, indication of tumor growth inhibition activity in ovarian cancer and presented the results at ASCO-GI conference;

|

| |

●

|

received USAN adoption of the nonproprietary name of ivospemin for SBP-101;

|

| |

●

|

acquired and integrated CPP, adding a second lead asset in multiple forms and an expansive clinical development program ranging from pre-clinical to registration level clinical trials;

|

| |

●

|

European Medicines Agency (EMA) Committee for Orphan Medicinal Products issued a positive opinion on Panbela’s application for orphan designation of ivospemin in combination with gemcitabine and nab-Paclitaxel in patients with metastatic pancreatic ductal adenocarcinoma;

|

| |

●

|

announced the initiation of phase II program through Indiana University for early onset Type I diabetes utilizing eflornithine; and;

|

| |

●

|

announced the initiation of the Phase I/II clinical trial for the treatment of non-small lung cancer (NSCLC) possessing the STK11 mutation through Moffitt Cancer Center;

|

| |

●

|

entered into a sponsored research agreement with The University of Texas MD Anderson Cancer Center for the evaluation of polyamine metabolic inhibitor therapies in combination with CAR-T cell therapies in preclinical models;

|

| |

●

|

announced the SWOG Cancer Research Network’s PACES S0820 Phase III trial passed a single planned futility analysis and will continue; |

| |

●

|

announced the approval of US WorldMeds NDA Approval for Eflornithine (DFMO) in Pediatric Neuroblastoma, first polyamine approval in oncology and |

| |

●

|

exceeded 50% enrollment in ASPIRE global clinical trial.

|

Risks Associated with Our Company

Our business is subject to many significant risks, as more fully described in the section titled “Risk Factors” immediately following this prospectus summary. You should read and carefully consider these risks, together with the risks set forth under the section titled “Risk Factors” and all of the other information in this prospectus, including the financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in our securities. If any of the risks discussed in this prospectus actually occur, our business, financial condition or operating results could be materially and adversely affected. In particular, our risks include, but are not limited to, the following:

| |

●

|

our ability to obtain additional capital, on acceptable terms or at all, required to implement our business plan;

|

| |

●

|

our lack of diversification and the corresponding risk of an investment in our Company;

|

| |

●

|

our ability to maintain our listing on a national securities exchange;

|

| |

●

|

progress and success of our randomized Phase II/III clinical trial;

|

| |

●

|

our ability to demonstrate the safety and effectiveness of our product candidates: ivospemin ( SBP-101 ), Flynpovi, and eflornithine (CPP-1X);

|

| |

●

|

our ability to obtain regulatory approvals for our product candidates, SBP-101, Flynpovi and CPP-1X in the United States, the European Union or other international markets;

|

| |

●

|

the market acceptance and level of future sales of our product candidates, SBP-101, Flynpovi and CPP-1X ;

|

| |

●

|

the cost and delays in product development that may result from changes in regulatory oversight applicable to our product candidates, SBP-101, Flynpovi and CPP-1X ;

|

| |

●

|

the rate of progress in establishing reimbursement arrangements with third-party payors;

|

| |

●

|

the effect of competing technological and market developments;

|

| |

●

|

the costs involved in filing and prosecuting patent applications and enforcing or defending patent claims; and

|

| |

●

|

other risk factors included under the caption “Risk Factors” starting on page 9 of this prospectus.

|

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain scaled disclosure available to smaller reporting companies.

Corporate History

The primary business underlying Panbela Therapeutics, Inc., was originally incorporated under the laws of the State of Delaware under the name “Sun BioPharma, Inc.” in September 2011. In 2015, it became a public company by completing a merger transaction with a wholly owned subsidiary of a public company then organized under the laws of the State of Utah. In 2016, it was reincorporated under the laws of the State of Delaware via a merger with our operating subsidiary. That company changed its name to “Panbela Therapeutics, Inc.” on December 2, 2020. On June 15, 2022, we became a successor issuer to Panbela Therapeutics, Inc. and adopted its name, pursuant to a holding company reorganization via merger by operation of Rule 12g-3(a) promulgated under the Exchange Act, resulting in our current structure – consisting of two wholly owned subsidiaries: Panbela Research, Inc. and Cancer Prevention Pharmaceuticals, Inc.

Corporate Information

Our corporate mailing address is 712 Vista Blvd, #305, Waconia, MN 55387. Our telephone number is (952) 479-1196, and our website is www.panbela.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website. The information contained in or connected to our website is not incorporated by reference into, and should not be considered part of, this prospectus. The trade names, trademarks, and service marks of other companies appearing in this prospectus are the property of the respective holders.

THE OFFERING

|

Common stock offered by us

|

8,000,000 shares of our common stock, including shares of common stock issuable upon exercise of pre-funded warrants, plus up to 16,660,000 additional shares of our common stock issuable upon exercise of common warrants. |

| |

|

|

Common warrants offered by us

|

Class E Common Warrants to purchase up to 2,000,000 shares of our common stock (or 2,660,000 shares of common stock utilizing alternative cashless exercise) which will be exercisable during the period commencing on the date of their issuance and ending five years from such date at an exercise price of $ per share of common stock (100% of the public offering price per share and common warrants). After five business days, holders of Class E Warrants will have a separate option to elect an “alternative cashless exercise” pursuant to which they would receive an aggregate number of shares equal 1.33 times the number of shares of common stock that would be issuable upon a cash exercise.

Class F Common Warrants to purchase up to 14,000,000 shares of our common stock, which will be exercisable during the period commencing on the date of their issuance and ending five years from such date at an exercise price of $ per share of common stock (100% of the public offering price per share and common warrants).

|

| |

|

|

Pre-funded warrants offered by us

|

We are also offering to certain purchasers whose purchase of our common stock in this offering would otherwise result in the purchaser, together with its affiliates, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase pre-funded warrants (together with the common warrants, the “Warrants”) in lieu of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each pre-funded warrant and the accompanying common warrants will equal the price at which the common stock and the accompanying common warrants are being sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until exercised in full. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue common warrants to purchase 2 shares of common stock for each share of common stock and for each pre-funded warrant sold in this offering, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. |

| |

|

|

Assumed public offering price

|

$3.77 per share of common stock and accompanying common warrant, or $3.769 per pre-funded warrant and accompanying common warrant, as applicable, in each case assuming a public offering price equal to the last sale price of our common stock as reported by the Nasdaq Capital Market on January 23, 2024, which was $3.77. |

| |

|

|

Common stock outstanding before this offering

|

480,244 shares

|

| |

|

|

Common stock to be outstanding immediately after this offering

|

8,480,244 shares (assuming we sell only shares of common stock and no pre-funded warrants, and none of the common warrants issued in this offering are exercised). |

|

Use of proceeds

|

We estimate that the net proceeds from this offering will be up to approximately $27.8 million, based on an assumed combined public offering price of $3.77 per share of common stock and accompanying common warrants, after deducting the placement agent fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for the continued clinical development of our product candidates ivospemin and eflornithine and for working capital, and other general corporate purposes, which may include repayment of debt. Because this is a best efforts offering with no minimum amount as a condition to closing, we may not sell all or any of the securities offered hereby. As a result, we may receive significantly less in net proceeds than we currently estimate. See “Use of Proceeds” on page 21. |

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus beginning on page 10 for a discussion of factors to consider carefully before deciding to invest in our securities.

|

| |

|

|

Nasdaq Capital Market trading symbol

|

“PBLA”

|

The number of shares of our common stock outstanding before and after this offering is based on an estimated 480,244 shares of our common stock outstanding as of January 23, 2024 and excludes:

| |

●

|

all shares issuable upon the exercise of warrants sold in this offering;

|

| |

● |

pending settlements of fractional shares for cash in connection with the reverse stock split effected as of January 18, 2024; |

| |

●

|

599 shares of common stock issuable upon the exercise of outstanding stock options as of the date of this prospectus at a weighted average exercise price of $13,297.06 per share; and

|

| |

●

|

340,952 shares of common stock issuable upon exercise of stock purchase warrants at a weighted average exercise price of $64.09 per share.

|

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or warrants.

RISK FACTORS

Any investment in our securities involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our securities. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Business and Financial Position

We are a pre-revenue company with a history of negative operating cash flow.

We have experienced negative cash flows for our operating activities since inception, primarily due to the investments required to commercialize our primary drug candidates. Our financing cash flows historically have been positive due to proceeds from the sale of equity securities and promissory notes issuances. Our net cash used in operating activities was $15.3 million and $7.2 million for the years ended December 31, 2022 and 2021, respectively, and we had negative working capital of $6.0 million on December 31, 2022 and positive working capital of $9.6 million as December 31, 2021. For the quarter ended September 30, 2023 we had approximately $0.9 million in cash and approximately $7.0 million in negative working capital. Working capital is defined as current assets less current liabilities.

Our operations are subject to all the risks, difficulties, complications and delays frequently encountered in connection with the development of new products, as well as those risks that are specific to the pharmaceutical and biotechnology industries in which we compete. Investors should evaluate us considering the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

As a result of our current limited financial liquidity, our auditors have expressed substantial doubt regarding our ability to continue as a “going concern.”

As a result of our current limited financial liquidity, our auditors’ report for our 2022 financial statements, which is incorporated by reference herein, contains a statement concerning our ability to continue as a “going concern.” Our limited liquidity could make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we may obtain and our public stock price generally.

Our continuation as a “going concern” is dependent upon, among other things, achieving positive cash flow from operations and, if necessary, augmenting such cash flow using external resources to satisfy our cash needs. Our plans to achieve positive cash flow primarily include engaging in offerings of securities. Additional potential sources of funds include negotiating up-front and milestone payments on our current and potential future product candidates or royalties from sales of our products that secure regulatory approval and any milestone payments associated with such approved products. These cash sources could, potentially, be supplemented by financing or other strategic agreements. However, we may be unable to achieve these goals or obtain required funding on commercially reasonable terms, or at all, and therefore may be unable to continue as a going concern.

We may be unable to obtain the additional capital that is required to execute our business plan, which could restrict our ability to grow.

Our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital and will not be sufficient to fund our expected continuing opportunities. Our capital at the end of the third quarter of 2023 and funds raised subsequent to September 30, 2023 will be sufficient to fund operations into the first quarter of 2024. We will require additional capital to continue to operate our business and complete our clinical development plans.

Future research and development, including clinical trial cost, capital expenditures and possible acquisitions, and our administrative requirements, such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses, will require a substantial amount of additional capital and cash flow. There is no guarantee that we will be able to raise additional capital required to fund our ongoing business on commercially reasonable terms or at all.

We intend to pursue sources of additional capital through various financing transactions or arrangements, including collaboration arrangements, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions on commercially reasonable terms, in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources will not be sufficient to fund our operations going forward.

Any additional capital raised through the sale of equity may dilute the ownership percentage of our stockholders. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, both generally and in the pharmaceutical and other drug development industries in particular, the limited diversity of our activities and/or the loss of key personnel. If the amount of capital we are able to raise from financing activities is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations, we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs, which may adversely impact our financial condition.

The markets for our product candidates are highly competitive and are subject to rapid scientific change, which could have a material adverse effect on our business, results of operations and financial condition.

The pharmaceutical and biotechnology industries in which we compete are highly competitive and characterized by rapid and significant technological change. We face intense competition from organizations such as pharmaceutical and biotechnology companies, as well as academic and research institutions and government agencies. Some of these organizations are pursuing products based on technologies similar to our technology. Other of these organizations have developed and are marketing products or are pursuing other technological approaches designed to produce products that are competitive with our product candidates in the therapeutic effect these competitive products have on the diseases targeted by our product candidates. Our competitors may discover, develop or commercialize products or other novel technologies that are more effective, safer or less costly than any that we may develop. Our competitors may also obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for our product candidates.

Many of our competitors are substantially larger than we are and have greater capital resources, research and development staffs and facilities than we have. In addition, many of our competitors are more experienced in drug discovery, development and commercialization, obtaining regulatory approvals and drug manufacturing and marketing.

We anticipate that the competition with our product candidates and technology will be based on a number of factors including product efficacy, safety, availability and price. The timing of market introduction of our planned future product candidates and competitive products will also affect competition among products. We expect the relative speed with which we can develop our product candidates, complete the required clinical trials, establish strategic partners and supply appropriate quantities of the product candidate for late stage trials, if required, to be important competitive factors. Our competitive position will also depend upon our ability to attract and retain qualified personnel, to obtain patent protection in non-U.S. markets, which we currently do not have, or otherwise develop proprietary products or processes and to secure sufficient capital resources for the period between technological conception and commercial sales or out-license to pharmaceutical partners. If we fail to develop and deploy a proposed product candidate in a successful and timely manner, we will in all likelihood not be competitive.

Our lack of diversification increases the risk of an investment in our Company and our financial condition and results of operations may deteriorate if we fail to diversify.

Our Board of Directors has centered our attention on our drug development activities, which are currently focused on a limited number of product candidates. Our ability to diversify our investments will depend on our access to additional capital and financing sources and the availability and identification of suitable opportunities.

Larger companies have the ability to manage their risk by diversification. However, we lack and expect to continue to lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting pharmaceutical and biotechnology industries in which we compete than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our business. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact our business.

Our success depends on the ability of our management, employees, consultants and strategic partners, if any, to interpret market data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Further, no assurance can be given that our key personnel will continue their association or employment with us or that replacement personnel with comparable skills can be found. We will seek to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

We may be required to defend lawsuits or pay damages for product liability claims.

Product liability is a major risk in testing and marketing biotechnology and pharmaceutical products. We may face substantial product liability exposure in human clinical trials and in the sale of products after regulatory approval. Product liability claims, regardless of their merits, could exceed policy limits, divert management’s attention and adversely affect our reputation and the demand for our product. In any such event, your investment in our securities could be materially and adversely affected.

Risks Related to the Development and Approval of New Drugs