Filed Pursuant to Rule 424(b)(3)

Registration No. 333-272604

PROSPECTUS

ENERGY FOCUS, INC.

1,270,450 Shares of Common Stock

This prospectus forms a part of our Registration Statement on Form S-3 (Registration Statement No. 333-272604) filed on June 12, 2023. On June 16, 2023 at 5:00 p.m. Eastern time, or the effective time, we completed a 1-for-7 reverse stock split, or the Reverse Stock Split, of the outstanding shares of our common stock, par value $0.0001 per share, or common stock. At the effective time, every seven shares of common stock issued and outstanding automatically combined into one validly issued, fully paid and non-assessable share of common stock. No fractional shares were issued as a result of the Reverse Stock Split. The $0.0001 par value per share of common stock and other terms of the common stock are not affected by the Reverse Stock Split. Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares of our common stock that were registered under the Registration Statement were automatically proportionately reduced as a result of the Reverse Stock Split. Accordingly, the 8,893,164 shares of our common stock that were originally registered under the Registration Statement have been reduced to 1,270,450 shares of our common stock.

Pursuant to this prospectus, the selling stockholders identified herein are offering on a resale basis an aggregate of 1,270,450 issued and outstanding shares of our common stock. The outstanding shares of common stock were issued to the selling stockholders in connection with private placements we completed on January 5, 2023, January 10, 2023, January 20, 2023, February 24, 2023, March 28, 2023 and March 30, 2023, or, collectively, the Private Placements. We will not receive any of the proceeds from the sale by the selling stockholders of the common stock.

The selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in the section entitled “Plan of Distribution” on page 15. Discounts, concessions, commissions and similar selling expenses attributable to the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the Securities and Exchange Commission, or the SEC. You should carefully read this prospectus and any accompanying prospectus supplement, together with the documents we incorporate by reference, before you invest in our common stock.

Our common stock is listed on The Nasdaq Capital Market under the symbol “EFOI.” On July 10, 2023, the last reported sale price for our common stock was $1.95 per share.

Investing in our common stock involves substantial risk. Please read “Risk Factors” beginning on page 3 of this prospectus and any risk factors described in any applicable prospectus supplement and in the documents we incorporate by reference. Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 11, 2023

TABLE OF CONTENTS

| | | | | | | | |

| Page | |

| ABOUT THIS PROSPECTUS ............................................................................................................. | | |

| SUMMARY .......................................................................................................................................... | | |

| RISK FACTORS .................................................................................................................................. | | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS ...................................... | | |

| USE OF PROCEEDS ........................................................................................................................... | | |

| DESCRIPTION OF CAPITAL STOCK .............................................................................................. | | |

| PRIVATE PLACEMENTS OF SHARES OF COMMON STOCK ................................................................................................................................................. | | |

| SELLING STOCKHOLDERS ............................................................................................................. | | |

| PLAN OF DISTRIBUTION ................................................................................................................. | | |

| LEGAL MATTERS .............................................................................................................................. | | |

| EXPERTS ............................................................................................................................................. | | |

| WHERE YOU CAN FIND MORE INFORMATION ......................................................................... | | |

| INFORMATION INCORPORATED BY REFERENCE .................................................................... | | |

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, the selling stockholders may sell the securities described in this prospectus in one or more offerings. A prospectus supplement may add to, update or change the information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement, together with the information incorporated herein by reference as described under the heading “Information Incorporated by Reference.”

You should rely only on the information that we have provided or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not authorized, nor has any selling stockholder authorized, any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any applicable prospectus supplement. You should not rely upon any information or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any applicable prospectus supplement is delivered or securities are sold on a later date.

Unless the context otherwise requires, all references to “Energy Focus,” “we,” “us,” “our,” “our company,” or “the Company” in this prospectus refer to Energy Focus, Inc.

SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. The summary is not complete and does not contain all of the information that you should consider before investing in our common stock. After you read this summary, you should read and consider carefully the entire prospectus and any prospectus supplement and the more detailed information and financial statements and related notes that are incorporated by reference into this prospectus and any prospectus supplement. If you invest in our shares, you are assuming a high degree of risk.

Our Company and Business

Energy Focus, Inc. engages primarily in the design, development, manufacturing, marketing and sale of energy-efficient lighting systems and controls. We develop, market and sell high quality light-emitting diode, or LED, lighting and controls products in the commercial market and military maritime market, or MMM, and began to expand our offerings into the consumer market in the fourth quarter of 2021. Our mission is to enable our customers to run their facilities, offices with greater energy efficiency, productivity, and human health and wellness through advanced LED retrofit solutions. Our goal is to be the human wellness lighting and LED technology and market leader for the most demanding applications where performance, quality, value, environmental impact and health are considered paramount. We specialize in LED lighting retrofit by replacing fluorescent, high-intensity discharge lighting and other types of lamps in institutional buildings for primarily indoor lighting applications with our innovative, high-quality commercial and military-grade tubular LED, or TLED, products, as well as other LED and lighting control products for commercial and consumer applications. We are also evaluating adjacent technologies, including Gallium Nitride, or GaN, based power supplies and additional market opportunities for energy solution products that support sustainability in our existing channels.

The Company was founded in 1985 as Fiberstars, Inc., a California corporation, and reincorporated in Delaware in November 2006. In May 2007, Fiberstars, Inc. merged with and became Energy Focus, Inc., also a Delaware corporation. Our principal executive offices are located at 32000 Aurora Road, Suite B, Solon, Ohio 44139. Our telephone number is (440) 715-1300. Our website address is www.energyfocus.com. Information on, or that can be accessed through, our website is not part of this prospectus, other than the documents that we file with the SEC that are specifically incorporated by reference into this prospectus.

Private Placements

On January 17, 2023, the Company entered into a securities purchase agreement, or the Sander Purchase Agreement, with certain of the selling stockholders associated with Sander Electronics, Inc., or Sander Electronics, pursuant to which the Company agreed to issue and sell in a private placement an aggregate of 778,017 shares of our common stock. The issuance and sale of the shares of our common stock pursuant to the Sander Purchase Agreement closed on January 20, 2023. Mr. Chiao Chieh (Jay) Huang, one of the selling stockholders, was appointed to the Company’s board of directors as a condition of the Sander Purchase Agreement.

Further, on January 17, 2023, the Company entered into exchange agreements, or the Huang Exchange Agreements, with Ms. Mei Yun (Gina) Huang, a selling stockholder and member of our board of directors, to exchange the approximately $817,000 aggregate outstanding amounts of two short-term promissory notes that the Company previously sold and issued to Ms. Huang on September 16, 2022 and November 9, 2022, respectively, for an aggregate of 207,371 shares of common stock. The exchanges pursuant to the Huang Exchange Agreements closed on January 20, 2023.

Additionally, during the first quarter of 2023, the Company entered into securities purchase agreements, or the First Quarter Private Placement Agreements, with Ms. Huang and Mr. Huang, who are members of the Company’s board of directors and two of the selling stockholders, pursuant to which the Company agreed to sell, in private placements, shares of the Company’s common stock priced at fair market value. The table below sets forth the price, amounts and shares sold pursuant to the First Quarter Private Placement Agreements:

| | | | | | | | | | | | | | | | | |

| Director | Date | | $ Amount | | No. of Shares |

| Mei Yun (Gina) Huang | January 5, 2023 | | $100,000 | | 36,828 |

| January 10, 2023 | | $150,000 | | 46,543 |

| February 24, 2023 | | $400,000 | | 114,744 |

| March 30, 2023 | | $250,000 | | 71,428 |

| | | | | |

| Chiao Chieh (Jay) Huang | March 28, 2023 | | $55,000 | | 15,500 |

| | | | | |

| Total | | $955,000 | | 285,043 |

The Sander Purchase Agreement, the Huang Exchange Agreements and the First Quarter Private Placement Agreements are collectively referred to as the Purchase Agreements.

The issuance and sale of the shares of common stock pursuant to the Purchase Agreements were not registered under the Securities Act of 1933, as amended, or the Securities Act, and were made pursuant to certain exemptions from registration, including Sections 3(a)(9) and 4(a)(2) of the Securities Act and Regulation D promulgated thereunder as applicable.

In connection with the Sander Purchase Agreement, the Company entered into a registration rights agreement, or the Registration Rights Agreement, with certain of the selling stockholders. Pursuant to the Registration Rights Agreement, the Company agreed to file a registration statement on Form S-3 for the resale by such selling stockholders of the outstanding shares of common stock that were issued pursuant to the Sander Purchase Agreement and any securities issued or then issuable in respect of any such shares of common stock, by February 16, 2023. The Company and holders of a majority of the registrable securities subject to the Registration Rights Agreement mutually agreed to extend this filing deadline until June 16, 2023.

We are filing the registration statement of which this prospectus forms a part, among other reasons, to satisfy our obligations under the Registration Rights Agreement.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider and evaluate the risk factors included in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q that we file with the SEC, which are incorporated herein by reference, together with the risk factors and other information contained in or incorporated by reference into the applicable prospectus supplement, before making an investment decision. The occurrence of any of these risks and uncertainties could harm our business, financial condition, results of operations or growth prospects. As a result, the trading price of our common stock could decline, and you could lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement contains and incorporates by reference statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “feels,” “seeks,” “forecasts,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could” or “would” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and any prospectus supplement and in the documents incorporated by reference herein and include statements regarding our intentions, beliefs, or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, capital expenditures, and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we base these forward-looking statements on assumptions that we believe are reasonable when made in light of information currently available to us, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this prospectus and any prospectus supplement. In addition, even if our results of operations, financial condition and liquidity, and industry developments are consistent with the forward-looking statements contained in this prospectus and any prospectus supplement, those results or developments may not be indicative of results or developments in subsequent periods.

We believe that important factors that could cause our actual results to differ materially from forward-looking statements include, but are not limited to, the risks and uncertainties outlined in the “Risk Factors” incorporated by reference into this prospectus from our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and contained in or incorporated by reference into any prospectus supplement and other matters described herein generally. Some of these factors include:

•our need for and ability to obtain additional financing in the near term, on acceptable terms or at all, to continue our operations;

•our ability to regain and maintain compliance with the continued listing standards of The Nasdaq Stock Market LLC, or Nasdaq;

•our ability to refinance or extend maturing debt on acceptable terms or at all;

•our ability to continue as a going concern for a reasonable period of time;

•our ability to realize synergies with our strategic investor;

•instability in the U.S. and global economies and business interruptions experienced by us, our customers and our suppliers, particularly in light of supply chain constraints and other long-term impacts of the coronavirus, or COVID-19, pandemic;

•the competitiveness and market acceptance of our LED lighting and control technologies and products;

•our ability to compete effectively against companies with lower prices or cost structures, greater resources, or more rapid development capabilities, and new competitors in our target markets;

•our ability to extend our product portfolio into new applications and end markets;

•our ability to increase demand in our targeted markets and to manage sales cycles that are difficult to predict and may span several quarters;

•the timing of large customer orders, significant expenses and fluctuations between demand and capacity as we manage inventory and invest in growth opportunities;

•our ability to successfully scale our network of sales representatives, agents, distributors and other channel partners to compete with the sales reach of larger, established competitors;

•our ability to implement plans to increase sales and control expenses;

•our reliance on a limited number of customers for a significant portion of our revenue, and our ability to maintain or grow such sales levels;

•our ability to add new customers to reduce customer concentration;

•our ability to attract and retain a new chief financial officer;

•our ability to manage the size of our workforce while continuing to attract, develop and retain qualified personnel, and to do so in a timely manner;

•our ability to diversify our reliance on a limited number of third-party suppliers and development partners, our ability to manage third-party product development and obtain critical components and finished products on acceptable terms and of acceptable quality despite ongoing global supply chain challenges, and the impact of our fluctuating demand on the stability of such suppliers;

•our ability to timely, efficiently and cost-effectively transport products from our third-party suppliers by ocean marine and other logistics channels despite global supply chain and logistics disruptions;

•the impact of any type of legal inquiry, claim or dispute;

•the macro-economic conditions, including rising interest rates and recessionary trends, in the United States and in other markets in which we operate or secure products, which could affect our ability to obtain raw materials, component parts, freight, energy, labor, and sourced finished goods in a timely and cost-effective manner;

•our dependence on military maritime customers and on the levels and timing of government funding available to such customers, as well as the funding resources of our other customers in the public sector and commercial markets;

•business interruptions resulting from geopolitical actions such as war and terrorism, natural disasters, including earthquakes, typhoons, floods and fires, or from health epidemics or pandemics or other contagious outbreaks;

•our ability to respond to new lighting and control technologies and market trends;

•our ability to fulfill our warranty obligations with safe and reliable products;

•any delays we may encounter in making new products available or fulfilling customer specifications;

•any flaws or defects in our products or in the manner in which they are used or installed;

•our ability to protect our intellectual property rights and other confidential information, and manage infringement claims by others;

•our compliance with government contracting laws and regulations, through both direct and indirect sale channels, as well as other laws, such as those relating to the environment and health and safety;

•risks inherent in international markets, such as economic and political uncertainty, changing regulatory and tax requirements and currency fluctuations, including tariffs and other potential barriers to international trade; and

•our ability to maintain effective internal controls and otherwise comply with our obligations as a public company.

In light of the foregoing, we caution you not to place undue reliance on our forward-looking statements. Any forward-looking statement that we make in this prospectus and any prospectus supplement speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statement or to publicly announce the results of any revision to any of those statements to reflect future events or developments, except as required by law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition of the common stock covered by this prospectus. All proceeds from the sale of the common stock will be paid directly to the selling stockholders.

DESCRIPTION OF CAPITAL STOCK

The following is a brief description of our common stock and, to the extent the rights of the Series A Preferred Stock may materially limit or qualify the rights evidenced by our common stock, we describe our Series A Preferred Stock. This description of the terms of our common stock does not purport to be complete and is subject to and qualified in its entirety by reference to the applicable provisions of Delaware General Corporation Law, or the DGCL, and the full text of our certificate of incorporation and our bylaws.

General

Our certificate of incorporation provides that we may issue up to 55,000,000 shares of stock comprised of the following:

•50,000,000 shares of common stock, par value $0.0001 per share; and

•5,000,000 shares of preferred stock, par value $0.0001 per share.

Common Stock

Holders of our common stock are entitled to one vote per share on all matters to be voted upon by stockholders. In accordance with Delaware law, the affirmative vote of a majority of the shares represented and voting at a duly held meeting at which a quorum is present shall be the act of the stockholders. The shares of common stock have no pre-emptive rights, no redemption or sinking fund provisions, and are not liable for further call or assessment.

Holders of our common stock are entitled to receive dividends when and as declared by our board of directors out of funds legally available for dividends. We have not declared or paid any cash dividends and we do not anticipate paying cash dividends in the foreseeable future.

Upon a liquidation of the Company, our creditors and holders of our preferred stock with preferential liquidation rights will be paid before any distribution to holders of our common stock. The holders of common stock would be entitled to receive a pro rata distribution per share of any excess amount.

Preferred Stock

Our certificate of incorporation empowers our board of directors to issue up to 5,000,000 shares of preferred stock from time to time in one or more series. Our board of directors may fix the designation, privileges, preferences and rights and the qualifications, limitations and restrictions of those shares, including dividend rights, conversion rights, voting rights, redemption rights, terms of sinking funds, liquidation preferences and the number of shares constituting any additional series or the designation of the series. Terms selected could decrease the amount of earnings and assets available for distribution to holders of our common stock or adversely affect the rights and power, including voting rights, of the holders of our common stock without any further vote or action by the stockholders. The rights of holders of common stock will be subject to, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued by us in the future. The issuance of preferred stock could have the effect of delaying or preventing a change in control of us or make removal of management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock, and may adversely affect the voting and other rights of the holders of common stock.

Our board of directors has designated 3,300,000 shares of our preferred stock as Series A Convertible Preferred Stock, which have the following rights, preference and privileges in relation to our common stock.

Rank. The Series A Preferred Stock ranks senior to our common stock with respect to the payment of dividends and distribution of assets upon liquidation, dissolution or winding up of the Company.

Conversion. Any holder of Series A Preferred Stock has the right by written election to the Company to convert all or any portion of the outstanding shares of Series A Preferred Stock held by such holder into an

aggregate number of shares of our common stock initially on a one-for-one basis (as adjusted for any stock splits, stock dividends, recapitalizations or similar transaction with respect to our common stock). After taking into account the 1-for-5 reverse stock split of our common stock on June 11, 2020 and the 1-for-7 reverse stock split of our common stock on June 16, 2023, each share of Series A Preferred Stock is convertible into 0.02857 of a share of common stock.

Dividends. If we pay a dividend or distribution on our common stock, we will simultaneously declare and pay a dividend on the Series A Preferred Stock on a pro rata basis with our common stock determined on an as-converted basis assuming all shares of Series A Preferred had been converted into common stock as of immediately prior to the record date of the applicable dividend (or if no record date is fixed, the date as of which the record holders of our common stock entitled to such dividends are to be determined).

Voting. Each holder of outstanding shares of Series A Preferred Stock is entitled to vote with holders of outstanding shares of our common stock, voting together as a single class, with respect to any and all matters presented to the stockholders of the Company for their action or consideration, except as provided by law. In any such vote, each share of Series A Preferred Stock shall be entitled to a number of votes equal to 55.37% of the number of shares of common stock into which such share of Series A Preferred Stock is convertible. As a result, each share of Series A Preferred Stock is entitled to 0.01582 votes on each matter to be voted on by the stockholders of the Company.

Anti-Takeover Effects of Our Certificate of Incorporation and Bylaws

Our certificate of incorporation and bylaws contain certain provisions that are intended to enhance the likelihood of continuity and stability in the composition of our Board of Directors and that may have the effect of delaying, deferring or preventing a future takeover or change in control of the Company unless that takeover or change in control is approved by our Board of Directors. These provisions include:

Action by Written Consent. Our bylaws provide that stockholder action can be taken only at an annual or special meeting of stockholders and cannot be taken by written consent in lieu of a meeting.

Advance Notice Procedures. Our bylaws establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of our stockholders, including proposed nominations of persons for election to the Board of Directors. Stockholders at an annual meeting are only able to consider proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of the Board of Directors or by a stockholder who was a stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has given our Secretary timely written notice, in accordance with our bylaws, of the stockholder’s intention to bring that business before the meeting. Although the bylaws do not give the Board of Directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted at a special or annual meeting, the bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed or may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempting to obtain control of the Company.

Authorized but Unissued Shares. Our authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval. These additional shares may be utilized for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of common stock and preferred stock could render more difficult or discourage an attempt to obtain control of a majority of our common stock by means of a proxy contest, tender offer, merger or otherwise.

Delaware Anti-Takeover Statute

We are subject to the provisions of Section 203 of the DGCL regulating corporate takeovers. In general, Section 203 prohibits a publicly held Delaware corporation from engaging, under certain circumstances, in a

business combination with an interested stockholder for a period of three years following the date the person became an interested stockholder unless:

•prior to the date of the transaction, our board of directors approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

•upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, calculated as provided under Section 203; or

•at or subsequent to the date of the transaction, the business combination is approved by our board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

Generally, a business combination includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. An interested stockholder is a person who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status did own, 15% or more of a corporation’s outstanding voting stock. We expect the existence of this provision to have an anti-takeover effect with respect to transactions our board of directors does not approve in advance. We also anticipate that Section 203 may also discourage attempts that might result in a premium over the market price for the shares of common stock held by stockholders.

The provisions of Delaware law and the provisions of our certificate of incorporation and our bylaws could have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they might also inhibit temporary fluctuations in the market price of our common stock that often result from actual or rumored hostile takeover attempts. These provisions might also have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish transactions that stockholders might otherwise deem to be in their best interests.

Limitations on Liability and Indemnification of Officers and Directors

Our certificate of incorporation limits the liability of our directors to the fullest extent permitted by the DGCL, and our bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by such law.

Listing

Our common stock is listed on The Nasdaq Capital Market under the symbol “EFOI.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Broadridge Corporate Issuer Solutions, P.O. Box 1342, Brentwood, New York 11717.

PRIVATE PLACEMENTS OF SHARES OF COMMON STOCK

On January 17, 2023, the Company entered into the Sander Purchase Agreement with certain of the selling stockholders associated with Sander Electronics, pursuant to which the Company agreed to issue and sell in a private placement an aggregate of 778,017 shares of our common stock. The issuance and sale of the shares of our common stock pursuant to the Sander Purchase Agreement closed on January 20, 2023. Mr. Chiao Chieh (Jay) Huang, one of the selling stockholders, was appointed to the Company’s board of directors as a condition of the Sander Purchase Agreement.

Further, on January 17, 2023, the Company entered into the Huang Exchange Agreements with Ms. Mei Yun (Gina) Huang, a selling stockholder and member of our board of directors, to exchange the approximately $817,000 aggregate outstanding amounts of two short-term promissory notes that the Company previously sold and issued to Ms. Huang on September 16, 2022 and November 9, 2022, respectively, for an aggregate of 207,371 shares of common stock. The exchanges pursuant to the Huang Exchange Agreements closed on January 20, 2023.

Additionally, during the first quarter of 2023, the Company entered into the First Quarter Private Placement Agreements with Ms. Huang and Mr. Huang, who are members of the Company’s board of directors and two of the selling stockholders, pursuant to which the Company agreed to sell, in private placements, shares of the Company’s common stock priced at fair market value. The table below sets forth the price, amounts and shares sold pursuant to the First Quarter Private Placement Agreements:

| | | | | | | | | | | | | | | | | |

| Director | Date | | $ Amount | | No. of Shares |

| Mei Yun (Gina) Huang | January 5, 2023 | | $100,000 | | 36,828 |

| January 10, 2023 | | $150,000 | | 46,543 |

| February 24, 2023 | | $400,000 | | 114,744 |

| March 30, 2023 | | $250,000 | | 71,428 |

| | | | | |

| Chiao Chieh (Jay) Huang | March 28, 2023 | | $55,000 | | 15,500 |

| | | | | |

| Total | | $955,000 | | 285,043 |

The issuance and sale of the shares of common stock pursuant to the Purchase Agreements were not registered under the Securities Act and were made pursuant to certain exemptions from registration, including Sections 3(a)(9) and 4(a)(2) of the Securities Act and Regulation D promulgated thereunder, as applicable.

In connection with the Sander Purchase Agreement, the Company entered into the Registration Rights Agreement with certain of the selling stockholders. Pursuant to the Registration Rights Agreement, the Company agreed to file a registration statement on Form S-3 for the resale by such selling stockholders of the outstanding shares of common stock that were issued pursuant to the Sander Purchase Agreement and any securities issued or then issuable in respect of any such shares of common stock, by February 16, 2023. The Company and holders of a majority of the registrable securities subject to the Registration Rights Agreement mutually agreed to extend this filing deadline until June 16, 2023.

We are filing the registration statement of which this prospectus forms a part, among other reasons, to satisfy our obligations under the Registration Rights Agreement.

SELLING STOCKHOLDERS

The common stock being offered by the selling stockholders pursuant to this prospectus are those previously issued to the selling stockholders pursuant to the Purchase Agreements. For additional information regarding the issuances of those shares of common stock, see “Private Placements of Shares of Common Stock” above. We are registering the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. None of the selling stockholders or any persons who have control over the selling stockholders have had any material relationship with us within the past three years, except for (i) the beneficial ownership of securities of the Company, including the shares of common stock covered hereby, and (ii) as follows:

•Ms. Mei Yun (Gina) Huang has been a member of the Company’s board of directors since January 24, 2020.

•Ms. Huang was a holder of two short-term promissory notes issued and sold by the Company in September and November 2022, respectively, with an aggregate principal amount of $800,000. All outstanding amounts thereon, approximately $817,000 in the aggregate, were exchanged for shares of common stock pursuant to the Huang Exchange Agreements, upon which exchanges the notes were retired in full.

•Mr. Chiao Chieh (Jay) Huang was a holder of certain short-term promissory notes issued and sold by the Company during October 2022 to December 2022 with an aggregate principal amount of $600,000. All outstanding amounts thereon, approximately $607,000 in the aggregate, were exchanged as part of the consideration for the Sander Purchase Agreement, upon which exchanges the notes were retired in full.

•Pursuant to the Sander Purchase Agreement, the Company’s board of directors appointed Mr. Huang as a director of the Company, effective on January 23, 2023. Mr. Huang is not related to Ms. Huang.

Except as otherwise described below, based on the information provided to us by the selling stockholders, none of the selling stockholders is a broker-dealer or an affiliate of a broker-dealer.

The table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of the shares of common stock, as of July 10, 2023.

The third column lists the shares of common stock being offered by this prospectus by the selling stockholders. This prospectus generally covers the resale of the shares of common stock issued to the selling stockholders in the “Private Placements of Shares of Common Stock” described above. The fourth column assumes the sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| | | | | | | | | | | | | | | | | | | | |

| Name of Selling Stockholder | | Number of Shares of Common Stock Owned Prior to Offering | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | Shares of Common Stock Owned After Offering |

| Number | | Percentage of Outstanding Common Stock(1) |

| HUANG, MEI YUN (GINA) | (2) | 531,463 | 476,915 | 54,548 | | 1.98% |

| 黃教傑 HUANG, CHIAO CHIEH (JAY) | (3) | 680,536 | 337,071 | 343,465 | | 12.49% |

| 鄭麗珠 CHENG, LEE CHU | (3) | 285,257 | 285,257 | — | | —% |

| SANDER ELECTRONICS | (3) | 42,788 | 42,788 | — | | —% |

| 黃教強 HUANG, CHIAO-CHIANG | (3) | 28,525 | 28,525 | — | | —% |

| 林庭瑜 LIN, TINGYU | (3) | 14,316 | 14,316 | — | | —% |

| RADMAN, SLAYKO | (3) | 5,705 | 5,705 | — | | —% |

| 冉以琳 JAN, YI-LIN | (3) | 1,426 | 1,426 | — | | —% |

| 吳佳倩 GOTANCI, YVETTE TIU | (3) | 1,426 | 1,426 | — | | —% |

| 游淑華 YU, SHU-HUA | (3) | 2,852 | 2,852 | — | | —% |

| 黃彥能 HUANG, YEN-NENG | (3) | 2,852 | 2,852 | — | | —% |

| 黃思綺 HUANG, SSU-CHI | (3) | 2,852 | 2,852 | — | | —% |

| 劉承鴻 LIU, CHENG-HUNG | (3) | 2,852 | 2,852 | — | | —% |

| 徐華紳 HSU, HUA-SHEN | (3) | 2,852 | 2,852 | — | | —% |

| 黃教哲 HUANG, CHIAO-CHE | (3) | 2,852 | 2,852 | — | | —% |

| 蔡婷如 TSAI, TING JU | (3) | 2,852 | 2,852 | — | | —% |

| 游育如 YU, YU-JU | (3) | 2,852 | 2,852 | — | | —% |

| 徐惠娟 HSU, HUI-CHUAN | (3) | 2,852 | 2,852 | — | | —% |

| 林天佑LIN, TIEN-YU | (3) | 2,852 | 2,852 | — | | —% |

| 陳東宏 CHEN, TUNG-HUNG | (3) | 2,852 | 2,852 | — | | —% |

| 林玉堂 LIN, YUTANG | (3) | 2,852 | 2,852 | — | | —% |

| 黃教俊 HUANG, CHIAO-CHUN | (3) | 2,852 | 2,852 | — | | —% |

| 蔡鴻文 TSAI, HUNG-WEN | (3) | 2,852 | 2,852 | — | | —% |

| 謝志暉 HSIEH, CHIH-HUI | (3) | 2,852 | 2,852 | — | | —% |

| 鍾富榮 CHONG, FOO-WING | (3) | 2,852 | 2,852 | — | | —% |

| 江靜宜 CHIANG, CHING-YI | (3) | 2,852 | 2,852 | — | | —% |

| 黃教勝 HUANG, CHIAO-SHENG | (3) | 2,852 | 2,852 | — | | —% |

| 江淑芳 CHIANG, SHU FANG | (3) | 2,852 | 2,852 | — | | —% |

| 吳煥文 WU, HUAN-WEN | (3) | 2,852 | 2,852 | — | | —% |

| 劉美慧 LIU, MEI-HUI | (3) | 2,852 | 2,852 | — | | —% |

| 韓雲 HAN, YUN | (3) | 2,852 | 2,852 | — | | —% |

| SU, CHUN CHIEH | (3) | 2,852 | 2,852 | — | | —% |

| 陳金富 CHEN, KIN-FU | (3) | 2,852 | 2,852 | — | | —% |

| 黃教豪 HUANG, CHIAO-HO | (3) | 2,852 | 2,852 | — | | —% |

| 許光正 HSU, KUANG-CHENG | (3) | 2,852 | 2,852 | — | | —% |

| MEYER, LARRY | (3) | 2,852 | 2,852 | — | | —% |

| Total | | 1,668,446 | 1,270,433 | 398,013 | | 14.48% |

___________________

(1) Percentages are based on 2,749,087 shares of common stock outstanding on July 10, 2023.

(2) Beneficial ownership includes (i) 269,544 shares of common stock issued in connection with the closing of the First Quarter Private Placements, which are directly owned by Ms. Huang, (ii) 207,371 shares of common stock issued in connection with the Huang Exchange Agreements, which are directly owned by Ms. Huang, and (iii) 54,548 shares of common stock held by Brilliant Start Enterprise, Inc. or Jag International Ltd., which are controlled affiliates of Ms. Huang, or by Ms. Huang personally. Ms. Huang disclaims beneficial ownership over the shares of

common stock listed except to the extent of her pecuniary interest therein. The principal business address of Ms. Huang is 32000 Aurora Road, Suite B, Solon Ohio 44139.

(3) Beneficial ownership includes the aggregate of 778,017 shares of common stock issued in connection with the Sander Purchase Agreement. The shares of common stock are directly owned by each respective selling stockholder who disclaim beneficial ownership over the securities listed except to the extent of their pecuniary interest therein. The principal business address for purchasers involved in the Sander Purchase Agreement (with the exception of Larry Meyer) is 3F., No. 153, Ligong St., Beitou Dist., Taipei City, 112019, Taiwan. The principal business address for Larry Meyer is 9040 La Serena Drive, Fair Oaks, CA 75628.

PLAN OF DISTRIBUTION

Each selling stockholder and any of their assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the common stock is traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following methods when selling shares of common stock:

•ordinary brokerage transactions and transactions in which the broker‑dealer solicits purchasers;

•block trades in which the broker‑dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker‑dealer as principal and resale by the broker‑dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales;

•in transactions through broker‑dealers that agree with the selling stockholders to sell a specified number of such shares of common stock at a stipulated price per share;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•a combination of any such methods of sale; or

•any other method permitted pursuant to applicable law.

The selling stockholders may also sell shares of common stock under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker‑dealers engaged by the selling stockholders may arrange for other brokers‑dealers to participate in sales. Broker‑dealers may receive commissions or discounts from the selling stockholders (or, if any broker‑dealer acts as agent for the purchaser of shares of common stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Rule 2121 of the Financial Industry Regulatory Authority, or FINRA; and in the case of a principal transaction, a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the shares of common stock covered by this prospectus or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares of common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of common stock short and deliver these shares to close out their short positions, or loan the shares to broker-dealers that in turn may sell these shares. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares of common stock covered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and any broker-dealers or agents that are involved in selling the shares of common stock covered hereby may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the

Securities Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the shares of common stock.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the shares of common stock covered hereby. The Company has agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep the registration statement of which this prospectus forms a part effective until the earlier of (i) the date on which the shares of common stock covered hereby may be resold by the selling stockholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the shares of common stock covered hereby have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The shares of common stock will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the shares of common stock covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the shares of common stock covered hereby may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of the shares of common stock offered hereby will be passed upon for us by James R. Warren, the Company’s Senior Vice President, General Counsel and Corporate Secretary.

EXPERTS

The consolidated financial statements and financial statement schedule as of December 31, 2022 and 2021 and for the years then ended incorporated by reference in this prospectus and in the registration statement have been so incorporated in reliance on the report of GBQ Partners, LLC, an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting. The report on the consolidated financial statements contains an explanatory paragraph regarding the Company's ability to continue as a going concern.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act that registers the shares of our common stock covered by this prospectus. This prospectus does not contain all of the information set forth in the registration statement and the exhibits thereto. For further information with respect to us and our common stock, you should refer to the registration statement and the exhibits filed as a part of the registration statement. Statements contained in or incorporated by reference into this prospectus concerning the contents of any contract or any other document are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement or one of our filings with the SEC that is incorporated by reference into the registration statement, we refer you to the copy of the contract or document that has been filed. Each statement contained in or incorporated by reference into this prospectus relating to a contract or document filed as an exhibit is qualified in all respects by the filed exhibit.

We are subject to the informational reporting requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC. Our SEC filings are available over the Internet at the SEC’s website at http://www.sec.gov.

We make available, free of charge, on our website at www.energyfocus.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The contents of our website are not part of this prospectus, and the reference to our website does not constitute incorporation by reference into this prospectus of the information contained on or through that site, other than documents we file with the SEC that are specifically incorporated by reference into this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference the documents listed below and any future documents that we file with the SEC (excluding any portion of such documents that are furnished and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the initial filing of the registration statement of which this prospectus forms a part prior to the effectiveness of the registration statement and (2) after the date of this prospectus until the offering of the securities is terminated:

•our Annual Report on Form 10-K for our fiscal year ended December 31, 2022, filed with the SEC on March 23, 2023; •our Quarterly Report on Form 10-Q for quarterly period ended March 31, 2023, filed with the SEC on May 11, 2023; •our Current Reports on Form 8-K filed with the SEC on January 6, 2023, January 11, 2023, January 23, 2023, (Item 1.01, Item 2.03, Item 3.02, Item 5.02 and Item 9.01 (Exhibits 10.1, 10.2, 10.3, 10.4 and 10.5) only), February 23, 2023, February 24, 2023, February 28, 2023, April 3, 2023, June 22, 2023, and July 5, 2023; and •the description of our common stock contained in our Registration Statement on Form 8-A, registering our common stock under Section 12(b) under the Exchange Act, filed with the SEC on July 29, 2014, as updated by the description of our common stock contained in Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2022 and any amendments or reports filed for the purpose of updating such description. You may request a copy of these filings, at no cost, by writing or telephoning us at the following address: Energy Focus, Inc., 32000 Aurora Road, Suite B, Solon, Ohio 44139; telephone number (440) 715-1300.

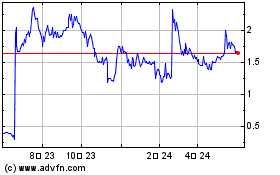

Energy Focus (NASDAQ:EFOI)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

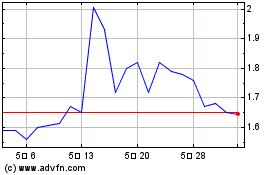

Energy Focus (NASDAQ:EFOI)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024