Filed Pursuant to Rule 424(b)(3)

Registration No. 333-277063

New Horizon Aircraft Ltd.

Primary Offering of

Up to 15,443,305 Class A Ordinary Shares Upon

the Exercise of Warrants

Secondary Offering of

Up to 10,562,939 Class A Ordinary Shares

Up to 565,375 Warrants

This

prospectus relates to the primary issuance by us of up to an aggregate of 15,443,305 Class

A ordinary shares, no par value (the “Common Shares”), of New Horizon

Aircraft Ltd. (the “Company” or “New Horizon”), which

consists of (i) up to 11,500,000 Common Shares issuable upon the exercise of 11,500,000

warrants, at an exercise price of $11.50 per share (the “Public Warrants”)

originally issued in the initial public offering of Pono Capital Three, Inc., a Cayman Islands

exempted entity (“Pono”), (ii) up to an aggregate of 565,375 Common

Shares issuable upon the exercise of 565,375 warrants, at an exercise price of $11.50 per

share (the “Placement Warrants”) that made up part of the private units

originally issued in a private placement in connection with Pono’s initial public offering

and (iii) up to an aggregate of 3,377,930 Common Shares issuable upon the exercise of 3,377,930

warrants, at an exercise price equal to the Reset Price (as defined herein), which is at

least $6.00 per share, issued to Meteora Capital Partners, LP (“MCP”),

Meteora Select Trading Opportunities Master, LP (“MSTO”) and Meteora Strategic

Capital, LLC (“MSC”) (with MCP, MSTO and MSC collectively as “Seller”

or “Meteora”) (as further described herein, the “Meteora Warrant

Shares”, and together with the Placement Warrants and the Public Warrants, the

“Warrants”). We will receive the proceeds from any exercise of the Warrants

for cash.

This prospectus also relates

to the offer and resale from time to time, upon the expiration of lock-up agreements, if applicable, by: (a) the selling shareholders

named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the

“Selling Shareholders”) of up to an aggregate of 10,562,939 Common Shares, consisting of (i) 200,000 shares of

Common Stock, issued in a private placement to the PIPE Investor (as defined below) pursuant to the terms of the Subscription Agreement,

dated December 27, 2023, in connection with the Business Combination (as defined below) at $10.00 per share, (ii) an aggregate of

5,600,997 Common Shares issued to Mehana Capital, LLC (the “Sponsor”) and its affiliates, including 4,935,622 Common

Shares originally issued as Class B ordinary shares in connection with the initial public offering of Pono for aggregate consideration

of $25,000, or approximately $0.005 per share, 100,000 Incentive Shares (as defined herein) transferred to Sponsor in connection with

the Business Combination at approximately $10.61 per share, and 565,375 Common Shares originally issued to Sponsor as part of the Placement

Units issued to Sponsor in connection with Pono’s initial public offering at $10.00 per unit, (iii) 103,500 Common Shares issued

to EF Hutton LLC (“EF Hutton”), the underwriter in Pono’s initial public offering, in connection with Pono’s

initial public offering, at $10.00 per share (the “Representative Shares”), (iv) 1,349,413 Common Shares issued

to vendors in connection with the closing of the Business Combination, including an aggregate of 103,500 Common Shares issued at $10.00

per share to EF Hutton in partial satisfaction of deferred underwriting commissions payable upon Pono’s completion of its initial

business combination, 265,734 Common Shares issued at a value of $1.63 per share to EF Hutton in partial satisfaction of deferred underwriting

commissions payable upon Pono’s completion of its initial business combination, 40,179 shares issued to MZHCI, LLC at a value of

$3.36 per share in satisfaction of fees earned in connection with the Business Combination, 400,000 Common Shares issued to Roth Capital

Partners, LLC at a value of $2.50 per share in satisfaction of fees earned in connection with the Business Combination, 15,000 Common

Shares issued to Benjamins Securities in satisfaction of fees owed to them for services provided in connection with the Business Combination

at $5.00 per share, and 300,000 Common Shares issued at a value of $2.26 per share and 225,000 Common Shares issued at a value of $2.85

per share to Spartan Crest Capital Corp. as consideration for fees earned in connection with continuing consulting services, (v) an aggregate

of 2,921,534 Common Shares, which were received as Exchange Consideration (as defined herein) in connection with the Business Combination

by certain of the Company’s insiders at a price of approximately $10.61 per share, and which are subject to six month lock-up restrictions

set forth herein, and (vi) an aggregate of 387,495 Common Shares issued at a value of $10.00 per share to Meteora and its affiliates

pursuant to the Forward Purchase Agreement and FPA Funding Amount Subscription Agreement (as defined herein); and (b) the selling

warrant holders named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively,

the “Selling Warrantholders” and, together with the Selling Shareholders and including their permitted transferees,

the “Selling Securityholders”) of up to an aggregate of 565,375 Placement Warrants.

On January 12, 2024, Pono

completed a series of transactions that resulted in the combination (the “Business Combination”) of Pono with Robinson

Aircraft, Ltd. d/b/a Horizon Aircraft (“Horizon”) pursuant to the previously announced Business Combination Agreement

(the “BCA”), dated August 15, 2023, by and among Pono, Pono Three Merger Acquisitions Corp., a British Columbia company

and wholly-owned subsidiary of Pono (“Merger Sub”) and Horizon, following the approval at the extraordinary general

meeting of the shareholders of Pono held on January 4, 2024 (the “Special Meeting”). On January 10, 2024, pursuant

to the BCA, Pono was continued and de-registered from the Cayman Islands and redomesticated as a British Columbia company on January

11, 2024 (the “SPAC Continuation”). Pursuant to the BCA, on January 12, 2024, Merger Sub and Horizon were amalgamated

under the laws of British Columbia, and Pono changed its name to New Horizon Aircraft Ltd. As consideration for the Business Combination,

the Company issued to Horizon shareholders an aggregate of 9,419,084 Class A ordinary shares (the “Exchange Consideration”),

including 282,573 shares held in escrow for any purchase price adjustments under the BCA, and 754,013 shares issued to the PIPE investor

or his designees, as set forth below.

Simultaneous with the closing

of the Business Combination, New Horizon also completed a series of private financings, issuing and selling 200,000 Common Shares in

a private placement to a PIPE investor (the “PIPE Investor”), issued 103,500 Common Shares to EF Hutton LLC, in partial

satisfaction of the deferred underwriting commission due from Pono’s initial public offering, and assumed options issued by Horizon

to purchase 585,230 Common Shares.

As

described herein, the Selling Securityholders named in this prospectus or their permitted

transferees, may resell from time to time up to 10,562,939 Common Shares and 565,375 Warrants.

We are registering the offer and sale of these securities to satisfy certain registration

rights we have granted. The Selling Securityholders may offer, sell or distribute all or

a portion of the securities hereby registered publicly or through private transactions at

prevailing market prices or at negotiated prices. We will not receive any of the proceeds

from such sales of our Common Shares or Warrants, except with respect to amounts received

by us upon the exercise of the Warrants. We will bear all costs, expenses and fees in connection

with the registration of these securities, including with regard to compliance with state

securities or “blue sky” laws. The Selling Securityholders will bear all commissions

and discounts, if any, attributable to their sale of Common Shares or Warrants. See section

entitled “Plan of Distribution” beginning on page 98 of this prospectus.

We

believe the likelihood that the warrant holders will exercise their Warrants, and therefore

the amount of cash proceeds that we would receive is, among other things, dependent upon

the market price of our Class A ordinary shares. If the market price for our Class A ordinary

shares is less than the exercise price of $11.50, subject to adjustment as described herein,

we believe such holders will be unlikely to exercise their Warrants, as applicable, For additional

information, see “Risks Related to an Investment in Our Securities.”

The Common Shares being registered

for resale in this prospectus represent a substantial percentage of our public float and of our outstanding Class A ordinary shares.

The number of shares being registered in this prospectus (which include shares issuable upon exercise of the Warrants) represents approximately

142.7% of the total Class A ordinary shares outstanding as of April 26, 2024. In addition, the securities beneficially owned by the Sponsor

represent approximately 30.7% of the total Class A ordinary shares outstanding, and this holder will have the ability to sell all of

its shares pursuant to the registration statement of which this prospectus forms a part so long as it is available for use and the six

month lockup period has expired. The sale of the securities being registered in this prospectus, or the perception in the market that

such sales may occur, could result in a significant decline in the public trading price of our Class A ordinary shares.

In addition, some of the

shares being registered for resale were acquired by the Selling Securityholders for nominal consideration or purchased for prices

considerably below the Business Combination price and the current market price of the Class A ordinary shares. Even though the current

market price is significantly below the price at the time of the Pono IPO, certain Selling Securityholders have an incentive to sell

because they will still profit on sales due to the lower price at which they acquired their shares as compared to the public investors.

In particular, the Sponsor may experience a positive rate of return on the securities they purchased due to the differences in the purchase

prices described above, to the extent they acquired such securities for less than the relevant trading price, and the public securityholders

may not experience a similar rate of return on the securities they purchased due to the differences in the purchase prices described

above. Based on the last reported sale price of Class A ordinary shares referenced below, shares acquired for less than such last reported

sale price, the Selling Securityholders may experience potential profit up to $2.36 per share.

Our Common Shares and our

Public Warrants are listed on the Nasdaq Capital Market under the symbols “HOVR” and “HOVRW,” respectively. On

April 25, 2024, the closing price of our Common Shares was $2.31 and the closing price for our Public Warrants was $0.06.

We are an “emerging

growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company

reporting requirements.

Investing in our Common

Shares and Warrants is highly speculative and involves a high degree of risk. See the section entitled “Risk Factors”

beginning on page 6 of this prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 10,

2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the SEC using a “shelf”

registration process. By using a shelf registration statement, the Selling Securityholders

may sell up to 10,562,939 Common Shares and up to 565,375 Warrants from time to time in one

or more offerings as described in this prospectus. We will not receive any proceeds from

the sale of Common Shares or Warrants by the Selling Securityholders. This prospectus also

relates to the issuance by up to 15,443,305 Common Shares upon the exercise of Warrants.

We will receive the proceeds from any exercise of the Warrants for cash.

We

may also file a prospectus supplement or post-effective amendment to the registration statement

of which this prospectus forms a part that may contain material information relating to these

offerings. The prospectus supplement or post-effective amendment, as the case may be, may

add, update or change information contained in this prospectus with respect to such offering.

If there is any inconsistency between the information in this prospectus and the applicable

prospectus supplement or post-effective amendment, you should rely on the prospectus supplement

or post-effective amendment, as applicable. Before purchasing any of the Common Shares or

Warrants, you should carefully read this prospectus and any prospectus supplement and/or

post-effective amendment, as applicable, together with the additional information described

under “Where You Can Find More Information.”

Neither we nor the Selling

Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained

in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to

which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. We and the Selling Securityholders will not make an offer to sell the Common Shares

or Warrants in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus

and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover.

Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and

any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on

independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not

guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the

market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment,

as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors,

including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective

amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus, the

terms “we,” “us,” “our” or “New Horizon”

refer to New Horizon Aircraft Ltd., a British Columbia company, and its consolidated subsidiaries. In addition, in this prospectus:

“2023 Equity Incentive

Plan” means the New Horizon Aircraft Ltd. 2023 Equity Incentive Plan.

“Amalgamation”

means the amalgamation of Merger Sub and Horizon pursuant to the BCBCA.

“BCA” or

“Business Combination Agreement” means the Business Combination Agreement, dated August 15, 2023, by and among

Pono, Merger Sub and Horizon.

“BCBCA”

means the Business Corporations Act (British Columbia), as now in effect and as it may be amended from time to time.

“Board”

means the board of directors of New Horizon.

“Business Combination”

means the Amalgamation, and the other transactions contemplated by the BCA.

“Class A ordinary

shares” means the Class A ordinary shares, no par value, of New Horizon.

“Class B ordinary

shares” means the Class B ordinary shares, no par value, of New Horizon.

“Closing”

means the closing of the Business Combination, which was completed on January 12, 2024.

“Code” means

the United States Internal Revenue Code, as amended.

“Common Shares”

means the Class A ordinary shares of New Horizon.

“Continental”

means Continental Stock Transfer & Trust Company, the transfer agent.

“EF Hutton”

means EF Hutton LLC, the representative of the underwriters in Pono’s IPO.

“Effective Time”

means the effective time of the Amalgamation in accordance with the BCBCA.

“Exchange Act”

means the United States Securities Exchange Act of 1934, as amended.

“Founder Shares”

means the 4,935,622 Common Shares, which were automatically converted at Closing from Class B ordinary shares owned by the Sponsor

and Pono’s directors.

“Fruci”

means Fruci & Associates II, PLLC.

“Horizon”

means Robinson Aircraft Ltd.

“Horizon Common Shares”

means the Class A Common Shares without par value in the authorized share structure of Horizon, the Class B Common Shares without

par value in the authorized share structure of Horizon, and the Class C Common Shares without par value in the authorized share

structure of Horizon.

“Horizon shareholders”

refers to holders of shares of Horizon as of the time immediately before the Effective Time.

“Marcum”

means Marcum LLP, New Horizon’s independent registered public accounting firm.

“Merger Sub”

means Pono Three Merger Acquisitions Corp., a British Columbia company and a wholly-owned subsidiary of Pono.

“Ordinary Shares”

means any of the New Horizon ordinary shares.

“Placement Shares”

means the Pono Class A ordinary shares included within the Placement Units;

“Placement Units”

means 563,375 units issued to the Sponsor in the Private Placement. Each Placement Unit consisted of one Placement Share and one

Placement Warrant.

“Placement Warrant”

means the warrants included within the Placement Units. Each Placement Warrant entitles the holder thereof to purchase one Pono Class A

ordinary share for $11.50 per share.

“Pono” means

Pono Capital Three, Inc., which continued from a Cayman Island exempted company to a British Columbia company pursuant to the SPAC Continuance

and was renamed “New Horizon Aircraft Ltd.” in connection with the Closing.

“Pono Charter”

or “Charter” means Pono’s second amended and restated memorandum and articles of association, dated February 9,

2023.

“Pono IPO,”

“IPO” or “Initial Public Offering” means Pono’s initial public offering that was consummated

on February 14, 2023.

“Pono IPO Prospectus”

means the final prospectus of Pono, dated as of February 9, 2023, and filed with the SEC pursuant to Rule 424(b) under

the Securities Act on February 10, 2023 (File No. 333-268283).

“Pono ordinary shares”

means the Class A ordinary shares, par value $0.0001 per share, of Pono and the Class B ordinary shares, par value $0.0001 per share,

of Pono, prior to the Closing.

“Pono Shareholders

Meeting” means the extraordinary general meeting of the shareholders of Pono, which was held virtually at 10:00 a.m., Pacific

Time, on January 4, 2024.

“Private Placement”

means the private placement consummated simultaneously with the Pono IPO in which Pono issued to the Sponsor the Placement Units.

“Public Shares”

means Class A ordinary shares included in the Public Units and Class A ordinary shares underlying the Public Warrants.

“Public Units”

means units issued in the Pono IPO, including any over-allotment securities acquired by Pono’s underwriters, consisting of

one Public Share and one Public Warrant.

“Public Warrants”

means warrants underlying the Public Units issued in the Pono IPO. Each whole Public Warrant entitles the holder thereof to

purchase one Class A ordinary share for $11.50 per share.

“Redemption”

means the right of the holders of Class A ordinary shares to have their shares redeemed in accordance with the procedures set forth

in this proxy statement/prospectus and the Pono Charter.

“SEC” means

the U.S. Securities and Exchange Commission.

“Securities”

means the Common Shares and Warrants.

“Securities Act”

means the United States Securities Act of 1933, as amended.

“Sponsor”

means Mehana Capital LLC.

“Trust Account”

means the trust account of Pono, which holds the net proceeds of the Pono IPO, including from over-allotment securities sold by

Pono’s underwriters, and the sale of the Placement Units, together with interest earned thereon, less amounts released to pay tax

obligations and up to $100,000 for dissolution expenses, and amounts paid pursuant to redemptions.

“U.S. GAAP”

means generally accepted accounting principles in the United States.

“Units”

means units consisting of a Class A ordinary share and a warrant to purchase a Class A ordinary

share, sold together as a unit in the Pono IPO (the “Public Units”) or

in the private placement that occurred simultaneously with the consummation of the Pono IPO

(the “Placement Units”).

“Warrant Agreement”

means the Warrant Agreement, dated February 9, 2023, by and between Pono and Continental Stock Transfer & Trust Company.

“Warrants”

means any of the Public Warrants and the Placement Warrants.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains

forward-looking statements, including statements about the anticipated benefits of the Business Combination, and the financial conditions,

results of operations, earnings outlook and prospects of New Horizon and other statements about the period following the consummation

of the Business Combination. Forward-looking statements appear in a number of places in this prospectus including, without limitation,

in the sections titled “New Horizon’s Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and “Business of New Horizon.” In addition, any statements that refer to projections, forecasts

or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking

statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,”

“intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,”

“could,” “may,” “might,” “possible,” “potential,” “predict,”

“should,” “would” and other similar words and expressions, but the absence of these words does not mean that

a statement is not forward-looking.

The forward-looking statements

are based on the current expectations of the management of New Horizon and are inherently subject to uncertainties and changes in circumstances

and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will

be those that have been anticipated.

All subsequent written and

oral forward-looking statements concerning the Business Combination or other matters addressed in this prospectus and attributable to

New Horizon or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or

referred to in this prospectus. Except to the extent required by applicable law or regulation, New Horizon undertakes no obligation to

update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence

of unanticipated events.

PROSPECTUS SUMMARY

This summary highlights

certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information

that you should consider before investing in our Securities and it is qualified in its entirety by, and should be read in conjunction

with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our Securities, you should

read the entire prospectus carefully, including “Risk Factors” and the financial statements of New Horizon and related notes

thereto included elsewhere in this prospectus.

The Company

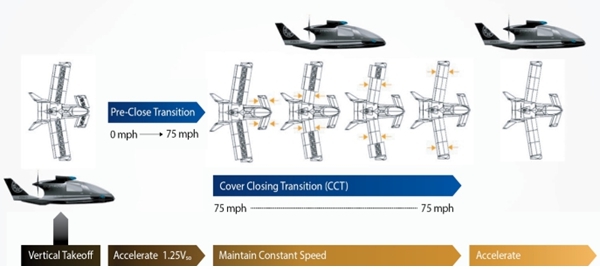

New Horizon is an advanced

aerospace Original Equipment Manufacturer (“OEM”) that is designing and aiming to build a next generation hybrid electric

Vertical Takeoff and Landing (“eVTOL”) aircraft for the Regional Air Mobility (“RAM”) market. Its unique aircraft

will offer a more efficient way to move people and goods at a regional scale (i.e., from 50 to 500 miles), help to connect remote communities,

and will advance our ability to deal with an increasing number of climate related natural disasters such as wildfires, floods, or droughts.

New Horizon aims to deliver

a hybrid electric 7-seat aircraft, called the Cavorite X7, that can take off and land vertically like a helicopter. However, unlike a

traditional helicopter, for the majority of its flight it will return to a configuration much like a traditional aircraft. This would

allow the Cavorite X7 to fly faster, farther, and operate more efficiently than a traditional helicopter. Expected to travel at speeds

up to 250 miles per hour at a range over 500 miles, New Horizon believes that this aircraft will be a disruptive force to RAM travel.

The Background

On January 12, 2024, Pono

Capital Three, Inc. (“Pono”) completed a series of transactions that resulted in the combination (the “Business Combination”)

of Pono with Robinson Aircraft, Ltd. d/b/a Horizon Aircraft (“Horizon”) pursuant to the previously announced Business Combination

Agreement (the “BCA”), dated August 15, 2023, by and among Pono, Pono Three Merger Acquisitions Corp., a British Columbia

company and wholly-owned subsidiary of Pono (“Merger Sub”) and Horizon, following the approval at the extraordinary general

meeting of the shareholders of Pono held on January 4, 2024 (the “Special Meeting”). On January 10, 2024, pursuant to the

BCA, Pono was continued and de-registered from the Cayman Islands and redomesticated as a British Columbia company on January 11, 2024

(the “SPAC Continuation”). Pursuant to the BCA, on January 12, 2024, Merger Sub and Horizon were amalgamated under the laws

of British Columbia, and Pono changed its name to New Horizon Aircraft Ltd. As consideration for the Business Combination, the Company

issued to Horizon shareholders an aggregate of 9,419,084 Class A ordinary shares (the “Exchange Consideration”), including

282,573 shares held in escrow for any purchase price adjustments under the BCA, and 754,013 shares issued to the PIPE investor or his

designees, as set forth below.

Simultaneous with the closing

of the Business Combination, New Horizon also completed a series of private financings, issuing and selling 200,000 Common Shares in

a private placement to a PIPE investor (the “PIPE Investor”), issued 103,500 Common Shares to EF Hutton LLC, in partial

satisfaction of the deferred underwriting commission due from Pono’s initial public offering, and assumed options issued by Horizon

to purchase 585,230 Common Shares.

Our Common Shares and our

Public Warrants are listed on the Nasdaq Capital Market under the symbols “HOVR” and “HOVRW,” respectively. On

April 25, 2024, the closing price of our Common Shares was $2.31 and the closing price for our Public Warrants was $0.06.

There is no assurance that

the holders of the Warrants will elect to exercise any or all of the Warrants, which could impact our liquidity position. To the extent

that the Warrants are exercised on a “cashless basis,” the amount of cash we would receive from the exercise of the Warrants

will decrease. We believe the likelihood that Warrant holders will exercise their Warrants, and therefore the amount of cash proceeds

that we would receive is, among other things, dependent upon the market price of our Class A ordinary shares. If the market price for

our Class A ordinary shares is less than the applicable exercise price of $11.50, subject to adjustment as described herein, we believe

such holders will be unlikely to exercise their Warrants. We believe, based on our current operating plan, that our existing cash and

cash equivalents, together with the cash flows from operating activities, will be sufficient to meet our anticipated cash needs for working

capital, financial liabilities, capital expenditures and business expansion for at least the next 12 months. To the extent the Company

is able to raise additional financing, either by way of the Forward Purchase Agreement, capital raise or by other means, the Company

will be in a position to expedite its business plan including hiring employees at a more rapid pace. To support its long-term business

objectives, the Company expects to continue efforts to raise additional capital over at least the next three years. The Company does

not believe this offering will have a significant impact on our ability to raise additional financing, although it may impact the per

share price and shares issued in any capital raise.

The Common Shares being registered

for resale in this prospectus represent a substantial percentage of our public float and of our outstanding Class A ordinary shares.

The number of shares being registered in this prospectus (which include shares issuable upon exercise of the Warrants) represents approximately

142.7% of the total Class A ordinary shares outstanding as of April 26, 2024. In addition, the securities beneficially owned by the Sponsor

represent approximately 30.7% of the total Class A ordinary shares outstanding, and the Sponsor will have the ability to sell all of

its shares pursuant to the registration statement of which this prospectus forms a part so long as it is available for use and the six

month lockup has expired. The sale of the securities being registered in this prospectus, or the perception in the market that such sales

may occur, could result in a significant decline in the public trading price of our Class A ordinary shares.

The rights of holders of

our Common Shares and Warrants are governed by our articles (the “Articles”) and the Business Corporations Act (British

Columbia) (the “BCBCA”), and in the case of the warrants, the Warrant Agreement, dated February 9, 2023, by and between Pono

and Continental Stock Transfer & Trust Company (the “Warrant Agreement”). See the section entitled “Description

of Capital Stock.”

Implications of Being an Emerging Growth Company

We are an “emerging

growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”),

as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may benefit

from specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions

include:

| ● | presentation

of only two years of audited financial statements and only two years of related management’s

discussion and analysis of financial condition and results of operations in this prospectus; |

| ● | reduced

disclosure about our executive compensation arrangements; |

| ● | no non-binding stockholder

advisory votes on executive compensation or golden parachute arrangements; |

| ● | exemption

from any requirement of the Public Company Accounting Oversight Board regarding mandatory

audit firm rotation or a supplement to the auditor’s report providing additional information

about the audit and the financial statements (i.e., an auditor discussion and analysis);

and |

| ● | exemption

from the auditor attestation requirement in the assessment of our internal control over financial

reporting. |

We may benefit from these

exemptions until December 31, 2025 or such earlier time that we are no longer an emerging growth company. We will cease to be an

emerging growth company upon the earliest of: (1) May 31, 2029; (2) the first fiscal year after our annual gross revenues

are $1.235 billion or more; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion

in non-convertible debt securities; or (4) the date on which we are deemed to be a “large accelerated filer” under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We may choose to benefit from some but not all

of these reduced disclosure obligations in future filings. If we do, the information that we provide stockholders may be different than

you might get from other public companies in which you hold stock.

Summary Risk Factors

You should consider all the

information contained in this prospectus before making a decision to invest in our Securities. In particular, you should consider the

risk factors described under “Risk Factors” beginning on page 6. Such risks include, but are not limited to, the following

risks with respect to the Company subsequent to the Business Combination:

Risks Related to New Horizon’s

Business and Industry

| |

● |

New Horizon has incurred losses and expect to incur significant expenses

and continuing losses for the foreseeable future, and it may not achieve or maintain profitability; |

| |

● |

The eVTOL market may not continue to develop, eVTOL aircraft may not

be adopted by the transportation market, eVTOL aircraft may not be certified by transportation and aviation authorities or eVTOL

aircraft may not deliver the expected reduction in operating costs or time savings; |

| |

● |

New Horizon has a limited operating history and faces significant challenges

to develop, certify, and manufacture its aircraft. New Horizon’s Cavorite X7 eVTOL aircraft remains in development, and New

Horizon does not expect to deliver any aircraft until 2027, at the earliest, if at all; |

| |

● |

The success of New Horizon’s business depends on the safety and

positive perception of its aircraft, the establishment of strategic relationships, and of its ability to effectively market and sell

aircraft that will be used in Regional Air Mobility services; |

| |

● |

The Regional Air Mobility market for eVTOL passenger and goods transport

services does not exist; whether and how it develops is based on assumptions, and the Regional Air Mobility market may not achieve

the growth potential we expect or may grow more slowly than expected; |

| |

● |

New Horizon may be unable to adequately control the costs associated

with its pre-launch operations, and its costs will continue to be significant after it commences operations; |

| |

● |

New Horizon is a relatively small company in comparison to current

industry leaders in the Regional Air Mobility market. New Horizon may experience difficulties in managing its growth; |

| |

● |

Any delay in the design, production, or completion or requisite testing

and certification, and any design changes that may be required to be implemented in order to receive certification of the Cavorite

X7 aircraft, would adversely impact New Horizon’s business plan and strategic growth plan and its financial condition; |

| |

● |

New Horizon’s business depends substantially on the continuing

efforts of its key employees and qualified personnel; its operations may be severely disrupted if it loses their services; |

| |

● |

New Horizon is subject to substantial regulation and unfavorable changes

to, or its failure to comply with, these regulations could substantially harm its business and operating results; |

| |

● |

New Horizon will need to improve its operational and financial systems

to support its expected growth, increasingly complex business arrangements, and rules governing revenue and expense recognition and

any inability to do so will adversely affect its billing and reporting; |

| |

● |

the need to raise additional capital; |

| |

● |

New Horizon will rely on third-party suppliers and strategic parties

for the provision and development of key emerging technologies, components and materials used in its Cavorite X7 aircraft, such as

the lithium-ion batteries that will help to power the aircraft, a significant number of which may be single or limited source suppliers; |

Risks Related to Intellectual

Property

| |

● |

New Horizon may not be able to prevent others from unauthorized use

of its intellectual property, which could harm its business and competitive position; |

| |

● |

New Horizon may not be able to prevent others from developing or exploiting

competing technologies. |

| |

● |

New Horizon may need to defend itself against intellectual property

infringement claims; |

Risks Related to the Regulatory

Environment in Which We Operate

| |

● |

It is intended for third-party air carriers to operate the Cavorite

X7 aircraft in Canada, the U.S. and Europe. These third-party air carriers are subject to substantial regulation and laws, and unfavorable

changes to, or the third-party air carriers’ failure to comply with, these regulations and/or laws could substantially harm

New Horizon’s business and operating results; |

| |

● |

New Horizon may be subject to governmental export and import control

laws and regulations as it expands its suppliers and commercial operations outside Canada, the U.S. and Europe; |

| |

● |

The adverse effect of violations of the U.S. Foreign Corrupt Practices

Act, Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act and similar worldwide anti- bribery and

anti-kickback laws. |

Risks Related to New Horizon’s

Organization and Structure

| |

● |

British Columbia law and New Horizon’s Articles will contain

certain provisions, including anti-takeover provisions, that limit the ability of shareholders to take certain actions and could

delay or discourage takeover attempts that shareholders may consider favorable; |

| |

● |

New Horizon’s management team may not successfully or efficiently

manage its transition to being a public company; |

| |

● |

New Horizon is an “emerging growth company,” and its reduced

SEC reporting requirements may make its shares less attractive to investors.; |

| |

● |

If New Horizon qualifies as a foreign private issuer, it will be exempt

from a number of rules under the U.S. securities laws and will be permitted to file less information with the SEC than a U.S. domestic

public company, which may limit the information available to its shareholders.; |

Risks Related to an Investment

in Our Securities

| |

● |

An active market for New Horizon’s securities may not develop,

which would adversely affect the liquidity and price of New Horizon’s securities.; |

| |

● |

Failure to meet Nasdaq’s continued listing requirements could

result in a delisting of New Horizon’s Common Shares and Public Warrants; |

| |

● |

The market price for New Horizon Common Shares may decline following

the Business Combination; |

| |

● |

The Common Share price may fluctuate and you could lose all or part

of your investment as a result; |

| |

● |

New Horizon shareholders may experience dilution in the future; |

| |

● |

There is no guarantee that the Warrants will ever be in the money;

they may expire worthless or the terms of Warrants may be amended; and |

| |

● |

The future exercise of registration rights may adversely affect the

market price of the Common Shares. |

Corporate Information

New Horizon’s principal

executive offices are located at 3187 Highway 35, Lindsay, Ontario, K9V 4R1, and New Horizon’s telephone number is (613) 866-1935.

THE OFFERING

| Issuer |

|

New

Horizon Aircraft Ltd. |

| |

|

|

| Common

Shares Offered by us |

|

15,443,305

Common Shares issuable upon the exercise of Warrants. |

| |

|

|

| Common

Shares Offered by the Selling Securityholders |

|

Up to 10,562,939 Common Shares. |

| |

|

|

| Warrants

Offered by the Selling Securityholders |

|

Up

to 565,375 Warrants. |

| |

|

|

| Exercise

Price of Warrants |

|

$11.50

per share, subject to adjustment as defined herein. |

| |

|

|

| Shares Outstanding Prior to Exercise

of All Warrants as of April 26, 2024 |

|

18,220,436 shares. |

| |

|

|

| Shares Outstanding Assuming Exercise

of All Warrants as of April 26, 2024 |

|

33,663,741

shares. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of Common Shares or Warrants by the Selling Securityholders. We would receive up to an

aggregate of approximately $177.6 million from the exercise of the warrants, assuming the exercise in full of all of such warrants

for cash, however, it is not certain how many warrants would be exercised for cash or if at all. We expect to use the net proceeds

from the exercise of any warrants for general corporate purposes. We believe the likelihood that Warrant holders will exercise their

Warrants, and therefore the amount of cash proceeds that we would receive is, among other things, dependent upon the market price

of our Class A ordinary shares. If the market price for our Class A ordinary shares is less than the exercise price of $11.50, we

believe such holders will be unlikely to exercise their Warrants. See “Use of Proceeds.” |

| |

|

|

| Market

for Common Shares and Public Warrants |

|

Our

Common Shares and our Public Warrants are listed on the Nasdaq Capital Market under the symbols “HOVR” and “HOVRW,”

respectively. |

| |

|

|

| Risk

factors |

|

Any

investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the

information set forth under “Risk Factors” and elsewhere in this prospectus. |

In this prospectus, unless

otherwise indicated, the number of Common Shares outstanding as of April 26, 2024 and the other information based thereon:

| ● | Does

not reflect 1,697,452 Common Shares reserved for issuance under our 2023 Equity Incentive

Plan; |

| ● | Does

not reflect the exercise of Warrants to purchase up to 15,443,305 Common Shares. |

RISK FACTORS

You should carefully consider

all the following risk factors, together with all of the other information included or incorporated by reference in this prospectus,

including the consolidated financial statements and the accompanying notes and matters addressed in the section titled “Cautionary

Note Regarding Forward-Looking Statements,” in evaluating an investment in the Common Shares or Warrants. The following risk factors

apply to the business and operations of New and its consolidated subsidiaries. The occurrence of one or more of the events or circumstances

described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to realize

the anticipated benefits of the Business Combination and may have an adverse effect on the business, cash flows, financial condition

and results of operations of New Horizon following the consummation of the Business Combination. We may face additional risks and uncertainties

that are not presently known to us or that we currently deem immaterial, which may also impair our business, cash flows, financial condition

and results of operations.

Risks Related to Our Business and Industry

We have incurred losses and expect to incur significant expenses

and continuing losses for the foreseeable future, and we may not achieve or maintain profitability.

We

have incurred significant operating losses. Our operating losses were $1,739,122 and $1,246,899

for the years ended May 31, 2022 and 2023, respectively. We expect to continue

to incur losses for the foreseeable future as we develop our aircraft.

We have not yet started commercial

operations, making it difficult for us to predict our future operating results, and we believe that we will continue to incur operating

losses until at least the time we begin commercial operations. As a result, our losses may be larger than anticipated, and we may not

achieve profitability when expected, or at all, and even if we do, we may not be able to maintain or increase profitability.

We expect our operating expenses

to significantly increase over the next several years as we complete our aircraft design, build, testing and manufacturing. We expect

the rate at which we incur losses will be significantly higher for 2024 through at least 2027 as we engage in the following activities:

| ● | continuing

to design our Cavorite X7 hybrid eVTOL aircraft with the goal of having such aircraft certified

and ultimately produced; |

| ● | engaging

suppliers in the development of aircraft components and committing capital to serial production

of those components; |

| ● | building

our production capabilities to assemble and test the major components of our aircraft : propulsion

systems, energy system assembly and aircraft integration, as well as incurring costs associated

with outsourcing production of subsystems and other key components; |

| ● | hiring additional

employees across design, production, marketing, administration and commercialization of our

business; |

| ● | engaging

with third party providers for design, testing, certification and commercialization of our

products; |

| ● | building

up inventories of parts and components for our aircraft; |

| ● | further

enhancing our research and development capacities to continue the work on our aircraft’s

technology, components, hardware and software performance; |

| ● | testing

and certifying the performance and operation of our aircraft; |

| ● | working

with third-party providers to train our pilots, mechanics and technicians in our proprietary

aircraft operation and maintenance; |

| ● | developing

and launching our digital platform and customer user interface; |

| ● | developing

our sales and marketing activities and developing our vertiport infrastructure; and |

| ● | increasing

our general and administrative functions to support our growing operations and our responsibilities

as a public company. |

Because we will incur the

costs and expenses from these efforts before we receive any associated revenue, our losses in future periods will be significant. In

addition, we may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in the

revenue we anticipate, which would further increase our losses. Furthermore, if our future growth and operating performance fails to

meet investor or analyst expectations, or if we have future negative cash flow or losses resulting from our investment in acquiring customers

or expanding our operations, this could have a material adverse effect on our business, financial condition and results of operations.

The eVTOL market may not continue to develop,

eVTOL aircraft may not be adopted by the transportation market, eVTOL aircraft may not be certified by transportation and aviation authorities

or eVTOL aircraft may not deliver the expected reduction in operating costs or time savings.

eVTOL aircraft involve a

complex set of technologies and are subject to evolving regulations, many of which were originally not intended to apply to electric

and/or VTOL aircraft. Before any eVTOL aircraft can fly passengers, manufacturers and operators must receive requisite regulatory approvals,

including — but not limited to — aircraft type certificate and certification related to production of

the aircraft (i.e., a Production Certificate). No eVTOL aircraft have passed certification by TCCA, EASA or the FAA for commercial operations

in Canada, Europe or the United States, respectively, and there is no assurance that our current serial prototype for the Cavorite

X7 aircraft will receive government certification in a way that is market-viable or commercially successful, in a timely manner or at

all. Gaining government certification requires us to prove the performance, reliability and safety of its Cavorite X7 aircraft, which

cannot be assured. Any of the foregoing risks and challenges could adversely affect our prospects, business, financial condition and

results of operations.

The success of our business depends on

the safety and positive perception of our aircraft, the establishment of strategic relationships, and of our ability to effectively market

and sell aircraft that will be used in Regional Air Mobility services.

We have not yet begun to

sell our aircraft, and we expect that our success will be highly dependent on our target customers’ embrace of Regional Air Mobility

and eVTOL vehicles, which we believe will be influenced by the public’s perception of the safety, convenience and cost of our Cavorite

X7 specifically but also of the industry as a whole. As a new industry, the public has low awareness of Regional Air Mobility and eVTOL

vehicles, which will require substantial publicity and marketing campaigns in a cost-effective manner to effectively and adequately target

and engage our potential customers. If we are unable to demonstrate the safety of our aircraft, the convenience of our aircraft, and

the cost-effectiveness of our use in Regional Air Mobility services as compared with other commuting, goods transportation, airport shuttle,

or regional transportation options, our business may not develop as we anticipate we could, and our business, revenue and operations

may be adversely affected. Further, our sales growth will depend on our ability to develop relationships with infrastructure providers,

airline operators, other commercial entities, municipalities and regional governments and landowners, which may not be effective in generating

anticipated sales, and marketing campaigns can be expensive and may not result in the acquisition of customers in a cost-effective manner,

if at all. If conflicts arise with our strategic counterparties, the other party may act in a manner adverse to we and could limit our

ability to implement our strategies. Our strategic counterparties may develop, either alone or with others, products or services in related

fields that are competitive with our products and services.

We have a limited operating history and

face significant challenges to develop, certify, and manufacture our aircraft. Our Cavorite X7 eVTOL aircraft remains in development,

and we do not expect to deliver any aircraft until 2027, at the earliest, if at all.

We were incorporated in 2013,

and we are developing an aircraft for the emerging Regional Air Mobility market, which is continuously evolving. Although our team has

experience designing, building and testing new aircraft, we have no experience as an organization in volume manufacturing of our planned

Cavorite X7 aircraft. We cannot assure that us or our suppliers and other commercial counterparties will be able to develop efficient,

cost-effective manufacturing capability and processes, and reliable sources of component supplies that will enable us to meet the quality,

price, engineering, design and production standards, as well as the production volumes, required to successfully produce and maintain

Cavorite X7 aircraft. Based on our current testing and projections, we believe that we can achieve our business plan and forecasted performance

model targets in terms of aircraft range, speed, energy system capacity, and payload for our full-scale Cavorite X7 aircraft; however,

we currently only has a 50%-scale prototype aircraft completed and undergoing flight testing.

Detailed design of our full-scale

Cavorite X7 aircraft has not yet been completed, and many of the systems, the aerodynamics, the structure, and other critical elements

of the design have yet to be designed, produced, and tested at full-scale. As such, we might not achieve all, or any, of our performance

targets, which would materially impact our business plan and results of operations.

You should consider our business

and prospects in light of the risks and significant challenges we face as a new entrant into a new industry, including, among other things,

with respect to our ability to:

| ● | design,

build, test and produce safe, reliable and high-quality Cavorite X7 aircraft and scale that

production in a cost- effective manner; |

| ● | obtain the

necessary certification and regulatory approvals in a timely manner; |

| ● | build a

well-recognized and respected brand; |

| ● | establish

and expand our customer base; |

| ● | properly

price our aircraft, and successfully anticipate the demand by our target customers; |

| ● | improve

and maintain our manufacturing efficiency; |

| ● | maintain

a reliable, secure, high-performance and scalable technology infrastructure; |

| ● | predict

our future revenues and appropriately budget for our expenses; |

| ● | anticipate

trends that may emerge and affect our business; |

| ● | anticipate

and adapt to changing market conditions, including technological developments and changes

in competitive landscape; |

| ● | secure,

protect and defend our intellectual property; and |

| ● | navigate

an evolving and complex regulatory environment. |

If we fail to adequately

address any or all of these risks and challenges, our business may be materially and adversely affected.

The Regional Air Mobility market for eVTOL

passenger and goods transport services does not exist; whether and how it develops is based on assumptions, and the Regional Air Mobility

market may not achieve the growth potential we expect or may grow more slowly than expected.

Our estimates for the total

addressable market for eVTOL Regional Air Mobility, regional passenger and goods transport, and military use are based on a number of

internal and third-party estimates, including customers who have expressed interest, assumed prices at which we can offer our services,

assumed aircraft development, estimated certification and production costs, our ability to manufacture, obtain regulatory approval and

certification, our internal processes and general market conditions. While we believe our assumptions and the data underlying our estimates

are reasonable, these assumptions and estimates may not be correct and the conditions supporting our assumptions or estimates may change

at any time, thereby reducing the predictive accuracy of these underlying factors. As a result, our estimates may prove to be incorrect,

which could negatively affect our operating revenue, costs, operations and potential profitability.

We may be unable to adequately control

the costs associated with our pre-launch operations, and our costs will continue to be significant after we commence operations.

We will require significant

capital to develop and grow our business, including designing, developing, testing, certifying and manufacturing our aircraft, educating

customers of the safety, efficiency and cost-effectiveness of our unique aircraft and building our brand. Our research and development

expenses were $752,185 and $675,758 in 2022 and 2023, respectively, and we expect to continue to incur significant expenses which will

impact our profitability, including continuing research and development expenses, manufacturing, maintenance and procurement costs, marketing,

customer and payment system expenses, and general and administrative expenses as we scale our operations. Our ability to become profitable

in the future will not only depend on our ability to successfully market our aircraft for global use but also our ability to control

our costs. If we are unable to cost efficiently design, certify, manufacture, market, and deliver our aircraft on time, our margins,

profitability and prospects would be materially and adversely affected.

We are a relatively small company in comparison

to current industry leaders in the Regional Air Mobility market. We may experience difficulties in managing our growth.

With under 20 employees currently,

we expect to experience significant growth in team size as we experience an increase in the scope and nature of our research and development,

manufacturing, testing, and certification of our aircraft. Our ability to manage our future growth will require us to continue to improve

our operational, financial and management controls, compliance programs and reporting systems. We are currently in the process of strengthening

our compliance programs, including our compliance programs related to internal controls, intellectual property management, privacy and

cybersecurity. We may not be able to implement improvements in an efficient or timely manner and may discover deficiencies in existing

controls, programs, systems and procedures, which could have an adverse effect on our business, reputation and financial results. We

also may not be able to grow the team in a timely manner or hire the expertise required in order to successfully continue our aircraft

development.

Our forward-looking operating information

and business plan forecast relies in large part upon assumptions and analyses that we have developed or obtained from respected third

parties. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our forecasted

results.

Our management has prepared

our projected financial performance, operating information and business plan, which reflect our current estimates of future performance.

Whether our actual financial results and business develops in a way that is consistent with our expectations and assumptions as reflected

in our forecasts depends on a number of factors, many of which are outside our control. Our estimates and assumptions may prove inaccurate,

causing the actual amount to differ from our estimates. These factors include, but are not limited to, the risk factors described herein

and the following factors:

| ● | our ability

to obtain sufficient capital to sustain and grow our business; |

| ● | our effectiveness

in managing our costs and our growth; |

| ● | our ability

to meet the performance and cost targets of manufacturing our aircraft; |

| ● | our ability

to effectively develop our fan-in-wing eVTOL technology that underpins our Cavorite X7 aircraft

design and operation; |

| ● | establishing

and maintaining relationships with key providers and suppliers; |

| ● | the timing,

cost and ability to obtain the necessary certifications and regulatory approvals; |

| ● | the development

of the Regional Air Mobility market and customer demand for our aircraft; |

| ● | the costs

and effectiveness of our marketing and promotional efforts; |

| ● | competition

from other companies with compelling aircraft that may emerge to compete directly or indirectly

with our Cavorite X7 aircraft; |

| ● | our ability

to retain existing key management, to integrate recent hires and to attract, retain and motivate

qualified personnel; |

| ● | the overall

strength and stability of domestic and international economies; |

| ● | regulatory,

legislative and political changes; and |

| ● | consumer

spending habits. |

Unfavorable changes in any

of these or other factors, most of which are beyond our control, could materially and adversely affect our business, results of operations

and financial results. It is difficult to predict future revenues and appropriately budget for our expenses, and we have limited insight

into trends that may emerge and affect our business. If actual results differ from our estimates or we adjust our estimates in future

periods, our operating results and financial position could be materially affected.

We anticipate delivering our first Cavorite

X7 eVTOL aircraft to customers in 2027, pending receipt of regulatory approval and certification; however, the aircraft remains in the

detailed design phase and has yet to complete any testing and certification process. Any delay in the design, production, or completion

or requisite testing and certification, and any design changes that may be required to be implemented in order to receive certification,

would adversely impact our business plan and strategic growth plan and our financial condition.

We are currently in rigorous

testing of our 50%-scale prototype and is still refining the detailed design of a full-scale aircraft. While we currently have an experienced

aircraft prototyping team, there are many important milestones to achieve prior to being able to deliver our first commercial aircraft,

including completing the detailed design, sub-system assembly, airframe manufacturing, systems integration, testing, design refinement,

type certification of the aircraft, and production certification of our manufacturing facility. Our inability to properly plan, execute

our operations, and analyze and contain the risk associated with each step could negatively impact our ability to successfully operate

our business.

Any delays in the development, certification,

manufacture and commercialization of our Cavorite X7 aircraft and related technology, such as battery technology or electric motors,

may adversely impact our business, financial condition and results of operations.

We may experience future

delays or other complications in the design, certification, manufacture, and production of our aircraft and related technology. These

delays could negatively impact our progress towards commercialization or result in delays in increasing production capacity. If we encounter

difficulties in scaling our production, if we fail to procure the key enabling technologies from our suppliers (e.g., batteries, power

electronics, electric motors, etc.) which meet the required performance parameters, if our aircraft technologies and components do not

meet our expectations, or if such technologies fail to perform as expected, are inferior to those of our competitors or are perceived

as less safe than those of our competitors, we may not be able to achieve our performance targets in aircraft range, speed, payload and

noise or launch products on our anticipated timelines, and our business, financial condition and results of operations could be materially

and adversely impacted.

Adverse publicity stemming from any incident

involving us or our competitors, or an incident involving any air travel service or unmanned flight based on eVTOL technologies, could

have a material adverse effect on our business, financial condition and results of operations.

Electric aircraft are based

on complex technology that requires skilled pilot operation and maintenance. Like any aircraft, they may experience operational or process

failures and other problems, including adverse weather conditions, unanticipated collisions with foreign objects, manufacturing or design

defects, pilot error, software malfunctions, cyber-attacks or other intentional acts that could result in potential safety risks. Any

actual or perceived safety issues with our aircraft, other electric aircraft or eVTOL aircraft, unmanned flight based on autonomous technology

or the Regional Air Mobility industry generally may result in significant reputational harm to our business, in addition to tort liability,

increased safety infrastructure and other costs that may arise. The electric aircraft industry has had several accidents involving prototypes.

Lilium’s first Phoenix demonstrator was destroyed by a ground-maintenance fire in February 2020; Eviation’s prototype

eVTOL vehicle caught fire during testing in January 2020; a small battery-operated plane operated by Avinor and built by Slovenia’s

Pipistrel crashed in Norway in August 2019; and an electric-motor experimental aircraft built by Siemens and Hungarian company Magnus

crashed in Hungary in May 2018, killing both occupants.

We are also subject to risk

of adverse publicity stemming from any public incident involving the company, our employees or our brand. If our personnel, our 50%-scale

prototype aircraft, or the personnel or vehicles of one of our competitors, were to be involved in a public incident, accident or catastrophe,

the public perception of the Regional Air Mobility industry or eVTOL vehicles specifically could be adversely affected, resulting in

decreased customer demand for our aircraft, significant reputational harm or potential legal liability, which could cause a material

adverse effect on sales, business and financial condition. The insurance we carry may be inapplicable or inadequate to cover any such

incident, accident or catastrophe. If our insurance is inapplicable or not adequate, we may be forced to bear substantial losses from

an incident or accident.

Our business plans require a significant

amount of capital. In addition, our future capital needs may require us to sell additional equity or debt securities that may adversely

affect the market price of our shares and dilute our shareholders or introduce covenants that may restrict its operations.

We expect our capital expenditures

to continue to be significant in the foreseeable future as we expand our development, certification, production and commercial launch,

and that our level of capital expenditures will be significantly affected by customer demand for our services. The fact that we have

a limited operating history and are entering a new industry means we have no historical data on the demand for its aircraft. As a result,

our future capital requirements may be uncertain and actual capital requirements may be different from those we currently anticipate.

We may seek equity or debt financing to finance a portion of its capital expenditures. Such financing might not be available to us in

a timely manner or on terms that are acceptable, or at all.

Our ability to obtain the

necessary financing to carry out our business plan is subject to a number of factors, including general market conditions and investor

acceptance of our industry and business model. These factors may make the timing, amount, terms and conditions of such financing unattractive

or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel

our planned activities or substantially change our corporate structure. We might not be able to obtain any funding, and we might not

have sufficient resources to conduct our business as projected, both of which could mean that we would be forced to curtail or discontinue

our operations. We may seek to raise such capital through the issuance of additional shares or debt securities with conversion rights

(such as convertible bonds and option rights). An issuance of additional shares or debt securities with conversion rights could potentially

reduce the market price of our shares, and we currently cannot predict the amounts and terms of such future offerings.

In addition, our future capital

needs and other business reasons could require us to sell additional equity or debt securities or obtain a credit facility. The sale

of additional equity or equity-linked securities could dilute our shareholders. In addition, such dilution may arise from the acquisition

or investments in companies in exchange, fully or in part, for newly issued shares, options granted to our business partners or from

the exercise of stock options by our employees in the context of existing or future share option programs or the issuance of shares to

employees in the context of existing or future employee participation programs. The incurrence of indebtedness would result in increased

debt service obligations and could result in operating and financing covenants that would restrict our operations.

If we cannot raise additional

funds when we need or want them, our operations and prospects could be negatively affected.

If we are unable to successfully design

and manufacture our aircraft, our business will be harmed.

We are currently developing

plans to expand our primary manufacturing infrastructure near Toronto, Ontario, and we plan to begin production of our certified aircraft

in 2027; however, currently we have 50%-scale prototype aircraft in active flight testing and are in an early design phase of our full-scale

aircraft. We may not be able to successfully develop and certify a full-scale aircraft. We may also not be able to successfully develop

commercial-scale manufacturing capabilities internally or supply chain relationships with our intended Tier 1 suppliers. Our production

facilities and the production facilities of our outsourcing parties and suppliers may be harmed or rendered inoperable by natural or

man-made disasters, including earthquakes, flooding, fire and power outages, or by health epidemics, such as the COVID-19 pandemic, which

may render it difficult or impossible for us to manufacture our aircraft for some period of time.

If the Cavorite X7 eVTOL aircraft we build

fails to perform as expected our ability to develop, market, and sell our aircraft could be harmed.

We have not yet produced

a full-scale Cavorite X7 aircraft. Although we are satisfied with early flight testing of our 50%-scale prototype, there is no guarantee

that the full-scale aircraft will perform as we anticipate. Our aircraft may contain defects in design and manufacture that may cause

them not to perform as expected or that may require design changes and/or repairs. Further, our Cavorite X7 aircraft may be impacted

by various performance factors that could impair customer satisfaction, such as excessive noise, turbulent air during flight, foreign

object damage, fan stall or wing flutter, overloading, hail and bird strike, or adverse icing accumulation. If our Cavorite X7 aircraft

fails to perform as expected, we may need to delay delivery of initial aircraft, which could adversely affect our brand in our target

markets and could adversely affect our business, prospects, and results of operations.

Our Cavorite X7 aircraft require complex

software, hybrid electric power systems, battery technology and other technology systems that remain in development and need to be commercialized

in coordination with our vendors and suppliers to complete serial production. The failure of advances in technology and of manufacturing

at the rates we project may impact our ability to increase the volume of our production or drive down end user pricing.

Our Cavorite X7 will use

a substantial amount of third-party and in-house software codes and complex hardware to operate. Our software and hardware may contain

errors, bugs or vulnerabilities, and our systems are subject to certain technical limitations that may compromise our ability to meet

our objectives. Some errors, bugs or vulnerabilities inherently may be difficult to detect and may only be discovered after the code

has been implemented. We have a limited frame of reference by which to evaluate the long-term performance of our software and hardware

systems and our aircraft, and we may be unable to detect and fix any defects in the aircraft prior to commencing commercial operations.

The development and on-going monitoring of such advanced technologies is inherently complex, and we will need to coordinate with our

vendors and suppliers in order to complete full-scale production. Our potential inability to develop the necessary software and technology

systems may harm our competitive position or delay the certification or manufacture of our aircraft.

We are relying on third-party

suppliers to develop a number of emerging technologies for use in our products, including lithium-ion battery technology. Many of these

technologies are already commercially viable, and our survey of commercially available products has already yielded promising results.

However, the final cell design of our potential suppliers may not be able to meet the safety, technological, economical or operational

requirements to support the regulatory requirements and performance assumed in our business plan.

We are also relying on third-party

suppliers to commercialize these technologies (such as battery cell technology) at the volume and costs they require to launch and ramp-up

our production. Our suppliers may not be able to meet the production timing, volume requirements or cost requirements we have assumed

in our business plan. Our third-party suppliers could face other challenges, such as the lack of raw materials or machinery, the breakdown

of tools in production or the malfunctioning of technology as they ramp up production. As a result, our business plan could be significantly

impacted, and we may incur significant delays in production and full commercialization, which could adversely affect our business, prospects,

and results of operations.

Our Cavorite X7 aircraft will make extensive

use of lithium-ion battery cells, which have been observed to catch fire or vent smoke and flame.

The battery packs within

our Cavorite X7 aircraft will use lithium-ion cells. On rare occasions, lithium-ion cells can rapidly release the energy they contain

by venting smoke and flames in a manner that can ignite nearby materials as well as other lithium-ion cells. While the battery pack is

designed to contain any single cell’s release of energy without spreading to neighboring cells, a failure of battery packs in our

aircraft could occur or batteries could catch fire during production or testing, which could result in bodily injury or death and could

subject us to lawsuits, regulatory challenges or redesign efforts, all of which would be time consuming and expensive and could harm

our brand image. Also, negative public perceptions regarding the suitability of lithium-ion cells for automotive applications, the social

and environmental impacts of cobalt mining, or any future incident involving lithium-ion cells, such as a vehicle or other fire, could

seriously harm our business and reputation.

We will rely on third-party suppliers and

strategic parties for the provision and development of key emerging technologies, components and materials used in our Cavorite X7 aircraft,

such as the lithium-ion batteries that will help to power the aircraft, a significant number of which may be single or limited source

suppliers. If any of these prospective suppliers or strategic parties choose to not do business with us at all, or insist on terms that

are commercially disadvantageous, we may have significant difficulty in procuring and producing our aircraft, and our business prospects

would be harmed.

Third-party suppliers and

strategic parties will provide key components and technology to the Cavorite X7 aircraft. Collaborations with strategic parties are necessary

to successfully commercialize our existing and future products. If we are unable to identify or enter into agreements with strategic